Apple's iPhone 17 Series Holds Firm on Pricing Withstands Tariff Pressure, but AI Progress Still Lags

01:43 September 10, 2025 EDT

On September 9 local time, Apple Inc. held its highly anticipated 2025 Fall Event, unveiling the iPhone 17 series, AirPods Pro 3, and updated Apple Watch lineup. The event continued Apple’s hardware iteration strategy, emphasizing enhancements in chip performance, imaging systems, and health monitoring features, while integrating AI elements to improve user experience.

Despite the comprehensive product refresh, Apple’s stock opened lower, briefly rallied, but ultimately retreated, closing down 1.48 percent at $234.35 per share. The company’s market capitalization stood at $3.48 trillion. In after-hours trading, the stock declined an additional 0.38 percent, reflecting investor disappointment over the lack of breakthrough innovations in the new products.

Source: TradingView

New Product Specifications and Feature Evaluation

Apple's Launch Event Introduces Four iPhone Models, AirPods Pro 3, and Three Apple Watch Variants, Covering Smartphones, Earphones, and Wearables. Overall, These Updates Emphasize Hardware Specification Improvements and Feature Integration, but Lack Breakthrough Design Innovations Such as Foldable Screens or New Interaction Models. This May Limit the New Products' Appeal to Consumers, Particularly in a Saturated Smartphone Market.

As the Core Revenue Driver, the iPhone Series Now Comprises Four Models Forming a Complete Product Matrix: iPhone 17 Base Model, iPhone Air, iPhone 17 Pro, and Pro Max, Covering a Price Range from US$799 to US$1,199 (RMB 5,999 to RMB 9,999). The Debut of iPhone Air Has Become a Focal Point for Market Attention.

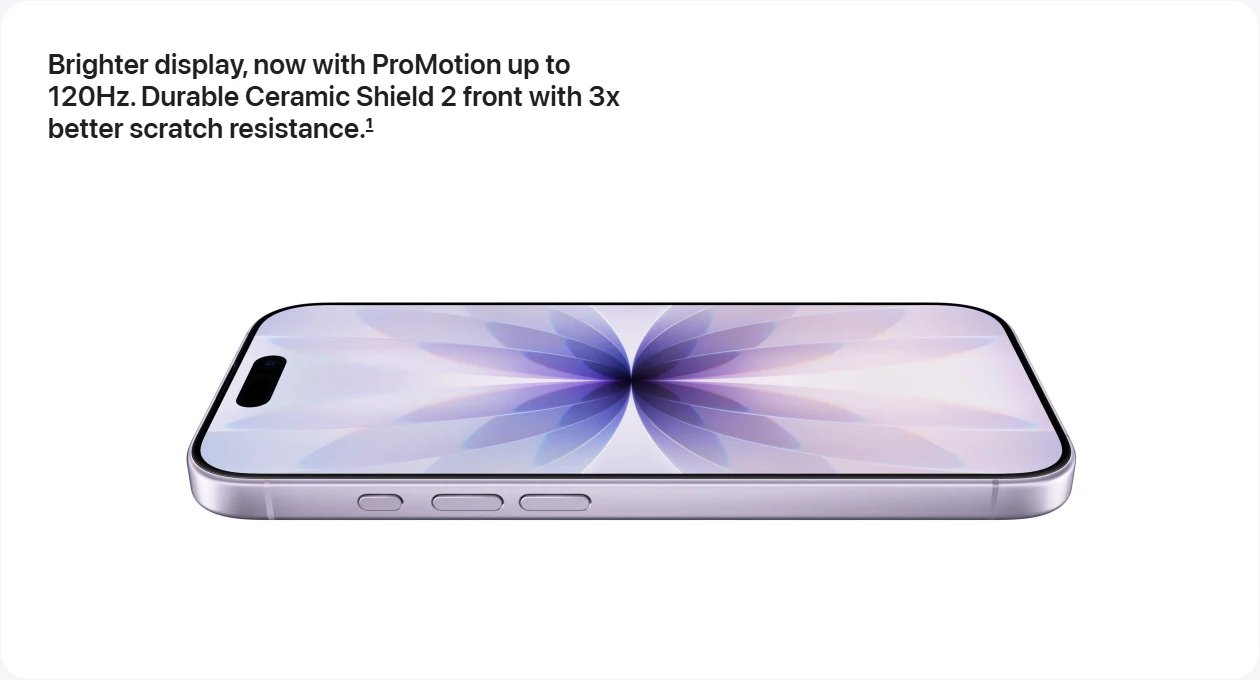

The Technological Evolution of the iPhone Series Demonstrates a Dual Path of Standardizing Basic Features and Specializing High-End Functions. The Base Model iPhone 17 Introduces 120Hz ProMotion Adaptive Refresh Rate Technology for the First Time in a Standard Version, Expands the Screen Size to 6.3 Inches OLED, and Upgrades the Rear Camera to a 48-Megapixel Fusion Dual-Camera System. The Inclusion of Features Previously Exclusive to the Pro Series Significantly Enhances the Base Model’s Competitiveness. Notably, the Storage Strategy Has Been Adjusted: the 128GB Option Has Been Discontinued Across the Series, with 256GB Now as the Entry-Level Storage. The Base Model Maintains the Same Starting Price of RMB 5,999, Adopting a "More for the Same Price" Strategy to Improve Cost-Effectiveness.

Source: Apple

Goldman Sachs Analysts Believe This Adjustment Will Effectively Stimulate Upgrade Demand Among Users Holding iPhone 14 and Earlier Models, Who Account for Nearly Half of the Current User Base.

The Pro Series Achieves Breakthroughs in Performance and Thermal Management. The A19 Pro Chip Delivers a 40% Performance Improvement Over the Previous Generation, Coupled with a New VC Vapor Chamber Cooling System, Enabling a 40% Increase in Sustained Performance Output. The Imaging System Features Three 48-Megapixel Lenses, Supports 8x Optical Zoom and ProRes RAW Format Recording, Strengthening Its Appeal to Professional Creators.

Source: Apple

The iPhone Air, as a New Category, Becomes the "Thinnest and Lightest iPhone" with a Thickness of 5.64mm and a Weight of 165g. It Equips a Streamlined Version of the A19 Pro Chip, Using a Titanium Frame and Ceramic Shield Glass to Balance Lightweight Design and Durability. The 6.5-Inch Screen Boasts a Peak Brightness of 3,000 Nits, Setting a New Record for iPhones.

Source: Apple

Advances in Network Technology Represent a Subtle Highlight of This iPhone Upgrade. All Four New Models Feature Apple’s Custom N1 Wireless Chip, with the iPhone Air Further Incorporating an Upgraded C1X Modulator, Theoretically Supporting Faster Cellular Connections. However, This Model Entirely Eliminates the Physical SIM Tray, Supporting Only eSIM Technology. In Mainland China, It is Exclusively Available to China Unicom Users Who Must Activate the Service Offline at Operator Stores. This Limitation May Impact Its Adoption Rate in the Domestic Market.

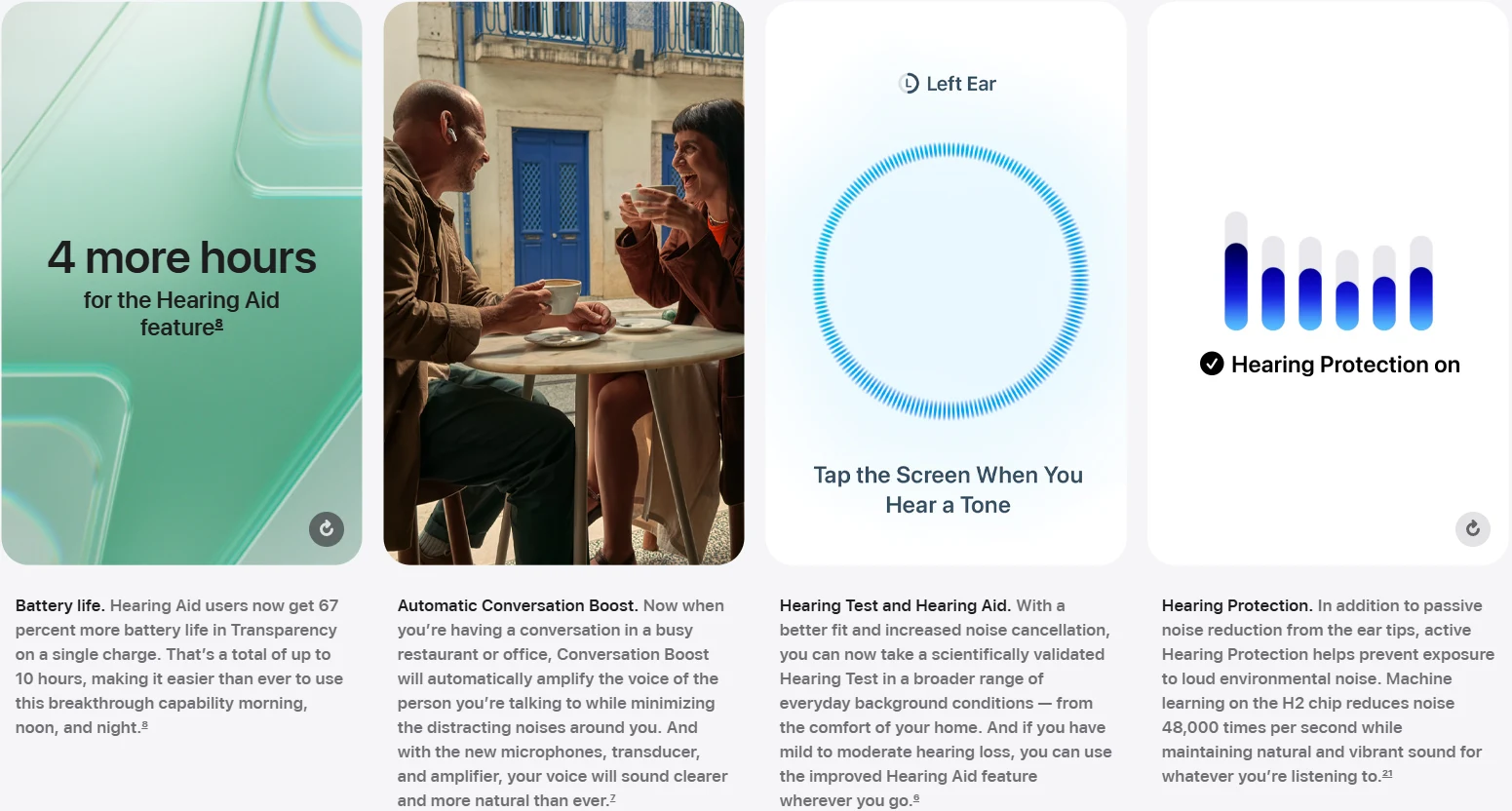

The Wearables Lineup Also Sees Significant Updates. The AirPods Pro 3 Doubles the Active Noise Cancellation Capability Compared to Its Predecessor, Introduces Apple Intelligence-Powered Real-Time Voice Translation for Cross-Language Communication, and Includes a Built-in PPG Heart Rate Sensor Capable of Monitoring Heart Rate Data for 50 Types of Exercises. The Battery Life Per Single Charge Extends to 8 Hours. Priced at RMB 1,899, It Maintains Competitiveness in the High-End Wireless Earphone Market, Despite a Slight Increase from the Previous Starting Price of RMB 1,799.

Source: Apple

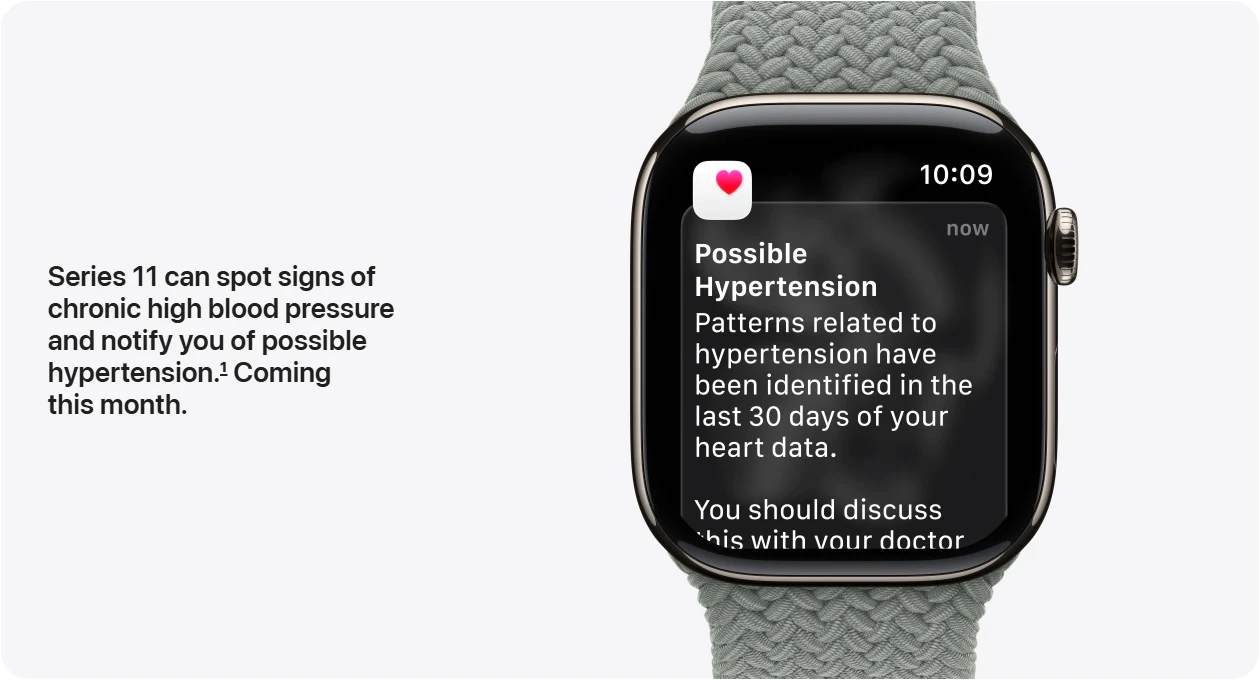

The Apple Watch Series Focuses on Enhancing Health Monitoring and Communication Capabilities. The Series 11 Becomes Apple’s First Smartwatch to Support 5G Cellular Networks, Compatible with All Three Major Carriers in China. It Adds a Hypertension Notification Feature, Using Optical Heart Sensor Data Analyzed Over 30 Days to Detect Signs of Chronic High Blood Pressure. The Ultra 3 Upgrades Satellite Connectivity, with Optimized Antenna Design Doubling Signal Strength, Allowing Users to Send Messages and Share Locations with Emergency Services in Areas Without Cellular Coverage. Its Display Size Sets a New Record for Apple Watch. The SE 3, as the Entry-Level Model, Priced at RMB 1,999, Adds Wrist Temperature Sensing and Sleep Apnea Detection Features, Significantly Improving Its Value Proposition.

Source: Apple

The Overall Logic Behind These Hardware Upgrades Indicates Apple is Gradually Trickling Down Mature Technologies to Lower-Price Segments While Exploring the Boundaries of Professional Features in High-End Models. This Strategy Aims to Expand the User Base While Maintaining Premium Pricing Power for High-End Products. However, It Also Reflects the Reality of a Lack of Era-Defining Innovations—All Improvements Remain at the Level of Parameter Optimization and Feature Integration, Without Breakthroughs Like the Retina Display in iPhone 4 or Face ID in iPhone X.

AI Strategic Progress Continues to Lag Behind

Despite unveiling a range of AI-related features at its latest product launch, Apple’s AI strategy continues to lag behind peers such as Google and Microsoft. The gap lies in technical scale, product rollout pace, and depth of ecosystem integration. According to the event, Apple Intelligence is built primarily on a 3-billion-parameter on-device model, whereas rival cloud-based AI systems generally operate at trillion-parameter scale. Even Apple’s own cloud model reaches only 150 billion parameters, leaving a generational gap in core areas such as natural language processing and multimodal interaction.

Apple has focused its AI applications on three main areas: imaging, health monitoring, and voice interaction. The iPhone 17 series introduces upgraded AI-powered imaging with real-time scene recognition to optimize shooting parameters, intelligent background removal and lighting adjustments in video capture, and—exclusive to the Pro Max model—a multi-focal fusion algorithm that maintains professional-grade image quality from macro shots to 10x optical zoom.

In health monitoring, Apple is pursuing a differentiated path. The Apple Watch Series 11 introduces a heart attack alert system capable of localized risk detection through 48 hours of continuous data analysis, with all processing performed on-device to ensure no data is uploaded to the cloud. This “privacy first” design philosophy remains consistent with Apple’s longstanding approach. Noninvasive blood glucose monitoring, enabled by optical sensors and AI algorithms, allows users to measure glucose levels without blood sampling, expanding the role of wearables in health management. Meanwhile, the AirPods Pro 3 integrate AI into real-time translation and environmental awareness, supporting two-way multilingual instant translation. When combined with active noise cancellation, this delivers seamless cross-language communication, while adaptive environmental sound switching automatically toggles between transparency and noise-cancellation modes depending on user activity.

Source: Apple

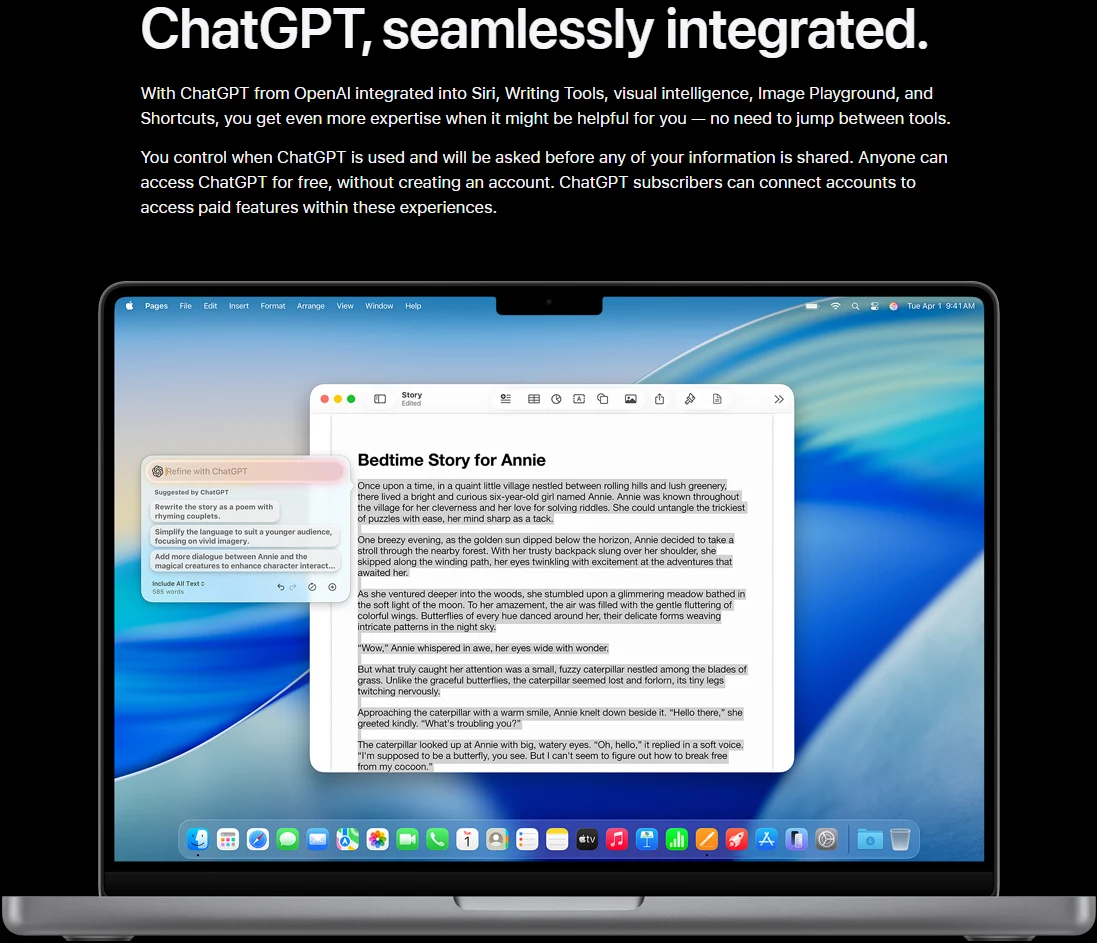

The China-specific architecture of Apple Intelligence illustrates its balance between regulatory compliance and user experience. To align with China’s data security rules, the domestic version adopts a hybrid on-device and cloud-collaborative model: a 3-billion-parameter on-device foundation model processes privacy-sensitive tasks to ensure core data never leaves the device; Baidu’s 7-billion-parameter Ernie Bot handles more complex reasoning tasks, delivering an 18% improvement in Chinese language accuracy over the overseas version of ChatGPT; and Alibaba provides a real-time compliance filter capable of detecting restricted content within 0.3 seconds. While this framework meets regulatory standards, it comes at the cost of slower response times and less seamless AI functionality.

Source: Apple

Market data indicates that Apple’s lagging AI strategy is already eroding its competitiveness. Canalys projects global AI smartphone penetration will reach 34% by 2025, but Apple’s adoption remains relatively slow. In China, Apple still controls nearly 40% of the premium smartphone segment, yet some users are migrating to third-party AI applications due to the limited capabilities of Apple’s native features—posing a potential risk to its market share.

Compared with its clear trajectory in hardware innovation, Apple’s AI strategy appears reactive. On the company’s earnings call, CEO Tim Cook described AI as “one of the most profound technologies of this generation” and disclosed that Apple had acquired seven AI-related companies in 2025. However, these acquisitions have yet to yield breakthrough product experiences. As OpenAI, Google, and others accelerate the integration of large-scale AI models with hardware, Apple’s cautious stance has allowed it to sidestep privacy controversies but may cause the company to miss a critical strategic window to reshape the user experience through AI.

Wall Street's View

Analyst commentary following the launch event was notably divided. Goldman Sachs analysts argued that upgrades to the iPhone 17 series’ display, camera, and processor will effectively drive replacement demand among existing users, projecting iPhone revenue growth of 5% in fiscal 2025 and 7% in fiscal 2026. Morningstar analyst William Kerwin, however, struck a more cautious note on the market potential of the iPhone Air, suggesting that the “slimmed-down” design may not meaningfully boost overall sales.

More pointed criticism came from Forrester Vice President Dipanjan Chatterjee, who underscored the lack of major design changes or form factor innovations, making it unlikely to spark a supercycle of upgrades.

Market reaction to Apple’s pricing strategy has been mixed. According to JPMorgan, Apple effectively raised the starting price of the iPhone 17 Pro by eliminating the 128GB option and setting the base configuration at 256GB. This move shifts the entry price from $999 to $1,099, lifting the average selling price by an estimated $50. While this may help sustain gross margins in the near term, it could intensify price competition with high-end Android models over the longer term. In China, where rivals like Huawei are rapidly iterating AI features, Apple’s price premium faces mounting challenges.

From a technical perspective, Apple shares delivered a three-month cumulative return of 14.35% ahead of the launch, significantly outperforming the S&P 500’s 4.96%. Yet, on a one-year basis, Apple’s return remains negative, lagging the broader index and signaling investor concerns over longer-term growth prospects. Volatility models suggest Apple’s stock may trade within a range of $226.65 to $234.33 in the near term, with a 67% probability of remaining in a consolidation pattern.

Source: TradingView

Meanwhile, several analysts have warned that Apple’s delayed AI rollout could undermine its long-term competitiveness. Current data show Android-based devices with AI features already surpassing 1 billion units, while Apple’s AI penetration stands at just 8%. This raises the risk that Apple could be marginalized in the next wave of AI-driven upgrade cycles.

Apple has announced plans to roll out Apple Intelligence in China by the end of 2025 through partnerships with domestic firms to comply with local regulations. Whether this move will help Apple recover lost ground remains uncertain, as Android rivals are expected to complete another cycle of AI feature upgrades by then, further narrowing Apple’s ability to regain a first-mover advantage.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates