Tesla Breaches $400 Level With Potential for Further Gains

05:13 September 16, 2025 EDT

Tesla's stock closed at $410.04 in U.S. stock market trading on September 15, 2025, rising 3.6% on the day and peaking at an intraday high of $425. This marks the first time the stock has climbed back above the key psychological level of $400 since late January 2025.

This stock price increase has pushed Tesla's year-to-date cumulative gain to 1.5%, erasing the sharp declines seen from the start of the year through March-April. Since hitting its year-to-date low of $214.25 on April 8, the stock has rallied nearly 100%, nearly doubling in value.

Source: TradingView

Factors Driving the Breakout

The strong performance of Tesla's stock since September has been driven by a combination of positive factors.

Among these, the share purchase by Elon Musk, the company's founder and CEO, has served as a direct catalyst. According to regulatory filings, Musk purchased a total of 2.57 million Tesla shares through 25 transactions on September 12, with a price range of $372 to $396 per share, totaling approximately $1 billion. This marks Musk’s first public market purchase of the company’s shares since February 2020, sending a clear signal of confidence to the market.

The market responded quickly and strongly: within three trading days after the news was announced, Tesla’s stock price rose by more than 20% cumulatively. On September 12 alone, the stock surged 7.4%, marking the largest single-day gain in nearly three months. This demonstrates the significant role of key management statements in boosting market sentiment.

Source: TradingView

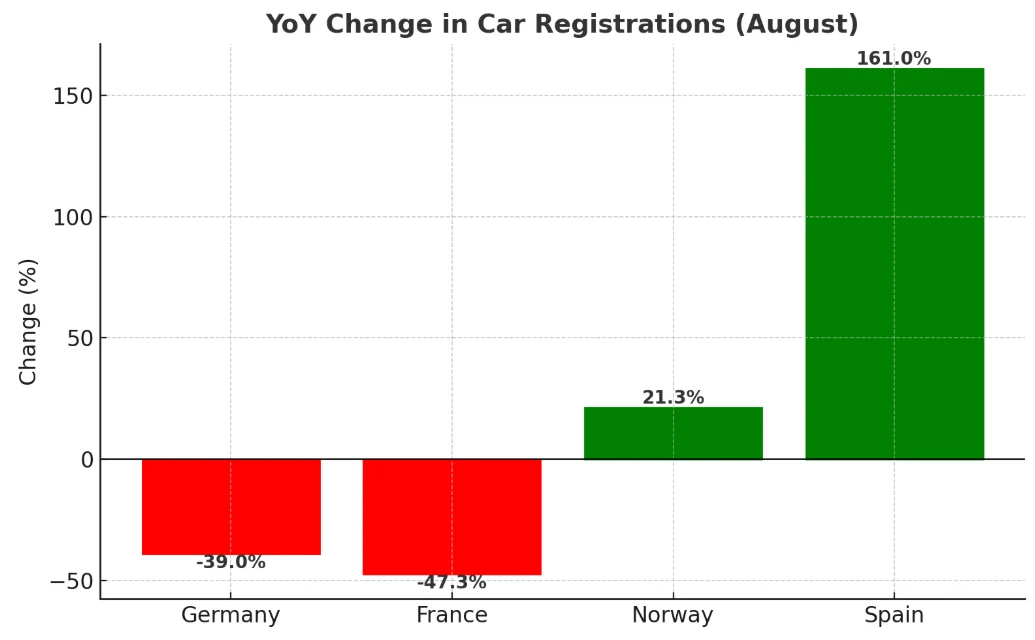

Positive adjustments on the production side have provided fundamental support for the stock price. André Thierig, head of Tesla's German factory, previously stated that due to improved sales performance, the factory has raised its production plans for the third and fourth quarters. The Giga Berlin-Brandenburg factory near Berlin, a key production base for the Model Y, currently maintains an annual production capacity of 375,000 units, and this production increase plan covers all European markets it supplies. While the European market showed a mixed overall performance—German market registrations fell 39% year-on-year in August, and French registrations dropped 47.3%—the Norwegian market grew by 21.3%, and the Spanish market saw sales jump from 549 units in the same period last year to 1,435 units, representing a 161% increase. These figures reveal potential opportunities in regional markets. Tesla’s flexible adjustment capabilities on the production side allow it to better align with demand changes across different regions.

Notably, data from the China Passenger Car Association (CPCA) shows that Tesla’s Shanghai Gigafactory recorded wholesale sales of 83,192 units in August, up 22.6% month-on-month and hitting a new high for the year. Among these, the Model Y claimed the top spot in the August SUV sales ranking with 39,413 units sold, while also ranking among the top in sales within the new energy vehicle (NEV) segment. Sales of the Model Y accounted for 68.96% of Tesla China's total sales in August. Orders for the new Model Y L have been scheduled into November, demonstrating the continuous release of the product's competitiveness.

To further stimulate demand, Tesla lowered the price of the Model 3 Long-Range Rear-Wheel Drive variant by RMB 10,000 to RMB 259,500 on September 1. This variant had only been launched on August 12, and price adjustments were initiated in just over half a month after its release. Although cumulative sales of the Shanghai Gigafactory in the first half of the year still fell 5.4% year-on-year, the month-on-month growth in August indicates that the Chinese market has entered a recovery trajectory.

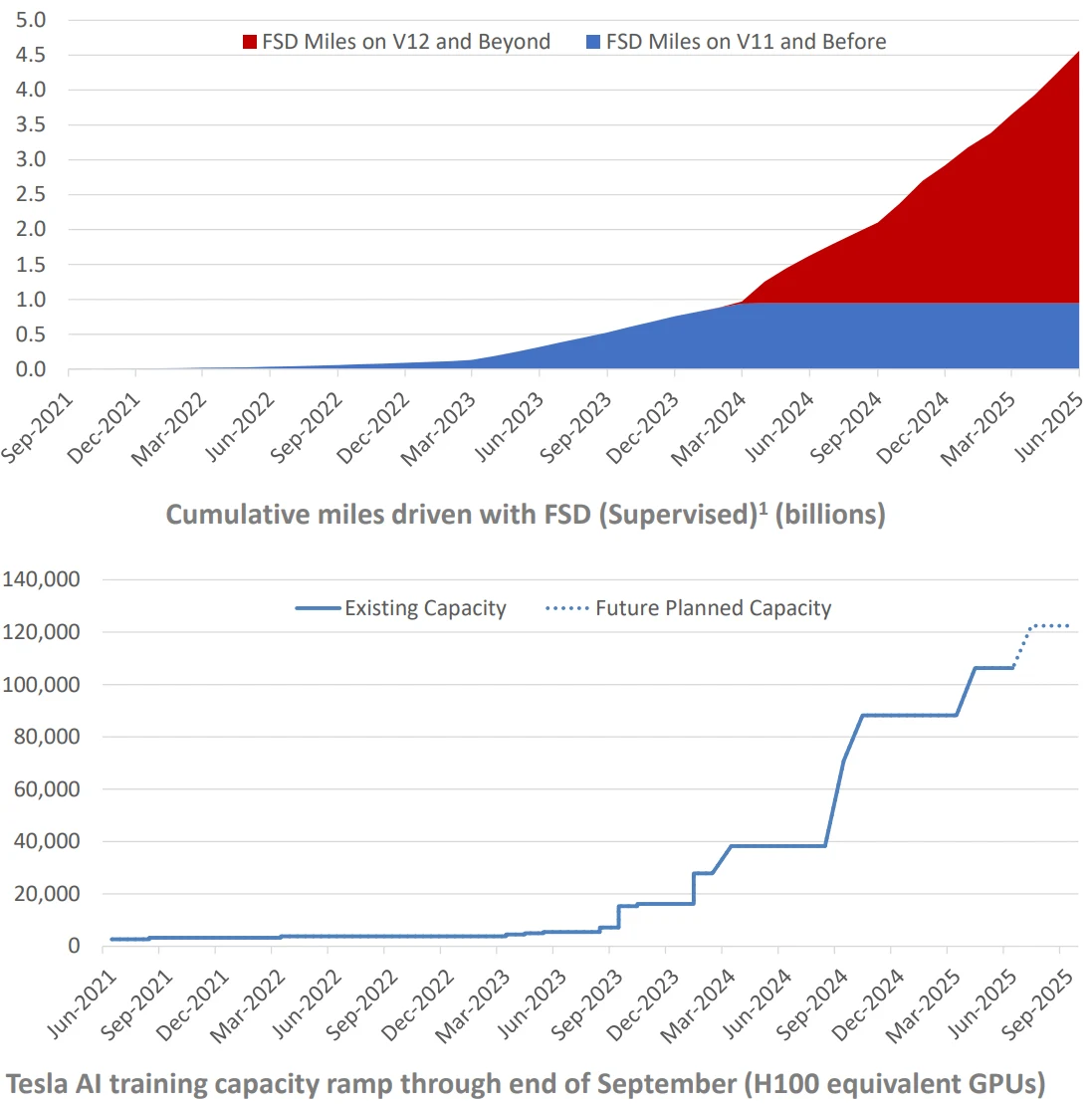

In addition, breakthroughs on the technical front and the recovery of market sentiment have combined to drive growth. Morgan Stanley's trading division noted that the current underweight positioning in Tesla among institutional investors, catch-up demand in AI-related sectors, and market enthusiasm for Version 14 of Full Self-Driving (FSD) have together constituted the market factors driving the stock price higher. From a capital perspective, after Tesla's stock price experienced a maximum pullback of approximately 55% (from a high of $488.54 in December 2024 to a low of $214.25 in March 2025), its valuation appeal has significantly increased.

As of press time, market sentiment indicators show a rebound in risk appetite for growth stocks among investors. As a leading enterprise at the intersection of the new energy and AI sectors, Tesla has naturally become a key target for capital inflows.

Rationale for Continued Appreciation

Tesla’s recent stock rebound is likely not merely a result of market sentiment fluctuations; instead, it more closely reflects the company’s substantial progress in strategic transformation, technological breakthroughs, and product layout. These changes are gradually being priced in by the capital market and will provide sustained support for the stock price in the mid-to-long term.

At the strategic level, Tesla has clearly defined that its future growth curve will no longer be limited to electric vehicles and energy businesses, but will shift toward AI and robotics technology. In the fourth chapter of its released "Master Plan," Tesla proposed that approximately 80% of the company’s future value will come from the Optimus humanoid robot. While the actual production volume of Optimus was only a few hundred units as of July 2025—far below the original target of 5,000 units—the pace of technological iteration warrants attention. The V3 version, expected to be unveiled by the end of the year, will be equipped with 26 actuators, featuring human-like dexterous hand operation capabilities, and Tesla plans to reduce its cost to the range of $20,000 to $30,000.

Source: Tesla

Complementing the robotics business is the accelerated commercialization of autonomous driving. Tesla has launched Robotaxi pilot operations in Austin and San Francisco, with coverage continuing to expand, and its technical performance has withstood the test of real-world road testing. Operational data shows that as of the second quarter of 2025, the Austin fleet had accumulated over 7,000 miles of driving without any safety-critical interventions. Meanwhile, after the launch of the FSD V12 version in North America, subscription rates increased 45% quarter-on-quarter, and the overall penetration rate rose by 25%—laying a user and data foundation for the large-scale operation of Robotaxi. Tesla plans to expand coverage to major cities with a total population of 160 million by the end of the year; this process will not only strengthen its autonomous driving ecosystem but also open up new software revenue streams for the company.

Source: Tesla

The core underpinning both the autonomous driving and robotics businesses is Tesla’s continuous breakthroughs in AI chip technology. Elon Musk revealed that the design review for the AI5 chip has been completed, with computing power reaching 2,000–2,500 TOPS—far exceeding the 500 TOPS of the previous-generation AI4 chip—and mass production is expected by the end of 2026. Notably, the next-generation AI6 chip will be prioritized for use in Robotaxi and Optimus, with production entrusted to Samsung’s Texas factory. This layout not only enhances the computing power and algorithm adaptability of its products but also enables Tesla to compete head-on with NVIDIA in the AI hardware segment, forming a technical barrier that is difficult to surpass in the short term.

Beyond AI and robotics, Tesla is expanding its product lineup. In the fourth quarter of 2025, the company will launch an affordable model priced at RMB 150,000 (approximately $20,800) at launch, positioned as a "compact Model Y." Production of this model began in June, and it entered the capacity ramp-up phase in the third quarter, with a planned annual production capacity of 4 million units—1 million each at the Shanghai and Berlin gigafactories. This will allow Tesla to enter a larger consumer market and form a product portfolio covering different price segments alongside its existing models.

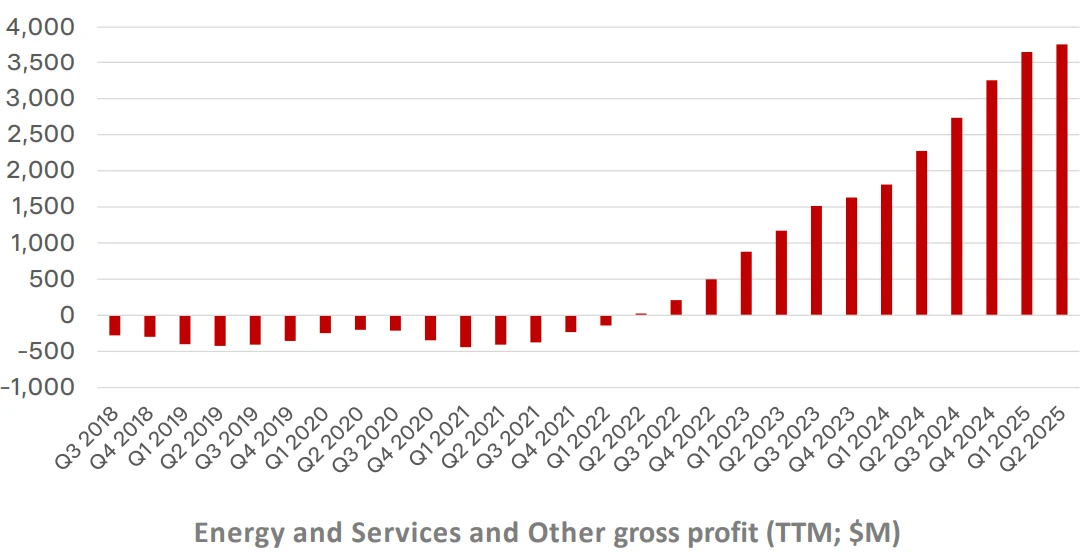

At the same time, the energy storage business is also expanding rapidly. Since construction began in 2024, Tesla’s Shanghai Energy Storage Gigafactory has started delivering products in the first quarter of 2025, with a planned annual production capacity of 10,000 Megapacks, corresponding to an energy storage scale of nearly 40 GWh. With a gross margin of 30.5%, the energy storage business has become a new profit growth driver for the company, further reducing its reliance on the vehicle business.

Source: Tesla

Market Sentiment

Sentiment toward Tesla in the capital markets is gradually shifting to optimism, with analysts’ rating adjustments and target price hikes providing crucial support. Dan Ives, Global Head of Tech Research at Wedbush Securities, noted that Musk’s share purchase is “a major confidence signal for Tesla bulls,” reflecting management’s firm commitment to the company’s AI strategy.

Jed Dorsheimer, an analyst at William Blair, also believes that as delivery expectations improve and autonomous taxi services advance, the investment thesis for Tesla is becoming clearer. From the perspective of institutional holdings, data from Morgan Stanley’s Trading Division shows that the previous underweight positions in Tesla among market participants are being reversed, and position-closing demand ahead of the quarter-end will continue to drive capital inflows.

A long-term incentive mechanism has been established at the shareholder level. Tesla’s $975 billion compensation package for Musk has been approved by shareholders, with highly challenging performance targets: market capitalization to rise above $2 trillion, cumulative vehicle deliveries to reach 20 million units, and active FSD subscribers to hit 10 million. This mechanism, which deeply aligns management interests with the company’s long-term development, provides institutional guarantees for the execution of its strategy.

Changes in the market environment have also worked to Tesla’s advantage. While the U.S. electric vehicle (EV) tax credit policy is set to expire, Tesla has partially offset the policy’s impact through product structure adjustments and cost control. In the Chinese market, the penetration rate of new energy vehicles (NEVs) continues to rise: in August 2025, national wholesale sales of NEV passenger vehicles reached 1.282 million units, up 22.3% year-on-year and 9.6% month-on-month. The dividends from industry growth have created market space for Tesla.

More importantly, the rapid development of the global artificial intelligence (AI) industry has driven valuation recovery in related sectors. As a representative enterprise in the application of AI technology in the physical world, Tesla stands to benefit from this market trend.

Technical Patterns

Breakthroughs on the technical front have reinforced the market trend for Tesla’s stock. Since its April low, the stock has formed a "higher lows" pattern, indicating the completion of its bottoming process.

On September 15, the stock price briefly touched $425 intraday, breaking through the previous resistance range, while trading volume expanded simultaneously—signaling strong buying pressure. The moving average system shows that the stock price has steadily stood above the 50-day moving average (50 DMA) and 200-day moving average (200 DMA).

Source: TradingView

Technical analysts believe that the $400 level has shifted from a resistance level to a support level, providing a technical foundation for further upside. The short-term resistance level is around $430; if this level is breached, it may open up room for a move toward $450. Key downside support levels are located at $380 and $350.

Source: TradingView

From a valuation perspective, Tesla’s current stock price corresponds to an estimated price-to-earnings (P/E) ratio of approximately 155x for 2025. While this is lower than its historical average, it remains far higher than that of traditional automakers. This valuation not only reflects market concerns about the slowing growth of Tesla’s automotive business but also incorporates growth expectations for its new AI and robotics businesses. If these new businesses can be launched as scheduled, Tesla’s valuation framework is expected to align more closely with that of tech companies; conversely, it may be weighed down by risks in the automotive segment.

Final Assessment

Currently, institutions such as Morgan Stanley believe that Tesla has transitioned from an electric vehicle manufacturer to an AI-robotics platform company, and its valuation framework needs to incorporate multiple growth drivers including robotaxis, Optimus humanoid robots, and the low-altitude economy.

If Tesla can effectively execute its strategic transformation plan—maintaining its position in the electric vehicle market while successfully developing new AI and robotics businesses—the stock price may have room for further upside. However, investors also need to pay attention to challenging factors such as intensified competition, technology execution risks, and global market uncertainties.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates