Potential Winners in the AI Infrastructure Sector

03:57 September 15, 2025 EDT

The ongoing expansion of the artificial intelligence market is reshaping the global technology landscape. According to projections by the International Monetary Fund, the AI-related industry is expected to exceed $1 trillion by 2030, driving increased demand for data centers and computing infrastructure. While traditional tech giants such as Alphabet, Microsoft, and Nvidia have dominated the early stages of this expansion, emerging companies are capturing market share by focusing on specialized AI infrastructure and custom solutions.

This analysis examines three stocks—Oracle, CoreWeave, and Broadcom—based on their financial performance and strategic positioning. These companies have demonstrated strong growth momentum in 2025 and possess the potential to challenge the dominance of the "Magnificent Seven" U.S. equities over the next decade. Their revenue growth rates and partnership networks suggest an increasingly critical role in AI workload capacity and networking equipment segments.

Oracle’s Cloud Infrastructure Transition

Oracle has transitioned from database management to cloud infrastructure services, a shift that accelerated in 2025. The company reported cloud infrastructure revenue of $10.3 billion in fiscal 2025 and expects it to grow 77% to $18.2 billion in fiscal 2026. Management further projects revenue will reach $32 billion in fiscal 2027, $73 billion in fiscal 2028, $114 billion in fiscal 2029, and $144 billion by fiscal 2030. This outlook is driven by demand from AI customers for training and inference workloads. The company has signed multiple multi-billion-dollar contracts, resulting in total remaining performance obligations (RPO) growing to $455 billion in the second quarter of 2025, a 359% year-over-year increase.

Source: Oracle

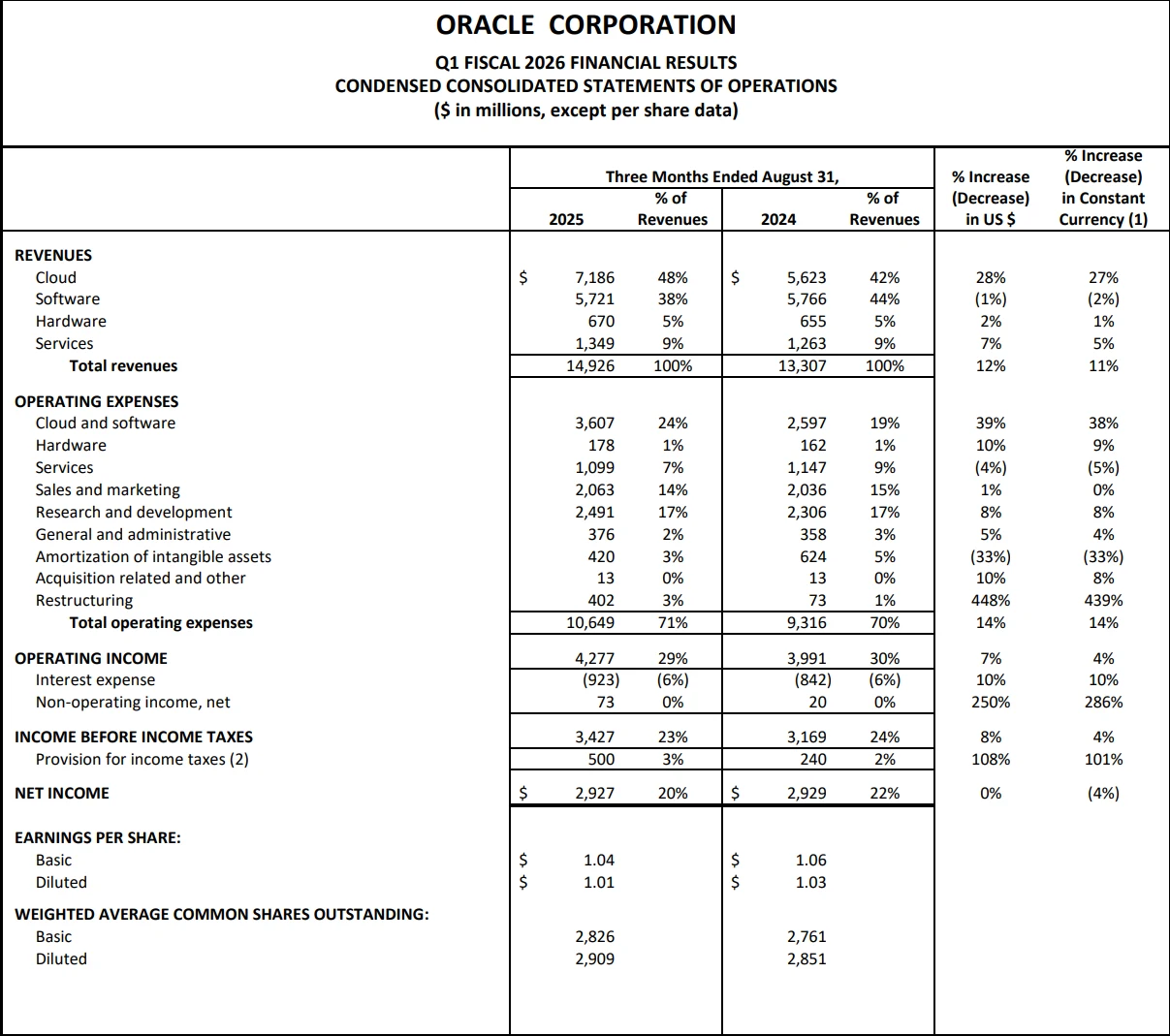

In the first quarter of fiscal 2026, Oracle’s total revenue reached $14.93 billion, up 12% year-over-year (11% on a constant currency basis), outperforming the software industry average. Adjusted earnings per share were $1.47, a 6% increase compared to the same period last year.

The most notable metric in the earnings report was the explosive growth in RPO, which surged from $99.1 billion at the end of Q1 fiscal 2025 to $455 billion—a 359% year-over-year increase. Compared to the previous quarter’s $138 billion, RPO increased by $317 billion, setting a record for the largest single-quarter contract reserve growth in the software industry’s history. Approximately 94.6% of this $317 billion increase stems from a five-year, $300 billion contract with OpenAI, set to take effect in 2027, which will contribute an average of $60 billion in annual revenue.

The explosion in demand for AI computing power is the core driver of Oracle’s transformation. Chairman and Chief Technology Officer Larry Ellison emphasized that the AI inference market will far surpass the AI training market. Oracle has launched an “AI Database,” which vectorizes corporate private data and integrates models such as OpenAI’s ChatGPT and Google’s Gemini to enable advanced inference combining private and public data while ensuring data security.

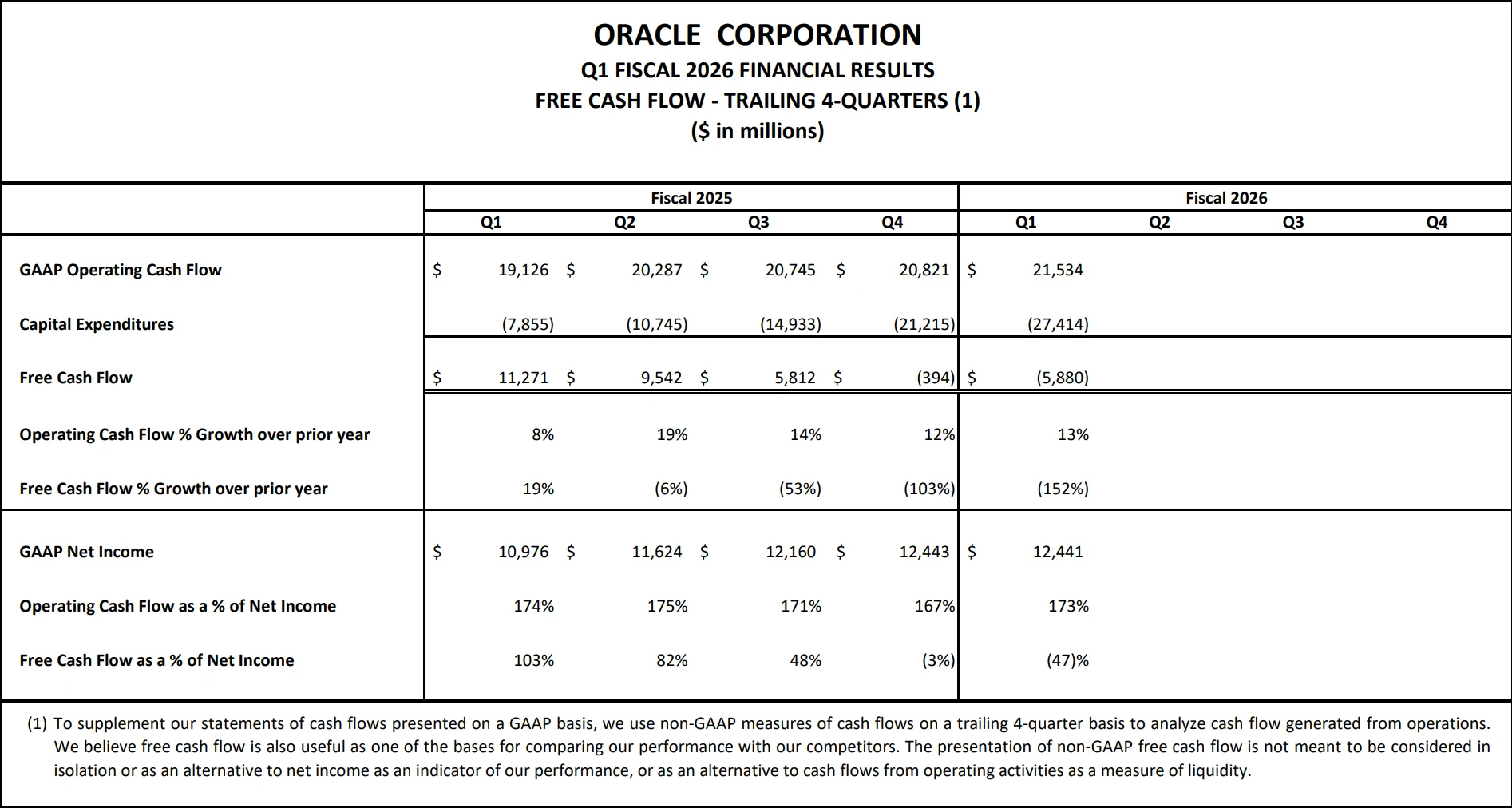

To support this expansion, Oracle announced capital expenditures of $35 billion for fiscal 2026, a 65% year-over-year increase, primarily allocated toward GPU servers and other hardware for AI data centers. The company, in partnership with OpenAI, plans to develop a large-scale data center in Abilene, Texas, equipped with 64,000 Nvidia GB200 semiconductor chips by the end of 2026. Wisconsin is also a potential location for additional facilities. While these initiatives have temporarily pushed free cash flow into negative territory, they establish the production capacity necessary to support future revenue realization.

Source: Oracle

The integration of Oracle’s database technology with AI provides data security and efficiency advantages, attracting enterprise customers. The company’s market capitalization increased by $234 billion following the recent earnings release, briefly bringing its total market value close to $1 trillion. With the upcoming AI World Conference scheduled for October 13–16, Oracle may be poised for another catalyst.

Source: TradingView

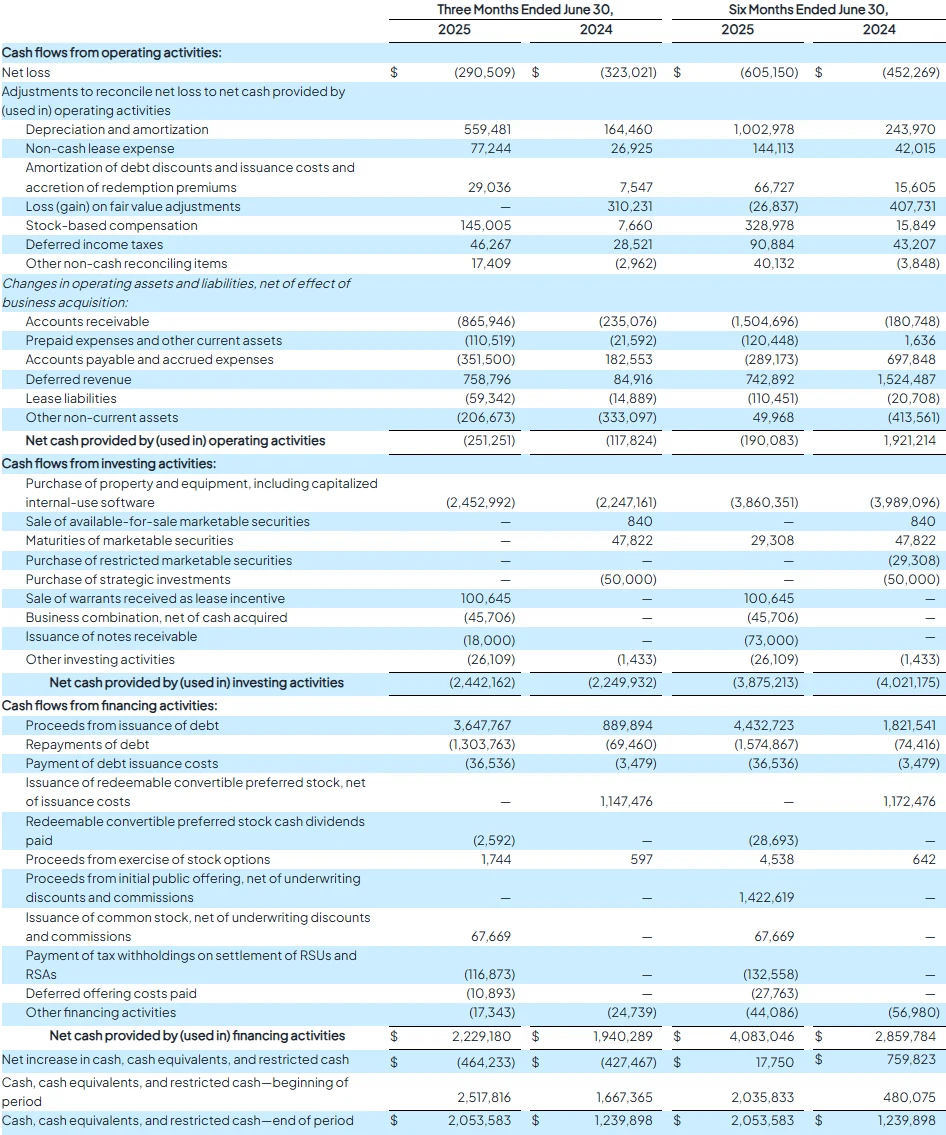

CoreWeave's Dedicated AI Cloud Platform

CoreWeave specializes in cloud infrastructure optimized for AI workloads, with its partnership with Nvidia being a core competitive advantage. In 2025, the company became the first hyperscale provider to deploy NVIDIA’s GB300 NVL72 platform and RTX Pro 6000 Blackwell GPUs. This first-mover advantage allows customers to rent GPUs by the hour or on a long-term basis, catering to the flexible demands of AI training. The company’s revenue tripled in the first half of 2025, exceeding $1.2 billion.

Source: CoreWeave

Unlike the "Magnificent Seven" U.S. tech giants, CoreWeave’s business model focuses exclusively on AI-specific computing, avoiding the complexities of diversified technology firms. Analysts predict its stock price could double over the next 12 months, benefiting from sustained growth in AI infrastructure demand. The company’s collaborations with Dell, Switch, and Vertiv further enhance its deployment capabilities.

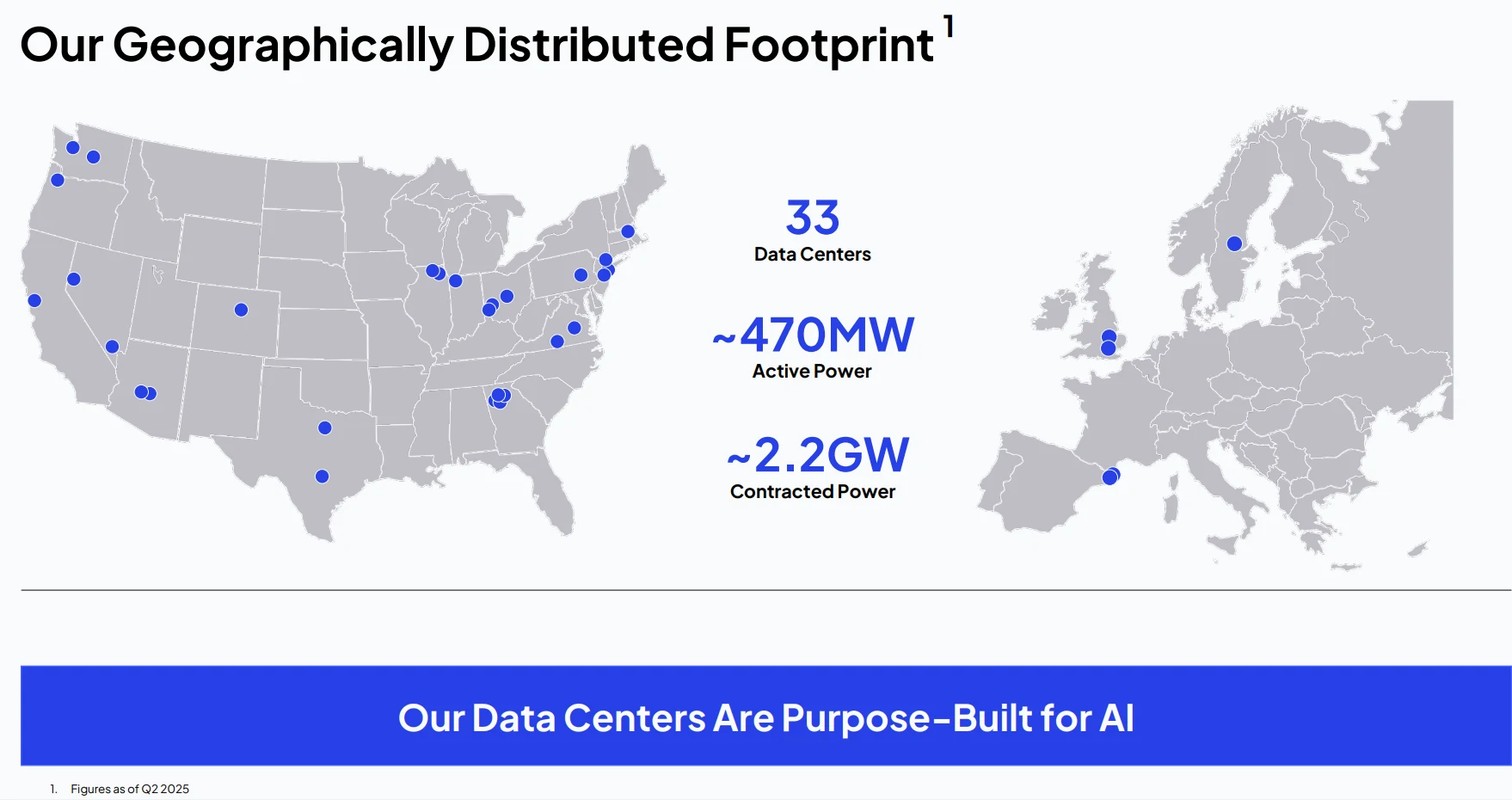

CoreWeave is positioned as a cloud service provider specializing in high-performance AI computing. It supplies clients with rentals of Nvidia’s high-end GPUs—including H100, H200, and Blackwell architecture products—through 28 data centers worldwide. This model targets the high-computing demands of machine learning, generative AI, and deep learning training, offering differentiated services compared to traditional general-purpose cloud providers. By optimizing Kubernetes cluster management and software stacks, CoreWeave achieves 30%-50% higher training efficiency than competitors. In Q1 2025, the company was among the first cloud providers to offer Blackwell Ultra chips, ensuring clients have immediate access to cutting-edge hardware.

The customer base shows a trend toward diversification. In March 2025, CoreWeave signed a $12 billion long-term agreement with OpenAI, followed by an additional $4 billion contract. Through Nebius, it also secured a $19 billion partnership with Microsoft. Companies such as Google and Meta are in discussions for potential projects. The establishment of CoreWeave Ventures, which invests in AI startups, forms a closed-loop ecosystem connecting infrastructure and applications.

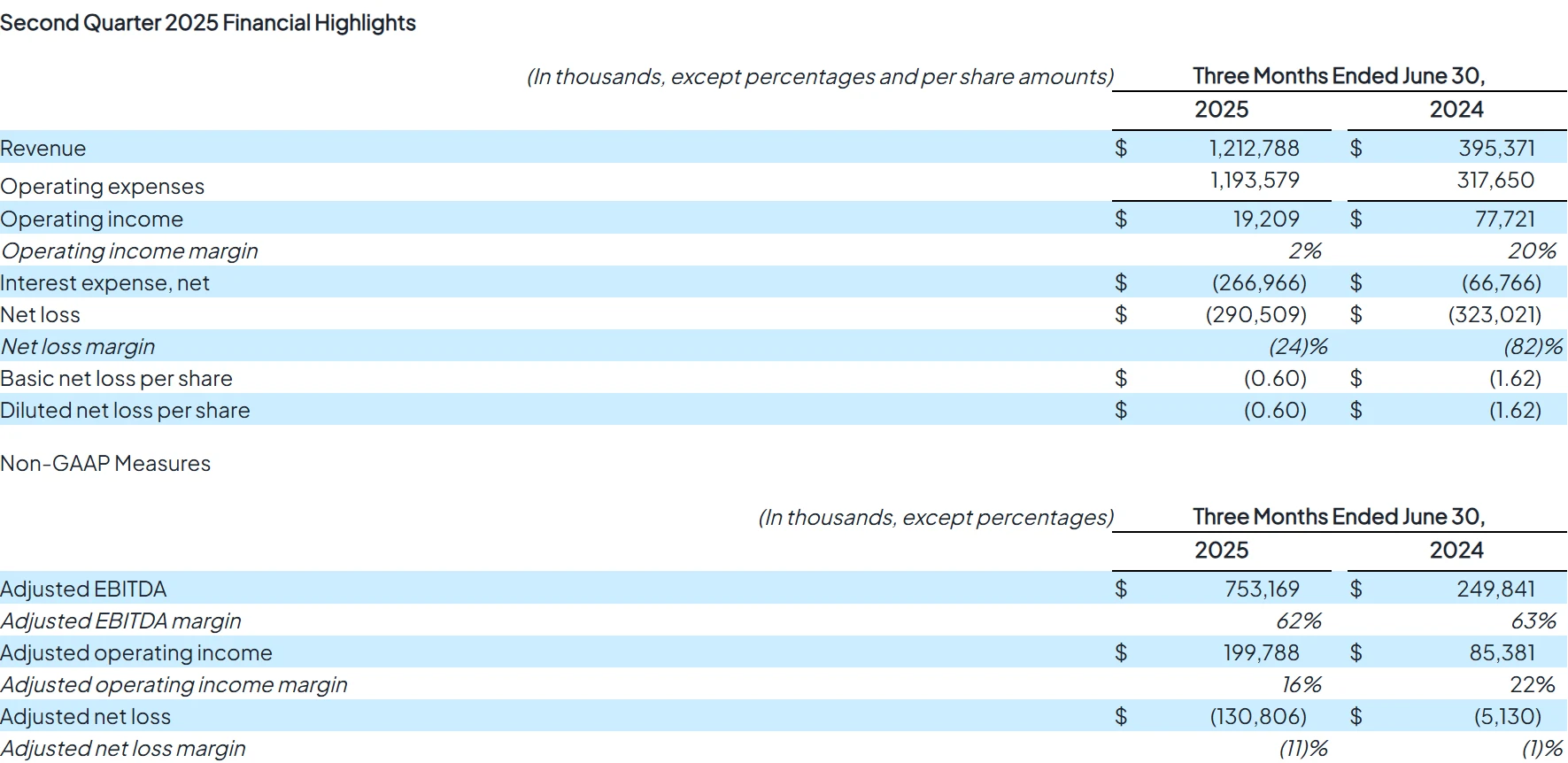

Financial data reflects rapid expansion. Q2 2025 revenue reached $1.213 billion, a 207% year-over-year increase, exceeding market expectations by $120 million. Adjusted operating income grew 550%, with operating income standing at $19.2 million, indicating improved profitability. Management raised its full-year revenue guidance to $5.15–5.35 billion, an increase of $250 million from previous projections, reflecting optimism about AI demand. The company expects Q3 revenue between $1.26 billion and $1.3 billion, above analysts’ consensus of $1.25 billion.

Source: CoreWeave

CoreWeave’s capital expenditures totaled $2.9 billion in Q2, primarily allocated to new data centers and Blackwell Ultra chips, each costing approximately $40,000. Capital spending exceeded $8.5 billion in 2024, with plans to add 10 new data centers in 2025, bringing the total to 38. While this expansion drives revenue, it has temporarily eroded profits. The company is planning an all-stock acquisition of Core Scientific to reduce over $10 billion in leasing liabilities and strengthen its owned data center assets. CoreWeave aims to achieve positive free cash flow by 2026.

Source: CoreWeave

Since its IPO in March 2025, CoreWeave’s stock price has risen from $40 to a peak of $187, a gain of over 360%, before correcting to the $80–100 range—down approximately 50% from its high but still double its IPO price.

Source: TradingView

According to market forecasts, the AI cloud computing market is expected to reach $180 billion in 2025, with a compound annual growth rate (CAGR) of 37% from 2023 to 2028. CoreWeave holds a first-mover advantage in GPU optimization and iteration. Additionally, the company’s appeal lies in its unique positioning, endorsement by Nvidia, strong revenue performance, and extensive customer resources, giving it a competitive edge in AI infrastructure. If it achieves positive free cash flow in 2026 as targeted, its market capitalization could reach $70 billion, moving toward a more reasonable valuation.

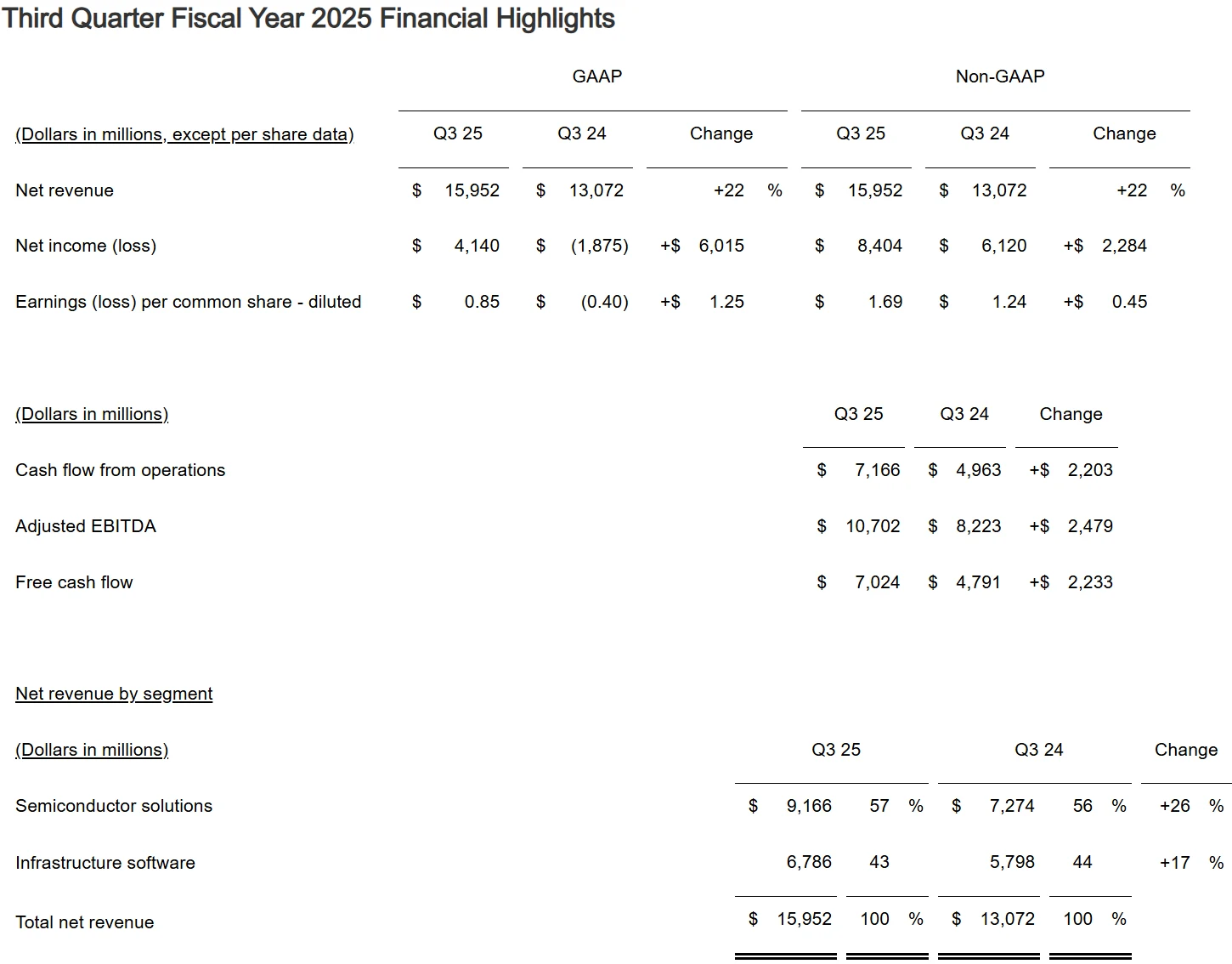

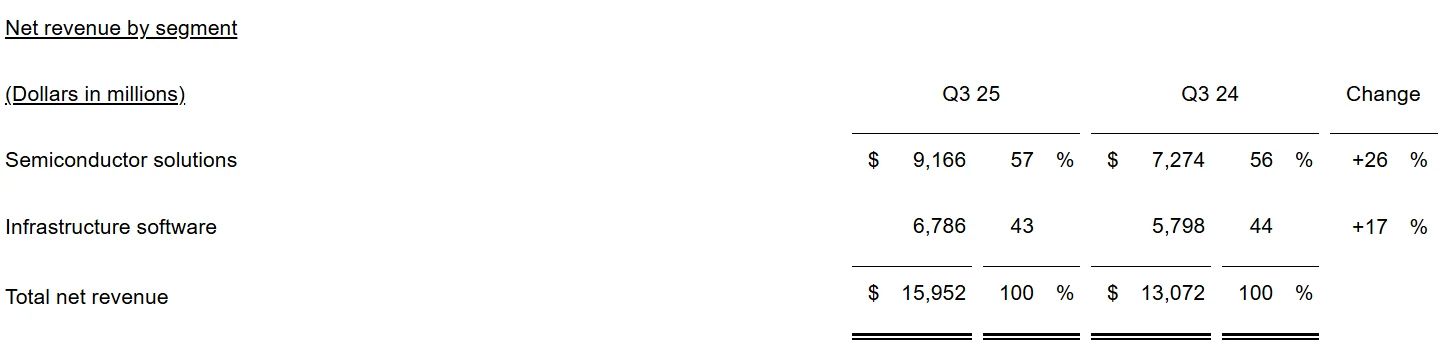

Broadcom's Custom Silicon and Networking Solutions

Broadcom’s leadership in the networking and custom chip sectors has positioned it to benefit from AI expansion. In the third quarter of fiscal 2025 (F3Q25), the company reported total revenue of $16 billion, with AI chip revenue accounting for $5.2 billion—representing a 63% year-over-year (YoY) growth. For the fourth quarter, AI chip revenue is projected to reach $6.2 billion, which would account for 33% of total revenue. Broadcom has already developed custom AI chips for three major clients and, in September 2025, announced a $10 billion order from OpenAI for XPUs (Expanded Processing Units).

Source: Broadcom

Broadcom’s business is organized into two core divisions: Semiconductor Solutions and Infrastructure Software, both of which drove the company’s growth in Q3.

Source: Broadcom

The Semiconductor Solutions division generated $9.17 billion in revenue, up 57% YoY, with AI semiconductor revenue totaling $5.2 billion—exceeding the company’s prior guidance of $5.1 billion. This division benefited from strong demand for custom AI accelerators (XPUs) and networking products. Broadcom CEO Hock Tan noted that AI revenue has grown for 11 consecutive quarters and is expected to rise to $6.2 billion in Q4. Currently, XPUs account for 65% of the company’s AI revenue. Broadcom has also added a fourth major client, securing over $10 billion in production orders, with deliveries slated to begin in the second half of fiscal 2026. This order has lifted the company’s 2026 AI revenue forecast, and XPUs are expected to account for an even larger share of AI revenue going forward.

According to reports, OpenAI plans to use these new chips exclusively for internal purposes rather than making them available to external clients—a key initiative to meet its massive computing power needs. By partnering with Broadcom, OpenAI has secured advanced manufacturing capacity at TSMC (Taiwan Semiconductor Manufacturing Company) in advance, with production expected to start in 2026.

This reflects the intense competition among companies for chip resources amid the current computing power crunch. NVIDIA currently holds an 80% market share in GPUs, forcing many Silicon Valley giants to compete fiercely for GPU access—driving up costs and prompting more companies to explore alternatives such as in-house chip development or external substitute solutions.

Notably, Broadcom’s strong rise in the AI chip market is reshaping its competitive landscape with NVIDIA. The two companies pursue distinct technical paths: NVIDIA focuses on general-purpose GPU computing chips, while Broadcom’s core strength lies in developing custom ASICs (Application-Specific Integrated Circuits) for cloud service providers.

These custom ASICs are designed for specific AI inference scenarios, offering unique advantages in energy efficiency and business adaptability. GPUs are better suited for AI training tasks involving large, variable-scale models, whereas ASICs deliver greater cost-effectiveness for inference tasks based on fixed algorithms.

Broadcom has extensive experience in custom chip development—for example, it partnered with Google to develop custom TPU (Tensor Processing Unit) AI chips. HSBC analysts project that by 2026, the growth rate of Broadcom’s custom chip business will outpace that of NVIDIA’s GPU business.

Long-term trends indicate a diversified development trajectory for the AI chip market. DIGITIMES analyst Chen Chenfei points out that between 2023 and 2028, the annual compound growth rate (CAGR) of shipments for high-end cloud AI accelerators is expected to reach 50% for GPUs and 52% for AI ASICs. Thus, AI ASIC shipments are anticipated to surpass those of GPUs by 2028—highlighting the greater growth potential of the niche market where Broadcom operates.

Broadcom has provided an optimistic outlook for F4Q25, projecting revenue of $17.4 billion (a 24% YoY increase), which far exceeds the market consensus of $17 billion. The company also expects adjusted EBITDA for Q4 to account for 67% of projected revenue. CEO Hock Tan forecasts that Broadcom’s AI business will grow by an additional 60% in 2026—this projection is well above the market’s general expectation of a significant slowdown in global AI capital expenditures (Capex) next year. Broadcom has already surpassed AMD in terms of market share in the AI chip market, opening up greater room for growth in the custom ASIC market.

Source: Broadcom

Conclusion

The growth of these companies stems from the surge in investment in AI infrastructure. Global data center capacity is projected to triple by 2030, driving demand for cloud services and chips. The Magnificent Seven (major U.S. tech giants) delivered an average return of approximately 75% between 2023 and 2025, yet emerging AI stocks such as CoreWeave and Broadcom have posted even higher growth rates. For instance, signs of a bubble at Nvidia—such as sharp stock price volatility in 2025—may lead investors to shift toward these more focused companies. Economic models indicate that AI investment will contribute 0.8% to global GDP, but supply chain bottlenecks could amplify the risks associated with these stocks.

Over the next decade, the potential of these stocks will depend, in part, on the AI adoption rate. Oracle’s cloud revenue forecast shows a compound annual growth rate (CAGR) of over 50%. CoreWeave’s partnership with Nvidia is likely to drive its market share from 5% in 2025 to 15%. Broadcom’s order from OpenAI is expected to contribute an additional 10% of revenue. However, intensified competition and regulatory risks—such as chip export restrictions—may impact their performance. Investors should monitor quarterly reports to assess sustained growth.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates