Will Apple Successfully Avoid Trump’s Tariff Impact?

09:00 August 8, 2025 EDT

Key points:

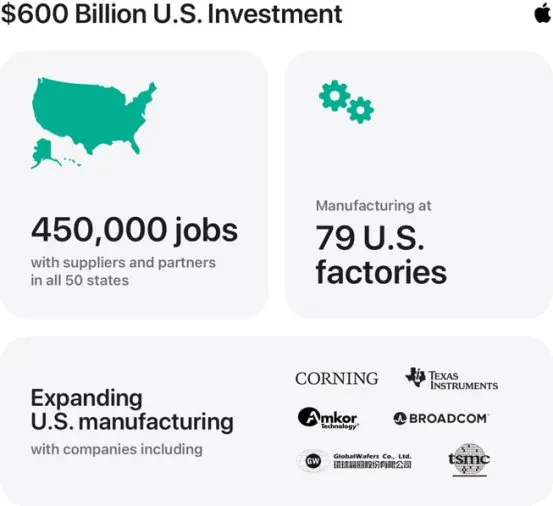

Apple announced it will invest $600 billion in the U.S. over the next four years, including an additional $100 billion to advance the “American Manufacturing Plan” , aimed at strengthening domestic supply chains and manufacturing capabilities.

Analysts believe this strategy is a direct response to the Trump administration’s renewed tariff threats on semiconductors and electronics, seeking to mitigate potential cost increases through localized production.

On August 6, 2025, Apple disclosed plans to invest an additional $100 billion in the U.S. over the next four years, bringing its total domestic investment to $600 billion to bolster local supply chains and manufacturing capacity.

On the day of the announcement, Apple’s stock rallied sharply, surging over 5% intraday and closing at $220.03, up 3.18% from the previous session. The market clearly views this move with confidence and expects it to effectively alleviate the adverse impact of Trump’s “reciprocal tariffs.”

Source: TradingView

Behind the Massive Investment

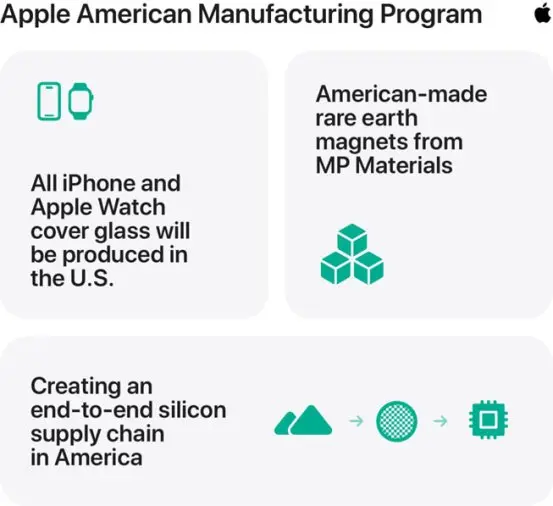

Apple’s “American Manufacturing Plan” (AMP) is designed to strengthen domestic supply chains, focusing on the production of glass cover panels for iPhone and Apple Watch, rare earth magnets, and an end-to-end silicon chip production chain. Within the additional $100 billion investment, chip manufacturing dominates, involving 24 factories across 12 states with an annual output of 19 billion chips. This initiative directly addresses Trump’s “Made in America” mandate and lays a solid foundation for securing semiconductor tariff exemptions.

Source: Apple

On August 7, Trump indicated that companies committing to invest domestically may qualify for semiconductor tariff exemptions, offering Apple a potential path to avoid tariffs.

However, Apple has not committed to relocating final assembly of all its products back to the U.S. iPhone final assembly continues overseas, reflecting Apple’s flexible strategy of “partial supply chain localization” that balances cost efficiency with regulatory compliance. This approach strengthens the U.S. presence across the supply chain through close collaboration with key suppliers such as Corning (glass manufacturing), MP Materials (rare earth magnets), Coherent (laser equipment), TSMC, and Samsung (chip manufacturing).

Source: Apple

Notably, many of these partnerships build upon suppliers’ previously planned capacity expansions, underscoring Apple’s reliance on ecosystem partners to share the burden of domestic manufacturing transformation.

Since 2025, the Trump administration’s aggressive tariff policies have pushed Apple and other tech giants to adjust strategies to mitigate tariff costs, ultimately promoting the reshoring of critical sectors like semiconductor manufacturing and fostering domestic industrial growth.

Previously, Apple pledged a $350 billion investment over five years in 2018 to support U.S. manufacturing, successfully obtaining partial tariff exemptions. The current increase to $600 billion represents both a continuation and an escalation of this commitment. The 2025 tariff exemption policies specifically incentivize companies expanding domestic production, establishing clear regulatory motivation.

Additionally, the Biden administration’s CHIP Act provides funding support for semiconductor manufacturing expansion. Apple leverages this policy to advance wafer fab construction and enhance high-end chip production capabilities. Projects such as GlobalWafers, TSMC’s Arizona facility, and Samsung’s Austin plant have received government subsidies, serving as critical pillars for Apple’s supply chain localization. These multiple policy benefits offer institutional support for Apple’s manufacturing investments and help lower transition costs.

Potential Returns

Apple’s $600 billion investment plan could secure exemptions from semiconductor tariffs.

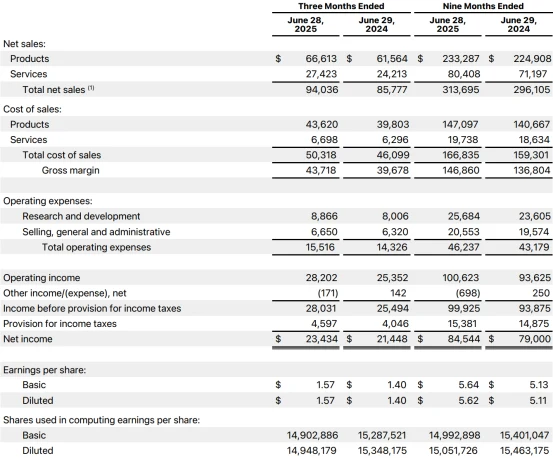

Bank of America analyst Wamsi Mohan highlighted that if competitors face tariffs while Apple obtains exemptions, the company could further increase its U.S. smartphone market share. In the third quarter of fiscal 2025, iPhone revenue reached $44.58 billion, up 13.5% year-over-year, accounting for 47% of total revenue. Tariff exemptions would shield this core segment from rising costs and help maintain stable profit margins.

Source: Apple

Through partnerships with suppliers like Corning and TSMC, Apple has strengthened domestic component production capacity. For instance, a $2.5 billion collaboration with Corning secures glass cover supply, while chip manufacturing with TSMC benefits from subsidies under the CHIP Act. These measures reduce the direct impact of tariffs on the supply chain while avoiding the high costs associated with fully relocating iPhone assembly to the U.S.

JPMorgan analysts estimate that full domestic assembly could increase iPhone production costs by 20% to 30%, significantly squeezing profit margins. Apple’s current strategy of partial localization strikes a balance between cost efficiency and regulatory compliance.

Following the announcement, Apple received broad support from Wall Street, with Bank of America, JPMorgan, and Wedbush raising their price targets. Wedbush analyst Dan Ives, a long-term Apple bull, called this a “strategic poker move” by Tim Cook and maintained his top price target of $270.

HSBC’s report noted that Apple’s plan supports scenarios for margin stability, while Gene Munster of Deepwater Asset Management emphasized that partial localization avoids the cost pressure of full assembly relocation. These reactions reflect market confidence in Apple’s strategy.

Final Thoughts

Apple’s expanded investment in manufacturing is a direct response to the shifting global trade landscape, demonstrating the company’s strategic adaptability amid complex political and economic conditions. By increasing the proportion of its domestic supply chain, Apple is positioned to benefit from policy incentives, mitigate tariff risks, and strengthen its bargaining power and brand presence in the U.S. market.

In the long term, partial localization of Apple’s supply chain will enhance resilience against geopolitical shocks. However, this approach also requires highly coordinated execution, given the company’s reliance on key partners throughout the ecosystem.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates