The Next Growth Stock in the AI Infrastructure Boom Isn’t Nvidia

05:52 September 10, 2025 EDT

As demand for artificial intelligence (AI) infrastructure continues to accelerate in 2025, NVIDIA (NVDA) has significantly increased its stake in cloud computing company CoreWeave (CRWV) in its latest Q2 13F filing. CoreWeave’s weighting within NVIDIA’s overall investment portfolio has risen from 78.17% to 91.36%, with approximately 24.3 million shares held, valued at roughly $4.33 billion.

CoreWeave, a cloud service provider specializing in AI high-performance computing, has seen its stock surge over 150% since its IPO in March 2025, delivering standout performance. At the same time, the company’s high capital expenditures, lack of profitability, and recent stock pullback have prompted investors to carefully reassess its long-term investment potential.

Source: TradingView

Business Model

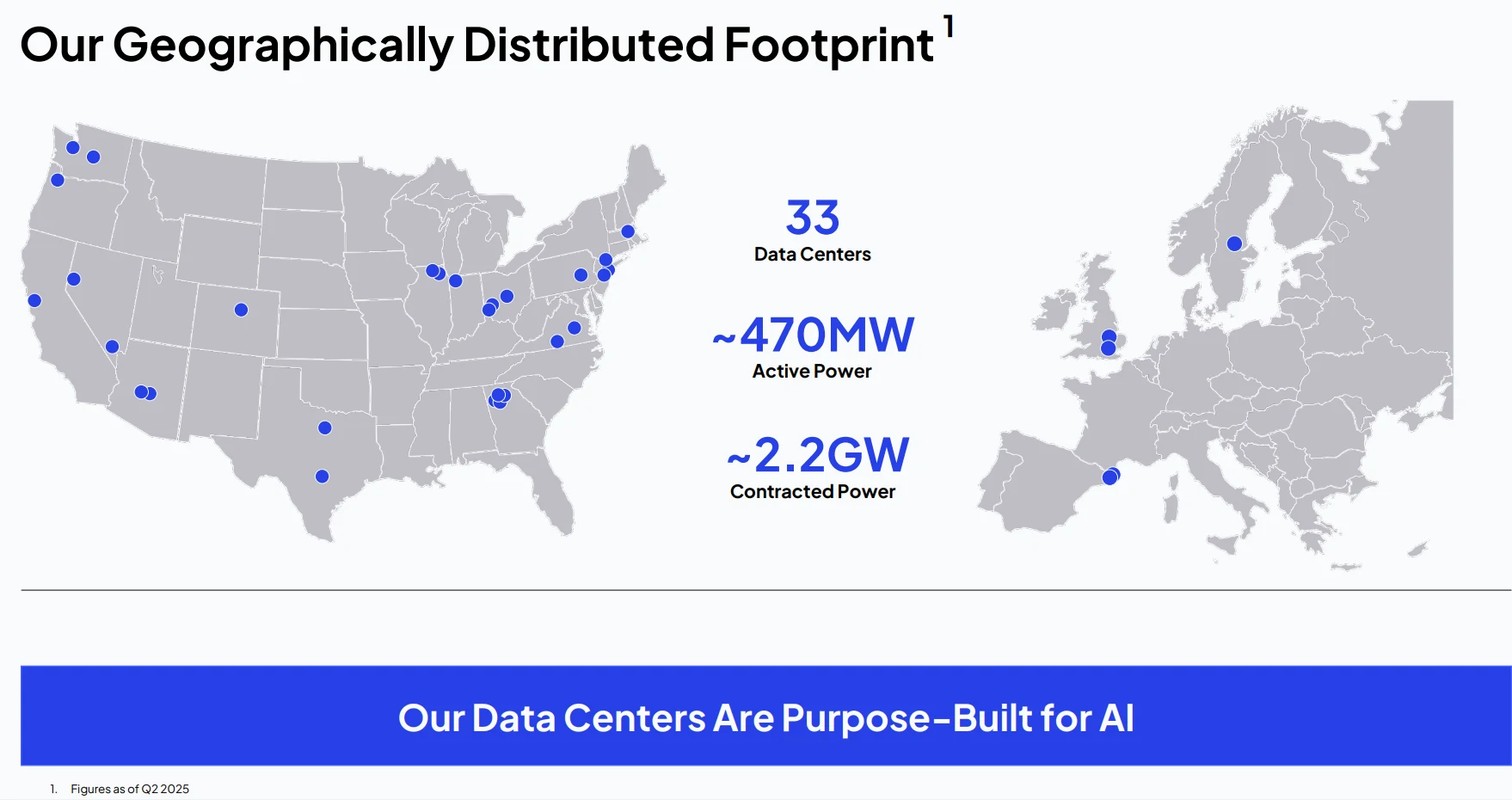

CoreWeave is positioned as a “next-generation cloud” provider, with its core focus on delivering GPU-accelerated computing resources for AI workloads, differentiating itself from traditional cloud giants’ general-purpose computing models. Its primary offerings include rental access to NVIDIA’s high-end GPUs—such as the H100, H200, and Blackwell architectures—through 28 global data centers, enabling enterprises to flexibly meet the high computational demands of machine learning, generative AI, and deep learning training.

Deep strategic alignment with NVIDIA represents CoreWeave’s key competitive advantage. In Q1 2025, CoreWeave became one of the first cloud providers to deploy the Blackwell Ultra chips, giving clients immediate access to cutting-edge hardware. Additionally, the company has optimized its software stack, including Kubernetes cluster management, to improve GPU utilization and reduce client costs. Its platform achieves 30%-50% faster model training efficiency compared with traditional cloud providers, attracting a diversified client base ranging from AI startups to large tech enterprises.

Source: CoreWeave

Particularly noteworthy is CoreWeave’s customer structure. In March 2025, the company signed a $12 billion long-term agreement with OpenAI, later adding an additional $4 billion contract. Microsoft also entered a $19 billion deal through Nebius, while other tech giants such as Google and Meta are exploring potential partnerships. Meanwhile, CoreWeave launched CoreWeave Ventures to invest in AI startups, creating a closed-loop ecosystem combining infrastructure and applications. Despite these strategic moves, revenue concentration remains high, with OpenAI and Microsoft contributing over 60%, posing a potential risk.

Financial Performance

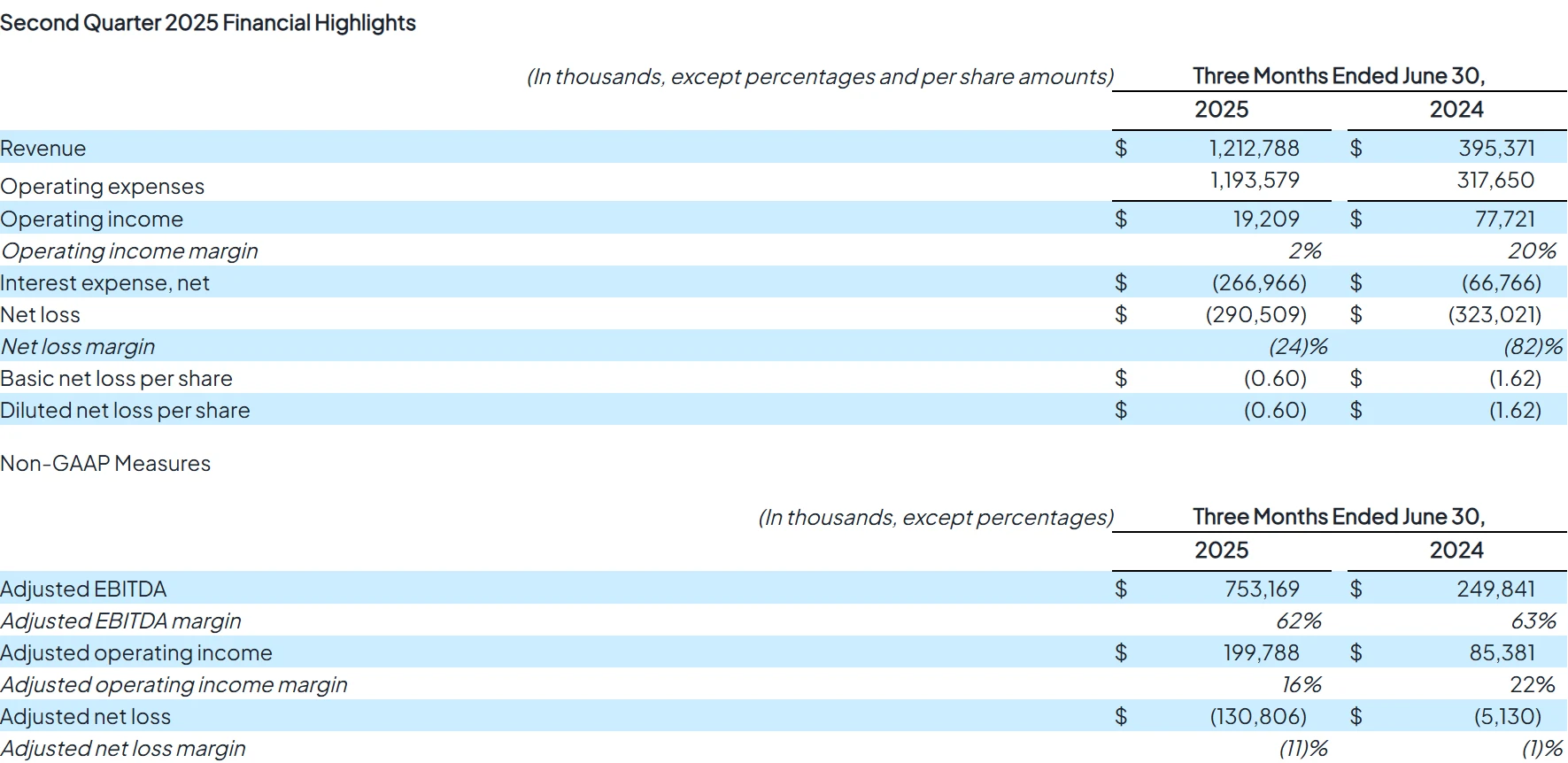

CoreWeave’s financial performance underscores the rapid expansion of the AI infrastructure market. In Q1 2025, the company reported revenue of $982 million, up 420% year-over-year, while Q2 revenue rose to $1.2 billion, a 207% increase, surpassing market expectations by $120 million. Adjusted operating income grew 550%, reflecting improvements in profitability.

Source: CoreWeave

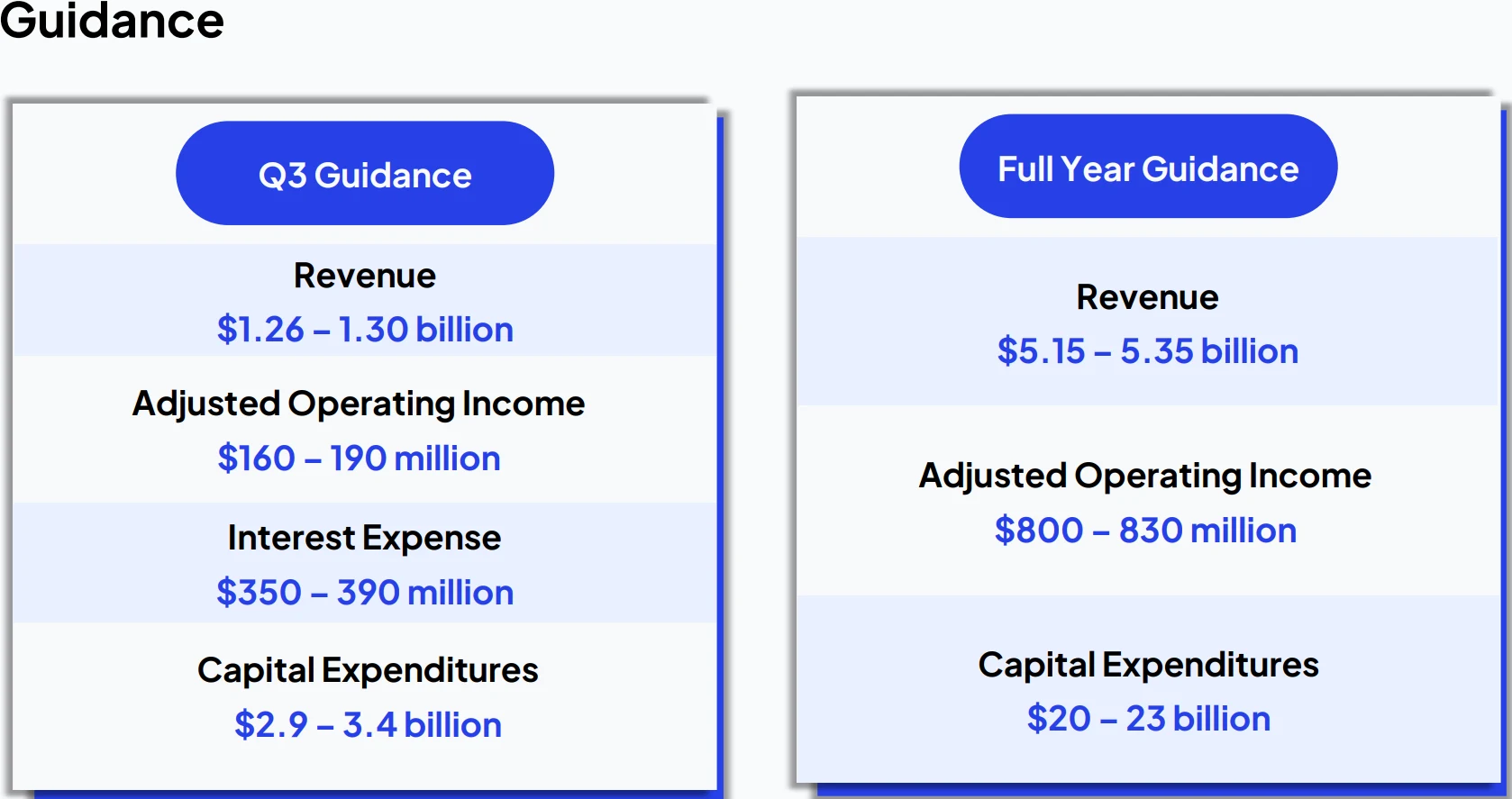

Management simultaneously raised the full-year revenue guidance to $5.15–$5.35 billion, an increase of $250 million from prior expectations, signaling continued optimism about AI demand.

Source: CoreWeave

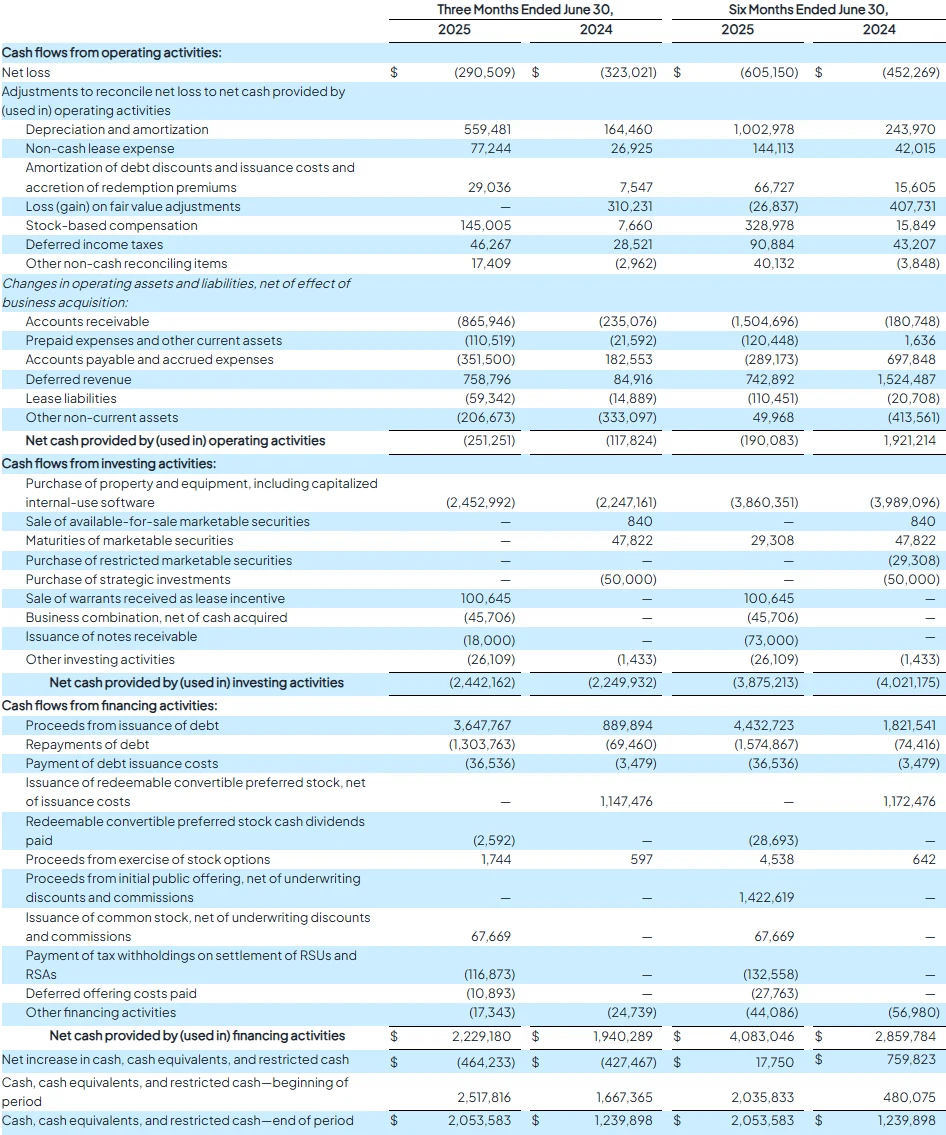

However, this rapid growth comes with significant capital expenditures. CoreWeave expects Q3 capex of at least $2.9 billion for new data center construction and the acquisition of Blackwell Ultra chips (approximately $40,000 per unit). In 2024, capital spending exceeded $8.5 billion, and the company plans to add 10 new data centers in 2025, bringing the total to 38. While this large-scale expansion effectively drives revenue growth, it continues to weigh on profitability. Additionally, CoreWeave reported a Q2 diluted EPS of -$0.60, exceeding analyst expectations of -$0.52. The company anticipates Q3 revenue of $1.26–$1.3 billion, above the $1.25 billion consensus estimate.

To strengthen its financial structure, CoreWeave is planning an all-stock acquisition of Core Scientific, which would reduce over $10 billion in leasing liabilities and reinforce ownership of its data center assets. While this deal could enhance long-term profitability, short-term integration risks remain. The company aims to achieve positive free cash flow by 2026, a milestone that will be closely watched by investors.

Source: CoreWeave

Investment Thesis

NVIDIA’s increased stake in CoreWeave goes beyond a financial investment and reflects a strategic positioning. In Q2 2025, the value of NVIDIA’s holdings rose 11% from Q1, representing over 90% of its investment portfolio—far exceeding stakes in other holdings such as Arm and Applied Digital. This underscores NVIDIA’s strong confidence in CoreWeave’s growth potential.

The historical collaboration between the two companies further supports this strategic move. Since 2023, CoreWeave has been one of NVIDIA’s largest cloud GPU customers, holding more than 250,000 GPUs, which account for 40% of NVIDIA’s chip supply to next-generation cloud clients. During CoreWeave’s IPO, NVIDIA invested $250 million at $40 per share; the stock now trades around $80, delivering over 100% ROI. This dual alignment of equity and business ensures not only a stable demand for NVIDIA hardware but also allows NVIDIA to share in the growth upside of the AI cloud services market.

However, the high ownership stake also introduces regulatory and potential conflict-of-interest risks, including scrutiny over preferential pricing or supply advantages granted to CoreWeave.

Market Performance

Since its IPO in March 2025, CoreWeave’s stock surged from the $40 issue price to a peak of $187, marking a gain of over 360%, before retracing to the $80–$100 range. While down roughly 50% from its high, the stock remains about double its IPO price, reflecting sustained long-term investor confidence.

From a technical perspective, a cup-and-handle pattern formed between April and May has already been broken, with the RSI peaking in overbought territory before settling around 55, now in neutral range. Key support levels stand at $94 (50-day moving average) and $40 (IPO price), while near-term resistance is at $105; a breakout above this could test $110. On the institutional side, ARK Invest added 120,229 shares in May, providing additional support to the stock. Overall, short-term volatility persists, but technical signals suggest mid-term upside potential.

Source: TradingView

Market Environment

The AI cloud computing market is projected to reach $180 billion in 2025, with a CAGR of 37% from 2023 to 2028. CoreWeave holds a first-mover advantage in GPU optimization and rapid iteration, yet the competitive landscape remains intense.

Dominant cloud providers—AWS, Google Cloud, and Azure—continue to expand their AI-customized services. AWS’s Trainium AI accelerator chips, which in some cases approach NVIDIA GPU performance, could erode CoreWeave’s technical edge. Emerging cloud players such as Lambda Labs and Vast.ai are also capturing market share through aggressive pricing, heightening the risk of a price war. Meanwhile, CoreWeave’s revenue remains heavily concentrated among a few major clients, making it vulnerable if any decide to build in-house infrastructure.

Although CoreWeave seeks to mitigate risk by investing in its ecosystem and expanding its small- and mid-sized enterprise customer base, competitive pressure is likely to persist in the near term.

Investment Potential Assessment

CoreWeave’s appeal lies primarily in its unique positioning, strategic backing from NVIDIA, robust revenue growth, and strong client base, which collectively provide it with a competitive edge in the AI infrastructure sector. Looking ahead, if the company achieves positive free cash flow in 2026, its market capitalization could rise to around $70 billion, bringing its valuation closer to industry norms.

However, assessing CoreWeave’s investment potential requires careful consideration of several risks. High capital expenditures mean the company will likely continue to incur losses in the near term, with the timing of a profitability inflection point still uncertain. The competitive landscape is intensifying, as CoreWeave must contend not only with the scale and resources of traditional cloud giants but also with emerging players leveraging pricing and operational flexibility to capture market share.

Additionally, CoreWeave’s valuation remains elevated, with a 2025 forward price-to-sales ratio of approximately 9.1–9.5x, significantly above the industry average, implying potential downside risk. The gradual unlocking of IPO-restricted shares may also create selling pressure and increase stock volatility. Lastly, macroeconomic uncertainties—particularly the Federal Reserve’s policy direction and interest rate movements—could directly impact the valuation base for high-growth tech stocks, adding further uncertainty.

Given its high valuation and current loss profile, CoreWeave is better suited for investors with a higher risk tolerance. More conservative investors may prefer to wait for additional clarity from upcoming earnings reports and the progress of the Core Scientific acquisition before committing capital.

Conclusion

NVIDIA’s substantial increase in its stake in CoreWeave underscores its long-term commitment to the AI cloud services market. CoreWeave demonstrates strong potential through revenue growth, rapid technology iteration, and ecosystem development; however, high capital expenditures, ongoing profitability pressure, and intense competition remain significant challenges.

For investors, deciding whether to follow NVIDIA’s lead ultimately depends on their individual risk tolerance. Overall, CoreWeave is well-positioned to claim a foothold in the AI infrastructure wave, but its stock performance and financial trajectory will require time to be fully validated.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates