Investment Signals from Buffett’s Q2 Holdings Adjustments

22:00 August 17, 2025 EDT

Key Points:

Berkshire Hathaway’s second-quarter activity shows a clear contrarian approach, entering UnitedHealth when its stock was halved, resuming Apple reductions, and increasing positions in undervalued sectors such as steel and real estate.

Berkshire’s cash holdings currently stand at $344.1 billion, highlighting a core strategy of buying undervalued assets, selling at high valuations, and maintaining a sufficient safety cushion.

Buffett’s second-quarter portfolio adjustments reflect Berkshire’s consistent strategic logic and offer a reference point for investors.

On August 14, according to filings with the U.S. Securities and Exchange Commission (SEC), Warren Buffett-led Berkshire Hathaway submitted its second-quarter 2025 holdings report (13F) as of June 30, 2025.

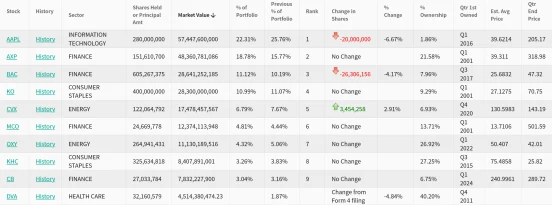

The filings show that in the second quarter, the company added six new stocks, increased positions in six stocks, reduced positions in five stocks, and fully exited one stock. In addition, the top ten holdings accounted for 87.29% of the total portfolio. Overall, Buffett continued to reduce Apple and Bank of America positions while increasing Chevron.

Source: WhaleWisdom

Notably, when Berkshire disclosed its first-quarter holdings in May, it requested certain positions remain confidential, reflecting Buffett’s influence as one of the world’s most prominent investors. Berkshire does not want investors to buy heavily ahead of completed acquisitions.

The market widely speculated that Berkshire might invest in an industrial company. Ultimately, the “mystery positions” included three stocks: Nucor, the largest U.S. steel producer; Lennar, a U.S. homebuilder; and D.R. Horton, one of the largest U.S. real estate developers.

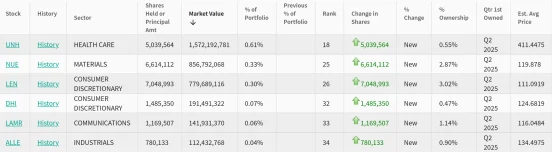

Major New Position in UnitedHealth

As of the end of the second quarter this year, Berkshire Hathaway added six new positions, covering healthcare, steel, real estate, and other sectors. Specifically, the company purchased approximately 5.04 million shares of UnitedHealth, with a quarter-end market value of about $1.57 billion; 6.61 million shares of Nucor, valued at $857 million; 7.05 million shares of Lennar, valued at $780 million; 1.485 million shares of Horton Homes, valued at $191 million; 1.17 million shares of Lamar Advertising, valued at $140 million; and 780,000 shares of Alliant Energy, valued at $110 million.

Source: WhaleWisdom

In the latest holdings disclosed by Berkshire Hathaway, UnitedHealth represented the largest new position for the quarter. The purchase of approximately 5.04 million shares made UnitedHealth the 18th-largest holding in Berkshire’s portfolio, accounting for 0.61% of total holdings. Following the disclosure, the stock reacted sharply, at one point rising nearly 12%.

Source: TradingView

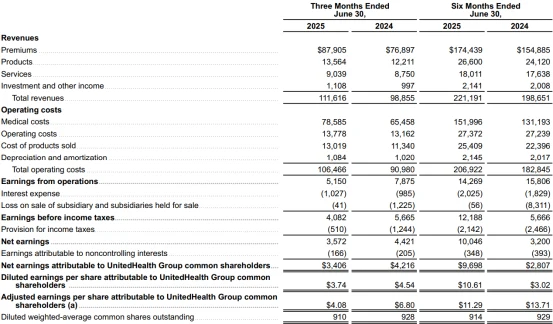

UnitedHealth’s market performance this year has faced significant challenges, with multiple negative developments. From an operational perspective, rising healthcare costs have been a key constraint. In Q2 2025, the company’s operating expenses increased 17% year-over-year to $106.5 billion, while premium-related revenue reached $87.9 billion, up only 14% year-over-year. Medical costs, a critical expense category, rose 20% to $78.6 billion, growing faster than revenue by six percentage points, which significantly compressed profit margins. As a result, net income for the quarter declined 19% year-over-year to $3.4 billion, and the UnitedHealthcare segment’s margin dropped 3.0 percentage points.

Source: UnitedHealth

On the regulatory front, in February, the U.S. Department of Justice (DOJ) opened both criminal and civil investigations into UnitedHealth’s Medicare Advantage billing practices. Regulators suspect the company inflated patient risk scores through improper diagnostic coding to secure higher government reimbursements. In addition, the DOJ filed an antitrust lawsuit to block UnitedHealth’s acquisition of home health company Amedisys.

Cybersecurity issues have also posed significant challenges. In February 2024, subsidiary Change Healthcare suffered a cyberattack, disrupting critical payment systems for healthcare providers nationwide. This triggered investigations by the U.S. Department of Health and Human Services (HHS) and congressional inquiries, requiring federal intervention to manage Medicare and Medicaid payments for several months. UnitedHealth initially denied any patient data breach but later confirmed that 190 million patients were affected, adding $800 million in reserves.

At the executive level, on December 4, the CEO of UnitedHealth, Brian Thompson, was fatally shot outside a Manhattan Hilton hotel, shocking the industry and affecting internal morale and external confidence. In May of this year, CEO Andrew Witty resigned. These multiple negative events contributed to a nearly 50% decline in UnitedHealth’s stock price so far this year.

Source: TradingView

It is worth noting that Buffett has a prior connection with UnitedHealth. He held shares in the company from 2006 to 2009 before exiting in 2010. The current re-entry marks 15 years since his last position. Market observers speculate whether Buffett’s decision reflects the company’s potential value amid current challenges or a long-term view on trends in the healthcare industry.

Continued Apple Reduction, Chevron Increase

In Berkshire Hathaway’s latest second-quarter holdings disclosure, the list of the top ten positions remained largely stable, with only minor ranking adjustments. The top ten are Apple, American Express, Bank of America, Coca-Cola, Chevron, Moody’s, Occidental Petroleum, Kraft Heinz, Swiss Re, and DaVita Healthcare Services.

Looking at specific moves, Berkshire significantly reduced its core technology holdings in Q2. The company sold 20 million shares of Apple, representing a 6.67% reduction, yet Apple remains its largest position by a wide margin. Looking back, Berkshire had cumulatively reduced its Apple holdings by nearly 67% through the first three quarters of 2024, decreasing from 905 million shares to 300 million shares. Reductions were paused in Q4 2024 and Q1 2025, and the Q2 sales marked the resumption of this selling pattern.

Source: WhaleWisdom

During the same period, U.S. equity markets performed strongly. In Q2 2025, the S&P 500 rose 10.57%, the Nasdaq gained 17.75%, and the Dow Jones increased 4.98%. With broad market gains driving tech stock valuations higher, Apple’s share price climbed, yet Berkshire chose to reduce its stake. This likely reflects a cautious view on short-term tech valuations and market volatility, suggesting that Berkshire perceives elevated risk of a pullback after a rapid market upswing.

Source: TradingView

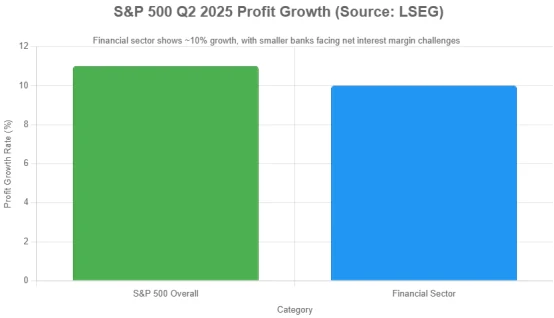

In the financial sector, Bank of America also saw a substantial reduction, with approximately 26.31 million shares sold, a 4.71% quarter-over-quarter decline in holdings, reducing its position value by $1.24 billion. Despite this, it remained Berkshire’s third-largest holding. While overall U.S. markets were strong, the financial sector faces potential pressures from interest rate fluctuations and tighter regulation. According to data from the London Stock Exchange Group, S&P 500 constituent companies saw Q2 profit growth exceeding 11% year-over-year, with financial firms averaging around 10%, though internal structure divergence was evident, and some smaller banks faced net interest margin compression.

Berkshire’s moves reflect a strategy of maintaining core financial positions while adjusting exposure to select banks like Bank of America based on short-term profit expectations. Even amid broad market gains, these adjustments indicate a focus on risk management within sector-specific contexts.

On the buy side, increases were concentrated in traditional and defensive sectors. Among the top ten holdings, only energy giant Chevron was added to, with 3.45 million shares purchased, increasing the position’s value by $495 million quarter-over-quarter, maintaining its fifth-largest position.

Berkshire also increased holdings in Constellation Brands by approximately 1.39 million shares, POOL Corporation by nearly 2 million shares, and aerospace firm Heico, while modestly adding shares in Domino’s Pizza and other consumer and industrial sub-sector companies. These moves further diversified Berkshire’s exposure to traditional and consumer staples sectors. Industry data indicates that although profit growth in the consumer staples sector was modest in Q2, the sector’s stability and lower sensitivity to macroeconomic fluctuations make it a stabilizing factor for investment portfolios during market corrections.

Source: WhaleWisdom

On the divestment side, Berkshire fully exited its position in telecommunications operator T-Mobile, selling all 3.88 million shares, eliminating the 0.4% stake held at the end of Q1. The telecom sector currently faces multiple challenges, including large 5G deployment costs, a mature competitive landscape, and plateauing user growth. Overall, the sector’s performance lagged significantly behind the S&P 500 in Q2, with many companies reporting weak earnings growth.

Source: TradingView

Net Seller for 11 Consecutive Quarters

Looking at the overall data, as of the end of Q2, Berkshire Hathaway’s total equity holdings were valued at $257.522 billion, down $6.254 billion from $263.776 billion in the previous quarter. In Q2 2025, the company purchased approximately $4 billion in stock while selling around $7 billion, marking its 11th consecutive quarter of net equity sales.

As of the end of June, Berkshire’s cash and cash equivalents totaled $344.1 billion, a multi-year high, highlighting the company’s focus on maintaining a “margin of safety” and preserving firepower for future investment opportunities.

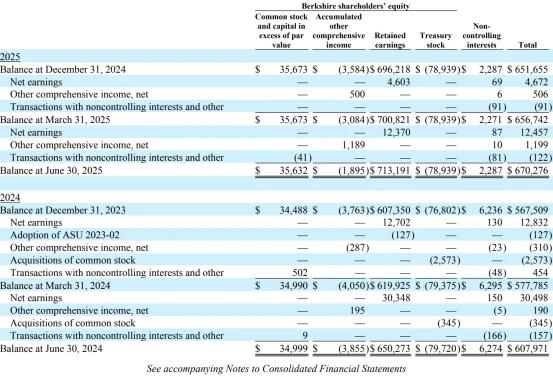

Source: Berkshire Hathaway

It is worth noting that in May, 94-year-old Warren Buffett announced that he will officially retire at the end of 2025. His retirement is not health-related but reflects long-term planning for the company’s future. He emphasized that he has no intention of selling his Berkshire shares, which will ultimately be donated in full, and he stated that he will remain “in the background” to provide support for the company under special circumstances.

At the shareholder meeting, Buffett also expressed concerns about U.S. trade policy, warning that the misuse of tariff tools could have far-reaching negative consequences. Berkshire’s financial statements similarly noted that rapidly changing trade policies, including tariffs, could affect the company’s operating performance, though the specific impact remains “unpredictable at this time.”

Investment Insights

Buffett’s Q2 portfolio adjustments reflect Berkshire Hathaway’s consistent, clear strategic logic and offer actionable insights for investors. First, investing requires patience and a willingness to act counter to prevailing sentiment. Buffett rebuilt a position in UnitedHealth when market sentiment was weak and the stock had dropped sharply, rather than chasing short-term hot sectors. This demonstrates that investment decisions should be based on long-term value rather than market swings or public opinion. His request for Q1 holdings to remain confidential further illustrates the principle of patient capital allocation—successful investing takes time to prove itself, not publicity.

At the same time, Berkshire’s portfolio is not simply diversified; it is a cross-industry selection of high-quality assets, centered on the core logic of buying undervalued opportunities. Unlike retail investors who often “scatter their bets,” Buffett prefers concentrated positions in a few high-conviction opportunities rather than holding many under-researched stocks. For individual investors, portfolio management should reduce risk without sacrificing returns, and should not rely on blind averaging.

Buffett also emphasizes maintaining ample liquidity. As of Q2, Berkshire’s cash reserves reached $344.1 billion, alongside 11 consecutive quarters of net stock sales, reflecting disciplined profit-taking at high valuations and patience in waiting for better opportunities. Cash is not idle—it is ammunition for future investments. In an environment of heightened market uncertainty, holding sufficient cash allows decisive purchases of high-quality assets during pullbacks and avoids forced sales at low points.

Moreover, position sizing should align with research depth and investment conviction. Berkshire’s increased stake in Chevron and new position in UnitedHealth illustrate concentrated allocations to high-certainty opportunities, while the complete exit from T-Mobile demonstrates a “get out if you don’t believe” approach. Many investors today misalign position size and conviction, overcommitting to unfamiliar stocks while hesitating to allocate enough to the opportunities they truly believe in.

Overall, Buffett’s investment approach is grounded in value judgment, patient allocation, and disciplined management. It does not rely on extraordinary talent but follows a method that can be understood and applied. Rather than focusing on individual trades, the more important lesson lies in the underlying long-term thinking and discipline that drive those decisions.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates