Nvidia Will Surpass Apple to Become the Most Valuable Company in History

03:53 July 18, 2025 EDT

Key Points:

1. On Thursday, July 3, Nvidia's market capitalization reached $3.89 trillion, briefly touching $3.92 trillion during the day, surpassing Apple's historical record of $3.915 trillion set in December 2024.

2. Wall Street analysts predict that Nvidia could exceed a $5 trillion market cap within the next 18 months.

Amid intense competition in the global tech stock space, Nvidia is undeniably at the center of attention. On July 3, 2025, as Wall Street's optimism around the AI (artificial intelligence) wave continued to grow, Nvidia's stock hit a historic high, with its market cap nearing $4 trillion, making it the closest tech company to the title of the world’s most valuable company, behind Apple.

In regular trading on Thursday, Nvidia's stock rose by 1.33%, but it fell by 0.06% in after-hours trading. Year-to-date, the stock has gained 18.67%. Currently, Nvidia is just about 3% away from crossing the $4 trillion market cap threshold.

Source: TradingView

Rapid Market Value Growth

Nvidia's stock price surge is largely driven by its dominance in the AI space, particularly in the production and application of Graphics Processing Units (GPUs). As AI technology rapidly advances, Nvidia has become the hardware supplier of choice for numerous major companies and research institutions. From 2021 to 2025, Nvidia's market capitalization has increased nearly 8-fold, soaring from $500 billion to nearly $4 trillion. This growth reflects market expectations for its future profit expansion and highlights investor optimism surrounding AI technology.

As of the close of trading on July 3, 2025, Nvidia's market cap stood at $3.89 trillion, briefly touching $3.92 trillion during the day, surpassing Apple's historical high of $3.915 trillion set on December 26, 2024. The current stock price is $159.60, marking a 68% rebound from its low on April 4 and a 18.67% year-to-date increase.

Source: TradingView

Currently, Microsoft ranks second with a $3.7 trillion market cap, while Apple's market cap has fallen to $3.19 trillion, placing it in third. If Nvidia’s stock rises by about 3% to $163.93, it will become the first company globally to surpass the $4 trillion market cap threshold.

Driving Factors

Since the end of 2024, Nvidia's stock price has continued to rise, reflecting Wall Street's recognition of the profound potential of AI technology. Major tech giants like Microsoft, Amazon, and Google are also actively investing in AI technology, driving demand for high-end AI chips. This trend indicates that AI has become the core growth engine of the tech industry and is expected to continue dominating investment trends in the coming years.

In a report from July 2025, Wedbush analyst Dan Ives stated that both Nvidia and Microsoft are likely to break through the $5 trillion market cap barrier within the next 18 months. Ives pointed out that the growth of AI technology will bring at least $2 trillion in market spending, and this massive influx of capital will further propel Nvidia’s stock price. The analyst believes that the widespread application of AI technology across businesses and governments will continue to drive strong demand for Nvidia's products.

According to data from LSEG, Nvidia's current market capitalization has already surpassed the combined market caps of the Canadian and Mexican stock markets, and has exceeded the total market value of all listed companies in the UK. As a core hardware supplier in the AI field, Nvidia is poised to continue benefiting from the growth momentum in the coming years. Particularly with the rise of emerging markets such as data centers, autonomous driving, and generative AI, Nvidia's GPU demand is expected to keep growing.

Can it go higher?

Despite Nvidia's stock price continuing to rise, its current price-to-earnings (P/E) ratio remains reasonable. The stock is recently trading at around 32 times analysts' projected earnings for the next 12 months, which is lower than its average forward P/E of about 41 times over the past five years. This indicates that the market's expectations for Nvidia's future earnings growth remain at a steady level.

Therefore, despite the significant price increase, Nvidia's valuation is not considered excessively high from a P/E perspective. In fact, it suggests there is still room for growth.

Tony Kim, Head of Global Technology at BlackRock, believes that the rapid advancement of AI capabilities, coupled with untapped use cases and efficiency gains, will drive further adoption. Currently, AI applications are limited to routine tasks and virtual assistants, and full deployment of autonomous driving and robotics has not yet occurred, indicating that the industry is still in its early stages.

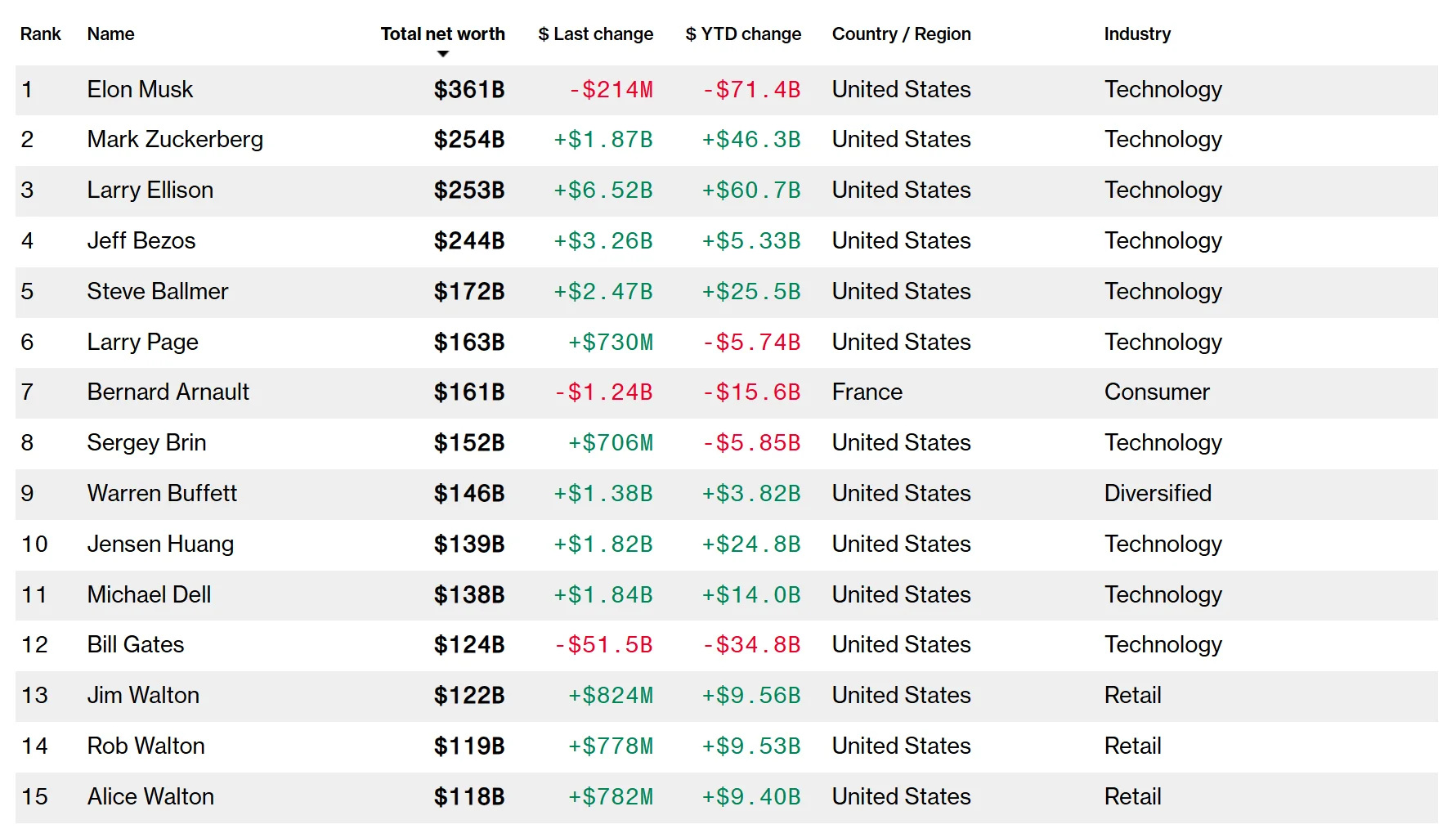

It's also worth noting that as Nvidia's stock price continues to climb, CEO Jensen Huang's net worth has also risen. According to Bloomberg’s Billionaire Index, Huang's net worth has increased by $24.8 billion this year alone, reaching $139 billion, placing him 10th among the world’s richest individuals.

Source: Bloomberg

Billionaire investor Mark Cuban predicts that AI will help create the world's first "trillion-dollar billionaire," a person who will find an innovative, undiscovered way to leverage artificial intelligence.

Currently, AI is limited to everyday tasks and virtual assistants, and autonomous driving and robotics are yet to be fully deployed, showing that the industry is still in its infancy. Nvidia is positioned at the heart of this transformative wave. As one of the world's most valuable companies, Nvidia's market cap surpassing $4 trillion seems to be a matter of time, and its leadership in AI could become the key driver of investment returns over the next decade.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates