Market Trends

Chip Stocks Rally as AI Chip Competition Enters a New Phase

In October 2025, U.S. chip stocks staged a notable rally. Shares of Advanced Micro Devices (AMD) jumped 11.37% on October 8, bringing their three-day cumulative gain to 43.05% and marking a record high. Micron Technology rose more than 5%, while TSMC gained over 3%. In the previous two trading sessi

OpenAI to Become the Next Trillion-Dollar Giant—Do You Believe Jensen Huang’s Prediction?

“OpenAI is highly likely to become the world’s next multi-trillion-dollar mega-cap company,” Nvidia CEO Jensen Huang declared in a recent podcast, making one of his boldest predictions to date. Yet his remarks come at a time when OpenAI CEO Sam Altman is warning that “too much capital is pouring int

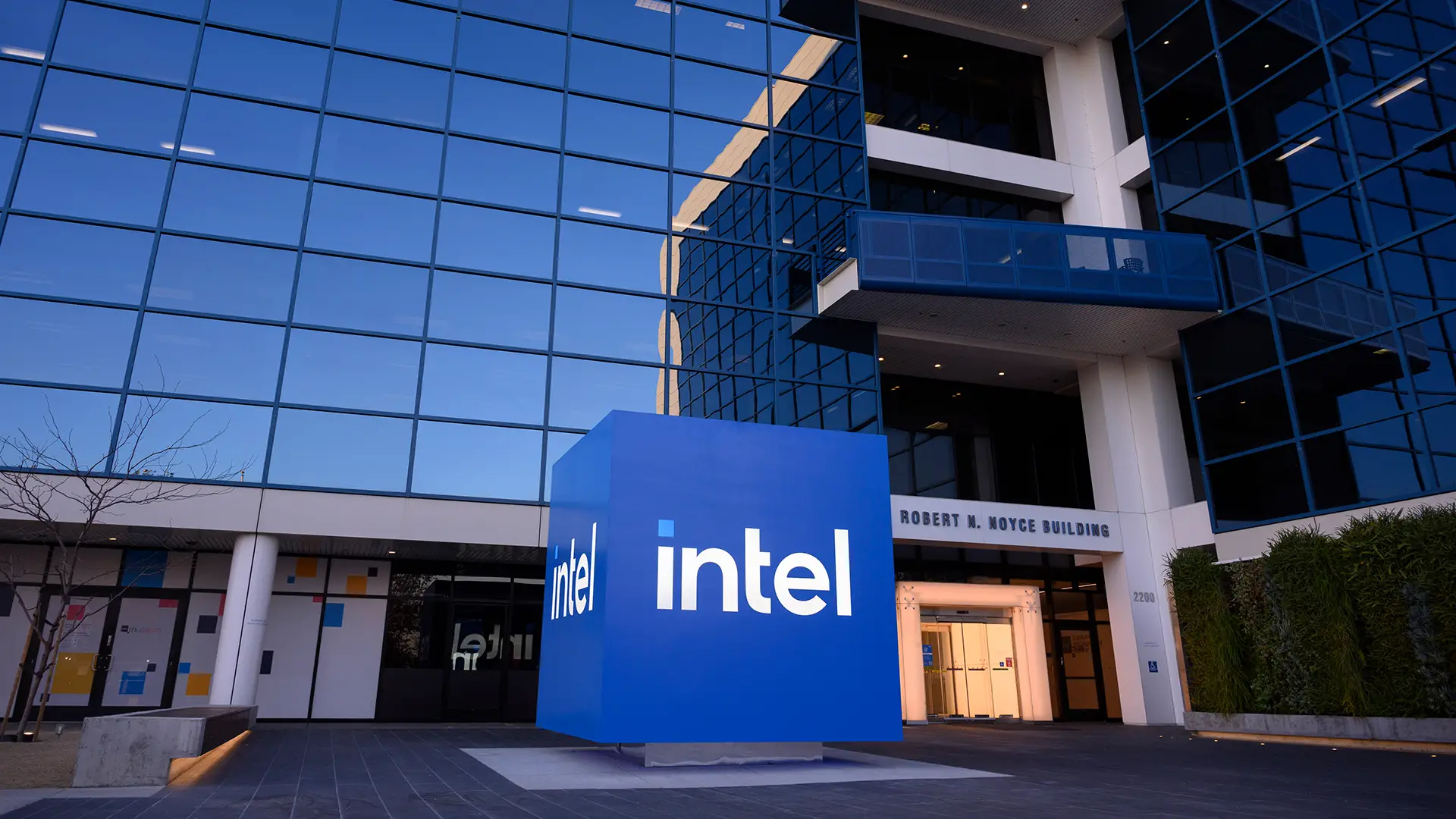

What Nvidia’s $5 Billion Strategic Stake in Intel Means for the Chip Industry

On September 18, 2025, Nvidia announced a strategic $5 billion equity investment in Intel Corporation, acquiring common shares at $23.28 per share. Upon completion of the transaction, Nvidia will hold approximately 4% of Intel's outstanding shares, positioning it as a significant minority stakeholde

On September 9 local time, Apple Inc. held its highly anticipated 2025 Fall Event, unveiling the iPhone 17 series, AirPods Pro 3, and updated Apple Watch lineup. The event continued Apple’s hardware iteration strategy, emphasizing enhancements in chip performance, imaging systems, and health monitor

Tesla’s Diverging Performance in China and the U.S. Puts Strategic Shift to the Test

Tesla’s latest sales data reveal a starkly contrasting picture. First, Tesla’s Shanghai factory posted wholesale deliveries of 83,192 vehicles in August, marking a new high for the year and a 22.6% month-over-month increase. Among them, the Model Y led the Chinese market with 58,888 units sold, recl

Implications of the U.S. Government's Equity Investment in Intel

On August 22, 2025, the U.S. government announced it would acquire a 9.9% equity stake in Intel for $8.9 billion, becoming the company’s second-largest shareholder. The transaction draws on $5.7 billion in unpaid subsidies under the CHIPS and Science Act, plus an additional $3.2 billion allocated fo

Investment Signals from Buffett’s Q2 Holdings Adjustments

On August 14, according to filings with the U.S. Securities and Exchange Commission (SEC), Warren Buffett-led Berkshire Hathaway submitted its second-quarter 2025 holdings report (13F) as of June 30, 2025.

Paying 15% of H20 Chip Sales Revenue in China——The Impact on Nvidia’s Profit

On August 11, 2025, the Financial Times reported a widely discussed development: Nvidia and AMD have reached a special agreement with the U.S. government, under which both companies agreed to remit 15% of their AI data center chip sales revenue destined for the Chinese market to the U.S. government

Will Apple Successfully Avoid Trump’s Tariff Impact?

On August 6, 2025, Apple disclosed plans to invest an additional $100 billion in the U.S. over the next four years, bringing its total domestic investment to $600 billion to bolster local supply chains and manufacturing capacity.

Despite Berkshire’s Profit Drop, Buffett’s Long-Term Thesis Still Deserves Your Trust

As Warren Buffett prepares to retire, Berkshire Hathaway released its Q2 2025 financial results during a period of transition. While both revenue and earnings surpassed market expectations, the sharp year-over-year declines signal growing pressure on earnings quality. The renewed impairment charge

On July 31, the White House issued an executive order to reset tariff rates for certain countries under the new "reciprocal tariffs" framework. According to Annex 1 of the order, specified countries will be subject to individualized tariff rates, while all others will face a uniform 10% rate.

1.In the second quarter of 2025, Tesla reported a broad decline in both revenue and profit, missing market expectations across the board. Revenue from its core automotive segment continued to fall by double digits.2.Despite the recent weakness in performance, Elon Musk reiterated Tesla’s plans for

Nvidia Will Surpass Apple to Become the Most Valuable Company in History

Wall Street analysts predict that Nvidia could exceed a $5 trillion market cap within the next 18 months

2025’s Biggest Tech IPO: Figma’s Valuation and Growth Outlook

Can Figma Maintain Its Growth After Going Public

Tesla's Challenges Go Beyond Musk's Political Actions

Recently, Elon Musk publicly criticized the "Big and Beautiful" bill signed by Trump and announced the creation of the "American Party."Tesla's global vehicle deliveries continued to decline in the first half of 2025.Despite Tesla's stock price plunge, Cathie Wood of Ark Invest remains