Alibaba Hits Four-Year Stock High as Company Enters New Phase

03:01 September 12, 2025 EDT

Key Points:

Alibaba's stock has recently experienced significant gains, breaching its previous high from March 2025 and signaling a comprehensive recovery from the antitrust regulatory cycle.

Major breakthroughs in AI models and chips are reshaping market perceptions of the company’s technological competitiveness.

As cloud business growth rebounds to over 20%, driven by AI, and instant retail demonstrates scaling effects, Alibaba’s valuation framework is shifting from an “e-commerce discount” to a “tech premium,” supporting medium- to long-term stock appreciation.

On September 11, Alibaba’s U.S.-listed shares surged significantly, rising 8% to close at $235.46, with the intraday high exceeding the peak level since November 2021. The Hong Kong market reacted similarly, with shares gaining nearly 7% in early trading the following day, bringing year-to-date gains to almost 90%.

Source: TradingView

This breach of the previous resistance level from March 2025 not only represents a technical breakthrough but, more importantly, indicates that Alibaba is moving beyond the adjustment period following antitrust regulations and entering a new phase centered on “technology-driven growth and ecosystem synergies.” The company’s transition from an e-commerce giant to a technology platform, and its shift from business model innovation to core technological advancements, are reshaping capital market perceptions of its value through coordinated technological, operational, and financial effects. The market is no longer focused solely on Alibaba’s e-commerce foundation but is increasingly valuing the long-term growth potential driven by its technological transformation.

Rapid Advancements in AI Technology

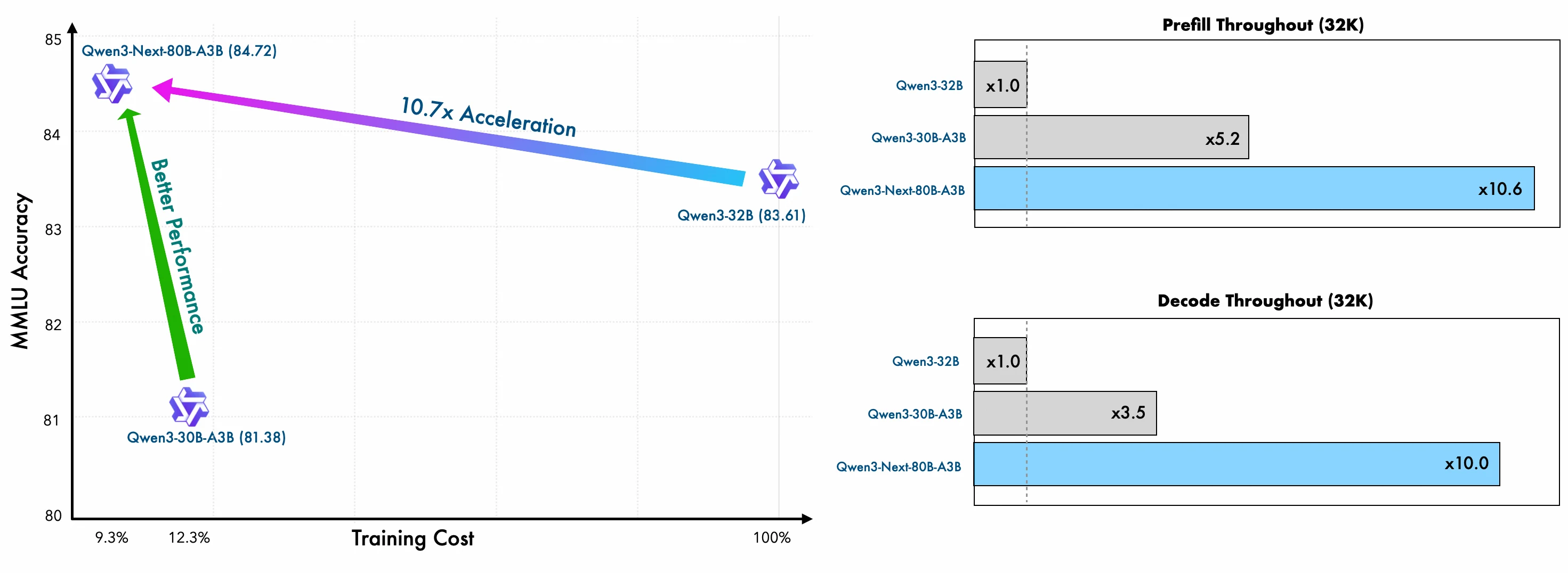

Alibaba's robust stock rebound is primarily attributed to its breakthrough advancements in core AI technologies. In the early hours of September 12, 2025, Alibaba open-sourced its new-generation large-scale model architecture, Qwen3-Next-80B-A3B. This model, which integrates a hybrid architecture of gated DeltaNet and gated attention, achieves a revolutionary balance between performance and efficiency. Its core innovation lies in the 3:1 ratio fusion of gated DeltaNet and standard attention mechanisms, preserving the inference accuracy of standard attention while enhancing long-context processing efficiency tenfold through gated DeltaNet, particularly excelling in ultra-long-text scenarios exceeding 32K tokens.

Source: Qwen

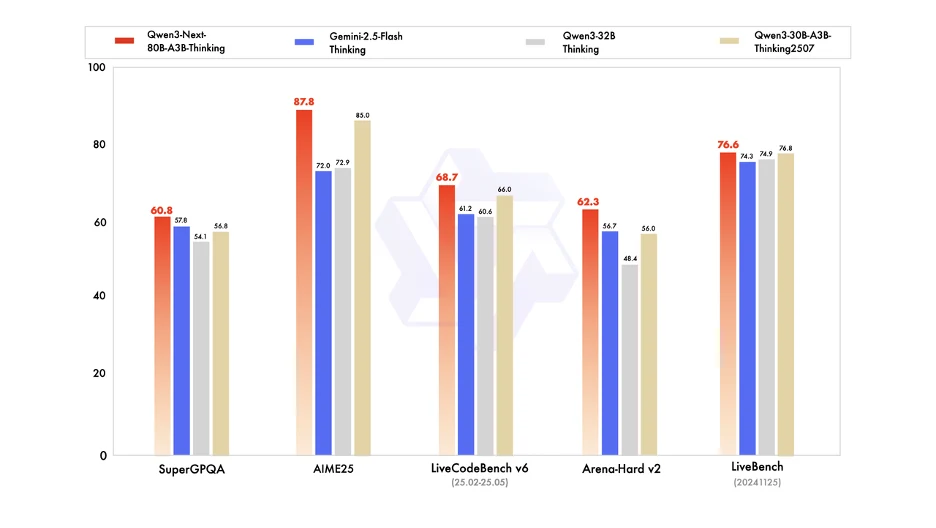

In terms of model design, Qwen3-Next adopts an ultra-high sparsity MoE structure, activating only 3 billion out of a total of 80 billion parameters (3.7%). This design reduces training costs by 90% compared to Qwen3-32B while delivering inference performance comparable to the flagship model Qwen3-235B. Notably, its natively integrated multi-token prediction (MTP) mechanism not only provides a high-acceptance-rate module for speculative decoding but also significantly improves decoding efficiency in practical applications through training-inference consistency optimization. In performance benchmarks, Qwen3-Next's thinking model outperformed Google's Gemini-2.5-Flash in multiple tests, establishing itself as one of the most powerful low-energy consumption open-source models currently available.

Source: Alizila

The commercialization of these technological breakthroughs has progressed rapidly. Qwen3-Coder has been fully integrated into Alibaba Cloud's Tongyi Lingma and is offered free of charge without usage limits, while the Qwen series open-source models have spawned over 90,000 derivative models globally, fostering a vibrant developer ecosystem. This strategy of "open-source technology + commercial implementation" consolidates technological leadership while rapidly realizing commercial value transformation, providing Alibaba Cloud with a distinct competitive advantage.

Concurrently, Alibaba's progress in self-developed chips provides hardware support for AI technology implementation. According to reports, Alibaba began using its self-designed Zhenwu processing units to train small AI models in early 2025. While high-end models still rely on NVIDIA chips, the self-developed chips have demonstrated effectiveness in reducing training costs and ensuring supply chain security. T-Head Semiconductor's Zhenyue 510 SSD controller chip has been deployed at scale in Alibaba Cloud's EBS, reducing latency by 92% in read-write mixed scenarios compared to other industry products, indirectly supporting efficient training and inference for large AI models.

Source: T-Head

Additionally, the upcoming delivery of the Xuantie C930 server-grade CPU, based on the RISC-V architecture, will further complete Alibaba's chip ecosystem layout.

In a research report, China International Capital Corporation (CICC) noted that chip supply and model iteration are fundamental to cloud computing acceleration and serve as key catalysts for valuation reassessment in the internet sector under the AI narrative. Alibaba's significant breakthroughs in AI models and chips are reshaping market perceptions of its technological competitiveness.

Strategic Offensive in Local Lifestyle and Cloud Services

On September 10, 2025, Gaode Maps, a subsidiary of Alibaba Group, announced the launch of the Gaode Street-Sweeping List—the world’s first ranking based on user behavior. The list aims to establish a new offline service credit system, leveraging users' "behavior + credit" dual dimensions to ensure authenticity and credibility. Currently, the Gaode Street-Sweeping List covers 1.6 million offline service merchants across over 300 cities in China, including 870,000 restaurants, 230,000 hotels, and nearly 50,000 scenic spots.

Source: Alizila

Gaode Maps’ traffic foundation provides support for this strategy. Data shows that Gaode Maps handles 120 million daily searches related to lifestyle services, guiding users to 13 million lifestyle service destinations. Its 186 million daily active users (DAUs) are more than six times that of Dazhong Dianping (Meituan’s local review platform) in the same period. To further strengthen competitiveness, Gaode simultaneously launched the Sparkling Local Stores Support Initiative, providing over RMB 1 billion in subsidies to drive an additional 10 million customer visits to offline catering and service businesses. This "traffic + subsidy" combined strategy triggered an immediate market reaction: the following day, Meituan's Hong Kong-listed shares dropped by over 5%, with market capitalization evaporating by more than HKD 30 billion.

In the "home delivery" business segment, Alibaba integrated Taobao and Ele.me to launch Taobao Flash Purchase. Since its launch in April 2025, Taobao Flash Purchase has demonstrated strong growth momentum. Latest operational data shows its peak daily order volume exceeds 120 million, with average daily orders stabilizing at around 80 million in August. In terms of user scale, its monthly active users (MAUs) have increased by 300% compared to April, reaching 300 million.

Source: Alibaba Group

More importantly, user quality and retention performance stand out: the retention rate of new Flash Purchase users reaches 72%, and their repurchase rate surpasses that of existing users after three months. The number of 88VIP members (Alibaba’s premium membership program) has exceeded 53 million, and the average daily opening frequency of these high-value users has increased by 37%. According to UBS data, Alibaba’s share of the takeaway market has surged from 11% (before its competitive push) to 28%, breaking the previous duopoly dominated by Meituan and Ele.me.

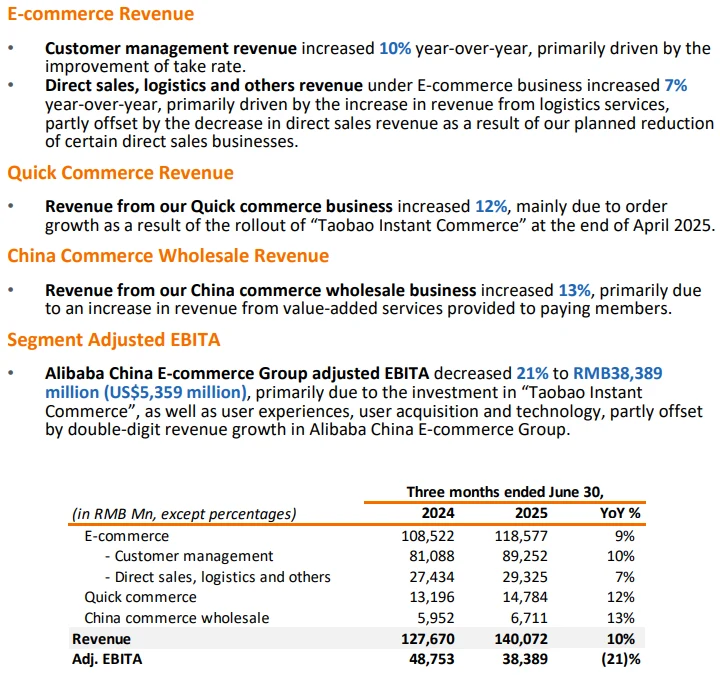

Jiang Fan, CEO of Alibaba's E-commerce Business Group, revealed in the quarterly earnings call that the instant retail business has exceeded its first-phase targets. He noted that user acquisition efficiency and fulfillment capability development have outperformed expectations, laying a solid foundation for future growth.

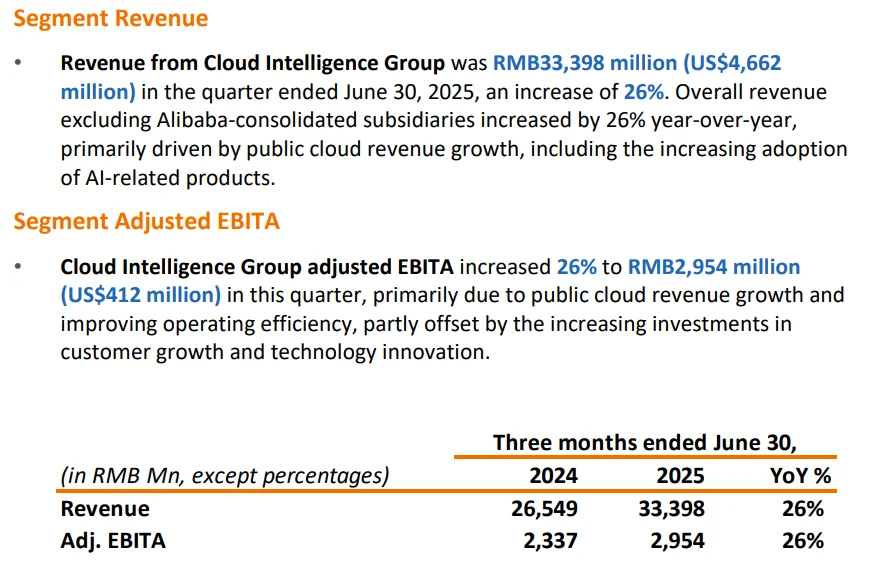

In the cloud services sector, Alibaba Cloud maintains strong growth momentum. In the first quarter of fiscal year 2026, Alibaba Cloud recorded revenue of RMB 33.398 billion, representing a 26% year-on-year (YoY) growth—its highest growth rate in three years. Among this, revenue from AI-related products has achieved triple-digit YoY growth for the eighth consecutive quarter, accounting for over 20% of its external commercial revenue.

Source: Alibaba Group

According to Omdia (Informa Group)’s report *China AI Cloud Market, 1H25*, the scale of China’s AI cloud market reached RMB 22.3 billion in the first half of 2025. Among participants, Alibaba Cloud ranked first with a 35.8% market share, ahead of Volcano Engine (14.8%) and Huawei Cloud (13.1%). Alibaba Cloud has built a complete system of end-to-end AI capabilities, covering chips, models, and industry solutions. Forrester’s *Wave™ Evaluation of Global Public Cloud Platforms* shows that Alibaba Cloud ranks among the leaders alongside Amazon AWS, Microsoft Azure, and Google GCP. It ranks second globally in terms of product and strategy capabilities, earning the highest score in 17 out of 30 evaluation criteria—affirming its technical strength at the international level.

The synergy between local lifestyle services and cloud services is becoming increasingly evident. The AI risk control technology for the Gaode Street-Sweeping List and the intelligent dispatch system for Taobao Flash Purchase both rely on Alibaba Cloud’s technical infrastructure. Meanwhile, the massive data generated by local lifestyle services feeds back into AI model training, forming a positive feedback loop of "business data → model iteration → service optimization." This ecosystem resonance not only enhances the competitiveness of individual businesses but also expands the overall valuation premium upside.

Valuation Assessment During Strategic Investment Phase

Despite being in a period of strategic investment, Alibaba’s financial performance still exhibits robust growth potential and risk resilience.

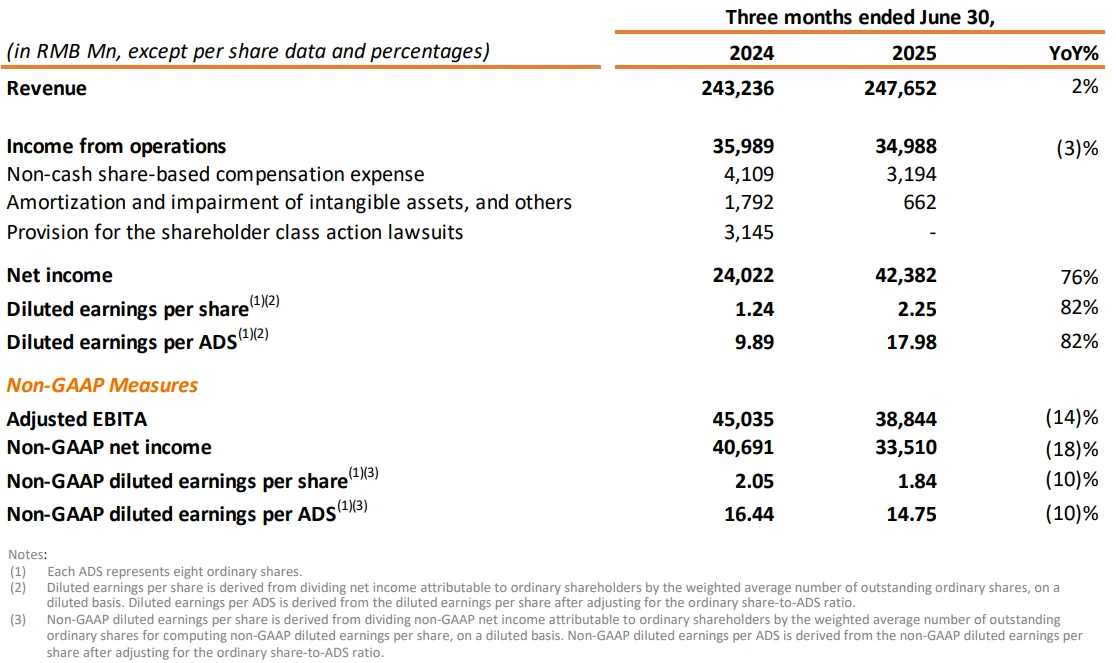

Financial data shows that Alibaba’s latest quarterly revenue reached RMB 247.652 billion, representing a 2% year-on-year (YoY) increase. Excluding revenue from the divested RT-Mart and Intime Retail businesses, the same-caliber revenue growth rate stands at 10%. In terms of profitability, net profit attributable to ordinary shareholders amounted to RMB 43.116 billion, up 76% YoY. However, non-GAAP net profit—an indicator that better reflects the profitability of core operations—decreased by 18% YoY to RMB 33.51 billion.

Alibaba International Digital Commerce Group (AIDC) continued its growth momentum, recording a 19% YoY revenue increase to RMB 34.741 billion, primarily driven by the strong performance of its cross-border business.

Source: Alibaba Group

Of greater note is the significant improvement in its profitability: adjusted EBITA loss narrowed sharply by 98% to only RMB 59 million, compared to a loss of RMB 3.7 billion in the same period last year. This indicates that the international business has gradually moved onto a healthy development trajectory while expanding its scale.

In an announcement, Alibaba stated that it will allocate 20% of the net proceeds from the note issuance to expand international business operations, with a focus on making operational investments to enhance its market position and efficiency.

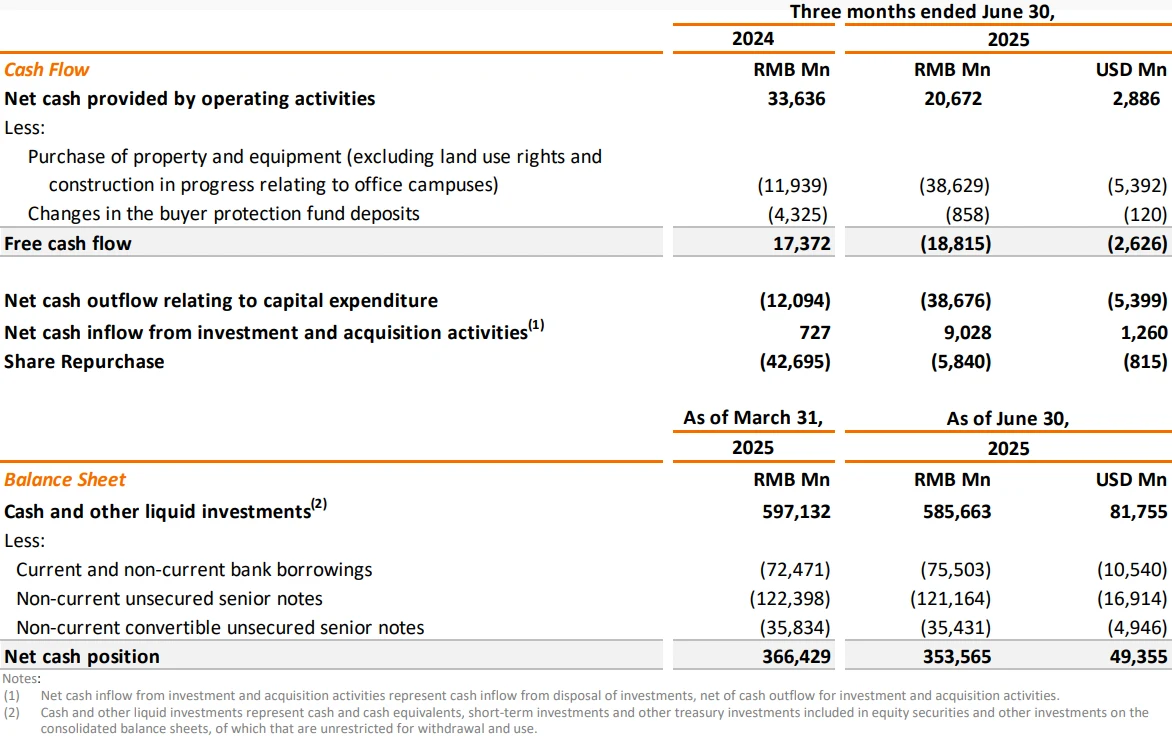

In addition, cash flow conditions have changed noticeably due to strategic investments. Net cash flow from operating activities decreased by 39% YoY to RMB 20.672 billion. Free cash flow shifted from a net inflow of RMB 17.372 billion in the same period last year to a net outflow of RMB 18.815 billion. As of June 30, 2025, the company’s cash and other current investments totaled RMB 585.663 billion (USD 81.755 billion), providing a foundation for sustained strategic investments.

Source: Alibaba Group

Broad-Based Institutional Optimism

Institutional analysts are generally optimistic about Alibaba’s future prospects and have revised up its target prices. Huaan Securities, in its latest research report, assigned a Buy rating to Alibaba-W (Hong Kong-listed).

Guosen Securities released a research report stating that it maintains an Outperform rating on Alibaba-W. The firm forecasts Alibaba’s revenue for fiscal years 2026-2028 to be RMB 1.0643 trillion / 1.1817 trillion / 1.2866 trillion, compared to previous estimates of RMB 1.0639 trillion / 1.1844 trillion / 1.2972 trillion—remaining largely unchanged.

Haitong International, in its latest research report, spoke positively of Alibaba’s strategic transformation. The report points out that Ele.me and Taobao Flash Purchase continue to expand their share in the instant retail market, while the accelerated growth of Alibaba Cloud’s revenue confirms the demand resilience of China’s cloud computing market. Based on these observations, the institution has revised up Alibaba’s U.S. stock target price to USD 167 and maintained an Outperform rating.

Capital markets have responded positively to Alibaba’s strategic transformation. As of press time, Alibaba’s market capitalization on the Hong Kong Stock Exchange has reached HKD 2.89 trillion, ranking 1st in the general retail sector.

Source: TradingView

From a valuation perspective, Alibaba’s current P/E ratio (TTM) is approximately 17.77x, and its P/B ratio is 2.6x—both in historically low ranges. Segmented valuation analysis shows that: its core e-commerce business is valued at 10-15x P/E; its cloud computing business is valued at 4.5x P/S; and the combined value of assets such as Ant Group, Cainiao, and Gaode Maps is approximately RMB 1.6 trillion. Given its current total market capitalization of HKD 2.89 trillion, this indicates that Alibaba’s core businesses are significantly undervalued.

The market generally believes that with AI-driven cloud business growth rebounding to over 20% and the emergence of economies of scale in the instant retail business, Alibaba’s valuation framework is shifting from "e-commerce discount" to "technology premium." This process will support mid-to-long-term stock price upside.

Conclusion

Currently, Alibaba is reshaping its growth trajectory through technological innovation and strategic adjustments. With the continuous development of AI and cloud computing, as well as breakthrough progress in its local lifestyle services business, the company is expected to achieve revaluation of its value and long-term business growth.

However, investors also need to closely monitor the company’s profit performance and changes in free cash flow during its period of large-scale investment, so as to conduct a comprehensive assessment of Alibaba’s investment value.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates