Oracle Ignites Market

02:56 September 11, 2025 EDT

Key Points:

Oracle's Q1 FY2026 report showed that the company's remaining performance obligations (RPO) reached $455 billion, surging 359% year-on-year.

The data, which significantly exceeded market expectations, drove a single-day stock price surge of over 36%, increasing its market capitalization by $244.6 billion and bringing it close to $1 trillion for the first time.

If Oracle can successfully execute its business plans and convert RPO into actual revenue, there remains further upside potential for its stock price.

On September 9, 2025, Oracle Corporation released its financial results for the first quarter of fiscal year 2026. The report indicated that the company's remaining performance obligations (RPO) reached $455 billion, representing a year-on-year increase of 359%.

This data, far exceeding market expectations, triggered a historic rally in the stock price, with a single-day gain of 36.07%, adding over $244.6 billion to its market capitalization. The company's market capitalization, which stood at approximately $400 billion at the end of 2023, climbed to $933 billion after this surge, effectively doubling in size in less than two years. This growth trajectory marks a stark contrast to the prolonged period of stable stock performance Oracle experienced during the 2010s, highlighting a significant acceleration in its growth momentum.

Source: TradingView

Oracle's strong performance also boosted broader AI-related stocks, with companies such as Broadcom, Palantir, and AMD advancing in tandem. This在一定程度上 alleviated recent market concerns regarding the sustainability of AI-driven growth.

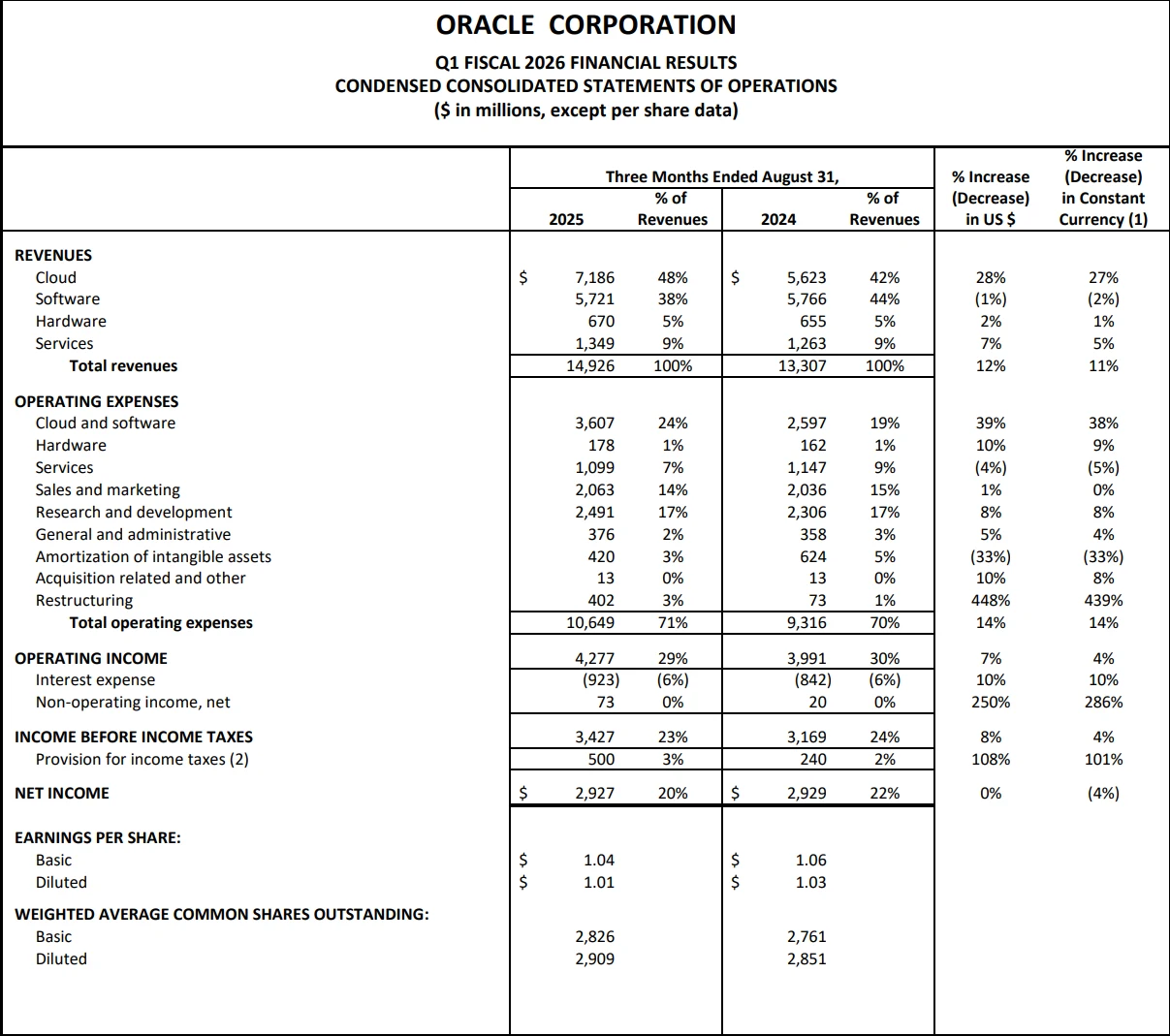

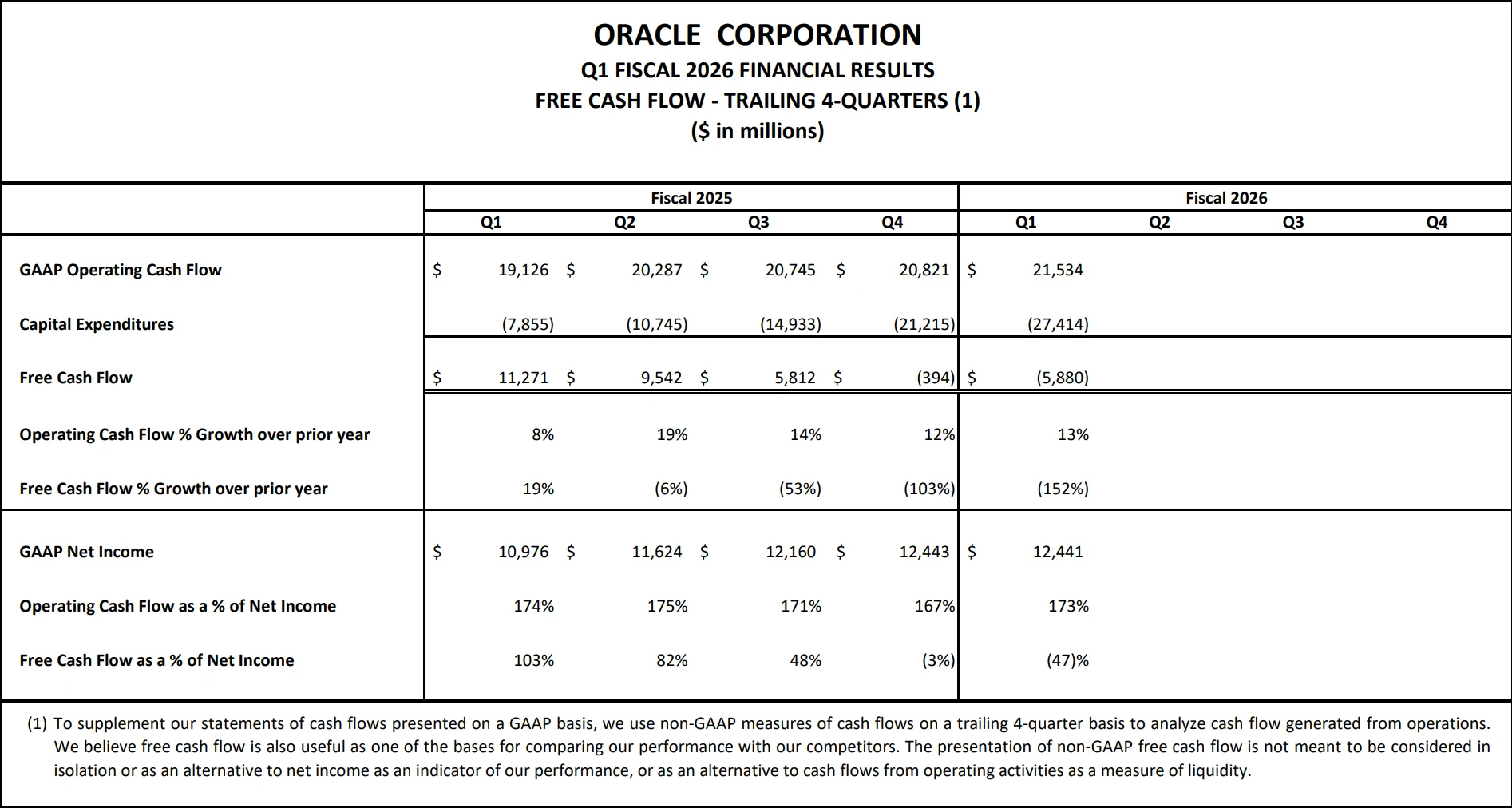

Core Financial Metrics

An analysis of Oracle's financial performance for the first quarter of fiscal year 2026 reveals that its core financial metrics demonstrated **steady growth**. According to the earnings report, the company's adjusted revenue for the quarter reached $14.93 billion, representing a 12% year-on-year increase and an 11% rise on a constant currency basis. This growth rate significantly outpaces the average for the software industry.

In terms of profitability, non-GAAP net income reached $4.3 billion, an 8% increase year-on-year, while adjusted earnings per share stood at $1.47, up 6% from the same period last year. These figures indicate maintained **profitability resilience** amid the company's expansion.

A notable shift in the company's business structure is evident. Cloud revenue grew 28% year-on-year to $7.186 billion, accounting for 48% of total revenue. Within this segment, cloud infrastructure (IaaS) revenue reached $3.3 billion, a 55% year-on-year increase, establishing it as the **primary growth driver**. In contrast, traditional software revenue declined 1% to $5.721 billion, its share of total revenue falling to 38%, while hardware revenue accounted for just 4.5%.

Source: Oracle

The most attention-grabbing metric in the earnings report was the explosive growth in remaining performance obligations (RPO). This figure surged from $99.1 billion at the end of Q1 FY2025 to $455 billion, a year-on-year increase of 359%. Compared to the $138 billion at the end of the previous quarter, this represents a jump of $317 billion, setting a historical record for contract reserve growth in a single quarter within the software industry.

A deeper analysis of the RPO composition shows that approximately 94.6% of the新增的$317 billion came from a five-year contract with OpenAI, valued at $300 billion and set to take effect in 2027, contributing an average of $60 billion in annual revenue. The remaining 5.4% derived from four separate multi-billion-dollar contracts with three technology companies, including xAI and Meta.

From a cash flow perspective, the report indicates the company is in a phase of "aggressive spending," with free cash flow turning negative rapidly. This is directly linked to its annual capital expenditure plan of $35 billion. CEO Safra Catz emphasized that these expenditures are "overwhelmingly directed toward revenue-generating equipment, rather than land or buildings," primarily encompassing core hardware such as GPU servers procured for AI data centers. While this strategic investment impacts cash flow in the short term, it lays the production capacity foundation for future revenue growth.

Source: Oracle

Building on these substantial contracts, Oracle has provided aggressive growth projections for its cloud infrastructure business. The company anticipates cloud infrastructure revenue will increase 77% in FY2026 to $18 billion. Over the next four years, it expects cloud infrastructure revenue to reach $32 billion, $73 billion, $114 billion, and $144 billion, respectively. These forecasts are substantially higher than Wall Street's previous estimates.

Historic Stock Price Surge

Oracle's stock experienced a historic rally following its earnings release. During Wednesday's trading session, the share price surged 36.07% to $328.62 per share, marking its strongest single-day performance since 1992.

This increase added $244.6 billion to Oracle's market capitalization, bringing its total market value to $933 billion. This single-day gain ranks among the largest in U.S. stock market history, surpassed only by previous records set by Nvidia and Apple.

With this substantial market cap growth, Oracle became the tenth most valuable publicly traded company in the U.S., surpassing giants such as JPMorgan Chase. This represents Oracle's first return to the top ten since May 2011, during the golden age of enterprise software. Over the following decade, as mobile internet adoption accelerated, top market cap positions were gradually occupied by consumer internet and hardware companies, while Oracle's relative market influence declined.

Year-to-date in 2025, Oracle's stock has gained 45%, compared to an 11% rise in the S&P 500 index over the same period. The company has surpassed six other companies in the U.S. market capitalization rankings, with its market value more than doubling and approaching $1 trillion for the first time.

Source: TradingView

Concurrently, multiple Wall Street investment institutions raised their price targets for Oracle following the earnings release.

Analysts at Jefferies, led by Brent Thill, noted: "RPO performance in the first quarter was exceptional, significantly exceeding market expectations. This further validates the accelerating growth trend in Oracle's business."

Notably, Oracle's stock surge drove a substantial increase in the wealth of its founder, Larry Ellison. According to the Bloomberg Billionaires Index, Ellison's net worth grew by nearly $100 billion in a single day.

At intraday levels, Ellison's wealth reached $393 billion, briefly surpassing Elon Musk to become the world's richest person. This marked Ellison's first time atop the wealth rankings in 25 years and the first brief interruption of Musk's prolonged reign as the world's wealthiest person. By the market close, Oracle's shares had pared some gains, leaving Ellison's wealth at $383 billion—$10 billion behind Musk, who regained the top position with $384 billion.

Ellison owns approximately 41% of Oracle, with the majority of his wealth tied to the software giant's stock. Since the beginning of 2025, Oracle's share price has nearly doubled, while Musk's Tesla shares have declined 14% over the same period, steadily narrowing the wealth gap between the two billionaires.

Source: TradingView

Surge in AI Computing Power Demand

Oracle's latest earnings report demonstrates the company's successful transition from a traditional software provider to an AI infrastructure giant, with the surge in AI computing demand representing the core growth driver.

Chairman and Chief Technology Officer Larry Ellison emphasized that the AI inference market will substantially exceed the AI training market.

Oracle has launched an "AI Database" that vectorizes enterprise private data and integrates mainstream AI models including OpenAI's ChatGPT and Google's Gemini, enabling advanced reasoning that combines private and public data while ensuring data security.

Ellison revealed during the earnings call: "Multi-cloud database revenue from Amazon, Google, and Microsoft achieved a growth rate of 1,529% in the first quarter." He added: "We expect multi-cloud revenue to continue growing significantly quarter after quarter in the coming years. We are currently constructing 37 additional data centers for these three cloud service giants, which will bring the total to 71."

To support this business expansion, Oracle announced its fiscal year 2026 capital expenditures will reach $35 billion, representing a 65% year-on-year increase. This investment scale reflects the company's substantial infrastructure expansion to meet AI computing demands.

According to available information, Oracle and OpenAI plan to construct large new data centers in Texas. By the end of 2026, the data center in Abilien, Texas is expected to deploy 64,000 Nvidia GB200 semiconductor chips. Oracle is collaborating with OpenAI on the design and delivery of the Abilien data center, with Oracle responsible for acquiring and operating the supercomputers built there. Additionally, Wisconsin is under consideration by OpenAI and SoftBank teams as a potential future data center location. This capacity expansion, aligned with order growth, provides the physical foundation for revenue realization.

Pressures Behind High Growth

It is important to note that despite the optimistic outlook, we cannot overlook the series of risks and challenges facing Oracle.

Morgan Stanley maintains an "equal-weight" rating on Oracle with a price target of $246, significantly below the current stock price. An analyst team led by Keith Weiss stated: "Oracle's first-quarter new orders reached $332 billion, which is not only the highest quarterly order volume ever recorded in the software industry but also signals a fundamental transformation in the company's business model—shifting toward becoming a 'data center operator.'"

Although D.A. Davidson raised its price target for Oracle from $220 to $300, it maintained a "neutral" rating on the stock. The firm expressed concerns about Oracle's long-term profit margins, particularly noting that "Oracle's virtual machine or GPU leasing business at best achieves single-digit operating margins, and in some cases may even provide computing services at a loss."

Additionally, Oracle's massive contract with OpenAI carries execution risks. OpenAI disclosed in June that its annualized revenue was approximately $10 billion, yet it is required to pay Oracle an average of $60 billion annually over five years starting in 2027. Meanwhile, Oracle will likely need to make significant investments in AI chips to meet the computational demands associated with this substantial contract.

Intensifying competition presents another potential risk. Cloud giants such as Amazon AWS and Microsoft Azure are also increasing their investments in AI infrastructure, while Google holds an advantage in the AI training领域 with its TPU chips. As more players enter the AI computing market, Oracle may face pricing pressures that could impact its profit margins. Furthermore, hardware manufacturers like Nvidia are expanding upstream, potentially squeezing Oracle's market space.

The rationality of valuation levels also requires scrutiny. Oracle's current price-to-earnings ratio of 76 times not only far exceeds its historical average but also significantly surpasses the industry average. This valuation implies extremely high expectations for future growth, and any failure to meet these growth targets could trigger a valuation correction. Historical experience shows that technology companies relying on a single major customer for high growth often experience significant valuation fluctuations.

From an industry cycle perspective, AI infrastructure investments may be subject to cyclical fluctuations. Gartner predicts that global generative AI spending will reach nearly $644 billion in 2025, with investments in AI-optimized servers expected to exceed $180 billion. However, whether such rapid growth can be sustained remains uncertain. If the AI industry experiences an investment bubble burst in the coming years, Oracle's long-term growth targets will face challenges.

Conclusion

Oracle's stock rose an additional 1.03% in pre-market trading on Thursday, reflecting the market's continued optimism about its long-term prospects. Wall Street analysts generally agree that if Oracle can successfully execute its business plan and convert its Remaining Performance Obligations (RPO) into actual revenue, there remains room for further upside in its stock price.

As the AIWorld Conference (scheduled for October 13-16) approaches, Oracle is poised to gain its next key catalyst. This established tech giant is reinventing itself amid the AI boom, seeking to compete head-to-head with Amazon, Microsoft, and Google in the cloud computing infrastructure space. Whether it succeeds will not only shape the company's own future but also potentially test the sustainability of the AI frenzy and its real economic value.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates