The Mitigating Effect of the U.S.-China Madrid Trade and Economic Talks

02:34 September 15, 2025 EDT

On September 14, 2025, local time, Chinese and U.S. delegations held the first day of trade and economic talks in Madrid, Spain. The discussions were led by Chinese Vice Premier He Lifeng and U.S. Treasury Secretary Scott Besant. Key agenda items included U.S. unilateral tariff measures, the misuse of export controls, and trade-related issues involving TikTok.

This round of talks continues the framework established during previous consultations in Geneva (May), London (June), and Stockholm (July), aiming to implement the consensus reached by the two heads of state and inject stability into bilateral relations. The discussions are scheduled to resume on September 15.

It is noteworthy that the talks coincide with the impending conclusion of the U.S.-China tariff truce period and the approaching deadline for the forced divestiture of TikTok's U.S. operations. The dialogue may serve to mitigate immediate risks in the short term.

Historical Context

The onset of U.S.-China trade frictions dates back to 2018. Based on its Section 301 investigation, the United States imposed tariffs on approximately $60 billion worth of Chinese goods, expanding the coverage to $370 billion of goods by the following year, with tariff rates reaching up to 25%. During this phase, the U.S. trade deficit with China narrowed from $419 billion to $295 billion by 2024. However, the overall U.S. trade deficit expanded to approximately $1 trillion, as imports shifted to countries such as Vietnam and Mexico.

Data from the Peterson Institute for International Economics indicates that the tariffs imposed in 2018-2019 cost U.S. consumers an additional $1.4 billion per month and reduced GDP by 0.2-0.4%.

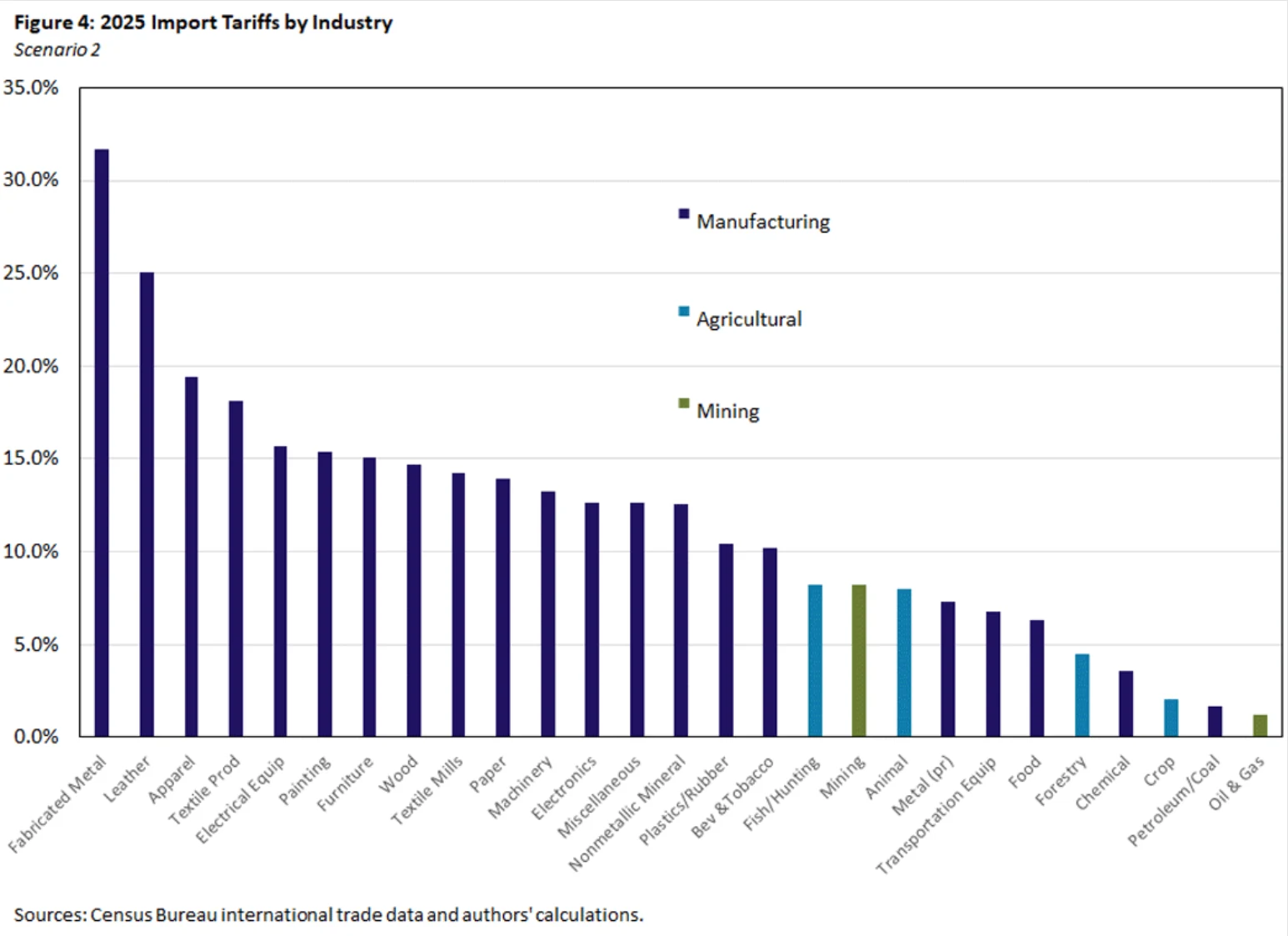

In 2025, during the second term of President Donald Trump, tariff policy became more aggressive: a 10% tariff on all Chinese goods was announced in February and implemented in March, followed by an expansion in April targeting integrated circuits and other products. At one point, the cumulative tariff rate on Chinese goods reached 145%. A report from the Federal Reserve Bank of Richmond noted that the 2025 tariffs increased the cost of Chinese imports by 22 cents per dollar, higher than the levels observed during the 2018-2019 period.

Source: Federal Reserve Bank of Richmond

This evolution represents more than a mere trade adjustment; it is embedded within a geopolitical framework. The U.S. has restricted China's semiconductor development through export controls, while China has responded with anti-dumping investigations, creating a pattern of mutually reinforcing friction. Historical data show that while such cyclical high-pressure tactics may narrow the bilateral deficit in the short term, they amplify global supply chain costs and accelerate economic decoupling.

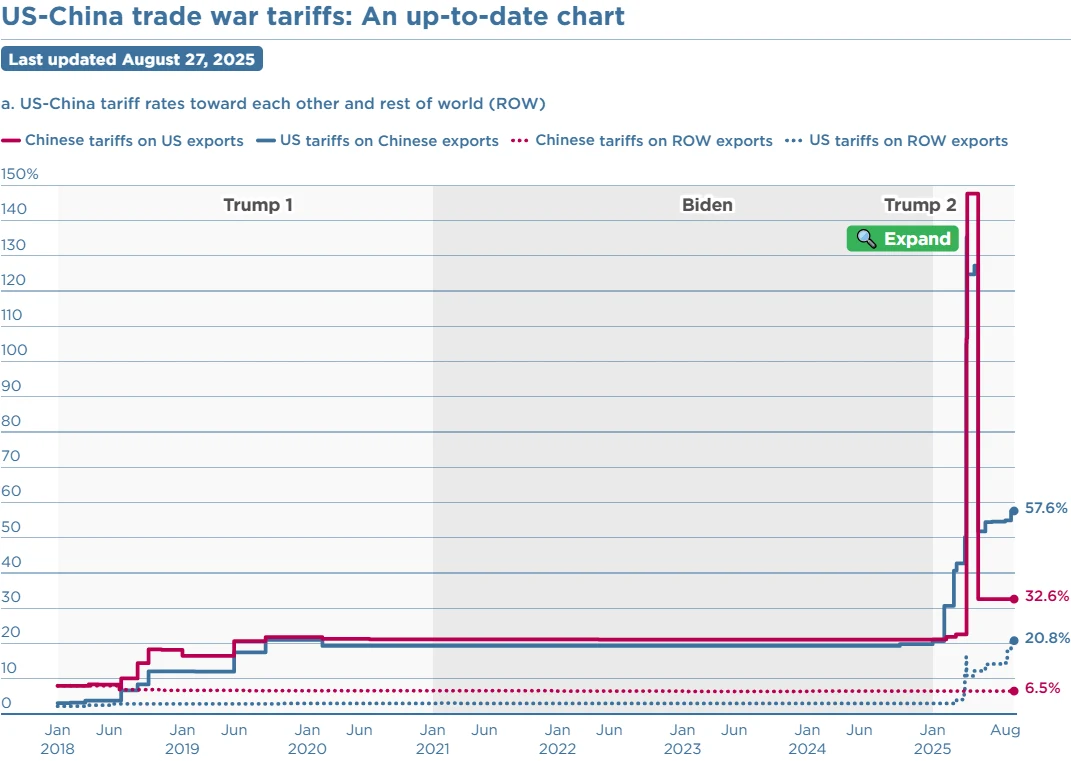

According to data from the Peterson Institute for International Economics, the average U.S. tariff rate on Chinese goods rose to 57.6% in 2025, an increase of 36.8 percentage points since the beginning of Trump's second term—more than double the 16.2-percentage-point increase during his first term. China's average tariff rate on U.S. goods stood at 32.6%, covering 100% of imported products.

Source: Peterson Institute for International Economics

These changes reflect increasingly aggressive policy measures and signal a deepening of friction in the technology sector, exemplified by U.S. restrictions on chipmaking equipment since 2022 and China's anti-dumping response targeting analog chips in 2025.

Current Status of Negotiations

Current Negotiations Focus on Three Core Issues: Tariffs, TikTok, and Export Controls.

In the lead-up to the talks, actions from both sides heightened tensions. On September 12, the U.S. Commerce Department added 23 Chinese companies to its Entity List, including two firms alleged to have assisted SMIC in acquiring chipmaking equipment. On September 13, China’s Ministry of Commerce initiated an anti-dumping investigation into U.S.-origin analog chips, covering 40nm and above general-purpose interface and gate driver chips. The investigation period spans the entirety of 2024, with an alleged dumping margin exceeding 300%, targeting U.S. firms such as Texas Instruments and Analog Devices. On the same day, China launched an anti-discrimination probe into U.S. measures concerning the integrated circuit sector, targeting tariffs imposed since 2018 and export control rules issued from 2022 to 2025, including restrictions on Huawei’s Ascend chips.

Regarding tariffs, on April 10, 2025, the U.S. government announced an increase in its "reciprocal tariffs" on Chinese imports to 125%. China correspondingly raised its additional tariffs on all U.S.-origin goods from 84% to 125%.

After May 14, the U.S. reduced its additional tariffs from 145% to 30%, with China implementing corresponding reductions. The tariff truce is set to expire on November 10. On August 11, President Trump signed an executive order extending the truce by 90 days, maintaining the pause agreed upon in the May Geneva Joint Statement.

The TikTok issue remains equally urgent: U.S. law requires ByteDance to divest its U.S. operations by September 17, or face a ban. President Trump has granted three extensions, including a 90-day order on June 19, and has hinted at the existence of "a U.S. buyer," though no final agreement has been confirmed. He has emphasized that the outcome depends on actions from Beijing. On September 14, Trump stated that progress was "going well," but that TikTok's fate "depends on China," suggesting a potential fourth extension.

Currently, market expectations of a TikTok extension are contributing to volatility in tech stocks. Some users worry that a ban could impact the app's 170 million U.S. users and its $24.2 billion in annual advertising revenue. While the negotiations provide a channel for dialogue, the lack of mutual trust and escalating technological friction continue to make a near-term breakthrough challenging.

Short-Term Cushion vs. Long-Term Uncertainty

A likely outcome of the Madrid talks could be a 90-day extension of the current tariff truce and the TikTok divestiture deadline. Analysts anticipate that substantive results—such as a resolution to the TikTok issue or commitments to purchase U.S. soybeans—are more likely to be addressed during an anticipated summit. However, China’s recently launched investigation into U.S. semiconductor practices could trigger a new round of retaliatory measures.

Analysis from the Centre for Economic Policy Research (CEPR) indicates that, under the dynamic tariff environment of 2025, the U.S. trade deficit could be reduced by 11-19%. However, this would come at the cost of reduced state-level economic output and employment. The Peterson Institute for International Economics has warned that the tariffs are expected to exacerbate the projected economic slowdown in 2025, potentially raising the CBOE Volatility Index (VIX) by more than 30 points. In the long term, should disputes persist, the global economy faces a heightened risk of further decoupling.

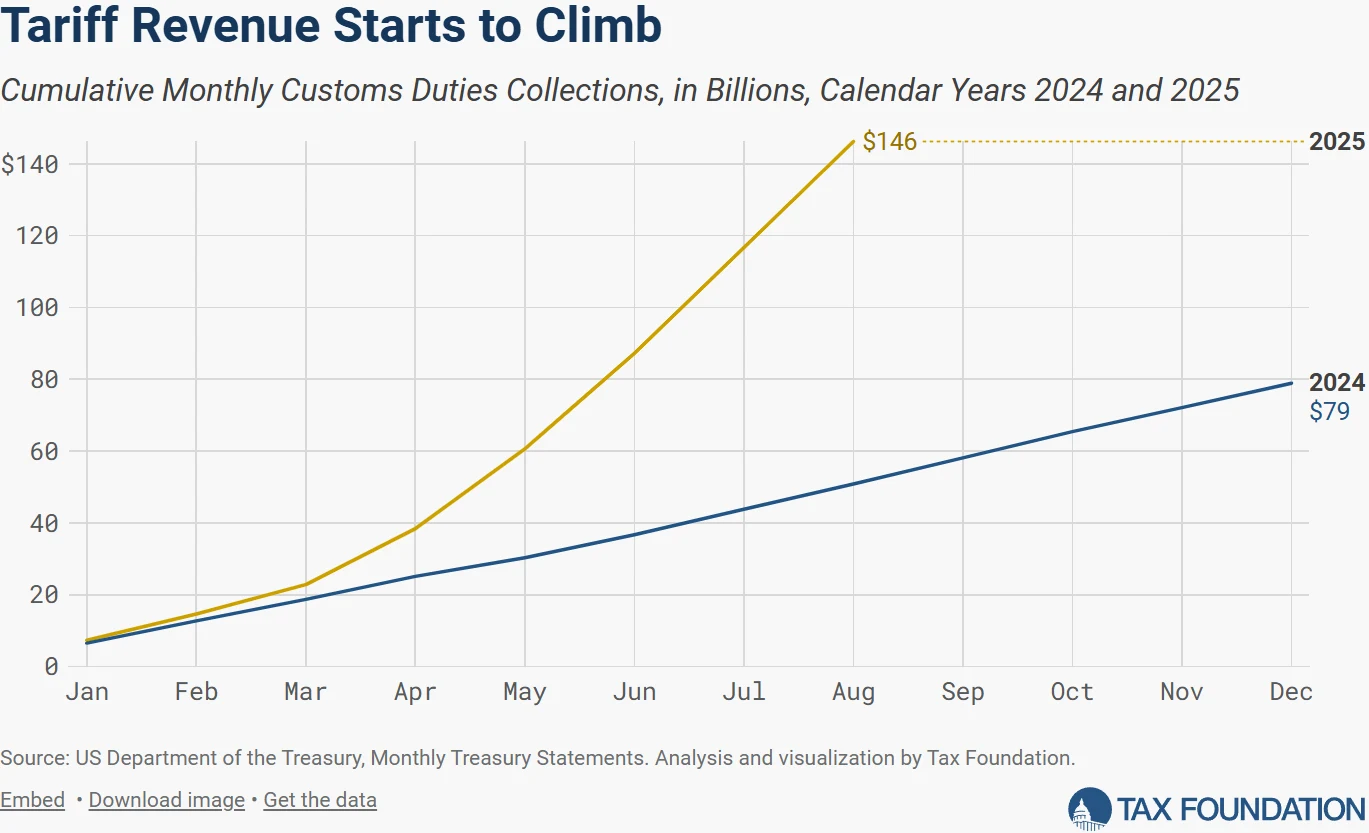

Against this backdrop, negotiations may need to move beyond temporary extensions and instead focus on supply chain complementarity and the coordination of technical standards. Failure to do so could allow continued uncertainty to erode investment and trade potential. Data from the Tax Foundation shows that if the tariffs authorized under the International Emergency Economic Powers Act (IEEPA) were made permanent, they would generate only $38.3 billion in additional tax revenue in 2025, amounting to just 0.13% of GDP—a limited economic benefit.

Source: Tax Foundation

Overall, the Madrid talks have sustained the channel of U.S.-China economic dialogue. However, historical precedent and economic data suggest that short-term de-escalation is unlikely to reverse fundamental frictions. Should the two sides manage to secure verifiable commitments at an upcoming summit—such as a clear framework for technical cooperation or defined trade quotas—it could inject stability into the global economy. Otherwise, rising costs and market fragmentation will test the resilience of both nations' policies, and the global economy will face deeper uncertainty.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates