2025’s Biggest Tech IPO: Figma’s Valuation and Growth Outlook

02:17 July 18, 2025 EDT

Though not a frequent topic on everyday social media, if you have worked in design, product development, or used internet collaboration tools, you have most likely encountered Figma’s products. This company is not a typical “innovation story,” but a design collaboration leader built on solid technology and product strength—so much so that Adobe nearly acquired it.

Figma has now officially filed for an IPO with a target valuation exceeding $20 billion. This article will provide an in-depth analysis of the company’s core competitive advantages, examine how it is building the “Google Docs of design,” and assess whether it will be the largest and most noteworthy tech IPO of 2025.

What Kind of Company Is This?

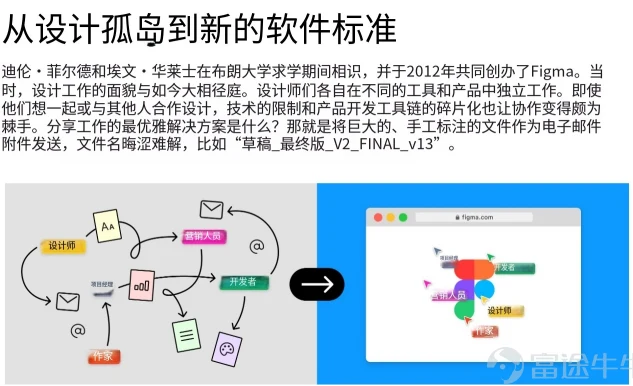

Figma was founded in 2012 by Dylan Field and Evan Wallace, both computer science students at Brown University. Dylan received the prestigious Thiel Fellowship and chose to drop out to pursue entrepreneurship full-time.

In its early years, Figma’s progress was slow because its goal was not merely to build the “next-generation Sketch,” but to create a browser-based, Photoshop-level graphics editor. At that time, technologies like WebGL were still in their infancy, and complex graphics processing in browsers was rare. The Figma team spent four years developing their browser graphics engine behind closed doors, with no releases or revenue, laying a solid foundation for later rapid growth.

Evan was responsible for the technical architecture, while Dylan led product direction, forming a strong partnership combining technology and vision. Dylan also evolved from a hands-on manager to a leader who empowers others and builds organizational capability, driving the company’s ongoing development.

Figma is a SaaS company focused on design collaboration tools, but it is far from ordinary drawing software. It offers a comprehensive “team collaboration design” solution.

In traditional design workflows, designers complete interface designs and then export files to be repeatedly shared via email or messaging with product managers and developers, resulting in high communication costs and low efficiency.

Figma, by contrast, functions like “Google Docs for design,” enabling multiple users to edit in real time, comment, control versions, and manage permissions—all within the same platform. In other words, Figma is not just a design tool; it is a workflow platform that restructures team collaboration.

Product Ecosystem

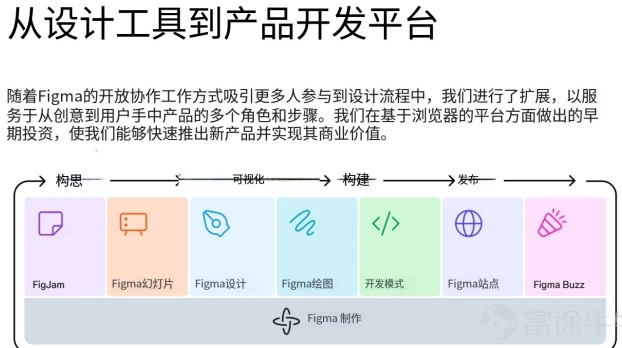

Figma has evolved beyond a single design tool to build a full-process design collaboration platform centered on three core product layers, creating clear synergies.

Its core product, Figma Design, is a browser-based UI design tool supporting real-time multi-user editing, commenting, and version control. It integrates Dev Mode and Code Connect to enable efficient collaboration between design and development. This tool serves cross-functional teams including design, product, engineering, and marketing, significantly improving collaboration efficiency.

FigJam, launched in 2021, is a collaborative whiteboard tool mainly used for early-stage design ideation and flowchart creation. It seamlessly connects with Figma Design to cover the complete process from concept to design, expanding Figma’s user base.

In 2024, Figma began introducing AI-assisted features that automatically generate drafts, annotate interactions, name layers, fill text, and support visual search and background removal. These functions enhance efficiency and lower the usage barrier, enabling non-professional users and small teams to participate effectively in the design process.

Building on a gradually improved product system, Figma has established multi-layered competitive barriers, strengthening its stability and resilience in the collaborative design market.

First is network effects. Figma supports simultaneous multi-user collaboration. As user numbers grow, team efficiency increases directly. This drives different functional teams within an organization to concentrate work on a single platform, raising usage frequency and necessity within enterprises.

Second is high switching costs. Once an enterprise establishes a complete design system, component library, and collaboration workflow on Figma, migrating to another platform involves extensive data transfer, process rebuilding, and staff retraining, making tool replacement costly and difficult.

Third is industry penetration and community influence. Figma is widely adopted as the standard UI/UX design tool, covering users from freelancers to large enterprises. Experience with Figma has become a default requirement in education, recruitment, and project collaboration, further solidifying its industry foundation.

Fourth is the plugin ecosystem. Figma offers open API access, allowing third-party developers to extend its functionality. Users can integrate plugins based on specific business needs to improve efficiency. This flexibility also enhances user stickiness.

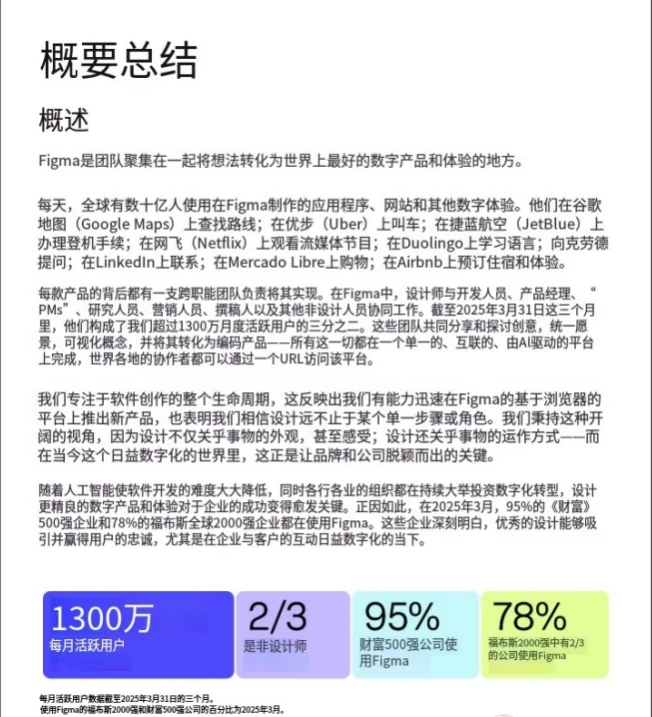

Together, these factors increase Figma’s retention among enterprise users and create conditions for expanding its usage to a broader range of knowledge workers. Figma’s target audience now goes beyond professional designers, continuously covering product, development, operations, and other teams seeking rapid prototyping and remote collaboration. This trend will significantly expand its potential market size and establish a foundation for long-term growth.

Growth Path

Over the past few years, the UI design tool market was characterized by a three-way competition among Sketch, Adobe XD, and Figma. However, the landscape has fundamentally shifted. Sketch, limited to the Mac platform, struggled to meet cross-platform collaboration needs and was gradually marginalized by remote teams. Adobe XD, after its acquisition attempt by Figma was blocked by antitrust authorities, underwent internal resource reallocation, leading to a gradual weakening of its product. In contrast, Figma rapidly became the mainstream design tool, leveraging its freemium strategy, real-time collaboration capabilities, and community network effects to establish itself as the de facto industry standard among product teams.

While products like Miro, Canva, and Framer cover some related design scenarios—such as collaborative whiteboards, content creation, and no-code site building—their positioning differs from Figma’s core user focus and has yet to pose a direct threat to Figma’s dominance in the collaborative UI design platform space.

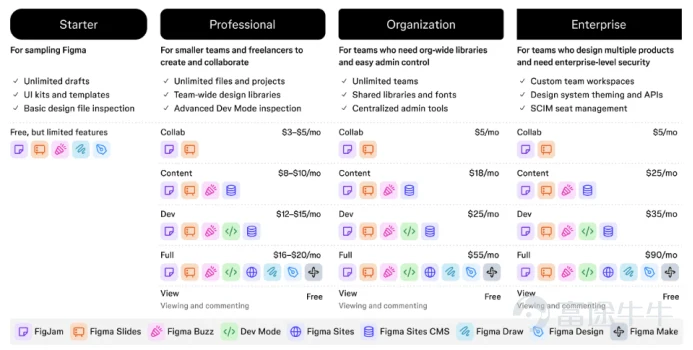

Figma employs a typical “bottom-up” growth strategy, attracting individual users and small teams through a freemium model and gradually expanding to enterprise-level customers. Its product offerings are divided into four subscription tiers, ranging from a free version to enterprise editions that support security and compliance, catering to teams of varying sizes and management requirements.

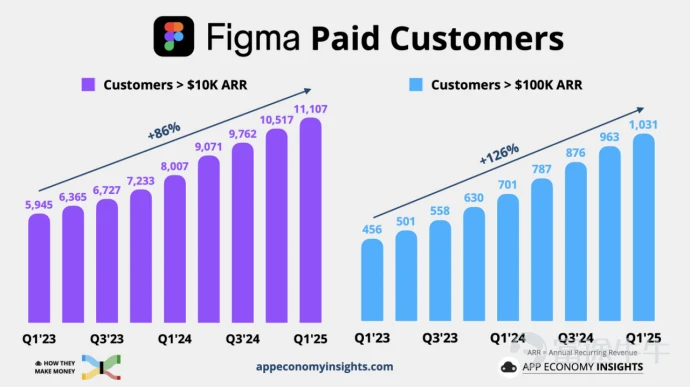

The pricing model charges per “editor,” while collaborators and viewers are free, facilitating rapid adoption across broader organizational members. The product penetration process exhibits a clear growth flywheel effect: designers invite colleagues to collaborate, further bringing in product managers and engineers, embedding the tool into the entire organization’s workflows, and ultimately driving enterprise procurement. This mechanism has steadily increased Figma’s penetration in mid-to-large customer segments, with over 11,000 customers paying more than $10,000 annually and more than 1,000 customers paying over $100,000 annually.

Financial Performance

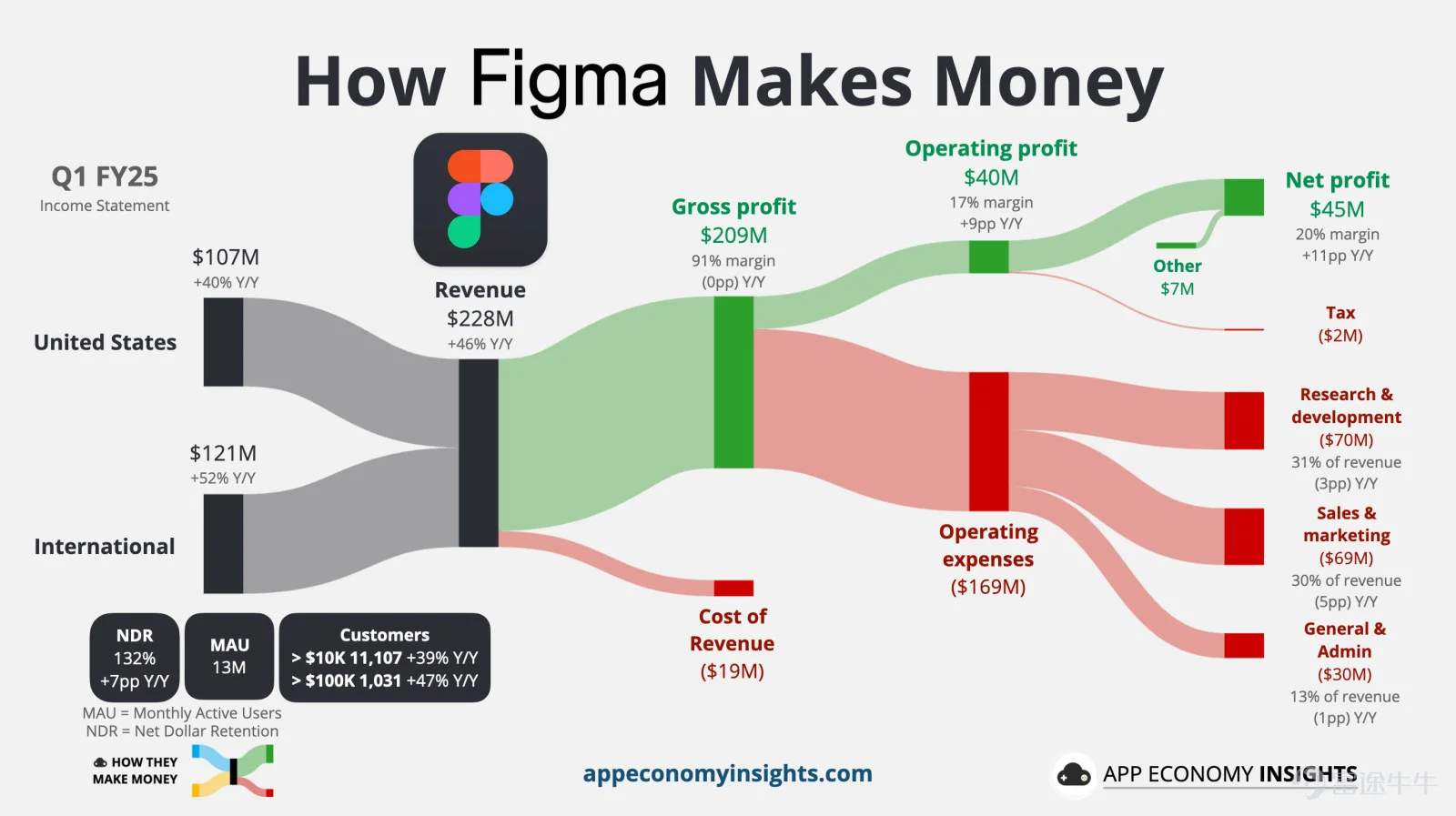

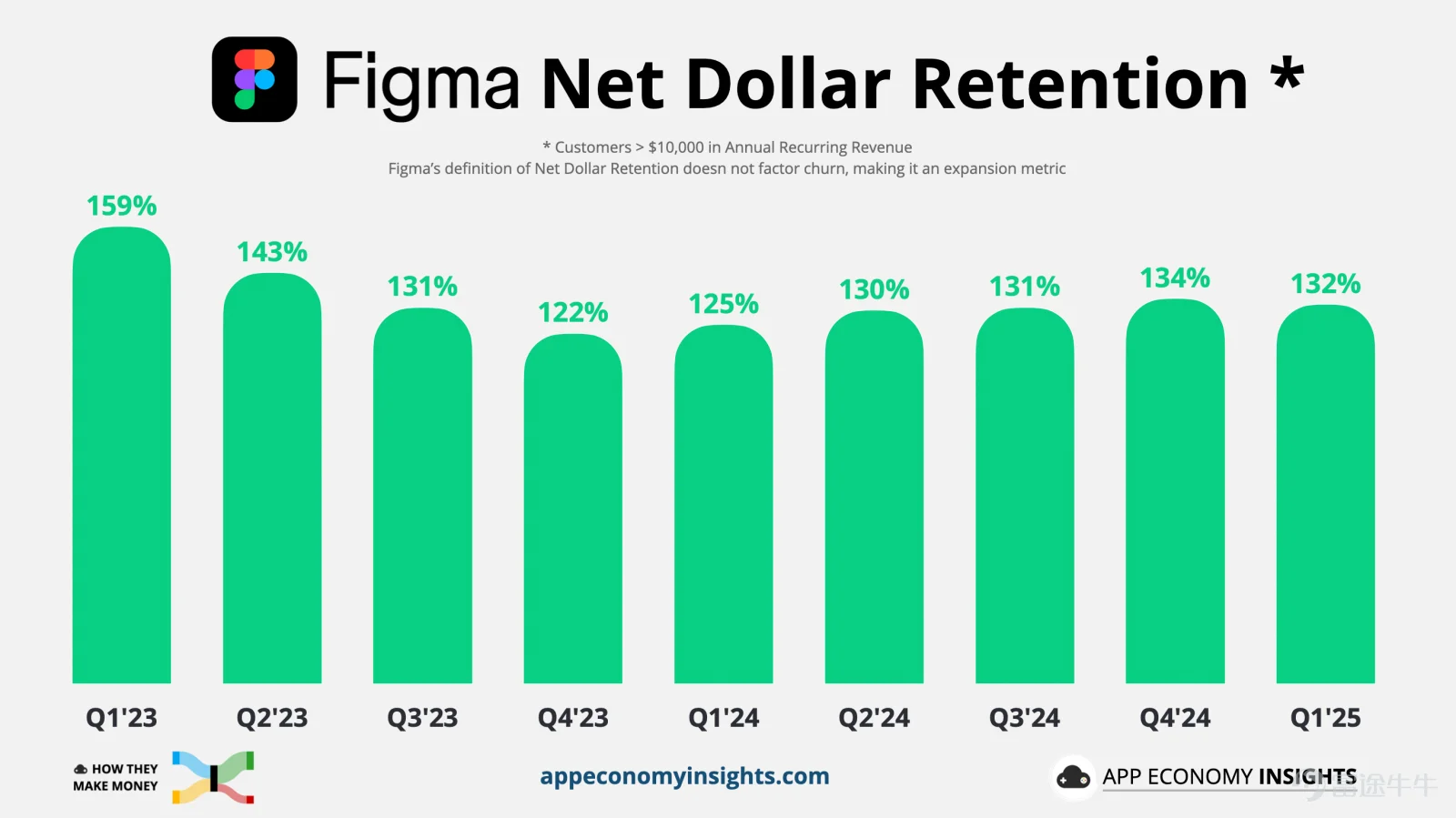

In terms of revenue scale and profitability, Figma exhibits the typical characteristics of a mature SaaS company. Its annual recurring revenue (ARR) grew from $75 million in 2020 to $913 million in Q1 2025, representing a compound annual growth rate (CAGR) of 46%. Meanwhile, the company maintains a high gross margin above 90%, with a net dollar retention (NDR) rate of 132%, indicating that customers are continually expanding their usage. Its non-GAAP profit margin has reached 18%, a relatively high level in the SaaS industry. Scoring 64% on the “SaaS 40 Rule,” Figma demonstrates an excellent balance between growth and profitability.

The company currently holds $1.5 billion in cash reserves with almost no debt, reflecting a strong financial position. Across multiple funding rounds, Figma has raised a total of $750 million, backed by top-tier investors such as Sequoia, a16z, and Greylock.

Based on the current ARR, and applying a typical SaaS industry revenue multiple range of 20 to 30 times, Figma’s valuation is estimated between $18.3 billion and $27.4 billion, with an expected IPO pricing likely in the $20 billion to $25 billion range.

Final Thoughts

Figma has evolved from a traditional design tool into a comprehensive collaboration platform covering all stages of the design process, establishing clear product and synergy advantages. It has now essentially secured its leading position in the UI design collaboration space.

The ongoing enhancement of its AI capabilities is expected to be a key driver for expanding its user base and tapping into the non-professional design market. Additionally, as Figma approaches its IPO, market attention will focus on whether the company can sustain its rapid growth and whether it will face new competitive dynamics or alternative solutions from Adobe following the blocked acquisition attempt.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates