Prospects for Fed Rate Cuts as Inflation Rebounds

03:15 June 30, 2025 EDT

Key Points:

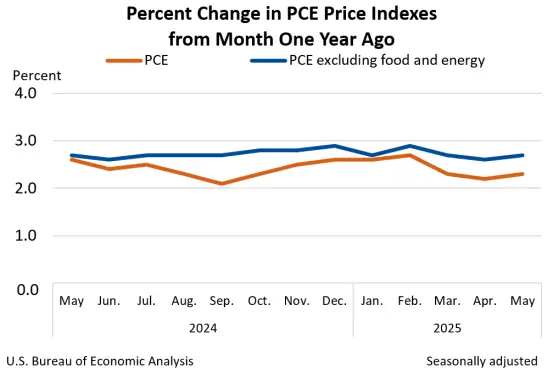

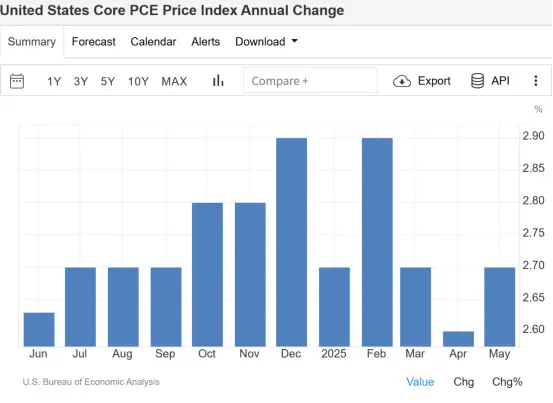

1. The core PCE price index rose 2.7% year-over-year and 0.2% month-over-month in May, both higher than market expectations.

2. The data breaks a three-month streak of declining core PCE, with year-over-year growth now holding above 2.5% for three

consecutive months—well above the Federal Reserve’s 2% policy target.

3. If June’s nonfarm payrolls data disappoint and July’s CPI shows cooling inflation, the Fed may move to cut rates.

In May 2025, the U.S. core Personal Consumption Expenditures (PCE) price index rose 2.7% year-over-year, exceeding both market

expectations and the Federal Reserve’s 2% inflation target. Against the backdrop of renewed tariff pressure from the Trump administration,

the trend of rising inflation could intensify, making the Fed’s rate-cutting window increasingly narrow and complex.

Inflation Pressures Intensify

On June 27, the U.S. Department of Commerce reported that the core Personal Consumption Expenditures (PCE) price index—excluding

food and energy—rose 2.7% year-over-year in May, higher than the market expectation of 2.6% and April’s upwardly revised 2.6%. On a

monthly basis, core PCE increased 0.2%, exceeding both the forecast of 0.1% and April’s 0.1% gain.

Source: BEA

As the Fed’s preferred inflation gauge, the core PCE index carries a target annual rate of 2%. The May reading ended a three-month streak

of declining inflation, suggesting underlying price pressures may be stronger than anticipated. Notably, the core PCE has now held above

2.5% year-over-year for three consecutive months, well above the Fed’s 2% goal, indicating inflation has not been effectively contained.

Source: Trading Economics

The headline PCE index—which includes food and energy—rose 2.3% year-over-year, in line with expectations and slightly above April’s

upwardly revised 2.2%. On a monthly basis, it climbed 0.1%, also matching forecasts. Falling gasoline prices helped temper overall inflation,

mirroring the trend seen in the May Consumer Price Index (CPI).

Importantly, May marks the first full month of implementation for the Trump administration’s “reciprocal tariffs” policy, which began in April.

The stronger-than-expected rise in core PCE may already be partially reflecting the inflationary pass-through effect of those tariffs.

Consumer Spending Cools

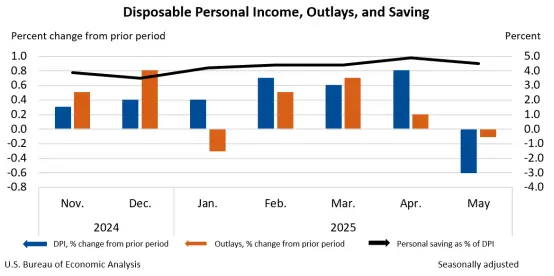

In contrast to the rebound in inflation, consumer spending unexpectedly declined in May, falling 0.1% month-over-month, below market

expectations for a 0.1% increase. Personal income also dropped 0.4% year-over-year, marking the first annual decline since 2021. While

part of this may reflect technical factors—such as the expiration of one-off Social Security benefits—the underlying trend shift is difficult to

ignore.

Source: BEA

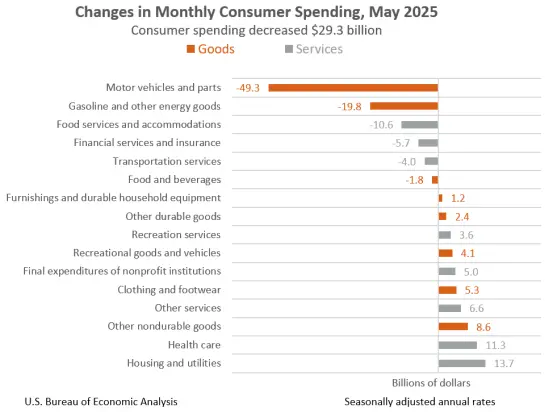

Breaking down the data, goods spending fell by $49.2 billion, with notable declines in automobile and gasoline purchases. While services

spending still grew, categories such as healthcare and financial services saw reductions. Multiple surveys indicate that consumer

confidence in the economic outlook is weakening. With expectations of new tariffs on the rise, post-“front-loading” demand has given way to a clear loss of spending momentum.

Source: BEA

CIBC economist Katherine Judge noted: “This may reflect a combination of tariff effects, slowing growth, and shifting consumer sentiment.

As inflation remains sticky while growth softens, the risk of stagflation is being repriced by the market.”

The Case for Rate Cuts

Faced with this data combination, the Federal Reserve’s policy dilemma has become increasingly pronounced. While the federal funds rate

remains elevated at 4.25%–4.50%, the rebound in inflation and weakening consumer demand are offsetting forces—on one hand, the

inflation fight is far from over; on the other, economic momentum is starting to cool.

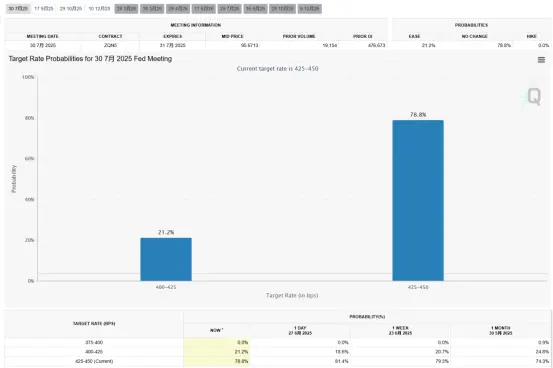

Federal funds futures show that market expectations for a July rate cut have diminished. According to the CME FedWatch Tool, there is a

78.8% probability that rates will be left unchanged in July. However, bets on a September rate cut remain strong, with markets pricing in

over a 70% chance of at least one cut in the next six months.

Source: CME

If the June nonfarm payroll report shows signs of labor market softness, and the July CPI confirms a disinflation trend, the Fed may

proceed with easing. Goldman Sachs projects 25-basis-point cuts per move, aiming for a gradual path to balance growth risks with inflation

concerns.

Still, the decision path is far from straightforward.

While weaker consumer spending may help contain inflation in the short term, structural inflationary pressures remain elevated. Housing

rents, service-sector wages, and medical costs continue to run high.

Adding to the complexity is the July 9 deadline for the current pause in tariff actions. If the Trump administration moves ahead with 20–50%

tariffs on certain countries—as it has threatened in the case of Canada—price pressures could escalate, further narrowing the Fed’s room to

ease. Henrietta Treyz of Veda Partners notes that maintaining the current 10% tariff rate would be the “best-case scenario,” but the risk of

escalation remains significant.

This means that even if upcoming jobs data show signs of slowing, the Fed may not rush into rate cuts—especially with fears of prematurely

easing and triggering a “second wave” of inflation. If tariffs continue to push prices higher and core inflation stays above 3%, the central

bank could be forced to delay the first cut until December or even early 2026.

Meanwhile, Donald Trump’s renewed public criticism of Fed Chair Jerome Powell, coupled with hints at a “shadow replacement,” could inject

further uncertainty into the Fed’s decision-making process—raising concerns over the Fed’s independence and the coherence of future

policy direction as the election draws near.

Bottom Line

The stronger-than-expected 2.7% year-over-year rise in May core PCE, coupled with inflationary pressures from new tariff policies, has

reduced the likelihood of a rate cut in July. Markets now see September as the more probable starting point for Fed easing. While declining

consumer spending and income suggest a slowing economy, persistent inflation and tariff uncertainty limit the Fed’s policy flexibility.

The upcoming June jobs report and July CPI data will be key in shaping expectations. If they point to further economic weakness and

cooling inflation, the case for a September rate cut will strengthen. However, for markets, the current optimism in equities may be

underestimating the macro volatility risks heading into the second half of the year.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates