Tesla’s Diverging Performance in China and the U.S. Puts Strategic Shift to the Test

03:30 September 9, 2025 EDT

Tesla’s latest sales data reveal a starkly contrasting picture. First, Tesla’s Shanghai factory posted wholesale deliveries of 83,192 vehicles in August, marking a new high for the year and a 22.6% month-over-month increase. Among them, the Model Y led the Chinese market with 58,888 units sold, reclaiming its position at the top of the sales leaderboard.

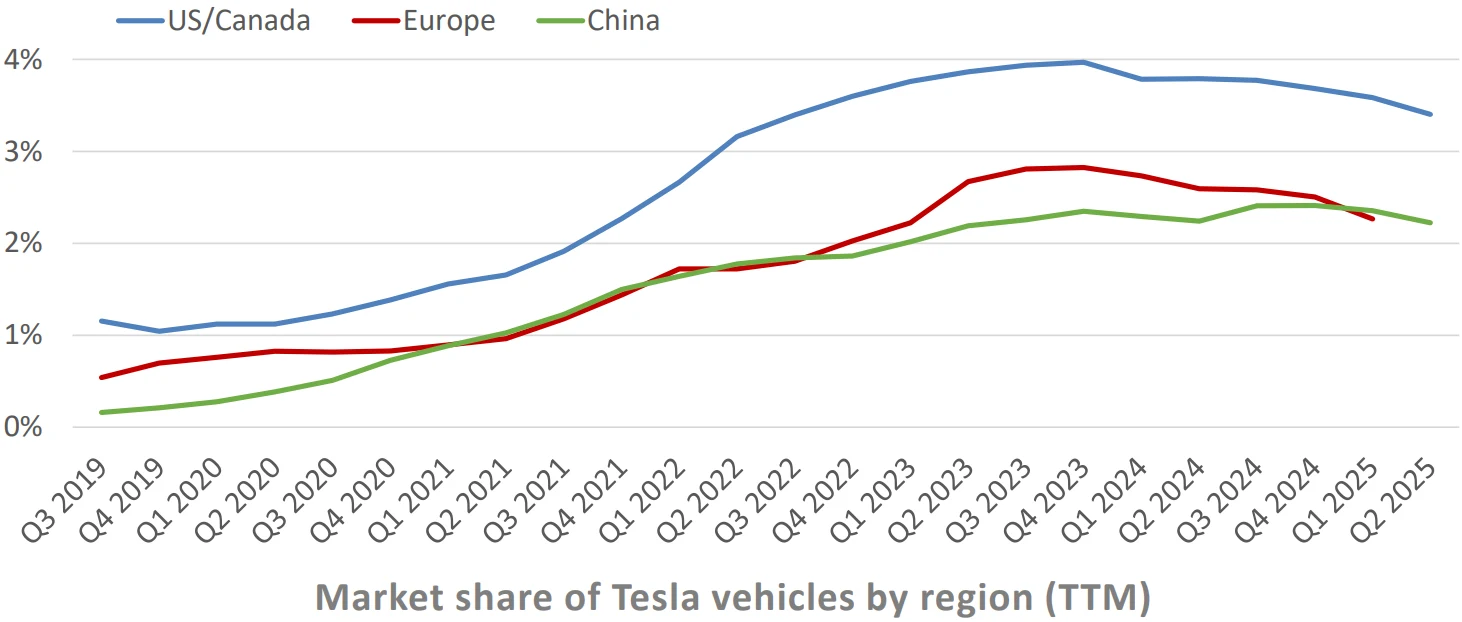

However, the other side of China’s growth story is Tesla’s continued struggles in the North American market. Cox Automotive data show that Tesla’s U.S. electric vehicle market share has plummeted from around 65% in 2022 to 38% in August 2025, hitting its lowest level since October 2017.

Market Divergence

Tesla’s performance in the world’s two largest automotive markets has shown a pronounced divergence. According to the China Passenger Car Association, nationwide wholesale deliveries of new energy passenger vehicles reached approximately 1.3 million units in August, up 24% year-over-year and 10% month-over-month. Tesla’s Shanghai factory posted wholesale deliveries of 83,192 vehicles in August, a 22.6% month-over-month surge; although still down 4% year-over-year, the strong sequential growth clearly signals a market recovery.

In contrast, Tesla’s performance in the U.S. market remains disappointing. A 38% market share is not only far below the previous peak of 80% but also marks the lowest level since October 2017.

This contrast highlights the contradictions in Tesla’s global strategy. In China, the Model Y maintains competitiveness through a starting price of 263,500 yuan (2025 rear-wheel-drive model) and continuous software updates, while the U.S. market faces strong competition from models such as the Hyundai IONIQ 5 and Ford F-150 Lightning. The situation is further complicated by inventory dynamics: Tesla’s inventory turnover was roughly 7 days in 2023, but as of August 9, 2025, inventory turnover had risen to 61.29 days.

Stephanie Walders-Striti, Director of Industry Insights at Cox Automotive, noted: “I know they are positioning themselves as a robotics and AI company. But when you are an automotive company, if you don’t have new products, your market share will start to decline.”

Core Business Under Pressure

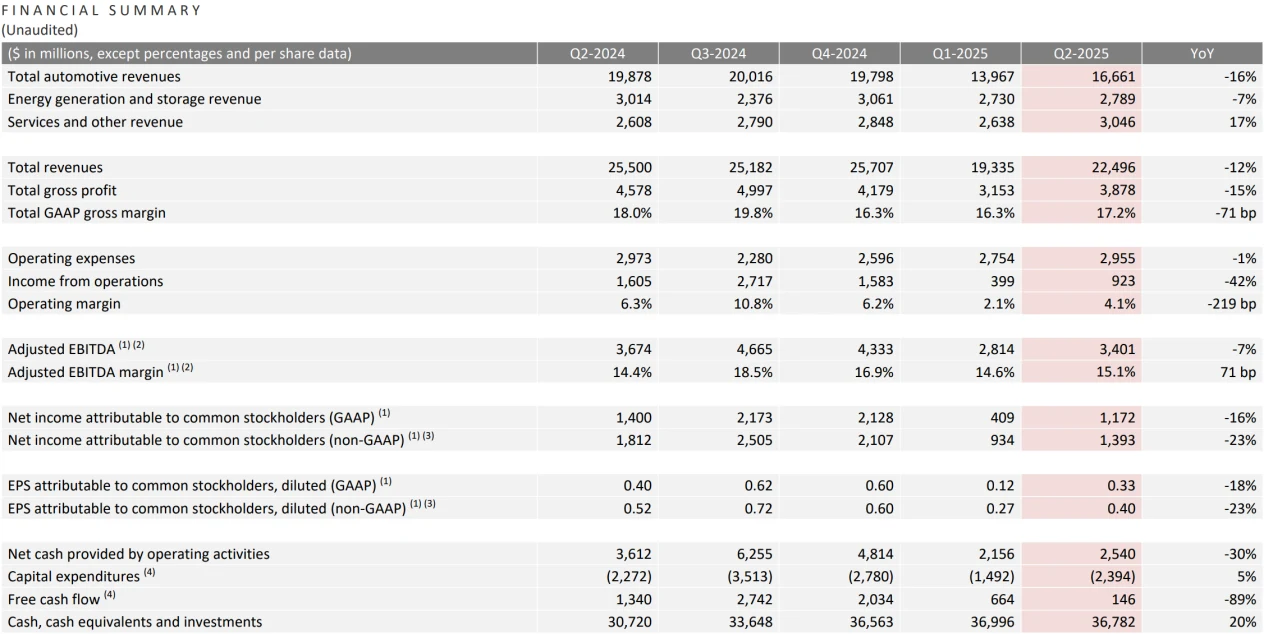

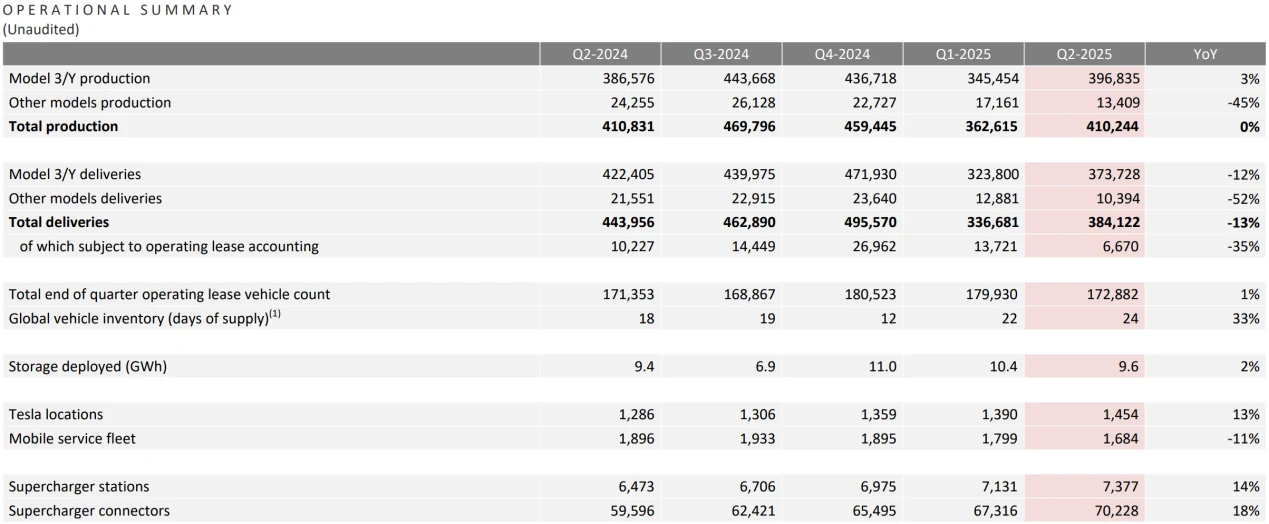

Tesla’s Q2 2025 earnings report shows the company is under significant financial pressure. Total revenue for the quarter reached $22.496 billion, down roughly 12% from $25.5 billion in the same period last year. Vehicle sales revenue was the most affected segment, totaling $16.661 billion this quarter, a 16% decline from $19.878 billion in Q2 2024.

Source: Tesla

Tesla’s gross margin also fell, dropping from 18% a year ago to 17.2%. Operating income came in at $923 million, a 42% year-over-year decline, with the operating margin falling to 4.1%. Net income attributable to Tesla shareholders was $1.172 billion, down 16% year-over-year, while adjusted net income was $1.393 billion, a 23% decline.

Source: Tesla

Of particular concern to investors, free cash flow fell sharply to $146 million, an 89% decrease from $1.34 billion in the same period last year.

Intensifying Competition

In the Chinese market, Tesla faces strong competition from domestic brands such as BYD, as well as the rapid rise of emerging players like Xiaomi.

In August 2025, BYD sold 373,600 vehicles, with exports exceeding 80,000 units for the month. Geely sold 250,200 vehicles, with new energy vehicles accounting for more than half of sales, and both pure electric and plug-in hybrid models posting year-over-year growth of over 90%. XPeng delivered 37,700 units, up 169% year-over-year, while Leapmotor saw sales rise 88% to 57,100 units. These figures indicate that Chinese automakers are not only increasing volume but also strengthening their capabilities in technology and cost control.

In the U.S. market, competitors such as Hyundai, Kia, Toyota, and Honda have stepped up incentives, driving a 120% increase in electric vehicle sales in July.

Although Tesla’s sales in August still grew 3.1%, the overall EV market expanded by 14%, highlighting the company’s underperformance relative to the sector.

From Automobiles to Robotics and AI

Facing intensified market competition and financial pressure, Tesla is actively advancing its strategic transformation. On September 2, 2025, Tesla officially released the fourth chapter of its “Master Plan,” with a noticeably greater emphasis on AI and robotics. The core vision is to “build products and services that bring artificial intelligence into the physical world,” ultimately achieving “sustainable abundance.”

Elon Musk reiterated the strategic significance of the robotics business for Tesla, stating: “In the future, roughly 80% of Tesla’s value will come from the Optimus robot.”

In terms of product planning, Tesla is pushing forward both autonomous vehicles and the humanoid robot Optimus. The company has launched a Robotaxi autonomous driving pilot in Austin, Texas, and plans to expand the service to the Bay Area and other states by year-end.

Source: Tesla

For the Optimus humanoid robot, Tesla plans to release the third-generation prototype by the end of 2025 and begin mass production in 2026, aiming to reach an annual production scale of one million units within five years.

Source: Tesla

However, Tesla’s strategic transformation faces multiple challenges. As of July 2025, actual Optimus production has reached only a few hundred units, far below the originally planned 5,000 units. Tesla’s Q2 earnings report showed overall operational pressure, with declining vehicle deliveries leading to parts initially intended for robots being reallocated to automotive production lines, further delaying Optimus mass production.

From a technical perspective, the design of the robotic hand faces major challenges. Achieving high degrees of freedom in a confined space imposes stringent requirements on material strength, weight, and wear resistance. Purely vision-based systems encounter delays in object recognition in complex environments, and the perception range has blind spots.

Supply chain risks are also significant. China’s export controls on rare earths pose raw material risks for Optimus. Each robot’s arm joints rely on high-performance neodymium-iron-boron magnets, consuming 3.4 kilograms per unit. At a planned capacity of one million units annually, demand would reach 3,400 tons, while China controls the majority of global terbium and dysprosium oxide supplies. In terms of market competition, preliminary statistics from the New Strategic Humanoid Robotics Institute show that, as of April 2025, there are over 300 global humanoid robot companies, with more than 150 based in China.

Deutsche Bank projects that by 2035, Optimus will generate annual revenue of $10 billion with sales of 200,000 units. By comparison, Tesla’s 2024 revenue was approximately $97.69 billion. For Optimus to contribute 80% of Tesla’s value, annual revenue would need to reach $390.8 billion, highlighting a massive gap.

Challenging Transformation

Tesla plans to launch a new affordable all-electric model in Q4 2025, with a starting price potentially as low as 150,000 yuan. This move could trigger a new wave of market volatility while further eroding Tesla’s brand value. Tesla also stated that the more economical model entered production in June 2025, with capacity gradually ramped up during the current quarter, and the new model scheduled for release in Q4 2025.

However, external challenges persist. U.S. government tariff policies have increased costs by roughly $300 million, and the imminent expiration of EV tax credits could further weaken demand. Elon Musk’s previous role as a “Government Efficiency Advisor” under the Trump administration, along with certain controversial policy positions, has also posed reputational risks for the brand.

Source: Tesla

Currently, Tesla plans to begin mass production of the Optimus humanoid robot in 2026, targeting an annual output of one million units within five years. Yet Deutsche Bank’s projections reveal a stark gap between ambition and reality: by 2035, Optimus is expected to generate $1 billion in annual revenue with sales of 200,000 units.

To achieve the target of contributing 80% of Tesla’s value, Optimus would need annual revenue of $390.8 billion, equivalent to 39% of the global market and a unit price of $726,100—far from Musk’s pledged cost target of $20,000 to $30,000 per robot.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates