Netflix's Trillion-Dollar Dream: Is the Valuation Expected?

17:38 September 13, 2025 EDT

Is Netflix about to break a trillion-dollar valuation? Here's what it would take for it to get there, and how you should be concerned about this plausible target valuation.

There was a time, not so long ago, when Netflix was a driving force in the stock market. As one of the four tech giants known as the "FANG" group, and its successor, Netflix made headlines whenever it had problems. Back then, it wasn't yet a sprawling entertainment empire, but many investors foresaw Netflix's future as early as 2013 or 2017.

In recent years, things have changed. Netflix has weathered some tough times, appointing two co-CEOs and changing the management and reporting structure of its streaming business. A new industry of streaming platforms with exclusive content has developed around the company. After several significant stock price declines and rebounds, Netflix's market capitalization now exceeds $500 billion.

Can Netflix finally join the trillion-dollar club of current stock market giants? Or is this just an impossible fairy tale? We'll have to wait and see.

Netflix's place among tech giants

Things change, and the more familiar they become, the more familiar they become. The modern version of FANG refers to the "Magnificent Seven," or large-cap tech stocks. Netflix is the only FAANG stock not currently on the "Magnificent Seven" list.

Still, it's not far off. There are only 10 companies with a market capitalization exceeding $1 trillion, and Netflix is currently in the top 20. From a purely numerical perspective (set theory at work!), Netflix is more likely than most to join the trillion-dollar club someday.

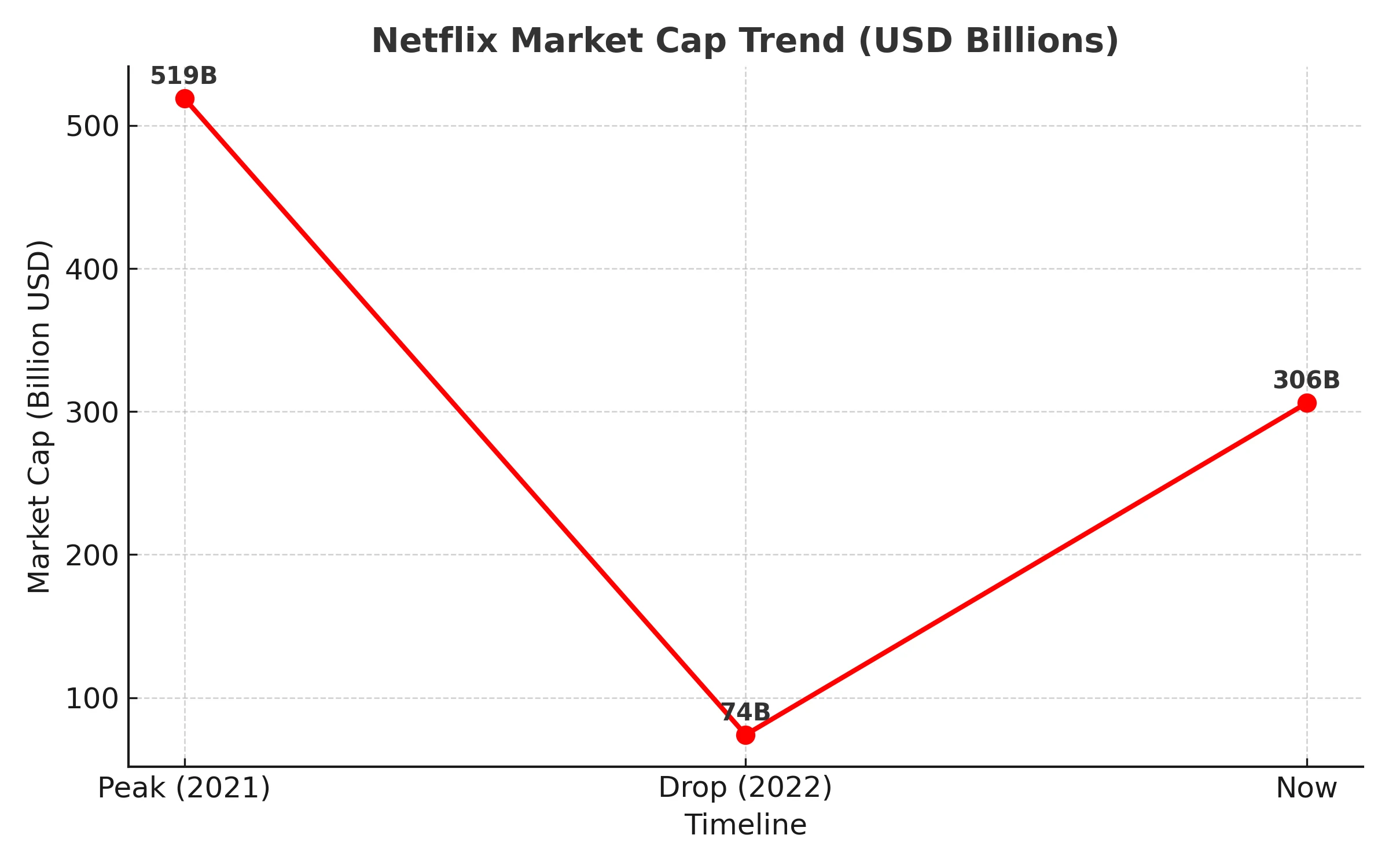

A few years ago, Netflix's lofty position, with a market capitalization of $519 billion, seemed unlikely. The inflation fears of 2022 have converged with the maturing streaming industry, and Netflix has adapted to these changes in some uncomfortable ways. Many investors were initially unhappy with the company's crackdown on account-sharing members, while new subscription plans with built-in advertising but lower monthly fees also irked Netflix viewers.

Netflix's soaring stock price plummeted from that moment on. In just a few months, its market capitalization plummeted from $306 billion to $74 billion.

So Netflix has proven it can quickly deliver strong returns to shareholders—at least when it starts at a temporarily cheap discount.

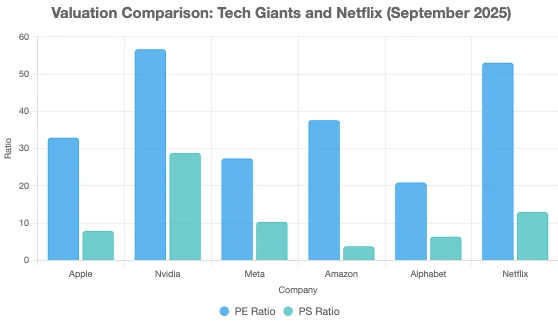

Of course, that's not the case today. Netflix's valuation is high, trading at 52 times earnings and 61 times free cash flow. Even accounting for the company's breakneck growth, its stock price remains expensive.

The stock may see a price correction someday. However, I'm not going to sell my shares to cash out my Netflix gains. Remember what I said earlier about market timing—I don't know where Netflix's stock price will be next week or next year, but I'm confident that over the long term, its growth story will continue.

Netflix enters the real world

This is a lot of real-world action from the experts in pure digital entertainment.

Before this abundance of physical content, Netflix fans had to satisfy their Netflix merchandise cravings with licensed Target (TGT -0.14%) T-shirts and Funko Pop figures. I mean, Netflix.shop has been online since 2021, but when was the last time you visited one? Even if it delivers some physical merchandise to your mailbox, it's still an online experience. It's a completely different experience than experiencing your favorite brand, band, studio, or show in person at a local store.

Only time will tell if Netflix moves further in the direction of physical entertainment. While playing Bridgerton mini-golf or entering the world of Squidward Illusion in VR can be thrilling, brand-centric exploration hubs can become tedious over time. Furthermore, it takes a special kind of creative talent to dominate the pop charts like the K-pop hit "Devil May Cry" is currently doing. You can't expect to hit those highs often.

So investors do hope Netflix will try more realistic ideas, perhaps one day creating a fully functional theme park. Every step Netflix takes down this path brings it closer to old-school entertainment empires like Comcast's (CMCSA -0.61%) Universal Studios or Walt Disney (DIS -1.25%).

It’s impossible to tell whether this will be good or bad for Netflix, its customers, or its investors in the long run. Done right, stepping back in time to the golden age of theme parks, radio dramas, and cinemas might be refreshing—but how long will it last? And what happens next?

But these are extremely long-term issues that likely won't impact the increasingly digital entertainment industry for another decade or so. For now, I admire Netflix's openness to alternative business strategies. It was this openness that allowed Netflix to successfully kill Blockbuster, shut down the resulting DVD-by-mail winner, and build its current streaming business on top of those wreckage.

Creating physical experiences can also help Netflix elevate its brand in a similar way. Notably, the company plans to launch Netflix Houses in Dallas and Philadelphia this year, and in Las Vegas in 2027. These are small, permanent locations (approximately 100,000 square feet) located within shopping malls, featuring interactive experiences, dining options, and retail stores.

Financial impact

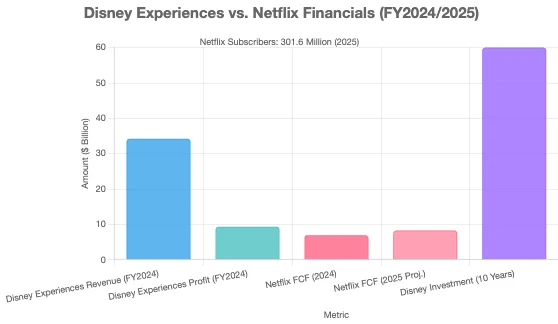

When making strategic decisions like these, the potential for financial success is paramount. Disney's Experiences division is its most profitable, projecting $9.3 billion in operating profit on $34.2 billion in revenue for fiscal year 2024 (ending September 28, 2024).

Netflix reported $6.9 billion in free cash flow in 2024 and expects it to reach $8 billion to $8.5 billion this year. Investing in theme parks would require significant capital expenditures, which would undoubtedly weaken Netflix's strong financial position. Return on invested capital is a key metric management teams should consider when allocating cash to its best uses. Creating physical experiences at the level of Disney would divert resources from the top-tier content creation for which the company is renowned.

In September 2023, Disney announced it would invest $60 billion over the next decade to expand its experiences business, a daunting undertaking that Netflix could avoid.

Today's streaming-driven media industry is incredibly competitive. With so many companies vying for viewers' attention, finding ways to stand out is crucial. However, Netflix holds a dominant position, with over 300 million subscribers worldwide. With the upcoming launch of Netflix Houses, Netflix's operational advantages will become even more significant.

Netflix doesn't need to emulate Disney. It's still firing on all cylinders. The more compelling argument is that Disney needs to emulate Netflix—at least when it comes to its recently profitable streaming business.

Solid growth and positive outlook

Netflix says the key to its success is providing a diverse selection of high-quality series and films that resonate with viewers. The company notes that a hit series or film typically accounts for only about 1% of total viewing, so it seeks to consistently offer high-quality content across regions and genres to retain existing viewers and attract new ones.

As an international company, Netflix also employs a "localized, localized" content strategy to attract and connect with audiences in its home country. The company states that non-English content currently accounts for over a third of its viewing hours. These shows, like South Korea's "Squidward Idol" or Japan's "Alice in Wonderland," can also be popular with American audiences.

Netflix's investment in local content has been driving its performance, with international revenue growth consistently outpacing growth in the U.S. and Canada. This trend continued in the second quarter.

Revenue growth in the Asia-Pacific region led the way, increasing 24% to $1.3 billion, while revenue in the EMEA (Europe, Middle East, and Africa) region grew 18% to $3.5 billion. Latin America revenue grew 9% to $1.3 billion, but increased 23% in local currencies. Meanwhile, revenue in the United States and Canada region grew 15% to $4.9 billion.

Netflix's total revenue rose 16% to $11.08 billion, slightly exceeding the average analyst estimate of $11.07 billion compiled by the London Stock Exchange (LSEG). Earnings per share (EPS) soared 47% to $7.19, exceeding the average analyst estimate of $7.08.

Currently, Netflix appears to be generating most of its revenue growth from price increases and membership expansion, a departure from the traditional revenue model of the Big Seven. However, growing its advertising business is a top priority. It expects ad revenue to double this year and recently rolled out its new ad technology platform to all advertising markets.

The company is also continuing to expand its live programming, including boxing matches and two NFL games scheduled for Christmas, in addition to its weekly live broadcasts of WWE's Monday Night Raw.

The company raised its full-year revenue forecast to a range of $44.8 billion to $45.2 billion, up from its previous forecast of $43.5 billion to $44.5 billion. It also raised its operating margin forecast to 30% from 29%. Currency effects accounted for about half of the increase in operating margin.

Netflix's stock price had a strong year leading up to its earnings report, leading to high expectations. While the company delivered solid results and raised its forecast, that wasn't enough for investors to continue bidding up the stock. Following the report, the stock fell about 1.6%.

That said, Netflix's situation hasn't fundamentally changed. The company continues to benefit from price increases and its membership base continues to grow, particularly in international markets. Meanwhile, advertising is expected to become the company's biggest growth driver as its ad-supported tiers and live content scale.

However, I wouldn't buy at current levels even after a pullback, given the stock is trading at 47 times analysts' expected price-to-earnings (P/E) for 2025. I think the stock has great potential long-term, but I'd still prefer a lower valuation before jumping in.

Conclusion

It's encouraging to see Netflix testing the waters with physical experiences. It may not have the breadth and depth of IP like Disney, especially when it comes to kids and family content, but it has popular shows and movies that people love. Netflix would be wise not to go all-in on a real theme park, as it likely won't be able to compete with Disney's dominance or Comcast's Universal Studios.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates