S&P 500 Bull Market Extends Gains as Index Sustains upward trajectory

23:39 September 15, 2025 EDT

On September 15, 2025, Eastern Time, the S&P 500 Index advanced 31.02 points, or 0.47%, to close at a record high of 6,615.28.

Source: TradingView

The market gains were driven by rising investor expectations for Federal Reserve monetary easing, coupled with sustained momentum in artificial intelligence investments and improved corporate earnings. As of September 15, the S&P 500 has advanced 12.47% year-to-date, having rallied 36% from its April low.

Expectations for Accommodative Liquidity Conditions Drive Market Pricing Dynamics

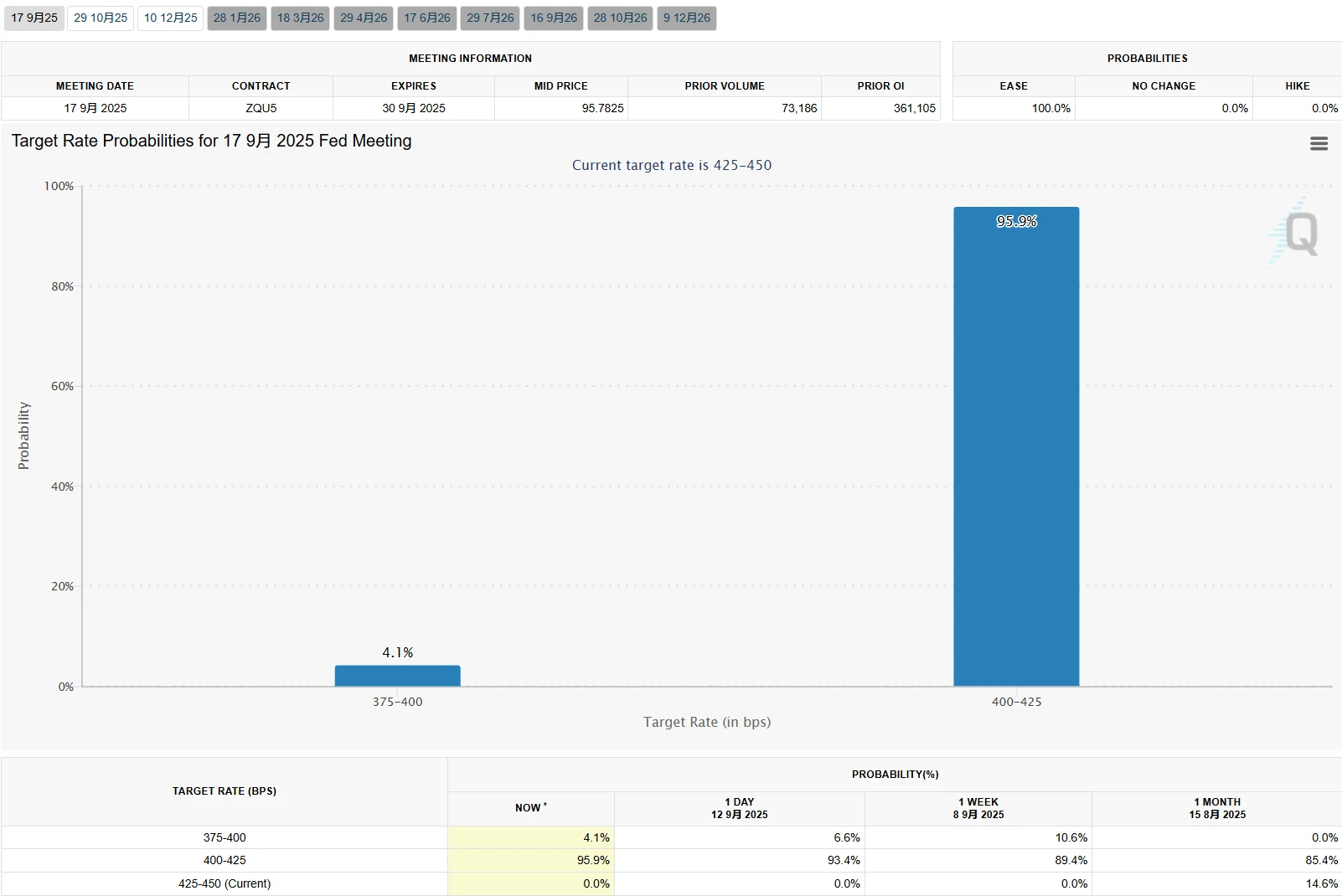

The S&P 500's breakthrough essentially represents the market's forward pricing of an impending monetary policy pivot. As of mid-September, the CME FedWatch Tool indicates a greater than 95% probability of a 25-basis-point Fed rate cut in September, compared to just 65% one month prior.

Source: CME Group

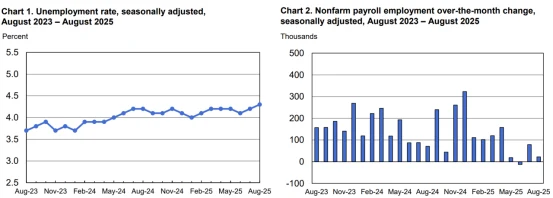

This shift in expectations follows a series of marginally weaker labor market indicators: August nonfarm payrolls increased by 22,000, significantly below the consensus estimate of 75,000. The unemployment rate rose to 4.3%, marking the second consecutive monthly increase of 0.1 percentage points and reaching its highest level in nearly four years. Year-over-year wage growth came in at 3.7%, below the 3.8% forecast. These indicators collectively form what analysts describe as a "perfect evidence chain" supporting rate cuts.

Source: U.S. Bureau of Labor Statistics

Carol Schleif, Chief Investment Officer at BMO Family Office, noted: "The market is pricing in a Goldilocks scenario where labor market softness is sufficient to prompt the Fed to initiate a full easing cycle rather than implementing a single cut, while avoiding significant damage to overall growth."

Concurrently, the 10-year Treasury yield has declined 16 basis points over two weeks to 4.04%, further confirming market expectations for the beginning of an easing cycle.

Source: TradingView

The evolving monetary policy outlook coincides with significant changes in Federal Reserve leadership. Stephen Miran, nominated by President Trump, was confirmed by the Senate through an accelerated process and officially assumed his role as Fed Governor on September 15, gaining voting rights for this week's FOMC meeting. This sets a historical record for the fastest participation in rate decisions by a newly appointed Governor. The economist, who has previously criticized the Fed's independence, has shifted his policy stance from opposing rate cuts last year to supporting aggressive easing, aligning with the White House's call to "lower rates to 1%."

Market participants are closely monitoring whether Miran, along with Governor Waller and other officials, might form an "aggressive easing coalition" that could push for measures beyond current expectations, despite the probability of a 50-basis-point cut remaining just 7%.

This policy-driven market sentiment is particularly evident in asset pricing. The S&P 500's price-to-book ratio has reached a historical high of 5.3x, placing it in the 85th percentile of historical valuations, while the Shiller CAPE ratio stands at 38.6x. This valuation expansion is primarily driven by declining discount rate expectations: with markets pricing in a greater than 90% probability of cumulative 75-basis-point cuts by year-end, equities maintain their attractiveness relative to bonds, even as the equity risk premium has compressed to -0.8%, near historical lows.

U.S.-China Talks Show Signs of Thawing Trade Relations

Improving U.S.-China trade relations have provided additional support to market sentiment. On September 14-15 local time, Chinese Vice Premier He Lifeng, the country's chief representative for trade talks, met with U.S. Treasury Secretary Besanter and Trade Representative Greer in Madrid, Spain.

The two sides reached a framework consensus on addressing TikTok-related issues through cooperative measures, reducing investment barriers, and enhancing bilateral economic and trade cooperation. China will conduct technology export reviews in accordance with laws and regulations while supporting enterprises in conducting commercial negotiations on equal terms based on market principles. Both parties committed to implementing the important consensus reached by their leaders in previous calls and fully utilizing the U.S.-China trade consultation mechanism.

The constructive signals from the talks alleviated market concerns about technological decoupling. The Nasdaq Golden Dragon China Index closed 0.87% higher, with most popular U.S.-listed Chinese stocks advancing.

Source: TradingView

AI Investment and Corporate Earnings Underpin Market Performance

Significant advancements in artificial intelligence continue to propel market gains. Oracle Corporation recently announced a $300 billion cloud computing agreement with AI pioneer OpenAI, triggering a massive rally that saw Oracle's shares surge as much as 40% during the trading session.

Source: TradingView

Palantir Technologies, the data analytics firm co-founded by investor Peter Thiel, has seen its stock price quadruple over the past year, capitalizing on its niche expertise in helping large institutions transform their operations through AI integration.

Since the market bottom in April, shares of Microsoft, Alphabet, and NVIDIA have all advanced more than 50%. Major technology companies have emerged as crucial drivers of the market advance, benefiting from growing optimism about AI's potential to transform business operations.

Ross Mayfield, Investment Strategy Analyst at Baird Private Wealth Management, noted: "The health of the AI theme has become more important to stock performance than the health of the underlying economy, and the AI economy is clearly thriving."

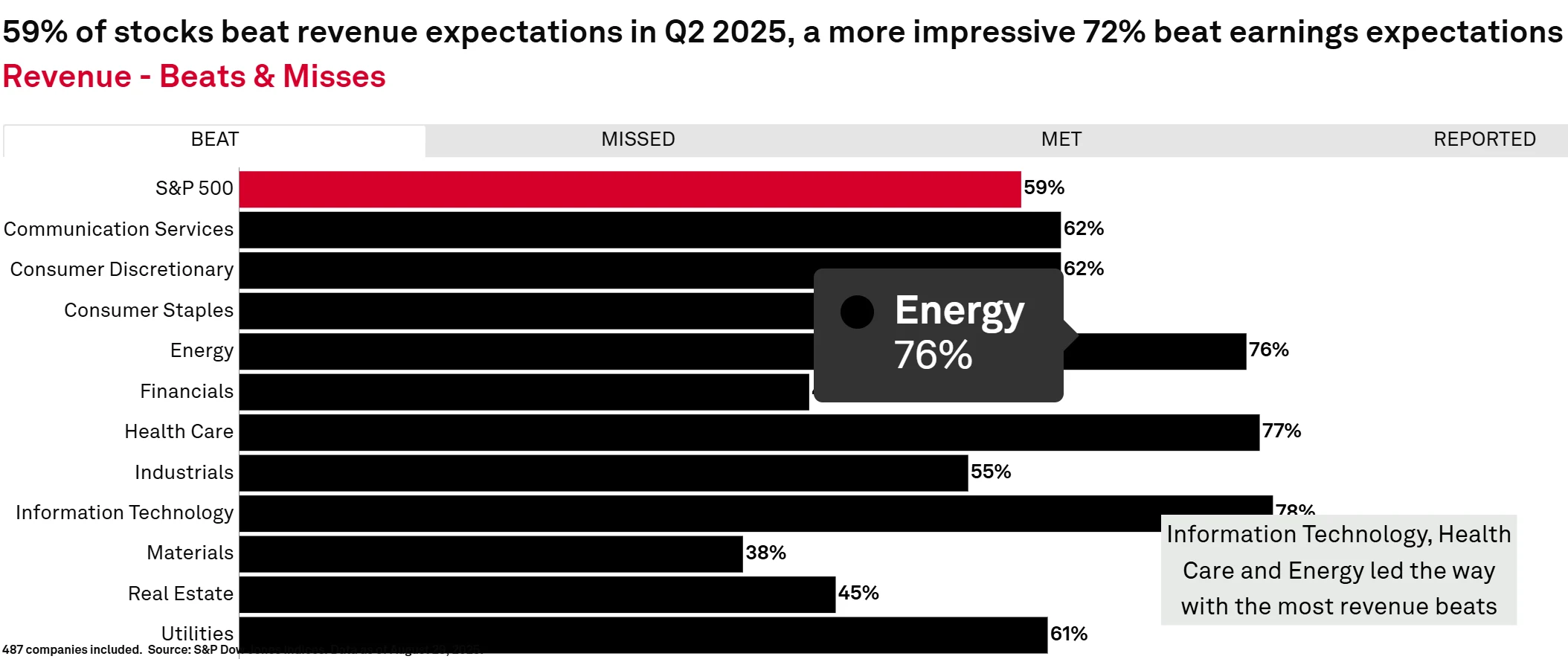

Corporate earnings prospects have also become a core factor supporting Wall Street's optimistic sentiment. Although market participants previously worried about potential tariff impacts, the actual effect has been less severe than anticipated.

Data compiled by Bloomberg Intelligence indicates S&P 500 component companies are projected to deliver nearly 10% earnings growth in 2025, with expansion accelerating to 13% in 2026. While recent labor market softening has renewed concerns about economic stagnation, robust earnings expectations have provided investors with greater confidence.

According to statistics from S&P Global, S&P 500 companies delivered better-than-expected quarterly earnings performance in Q2 2025, with both profits and revenue surpassing expectations. The information technology, communication services, and healthcare sectors delivered standout earnings performance, benefiting from AI adoption, digital advertising recovery, and stable underlying demand. The technology sector once again played a pivotal role, with mega-cap U.S. tech firms driving approximately 50% of the quarter's earnings growth.

Source: S&P Global

Technical Indicators Show Overbought Signals

From a technical perspective, the S&P 500 has maintained a well-defined ascending channel formed since April 2025, with lower-bound support at 6,350 and upper resistance at 6,650. The index has currently reached this critical upper channel boundary.

Source: TradingView

However, multiple indicators suggest the market has entered short-term overbought territory: the 14-day RSI approaches the overbought threshold of 70. While the MACD histogram has remained positive for four consecutive weeks, the indicator's failure to achieve new highs alongside price advances has formed a potential bearish divergence pattern, typically signaling increased near-term correction risk.

Source: TradingView

Capital flows present complex characteristics. During early September, the major S&P 500 ETF (513500) recorded three consecutive days of net inflows totaling 73.9787 million yuan, while another tracking product (159612) simultaneously registered 5.1538 million yuan in outflows, indicating divergent views between domestic and foreign capital regarding future market direction. Institutional positioning similarly reflects market sentiment complexity: actively managed funds have elevated equity allocations to 87%—near historical highs—while quantitative funds maintain extreme risk exposure levels. This crowded positioning may amplify market sensitivity to policy signals.

Seasonal factors contribute additional September uncertainty. Historical data shows the S&P 500 has averaged a 1.17% decline over the past 97 Septembers, with only 44.33% of months closing positive, making it the worst-performing month annually.

The market is currently pricing in this seasonal expectation, with capital beginning to migrate toward defensive sectors. Utilities and consumer staples have recently demonstrated relative outperformance, trading at approximately 25% discounts to the S&P 500's overall P/E ratio, making them attractive destinations for risk-averse capital.

Future Scenarios

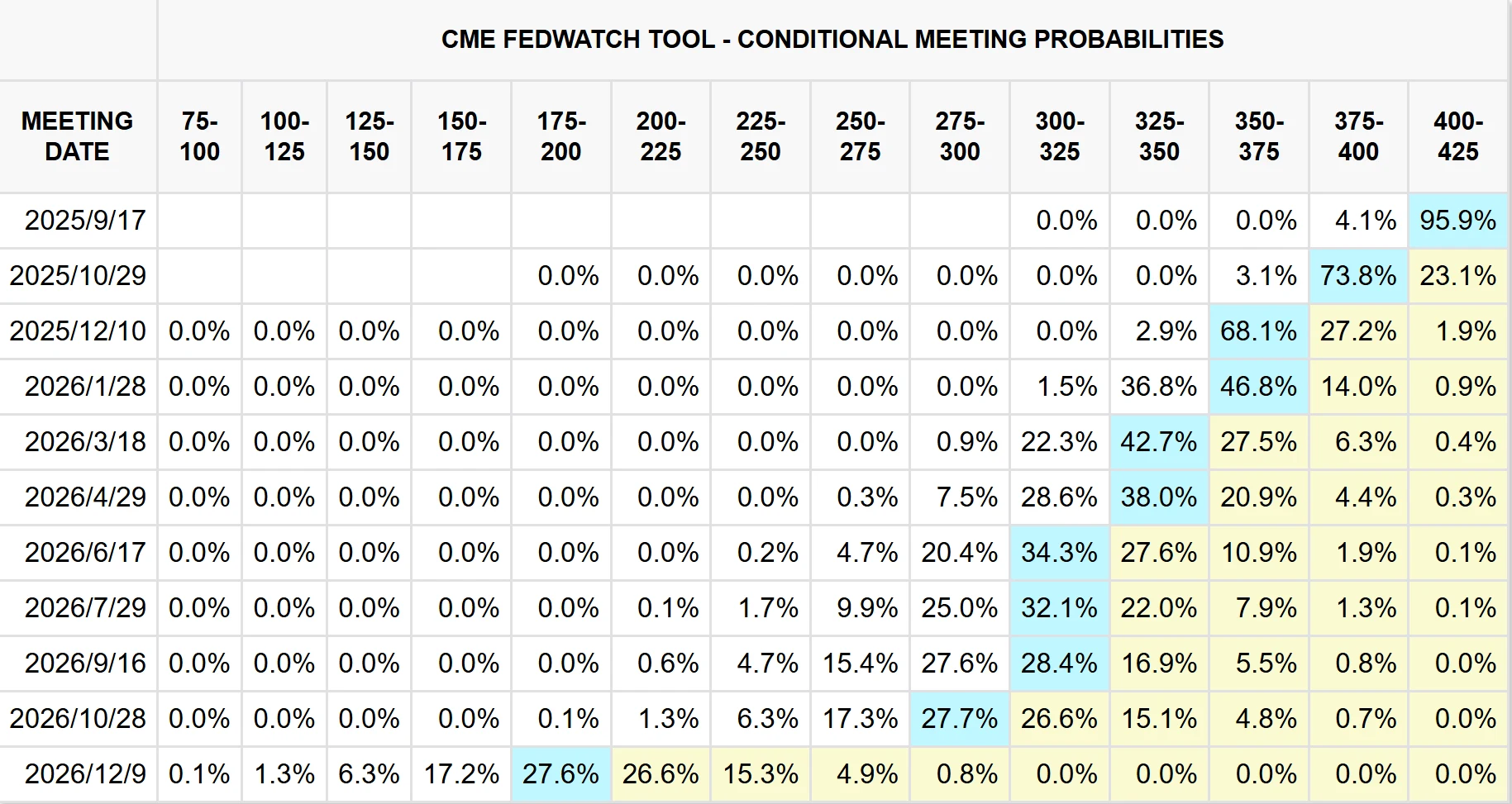

The future trajectory of the S&P 500 will largely depend on the alignment between the Federal Reserve's policy path and corporate earnings growth.

Source: CME Group

Under the baseline scenario, where the Fed implements a widely expected 25-basis-point cut while maintaining cautious forward guidance, markets may experience classic "buy the rumor, sell the fact" behavior, potentially keeping the index range-bound between 6,500 and 6,600. Morgan Stanley's strategy team notes that in this scenario, investors should focus on AI investment conversion rates in Q3 earnings reports, which will determine the sustainability of tech valuation expansion. Their most optimistic projection suggests the S&P 500 could reach 7,200 by mid-2026.

An optimistic scenario would require multiple favorable developments: broader U.S.-China trade agreements, Governor Miran successfully advocating for a 50-basis-point cut, and better-than-expected AI commercialization among tech companies. In this case, the index could break through the 6,650 resistance level and test the 7,000 threshold, with information technology sector valuations potentially expanding further. Goldman Sachs analysis indicates that if the easing cycle proves more aggressive than currently anticipated, the S&P 500 could deliver 12% annual returns, with semiconductors and software services showing the greatest elasticity.

A pessimistic scenario could materialize from policy missteps or deteriorating economic data. Should the Fed unexpectedly maintain current rates or core CPI rebound above 3.5%, forcing a policy reversal, the index might retreat to test key support at 6,300. UBS warns that under such conditions, quantitative fund stop-loss mechanisms could be triggered, potentially driving a technical correction toward 5,600.

Notably, growing debates over Federal Reserve independence are undermining policy credibility. The contrast between the administration's legal challenge against Governor Cook and Miran's expedited confirmation creates uncertainty, suggesting political interventions may amplify market volatility.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates