Tesla Falls Back to Reality

21:39 July 24, 2025 EDT

Key Points:

1. In the second quarter of 2025, Tesla reported a broad decline in both revenue and profit, missing market expectations across the board. Revenue from its core automotive segment continued to fall by double digits.

2. Despite the recent weakness in performance, Elon Musk reiterated Tesla’s plans for upcoming vehicle launches. The company’s affordable model is scheduled to begin pilot production in the first half of 2025, with mass production planned for the second half.

3. While Tesla retains its advantages in technology and capital, it continues to face a tug-of-war between ambition and reality amid intense market competition, regulatory hurdles, and execution risks.

After years of hypergrowth driven by lofty expectations, Tesla is entering a new phase—one where it can no longer rely solely on future narratives to sustain its valuation. Although the stock has seen a partial rebound in 2025 on the back of the Robotaxi story, its overall trajectory remains weak. As of July 23, Tesla shares are down roughly 38% from their late-2024 peak, signaling a shift in market sentiment toward heightened skepticism over speculative themes.

Source: TradingView

Tesla’s Q2 2025 earnings show mounting pressure on global vehicle deliveries and declining product competitiveness. Valuation premiums once enjoyed by the company have started to fade. Investors are now re-evaluating the fundamental case for the EV and tech giant—if its AI vision fails to materialize in the near term, what else is left to support confidence in the stock?

Financial Performance

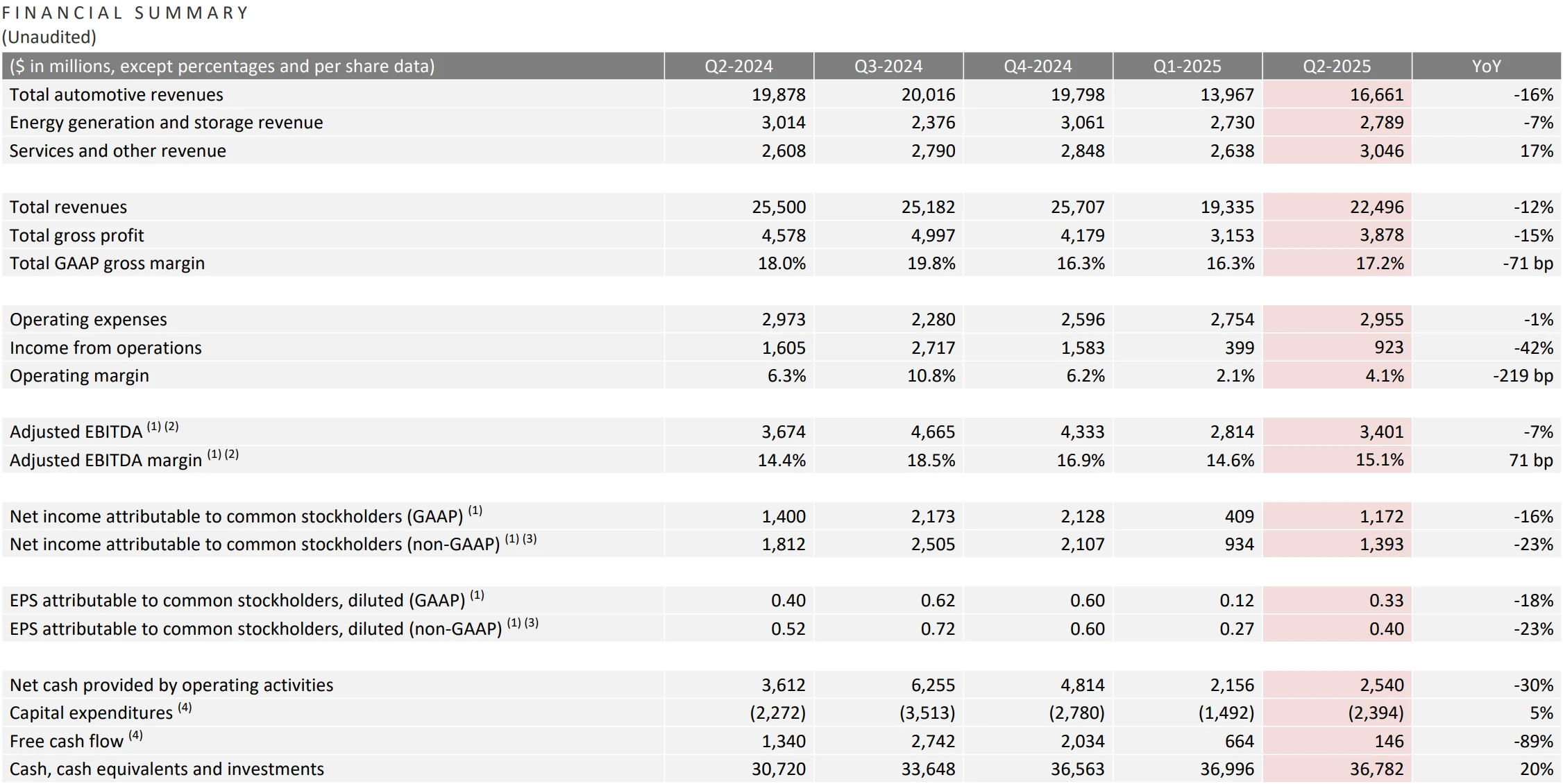

Tesla’s Q2 2025 earnings reveal a broad deterioration across key financial metrics.

Source: Tesla

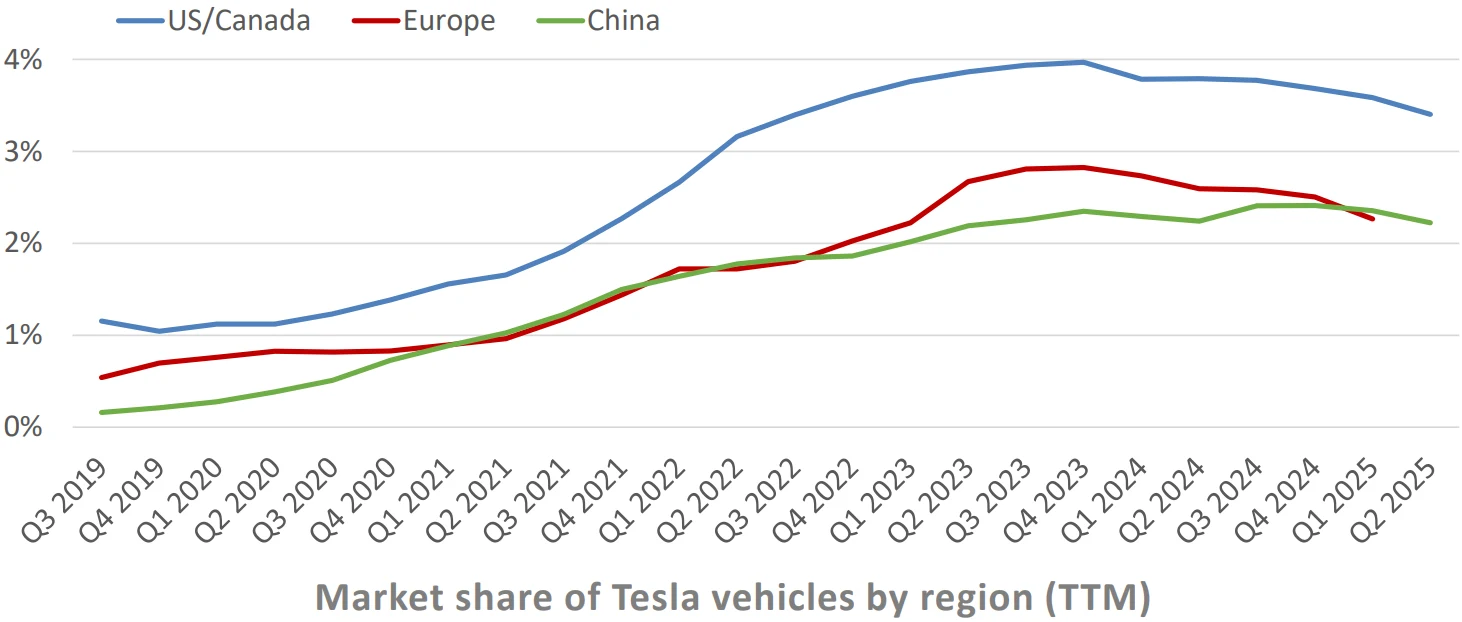

Automotive revenue dropped 16% year-over-year to $16.66 billion, with vehicle deliveries falling 13.5% to 384,122 units from 443,956 a year earlier—reflecting weakening demand and shrinking market share. Excluding regulatory credits, automotive gross margin declined from 18.2% to 15%, pressured by rising raw material costs and pricing adjustments. Regulatory credit revenue fell 50.7% to $439 million, marking a fourth consecutive quarterly decline and signaling waning policy support.

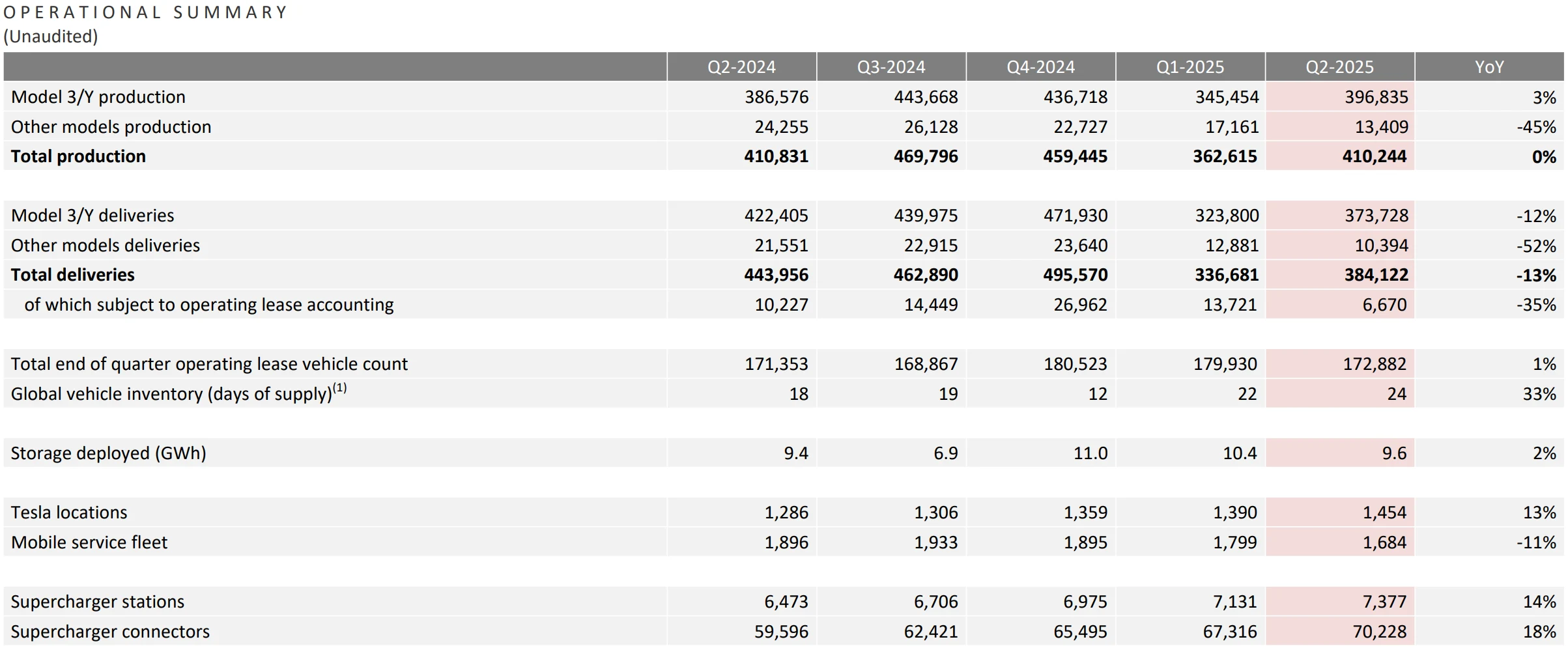

Source: Tesla

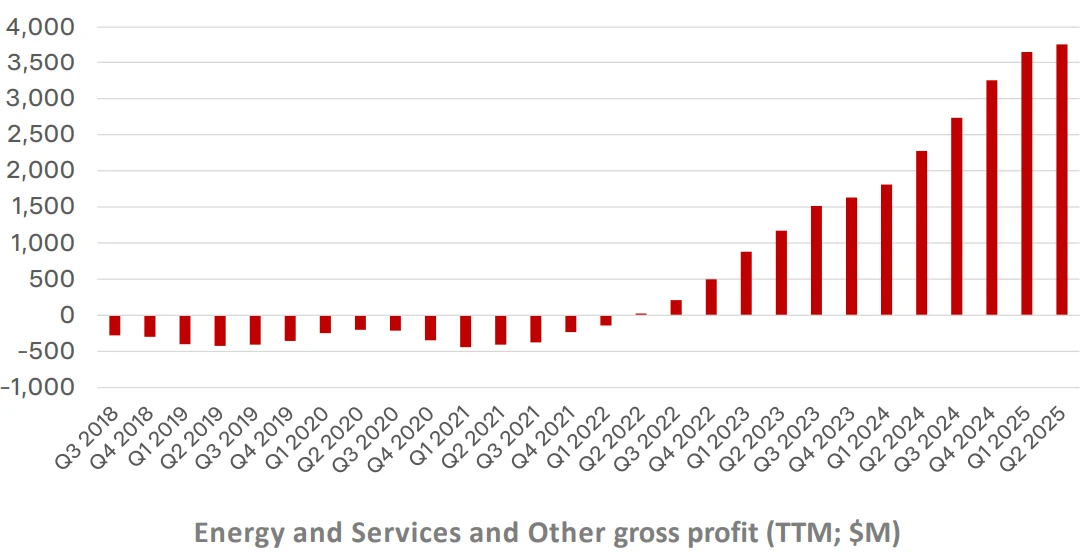

Revenue from the energy segment declined 7% to $2.79 billion, reversing the 67% growth seen in Q1—likely due to tariff-related supply chain disruptions. However, gross profit reached $846 million, supported by continued Powerwall deployments. Service and other revenue rose 17% to $3.05 billion, benefiting from the addition of approximately 2,900 new Supercharger stalls.

Source: Tesla

Operating income dropped 42% to $923 million, and operating margin narrowed from 6.3% to 4.1%. Capital expenditures rose 5% to $2.39 billion, while free cash flow plunged 89% to $146 million. This was partially offset by $3.2 billion in other income and $2.84 billion in digital asset gains—mainly from Bitcoin—masking underlying cash flow pressures.

Tesla’s Q2 performance exposes its vulnerability to external shocks and continued reliance on future technologies to offset stagnation in its core automotive business. While a 12% drop in overall revenue is significant, it was less severe than the 16% decline in vehicle deliveries—suggesting some resilience from the energy and services segments. Still, the sharp 89% decline in free cash flow raises liquidity concerns, especially amid elevated capital spending.

External Pressure

Tesla’s performance has been significantly impacted by external factors, notably the Trump administration’s tariff policies and the phase-out of electric vehicle tax credits.

The company’s Chief Financial Officer, Vaibhav Taneja, estimated that tariffs added approximately $300 million in costs and noted that the expiration of tax credits in September 2025 could further weaken demand. Tesla plans to boost sales efforts before that date and delay new product launches. About 36% of Tesla’s revenue from the Chinese market is affected by the Trump administration’s tariffs on China, with supply chain disruptions impacting the Cybercab project.

Source: Tesla

Additionally, CEO Elon Musk’s involvement with the Trump administration and support for controversial policies has damaged the brand’s reputation. Reports indicate Musk’s public support for certain far-right movements sparked controversy, contributing to a 28% decline in Tesla’s sales in Europe. Meanwhile, China’s BYD has surpassed Tesla as the global leader in electric vehicle sales, eroding Tesla’s pricing power and market position.

A Clouded Outlook

Despite Tesla’s recent performance decline, Elon Musk reiterated the company’s future new vehicle plans. The affordable model is scheduled for pilot production in the first half of 2025 and mass production in the second half, clearly aiming to capture the mass market. However, given the intense competition and extremely low prices from BYD, this plan may struggle to yield quick results. Whether Tesla can truly open a new growth avenue with this affordable vehicle remains uncertain.

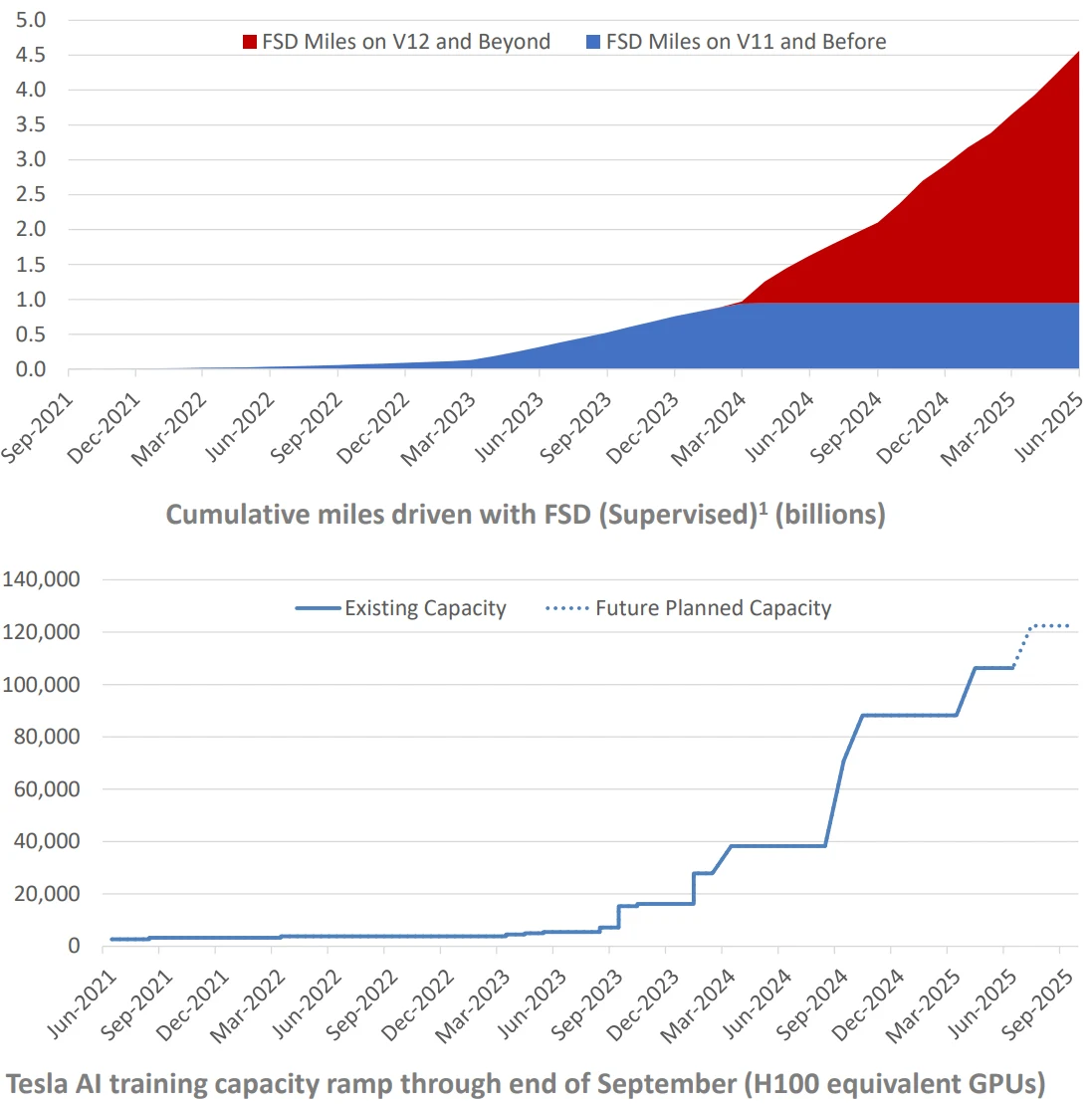

As for the much-anticipated Cybercab autonomous taxi and Semi truck, the company has set a 2026 production target. But considering multiple past delays in autonomous driving projects, on-time delivery remains uncertain and execution risks cannot be ignored. Musk emphasized that the Full Self-Driving (FSD) software is progressing well, with paying users surpassing 4 million, and plans to pilot the system in the EU and Japan in the second half of this year.

Source: Tesla

The Austin Robotaxi pilot is also underway, but California regulators have made clear that Tesla has not yet submitted an application for autonomous driving permits. Regulatory approval remains the biggest bottleneck. Any large-scale rollout must face strict oversight and safety reviews, with the shadow of accident investigations still looming. In contrast, Alphabet’s Waymo is clearly ahead in autonomous driving technology and regulatory compliance, putting Tesla under growing pressure in this race.

Source: Tesla

On the technology front, the Texas Gigafactory added 16,000 Nvidia H200 GPUs, boosting AI training capacity to industry-leading levels. The 4680 battery yield rate improved to 85%, with an 18% cost reduction, and its usage in North American Model Y vehicles increased to 30%. These advancements have indeed enhanced Tesla’s technical competitiveness and cost control, but amid fierce market competition and macroeconomic pressure, external concerns remain.

In terms of capital expenditure, Tesla plans to invest $12-14 billion in 2025, a significant reduction compared to 2024, indicating a strategic shift from traditional capacity expansion toward AI and robotics. While Tesla’s approximately $23 billion cash reserves and steady energy business growth provide some cushion, the effectiveness of future investments is still unclear, and risks cannot be overlooked.

Market analysts show marked divergence in their outlook on Tesla’s future. Bank of America sees tariffs and other external factors as short-term headwinds. Meanwhile, Reuters optimistically predicts that if Robotaxi is successfully commercialized, Tesla’s valuation could surpass $2 trillion by 2029. However, considering Musk’s repeated failures to meet autonomous driving timelines, investors remain cautious toward these optimistic expectations.

Shaken Confidence

Following the disappointing Q2 2025 earnings report, Tesla’s stock price declined after the earnings release.

On July 23, Tesla shares rose $0.45 in regular trading to close at $332.56, up 0.14%. However, as of the market close on the same day post-earnings, Tesla’s stock fell 8.20% to $305.30 compared to the previous trading day, with its market capitalization shrinking to $983.358 billion. Over the past year, Tesla has suffered a cumulative decline of 24%, significantly underperforming the S&P 500 index for the same period.

Source: TradingView

From a technical perspective, the stock remains capped at the $338 resistance level and has yet to achieve a decisive breakout. Without a boost in expectations from improved earnings or policy margins, the stock may continue to trade within a range.

Source: TradingView

Although Tesla holds advantages in technology and capital, it still faces a tug-of-war between “idealism and reality” amid fierce market competition, regulatory bottlenecks, and execution risks. Whether Tesla can deliver on its promises and achieve a genuine transformation remains the core concern for investors moving forward.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates