SGH's EBITDA growth: WestTrac is the core growth engine

17:43 September 13, 2025 EDT

Business Strategy and Outlook

SGH's industrial equipment businesses, WesTrac Australia and Coates, provide solid income and cash flow through investments in local government, civil engineering, and mining. Boral, a wholly owned building products and materials company, strengthens its infrastructure focus. Demand for mining service equipment is a key determinant of its earnings, a significant advantage given the government's preference for infrastructure investment to stimulate the economy. A 30% stake in Beach Energy increases its energy exposure and leverages oil and gas prices, while a 40% stake in Seven West Media provides interests in domestic television, newspapers, and magazines.

WesTrac's business is a major strength of the Group, contributing over 40% of its earnings and cash flow . WesTrac is the sole authorized Caterpillar dealer in Western Australia, New South Wales, and the Australian Capital Territory. The company provides heavy equipment, service, and support to major companies in the construction and mining industries, particularly in the iron ore and coal sectors. While either party may terminate the Caterpillar dealership with 90 days' notice, we do not anticipate that the partnership, which has spanned over 35 years in Western Australia and over 20 years in New South Wales, will end anytime soon.

Boral accounts for approximately 30% of the group's profits. It is Australia's largest integrated building materials company, producing and selling a wide range of materials, including quarried products, cement, concrete, asphalt, and recycled materials. Boral's integrated quarry network in southern New South Wales is conveniently connected to Sydney by rail.

Coates is the largest general equipment rental company in the United States. Coates and WesTrac have achieved cost efficiencies by sharing procurement and other headquarters functions. Increased mining capital expenditures and infrastructure development are driving demand.

Financial strength

SGH is in a strong financial position, with net debt of A$4.2 billion at the end of June 2025, a gearing ratio of 87%, and a net debt/EBITDA ratio of 2.1. The Boral acquisition increased leverage, but SGH has already completed its commitment to reduce net debt ahead of schedule. With an average debt maturity of just under five years, we expect relatively rapid repayments, leading to a gearing ratio below 30% and a net debt/EBITDA ratio below 1.0 by as early as 2028, all else being equal. However, this target is unlikely to be achieved due to SGH's acquisition bias and heavily geared balance sheet. SGH's target is a net debt/EBITDA ratio of 2.0. Its five-year average net debt/EBITDA ratio is 2.5. While SGH's debt levels are typically high, this is in part a reflection of its status as a conglomerate.

SGH's industrial operations, WesTrac, Boral and Coates, provide the majority of the company's cash flow.

Economic moat

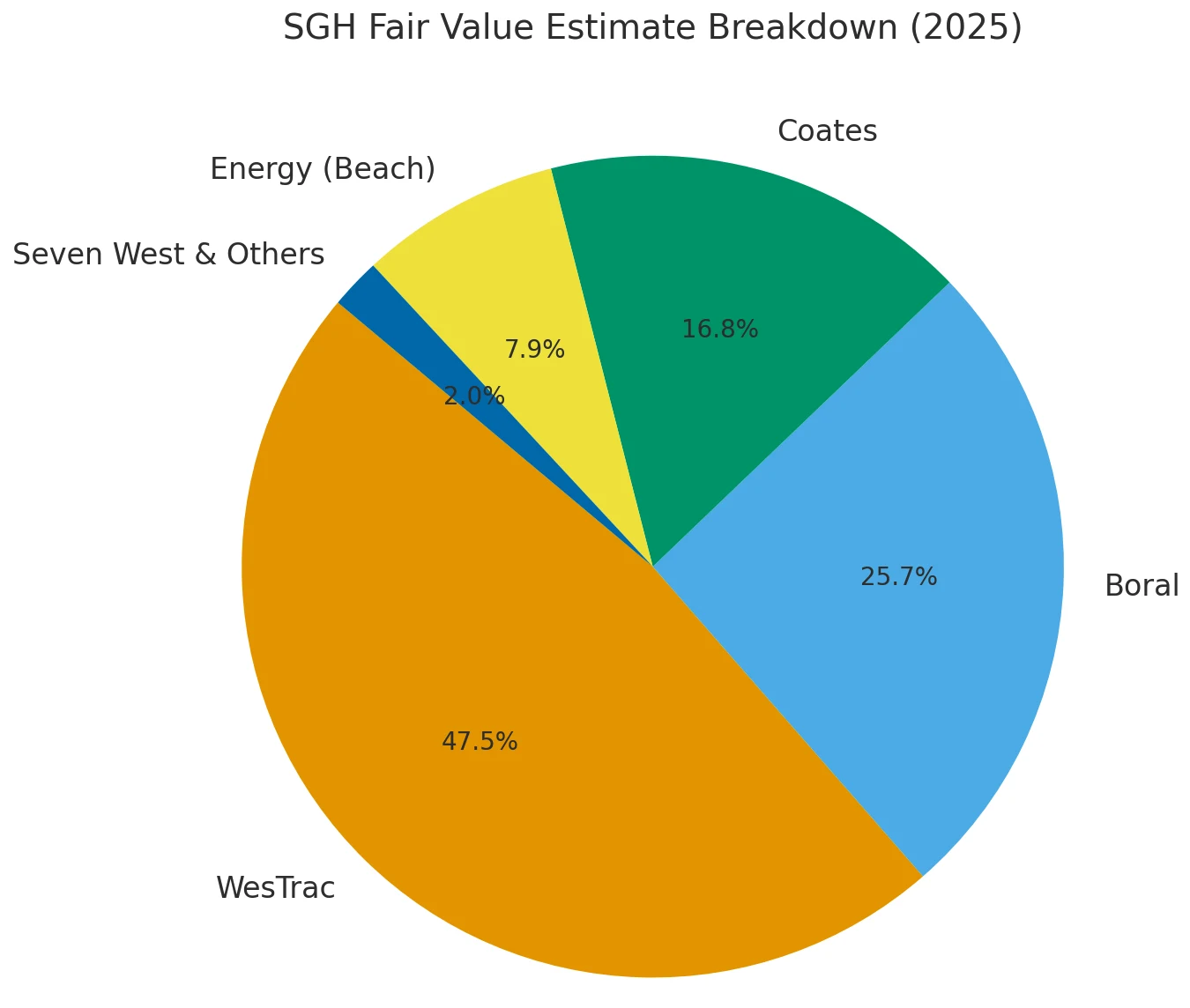

We believe SGH has a narrow economic moat. Our fair value estimate for the industrial services and energy group is as follows: approximately 48% for WesTrac and related businesses, 26% for Boral, 17% for Coates, 8% for Energy (including Beach Energy), and 2.0% for Seven West and other businesses.

For 15 years, SGH has consistently delivered improved returns despite the ups and downs of the mining industry cycle. Since 2019, the group's return on capital employed (ROIC) has exceeded our estimated weighted average cost of capital (WACC) of 8.0%, currently at approximately 11%, and is expected to rise to 14.0% by mid-cycle.

We consider WesTrac and Coates to be "moat" businesses, with efficient economies of scale and cost advantages. We consider Boral, Beach Energy, and Seven West Media to be non-moat businesses, but these factors only account for 40% of group earnings. Boral's quarries have "moat" attributes, but these factors only account for a small portion of earnings. Beach Energy is not a low-cost energy producer.

WesTrac is a strong company with world-class Caterpillar service territory in Australia. It is the only authorized Caterpillar and Cyrus distributor and service dealer in Western Australia, New South Wales, and the Australian Capital Territory. While either party can terminate the Caterpillar dealership with 90 days' notice, we believe the partnership, which has spanned more than 35 years in Western Australia and more than 20 years in New South Wales, will not end anytime soon. WesTrac holds a semi-regional monopoly on Caterpillar sales and service.

Coates is another company with a strong moat. The rental businesses of Coates Hire and National Hire merged in fiscal 2012, creating the two largest construction equipment rental companies in Australia. Coates boasts efficient scale in a fragmented industry. It has the largest national footprint, close proximity to customers, and attracts tier-one clients, including government agencies.

We do not believe Boral possesses an economic moat. Its integrated network of quarries in southern New South Wales, connected to Sydney by rail, is nearly impossible to replicate. However, this segment's relatively small contribution to Boral's revenue, at just 15%, is insufficient to justify its overall narrow moat rating. While the other segments are robust and do not diminish the advantages of their quarrying products, they do not demonstrate strong moat attributes.

We believe Beach Energy lacks a competitive moat. Resource stocks primarily derive their competitive advantage from a lower and sustainable cost structure than their peers. We believe Beach Energy currently lacks this advantage. The five-year average EBITDA margin through fiscal 2023 is 65%, a significant improvement from the five-year average of 50% prior to 2018. However, regardless of this margin improvement, it still pales in comparison to peers Woodside and Santos, which boast industry-leading five-year EBITDA margins (excluding third-party sales) of 80% and 76%, respectively. Furthermore, at current production rates, the average field life based on reserves is approximately 13 years, insufficient to create a competitive moat, and this figure will decline with the commissioning of the Waitsia Phase 2 gas project. We expect Beach Energy's return on invested capital (ROIC) to not exceed our assumed weighted average cost of capital (WACC) of 11.0% over the forecast period.

We believe Seven West Media lacks an economic moat. The proliferation of alternative digital delivery channels (smartphones, broadband, personal devices) and new entertainment formats (video streaming, short-form content, social media) is fragmenting the television audience, reducing switching costs. Our five-year forecast suggests Seven West's return on invested capital (ROIC) will not exceed our assumed weighted average cost of capital (WACC) of 8.0%.

Fair value and profit drivers

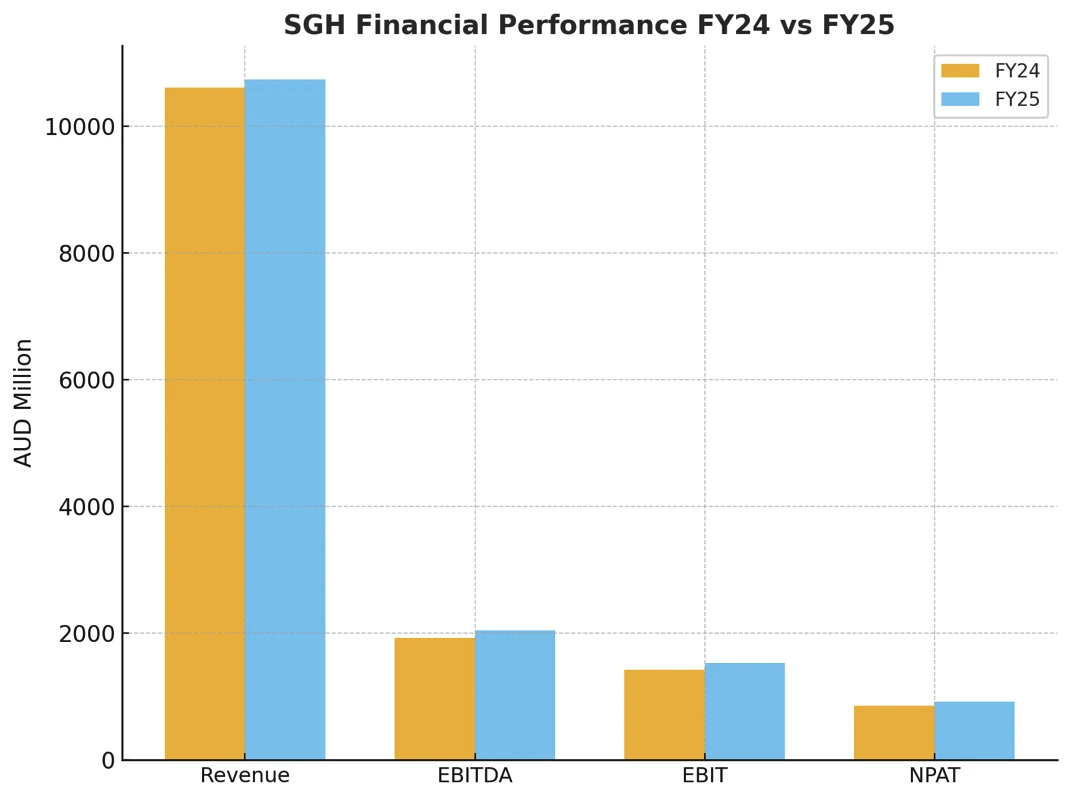

SGH reported an 8% increase in underlying net profit after tax to A$924 million for the 2025 financial year. Underlying EBITDA rose 9% to A$1.6 billion, meeting expectations for high-single-digit EBITDA growth.

Our fair value estimate for SGH remains unchanged at A$38. Our fair value estimate implies a five-year compound annual growth rate (CAGR) of 6% for group EBITDA to A$2.6 billion by fiscal 2030, with a medium-term EBITDA margin of 19.5%. Our medium-term margin assumption is above the five-year historical average of 18.3% to fiscal 2024 and 18% by 2025. In addition to improved performance at Boral, this margin improvement suggests strong earnings growth in higher-margin energy businesses, including Beach Energy's performance from its Waitsia gas project development.

Our fair value estimate is broken down as follows: approximately 48% for WestTrac and its related businesses, approximately 26% for Boral, approximately 17% for Coates, approximately 8% for Energy (including Beach Energy), and approximately 2.0% for Seven West and other businesses.

Our SGH discounted cash flow valuation uses a 9% cost of equity and assumes a long-term 75% equity weighting to drive a weighted average cost of capital of 8%.

Risks and uncertainties

We have a "Moderate" uncertainty rating for SGH. As an industrial company and investment firm, SGH faces multiple risks. WesTrac primarily sells Caterpillar heavy equipment to mining companies in the coal and iron ore sectors. The company relies on Caterpillar for its business, and while the relationship has been strong, the distribution agreement can be terminated with 90 days' notice. Demand for heavy equipment in the mining industry is highly dependent on continued strong economic growth in China and other parts of Asia. Financial performance and future dividends from its media investments depend on strong consumer spending levels, growth in advertising revenue, and economic conditions.

Significant environmental, social, and governance risks pose additional risks to investors in industrial groups like SGH. These ESG risks are primarily based on industry risks and are incorporated into our base case analysis. We incorporate a 9.0% cost of equity into our discounted cash flow fair value estimate for SGH.

The most significant ESG risks relate to corporate governance. Industrial companies face elevated baseline corporate governance risks, including management and compensation risks. Kerry Stokes holds a 51% stake in the company and holds a dominant position in strategy, policies, structure, and management, which creates the risk of undue influence.

Industrial relations issues and potential skills shortages could increase operating costs and impact revenue. Furthermore, SGH and its customers have a significant carbon footprint, which could lead to future compliance issues. SGH sells and services carbon-emitting heavy equipment and holds a 30% stake in oil and gas producer Beach Energy. However, given SGH's high diversification and well-managed risk profile, its overall ESG risk is assessed as medium.

Capital Allocation

SGH has a strong balance sheet. Net debt was A$4.2 billion at the end of June 2025, with a gearing ratio of 87% and a net debt/EBITDA ratio of 2.1. The Boral acquisition increased leverage, but SGH is ahead of schedule on its committed net debt reduction schedule. With a generous average debt maturity of just under five years, we expect repayments to be relatively rapid, leading to a gearing ratio below 30% and a net debt/EBITDA ratio below 1.0 as early as 2028, all else being equal. However, SGH's acquisition bias and high gearing make this scenario unlikely.

On the investment side, we believe SGH has performed reasonably well. Despite the ups and downs of mining cycles, SGH has consistently delivered returns over the past 15 years. Since 2019, the group's return on capital employed (ROIC) has consistently exceeded our estimated weighted average cost of capital (WACC) of 8.0%. Our metric currently stands at approximately 11%, and we forecast it to rise to 14.0% by mid-cycle.

Over the long term, we expect ROIC to remain in the mid-double digits, above WACC.

Finally , the dividend payout has been a mixed bag. Over the past three years, SGH's dividend payout ratio has been approximately 30%. We believe this ratio is low given its high debt level, as the company has favored M&A activity over dividends. Nevertheless, its share price has more than doubled over the past three years, and the company has continued to pay a dividend even during the COVID-19 pandemic, which is impressive. We believe that if acquisition-related debt were reduced, capital allocation could be better tilted toward income.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates