This Week in Markets: Fed Rate Decision Released; U.S.-China Trade Talks Continue; U.S. Tech Giants to Invest in U.K. Data Center Projects

23:01 September 14, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

Fed September Meeting May Cut Rates by 25 Basis Points

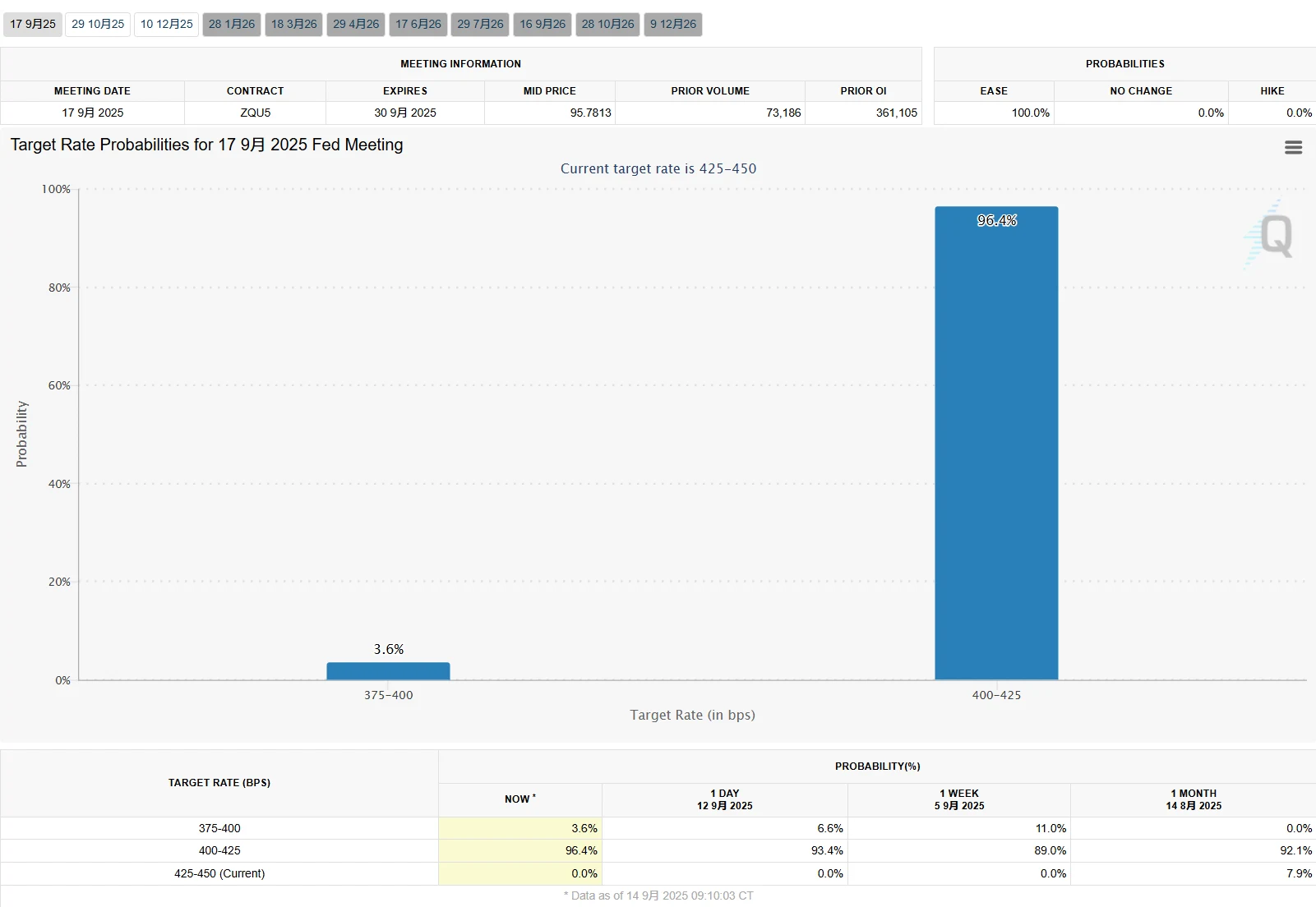

The Federal Open Market Committee (FOMC) is set to convene on September 16-17. Markets widely expect the committee to announce a 25-basis-point cut to the federal funds rate, lowering the target range to 4.00%-4.25% from the current 4.25%-4.50%. This potential adjustment is primarily based on considerations for slowing economic growth, a softening labor market, and stabilized inflation.

Market pricing suggests a 96.4% probability of a 25-basis-point cut, with a 3.6% chance of a 50-basis-point reduction. Fed Chair Jerome Powell has previously characterized such a move as a precautionary measure, noting that the future path of rate adjustments will be data-dependent, allowing the Fed to accelerate, slow, or pause easing as economic conditions evolve.

Source: CME Group

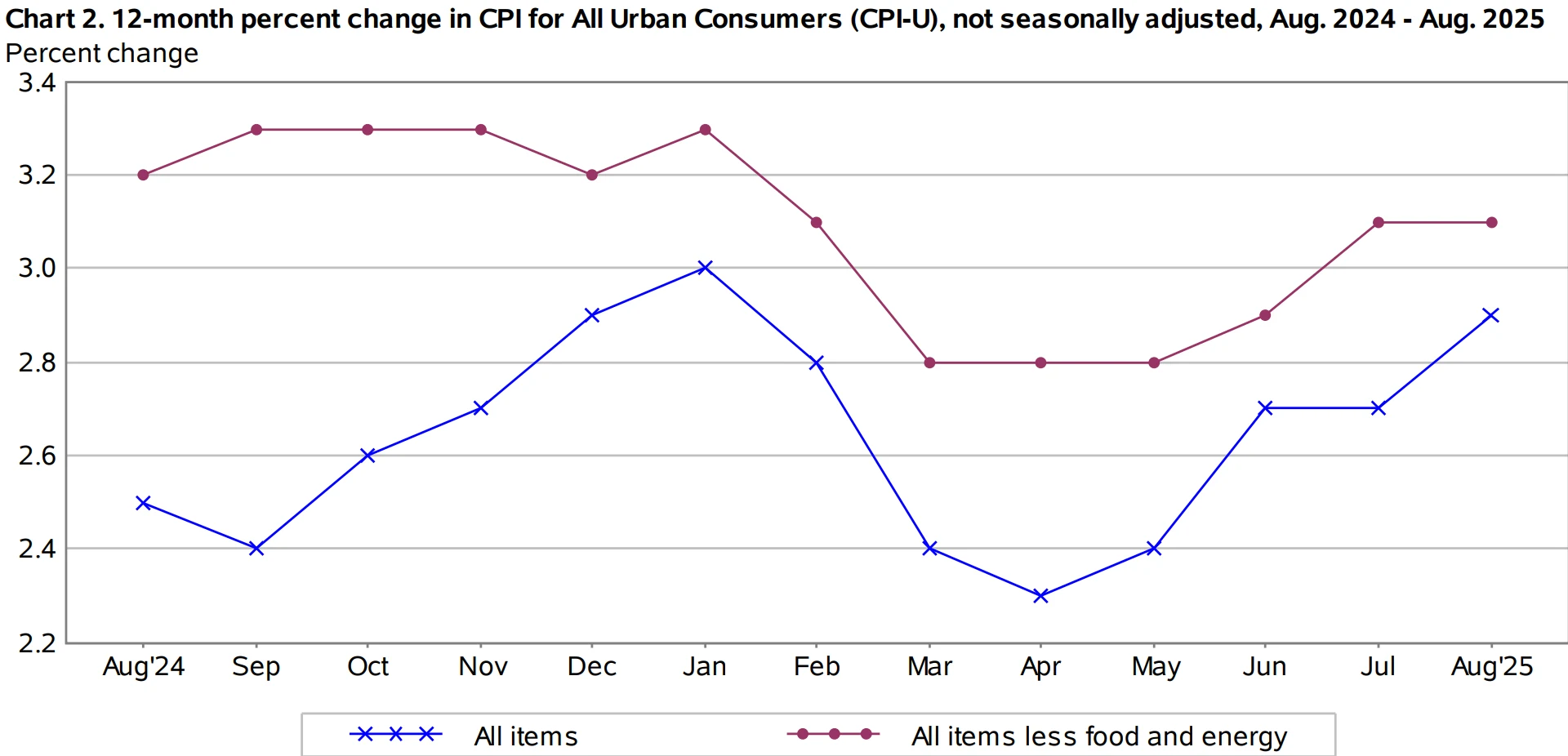

The recently released August CPI report indicated overall moderate inflation. Headline CPI rose year-on-year to 2.9%, while core CPI readings, both monthly and annual, were in line with expectations, showing no signs of runaway inflation triggered by tariff measures.

Source: U.S. Bureau of Labor Statistics

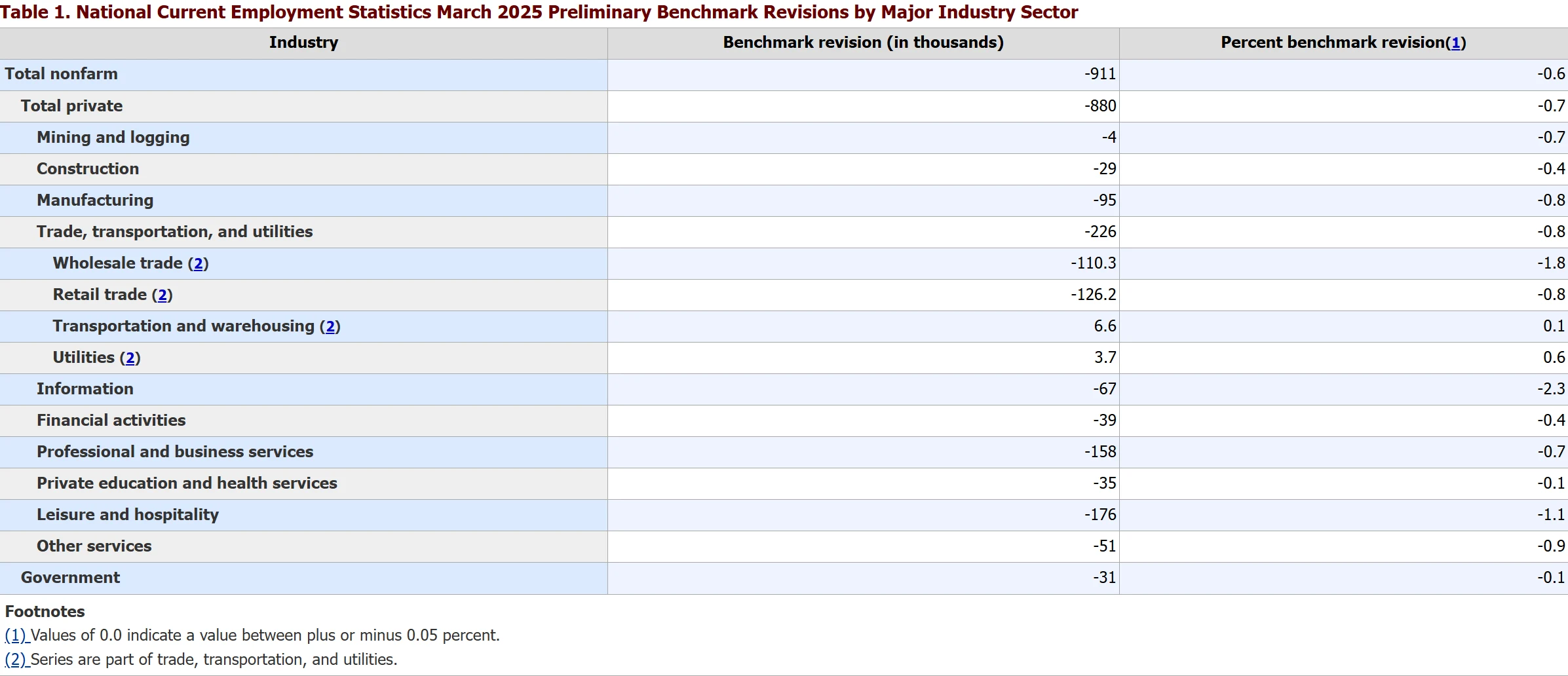

Simultaneously, the preliminary annual benchmark revision for nonfarm payrolls showed a downward revision of 911,000 jobs for the period ending in March, significantly exceeding the market expectation of 682,000. This represents the largest downward revision since 2000, intensifying concerns about the health of the U.S. economy and providing further rationale for Fed easing.

Source: U.S. Bureau of Labor Statistics

Citi analysis suggests that the combination of moderate inflation and weak labor market signals clears the path for the Fed to commence an easing cycle. They project a cumulative 125 basis points of cuts over the next five FOMC meetings, potentially bringing the policy rate below 3%. However, Goldman Sachs strategists caution that while the initiation of the rate-cut cycle appears straightforward this year, it could become more complex by 2026. Factors such as a shift toward looser fiscal policy, the dovish倾向 of a new Fed Chair, and AI-driven productivity gains could potentially push asset prices and inflation expectations higher.

The final decision will be confirmed upon the release of the September FOMC statement and policy decision in the early hours of September 17.

BlackRock Executive Rises in Fed Chair Succession Rankings

According to a U.S. government official, Rick Rieder, a senior executive at BlackRock, is rising on the list of potential successors for the role of Federal Reserve Chair.

U.S. Treasury Secretary Besant held a two-hour extensive interview with Rieder in New York on September 12. Discussions covered monetary policy, the Fed's organizational structure, and regulatory policy. Sources familiar with the Secretary's thinking indicated that Besant was impressed by Rieder's extensive experience managing large teams in financial markets and his deep understanding of both micro and macroeconomic issues.

Riederis one of BlackRock's most senior executives, overseeing the firm's fixed income business. He joined BlackRock in 2009 after spending nearly two decades at Lehman Brothers. Earlier in September, Reed told CNBC that based on his reading of economic indicators, he believed the Federal Reserve should cut interest rates by 50 basis points, double the amount widely expected at the September FOMC meeting.

President Trump has previously listed his top candidates for Fed Chair as including Governor Waller, former Fed official Kevin Warsh, and former Director of the National Economic Council Kevin Hassett. However, he has authorized Secretary Besant to lead the selection process. Besides Rieder, Warsh, Waller, and Hassett, other candidates under Besant's consideration are reportedly Fed Vice Chair Michelle Bowman and former Fed official James Bullard.

U.S.-China Madrid Trade Talks Conclude First Day, to Continue Monday

On September 14, U.S. and Chinese officials held the first day of talks regarding trade and economic issues in Madrid, Spain. Chinese Vice Premier He Lifeng and U.S. Treasury Secretary Besant attended the discussions. Agenda items included U.S. unilateral tariff measures, the abuse of export controls, and issues related to TikTok. The talks aim to implement the important consensus reached by the two heads of state and inject more stability into the bilateral economic and trade relationship.

Detailed official readouts of the first day's outcomes are not yet available. However, prior to the talks, the U.S. Commerce Department announced on September 12 the addition of several Chinese entities to its so-called export control "Entity List." On September 13, China's Ministry of Commerce (MOFCOM) announced the initiation of two investigations into U.S. practices: an anti-discrimination investigation into U.S. measures concerning the integrated circuit (IC) sector towards China, and an anti-dumping investigation into imports of certain U.S.-origin analog chips. These moves may impact the ongoing discussions.

The talks are scheduled to continue on September 15 (Monday). Future developments and outcomes warrant close attention.

China's MOFCOM Initiates Anti-Dumping Probe into U.S. Analog Chips

On September 13, China's Ministry of Commerce (MOFCOM) announced the initiation of an anti-dumping investigation into imports of certain analog chips originating from the United States, effective immediately. The investigation was launched after MOFCOM reviewed an application formally submitted by the Jiangsu Semiconductor Industry Association on behalf of the domestic analog chip industry on July 23, 2025, determining that the application met the conditions for initiation under China's Anti-Dumping Regulations.

The dumping investigation period is from January 1, 2024, to December 31, 2024. The industry injury investigation period is from January 1, 2022, to December 31, 2024. The products under investigation are certain analog chips originating from the U.S., specifically covering general-purpose interface chips and gate driver chips manufactured using 40nm and above process technology.

According to the application document, from 2022 to 2024, the volume of investigated imports from the U.S.累计增长37%, while their import price累计下降52%, depressing and suppressing domestic product prices, causing injury to the domestic industry. The alleged dumping margin for exports to China exceeds 300%.

On the same day, MOFCOM also announced the initiation of an anti-discrimination investigation into U.S. measures concerning China's integrated circuit sector (Announcement No. 50 of 2025).

A MOFCOM spokesperson stated that the U.S. has recently adopted a series of prohibitive and restrictive measures against China in the IC sector, including Section 301 investigations and export controls. These protectionist practices are涉嫌对华歧视 and represent efforts to contain and suppress China's development in advanced computing chips, artificial intelligence, and other high-tech industries. They not only harm China's development interests but also severely undermine the stability of the global semiconductor industry chain and supply chain, to which China is firmly opposed.

Based on relevant provisions of China's Foreign Trade Law, China has decided to initiate this anti-discrimination investigation and will take corresponding measures against the U.S. based on the actual situation. The investigation began on September 13, 2025, and typically lasts three months, extendable under special circumstances.

The investigation will focus on U.S. measures related to the IC sector against China, specifically including:

- Tariffs imposed or planned since 2018 on Chinese products, including ICs, based on Section 301 findings, and other potential prohibitions, restrictions, or similar measures.

- Restrictions enacted since 2022, via rules and notification letters, on exports of IC-related products and manufacturing equipment to China, and restrictions on "U.S. persons" participating in Chinese semiconductor projects (e.g., rules released in October 2022, October 2023, December 2024, January 2025).

- Restrictions since 2022, under the CHIPS and Science Act and related rules, on certain enterprises and individuals engaging in economic, trade, and investment activities in China's relevant sectors.

- Restrictions announced in May 2025, via news and guidelines, on the use of Chinese advanced computing ICs (including Huawei Ascend chips) and restrictions on using U.S. AI chips for training Chinese AI models.

- Other discriminatory prohibitions, restrictions, or similar measures taken by the U.S. against China across all links of the IC sector (design, manufacturing, packaging, testing, equipment, components, materials, tools) and specific application scenarios.

MOFCOM stated that the investigation will be conducted following principles of fairness, justice, and transparency. It welcomes active participation from all interested parties, including domestic industries and enterprises affected by the U.S. measures, and will take all necessary measures to defend the legitimate rights and interests of Chinese enterprises.

OpenAI, Nvidia to Provide Billions in Funding for U.K. Data Center Project

U.S. President Trump is scheduled for a state visit to the U.K. on September 17-18. CEOs of major U.S. tech companies, including Sam Altman of OpenAI and Jensen Huang of Nvidia, will accompany the delegation.

These U.S. tech executives are expected to commit billions of dollars in funding for U.K. data center projects during the visit. The companies will collaborate on the project with London-based data center firm Nscale Global Holdings.

Separately, Reuters reported that ahead of Trump's visit, the U.K. government announced on September 13 that major U.S. financial firms including PayPal, Bank of America, Citigroup, and S&P Global will make new investments exceeding £1.25 billion (approximately RMB 12.07 billion) in the U.K.

The U.K. Department for Business and Trade stated that this investment is expected to create 1,800 jobs in London, Edinburgh, Belfast, and Manchester, and deepen transatlantic financial links.

Meta to Release First Consumer Smart Glasses with Display

Meta is scheduled to hold its Connect conference on September 18, where it is widely anticipated to unveil its first consumer-grade smart glasses.

Source: Meta

Meta's conference agenda includes three sessions dedicated to "new Meta developer tools launching September 18," featuring speakers Lansing Lee, Valentina Chacón Buitrago, and Conor Griffiths, whose work is related to the smart glasses project. This suggests the new SDK may be related to glasses development.

Reportedly, Meta's new smart glasses, codenamed "Hypernova," will feature a heads-up display (HUD) showing information such as time, weather, and notifications, controllable via a neural wristband. The final product may be named "Meta Celeste," with an expected price of around $800. Furthermore, Meta is already developing a second-generation version, codenamed "Hypernova 2," which will feature two screens and is not expected to be released until at least 2027.

Market Recap

Last Friday, the S&P 500 briefly broke above the 6,600 mark for the first time in history during the session but subsequently plummeted, ultimately closing down 0.05% at 6,584.29. The Nasdaq Composite rose 0.44% to 22,141.1, marking its fifth consecutive record closing high for the week. The Dow Jones Industrial Average fell 0.59% to 45,834.22. For the full week, the S&P 500 gained 1.59%, the Nasdaq advanced 2.03%, and the Dow increased 0.95%.

Source: TradingView

In individual stock movements, most major tech stocks closed higher: Nvidia rose 0.37%, Microsoft gained 1.77%, Apple advanced 1.76%, Google-C added 0.25%, Meta increased 0.62%, Broadcom edged up 0.07%, TSMC climbed 0.16%, and Tesla surged 7.36%.

Oracle fell for a second straight day, dropping a cumulative 11% over the period, on market concerns over its future growth becoming overly reliant on a single customer, OpenAI. Wedbush Securities analyst Gil Luria stated in a client report released Thursday: "Our optimism regarding Oracle's backlog was significantly tempered by the news that it is almost entirely attributable to OpenAI." He maintained a "Neutral" rating on Oracle stock and cautioned investors to monitor customer concentration risks.

Source: TradingView

Quantum computing stocks generally rose, with IONQ and LAES both gaining over 30% for the week. Previous reports suggested that quantum machines are expected to play a key role in scientific breakthroughs such as new material development and drug discovery, potentially solving problems of commercial value that traditional computers cannot handle.

Source: TradingView

In other market performances, U.S. Treasury yields moved higher on Friday, with the 10-year yield rising 4.2 basis points.

Source: TradingView

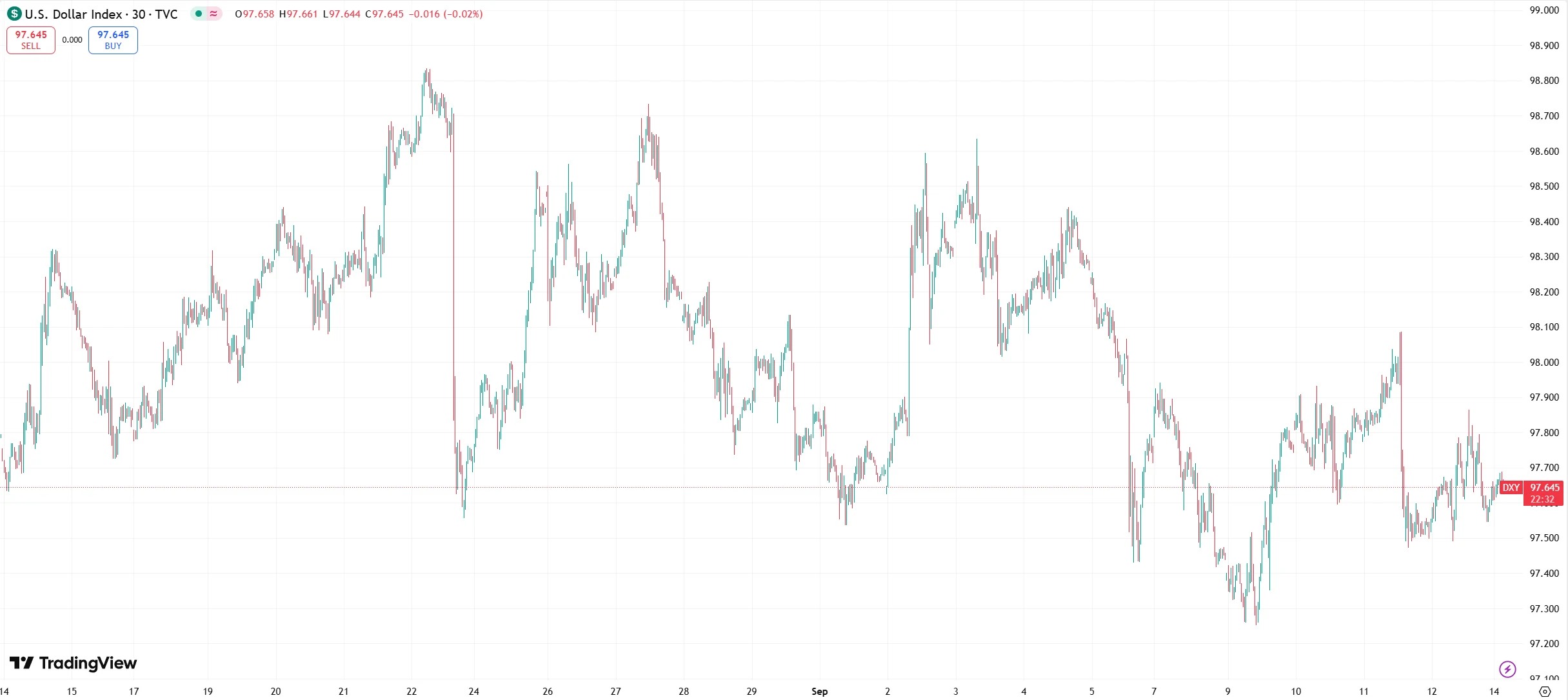

The U.S. dollar fluctuated above the 97 level during the day but recorded its largest weekly decline in approximately a month.

Source: TradingView

Cryptocurrencies moved higher across the board. Bitcoin rose approximately 2%, extending its gains for a third consecutive day. Ethereum broke out of a nearly two-week consolidation range, surging over 6.2% at one point.

Source: TradingView

Gold gained about 1.56% for the week, consolidating after retreating from a record high of $3,674 reached last week.

Source: TradingView

Currently, markets widely expect the Federal Reserve to implement its first 25-basis-point interest rate cut to address a softening labor market and respond to calls from the White House for lower rates. Additionally, the U.S. government faces another potential shutdown crisis. Democrats are insisting on including an extension of Affordable Care Act subsidies in the government funding bill, while Republican hardliners are demanding spending cuts, making a bipartisan agreement difficult to reach.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates