Fed Rate Cut Looms

04:22 September 10, 2025 EDT

Key Points:

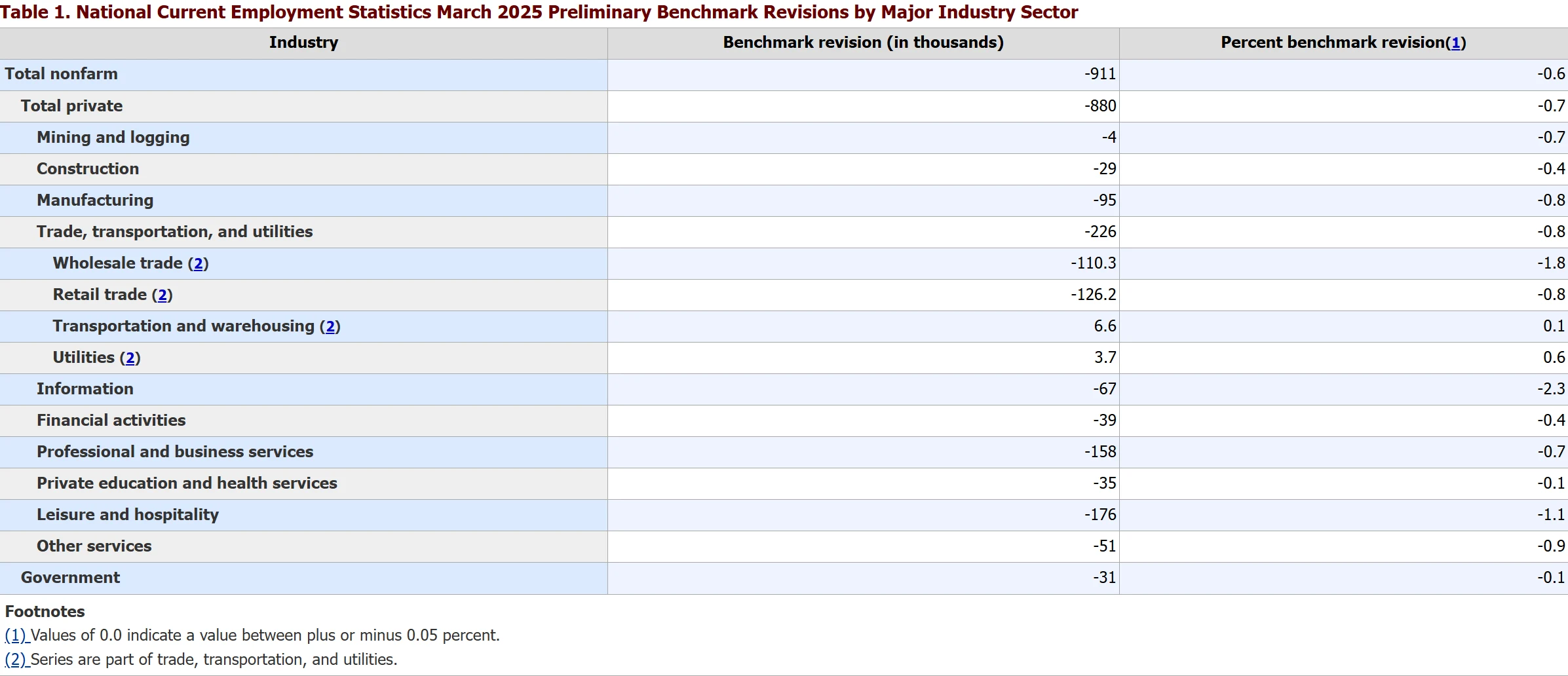

Between March 2024 and March 2025, U.S. nonfarm payrolls were revised down by 911,000 jobs compared with prior estimates, equivalent to an average reduction of nearly 76,000 jobs per month—the largest downward revision on record since 2000.

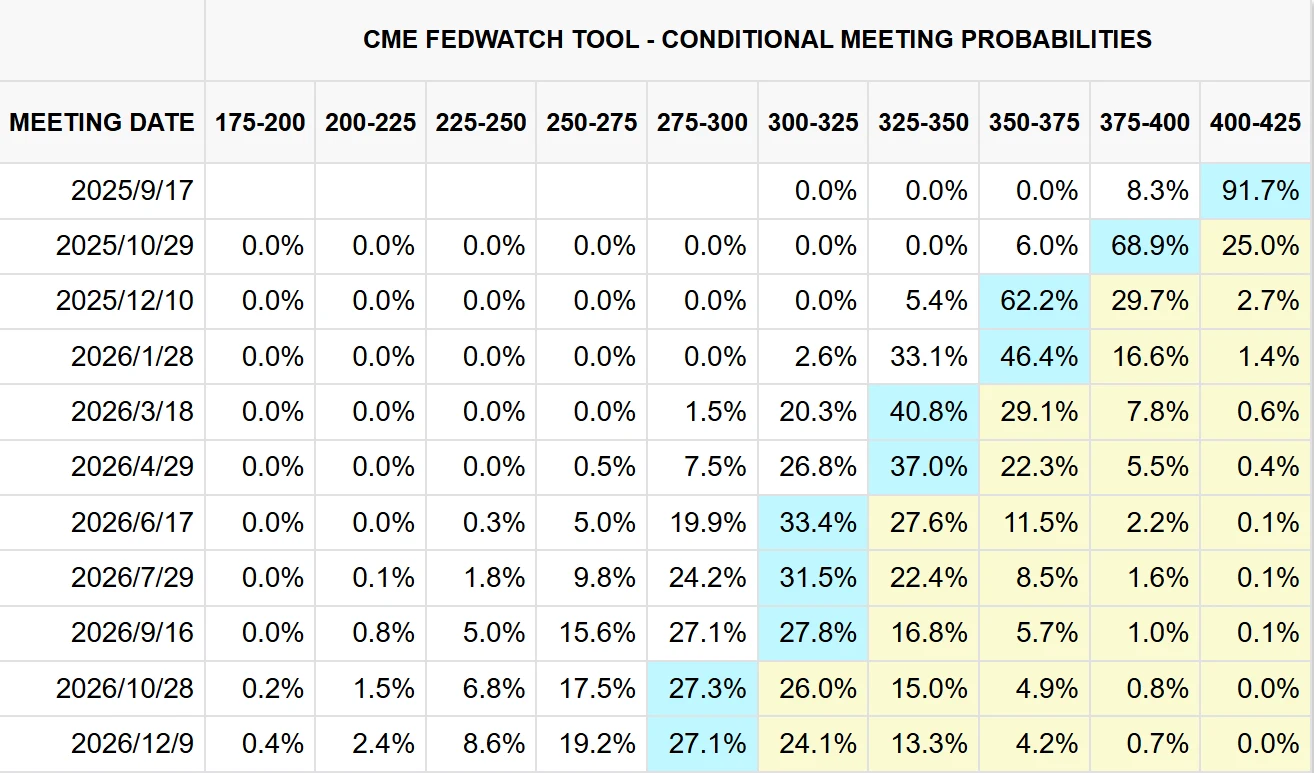

Market consensus has formed around the start of a Fed rate-cutting cycle. Traders now see a near certainty of a cut at the September 17 FOMC meeting, with additional cuts anticipated in October and December, implying the Fed could deliver three consecutive rate reductions before year-end.

The Federal Reserve is entering a period of heightened policy uncertainty, balancing between weak labor market conditions and inflation risks, reconciling market expectations with policy independence, and managing trade-offs between short-term stability and long-term objectives. These will likely define the central bank’s monetary policy challenges in the months ahead.

Ahead of the Federal Open Market Committee’s pivotal September meeting, U.S. labor market data have been sharply revised lower, intensifying concerns over economic growth. Coupled with inflationary pressures from tariffs, expectations that the Fed will begin an easing cycle have now become consensus.

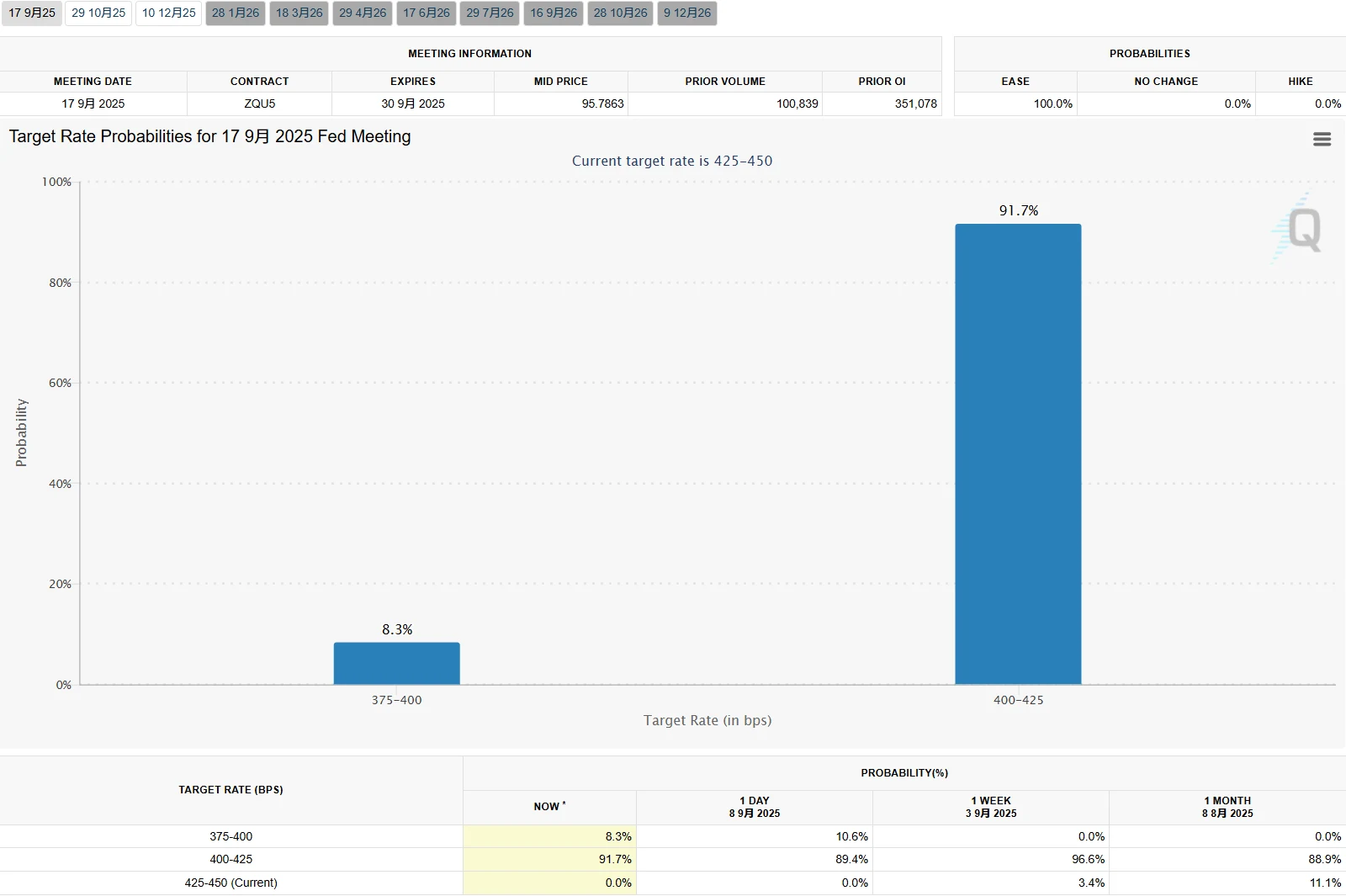

Market expectations for rate cuts are fully priced in. According to CME’s FedWatch tool, the probability of a 25-basis-point cut in September stands at 91.7%, while the probability of a 50-basis-point cut is 8.3%, leaving the overall probability of easing at 100%.

Source: CME

Labor Market Weakness Exceeds Expectations

On September 9, the U.S. Bureau of Labor Statistics (BLS) released preliminary benchmark revisions showing that, over the 12 months ending March 2025, nonfarm payrolls were revised down by 911,000 jobs compared with prior reports—an average reduction of nearly 76,000 jobs per month. This marks the largest downward revision on record since 2000, exceeding market expectations of 700,000–800,000 and surpassing the $800,000 cap previously flagged by U.S. Treasury Secretary Janet Yellen.

Source: U.S. Bureau of Labor Statistics

The revisions span a broad range of sectors, with employment in leisure and hospitality, retail, manufacturing, and information industries all adjusted downward. The primary driver of the revisions is the estimation bias in the “Business Birth-Death Model,” which is used to estimate net employment changes resulting from business openings and closures. Since the pandemic, structural shifts in the economy have significantly complicated the model’s calculations, likely leading to systematic overestimation of employment growth outside the survey sample.

This implies that, over the past 16 months, actual job growth has been reduced by roughly 1.2 million, with the monthly average revised down from 149,000 to approximately 73,000. Goldman Sachs’ proprietary model estimates a smaller downward adjustment of 550,000, suggesting that while the revisions provide limited insight into the current labor market, they confirm the overall trend of slowing employment growth.

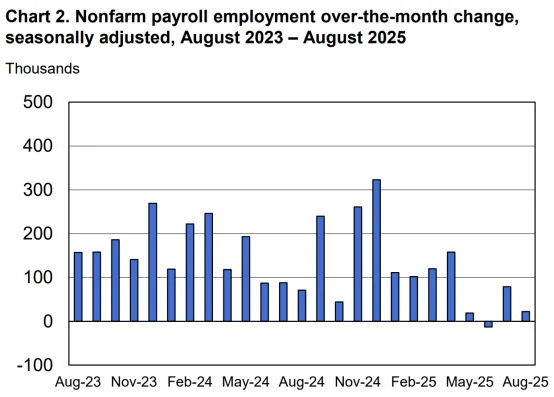

Additional data indicate that employment growth has nearly stalled. For example, already weak summer payrolls in 2025 showed only 22,000 nonfarm jobs added in August, signaling that the cooling of the U.S. labor market began earlier than previously anticipated and that the degree of weakness far exceeds the initial official reports.

Source: U.S. Bureau of Labor Statistics

Rate-Cut Expectations Rise Amid Policy Shift

Weak employment data, particularly the historic downward revisions, provide strong justification for the Federal Reserve to begin a rate-cutting cycle. Market expectations for a Fed rate cut at the September meeting have reached unprecedented levels. The market has now fully priced in a 25-basis-point cut in September, with the probability of rates remaining unchanged at zero. Just one week ago, expectations for three rate cuts this year were more conservative; the market now fully anticipates consecutive cuts in September, October, and December.

Source: CME

Fed officials have recently sent clear signals supporting rate cuts. On September 3, Fed Governor Christopher Waller told the media that the central bank should cut rates at the September meeting and indicated that multiple reductions could follow. He noted that whether cuts occur at each meeting or intermittently will depend on incoming data. Waller emphasized that while inflation may experience minor fluctuations in the near term, these are unlikely to be persistent, and he expects the rate to move closer to the 2% long-term target within six months.

On the same day, St. Louis Fed President James Bullard slightly upgraded his assessment of downside risks to the labor market, noting that some full-employment indicators have begun to deteriorate. He commented that tariffs have limited short-term impact on inflation and expects inflationary pressures to gradually return to the Fed’s 2% target by the second half of 2026.

The most influential remarks came from Fed Chair Jerome Powell. At the August Jackson Hole Global Central Banking Symposium, Powell shifted the policy focus from “controlling inflation” to “mitigating employment risks,” highlighting that the labor market appears balanced on the surface but harbors hidden downside risks that could trigger self-reinforcing layoffs. Markets interpreted this statement as a clear signal that a Fed rate-cut cycle is imminent.

Overall, the Fed appears to have coalesced around a consensus for rate cuts, though officials remain cautious in implementation. Most statements support an initial 25-basis-point cut rather than a more aggressive 50-basis-point adjustment, providing key guidance for the September FOMC meeting.

Following these developments, several Wall Street institutions adjusted their forecasts. Citigroup economist Andrew Hollenhorst noted that the downward revision in employment data “supports” the rationale for a 50-basis-point cut in September, but expects the Fed to likely choose a 25-basis-point reduction instead.

Bank of America projects two 25-basis-point cuts in 2025, in September and December. PGIM Fixed Income Chief Global Economist Daleep Singh anticipates the Fed will implement incremental 25-basis-point cuts until the target range reaches 3.0%–3.5%.

Complex Policy Choices at the Federal Reserve

Despite a marked cooling in the labor market, the Federal Reserve’s decision-making is far from unimpeded, as it faces a complex web of internal trade-offs.

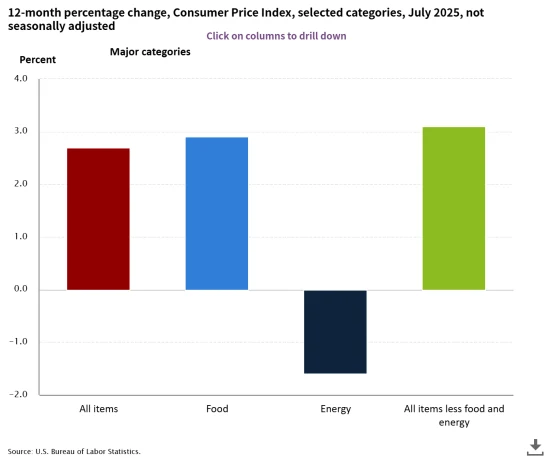

First, inflation risks have not been fully eliminated. Although inflation continues to ease, current levels remain above the Fed’s 2% target. Overall CPI rose 2.7% year-over-year in July, while core CPI remained at 3.1%. Earlier tariff policies are now beginning to affect prices of core goods such as furniture and apparel, and secondary inflation risks remain a central consideration in any potential rate cuts.

Source: U.S. Bureau of Labor Statistics

At the same time, there are clear divisions within the FOMC regarding the timing and pace of rate reductions. The dovish camp argues that employment risks now outweigh inflation concerns and advocates for immediate cuts. By contrast, the hawkish camp favors a “wait-and-see” approach, noting that real interest rates remain below neutral levels and cautioning that premature cuts could fuel speculative behavior in financial markets.

The Fed’s independence is also under pressure. President Trump’s dismissal of Fed Governor Lisa Cook, along with Treasury Secretary Janet Yellen’s calls for “comprehensive reforms” of the Fed, have cast a political shadow over monetary policy decisions.

Beyond employment and inflation, the Fed must weigh multiple other factors, including consumer spending, business investment, the housing market, and slowing global economic growth. Treasury Secretary Yellen previously warned that if the Supreme Court rules Trump’s tariffs unlawful, potential tariff refunds could range from $750 billion to $1 trillion, creating significant fiscal and market uncertainty.

The substantial downward revision of employment data has also fueled political debate. White House Press Secretary Karoline Leavitt called it “the largest downward revision in history,” criticized the Bureau of Labor Statistics (BLS) as “broken,” and urged Fed Chair Jerome Powell to “act immediately” on rate cuts, asserting there is “no excuse” for inaction.

President Trump has repeatedly questioned the accuracy of BLS data and, one month ago, dismissed the agency’s commissioner following a large monthly employment revision. The current annual benchmark revision further intensifies his criticism of the credibility of government statistics. Vice President Mike Pence also labeled BLS data “effectively useless” and stressed that reforms are necessary to restore its reliability.

This political pressure adds another layer of complexity to the Fed’s decision-making environment. Market participants must not only interpret economic data but also remain alert to the risks that monetary policy could be influenced by political considerations.

Final Thoughts

For both markets and policymakers, the Federal Reserve’s imminent decisions will determine short-term interest rates while simultaneously testing its ability to balance economic growth, price stability, and central bank independence.

The Fed’s policy trajectory going forward will be highly data-dependent, particularly on whether inflation continues its downward path and whether labor market conditions deteriorate further. Global markets are closely monitoring this critical juncture.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates