Key Considerations to Monitor Ahead of the FOMC Meeting

22:59 September 16, 2025 EDT

Key Points:

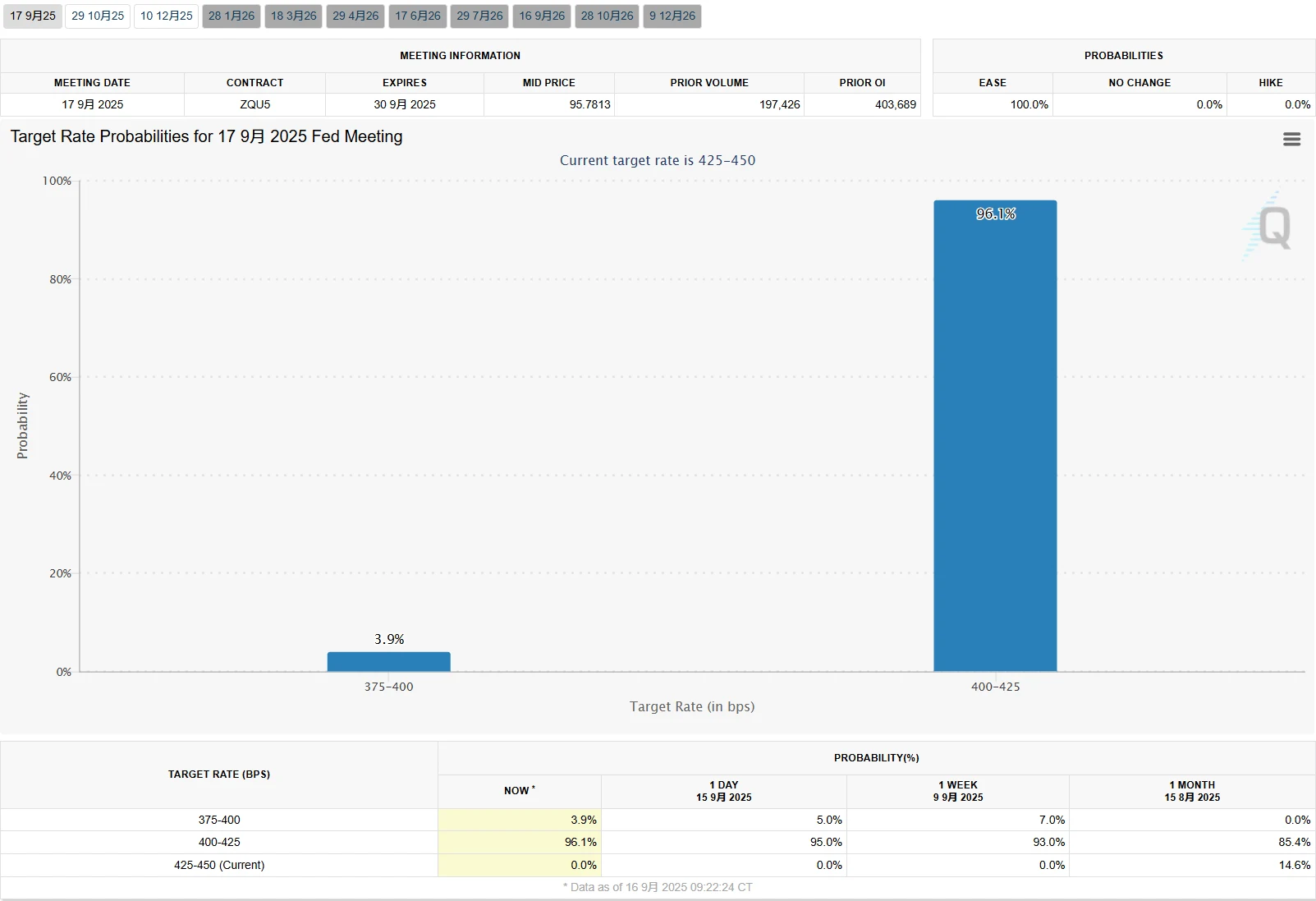

Markets have reached a heightened consensus regarding a 25 basis point rate cut at this meeting, with the primary focus shifting to the forward guidance on the rate path. Attention remains on whether officials will revise the projected number of rate cuts this year from two to three.

Federal Reserve Chair Jerome Powell is set to step down in May 2026, and his successor will be appointed by President Trump—a development that may influence longer-term monetary policy direction.

Nevertheless, the actual trajectory of the Fed’s policy path will ultimately be determined by subsequent economic data outcomes. Should labor market conditions deteriorate further, the Fed may accelerate the pace of rate cuts; should elevated inflation persist, it may opt to slow or pause easing measures.

The Federal Reserve will announce its September 2025 interest rate decision at 2:00 PM Eastern Time on September 17. Market participants widely anticipate a 25 basis point rate cut, which would mark the first cut of 2025 and the first easing move since the initial cut in September 2024—the first in over four years.

The key focus of this meeting has shifted away from the rate cut itself toward forward guidance on the policy path, internal policy divergence within the Fed, and the growing influence of political considerations on monetary policy.

Amid a Complex Context

The current policy meeting is taking place against the most complex backdrop in recent years.

On September 16, the first day of the meeting, newly appointed Federal Reserve Governor Stephen Miran formally joined the policy deliberations, while another Governor, Lisa Cook, continued her duties under the temporary protection of a federal appeals court ruling. This personnel arrangement has created notable policy tension—Miran, as an official nominated by the Trump administration, has publicly questioned the Fed’s independence and advocated for radical reforms. His academic work, A Guide to Restructuring the Global Trading System, is regarded as the theoretical foundation of Trump’s trade policies.

It is worth noting that during his nomination hearing, Miran cited the "moderate long-term interest rates" clause in the Fed’s charter, which markets interpreted as an attempt to legitimize intervention in the long-term bond market. The introduction of this so-called "hidden third mandate" could potentially undermine the core foundation of the Fed’s policy framework. History often repeats itself—this situation recalls the 1972 Nixon administration’s pressure on Fed Chair Arthur Burns to implement expansionary policies in support of the election, which ultimately led to a severe stagflation crisis.

Meanwhile, Cook, as a dovish representative on monetary policy, ensures a balance of perspectives within the Board. Although the federal appeals court issued a split 2-1 ruling to maintain the injunction temporarily halting her dismissal, allowing her to participate in this meeting, the White House has explicitly stated it will appeal to the Supreme Court, insisting on her removal over allegations of "mortgage fraud." It is noteworthy that the charges relate to actions prior to her tenure, and key evidence contains contradictions—in one document, her property was described as a "vacation home," while in another, it was referred to as a "second home." The Justice Department has not provided a clear explanation for this discrepancy.

Some analysts point out that this case essentially challenges the precedent set by the 1935 Humphrey’s Executor case, which protected officials of independent agencies. The implications for defining the legal boundaries of presidential power extend far beyond this individual case.

Changes in the composition of the Board are also reflected in the subtle balance of policy influence. Miran’s appointment brings the Trump-aligned contingent to three out of seven Board members. If Cook is successfully replaced, this would create a four-seat majority, significantly impacting the approval process for Reserve Bank president reappointments in 2026. This shift in personnel has raised concerns within academic circles about the Fed’s independence. Peter Berezin, Chief Global Strategist at BCA Research, noted that the Fed is in a difficult position—if it fails to respond effectively to an economic slowdown, it could provide Trump with further pretext for intervention, while excessive compromise would damage its policy credibility.

At the same time, the question of succession for the Fed Chair role adds another layer of uncertainty to current monetary policy. Treasury Secretary Besant confirmed a two-hour meeting with former St. Louis Fed President James Bullard, who stated in an interview with Reuters that if appointed Fed Chair, he would commit to upholding the dollar’s reserve currency status, maintaining low and stable inflation, and safeguarding the Fed’s independence.

Market Pricing vs. Policy Signals

Based on Data from the CME FedWatch Tool, As of the eve of the meeting, the probability that the Federal Reserve will cut interest rates by 25 basis points this week stands at a high 96.1%, while the probability of a 50-basis-point cut is only 3.9%, and the probability of keeping interest rates unchanged is nearly zero.

Source: CME Group

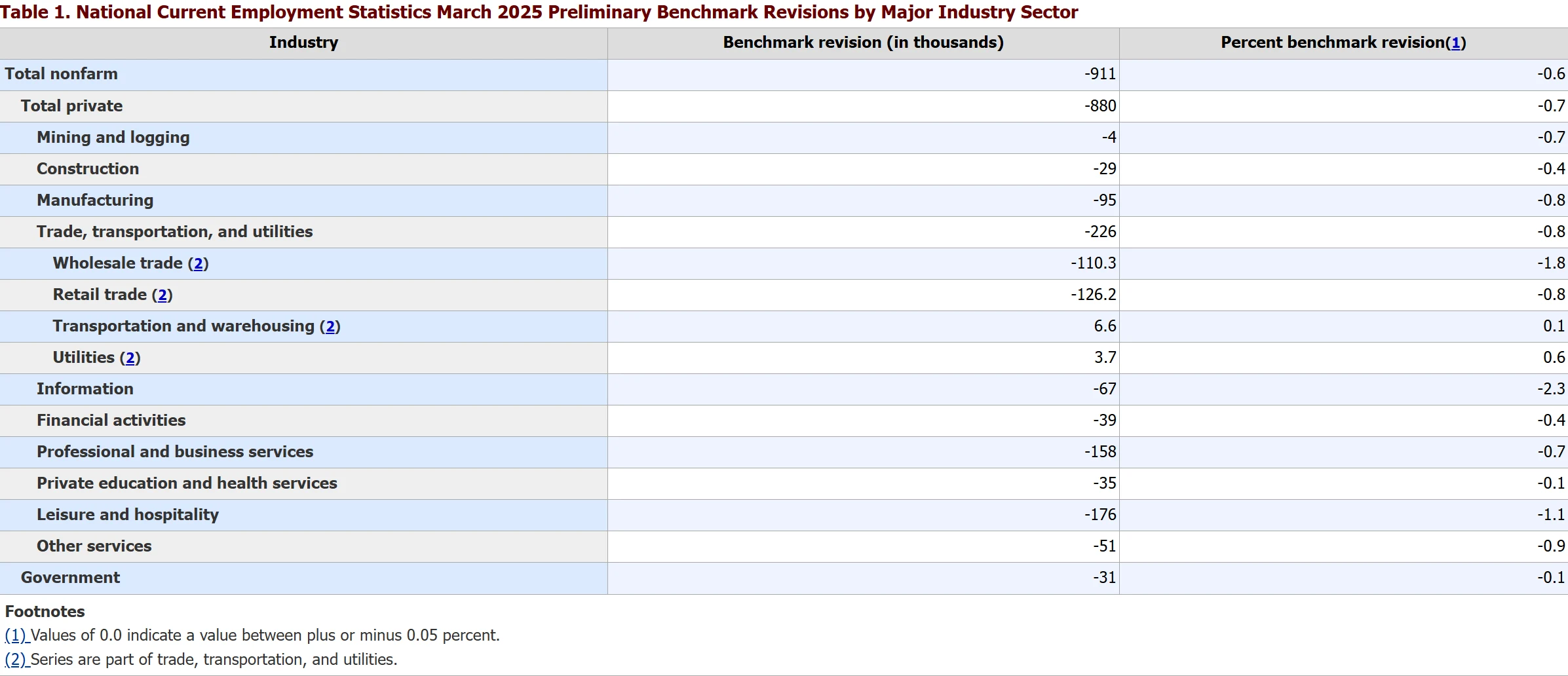

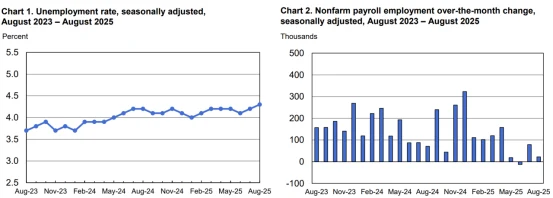

Market expectations for an interest rate cut at this meeting have reached an extremely high level of certainty. From the perspective of economic data, the labor market has sent clear signals of cooling, which constitutes the core basis for the interest rate cut. According to revised data, the number of newly added nonfarm payroll jobs in the U.S. from April 2024 to March 2025 was revised downward by 911,000, with an average monthly decrease of nearly 76,000. This revision magnitude is the largest since 2000.

Source: U.S. Bureau of Labor Statistics (BLS)

Crucially, the average number of newly added jobs in the three months ending in August was only 29,000, a sharp drop from the 96,000 recorded in the three months ending in June. This indicates a significant weakening of momentum in the labor market. In response to this weak trend, Jerome Powell stated in his Jackson Hole Symposium speech that he would prioritize "downside risks to employment" in policy considerations—a stark contrast to his stance at the July meeting, when he "worried more about inflation than employment risks."

Source: U.S. Bureau of Labor Statistics (BLS)

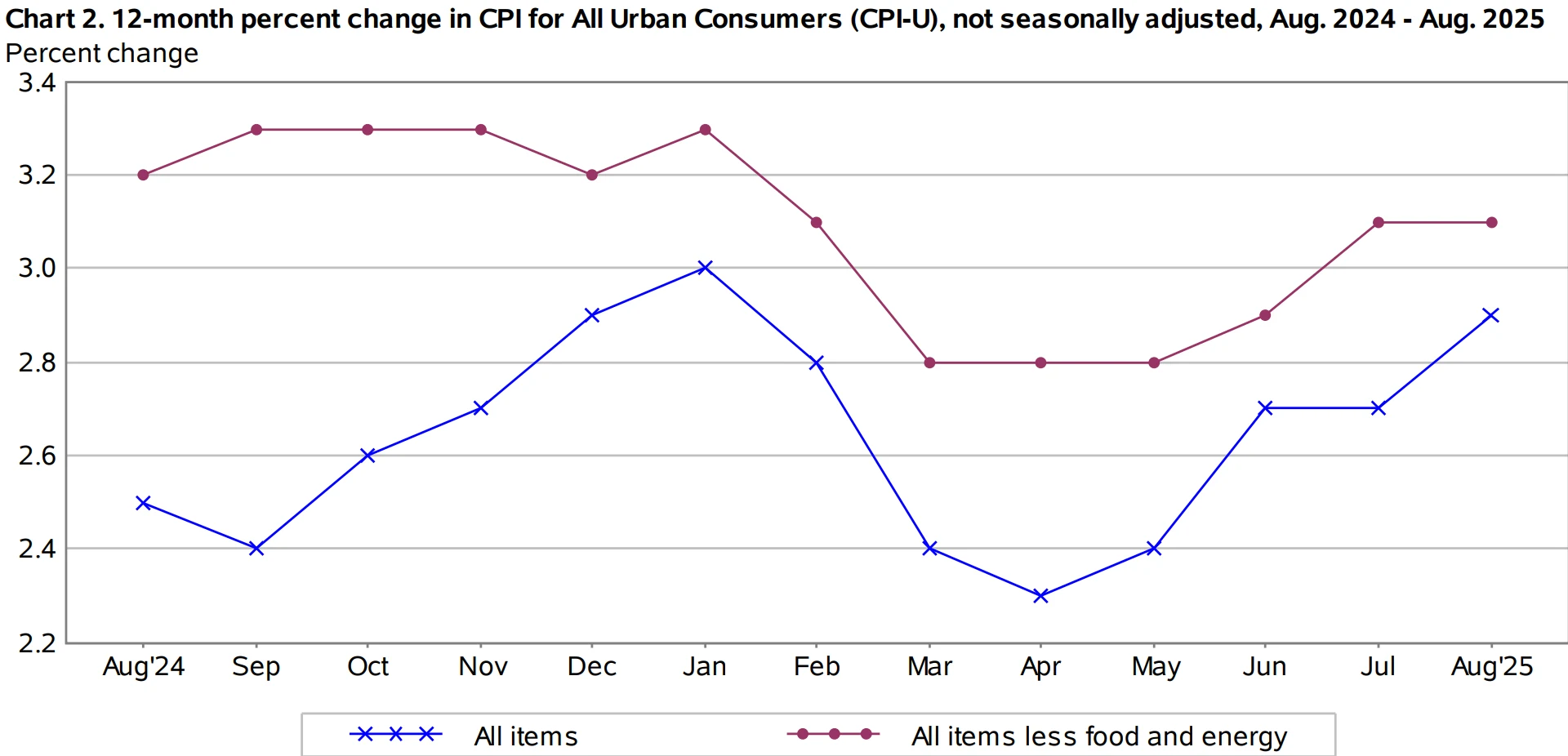

Inflation data, meanwhile, shows a "sticky yet moderating" trend, creating room for a cautious interest rate cut. In August, the Consumer Price Index (CPI) rose by 2.9% year-on-year, a slight increase from July’s 2.7%; core CPI (excluding volatile food and energy prices) rose by 3.1% year-on-year, remaining flat for two consecutive months. Breakdown data reveals that a 0.4% month-on-month increase in housing prices was the main driver, while the 0.7% month-on-month rise in energy prices included a 1.9% increase in gasoline prices—signaling that inflationary pressures have not been fully eliminated.

Source: U.S. Bureau of Labor Statistics (BLS)

Esther George, former President of the Federal Reserve Bank of Kansas City, expressed concerns about the rate cut, arguing that "the rationale for cutting rates purely to stimulate demand is weak" given the 4.3% unemployment rate, inflation above the target, and accommodative financial conditions.

Adjustments to the Federal Reserve’s own policy framework have also provided theoretical support for the interest rate cut. In its second Monetary Policy Framework Review released in August, the Fed reaffirmed its long-term 2% inflation target but emphasized that policies should be formulated "based on a balance of economic outlook and risks." This provides flexibility for implementing preemptive interest rate cuts when downside risks to employment rise. Powell specifically noted that the current policy rate is 100 basis points closer to the neutral level than it was a year ago and remains in a restrictive range, leaving room for adjustments.

Policy Path Divergence

While a 25-basis-point rate cut at this meeting is a foregone conclusion, debates over the future policy path have become the focus of market discussion and attention.

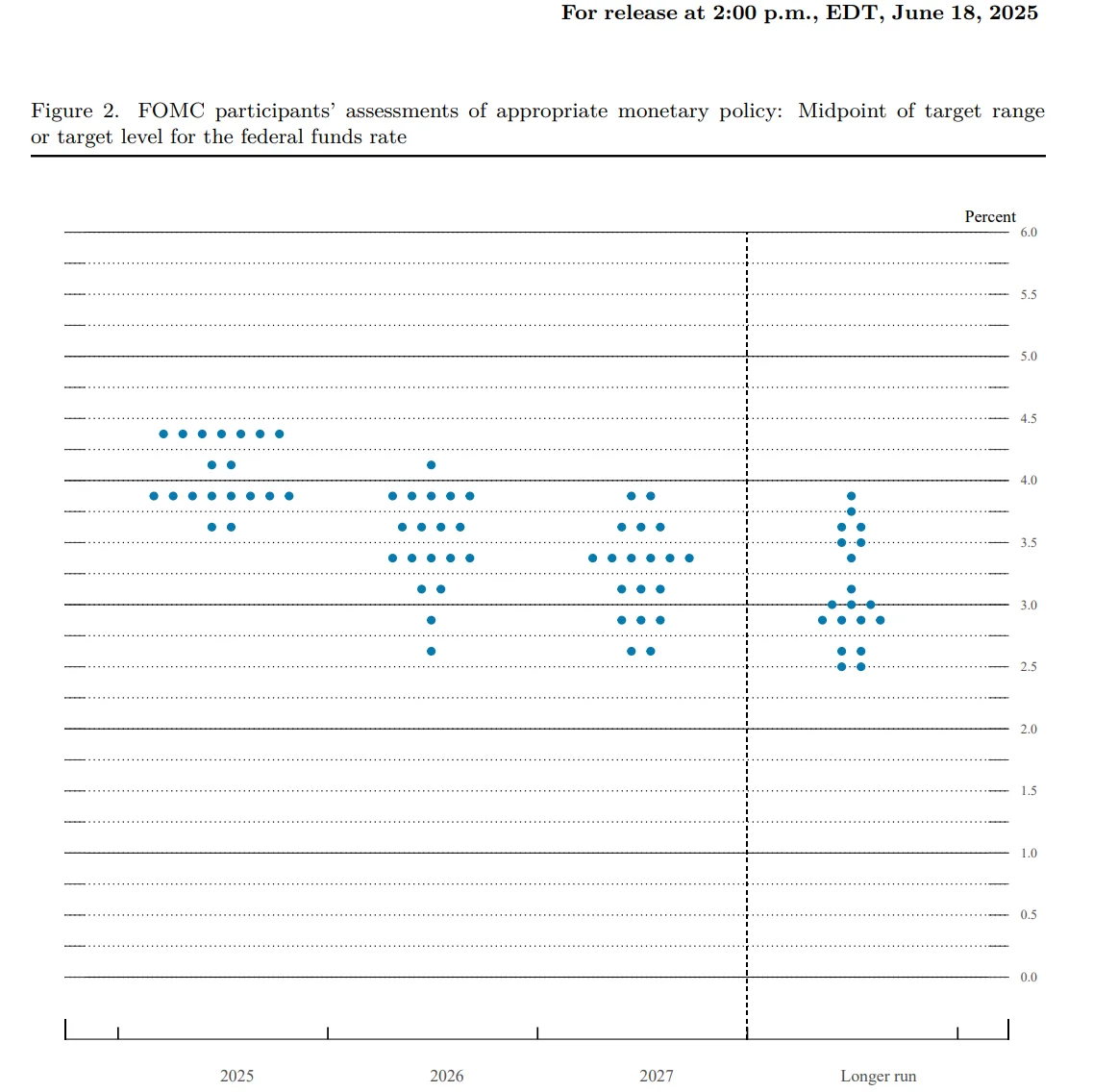

First, regarding the number of rate cuts remaining this year: the June dot plot showed that most officials expected two rate cuts in 2025, while current markets have priced in the possibility of a cumulative 75-basis-point cut by the end of the year. Goldman Sachs forecasts that the Federal Reserve will launch its rate-cutting cycle in September, completing three 25-basis-point cuts within the year and lowering the terminal rate to the 3.00%-3.25% range. Morgan Stanley, meanwhile, expects a rate cut at every meeting through January 2026, with the target range falling to 3.5%.

Source: Federal Reserve

In contrast, Loretta Mester, former President of the Federal Reserve Bank of Cleveland, explicitly opposed consecutive rate cuts, arguing that this week’s cut "reduces the degree of restrictiveness but still maintains a restrictive stance" and that policy should be made "meeting by meeting, based on data."

It is important to note that the definition of the neutral interest rate has become the theoretical core of disagreements over the policy path. Fed officials generally estimate the neutral interest rate (the rate that neither stimulates nor restrains the economy) at 3%, but Richard Kaplan, former President of the Federal Reserve Bank of Dallas, believes it should be raised to around 3.5%. This 0.5-percentage-point difference translates to a significant variance in policy adjustment space: based on a 3% neutral rate, approximately 125 basis points of cuts would be needed, whereas a 3.5% neutral rate would require only 75 basis points of cuts. Luke Tilley, Chief Economist at Wilmington Trust, has an even more dovish forecast, arguing that the Fed needs to implement six consecutive rate cuts (three this year and three next year) to lower rates to the 2.75%-3% range to reach the neutral level.

Debates over the positioning of the policy stance have also intensified due to public remarks by Treasury Secretary Besant. On the eve of the meeting, Besant accused the Fed of "consistently falling behind the curve" and emphasized that the key issue lies in "adopting a neutral or accommodative stance." He specifically noted that the "inversion at the front end of the yield curve" is a clear signal that markets expect policy easing.

This comment was interpreted by markets as pressure on the Fed to adopt more aggressive easing measures, aligning with the White House’s earlier position that "interest rates should be 150-175 basis points lower than current levels." However, the Fed has remained cautious internally. In his speech at the Jackson Hole Economic Symposium, Jerome Powell stressed that policy has "no preset path" and will be formulated entirely based on a balance of data and risks.

Therefore, the updated dot plot to be released at this meeting will be key to resolving these disagreements. Investors are highly focused on whether officials will raise the total number of rate cuts expected this year from two to three, as this will directly influence policy expectations for the October and December meetings. Looking at the current composition of voting members: among the four new rotating FOMC voters in 2025, there are two hawks (Mary Daly Musallem, Thomas Schmid), one dove (Austan Goolsbee), and one centrist (Susan Collins). This structure is likely to limit the degree of easing reflected in the dot plot.

Source: Federal Reserve

Conclusion

Taken together, the Federal Reserve’s policy path still faces considerable uncertainties. Inflation trends, fiscal deficits, and the political cycle will all constrain the formulation and implementation of monetary policy.

If core PCE rebounds above 3% in early 2026, the Fed may pause rate cuts. Meanwhile, the U.S. deficit ratio for fiscal year 2025 is projected to reach 6.2%—if rate cuts stimulate economic overheating, they could exacerbate debt risks. Ahead of the 2026 elections, the Fed may shift policy early to avoid being accused of "aiding election efforts." Fed Chair Jerome Powell will step down in May 2026, and the new chair will be appointed by Trump, which could exert an impact on the long-term direction of monetary policy.

However, what will truly determine the Fed’s policy path remains the performance of subsequent economic data. If the labor market deteriorates further, the Fed may accelerate the pace of rate cuts; if inflation remains persistently high, it may slow the rate-cutting pace or even pause rate cuts.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates