How to view the surge in Oracle

12:00 September 13, 2025 EDT

Oracle just reported its first-quarter 2026 earnings, and the market reaction will go down in history as one of the biggest single-day moves for the stock, and likely one of the biggest single-day increases in the net worth of its founder, Larry Ellison.

Over the past 12 months, ORCL's stock price has risen nearly 140%, reaching a price-to-earnings ratio of nearly 80. Such a high valuation implies that the market has little tolerance for future growth. If future performance falls even slightly short of expectations, the stock price could face a sharp correction. This irrational enthusiasm is compounded by potentially high risks, necessitating investor caution.

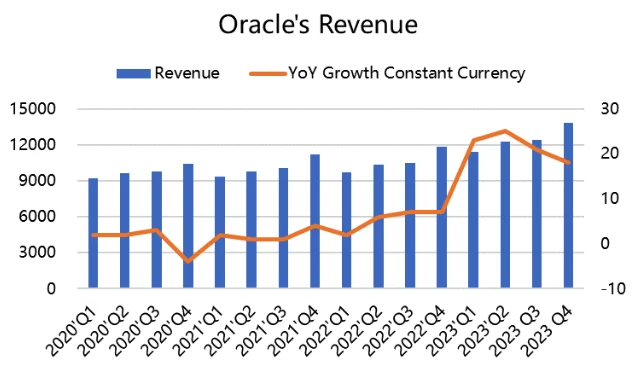

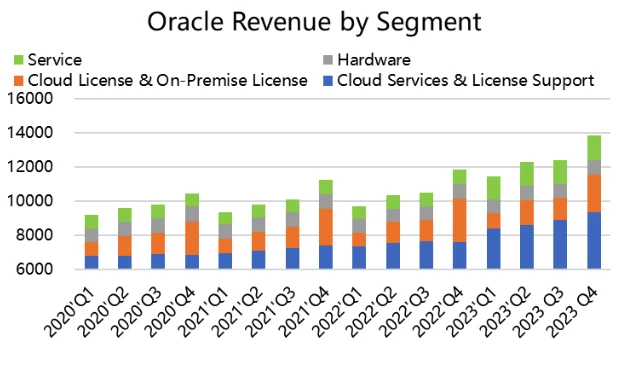

If we focus first on the business, it's easy to see the direction of growth surrounding ORCL in 2020. Clearly, management isn't interested in managing the business on a quarterly basis; their strategy is geared towards achieving long-term success. From a business perspective, Oracle's management consistently emphasizes a long-term strategic approach. The continued expansion of the company's cloud computing business and strong strategic execution over the past few years have already laid the foundation for growth. Therefore, investors who inflate valuations based solely on single-quarter earnings reports risk overlooking the true source of the company's value.

However, the stock market operates in a very different way. Share prices often fluctuate wildly in response to quarterly announcements, breaking news, or earnings that miss expectations during a given three-month period.

At first glance, ORCL's strong quarterly results appear to be the market's focus. ORCL's stock has risen nearly 140% over the past 12 months, trading at nearly 80 times earnings.

A significant portion of that year's returns occurred today, which means we should take a closer look at what happens in Oracle's first quarter of fiscal 2026 before we move on to discussing whether the current valuation is justified.

Big surprise of the quarter

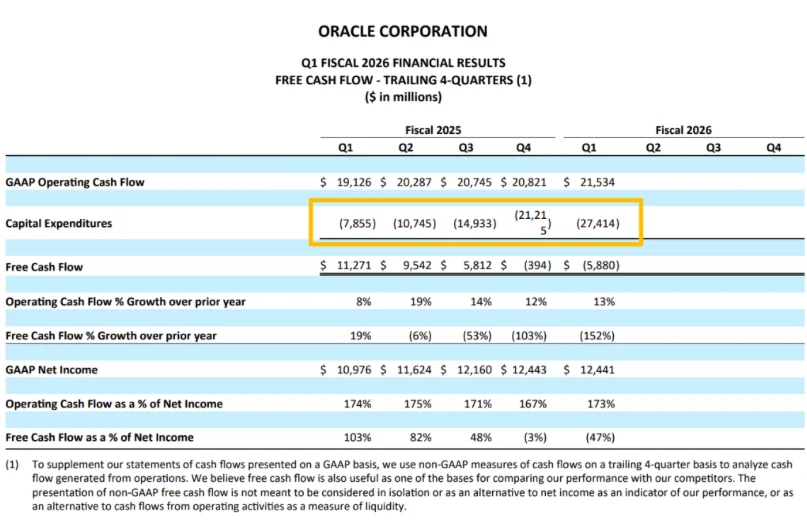

Capital expenditures, the primary metric for management's expectations for cloud infrastructure demand, continue to represent nearly 60% of quarterly revenue, and have been the primary driver of Oracle's stock price gains in recent quarters as we enter a new long-term cycle of strong demand for Oracle Cloud (OCI).

While this is a significant bullish development for the stock, it's worth noting that there weren't any meaningful changes during the quarter, with the capital expenditure-to-revenue ratio remaining at the same level as the previous quarter.

Quarterly revenue by segment also showed no significant changes compared to three months ago. Cloud Applications saw growth of 11%, slightly down from 12% in the previous quarter (see below). ERP Suites continued to grow at around 15%, also below the growth rate seen in the final quarter of fiscal 2025.

Source: Oracle

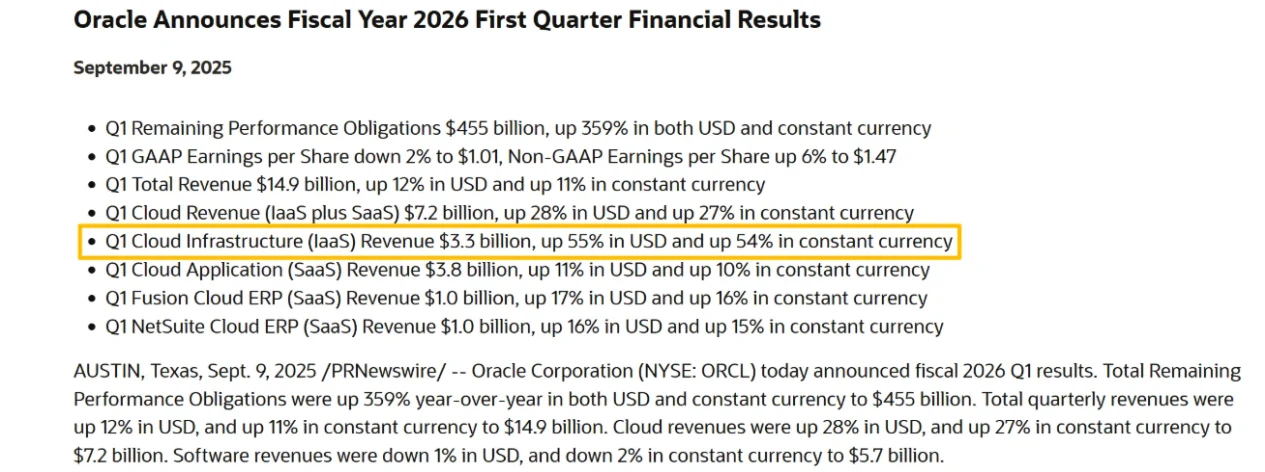

However, Oracle's remaining performance obligations saw a significant shift, with the total jumping 359% to $455 billion. While this caught the market off guard, it's worth noting that RPO (recruitment process outsourcing) saw a 41% growth rate (previous quarter). This doesn't make the current growth any less significant, but it does provide some context for market expectations.

Since RPO growth is the sole factor driving about one-third of Oracle's stock price increase, CEO Safra Catz's comments are critical to assessing our expectations for significant RPO growth and what it means for Oracle's valuation.

"We signed four multi-billion dollar contracts with three different customers in the first quarter," said Oracle CEO Safra Catz. "This resulted in a 359% increase in our RPO contract backlog to $455 billion. We expect to sign several new multi-billion dollar customers, with RPO likely exceeding $500 billion. Looking ahead, we expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year, and to $32 billion, $73 billion, $114 billion, and $144 billion over the next four years. The majority of the revenue in this five-year forecast is already included in our reported RPO."

But before we value ORCL, we should also remember that the remaining performance obligations consist of deferred revenue and backlog, the latter of which is contracted revenue that has not yet been invoiced.

Last quarter, deferred revenue increased by approximately $3 billion compared to the previous quarter, meaning that a significant increase in RPO has not yet been factored in. Furthermore, the ultimate factor affecting Oracle's valuation lies in the free cash flow generated by this higher revenue, making it difficult to determine overall earnings over the next five years. For example, how much capital expenditure will be required to support this growth, what the applicable profit margin will be, and so on.

fair value

According to Oppenheimer's analysis, Oracle's revenue growth accelerated at the beginning of fiscal year 2026, setting new sales records in several key metrics, including RPO, cloud revenue, OCI, and multi-cloud database revenue. Over the past 12 months, Oracle's revenue grew 9.67% to $59.02 billion, maintaining its leading position in the software industry.

The strong quarterly results support a significant increase in Oracle's mid-term OCI growth guidance and solidify the company's position as a software leader in AI transformation and a market share gainer for large enterprises.

Despite these positive developments, Oppenheimer highlighted that increased capital expenditures to support RPO growth are consuming Oracle's free cash flow, which is negatively impacting the company's cash efficiency and margin profile.

The research firm noted that investors may overlook these short-term financial headwinds as Oracle's OCI valuation has surged due to backlog growth, and a substantial OCI guidance hike would support its stock price. The company maintains strong profitability with a high gross margin of 69.66%, despite its current high P/E and EBITDA multiples.

In other recent news, Oracle's first-quarter fiscal 2026 earnings report triggered a flurry of analyst upgrades. Wolfe Research raised its price target to $400, citing significant growth in the cloud infrastructure market driven by AI demand. Oracle reported a tripling of its remaining performance obligations (RPO) to $455 billion, driven by major contracts such as the Stargate project. Mizuho Securities also raised its price target to $350, highlighting Oracle's 359% year-over-year RPO growth, positioning it as a key AI infrastructure provider.

Barclays followed suit, raising its price target to $347, noting that a large AI contract has significantly improved the efficiency of recruitment process outsourcing (RPO). Guggenheim raised its price target for Oracle to $375, highlighting its history of innovation and recent technological advancements. DA Davidson, while maintaining its "neutral" rating, raised its price target to $300, stating that earnings were "largely in line" with expectations. These developments reflect Oracle's strategic focus on AI and cloud infrastructure, two factors that have driven its impressive financial performance.

Is Oracle's stock price reasonably priced?

While ORCL remains my favorite business in the cloud computing space, I no longer share the same sentiment on the stock price.

Over the past 12 months, ORCL's stock price has risen nearly 140%, reaching a price-to-earnings ratio of nearly 80. Such a high valuation implies that the market has little tolerance for future growth. If future performance falls even slightly short of expectations, the stock price could face a sharp correction. This irrational enthusiasm is compounded by potentially high risks, necessitating investor caution.

Such wild swings in valuation multiples are rarely a good sign for future returns. In ORCL's case, its recent rally has been driven entirely by less certain forecasts that extend even further into the future. This poses a twofold problem:

First, even if these forecasts prove correct, the market has already factored them in, meaning investors will need better forecasts from now on to justify market-beating returns. Second, the further into the future we look to justify current stock prices, the higher the risk that these forecasts will be accurate. With this in mind, I find it difficult to justify the multiples we see below.

Nevertheless, if we try to understand these high-value forecasts, we should start with the initial data mentioned by Oracle's CEO. In the figure below, we can see Oracle's expected cloud infrastructure revenue for each fiscal year until 2030.

If we assume that Oracle's other businesses grow at 15% annually (a very optimistic assumption based on the company's current projected growth, which is somewhat similar to the recent growth of its software business), total revenue should reach around $240 billion by fiscal 2030. Therefore, based on Oracle's current market capitalization of $956 billion, assuming a 10% annual growth rate, which would generate returns for shareholders roughly in line with the long-term returns of the broader market, the stock would have a price-to-sales ratio of 6.5 in fiscal 2030.

To put this into perspective, a P/E ratio of 6.5 is still well above the company's historical average, not to mention the risks and uncertainties these valuations carry over the next five years.

The risk for investors buying ORCL at current levels is further exacerbated by uncertainty surrounding the actual profit margins on these contracted sales and the level of capital expenditures required to build these GPU-centric data centers.

in conclusion

As a longtime believer in the quality of Oracle's business model, I remain optimistic that the company will continue to make significant progress in its cloud infrastructure and applications businesses. While the first quarter of 2026 looks like another strong period for the company, the share price reaction is unjustified. Future shareholder returns from this point forward are subject to very high risk and uncertainty, and even if we assume a best-case scenario, ORCL shareholders are likely to ultimately receive returns in line with the broader market.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates