Prime Minister Shigeru Ishiba Resigns — What’s Next for Japan?

05:23 September 8, 2025 EDT

Japanese Prime Minister and Liberal Democratic Party (LDP) President Shigeru Ishiba announced his resignation on September 7, 2025, bringing an end to a tenure of less than one year. The decision triggered turbulence in Japan’s political landscape and financial markets, as the LDP’s recent string of electoral defeats cost the ruling coalition its majority in parliament.

Ishiba said he was stepping down to prevent further internal divisions within the party, adding that the conclusion of U.S.-Japan trade talks provided an appropriate moment for his departure. As of September 8, 2025, markets reacted swiftly: the yen weakened, equities staged a brief rebound, and government bond yields remained elevated.

Background to the Event

Shigeru Ishiba was elected president of the Liberal Democratic Party (LDP) and became prime minister in September 2024, with a term originally set to run until September 2027. However, the ruling coalition of the LDP and Komeito suffered back-to-back defeats in the October 2024 lower house election and the July 2025 upper house election, losing its majority in both chambers of parliament for the first time since the LDP was founded in 1955. The losses were closely tied to a party fundraising scandal involving unreported political donations, which steadily eroded voter trust and fueled mounting pressure within the party.

Historically, Japanese prime ministers have often stepped down in the wake of electoral setbacks or intraparty conflicts. For example, Taro Aso resigned in 2009 following the LDP’s lower house defeat, which forced the party into three years in opposition; Shinzo Abe left office in 2020 due to health reasons, triggering a period of policy adjustment. Ishiba’s resignation follows this pattern. At a press conference, he said he would remain in office until a successor is chosen, while making clear that he will not run in the upcoming leadership race. The LDP has already launched the process to elect a new president, with the timetable — including candidate registration and internal voting — expected later this week. If no candidate secures a majority in the first round, the contest will move to a runoff limited to parliamentary members and local representatives.

Market Reaction

Shigeru Ishiba’s resignation announcement prompted immediate adjustments across financial markets.

In the foreign exchange market, the yen fell 0.7% against the U.S. dollar in early trading on September 8, with USD/JPY reaching the 148 level. Over the past week, the yen had already been the weakest performer among the G10 currencies, reflecting investor concerns over political uncertainty and the prospect of fiscal expansion.

Source: TradingView

Japan’s bond market remained under sustained pressure. The 30-year JGB yield, which hit a record high of 3.285% on September 3, eased to 3.23% on September 8. The 20-year yield reached 2.69%, its highest level since 1999, while the 10-year yield held steady at 1.57%. Rising yields are being driven by expectations of looser fiscal policy, a trend that could intensify if Ishiba’s successor favors increased spending.

Source: TradingView

Equities showed a more positive tone. The Nikkei 225 opened 1% higher on September 8 and closed up 1.34% at around 43,644 points, while the TOPIX rose 0.7%. The weaker yen supported exporters, particularly in the automotive and electronics sectors, though overall market volatility increased. Historically, Japanese equities have often declined in the wake of prime ministerial resignations—for instance, the Nikkei fell about 5% after Taro Aso stepped down in 2009. This rebound may prove limited, depending on the policy stance of the next prime minister.

Source: TradingView

Taken together, these market moves suggest that investors are reassessing how political uncertainty may shape future economic policy. Ishiba, known for his fiscal discipline, leaves behind expectations of more accommodative policies, with potential implications for asset pricing.

Political Prospects

Shigeru Ishiba’s resignation marks a shift in leadership within the Liberal Democratic Party (LDP). As the ruling party, the LDP’s new president typically assumes the prime ministership. Once the new president is chosen, the Diet will hold a prime ministerial election, and if the LDP candidate secures a majority in both chambers, they will formally take office. However, the ruling coalition currently holds a minority in both houses, meaning a united opposition could potentially push through a non-LDP candidate, breaking the party’s long-standing dominance. Nevertheless, the LDP remains the largest party, and divisions among opposition parties make it unlikely that the new president will be defeated.

Potential candidates include former Foreign Minister Toshimitsu Motegi, former Minister of Economic Security Sanae Takaichi, Minister of Agriculture, Forestry and Fisheries Shinjiro Koizumi, and Chief Cabinet Secretary Yoshimasa Hayashi. Motegi has already declared his candidacy, focusing on trade and economic security policies. Takaichi is considered a front-runner, advocating a continuation of “Abenomics,” opposing central bank rate hikes, and supporting increased fiscal spending—policies that could boost equities in the short term but exacerbate debt pressures. Koizumi’s economic positions are less defined, though he has emphasized agricultural stability during periods of rising rice prices while serving as Agriculture Minister. Hayashi highlights central bank independence and brings multi-department experience, supporting a cautious monetary policy approach.

Among opposition parties, Constitutional Democratic Party leader Yoshihiko Noda calls for an end to central bank stimulus and consumption tax reform, while Democratic Party for the People leader Yuichiro Tamaki supports tax cuts and cautious fiscal tightening.

Fitch Ratings notes that the new prime minister may attempt to capitalize on a “honeymoon period” to hold elections and regain a majority, but the LDP’s losses in the 2024 election suggest this strategy carries significant risk. Regardless of who is elected, legislative challenges are likely to persist, requiring collaboration with Komeito or other smaller parties to advance the agenda.

Economic Prospects

Japan’s economy is in a phase of moderate recovery, but challenges and uncertainties are mounting. In Q2 2025, Japan’s seasonally adjusted real GDP—excluding price changes—grew 0.3% quarter-on-quarter, equivalent to an annualized increase of 1.0%. However, the International Monetary Fund (IMF) projects full-year growth at around 0.6%, highlighting continued headwinds from the external environment, particularly global trade frictions. Meanwhile, the labor market remains stable, with the unemployment rate holding at a low 2.3%. Inflation has eased: overall CPI fell to 3.1% in July, while core inflation (excluding fresh food) is expected to remain between 2.5% and 3.0% for the year, indicating moderated price pressures.

Source: TradingEconomics

Despite this, Japan’s fiscal vulnerability remains pronounced. Public debt is expected to reach 230%-235% of GDP by year-end, approaching the historical high of 250%. This severely constrains fiscal policy flexibility. The Ministry of Finance recently reported that outstanding debt is near 250% of GDP, the highest level among developed economies. Moreover, next fiscal year’s budget request is projected to set a record for the third consecutive year, heightening market concerns about fiscal sustainability. Against this backdrop, Shigeru Ishiba had long been viewed as a stabilizing force in Japan’s government bond market due to his fiscal conservatism. His resignation has shifted investor focus to potential successors and the possibility of a return to “Abenomics”-style policies.

During Shinzo Abe’s tenure, large-scale fiscal stimulus combined with unprecedented monetary easing formed the core of economic policy. Market participants widely expect that a revival of similar reflationary measures could increase pressure on the government bond market. Naka Matsuzawa, Nomura Securities’ Chief Macro Strategist in Tokyo, noted that the market’s instinctive reaction would likely be higher selling pressure on Japanese bonds, a weaker yen, and a modest rally in equities.

Source: TradingEconomics

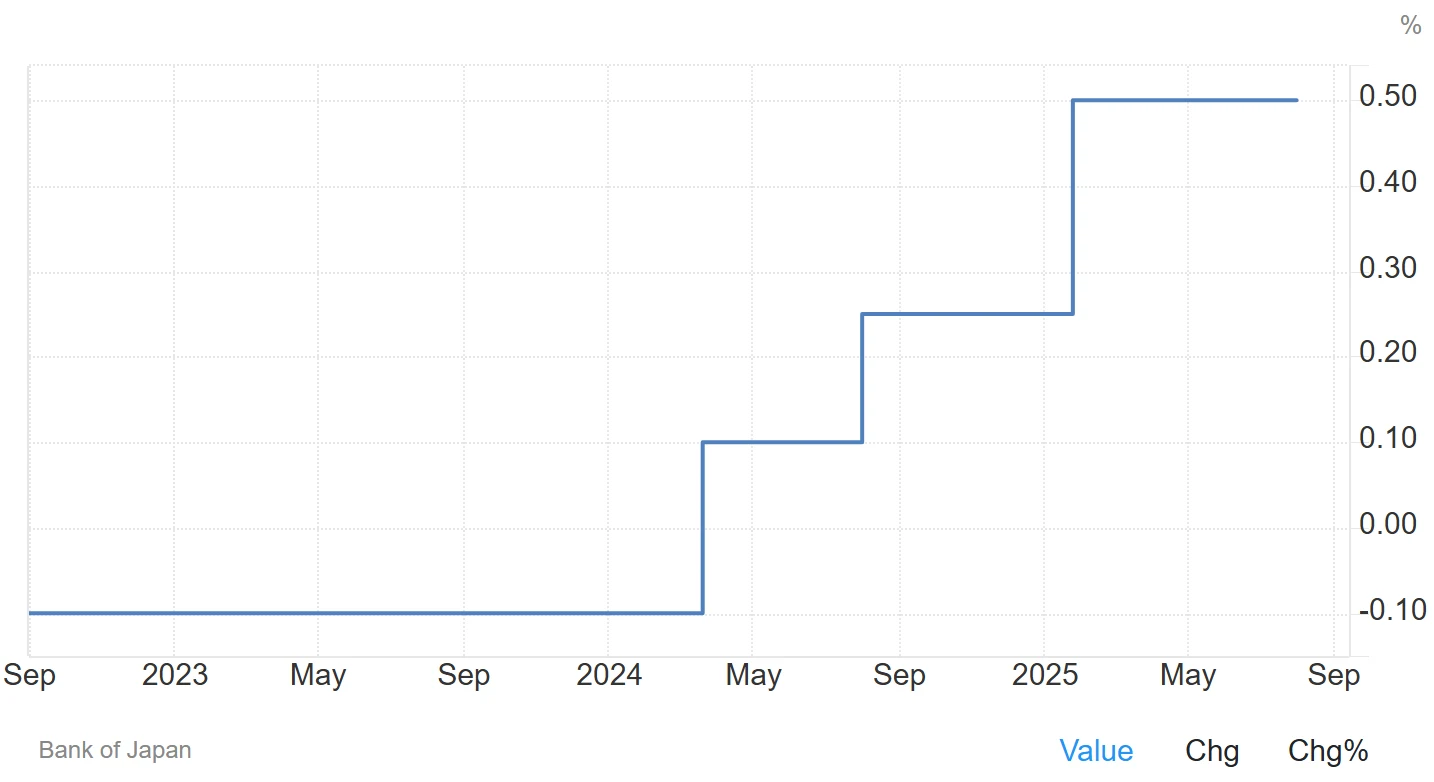

At the same time, the Bank of Japan’s policy path has become a new source of uncertainty. Over the past year, the BoJ has gradually withdrawn unconventional stimulus, attempting to normalize interest rates and reduce its government bond holdings. Ishiba’s resignation could disrupt this process. Markets are concerned that the central bank may “fall behind the curve” amid political turbulence, making the September and October policy meetings particularly critical in setting the tone for JGBs and the yen. Michael Brown, Senior Research Strategist at Pepperstone in London, observed that political uncertainty may push the BoJ to further delay tightening, continuing its historically cautious stance on rate hikes.

The choice of successor will also be pivotal for market outlooks. Should Sanae Takaichi assume office, equities could benefit from her inclination to boost government spending. At the same time, this would likely prolong the BoJ’s ultra-low interest rate policy, further delaying the tightening cycle. In other words, the combination of fiscal and monetary policy under the next administration is set to have a profound impact on Japan’s markets in the months ahead.

What Lies Ahead?

In the short term, Japan’s political landscape is likely to experience a one- to two-week transition period, during which the LDP leadership election will determine the next prime minister. If Sanae Takaichi wins, fiscal expansion could intensify bond selling and yen weakness, while equities may benefit in the near term from anticipated government spending. Conversely, if Yoshimasa Hayashi is elected, monetary policy continuity is expected to be stronger, and market volatility may be more contained. Expectations for a single BoJ rate hike in 2025 remain, though they are influenced by U.S. Federal Reserve policy and domestic inflation trends.

Over the longer term, the new prime minister may face legislative gridlock, with GDP growth projected below 1.5%. An early general election could be held in early 2026, but failure would carry risks of further weakening the governing coalition. Geopolitical tensions and a slowing global economy—such as U.S.-China trade frictions—could exacerbate challenges for Japan’s export-oriented economy.

Market analysts generally agree that political uncertainty will continue to weigh on the yen and government bonds, while equity performance will hinge on the clarity of the new prime minister’s economic policies. Japan will need to implement reforms to restore trust and stimulate growth, or risk entering an extended period of policy stagnation.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates