Can the bright fundamentals lead to a turnaround in Qualcomm’s stock price?

17:20 September 13, 2025 EDT

Tech giant Qualcomm is once again testing the patience of its most loyal investors as the stock struggles despite consistently beating earnings expectations, trading in one of the market's hottest sectors and against a backdrop of record highs.

The company's shares have fallen 3% this year, while the S&P 500 has risen more than 8%, with market leader NVIDIA's stock price surging 35%.

The stock's latest 10% drop in late July broke a steady upward trend dating back to the spring, leaving long-term holders questioning where the stock will go next. However, for those holding a wait-and-see approach, recent weakness may be creating an attractive entry point.

It doesn't necessarily require a multi-year holding period, but it's certainly a short- to medium-term trade worth considering.

Accelerate revenue

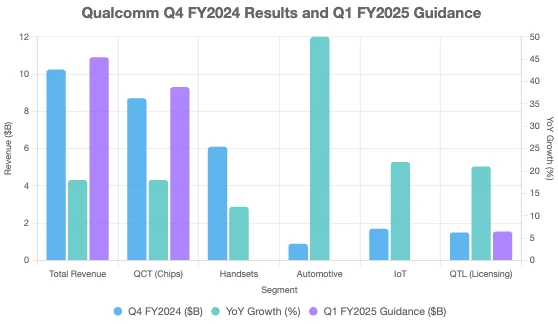

After revenue grew just 5% in the first quarter and just 1% in the second, Qualcomm's revenue growth accelerated in the second half of fiscal 2024. It achieved 11% revenue growth in the third quarter and then posted 19% revenue growth to $10.2 billion in the quarter ended September 29. That easily beat analysts' expectations of $9.9 billion compiled by Refinitiv.

Total chip revenue grew 18% to $8.7 billion. Revenue from mobile phone chips, including smartphones, rose 12% to $6.1 billion, while automotive chip revenue soared 68% to $899 million. Internet of Things (IoT) revenue grew 22% to $1.7 billion.

Mobile phone revenue was primarily driven by a 20% increase in Android revenue. Meanwhile, its new Snapdragon 8 Elite chip performed well in the early stages of the market. The company is also actively pursuing opportunities in artificial intelligence (AI) on edge devices and partnering with leading AI model companies to provide cloud-to-edge solutions.

In the automotive chip sector, the company said it benefited from the launch of more new models using its technology. The company found that its transformation to digital cockpits and advanced driver assistance systems was paying off. Meanwhile, in the Internet of Things sector, the company benefited from the launch of new products and the continued normalization of channel inventory.

Meanwhile, revenue from its high-margin licensing business grew 21% to $1.5 billion. Management said it completed several license renewals during the quarter. Adjusted earnings per share rose 33% to $2.69, beating analysts' consensus estimate of $2.56.

Looking ahead, Qualcomm expects first-quarter revenue to be between $10.5 billion and $11.3 billion, representing growth of 6% to 14%. The company expects chip revenue to be between $9 billion and $9.6 billion, and licensing revenue to be between $1.45 billion and $1.65 billion. Adjusted earnings per share are expected to be between $2.85 and $3.05.

Qualcomm said it expects mobile phone chip sales to grow by a mid-single-digit percentage, driven by demand from Chinese smartphone manufacturers and the release of new Android smartphones. The company expects automotive revenue to grow by more than 50%, and IoT revenue to grow by 20%, driven by growth in its consumer, industrial, and networking businesses.

Qualcomm's processors already enable AI computing in edge devices

Qualcomm is best known for making application processors for smartphones. The company also designs chips for personal computers (PCs), cars, and Internet of Things (IoT) applications. Most of these devices sit at the edge of the network, processing data locally without sending it to cloud servers.

These edge devices are already running AI applications. For example, smartphone manufacturers have been releasing models with on-device AI capabilities. Samsung's latest Galaxy S25 model will offer users a variety of on-device AI features, such as image generation, text interpretation, content summarization, and personalized experiences based on user behavior.

Notably, these features will be powered by the Qualcomm Snapdragon 8 Elite processor found in the latest Galaxy smartphones. However, this is just one aspect of Qualcomm's push into the edge AI market. The company also offers a chip platform for AI-enabled PCs through its Snapdragon X Elite processor. Qualcomm notes that computers equipped with this chip can locally run large language models (LLMs) with over 13 billion parameters.

Meanwhile, Qualcomm's smartphone processors can run LLMs with up to 10 billion parameters on the device itself. Generative AI offers methods for streamlining LLMs—decomposing larger models into smaller, more efficient models to perform specific tasks—potentially paving the way for widespread adoption of generative AI on edge devices.

LLMs typically require powerful hardware to run. However, edge devices like smartphones, PCs, cars, drones, and security cameras cannot handle such hardware. This is where LLM refinement comes in handy. While DeepSeek's R1 LLM, which has been successfully implemented in the past, boasts a whopping 671 billion parameters, the startup also offers similar streamlined versions with parameters ranging from 1.5 billion to 70 billion.

These streamlined models can run on edge devices because they require less computing power. The benefit is that lower computing costs mean lower costs for consumers to use AI on edge devices.

As edge devices become more affordable and can run more AI models, thanks to technologies like LLM refinement, demand for edge devices is likely to grow significantly in the future. For example, Fortune Business Insights estimates that the edge AI market could grow at an annual rate of 33% by 2032.

This could pave the way for stronger growth for Qualcomm.

Qualcomm's stock price has risen 97% over the past five years, lagging behind the 165% gain of the Philadelphia Stock Exchange Semiconductor Index over the same period. Sluggish smartphone sales have weighed on Qualcomm's stock over the past three years. However, generative AI smartphones could offer a new lease of life for Qualcomm, with shipments of these devices projected to grow 78% annually through 2028.

Furthermore, the firm estimates that growing demand for edge processors in the IoT and automotive sectors could drive revenue in these areas 2.5 times over the next five years, reaching $22 billion by fiscal 2029, representing a 22% annual growth rate. All of this suggests that Qualcomm's revenue growth over the next five years could be higher than the 15% annual growth rate it experienced over the past five years.

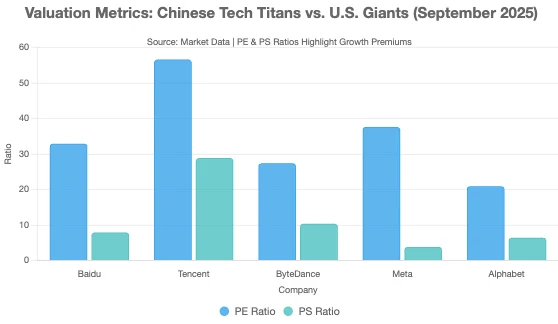

With Qualcomm trading at an attractive 19x P/E, it looks like the best AI stock to buy right now, considering the lucrative AI advantage opportunities it can capitalize on.

Is Qualcomm worth buying?

Qualcomm is starting to see growth from a recovery in smartphone sales and the upgrade cycle as consumers seek more powerful devices capable of running AI applications natively. This is also prompting consumers to buy more advanced smartphones, which benefits Qualcomm because these devices are often equipped with Qualcomm's newer chips.

In addition to smartphones, the company is also deeply involved in automotive, IoT, personal computers (PCs), and XR (extended reality) glasses. The launch of the Copilot+ PC is expected to be a strong growth driver for the company, and the company said its new Snapdragon X Plus 8-core chip will enable it to enter the $700 PC market.

From a valuation perspective, Qualcomm's stock price is attractive, trading at a forward price-to-earnings (P/E) ratio of just over 15, based on analyst forecasts. Meanwhile, its price-to-earnings-to-growth (PEG) ratio is just over 0.6. Stocks with a PEG ratio below 1 are generally considered undervalued, while growth stocks typically have significantly higher PEG ratios.

The stock remains well below its recent highs, and its revenue growth has accelerated in recent quarters. Given its attractive valuation, improving smartphone market, and growing opportunities in other sectors, Qualcomm remains a solid long-term investment even after the post-earnings share price increase.

Qualcomm's Centriq server CPU had little chance of success in 2018. The x86 architecture had too much inertia, and the software ecosystem was centered around the dominant architecture.

Qualcomm may have better luck this time around, thanks to AI. Tech giants like Microsoft are investing heavily in new AI data centers, and some are even designing their own Arm-based CPUs. The software stack is still evolving, and with companies like Microsoft and Amazon supporting Arm-based server CPUs, 2025 is poised to see significantly more momentum than 2018.

While the environment is more favorable for Qualcomm, the company will face competition from potential customers’ in-house chip design teams and other companies entering the market. Nvidia already sells its Grace series of data center CPUs based on the Arm architecture, and as Arm’s traction grows, other companies may follow suit.

If Qualcomm returns to the server CPU market, Intel and AMD will face stiffer competition, but both companies have strong product lineups that are difficult to beat. Intel improved its competitive position last year with the powerful Granite Rapids chip and the efficiency-focused Sierra Forest chip, and this year it plans to use its cutting-edge Intel 18A manufacturing process for the Clearwater Forest chip.

Meanwhile, AMD officially launched its Turin series of server CPUs in October, featuring 192 cores. The series also includes a CPU designed specifically for use as a host node CPU in AI accelerator clusters. AMD's previous generation of server CPUs was a resounding success, and the company is committed to building on this success.

Qualcomm appears to be preparing to re-enter the server CPU market. Due to the more favorable market environment for Arm-based CPUs, this time the progress should be better than last time, but the competition will also be extremely fierce.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates