With a Market Cap Topping HKD 3 Trillion, Is Alibaba Returning to Glory?

04:09 September 17, 2025 EDT

After several years of volatility and adjustment, Alibaba’s stock price is once again regaining market confidence. On September 17, Alibaba’s Hong Kong-listed shares surged intraday to over HKD 162, setting a nearly four-year high and bringing the company’s market capitalization back above the HKD 3 trillion mark.

As of the time of publication, Alibaba’s stock had further extended its gains to 5.37%, quoted at HKD 161.7, with a market capitalization of HKD 3.08 trillion and turnover exceeding HKD 11.1 billion. Year-to-date, the company’s stock has risen nearly 100%, becoming one of the key drivers of the Hang Seng Tech Index’s rebound.

Source: TradingView

Looking back, in October 2020, Alibaba’s U.S.-listed shares reached a record high of USD 319.32 per share, with a market capitalization close to USD 860 billion; its Hong Kong-listed shares peaked at HKD 309 per share, with a market capitalization exceeding HKD 6.65 trillion. At that time, Alibaba’s total market value ranked sixth globally, trailing only Apple, Microsoft, Google, Amazon, and Saudi Aramco.

However, the subsequent tightening of internet regulations, rising external uncertainties, and internal business restructuring caused the stock to fall to below HKD 80. Now, with the stock rebounding to around HKD 160, although it is still some distance from its historical peak, the pace of the rise and the market sentiment indicate that the company is gradually emerging from the adjustment period.

Fundamentals Drive Share Price Higher

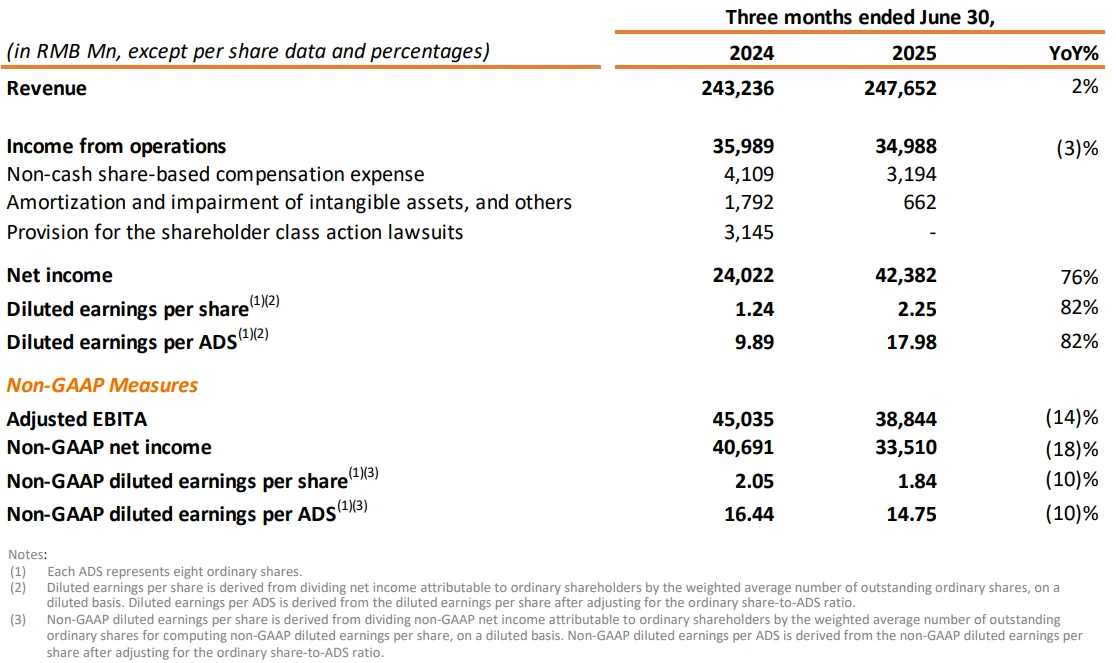

Alibaba’s sustained stock strength is primarily driven by the recovery in its financial results. In the first quarter of fiscal year 2026 (ending June 30, 2025), the company recorded revenue of RMB 247.652 billion, up 2% year-on-year. Excluding the divested GaoXin Retail and Intime businesses, revenue on a comparable basis grew 10%. Net profit reached RMB 42.382 billion, representing a substantial 76% year-on-year increase, significantly exceeding market expectations.

Source: Alibaba

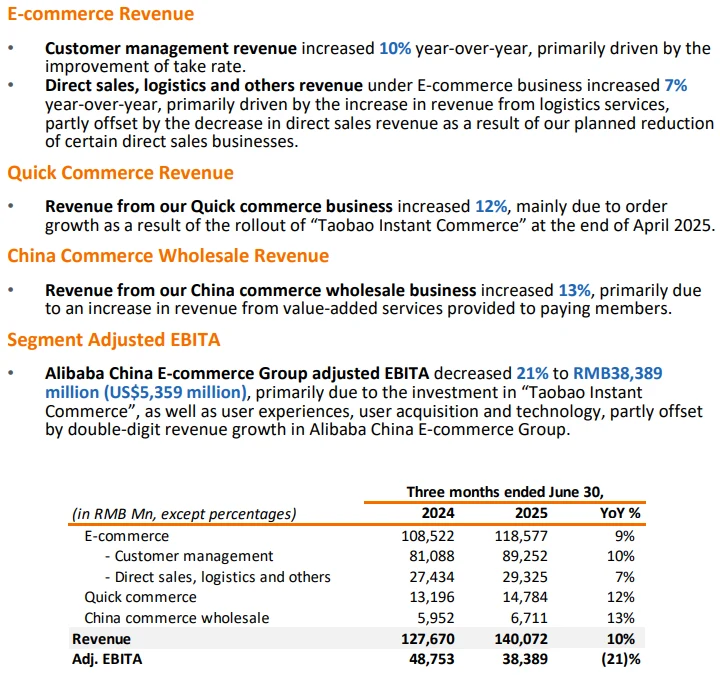

As the core segment, China E-commerce Group posted customer management revenue of RMB 89.252 billion, up 10% year-on-year, far surpassing market estimates. This performance was mainly driven by the explosive growth of the Taobao Flash Sale business.

Data indicate that in August, daily peak orders on Taobao Flash Sale reached 120 million, with average weekly orders stabilizing at 80 million. Monthly active buyers reached 300 million, a 200% increase from April, while daily active riders exceeded 2 million, tripling April’s level. User engagement on the Taobao app was also significantly boosted by the Flash Sale business; in the first three weeks of August, monthly active consumers on the app grew 25% year-on-year, with daily active users on the Flash Sale channel reaching 150 million. This expansion in user scale simultaneously strengthened user stickiness, providing momentum for continued growth on the main platform.

Source: Alibaba

Notably, the recently launched Gaode Map “Street Ranking” product further enhances the company’s local services ecosystem. Leveraging a user base of 1 billion and 170 million daily active users (DAU), Gaode drives offline merchant traffic and forms synergy with Taobao Flash Sale. Official data show that active users on the first day of launch exceeded 40 million.

Behind the improvement in profitability, Alibaba has enhanced operational efficiency through organizational restructuring. In August 2025, the company consolidated its former “1+6+N” structure into four core segments: China E-commerce, International Digital Commerce, Cloud Intelligence, and “Other,” with the concentration effect of core businesses beginning to emerge.

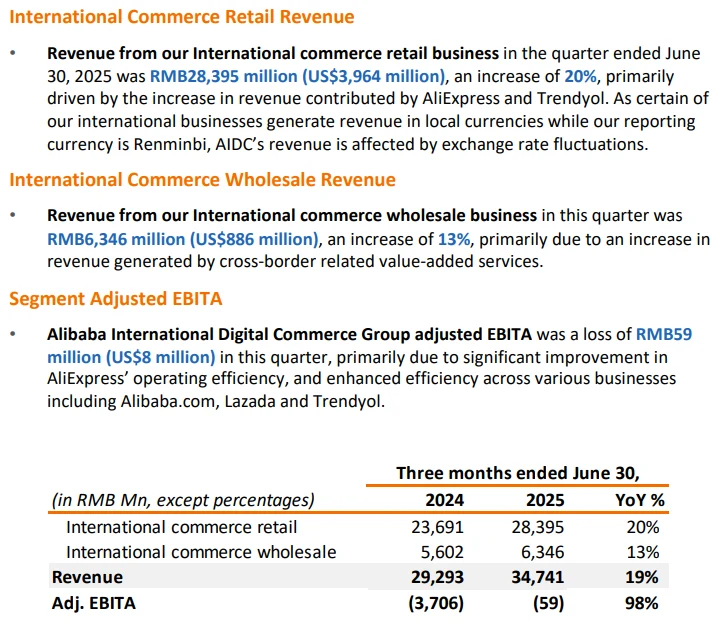

Alibaba International Digital Commerce Group (AIDC) maintained growth momentum, with revenue rising 19% year-on-year to RMB 34.741 billion, reflecting strong performance in cross-border business. Its profitability also improved significantly, with adjusted EBITA losses narrowing to RMB 59 million, down 98% from a RMB 3.7 billion loss in the same period last year. This indicates that the international business, while expanding in scale, is gradually moving toward a healthy development trajectory. Despite global economic uncertainties and geopolitical risks, international operations have become a key contributor to Alibaba’s revenue growth and a future profit driver.

Source: Alibaba

Other business segments, including Cainiao, local services, and digital entertainment, continue to deepen their presence in respective fields. These segments form synergies with core e-commerce operations, collectively driving the overall growth of the company.

Cloud and AI Emerge as Key Highlights

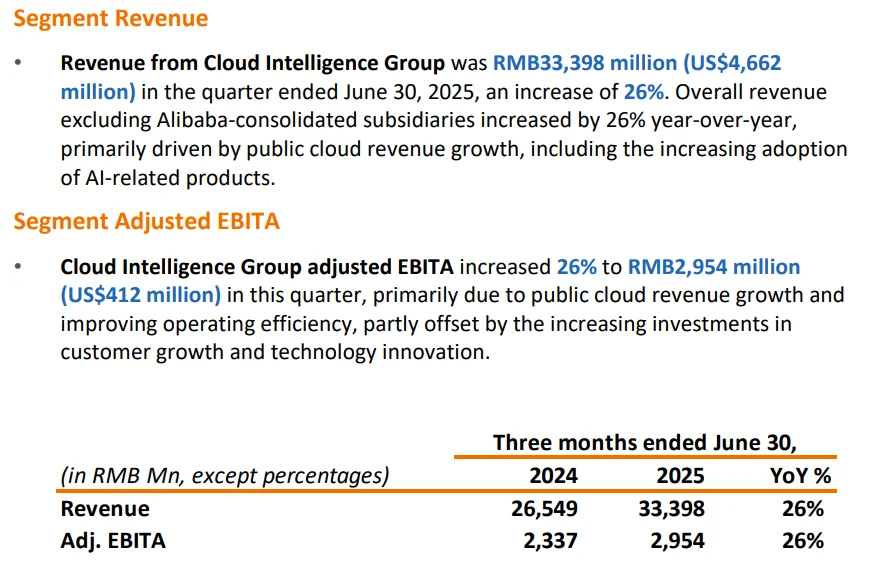

Alibaba Cloud Intelligence Group delivered an outstanding performance this quarter, with revenue rising 26% year-on-year to RMB 33.398 billion, marking the highest growth rate in nearly three years. Revenue from external customers also showed strong growth, driven by the accelerated deployment of AI applications. According to the latest IDC report, Alibaba Cloud’s market share has increased for three consecutive quarters. Globally, its public cloud products and strategic capabilities were ranked second by Forrester, with 17 out of 30 scoring criteria receiving the highest rating, and its strategy score rising to global second place, reflecting international recognition of its technological strength.

Revenue from AI-related products has maintained triple-digit growth for eight consecutive quarters, accounting for over 20% of external commercial revenue. Driven by this momentum, adjusted EBITA for the cloud business increased 26% year-on-year to RMB 2.954 billion, with profit margin up 0.8 percentage points sequentially to 8.8%.

Source: Alibaba

At the infrastructure level, Alibaba is accelerating its development of self-designed chips. The company is developing a new AI chip aimed at filling the gap left by Nvidia in the Chinese market; the chip is currently in the testing phase. The “Pingtouge” team has already launched chips including “Xuantie,” “Hanguang,” and “Yitian,” used for AI large model training and inference, with costs approximately 40% lower than Nvidia GPU solutions. Given constraints in the domestic market due to limited overseas GPU supply, self-developed chips have become a critical asset for Alibaba in AI competition.

Meanwhile, the Tongyi Qianwen large language model has been implemented in e-commerce recommendation, logistics scheduling, and local services, beginning to generate tangible revenue. In 2025, the company announced a planned investment of RMB 380 billion over three years in cloud and AI infrastructure. In the second quarter alone, capital expenditure reached RMB 38.6 billion, up 220% year-on-year, setting a record for a single quarter.

Capital Endorsement

Capital flows often serve as a direct indicator of market confidence. On September 16, southbound funds recorded a net outflow of HKD 3.189 billion, yet Alibaba bucked the trend with a net inflow of HKD 3.031 billion. As of September 16, Alibaba had seen net southbound inflows for 18 consecutive trading days. The sustained capital inflow indicates strong market confidence in Alibaba’s future growth prospects, which has positively supported the stock’s upward momentum.

Founder Jack Ma’s public appearances have also acted as a catalyst for market confidence. On September 16, Ma appeared at the HHB Music Bar in Zone B of Alibaba Xixi Campus in Hangzhou, marking one of several public engagements in 2025. Bloomberg reported that his direct involvement in group affairs reached the highest level in nearly five years, particularly focusing on AI strategy and e-commerce competition.

Alibaba’s strong performance has likewise prompted bullish sentiment among Wall Street investment banks. JPMorgan raised its price target from USD 140 to USD 170, citing a “dual-engine” growth potential from AI cloud business and local services. Citi increased its target from USD 148 to USD 187, highlighting that the cost advantages from self-developed chips could translate into profit leverage. Barclays maintained an “Overweight” rating, raising its target from USD 145 to USD 190.

Prominent global hedge fund manager Michael Burry purchased call options on Alibaba in Q2. Meanwhile, Invesco’s flagship emerging markets fund increased its holdings of Alibaba-W in July 2025 by 187.16%, and southbound investors’ positions in Alibaba’s Hong Kong stock nearly doubled. These strategic purchases by well-known funds and institutional investors further validate market confidence in Alibaba’s growth trajectory.

Valuation Recovery

From a valuation perspective, Alibaba currently trades at a trailing P/E of approximately 18.99x and a P/B of 2.78x, remaining at historically low levels. CICC estimates that the core e-commerce business warrants a P/E of 13x, the cloud computing segment a P/S of 3.5x, and combined with assets such as Ant Group, Cainiao, and Gaode totaling around RMB 1.6 trillion, the current market capitalization still has room for re-rating.

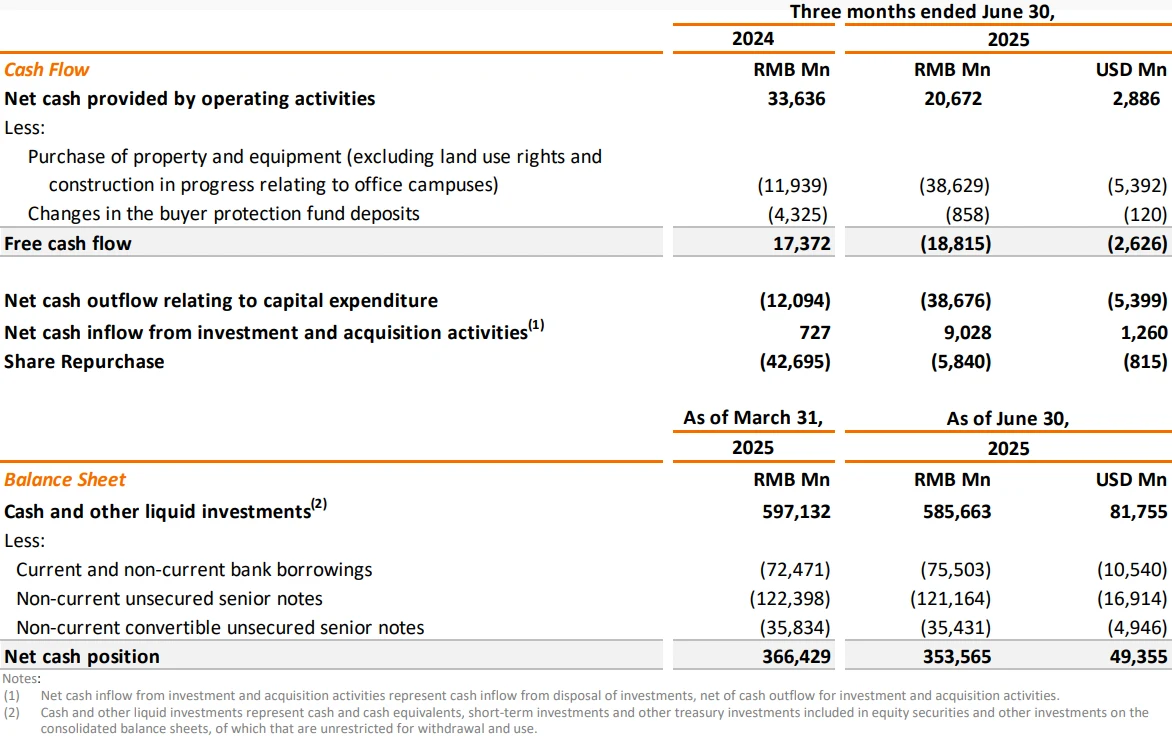

However, challenges remain. Large-scale investments in AI and cloud services are exerting short-term pressure on free cash flow and profit margins. In FY2026 Q1, free cash flow turned into a net outflow of RMB 18.815 billion, while selling and marketing expenses increased 8 percentage points year-over-year to 21.5%. In addition, uncertainties in international markets and intensified domestic competition could affect the pace of profit realization.

Source: Alibaba

To return to its 2020 peak market capitalization, Alibaba may still need to achieve breakthroughs in two areas: first, consistently demonstrating that the high growth of AI and cloud businesses can translate into sustainable profits; second, establishing a long-term competitive advantage in consumer and local services.

If the company’s upcoming quarterly results continue to validate its growth trajectory, the process of valuation re-rating could accelerate further, and a return to the ranks of global technology leaders would not be out of reach.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates