Oil Prices Amid Geopolitical Risks and Supply-Demand Imbalance

02:53 September 17, 2025 EDT

Key Points:

1. OPEC+ representatives are scheduled to meet in Vienna from September 18 to 19 to discuss methodologies for assessing the alliance’s maximum production capacity.

2. Persistent geopolitical risks and intensifying supply-demand imbalances have led to oil prices repeatedly fluctuating within a narrow range.

3. Despite ongoing geopolitical risks, the growth in oil supply is expected to outweigh the premium generated by these risks. The oil market may face a supply surplus by the end of this year.

In its September 2025 International Oil Market Report, the International Energy Agency (IEA) noted that the global oil market is currently being pulled in two directions: geopolitical instability and oversupply.

On one hand, market concerns over geopolitical risks have heightened as hopes for a near-term peace agreement between Russia and Ukraine have diminished. On the other hand, production increases by OPEC+ nations and continued strategic petroleum reserve purchases by China have offset market expectations of a future supply-demand shortfall.

As of mid-September 2025, Brent crude prices have been narrowly fluctuating within the $65-70 per barrel range, reflecting strong bearish sentiment in the market. This equilibrium remains fragile, and any unexpected developments could disrupt the current pattern, triggering significant volatility in oil prices.

Market Overview

Since the second quarter of 2025, international oil prices have generally exhibited a weak and oscillatory trend, with a notably lower price center compared to 2024. As of mid-September, Brent crude futures prices have declined by approximately 10% since the beginning of the year, while WTI crude has fallen by nearly 12%.

Source: TradingView

In terms of price volatility, the first half of September exhibited a tug-of-war pattern characterized by "geopolitical stimulus versus policy suppression." From September 9 to 16, driven by Ukrainian attacks on Russian refining facilities, WTI crude prices briefly rose by 1.9%, breaking through the $64 per barrel threshold, while Brent crude climbed to $68.64 per barrel. Attacks by Ukrainian forces on the Kirishi refinery near St. Petersburg and the Primorsk terminal sparked market concerns over disruptions to Russian oil supplies.

However, this geopolitical risk premium was quickly offset by news of OPEC+ production increases, causing oil prices to subsequently retreat back into their oscillation range.

Supply-Side and Demand-Side Dynamics

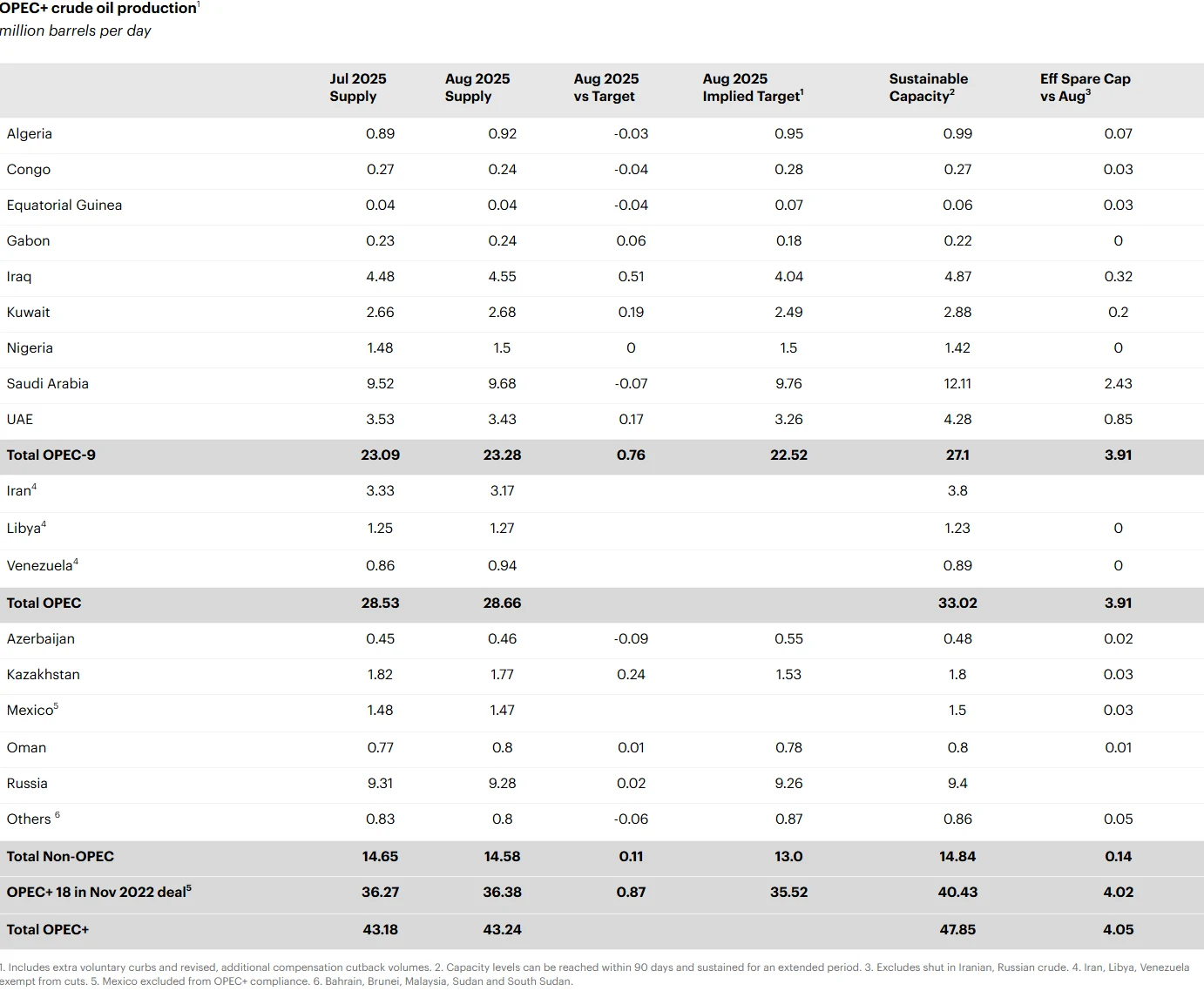

Oversupply Remains a Key Concern in the Global Oil Market. Following OPEC+ member countries' launch of the second round of their production cut exit plan on September 7, international oil prices fluctuated only slightly. Currently, OPEC+'s production increase plan is advancing steadily. Eight countries participating in the production hike plan to raise their production targets by 137,000 barrels per day (b/d) in October; at this pace, it will take 12 months to fully unwind the 1.65 million barrels per day (mb/d) production cut implemented since April 2023.

As of September, OPEC+ member countries have only achieved an actual crude oil production increase of 1.5 mb/d since the first quarter of 2025, significantly below the previously announced target of 2.5 mb/d.

Some countries that plan to boost production are already exceeding their quotas and are quickly approaching the upper limit of their currently releasable production capacity. Most of the production growth comes from Saudi Arabia and other core Middle Eastern oil-producing nations. Meanwhile, oil supply from non-OPEC+ countries continues to grow rapidly, with production in the United States, Canada, and other regions at or near historical peaks. U.S. crude oil production has reached 13.495 mb/d, with an active rig count of 416.

The International Energy Agency (IEA) has recently raised its forecast for global oil supply growth in 2025 from 2.1 mb/d to 2.5 mb/d, and revised up its 2026 supply growth forecast from 1.3 mb/d to 1.9 mb/d.

Source: IEA

However, the demand side has delivered disappointing performance. In its latest August forecast, the IEA projected that global oil demand growth in 2025 will only reach 700,000 b/d, with total demand hitting 104 mb/d—marking the lowest growth since 2009, excluding the 2020 COVID-19 pandemic period. This marks the fifth downward revision of global oil demand by the IEA this year, with a cumulative cut of 350,000–400,000 b/d from its initial annual demand forecast. Trade barriers persist, which will dampen the momentum of global economic and demand growth in the later period.

A notable shift has emerged in the demand structure. Benefiting from lower international oil prices, oil demand in developed economies has maintained steady growth. The Organization for Economic Co-operation and Development (OECD) countries saw their oil demand in the first half of 2025 exceed expectations, rising by 80,000 b/d year-on-year; however, demand is expected to turn negative in the second half.

In contrast, oil consumption in emerging economies remains relatively weak. While China’s continued buildup of strategic oil reserves has provided some support to the oil market, its domestic economic data has been lackluster—including retail sales and industrial output in August falling short of expectations.

Geopolitical Risks Persist, but Impact Moderates

Geopolitical Volatility Remains a Critical Factor Shaping the Global Oil Market. While Iran’s and Russia’s oil exports have been on a downward trend recently, the tough sanctions imposed on the two countries so far have had a relatively limited impact on global oil supply and trade flows.

The likelihood of further de-escalation in the later phase of the Russia-Ukraine conflict is relatively high. On July 14, U.S. President Trump stated during a meeting with NATO Secretary General Rutte in the Oval Office of the White House that if Russia and Ukraine fail to reach a peace agreement within 50 days, the U.S. will impose a 100% tariff on Russia and implement secondary sanctions on countries purchasing Russian oil. On July 29, Trump issued another warning, stating that if Russia fails to make positive progress in ending the Russia-Ukraine conflict, the U.S. will begin imposing tariffs within 10 days and take additional measures.

Subsequently, however, tensions eased: Trump and Putin held a meeting in Anchorage, Alaska, on August 15. Both sides expressed their willingness to advance efforts toward peace. Although no agreement was reached, Putin stated that the meeting would serve as a starting point for resolving the conflict, while Trump emphasized that the talks with Putin were productive and that the two had reached consensus on a number of issues.

If clear phased de-escalation signals emerge in the future, market expectations may gradually shift toward the loosening of U.S. and EU sanctions on Russia and weaker enforcement of such measures, which would lead to the unwinding of the geopolitical premium in international oil prices.

The situation in the Middle East also warrants attention. Israel launched an airstrike on the Yemeni port city of Hodeidah—a move that could escalate conflicts in the Middle East, threaten oil supplies from the region, and heighten market concerns about the security of oil transportation routes.

The European Union (EU) has announced that it will ban imports of refined products made from Russian crude oil starting in early 2026. This measure is likely to exert a significant impact on the structure of international oil trade in the coming months.

Future Trajectory

No consensus has yet emerged in the market regarding the future trend of oil prices. Some traders have taken large bets that Brent crude prices will fall below $50 per barrel by the end of this year. Their core rationale is that despite lingering geopolitical risks, the magnitude of growth in oil supply will outweigh the premium driven by these risks.

A put option trade with a notional size equivalent to 10 million barrels of Brent crude has emerged. If, by the option expiration date of December 23, the price of the February futures contract falls by approximately 25% from the current level of around $68 per barrel, the buyers of this $50/$49 put option spread will profit.

Behind this bet lies a growing view among several renowned global energy forecasting institutions: the oil market will slip into oversupply by the end of this year.

Macquarie analysts, including Vikas Dwivedi, noted in a report that global oil supply growth—driven by both OPEC+ and non-OPEC+ oil-producing nations—will lead to an oversupply of approximately 3 million barrels per day in the market during Q4 2025 and Q1 2026.

Taking into account that U.S. reciprocal tariffs will modestly reduce incremental global oil demand and that OPEC+ production will gradually align with its production increase targets, the supply-demand dynamics of the global oil market will shift gradually from a state of basic balance to looseness in the remaining months of this year.

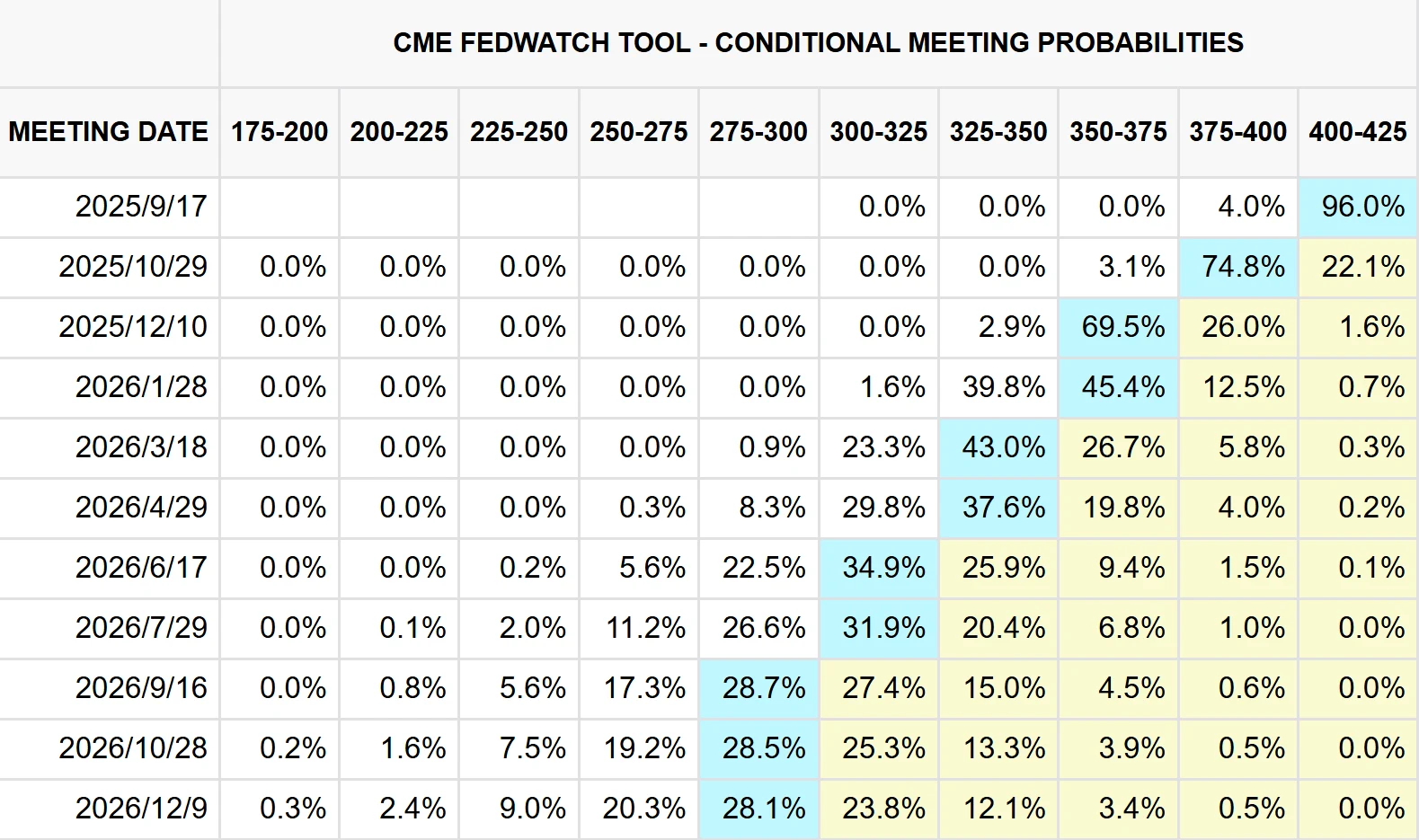

Notably, the trajectory of the Federal Reserve’s (Fed) monetary policy will also impact oil price trends. The federal funds target rate currently stands at a high level of 4.5%. Goldman Sachs projects that the Fed will cumulatively cut interest rates three times by the end of 2025, followed by two additional 25-basis-point (bps) rate cuts in 2026, bringing the terminal rate down to 3%-3.25%.

Source: CME Group

Based on correlation data from the past 40 years, when interest rates fall below 3%, they tend to provide significant support to oil prices. Although the terminal rate is expected to be 3%-3.25% by the end of 2026—close to the 3% threshold—if the Fed further cuts rates below 3% thereafter, it is still expected to provide notable support to oil prices.

OPEC+ will hold a meeting in Vienna from September 18 to 19 to discuss methods for assessing the alliance’s maximum production capacity. This issue is highly contentious: some member countries (such as the UAE) have expanded their production capacity and are demanding higher quotas, while some African member countries have seen a decline in their production capacity.

The outcome of the meeting will have a significant impact on production baselines from 2027 onward, which in turn will influence the global oil supply structure and long-term oil price trends.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates