Should You Consider Buying This Stock Ahead of the September 23 Earnings Release?

03:11 September 16, 2025 EDT

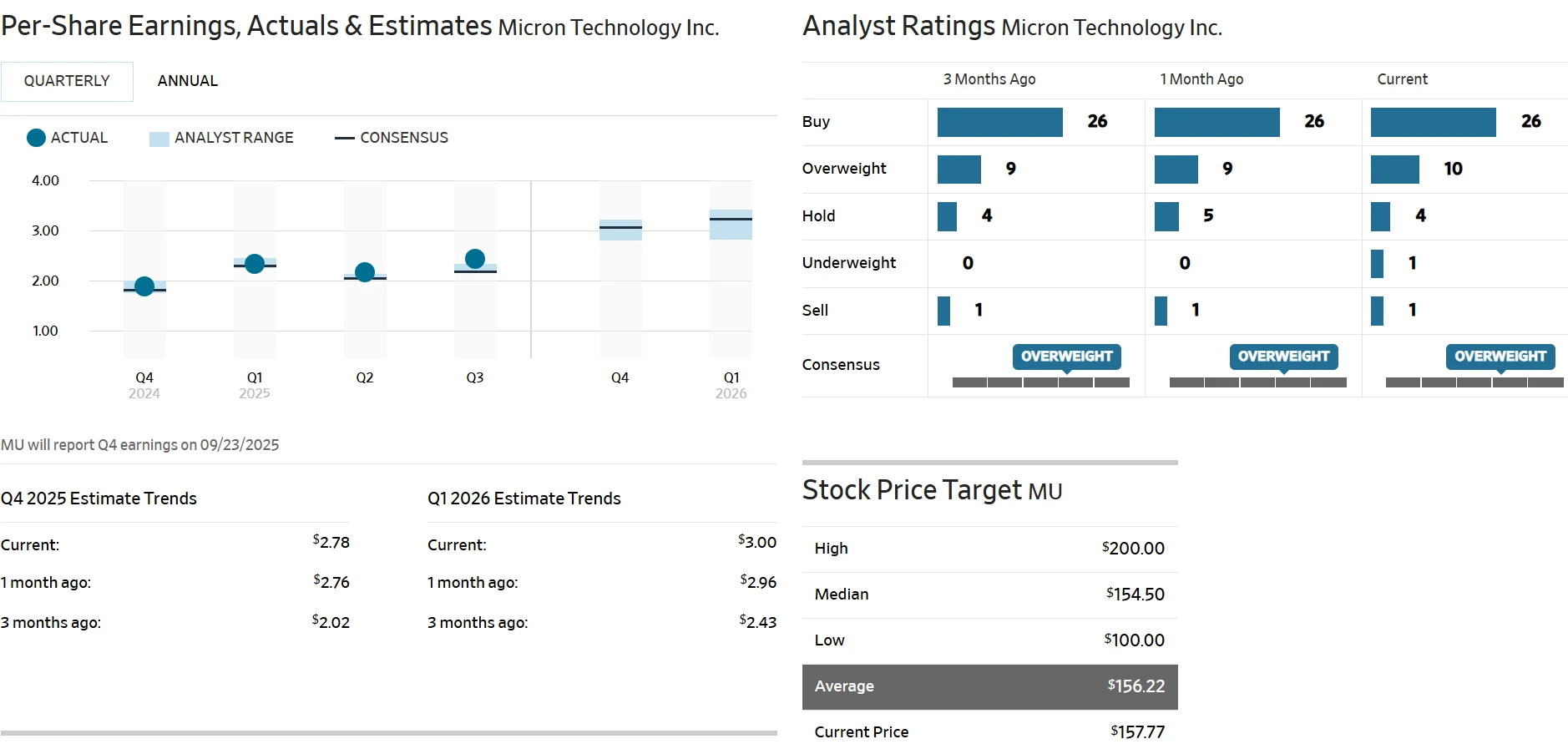

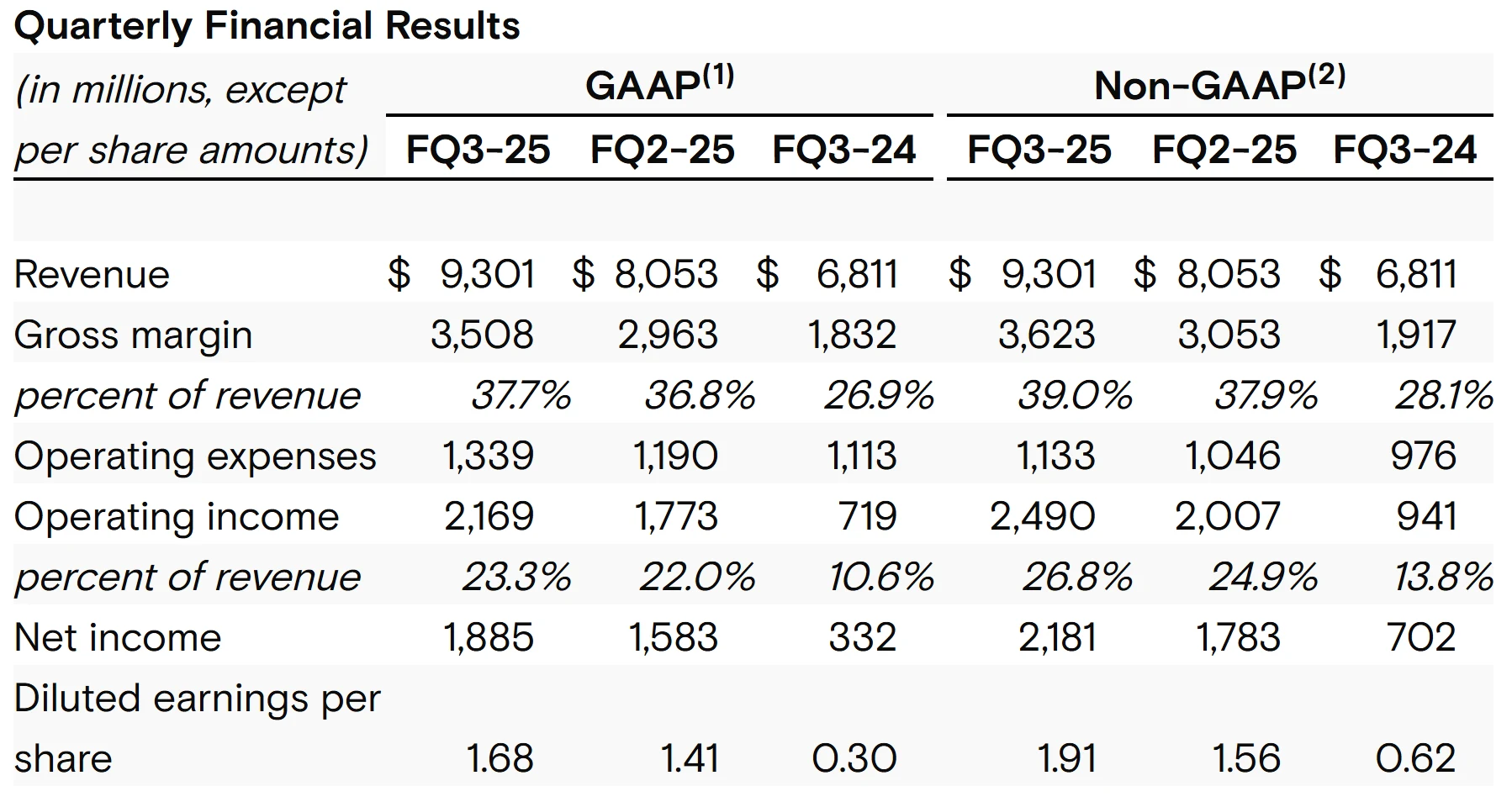

U.S. memory chip manufacturer Micron Technology is scheduled to report its fiscal 2025 fourth-quarter earnings after U.S. market hours on September 23. According to Bloomberg consensus estimates, the company is projected to post revenue of $11.115 billion, with adjusted net income of $3.173 billion and adjusted earnings per share of $2.85.

Since the beginning of 2025, Micron’s share price has advanced from an opening level of approximately $84, exhibiting volatile upward momentum. As of the close on September 15, the stock has gained over 86%, reaching a latest closing price of $157.77. The shares remain in an upward trend, having touched an intraday record high of $160.34 during the September 15 trading session.

Source: TradingView

Multiple Institutions Raise Target Price

Ahead of the earnings release, multiple Wall Street institutions have raised their target prices for Micron Technology, anticipating that the company's performance will continue to exceed expectations against the backdrop of AI-driven growth in high-bandwidth memory demand.

Mizuho increased its target price for Micron from $155 to $182, maintaining an "Outperform" rating. Deutsche Bank raised its target from $155 to $175, while UBS lifted its target from $155 to $185 and reaffirmed a "Buy" rating. Citigroup reiterated its "Buy" rating on Micron, raising its target price from $140 to $175.

Several other firms, including Stifel, also raised their target prices for Micron while maintaining "Buy" ratings. Among the 42 analysts tracked by The Wall Street Journal, 26 recommend "Buy," 10 advocate "Overweight," 4 suggest "Hold," and only 1 advises "Sell."

Source: WSJ

However, Goldman Sachs maintains a "Neutral" rating on Micron with a target price of $130. The firm noted that while Micron's performance is likely to slightly exceed market consensus, growth in the November quarter is expected to be relatively moderate, with focus remaining on the company's progress in expanding its high-bandwidth memory (HBM) production capacity.

Earnings Outlook

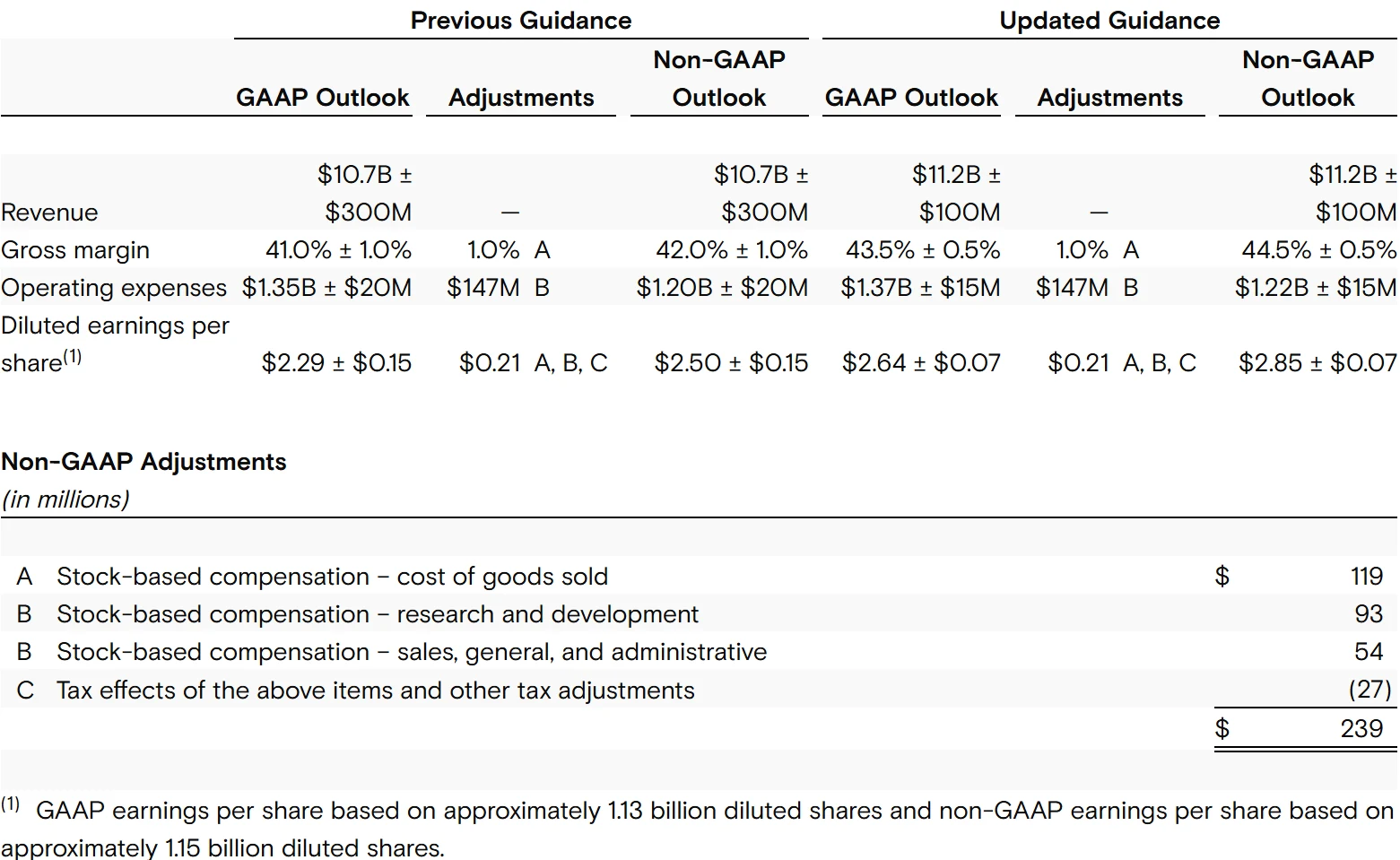

Micron Technology has comprehensively raised its fiscal fourth-quarter performance expectations. The company now anticipates revenue between $11.1 billion and $11.3 billion, up from its previous guidance range of $10.4 billion to $11.0 billion. Adjusted earnings per share are projected to be $2.78 to $2.92, exceeding the prior outlook of $2.35 to $2.65.

Source: Micron Technology

The company has also turned more optimistic about profitability, forecasting an adjusted gross margin of 44% to 45%, compared with the earlier expectation of 41% to 43. Micron management attributes the improved outlook to enhanced DRAM pricing and strong execution. UBS projects that DDR memory average selling prices will increase 3% quarter-over-quarter in Q3 2025, 5% in Q4 2025, and 3% in Q1 2026.

For NAND flash memory, the firm anticipates similar price growth during the same periods, at 3%, 5%, and 3% respectively.

The robust recovery in memory demand driven by artificial intelligence represents the core factor behind Micron's improved performance. Christopher Danely, analyst at Citigroup, stated: "The ongoing recovery in the memory market is being propelled by constrained capacity and stronger-than-anticipated demand, particularly from the data center end-market—which accounts for approximately 55% of Micron's revenue."

Demand for server DDR5 memory from hyperscale data centers remains particularly strong, with all major U.S. customers seeking long-term agreements extending into calendar year 2026. Citigroup's research indicates that cloud service providers have increased their fiscal 2025 capital expenditure by $18 billion this earnings season, directly boosting demand from the AI sector.

Jacob Bourne, analyst at research firm EMarketer, noted that constrained HBM production capacity coupled with robust AI demand has enabled Micron to command higher prices for its products, signaling a shift from the historically lower-margin environment that memory chip manufacturers have typically faced.

HBM Advancements

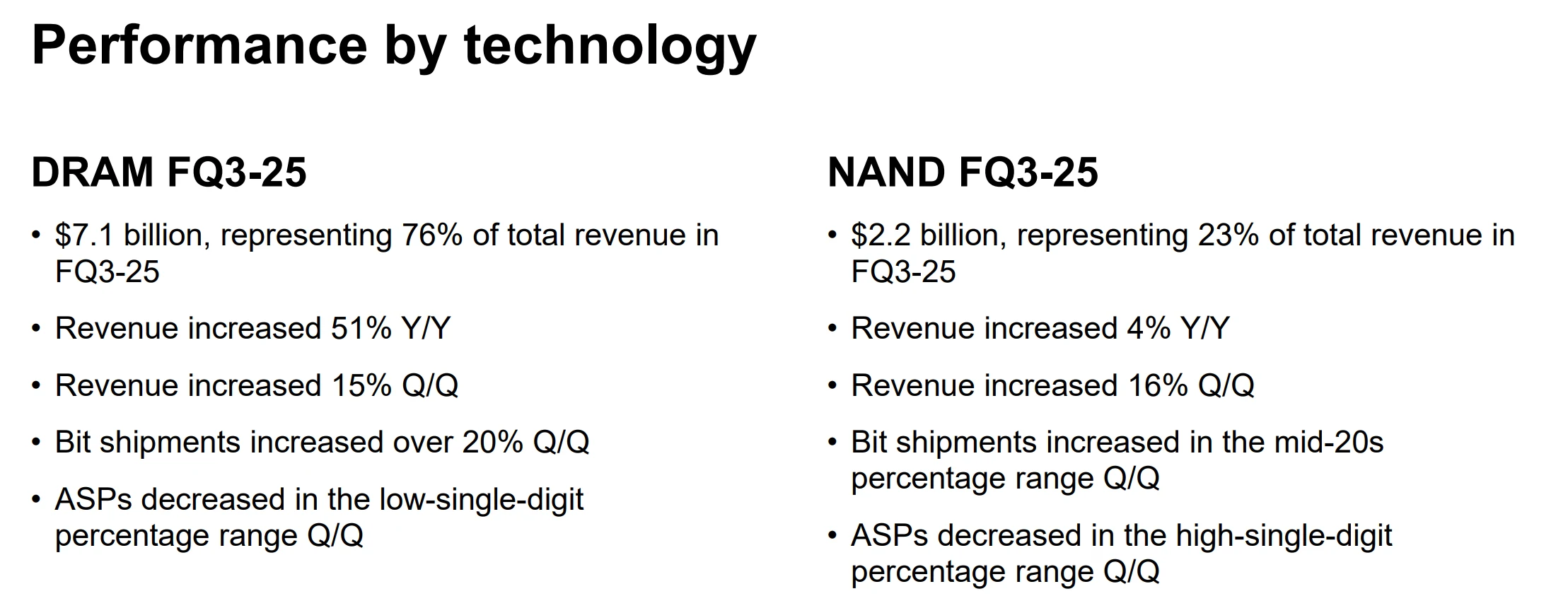

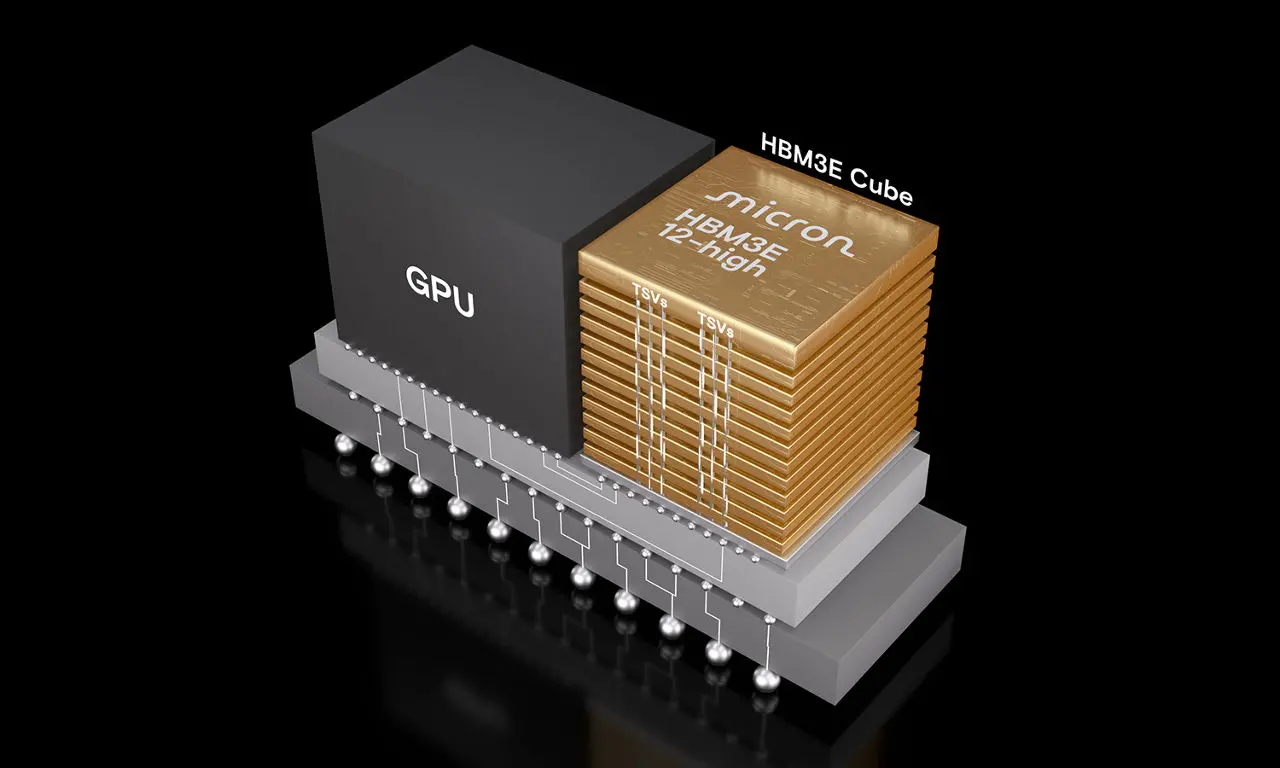

High-Bandwidth Memory (HBM) has emerged as Micron Technology's most critical growth driver. During the company's fiscal third quarter, sequential revenue growth for HBM chips reached nearly 50%. Micron's HBM development is making smooth progress: its HBM3E 12-high variant has secured design wins in NVIDIA's GB300, and the company is expected to enter a phase of mixed supply of 8Hi and 12Hi variants in the next quarter.

Source: Micron Technology

UBS maintains its industry demand forecast, projecting that HBM demand will reach approximately 16.9 billion gigabits in calendar year 2025 and 26.1 billion gigabits in 2026. The firm believes that despite an extended qualification timeline, Micron remains on track to complete HBM4 qualification by year-end and commence mass production shipments in 2026.

HBM is cannibalizing the traditional memory market, creating tight supply conditions that enable Micron to redirect its bit allocation toward higher-value market segments. This dynamic is expected to intensify through calendar year 2026, until new manufacturing capacities come online.

Mizuho holds the view that due to Samsung Electronics' ongoing challenges, the HBM4 market will evolve into a two-player dominance between Micron and SK Hynix. With the ramp-up in production capacity for NVIDIA's next-generation Rubin chips, Micron's revenue is poised to maintain strong growth from 2026 to 2027.

Source: Micron Technology

At the industry level, the memory chip market is exhibiting a distinct recovery trend. According to TrendForce's latest survey, the DDR4 market is expected to remain in a state of supply shortage through the second half of 2025, accompanied by robust price increases.

Strong growth in server orders is constraining supply for the PC and consumer markets, forcing PC OEMs to accelerate the adoption of DDR5. The supply-demand tightness in DRAM has also pushed up contract prices for mobile DRAM: LPDDR4X recorded the largest quarterly price increase in nearly a decade in the third quarter of 2025.

It is reported that due to strong demand for DRAM and NAND, Micron suspended quoting prices for a week over the past weekend. The expected price adjustment range is as high as 20% to 30%, with automotive and industrial-grade products potentially seeing price hikes of up to 70%.

JPMorgan noted in a report that driven by the synergy of technological iteration and AI demand, the supply-demand tightness in the DRAM market will persist until 2027. Micron and SK Hynix will lead this trend by leveraging their technological and production capacity advantages.

Risk Factors

Despite its strong current fundamentals, Micron still operates in a highly cyclical industry. Price volatility of memory chips, inventory fluctuations, and adjustments to capital expenditure plans may impact its future profit performance.

Key competitors including Samsung and SK Hynix are also accelerating their layout in high-end memory such as HBM. Last week, SK Hynix took the lead in announcing its readiness for mass production of HBM4, gaining a first-mover advantage. For its part, Micron announced in June that it had shipped HBM4 samples to multiple key customers, but has not yet provided a signal for mass production at present.

A slowdown in the AI investment cycle, or adjustments to HBM procurement pace by downstream manufacturers such as NVIDIA, could also lead to periodic fluctuations in Micron’s performance.

In response to business changes, Micron Technology stated that, given the persistently weak market financial performance of mobile NAND products and their slower growth compared to other NAND opportunities, the company will discontinue the future development of mobile NAND products globally—including terminating the development of UFS5. This decision only affects the development of mobile NAND products worldwide; the company will continue to develop and support other NAND solutions.

Source: Micron Technology

Furthermore, as a semiconductor company with global operations, Micron Technology faces supply chain risks posed by geopolitical uncertainties. The regionalization trend of the global semiconductor industry chain may increase production and logistics costs, while the stability of the supply of key materials and equipment could also be affected by changes in international trade policies.

Meanwhile, the complexity and high technical nature of HBM production result in a relatively fragile supply chain, and disruptions in any link may impact the progress of capacity ramp-up. In the process of expanding HBM capacity, Micron needs to ensure the stability of key supply chains such as advanced packaging technologies and special materials—this places higher demands on the company’s supply chain management capabilities.

Valuation Analysis

Despite a year-to-date stock price gain of over 86%, supported by the dual improvement in its performance and prospects, Micron’s valuation has not seen significant expansion. Based on the current stock price and the consensus expected earnings per share (EPS) for the next four quarters, Micron’s forward price-to-earnings (P/E) ratio stands at approximately 20x, which is lower than the overall average level of the AI hardware sector and still retains certain valuation appeal.

The HBM market is expected to reach $86 billion by 2030, with a compound annual growth rate (CAGR) of 68%, providing support for Micron’s long-term value. Based on the discounted cash flow (DCF) model—incorporating the 41% revenue growth expectation for fiscal year 2025 and the continuous growth in HBM demand—Micron’s fair value range is estimated at $150-$170, which aligns with analysts’ target prices.

Citi has raised its full-year revenue forecast for Micron Technology in fiscal year 2026 from $54.5 billion to $56 billion, and its EPS forecast from $14.62 to $15.02—representing a 26% premium over the market consensus. Additionally, Citi projects Micron’s first-quarter revenue for fiscal year 2026 to be $13 billion, with an EPS of $3.23.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates