Will Cooling Inflation Data Lead to a 50 Basis Point Fed Rate Cut?

23:01 September 10, 2025 EDT

Key Points:

The August PPI data indicate that inflationary pressures at the production level in the United States have eased more than expected, providing additional justification for a Federal Reserve rate cut in September.

The Federal Reserve is expected to balance addressing downside risks in the labor market with avoiding excessive easing amid ongoing economic resilience, while also monitoring potential long-term inflationary pressures stemming from tariff policies.

Given that the Fed’s inflation target remains a symmetric 2%, the threshold for a single 50-basis-point rate cut remains high. The Fed is more likely to adopt a cautious approach, starting with a 25-basis-point cut and then reassessing based on subsequent CPI and employment data.

The Producer Price Index (PPI) data released by the U.S. Bureau of Labor Statistics on September 10 showed that inflationary pressures at the production level eased more than expected in August, providing new grounds for the Federal Reserve to implement a rate cut in September.

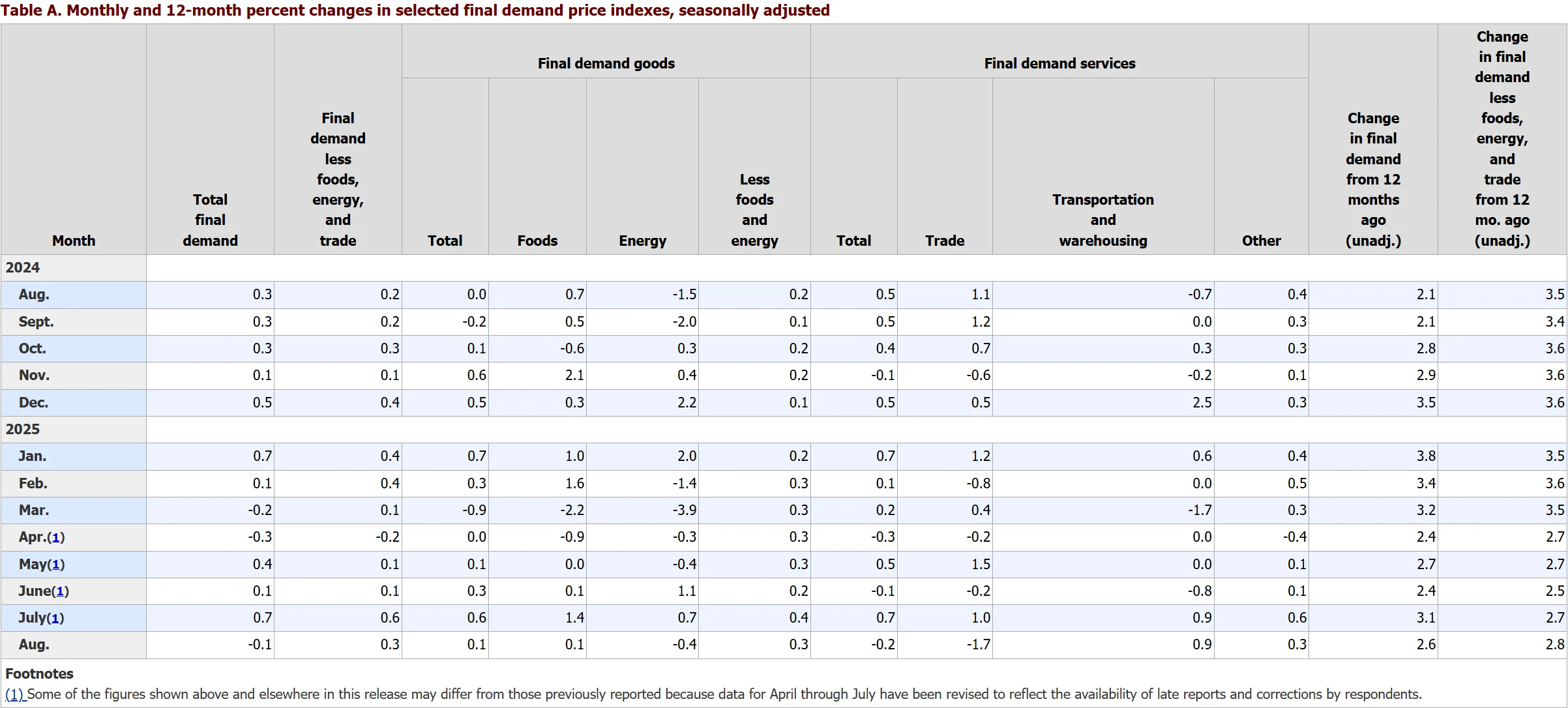

Although market consensus largely anticipates a 25-basis-point rate cut at the Fed’s September 17 policy meeting, the unexpected cooling of PPI data, combined with previously weak employment figures, has led markets to reassess the possibility of a 50-basis-point reduction.

PPI Data Shows Across-the-Board Cooling

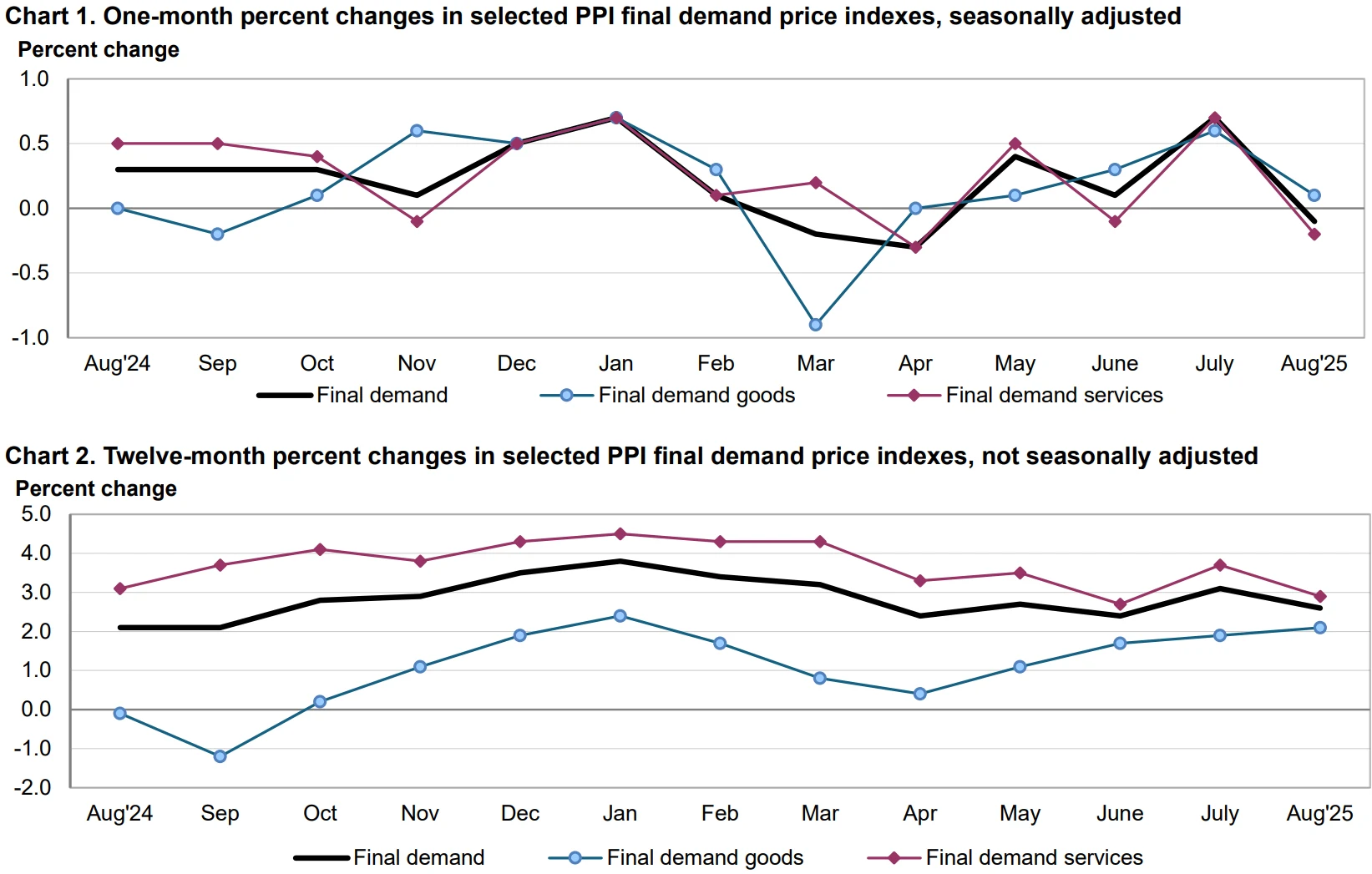

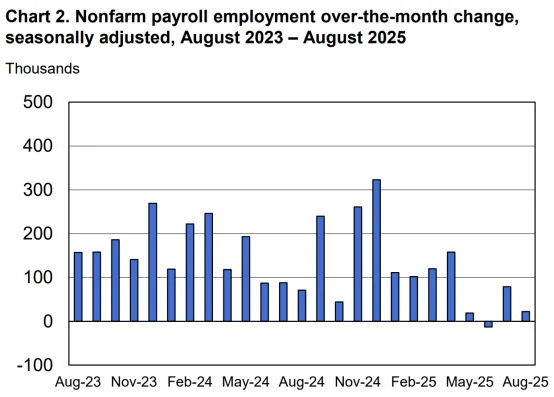

The U.S. August Producer Price Index (PPI) experienced a broad-based decline, with both headline and core measures—on both year-on-year and month-on-month bases—falling below market expectations.

The data revealed that the August PPI increased by 2.6% year-on-year, a noticeable deceleration from July’s revised 3.1% and below the market forecast of 3.3%. Month-on-month, the index fell by 0.1%, marking the first negative reading in four months and falling short of the expected 0.3% increase as well as the previous month’s revised 0.7%. Notably, the core PPI—which excludes food and energy—rose 2.8% year-on-year, lower than the anticipated 3.5% and the prior revised 3.7%. Month-on-month, core PPI declined by 0.1%, also below the projected 0.3% and the previous month’s revised 0.9%. This monthly drop was the largest recorded in the past decade.

Source: U.S. Bureau of Labor Statistics

Structurally, the cooling PPI was largely driven by adjustments in corporate pricing strategies. Despite increased import costs due to tariff policies under the Trump administration, businesses broadly chose to absorb costs rather than pass them on to consumers in August. Analysis from the U.S. Bureau of Labor Statistics indicated that companies across sectors such as leisure and hospitality, retail, and manufacturing exercised pricing restraint amid rising cost pressures, reflecting concerns that economic uncertainty could dampen consumer demand. This pricing behavior has weakened the pass-through effect of tariffs to end prices compared to the Fed’s earlier expectations, creating conditions for short-term disinflation.

For the Federal Reserve, the significance of the PPI data extends beyond wholesale price changes—certain components of the PPI are integral to calculating the core Personal Consumption Expenditures (PCE) Price Index, the central bank’s preferred inflation gauge. The August data showed mixed performance among key sub-components of core PCE: portfolio management services and airfare prices continued to rise, while healthcare service costs remained moderate. This divergence suggests the upcoming August core PCE reading may show neutral momentum, unlikely to serve as immediate justification for aggressive Fed easing.

Source: U.S. Bureau of Labor Statistics

Market reaction to the PPI release was swift and pronounced. Following the data, the yield on the 2-year U.S. Treasury note fell by 1.5 basis points to 3.552%, reflecting market expectations of a more dovish near-term rate path. Short-term U.S. interest rate futures rose, indicating that traders increased bets on monetary easing. According to the CME FedWatch Tool, the probability of a 50-basis-point rate cut in September edged up to 8%, while the likelihood of a 25-basis-point reduction remained high at 92%.

Source: CME Group

The Foundation for Rate Cuts Is in Place

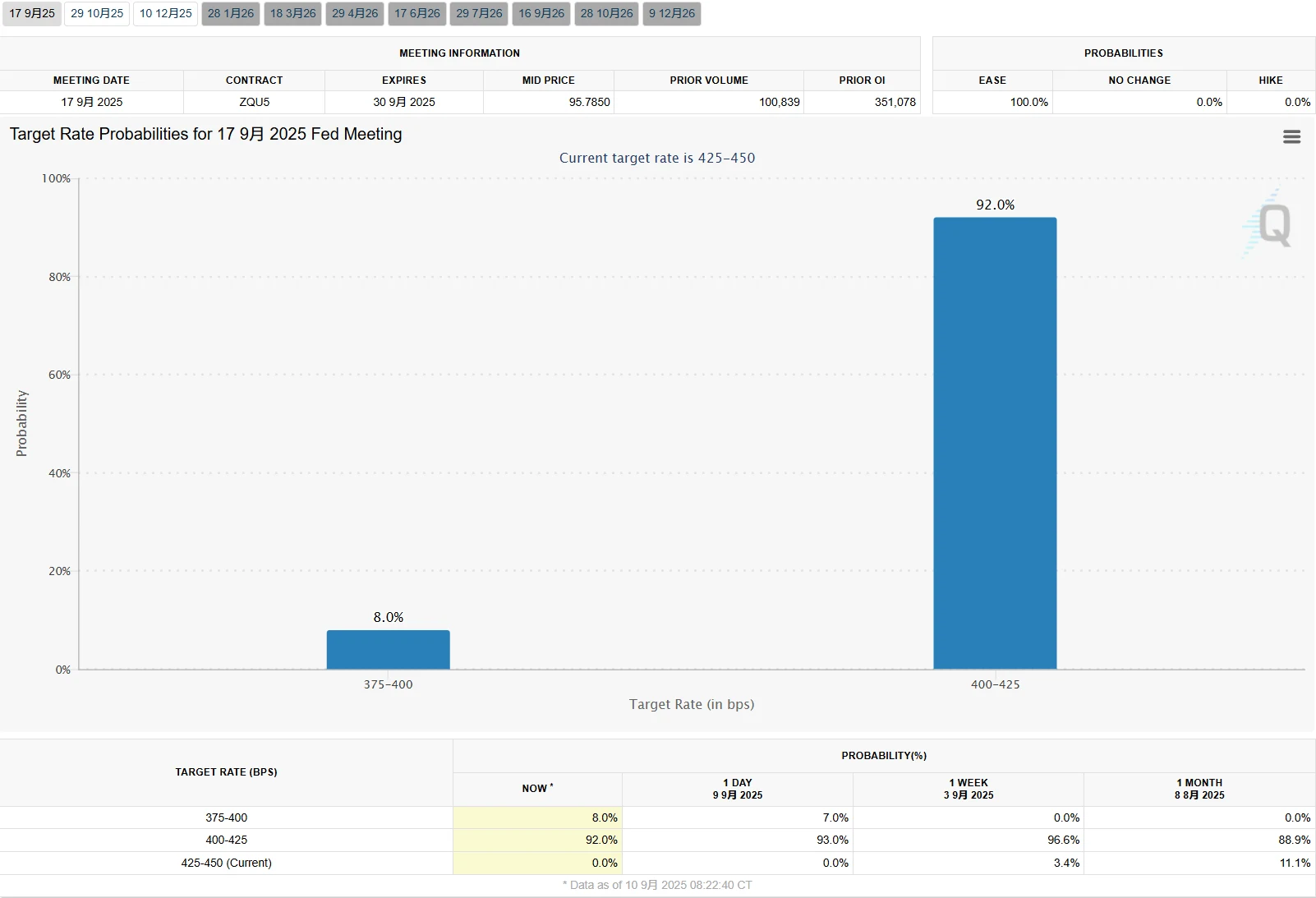

The cooling PPI data coincides with persistent weakness in the U.S. labor market, forming another critical support for Federal Reserve rate cuts.

U.S. nonfarm payrolls increased by just 22,000 in August, significantly below the expected 75,000. Additionally, June data was revised downward from an initially reported gain of 14,000 to a loss of 13,000, marking the first decline in employment since 2020.

Source: U.S. Bureau of Labor Statistics

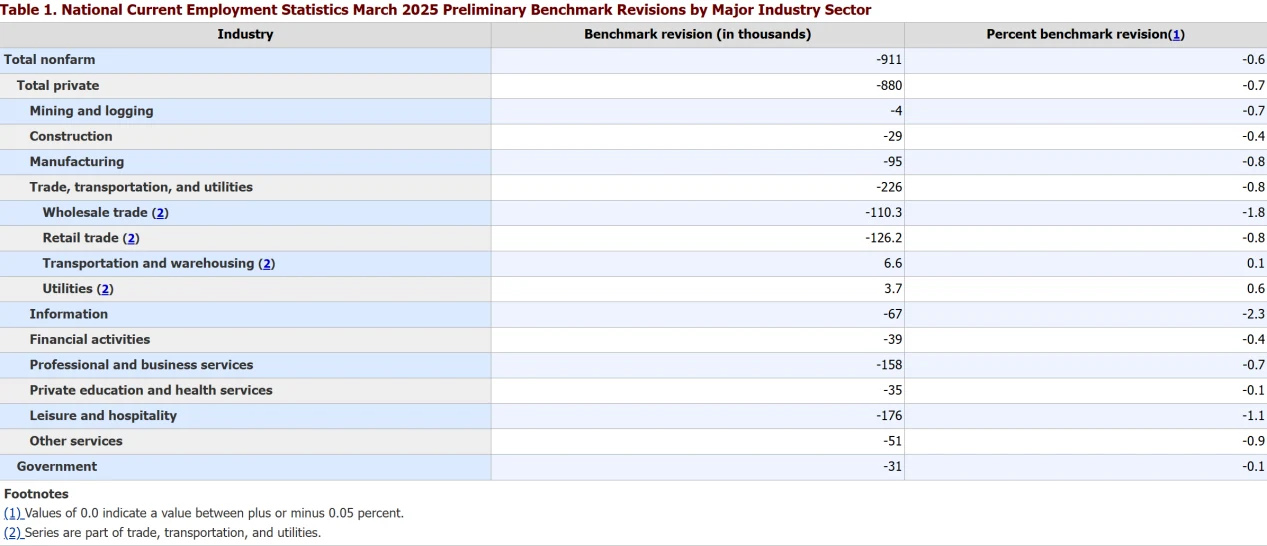

Notably, preliminary benchmark revision data released by the U.S. Bureau of Labor Statistics indicates that nonfarm employment for the period ending March 2025 was revised downward by 911,000 compared to previous reports, representing an average monthly reduction of 76,000 jobs. This is the largest downward revision since records began in 2000.

Source: U.S. Bureau of Labor Statistics

The employment data revisions reveal the true extent of weakness in the U.S. labor market. The revised data show that actual job growth over the past 16 months was approximately 1.2 million lower than initially reported, with average monthly payroll gains revised down from 149,000 to 73,000. While Goldman Sachs' proprietary model estimated a smaller downward revision of 550,000, it still acknowledges a clear trend of labor market softening. At the industry level, leisure and hospitality, professional and business services, and retail sectors were revised down by 176,000, 158,000, and 126,000 jobs respectively, indicating that employment weakness has spread across multiple key sectors.

The deterioration in the labor market has subtly shifted the Fed's policy focus. Fed Governor Waller explicitly stated in early September that he supports a 25-basis-point rate cut at the September meeting, citing significantly increased downside risks in the labor market. He noted that the current "moderately restrictive" stance of monetary policy needs adjustment to adapt to changes in the job market, while emphasizing that "no more than 25 basis points" of cuts are needed. This suggests that the Fed may need to ease pressure on the labor market through rate cuts while avoiding excessive accommodation that could reignite inflation.

Institutional analysis generally agrees that labor market weakness has surpassed inflation as the primary consideration affecting Fed policy decisions. Huaan Securities points out that in determining interest rate levels, the Fed's weighting of inflation is decreasing while employment considerations are rising, with Chairman Powell particularly concerned that labor market risks could quickly translate into expanded layoffs and rising unemployment. Bank of America predicts that persistent labor market weakness will prompt the Fed to cut rates by 25 basis points each in September and December, with the possibility of additional cuts in October if the job market weakens further, and "potentially larger" cuts in 2026.

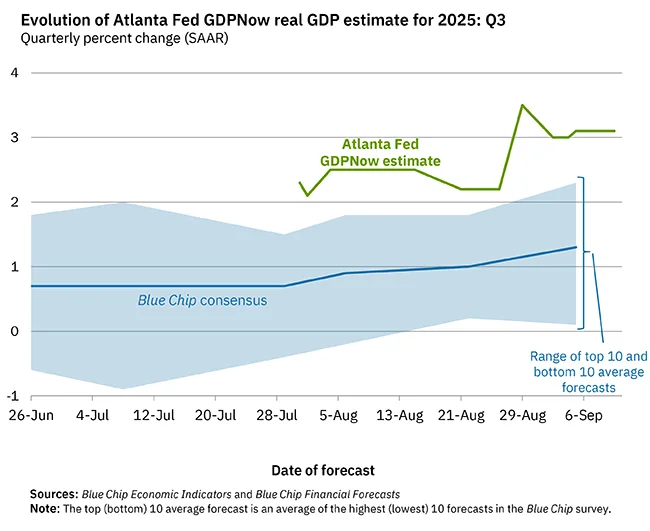

The combined impact of employment and inflation creates a complex policy environment. The Atlanta Fed's GDPNow model projects that U.S. real GDP will grow at an annualized rate of 3.1% in the third quarter, slightly down from 3.3% in the second quarter but still relatively strong.

Source: The Atlanta Fed

This combination of "high growth, weak employment, and declining inflation" presents challenges for Fed policymaking—balancing the need to address downside risks in the labor market while avoiding excessive easing amid economic resilience, all while monitoring potential long-term inflationary pressures from tariff policies.

The Key Implications of Tomorrow's CPI Data

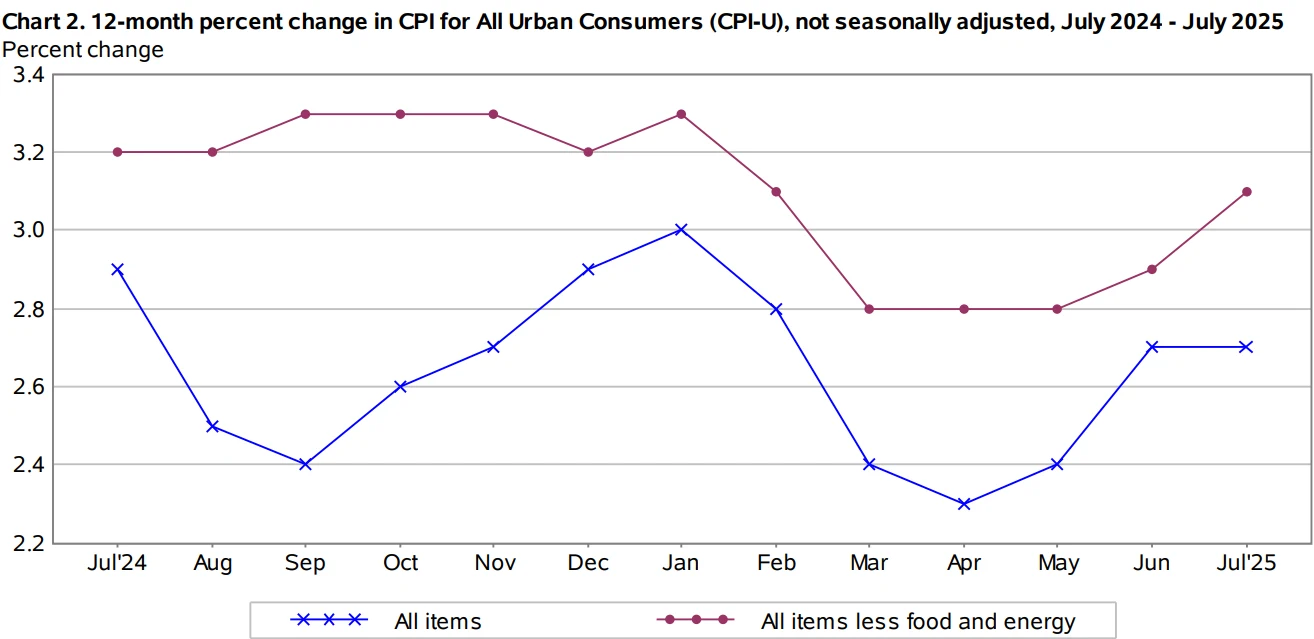

Following the release of PPI data, market attention has fully shifted to the U.S. August Consumer Price Index (CPI) report scheduled for release on Thursday. Historical data suggests that PPI trends often lead CPI by one beat, though the transmission elasticity and time lag are influenced by service price and wage stickiness.

Current market expectations for the CPI data show a neutral to moderate trend. The median forecast in a Bloomberg survey of economists indicates that August headline CPI will rise 2.9% year-on-year and 0.3% month-on-month, while core CPI is expected to increase 3.1% year-on-year and 0.3% month-on-month, unchanged from July. CPI swap rates, however, project a year-on-year increase of 2.91% and a month-on-month rise of 0.38%, slightly higher than economists' predictions. The sharper-than-expected cooling in PPI data introduces downside risks to the CPI figures. Some analysts note that the largest monthly drop in core PPI in a decade is a strong signal that CPI data may fall below expectations.

Source: U.S. Bureau of Labor Statistics

Structurally, the impact of tariff policies on CPI will be a key focus of this report. Fed officials generally expect import tariffs to push inflation higher through the remainder of 2025 but have yet to determine whether this will be a one-time adjustment or have lasting effects. Analysis by Citi Group suggests that the impact of tariffs on consumer prices will be slower and more prolonged than market expectations, with August-September being a critical window to validate this trend. If prices of tariff-affected goods categories within core CPI show significant increases, it could constrain the Fed's ability to cut rates.

Different CPI scenarios will have varying impacts on rate cut expectations. Scenario analysis constructed by Andrew Tyler, Global Market Intelligence Head at J.P. Morgan, shows: If core CPI month-on-month growth falls between 0.25%-0.3%, the S&P 500 could rise 1%-1.5%, further solidifying expectations of a 25-basis-point cut; if growth is below 0.25%, the index could surge 1.25%-1.75%, significantly increasing the probability of a 50-basis-point cut; if growth exceeds 0.4%, the index could fall 2%, though the probability of this scenario is only 5%.

The impact of CPI data on the Fed's policy path may extend beyond the September meeting. Although the market widely believes a September rate cut is certain, the CPI data will influence the pace of subsequent cuts. Barclays currently expects the Fed to implement three 25-basis-point cuts this year, followed by an additional 50 basis points of cuts in 2026; Morgan Stanley predicts quarterly cuts in 2026, totaling 100 basis points for the year. If August CPI shows stronger-than-expected inflation resilience, institutions may reduce their 2026 rate cut expectations, while weaker data could strengthen easing expectations.

Source: FRED

Notably, market expectations for CPI-driven volatility remain relatively modest. Stuart Kaiser, U.S. Equity Trading Strategy Head at Citi Group, points out that options markets are pricing in only a 0.7% move in the S&P 500 following the CPI report release, below the average 0.9% move over the past year. This expectation reflects the market's general view that CPI data is unlikely to alter the overall direction of a September rate cut but will more significantly influence the pricing of future policy paths.

Conclusion

The U.S. will release its August CPI data on September 11, which will serve as the final key inflation report ahead of the Federal Reserve’s September policy meeting. However, regardless of the CPI reading, markets widely expect the Fed to implement a rate cut at its September 17-18 meeting.

The cooling PPI has provided additional justification for Fed rate cuts, but a more aggressive 50-basis-point reduction would still require further evidence. Analysts at Standard Chartered noted, “The rapid shift in the labor market—from stability to weakness in just six weeks—creates room for the Fed to replicate last year’s catch-up rate cuts.”

Nevertheless, given that the Fed’s inflation target remains a symmetric 2%, the bar for a single 50-basis-point cut remains high. The central bank is more likely to adopt a cautious approach, beginning with a 25-basis-point cut and then reassessing based on subsequent CPI and employment data.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates