Final Inflation Data Before Fed Rate Decision Is In

22:57 September 11, 2025 EDT

Key Points:

U.S. August CPI rose 2.9% year-on-year, hitting a seven-month high, while weekly initial jobless claims surged to 263,000, a nearly four-year peak.

The current economic landscape—marked by persistent inflationary pressures and a noticeably cooling labor market—places the Federal Reserve in a typical policy dilemma: inflation remains above the central bank’s 2% target and continues to rise, while labor market momentum is clearly weakening.

Despite this, market consensus holds that these factors are unlikely to prevent the Federal Reserve from cutting interest rates next week. The latest data provide sufficient justification for a rate cut in September.

As the last major economic indicators released before the Federal Reserve’s September 17 monetary policy meeting, data from the U.S. Labor Department showed that U.S. August consumer price index (CPI) increased 2.9% year-on-year, reaching a seven-month high, while weekly initial jobless claims jumped to 263,000, a nearly four-year peak.

The inflation and employment data reveal the current economic situation: sustained price growth coupled with significant cooling in the labor market. Market signals indicate that concerns over pronounced labor market weakness have now outweighed worries about persistent inflation, fully justifying the start of a Fed rate-cutting cycle.

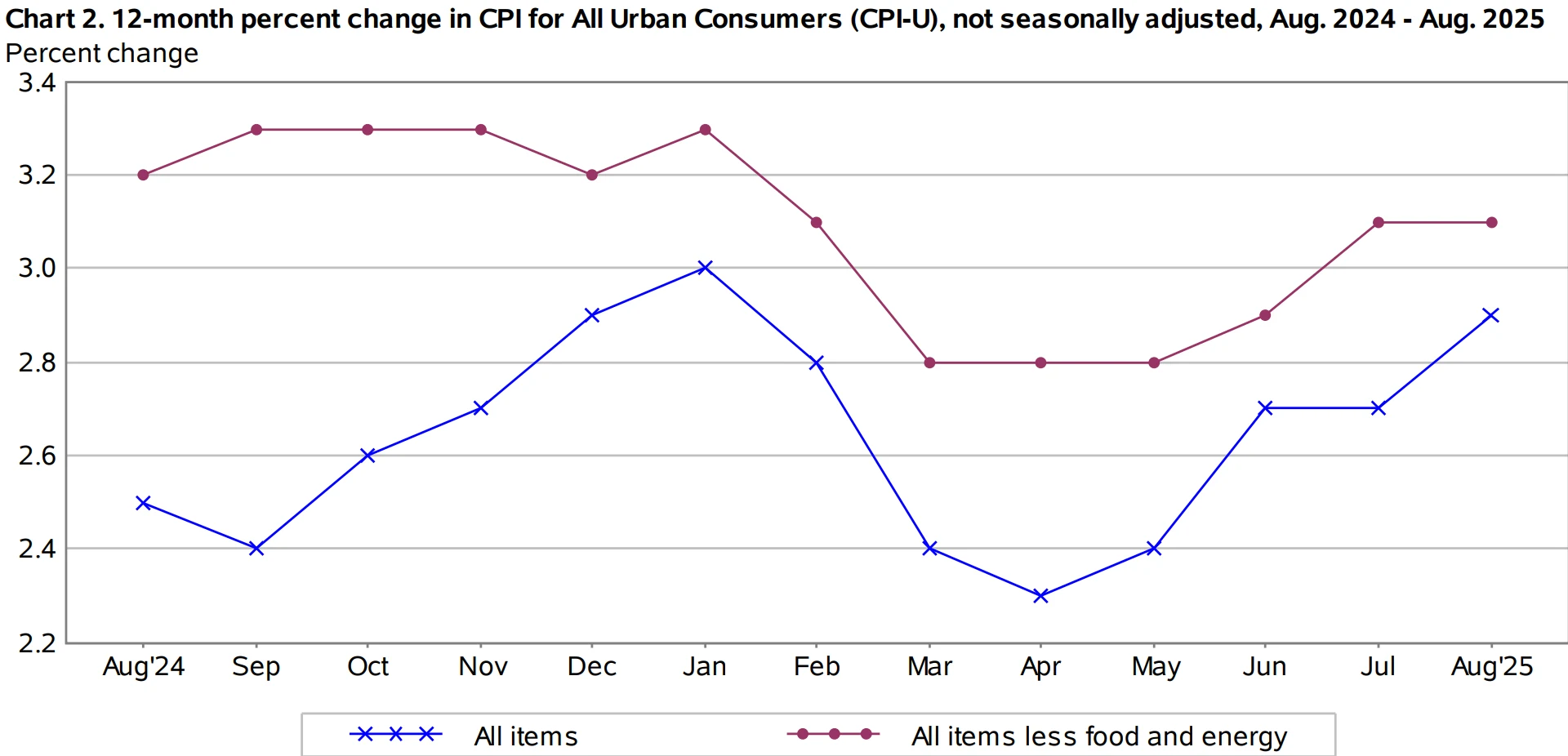

Inflation Heats Up as Labor Market Cools

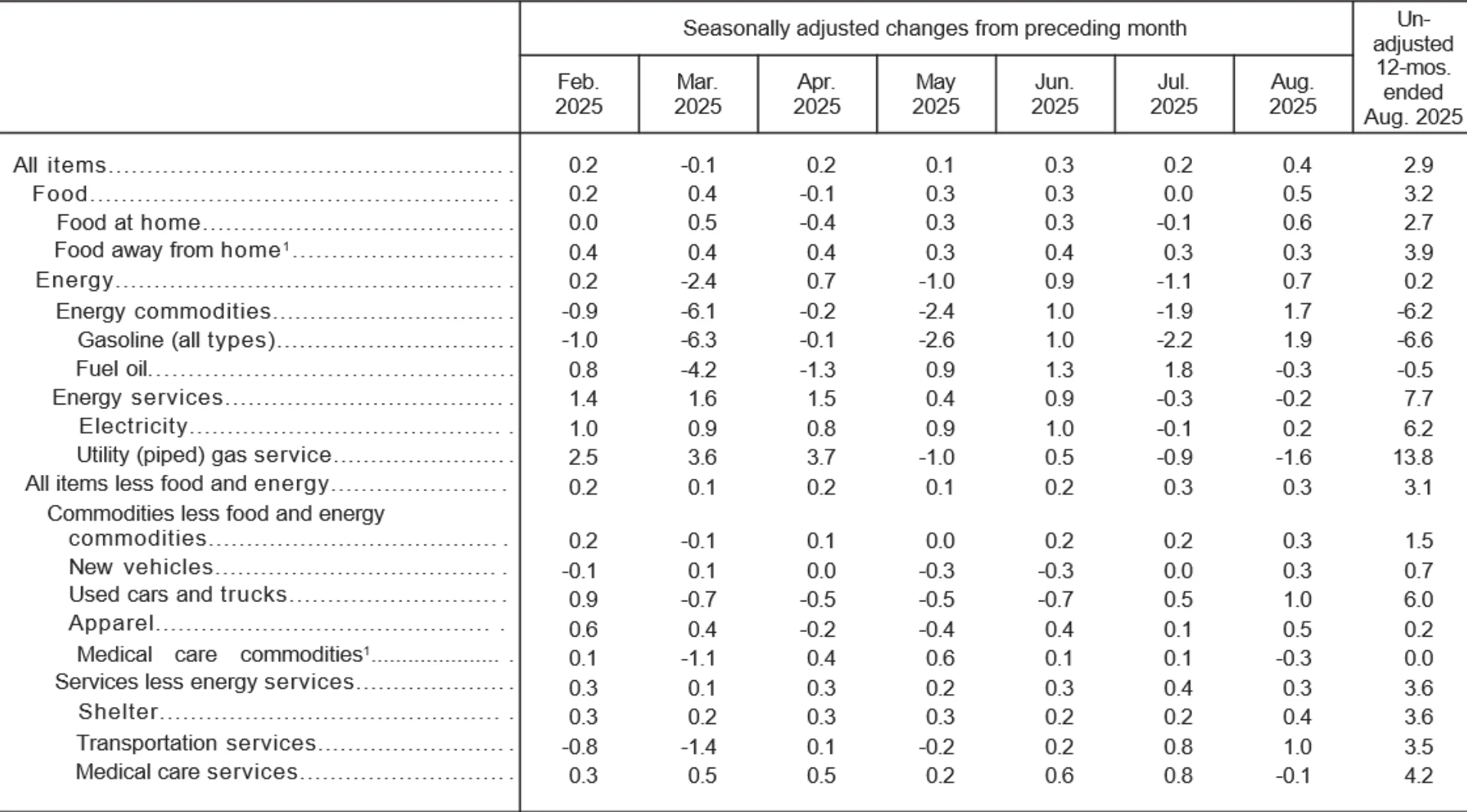

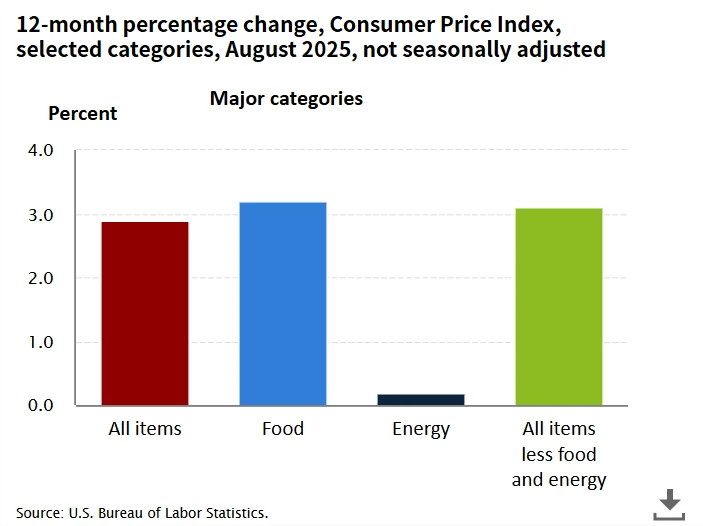

U.S. August inflation data showed a moderate rebound. According to the U.S. Labor Department, the CPI rose 2.9% year-on-year, up from 2.7% in July, marking the largest increase since January 2025. On a monthly basis, it increased by 0.4%, significantly higher than the 0.2% rise in July. Core CPI, which excludes food and energy prices, rose 3.1% year-on-year, unchanged from July, both in line with market expectations.

Source: U.S. Bureau of Labor Statistics

From a structural perspective, rising housing costs (up 0.4%, accounting for about one-third of the CPI weight), food prices (up 0.5%), and energy prices (up 0.7%) were the primary drivers of the inflationary rebound. Among these, gasoline prices increased by 1.9%, nearly reversing the previous month's 2.2% decline. Grocery prices were particularly notable, rising 0.6% from July to August—the largest monthly increase since August 2022—and 2.7% year-on-year, the highest annual gain since August 2023. This indicates that inflationary pressures are broadening into daily living expenses.

Source: U.S. Bureau of Labor Statistics

Notably, influenced by tariff policies, core goods prices have risen for three consecutive months, increasing 0.3% month-on-month in August—the largest gain since January—breaking the pre-pandemic trend of sustained declines in core goods prices.

Source: U.S. Bureau of Labor Statistics

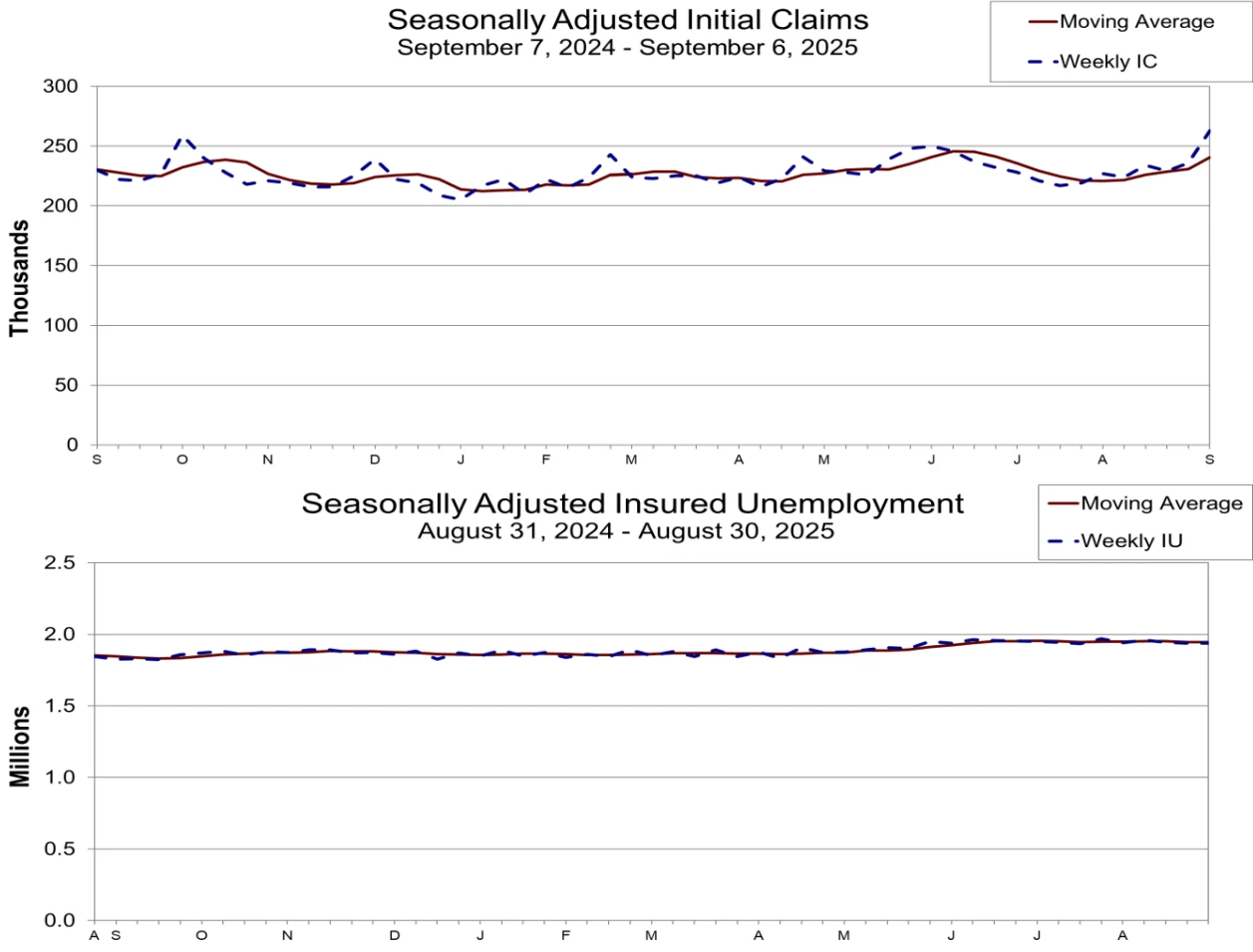

In contrast to the moderate rebound in inflation, the labor market has shown significant cooling. For the week ending September 6, U.S. initial jobless claims reached 263,000, an increase of 27,000 from the previous week, well above economists' expectations of 235,000 and the highest level since October 2021.

Source: U.S. Bureau of Labor Statistics

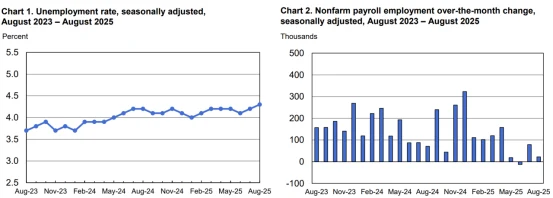

This data aligns with the August nonfarm payroll report released earlier this month, which showed the U.S. economy added just 22,000 jobs, far below the expected 75,000, while the unemployment rate rose from 4.2% to 4.3%. Additionally, June employment data was revised downward to -13,000. The softening trend in the labor market has now persisted for three consecutive months, indicating that the cooling labor demand is not a short-term fluctuation.

Source: U.S. Bureau of Labor Statistics

Combined Effects of Tariffs and Inventory Drawdowns

Analysts point out that one of the main reasons for the steady rise in inflation this year is that businesses are passing on the costs of comprehensive import tariffs implemented by the U.S. government to consumers. As enterprises had built up substantial inventories before the tariff measures took effect, but these inventories are gradually being depleted, their impact has been delayed.

Katie Stofs, Investment Manager at Mattioli Woods, stated: "As the buffer inventories accumulated before the tariff actions are nearly exhausted, businesses are now forced to replenish stocks at higher prices. Since the tariff measures appear more permanent, companies now have an excuse to pass these increased costs on to consumers."

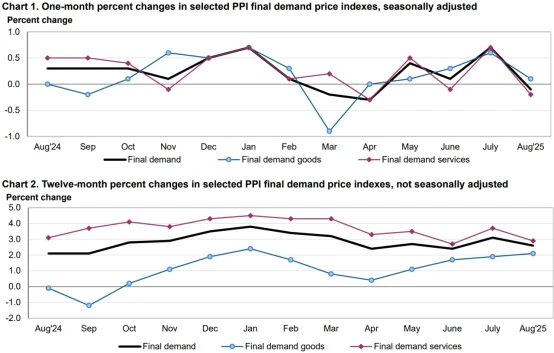

Furthermore, price pressures in the supply chain have actually eased. The U.S. Producer Price Index (PPI) for August fell to 2.6% year-on-year, down from 3.3% in July and below market expectations of 3.3%. Core PPI decreased to 2.8% year-on-year, with the month-on-month rate unexpectedly at -0.1%. These figures indicate that businesses are absorbing some of the tariff costs, mitigating inflationary pressures on consumers.

Source: U.S. Bureau of Labor Statistics

The diverging data places the Federal Reserve in a typical policy dilemma—on one hand, the inflation rate remains above the central bank's 2% target and continues to rise; on the other hand, labor market momentum is noticeably weakening. Ryan Sweet, Chief U.S. Economist at Oxford Economics, wrote: "This morning's new data shows that both aspects of the Fed's dual mandate—inflation and full employment—are moving in the wrong direction, placing the Fed in a difficult position."

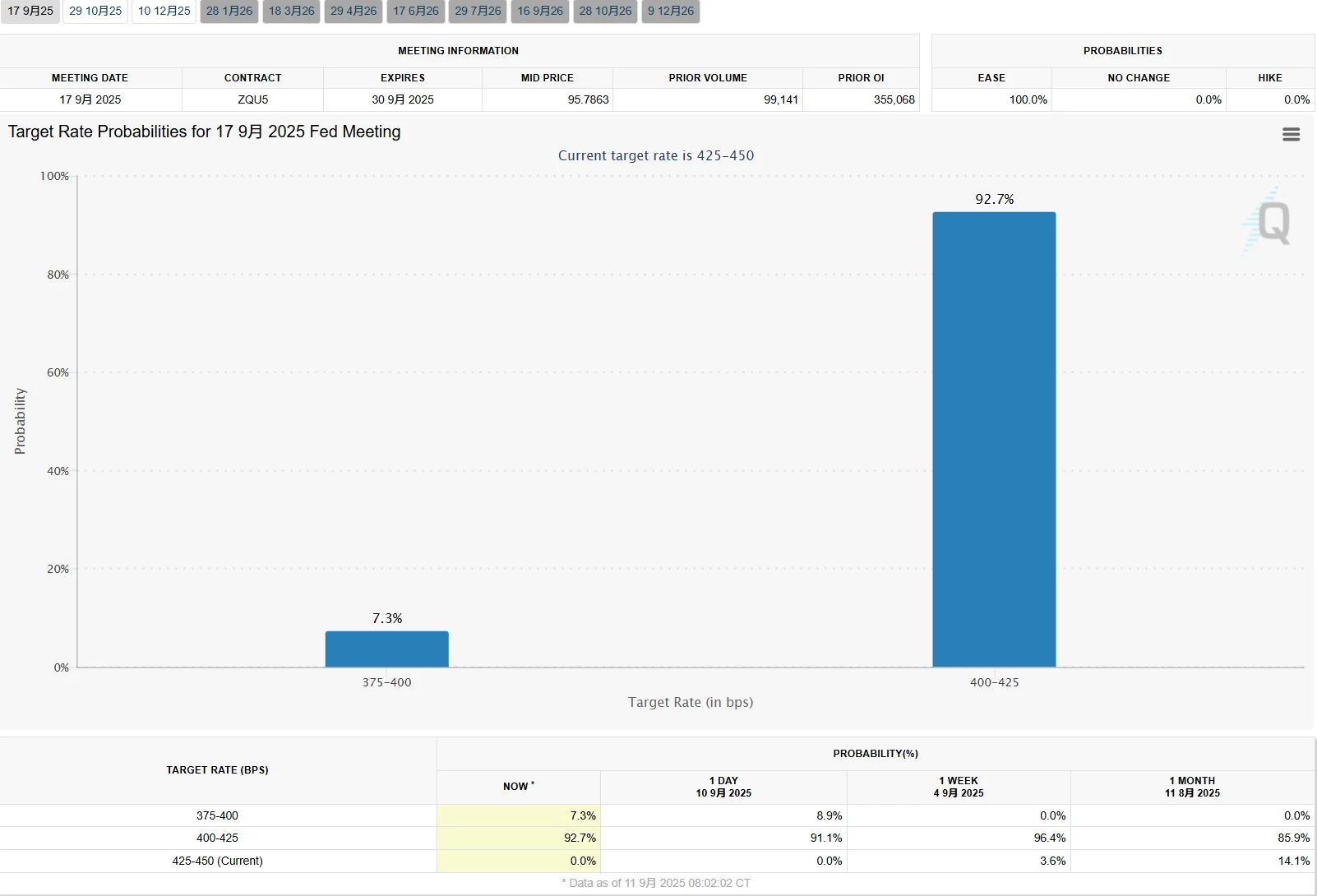

Nevertheless, market consensus holds that these factors are insufficient to prevent the Federal Reserve from cutting interest rates next week. The CME Group's FedWatch Tool shows that after the data release, financial markets priced in a 92.7% probability of a 25-basis-point rate cut in September, with a 7.3% probability of a 50-basis-point cut.

Source: CME Group

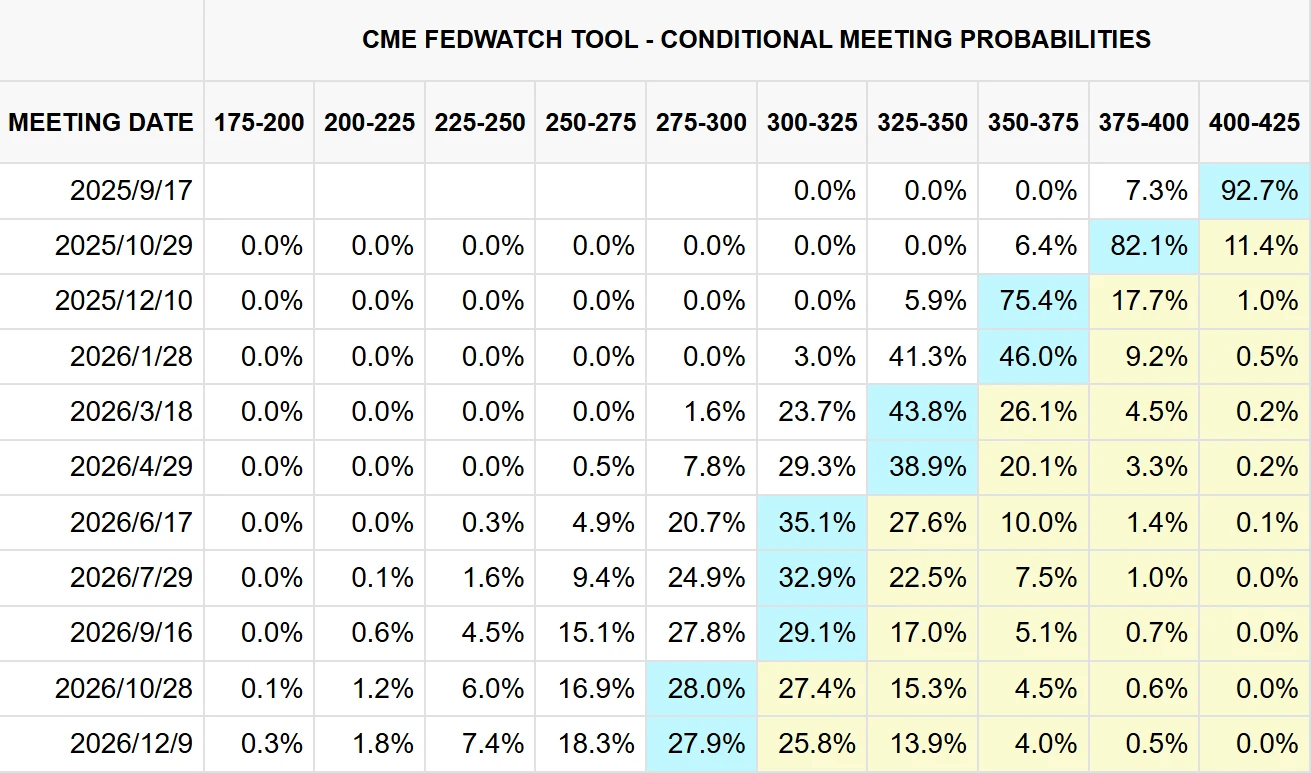

A Reuters survey of 107 analysts showed nearly unanimous expectation that the Federal Reserve will cut rates by 25 basis points on September 17. Interest rate futures pricing also reflects bets on three consecutive 25-basis-point rate cuts by the Federal Reserve, meaning that starting with next week's meeting, the Fed would cut rates by 25 basis points at each of its remaining meetings this year.

The Path Forward Beyond September Becomes More Critical

For the Federal Reserve, the September meeting may only mark the beginning of policy adjustments. Economic data performance in the coming months will determine the central bank's subsequent policy path.

The October 30 meeting could become a watershed for the pace of rate cuts. If the Fed cuts rates by 50 basis points in September, it might pause in October; if it only cuts by 25 basis points, the importance of the October meeting would significantly increase. The final meeting of the year on December 11 is also expected to influence policy expectations for 2026. Looking further ahead, Chair Powell's term ends in May 2026, and whether he remains as a governor until 2028 is uncertain; if Republicans achieve a major victory in the November 2026 midterm elections, they may push for legislation that weakens the Fed's independence, posing systemic challenges.

Source: CME Group

The Federal Reserve also faces a storm of personnel turmoil and policy shifts. Former President Trump's nomination of Stephen Milan to serve as a Federal Reserve Governor, if confirmed, would directly impact the September 18 FOMC meeting decision. Additionally, Trump's attempt to remove Governor Cook was blocked by the court, which required Cook to remain in office until the litigation concludes. These personnel changes add uncertainty to the direction of monetary policy.

Some analysts point out that the Federal Reserve is entering a period of personnel transitions, and the policy inclinations of newly appointed officials could lead to more rate cuts in the future.

Final Thoughts

Following the release of economic data through September 11, the yield on the 10-year U.S. Treasury note briefly fell below the critical 4% threshold, hitting a five-month low. This movement indicates that markets are positioning for imminent Federal Reserve rate cuts.

Source: TradingView

In his late August speech at Jackson Hole, Federal Reserve Chair Jerome Powell had already paved the way for potential rate cuts, emphasizing that policy had entered restrictive territory and that shifting risk balances could warrant a policy adjustment. The latest data now provides sufficient justification for the Federal Reserve to implement a rate cut in September.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates