Implications of the U.S. Government's Equity Investment in Intel

04:56 September 2, 2025 EDT

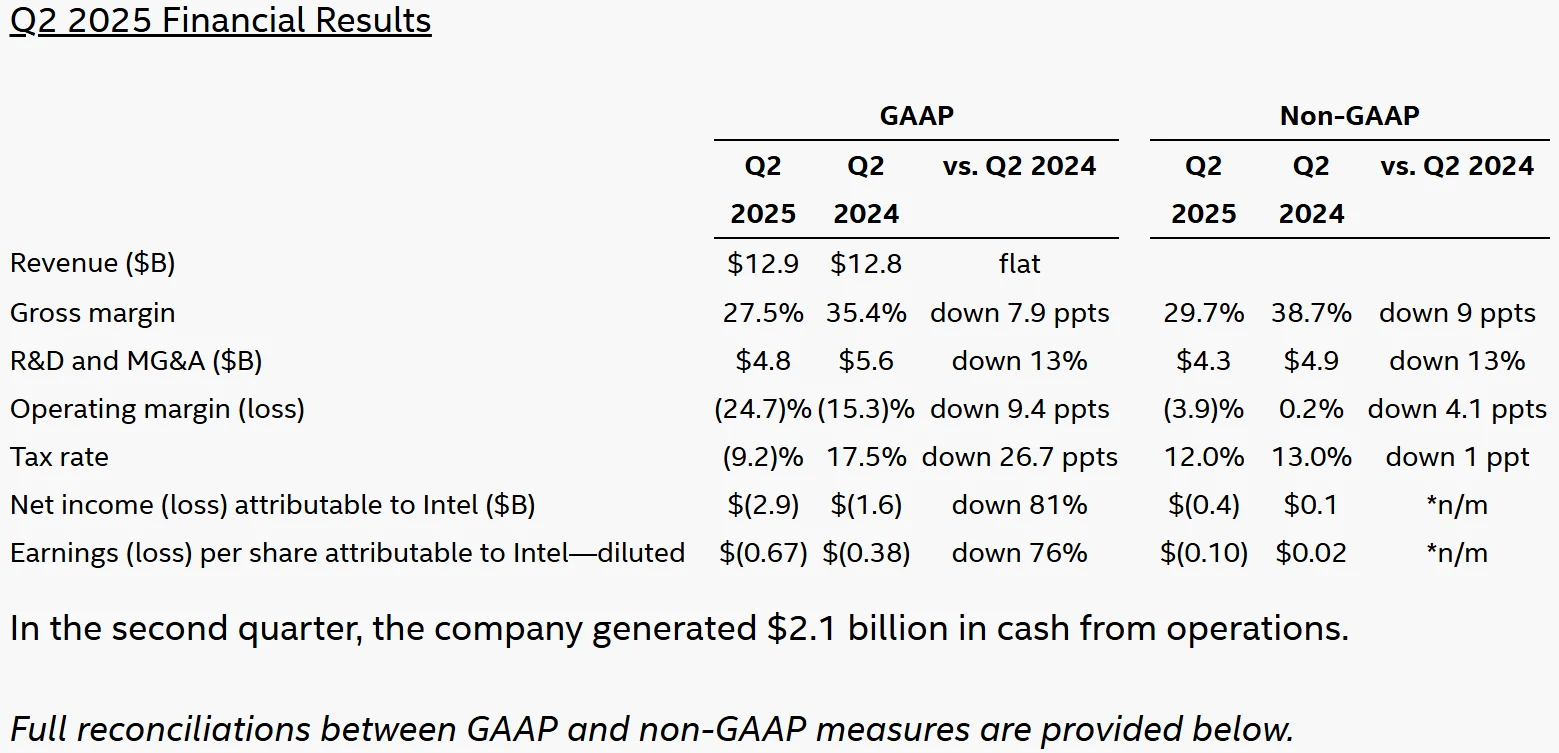

On August 22, 2025, the U.S. government announced it would acquire a 9.9% equity stake in Intel for $8.9 billion, becoming the company’s second-largest shareholder. The transaction draws on $5.7 billion in unpaid subsidies under the CHIPS and Science Act, plus an additional $3.2 billion allocated for a standalone secure-chip initiative.

Source: Intel

The government purchased approximately 433.3 million shares of Intel common stock at $20.47 per share, representing a discount of about 17% to the day’s closing price. Upon completion, together with SoftBank’s concurrent $2 billion investment, the combined transactions dilute existing shareholder equity by more than 10%.

From a policy perspective, this move represents an upgrade of U.S. semiconductor industrial strategy. Since its enactment in 2022, the CHIPS and Science Act has pledged over $52 billion in subsidies to Intel and other firms, but disbursements have been constrained by both geopolitical considerations and corporate performance benchmarks. Converting subsidies into equity effectively shifts “after-the-fact rewards” into “up-front alignment,” using capital ties to strengthen government influence over corporate strategy.

Investment Details

The transaction structure includes the U.S. government purchasing approximately 433 million Intel shares at $20.47 per share, while SoftBank is investing at $23 per share. The government’s investment is funded by previously committed subsidies—$5.7 billion already disbursed by the end of August 2025, with the remaining $3.2 billion contingent on Intel meeting specific project commitments, such as producing chips for the military under its “secure enclave” program. SoftBank’s investment carries no governance conditions but could encourage its portfolio companies to utilize Intel’s foundry services.

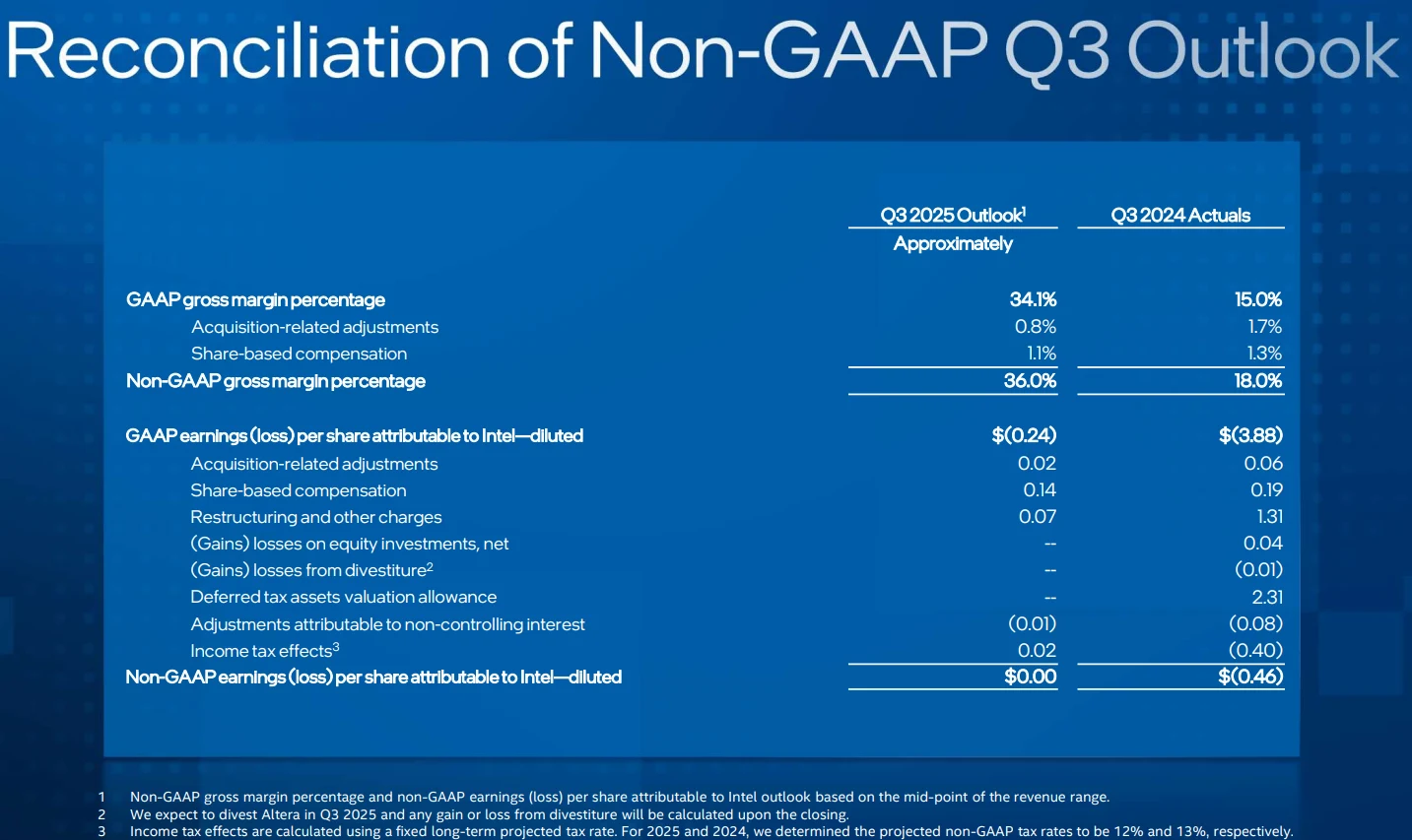

These investments dilute existing shareholder equity by roughly 10.9%. Based on Intel’s closing price of $24.80 on August 22, 2025, the government’s purchase price reflects a discount of about 17%, which in the short term adds pressure from earnings per share dilution. Nevertheless, despite the dilution, Intel’s stock price rose 5.2% on the day the announcement was made.

Source: TradingView

Historical data show that similar cases of government intervention—such as the U.S. government’s investment in General Motors during the 2008 financial crisis—led to significant adjustments in shareholder equity but also facilitated corporate restructuring.

Positive Implications

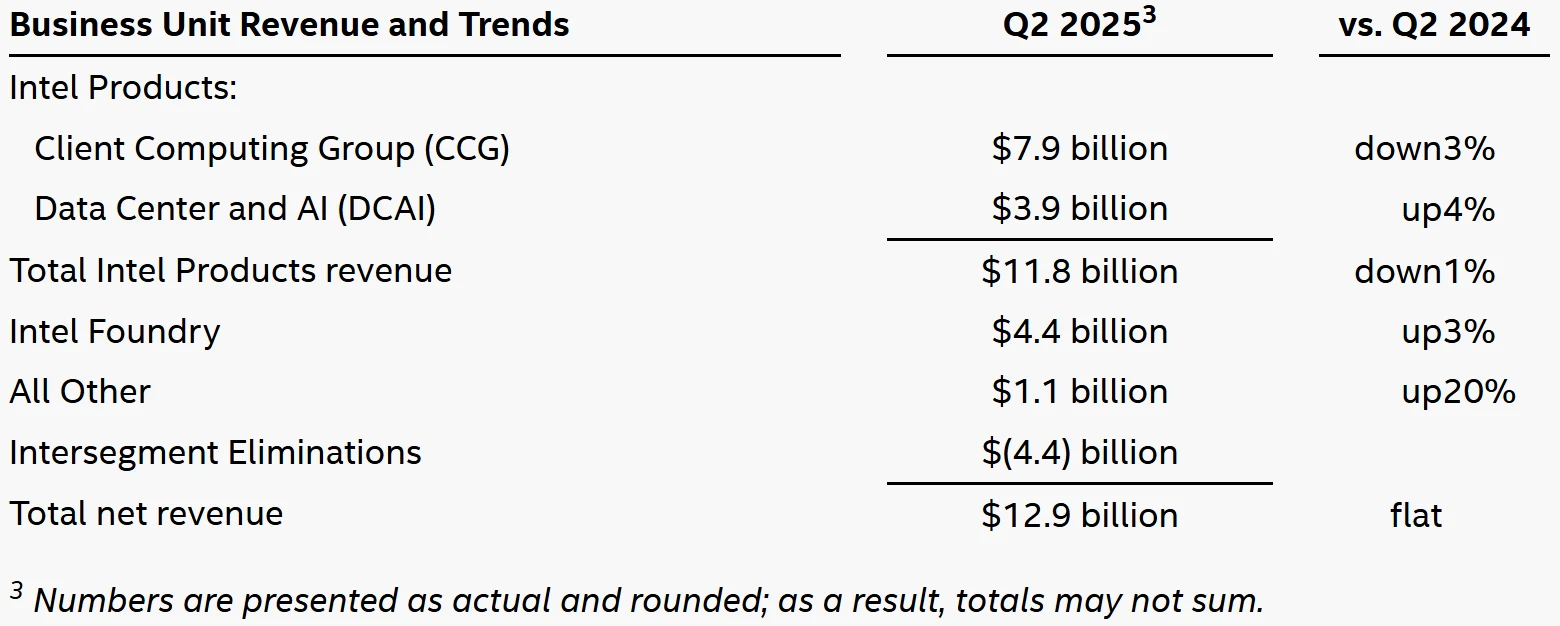

The capital infusion primarily improves Intel’s liquidity position. In Q2 2025, the company reported significant cash flow pressures, with its foundry business (IFS) incurring an operating loss of $3.17 billion, serving as the main drag on performance. The unconditional funding from both the U.S. government and SoftBank provides timely relief, ensuring adequate financing for Intel’s ongoing fab construction projects in Ohio and Arizona, which are expected to come online before 2026. Stable funding support enables Intel to accelerate the rollout of its IDM 2.0 strategy, integrating design, manufacturing, and advanced packaging to restore its technological and market competitiveness.

Source: Intel

Beyond financial improvement, the signaling effect to the market is equally notable. Direct government ownership reinforces Intel’s role in national security and supply chain strategies, bolstering external confidence. Analysts note that this policy endorsement helps reduce the market’s risk discount on Intel’s operations and stabilizes the company’s share price floor in the near term. According to Morgan Stanley research, semiconductor companies receiving similar policy support have seen an average market capitalization gain of about 12% in subsequent quarters.

Meanwhile, SoftBank’s equity stake may generate potential customer synergies. For example, its controlled subsidiary Arm Holdings is expected to leverage Intel’s 18A process node for AI chip production; SoftBank’s May 2025 acquisition of Ampere Computing could also broaden the AI server ecosystem, bringing high-value orders to Intel’s foundry business.

Over the longer term, this equity investment removes certain subsidy conditions—such as excess profit clawbacks and specific labor requirements—providing Intel with greater flexibility in future profitability. If Intel Foundry Services succeeds in attracting more customers, shareholder returns could outweigh the negative impact of equity dilution.

Source: Intel

Industry data indicate that the global semiconductor market is projected to reach $612 billion in 2025. If Intel’s market share rises from 4.9% in 2024 to 6%, this would significantly boost earnings per share and deliver measurable returns on its IDM 2.0 strategy.

Negative Implications

However, the potential downsides cannot be overlooked. Equity dilution will directly reduce the ownership stake and voting power of existing shareholders. Although the U.S. government has pledged not to interfere in operational decision-making, the agreement stipulates that its votes must align with the board of directors—an arrangement that effectively strengthens the board’s influence while weakening minority shareholders’ ability to drive strategic changes or executive turnover.

It is worth noting that Intel’s board has faced criticism in recent years for lacking semiconductor industry expertise and for its mixed evaluations of former CEO Pat Gelsinger’s management. These governance concerns have already drawn scrutiny.

In addition, operational risks from external factors are becoming increasingly apparent. With 76% of Intel’s revenue generated from overseas markets, the government’s ownership stake may subject the company to stricter foreign investment reviews as it expands internationally. In 2025, the White House announced reciprocal tariff measures that could lead to further erosion of Intel’s market share in China. More broadly, such policy-driven headwinds could compress profit margins in key emerging markets while making Intel less attractive to multinational clients.

Furthermore, the ripple effects of non-market factors should not be underestimated. Internal documents have indicated that investors, employees, and customers may feel uneasy about the government’s ownership, potentially affecting hiring, partnerships, and long-term order stability. While no significant customer defections have been observed so far, uncertainty surrounding corporate reputation and business relationships has become a mid- to long-term concern.

The risk of political interference, though limited, still exists. Analysts worry that Intel’s future strategy could be shaped more by national industrial policy than by pure commercial considerations. For example, during the Trump administration, a proposed 100% tariff on imported semiconductors—while indirectly supporting Intel’s domestic manufacturing—also heightened global trade uncertainty, forcing companies to balance policy directives against market-driven priorities.

Strategic Shift

Intel is currently pursuing its “five nodes in four years” roadmap to rebuild competitiveness. The 18A process, slated for high-volume manufacturing in Q4 2025, incorporates backside power delivery (BSPDN) and gate-all-around (GAA) transistor architecture, theoretically enabling transistor densities comparable to TSMC’s 3nm technology. Notably, Intel has procured ASML’s high-numerical-aperture EUV lithography tools and plans to deploy them at its 14A node as early as 2026—roughly 18 months ahead of TSMC’s timeline. This narrowing of the technology gap could allow Intel to reclaim up to 25% of the high-end CPU market by 2027.

Source: Intel

The establishment of Intel Foundry Services (IFS) as an independent subsidiary is intended to address customer concerns about Intel “playing both athlete and referee.” IFS has already signed an agreement with Amazon AWS to manufacture custom AI chips on its 18A node, which is expected to generate $1.5 billion in revenue by 2026. Equally significant, Arm—owned by SoftBank—plans to leverage IFS for its in-house AI chip production, while orders from portfolio companies such as Ampere could help IFS reach break-even on its foundry operations by 2028.

Challenges remain. In Q2 2025, IFS reported $4.4 billion in revenue but a $3.17 billion loss, driven largely by the high cost structure of pre-EUV nodes, which still account for more than 85% of output. Unless Intel can lift its share of advanced-node capacity to 60% by the end of 2026, IFS’s gross margin is unlikely to break past the critical -20% threshold.

Source: Intel

Geopolitical Risk

However, Intel’s technology roadmap remains constrained by geopolitical risk. On August 29, 2025, the U.S. Department of Commerce revoked the “Validated End-User” (VEU) status of Intel’s Dalian fab, requiring individual licenses for any U.S. semiconductor equipment imports after a 120-day grace period. This measure directly restricts technology upgrades for the plant’s 14nm production line and is expected to reduce NAND flash shipments by roughly 12% in 2026. More broadly, the move could prompt the South Korean government to activate compensation mechanisms for Samsung and SK Hynix, reshaping global memory-chip pricing dynamics.

At the same time, Intel’s market share in China is eroding rapidly. In 2024, the company generated $15.5 billion in mainland China revenue, accounting for 29% of its total. But with tariffs set to rise to 125% in 2025, high-end CPU costs have surged, allowing domestic rivals such as Huawei Ascend and Hygon to seize share at an accelerated pace. In addition, China’s export restrictions on critical materials such as gallium and germanium have introduced uncertainty into Intel’s wafer fabrication supply chain.

This “two-way squeeze” is forcing Intel to reconfigure its supply chain. To mitigate geopolitical exposure, the company has accelerated phase-two production at its Ohio fab to 2026 and plans to shift 30% of its advanced packaging capacity to Malaysia. However, the construction cycle for the new Malaysian facility could extend to 48 months—18 months longer than planned—adding near-term operational uncertainty and cost pressure.

Capital infusion and geopolitical headwinds are converging into a broader rebalancing of shareholder value. The U.S. government’s $8.9 billion equity injection will shrink Intel’s 2025 capital expenditure gap to $3 billion and improve its debt coverage ratio from 1.2× to 1.5×. Yet equity dilution is expected to reduce earnings per share (EPS) by about $0.18. If the foundry business fails to turn profitable as planned, Intel’s price-to-earnings (P/E) ratio—already negative at -5.10×—could deteriorate further in 2026.

Conclusion

Overall, the U.S. government’s equity investment provides Intel with crucial liquidity and strategic endorsement, but it also deepens the company’s entanglement with policy objectives. For investors, this represents both a short-term floor for valuation and a long-term test of governance and global business uncertainty. Future shareholder returns will likely hinge on Intel’s ability to deliver on its commitments in process-node advancement and foundry profitability, rather than relying solely on the cushion of policy-backed capital.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates