Chip Stocks Rally as AI Chip Competition Enters a New Phase

03:11 October 9, 2025 EDT

In October 2025, U.S. chip stocks staged a notable rally. Shares of Advanced Micro Devices (AMD) jumped 11.37% on October 8, bringing their three-day cumulative gain to 43.05% and marking a record high. Micron Technology rose more than 5%, while TSMC gained over 3%. In the previous two trading sessions, the Philadelphia Semiconductor Index had already advanced 4.3%.

Source: TradingView

Market sentiment indicates that investors remain highly focused on the sustained growth in AI and related chip demand, while dip-buying capital has flowed in, driving broad strength across the semiconductor sector.

Market Performance

From a segmental perspective, the recent surge in chip stocks has shown a clear pattern of “market leaders driving the broader supply chain.” In the U.S. market, AI chip–related companies stood out as top performers. Following the announcement of a four-year partnership with OpenAI, AMD’s shares jumped 11.37% on October 8, hitting a record high. Jefferies subsequently raised its price target from $170 to $300, estimating that the deal could generate over $100 billion in additional revenue for AMD.

Source: TradingView

Although Nvidia’s stock was briefly affected by news of AMD’s partnership, it still gained 2.20%, supported by robust demand for its Blackwell chips. CEO Jensen Huang stated in an interview that demand for the product is “extremely high,” underscoring how the latest round of technological upgrades is driving momentum across the semiconductor industry.

The memory chip segment also benefited from the rebound in prices. Micron Technology rose 5.84% on October 8, mainly driven by tightening supply in the DRAM market. Major DRAM producers in South Korea and the U.S. have temporarily halted price quotes to enterprise clients for a week. The market widely expects DDR4 prices to rise more than 30% in the fourth quarter, with some specifications possibly climbing over 50%. The supply gap over the next three quarters is projected at 10%–15%.

Source: TradingView

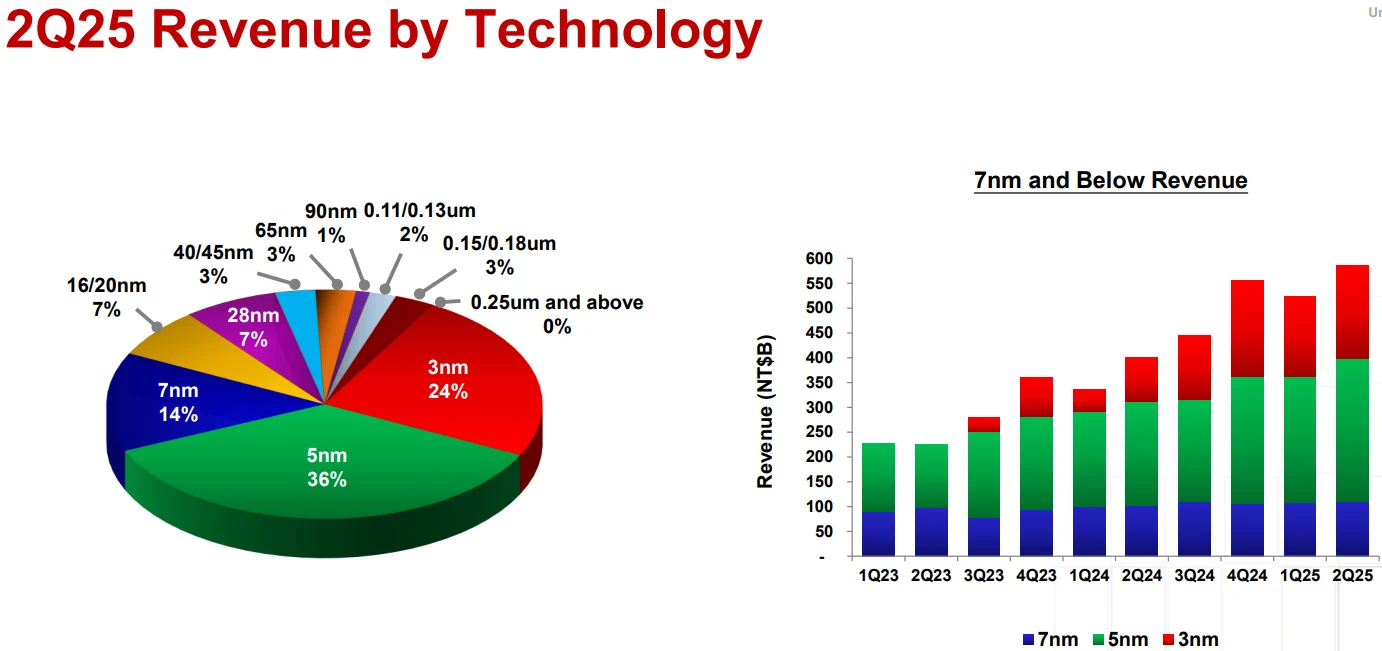

As a core player in the semiconductor supply chain, TSMC’s U.S.-listed ADR climbed 3.57%, reflecting the firm’s pricing power in advanced manufacturing nodes. The company’s 2nm process is priced at around $30,000 per wafer—15% to 20% higher than its 3nm counterpart. TSMC also plans to raise prices across its 3nm, 4nm, 5nm, and 7nm processes next year, sending a positive signal to the broader industry.

Source: TSMC

AI Demand Drives Industry Upturn

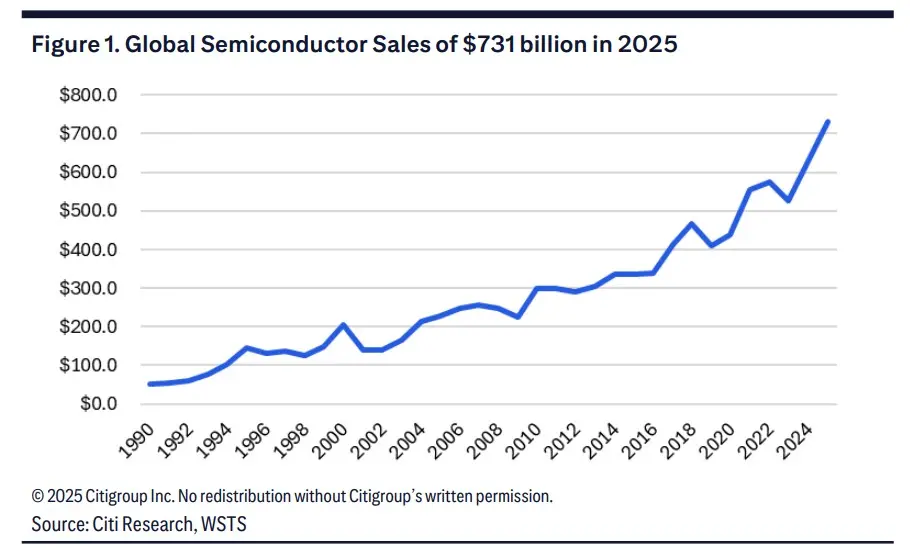

AI has become the core growth engine of the semiconductor industry in this cycle. According to Citi Research, AI-related sales have surged from virtually zero to over 25% of the total semiconductor market within just five years, driving the industry’s first acceleration in growth in a quarter century.

Source: Citi Research, WSTS

The rapid iteration of generative AI models has led to an exponential increase in computing power demand. To deploy its next-generation large models, OpenAI has signed major procurement agreements with both Nvidia and AMD. The deal with Nvidia is valued at roughly $500 billion, involving the deployment of at least 10 gigawatts of computing capacity, while the AMD agreement is worth about $270 billion for a phased rollout of 6 gigawatts. Together, these partnerships highlight the unprecedented scale of infrastructure investment behind the AI boom.

Beyond GPUs, this wave of demand is lifting the entire semiconductor value chain. High Bandwidth Memory (HBM), a critical component in AI servers, is experiencing even faster demand growth than logic chips. Micron Technology is expanding capacity aggressively to meet this need — its 2025 HBM output is already fully booked, while 2026 supply will be dominated by 12-layer HBM3E and next-generation HBM4 products. The company’s order coverage remains exceptionally high.

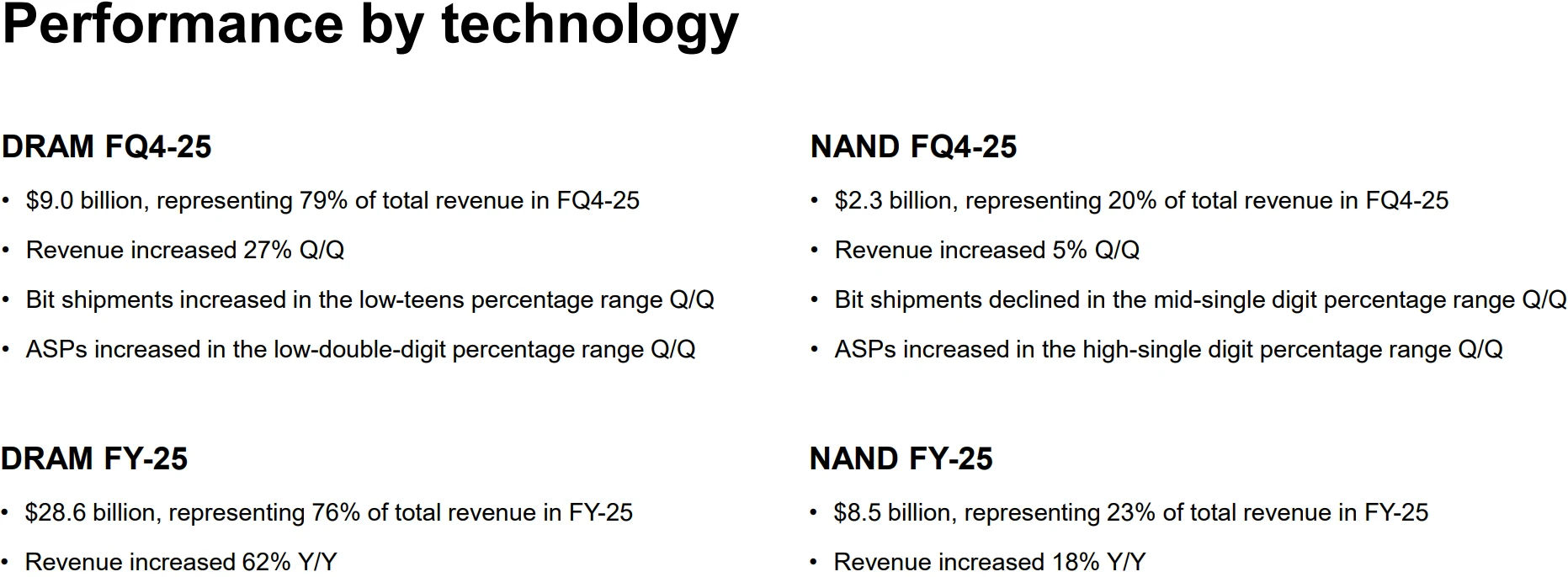

Source: Micron Technology

Advanced packaging capacity is also under intense pressure. TSMC’s CoWoS packaging remains in short supply, while JCET’s XDFOI Chiplet technology has been adopted by major players such as AMD, Nvidia, and Huawei for AI chip packaging. This segment has contributed more than 30% incremental revenue growth, with order visibility now extending into 2026, reflecting surging demand for high-performance computing packaging solutions.

From a market perspective, the global AI chip market is projected to exceed $80 billion in 2025, with semiconductor growth in the compute segment expected to reach 36%. The strength of data center demand stands out — global capital expenditure on compute chips alone could surpass $200 billion in 2025. This momentum is not a short-term spike but part of a structural trend, as AI continues to expand from the cloud to the edge. AI-enabled smartphones, autonomous driving platforms, and other intelligent devices are steadily generating new sources of computing demand.

Industry Cycle Reversal from the Bottom

Since bottoming out at the end of 2024, the semiconductor industry has entered a clear recovery cycle. Data shows that global semiconductor sales have recorded year-over-year growth for 12 consecutive months and are expected to rise 16% in 2025 to reach $731 billion — a potential all-time high. Notably, this round of growth is primarily price-driven: the average selling price (ASP) of semiconductors has climbed from around $0.72 in 2019 to about $1.26 in 2025, a 75% increase — marking the first four-year stretch of continuous price appreciation since 1992–1995.

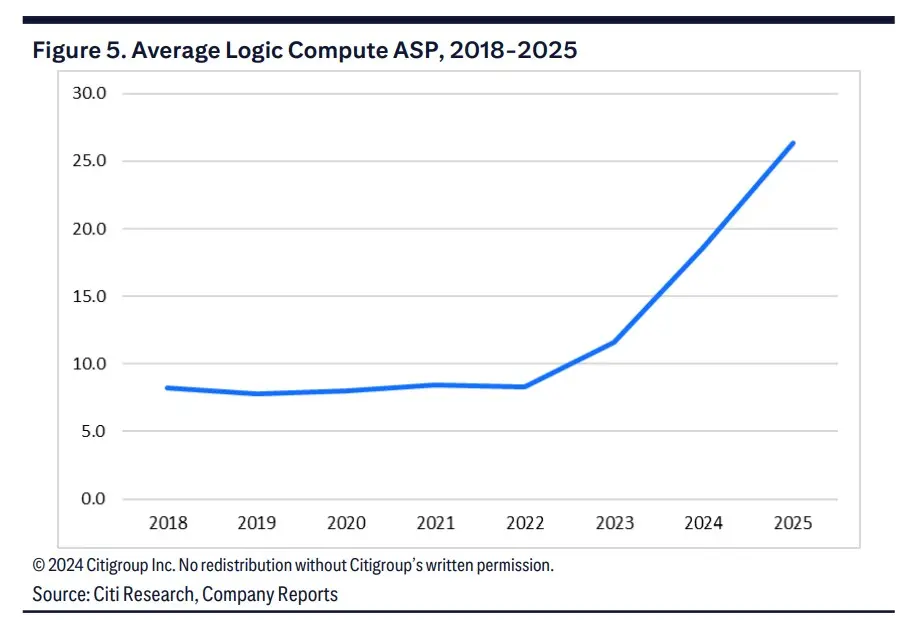

Among various segments, memory chips stand out as the most representative example of a cyclical rebound. Following a deep correction in 2023, DRAM and NAND prices began to recover at the end of 2024. Micron Technology’s DRAM ASP rose 15% quarter-over-quarter in Q3 2025. The logic chip segment has also shown robust performance: the average price of logic computing chips (including AI accelerators) has surged 24% over the past three years, far exceeding the 2% increase recorded in the previous decade. Their share of total semiconductor sales has expanded from 27% in 2020 to 39% in 2025, underscoring logic chips as a major driver of industry growth.

Source: Citi Research, Company Reports

Importantly, there remains ample room for further expansion. Total semiconductor shipments are still about 11% below their previous peak, and the current upcycle’s growth of 18% lags well behind the historical average of around 60%. This indicates that supply chain inventory levels remain lean, leaving room for shipment recovery and margin improvement. Leading manufacturers such as TSMC and Samsung continue to operate at high utilization rates — 8-inch wafer capacity remains above 90%, and 12-inch advanced nodes are in persistent shortage — further confirming the strength of the industry’s recovery foundation.

Building on this recovery, supportive policy frameworks worldwide are providing an increasingly stable environment for growth. In the U.S., more than $30 billion in subsidies have been distributed under the CHIPS and Science Act, accelerating construction at Intel’s Oregon fabs and TSMC’s Arizona facilities. The European Union, through its European Chips Act, has set a target to raise the region’s share of global semiconductor production to 20% by 2030. In China, the Ministry of Industry and Information Technology (MIIT) has outlined a goal to significantly enhance domestic self-sufficiency in semiconductor equipment and materials by 2025, providing policy support for the strengthening of its local supply chain.

Impact of the AI Closed-Loop Economy

Recently, OpenAI has established deep partnerships with companies including AMD, NVIDIA, Oracle, and SoftBank, forming what has been described as an “AI closed-loop economy.” The core concept is to tightly align future computing power demand with supplier incentives: AMD and NVIDIA gain potential upside through equity or investment arrangements while securing future hardware sales. This model closely links AI infrastructure demand with chipmaker profitability, marking a fundamental shift in the semiconductor industry’s profit structure and investment logic.

For example, AMD offsets part of its procurement costs through warrant coverage, while NVIDIA participates in xAI’s financing via a special purpose vehicle (SPV) and provides GPU leasing. Such arrangements reduce direct corporate leverage risks while enhancing overall supply chain coordination and capital efficiency.

Against this backdrop, short-term market focus should remain on the technological capabilities, partnership depth, and financial structuring of key suppliers. Companies such as AMD, NVIDIA, TSMC, and major cloud service providers play central roles in AI infrastructure development, underscoring their investment appeal. Meanwhile, memory and packaging firms like Micron Technology are also benefiting from tightening supply conditions, drawing increased investor attention in the near term.

Over the longer horizon, the sustained expansion of AI computing demand will have profound implications for global energy and infrastructure planning. OpenAI’s plan to build 10 gigawatts of data center capacity—consuming as much electricity annually as roughly eight million U.S. households—highlights the sector’s enormous energy requirements. China’s rapid advancement in data center energy infrastructure further illustrates how national strategies are reshaping the competitive dynamics of the global AI industry.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates