Tesla's Challenges Go Beyond Musk's Political Actions

02:50 July 16, 2025 EDT

Key Points:

1. Recently, Elon Musk publicly criticized the "Big and Beautiful" bill signed by Trump and announced the creation of the "American Party."

2. Tesla's global vehicle deliveries continued to decline in the first half of 2025.

3. Despite Tesla's stock price plunge, Cathie Wood of Ark Invest remains optimistic about the company.

Tesla has once again found itself embroiled in a public controversy due to the actions of CEO Elon Musk. On July 5, 2025, Musk announced the formation of the "American Party" and revealed plans to run for a seat in the U.S. Congress during the 2026 midterm elections. This political move instantly triggered another round of volatility in Tesla's stock price, which dropped nearly 7% on July 7. Year-to-date, Tesla's stock has fallen over 25%, making it the worst performer among the seven largest U.S. tech stocks.

For many long-term Tesla investors, Musk's increasing political involvement has led to growing frustration. Dan Ives, an analyst at Wedbush, clearly stated that many investors are disheartened by Musk’s "ongoing political involvement." In the eyes of these investors, Tesla could get back on track if Musk would focus more on the business and reduce his political activities.

Musk's Political Activities

On July 5, Elon Musk announced the formation of the "American Party" with the goal of securing a Congressional seat in the 2026 U.S. midterm elections. This move is seen as a signal of Musk's deeper involvement in U.S. politics, following his controversial support for Trump during the 2024 presidential election and brief involvement with the "Office of Government Efficiency." This latest political maneuver directly impacted Tesla's stock price. After the "American Party" announcement on July 7, Tesla's stock dropped by 6.79%, leading to a market capitalization loss of approximately $68 billion.

Source: TradingView

Additionally, Musk publicly criticized the "Big and Beautiful Bill" (BBB) signed on July 4, calling it a "hindrance to clean energy development" and claiming it would cause "long-term damage to the electric vehicle industry." The BBB, pushed by the Trump administration, reduces electric vehicle tax credits and supports traditional energy, directly conflicting with Musk's sustainability goals. This public criticism has only heightened tensions with political figures, including President Trump, who signed the bill.

Investor reactions to Musk's increased political engagement have been sharp. Analyst Dan Ives has expressed discontent, stating that Musk's political activities are distracting the company during a crucial period. Ives recommended that Tesla's board limit Musk's political involvement and implement a new compensation plan to ensure his focus, which would include granting Musk 25% voting control to facilitate a potential merger with xAI. However, Musk’s lukewarm response to these suggestions highlights the growing divide between him and investors.

In fact, consumer loyalty to a brand is often heavily influenced by the public image of its executives. Musk's controversial remarks in the political arena have tarnished Tesla's brand image, particularly for consumers who prioritize alignment with their values. According to a June 2025 consumer survey, around 15% of potential electric vehicle buyers reported a decreased likelihood of purchasing a Tesla due to Musk's public image.

While Musk's political activities have certainly amplified market volatility, attributing the stock price decline solely to these actions is overly simplistic. The company’s fundamentals, policy changes, and mounting competitive pressures also play a critical role in Tesla’s current challenges.

Declining Automotive Sales

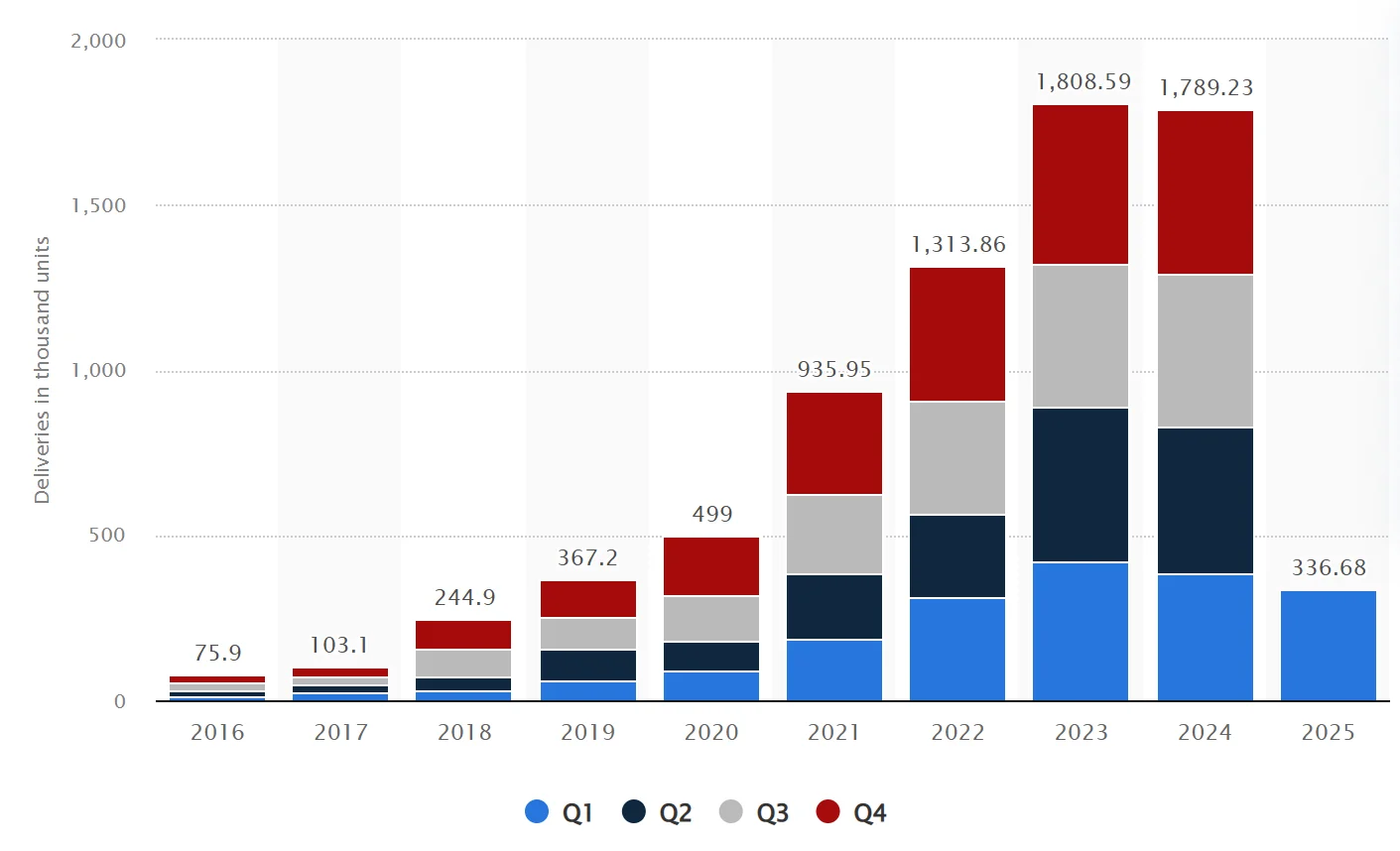

Although Tesla delivered a record 1.78 million electric vehicles at the beginning of 2024, this number fell short of the 1.8 million delivered in 2023, marking the company’s first year-over-year decline. Heading into 2025, Tesla’s sales issues have become even more pronounced, with weak performance in the first quarter and no significant improvement in deliveries during the second quarter.

Tesla Global Vehicle Deliveries from Q1 2016 to Q1 2025 Source: Statista

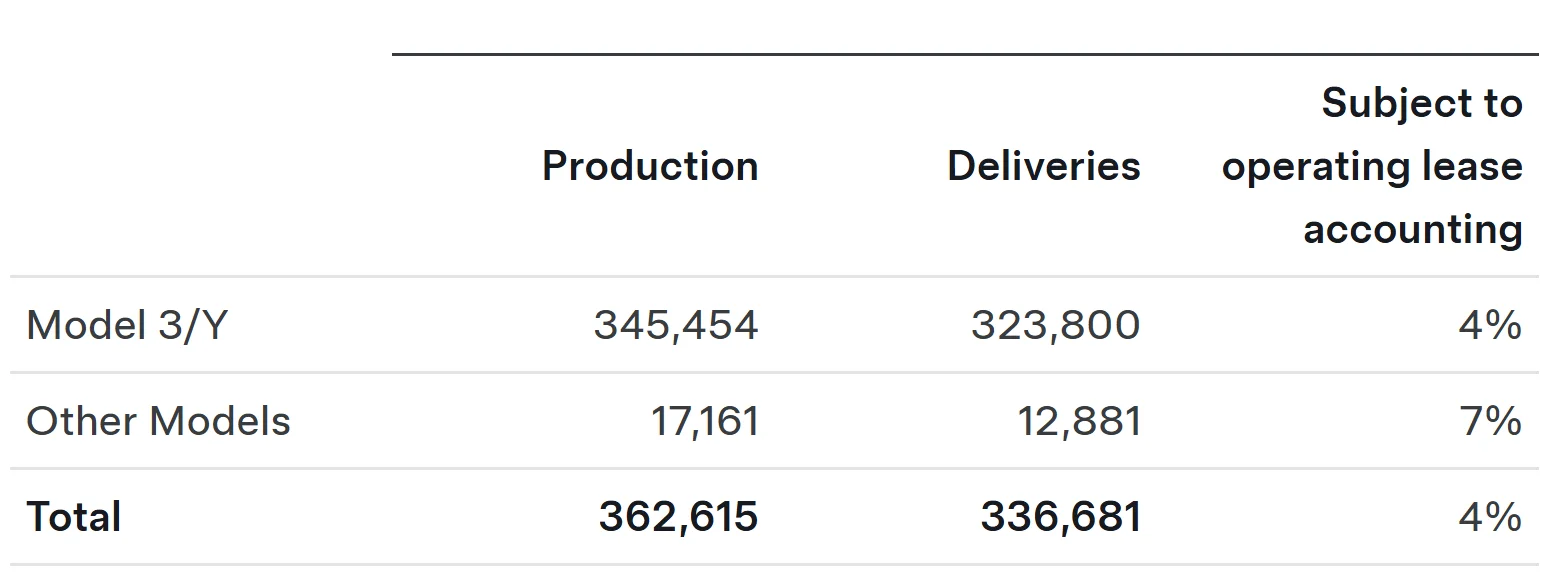

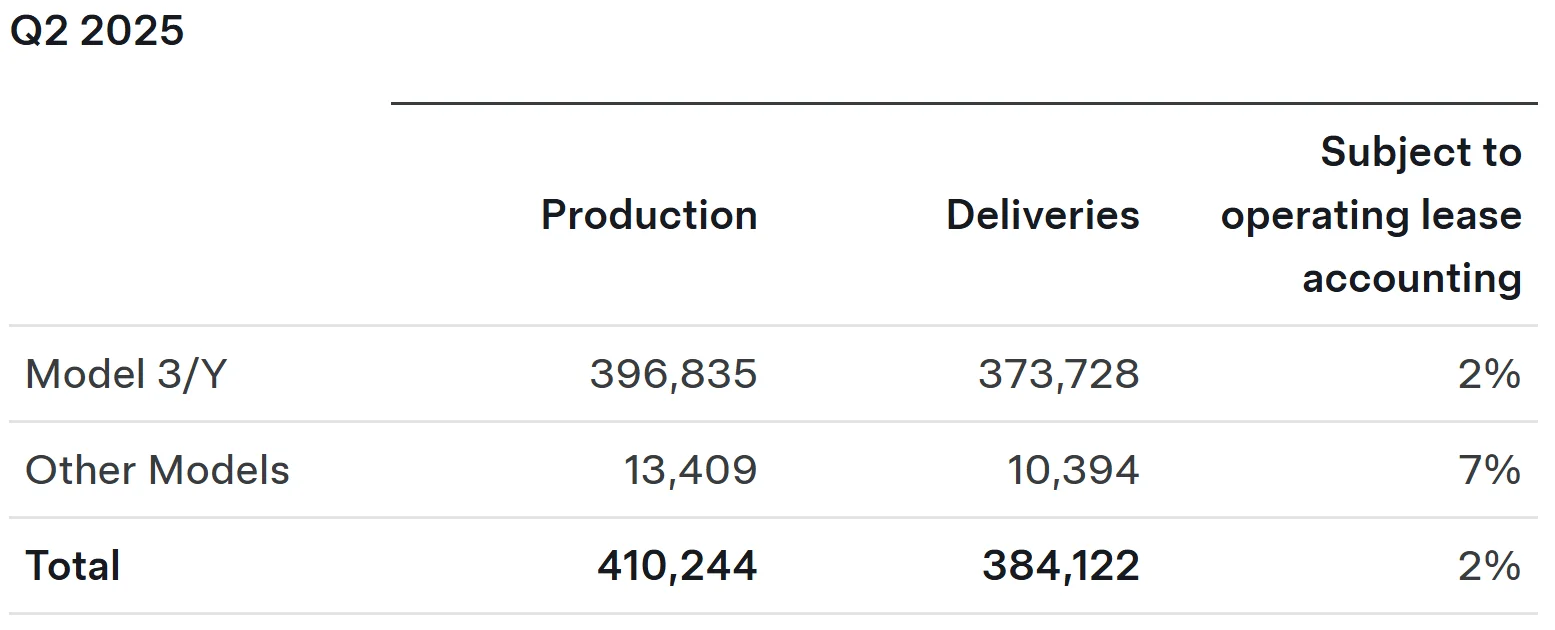

Data shows that Tesla delivered 720,700 vehicles globally in the first half of 2025, a noticeable drop compared to 830,800 units in the same period in 2024. Of this, approximately 336,700 units were delivered in Q1, and 384,100 units in Q2, marking a decline in deliveries for two consecutive quarters.

Q1 2025 Sales Data Source: Tesla

Q2 2025 Sales Data Source: Tesla

Sales in key markets such as China and Europe have been underperforming, especially amid intensifying competition. Tesla faces pressure from both traditional automakers like General Motors, Ford, and Volkswagen, as well as new entrants such as BYD, Xpeng, and Huawei. These competitors are offering electric vehicle models that are priced more competitively and equipped with advanced technology, which is gradually eroding Tesla’s market share.

For Tesla, the aging product lineup, consumer demand for more affordable options and greater variety, and the increasingly attractive models from competitors are all significant contributors to the decline in sales. Deutsche Bank analyst Edison Yu pointed out that Tesla’s long-promised affordable electric vehicle has yet to materialize, while the market now boasts over 70 electric vehicle models, many of which are becoming increasingly competitive.

Impact of the "BBB”

Aside from sales and political issues, Tesla is also facing mounting policy and regulatory pressure, particularly from the "Build Back Better" (BBB) Act signed by former President Trump. The act presents a significant threat to the electric vehicle (EV) industry and directly undermines Tesla's profit projections.

First, the act terminates the $7,500 EV tax credit, which has long been a key driver of Tesla's sales. According to JPMorgan's analysis, approximately 160,000 of Tesla's vehicles in 2024 were reliant on this incentive. With its removal, consumers will face a substantial increase in purchase costs, which is expected to lead to an annual profit loss of around $960 million.

The BBB also reduces fines for automakers that fail to meet the EPA Corporate Average Fuel Economy (CAFE) standards, thereby lowering the demand for Tesla’s regulatory credits. In 2024, Tesla generated $2.8 billion in revenue from credit sales, which accounted for 16% of its gross profit. William Blair analysts forecast that CAFE-related revenue will constitute 75% of Tesla's total regulatory credit income but is expected to fall to zero by 2027, severely impacting the company's profitability.

Additionally, the act limits subsidies for automakers that use Chinese battery components. Tesla's battery supplier CATL (Contemporary Amperex Technology Co. Limited) is excluded, which could force Tesla to turn to more expensive battery suppliers, thus raising its supply chain costs. The act also cuts clean energy subsidies, eliminating tax credits for Powerwall, Megapack, and SolarCity businesses, further affecting Tesla’s energy storage and solar operations.

Trump's legislation undoubtedly dealt a double blow to Tesla's profits, with the company’s market value evaporating by billions of dollars. The bill’s tilt toward traditional energy and its divergence from global clean energy trends may also weaken Tesla’s long-term competitive position.

Future Stakes

Tesla is pivoting toward artificial intelligence (AI) and autonomous driving to address the challenges in its core business. The company’s Robotaxi testing in Austin, Texas has shown promise, with Musk claiming that self-driving technology could unlock trillions of dollars in value.

Source: Tesla

However, the results of these tests have not always been satisfactory, particularly with frequent issues such as speeding and traffic violations, which have raised regulatory concerns. Competitors like Waymo and Amazon’s Zoox are also accelerating their efforts in the autonomous driving space.

Cathie Wood, CEO of ARK Invest, remains optimistic about Tesla’s future. She had previously predicted that Tesla’s stock could reach $2,600 by 2030, largely driven by the Robotaxi business, which she believes could represent 90% of the company’s valuation. Wood highlighted that Musk’s recent decision to personally oversee U.S. and European sales operations indicates his renewed focus on Tesla's business.

However, critics argue that Tesla’s high fixed costs and reliance on regulatory credits make its profitability vulnerable. If AI or new product developments fail to deliver significant breakthroughs, the risks will intensify.

As of July 8, 2025, Tesla's stock closed at $297.81, down from its recent highs. With the challenges Tesla is facing becoming increasingly evident, the company’s future will need to chart a more stable path under Musk’s leadership moving forward.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates