Tech Stock Opportunities for Budget-Conscious Investors to Watch

04:49 September 9, 2025 EDT

In the 2025 stock market environment, finding reasonably priced, high-quality stocks has become a challenge for many individual investors, especially when funds are limited. According to the latest survey, the median emergency savings for U.S. adults is around $10,000, with only about 46% of households having enough emergency savings to cover three months of expenses. Additionally, about 30% of Americans report that their emergency savings are insufficient to handle unforeseen events.

However, for those looking to grow their wealth through investments, the good news is that there are still some tech stocks with relatively reasonable valuations, priced well below several hundred dollars. These stocks can be evaluated using the Price-to-Earnings (P/E) ratio, which divides the stock price by earnings per share, helping investors assess whether they are getting good value.

This article highlights two stocks that have excelled in the fields of artificial intelligence and the digital ecosystem: Taiwan Semiconductor Manufacturing Company (TSMC) and Alphabet Inc. (GOOG/GOOGL).

TSMC: The Supply Chain Leader in AI Chip Production

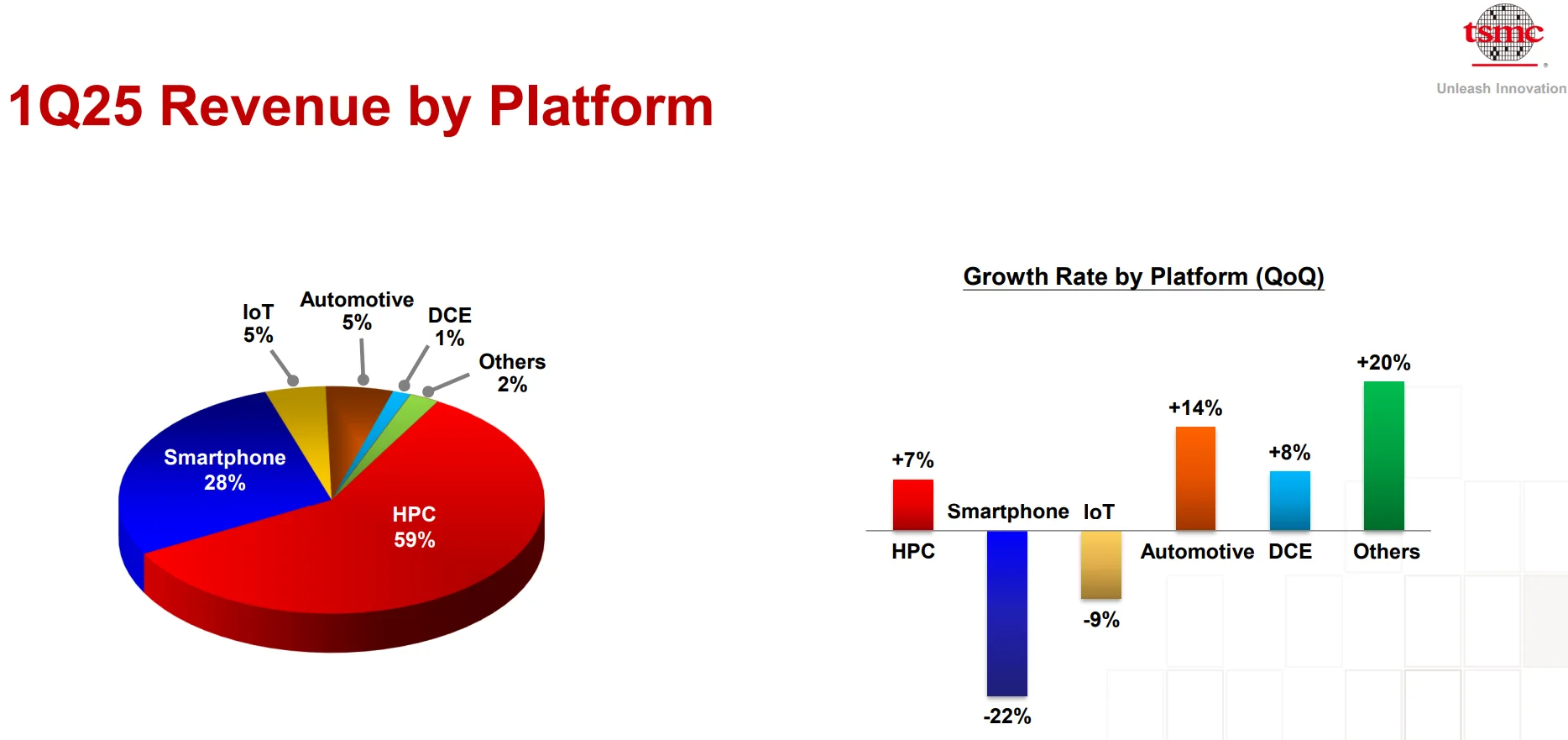

TSMC, as the global leader in semiconductor foundry services, dominates the advanced chip production sector. According to Q2 2025 data, the company holds 70.2% of the global pure-play foundry market share, significantly surpassing its competitors. This dominance is attributed to its technological leadership in 3nm and 5nm processes, which are core nodes in AI processor manufacturing. For instance, TSMC provides foundry services for several tech giants like NVIDIA and AMD, ensuring its key role in the AI wave.

Source: TSMC

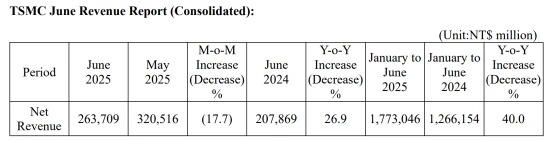

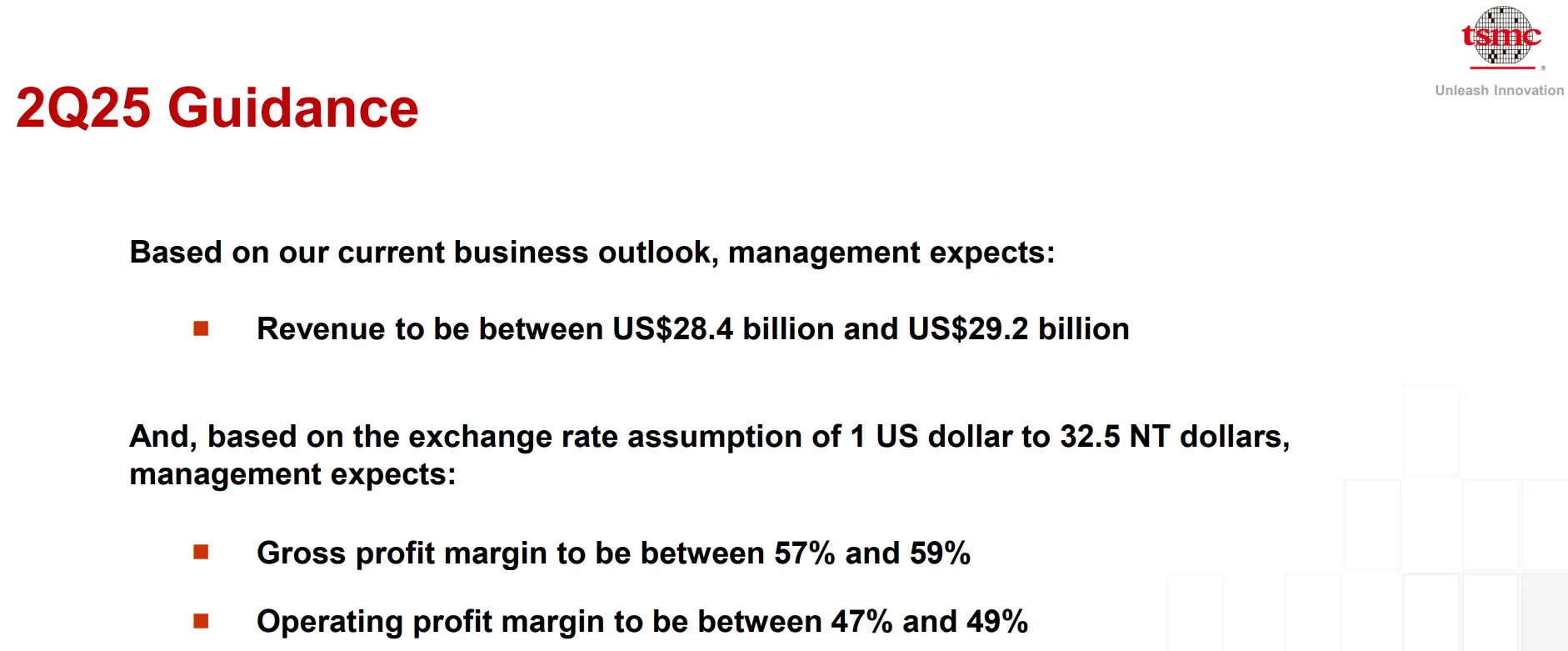

In terms of financial performance, TSMC achieved strong growth in Q2 2025, with revenue reaching $30.07 billion, a year-on-year increase of approximately 38.6%. Earnings per share (EPS) were $2.47, soaring by 60.7%.

Source: TSMC

The company’s management has revised its full-year revenue growth forecast to 30%, up from the previous estimate of “mid-20% range.” TSMC's management attributed this revision to the strong demand for 3nm and 5nm technologies and the growing high-performance computing (HPC) platform, both of which are closely tied to the explosive demand for AI infrastructure. The rapid development of AI-related business has led to a significant increase in demand for high-performance chips, and TSMC, as the world’s leading chip manufacturer, is well-positioned to benefit from this trend.

Source: TSMC

Analysts forecast that global AI infrastructure spending will reach $375 billion in 2025 and rise to $500 billion by 2030, possibly even exceeding $4 trillion. This will further drive TSMC’s order volume, with its AI-related revenue expected to experience significant expansion in 2025. Notably, TSMC’s technological advantages in advanced process nodes and its expanding production capacity place it in an irreplaceable position within the global AI chip market.

In terms of valuation, TSMC’s current P/E ratio is approximately 26.97, slightly higher than the semiconductor industry average. However, given its market leadership and growth prospects, this valuation remains reasonable. As of the market close on September 8, 2025, TSMC’s ADR price was $247.19, up $3.78 (+1.55%) on the day. The 52-week high was $248.28, and the low was $134.25, with a market capitalization of $1.28 trillion. Despite the overall volatility in the semiconductor industry, the stock has shown positive momentum, with a year-to-date return of over 20%, benefiting from the continued rise in AI demand and supply chain stability.

Source: TradingView

Currently, Wall Street analysts overwhelmingly give TSMC a “Strong Buy” rating, with an average target price of $276.81, implying nearly a 12% upside potential from its current level.

Alphabet: A Tech Giant with Diversified Growth

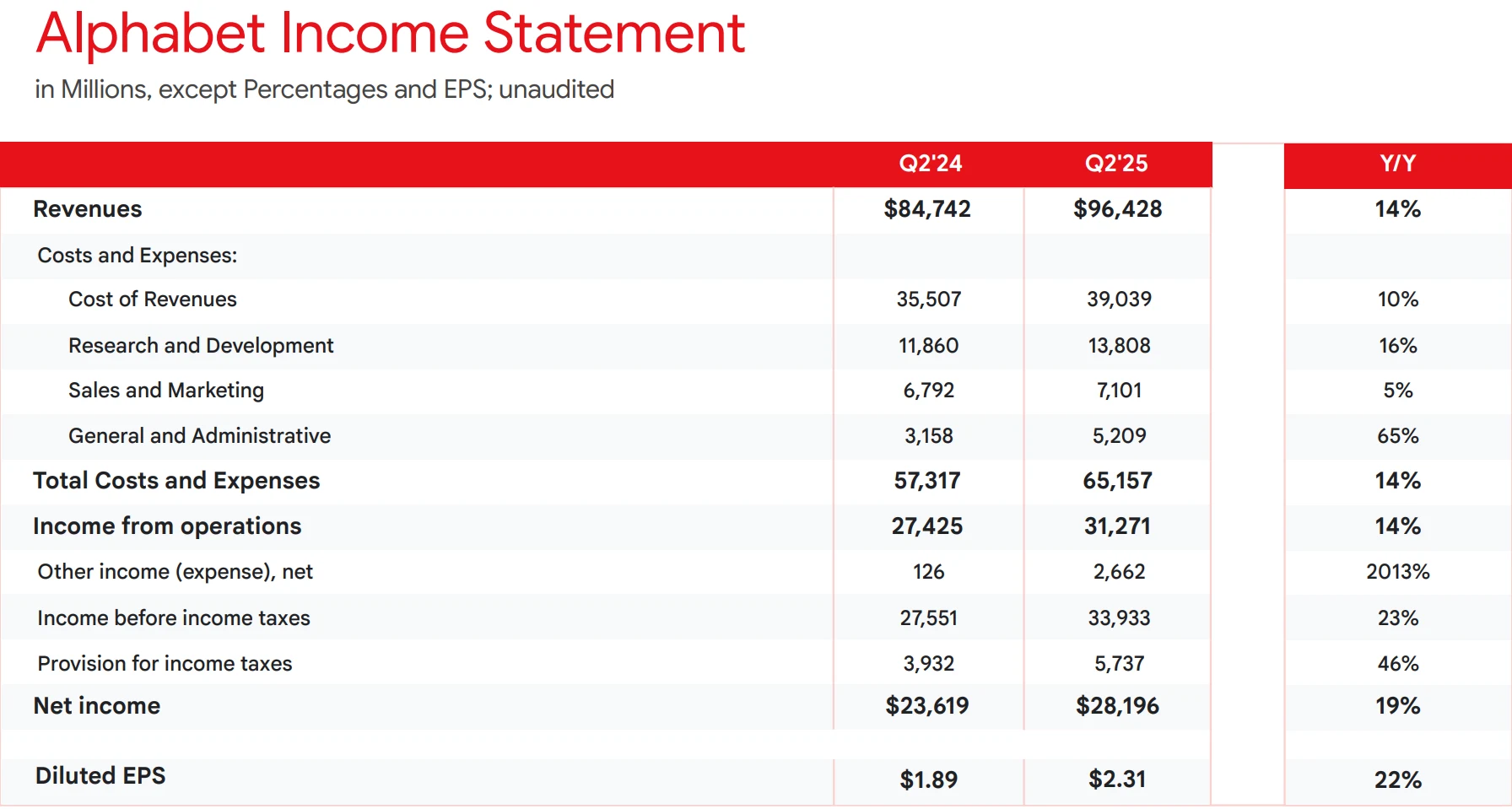

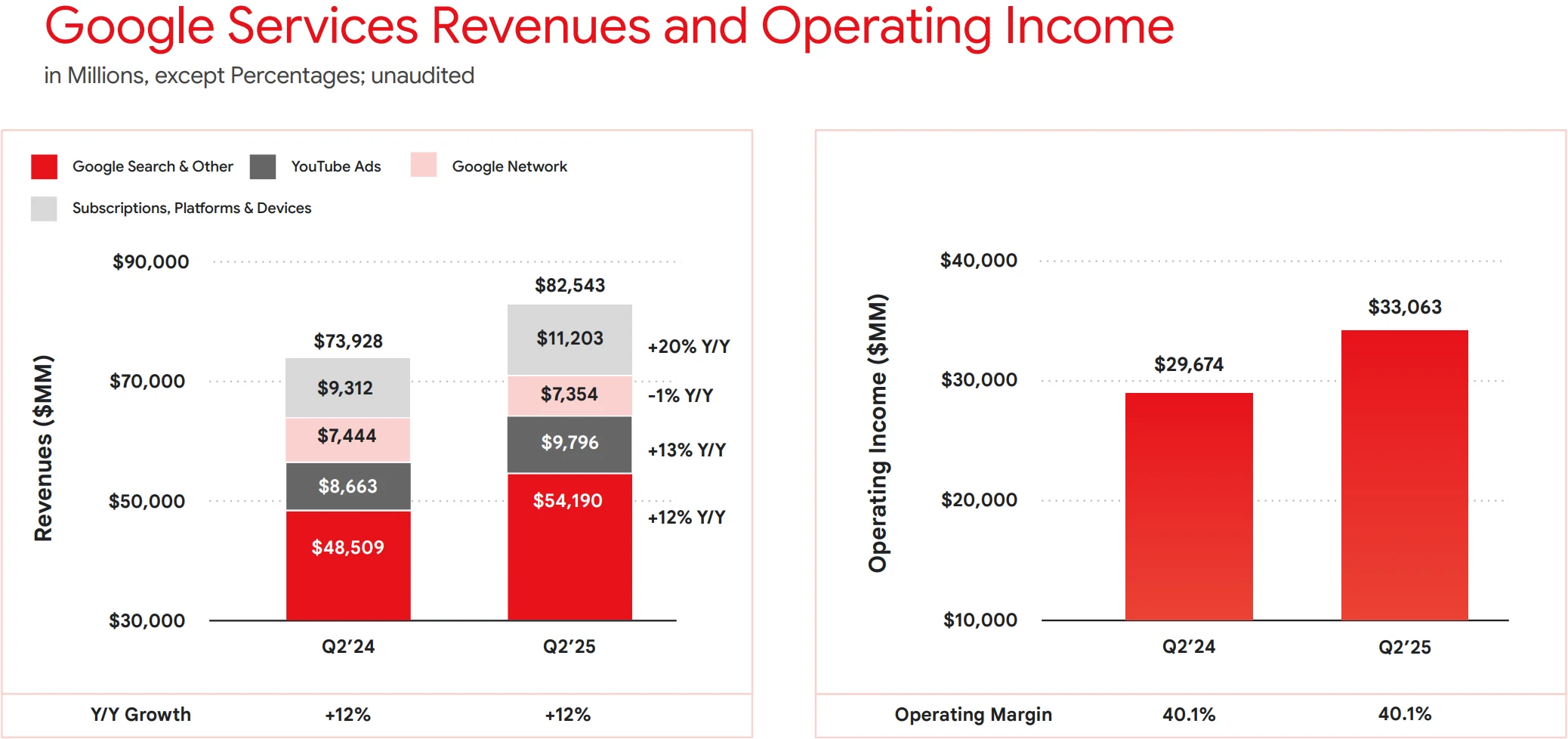

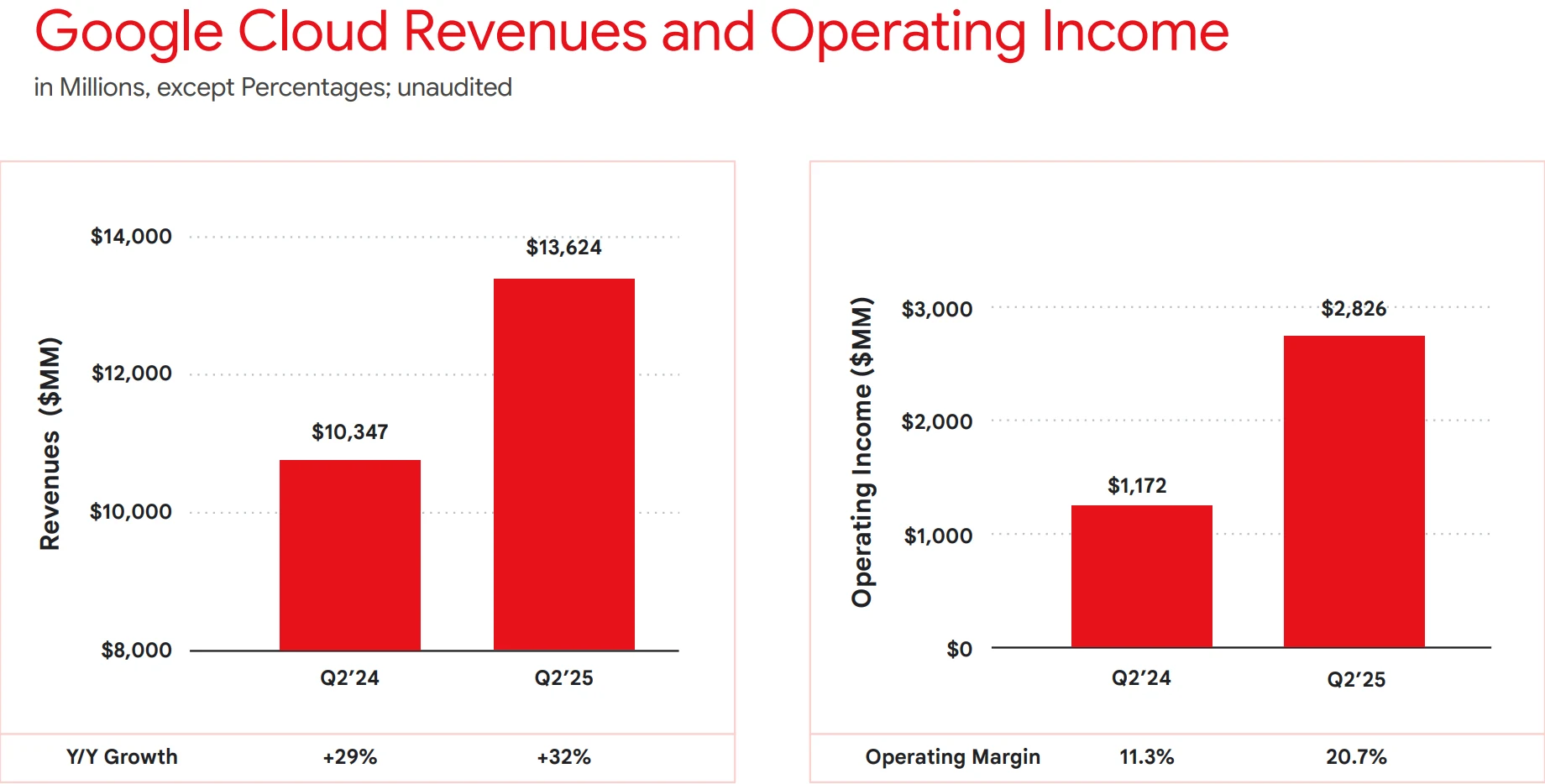

Alphabet, the parent company of Google, continues to make significant strides in areas such as search, AI, and cloud computing.

Source: Alphabet

A recent antitrust ruling has cleared some obstacles for the company: A federal judge ruled in September 2025 that Alphabet does not need to divest its Chrome browser or Android operating system but must stop exclusive contracts and share certain search data with competitors. This decision avoided a major business breakup, and Alphabet’s stock rose by about 7%, reflecting market confidence.

In the AI sector, Alphabet's Gemini chatbot has attracted hundreds of millions of active users, and its AI advertising platform saw a 50% year-over-year growth in user numbers, now covering over 2 million advertisers.

Source: Alphabet

Google Cloud, Alphabet’s cloud computing division, has shown exceptional performance: In Q2 2025, cloud revenue grew significantly, driving total company revenue to $96.4 billion, a 14% year-over-year increase. Google Cloud’s market share has reached 13%, making it the third-largest cloud provider globally, behind AWS and Azure. According to IDC, Google Cloud's market share has grown by over 40% in the past three years. The number of large contracts (worth over $250 million) in Q2 doubled year-over-year. The company also raised its 2025 capital expenditure forecast to $85 billion to support AI and cloud infrastructure expansion.

Source: Alphabet

Looking ahead, the cloud computing market is expected to reach $2 trillion by 2030, and Alphabet is positioning itself to capture market share through AI integration.

In terms of valuation, Alphabet’s P/E ratio is around 25, significantly lower than Microsoft’s 37, indicating relative attractiveness. As of the market close on September 8, 2025, the price of GOOGL was $234.04, down $0.80 (-0.34%) on the day. The 52-week high was $238.13, and the low was $140.53, with a market cap of $2.831 trillion. The stock has shown a stable performance recently, with a year-to-date return of over 24%. Despite facing antitrust pressures, the growth in its cloud and AI businesses has bolstered investor confidence. Analyst ratings are mostly “Buy,” with optimism surrounding its innovation in generative AI.

Source: TradingView

Why Now is the Right Time to Invest

These two stocks are affordably priced, well below the $400 threshold, and stand to benefit from macro trends in AI and digital transformation. The global semiconductor market is expected to make a strong rebound in 2025, with AI chip demand being a key driver. For budget-conscious investors, TSMC and Alphabet offer diversified options: the former focuses on hardware manufacturing, while the latter emphasizes software and services.

If you are optimistic about the future of the tech sector, these two stocks are undoubtedly worth serious consideration. If funds are limited and only one stock can be chosen, TSMC may be the priority. Its indispensable role in the AI supply chain could yield higher returns.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates