Performance far exceeded expectations, Broadcom Takes Aim at Nvidia

03:17 September 8, 2025 EDT

Key Highlights:

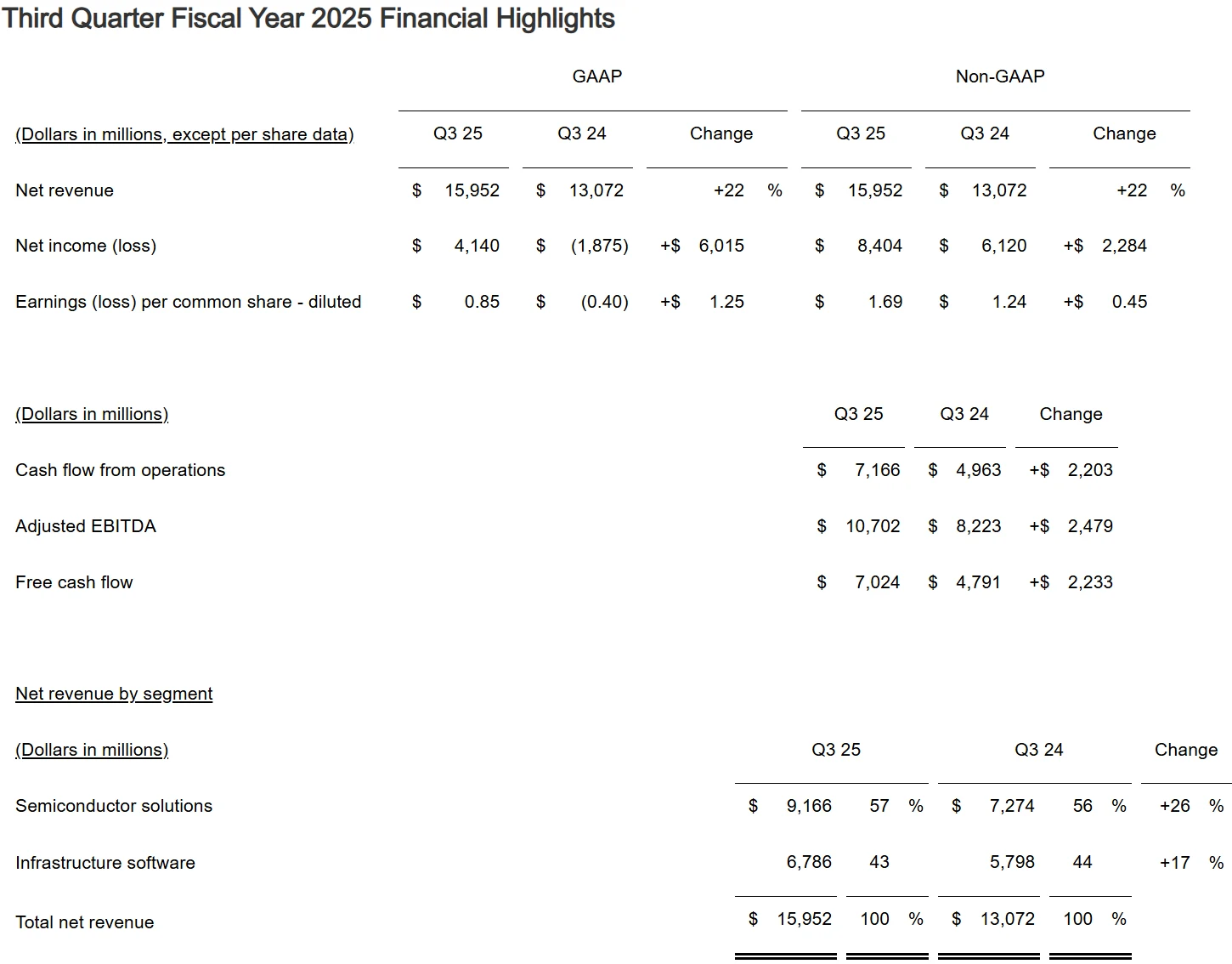

1. Broadcom's Q3 FY2025 financial results comprehensively exceeded market expectations. Revenue reached $15.952 billion, up 22% year-over-year (YoY) and 12% quarter-over-quarter (QoQ). GAAP net income was $4.14 billion, a significant improvement compared to a net loss of $1.875 billion in the same period last year.

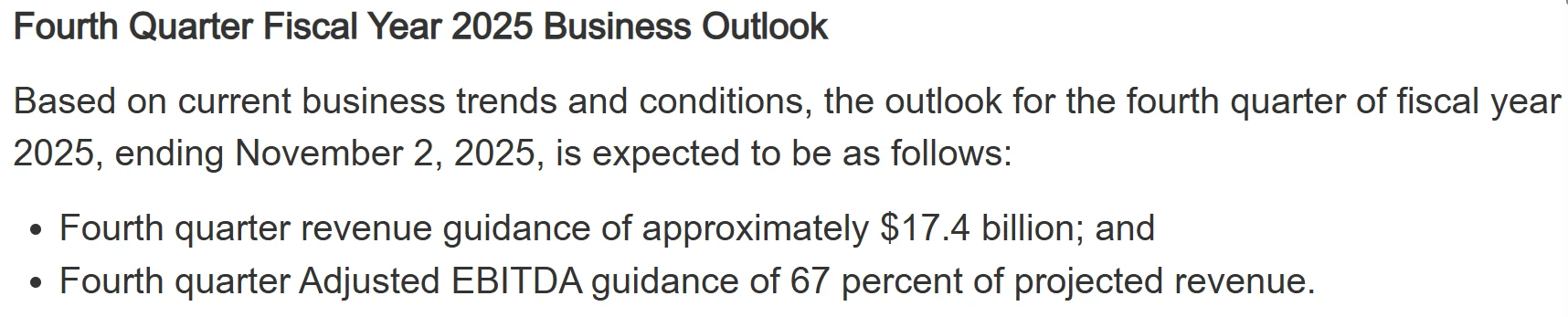

2. The company provided optimistic guidance for Q4 FY2025, projecting revenue of approximately $17.4 billion, representing 24% YoY growth and well above consensus estimates of $17.0 billion.

3. Leveraging its robust technological infrastructure, stable client relationships, and unique business model, Broadcom is carving out a distinct and successful trajectory in the AI chip sector, diverging from Nvidia’s approach.

September 4, 2025 — Broadcom Inc. (NASDAQ: AVGO) reported financial results for the third quarter of fiscal year 2025, ended August 3, 2025. Revenue for the quarter reached $15.95 billion, a 22% increase year-over-year, surpassing analyst expectations of $15.83 billion.

Non-GAAP diluted earnings per share (EPS) came in at $1.69, also exceeding Wall Street forecasts. CEO Hock Tan attributed the strong performance to sustained momentum in the company’s custom AI accelerators, networking infrastructure, and VMware business segments.

Strong Financial Performance

Broadcom's Q3 FY2025 financial results comprehensively exceeded market expectations. Revenue reached $15.952 billion, representing 22% year-over-year growth and 12% quarter-over-quarter growth, demonstrating sustained momentum. GAAP net income was $4.14 billion, marking a significant improvement from a net loss of $1.875 billion in the same period last year, reflecting a substantial turnaround to profitability.

The company's profitability metrics were equally impressive. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) reached $10.702 billion, accounting for 67% of revenue and representing 30% year-over-year growth, indicating strong operating leverage.

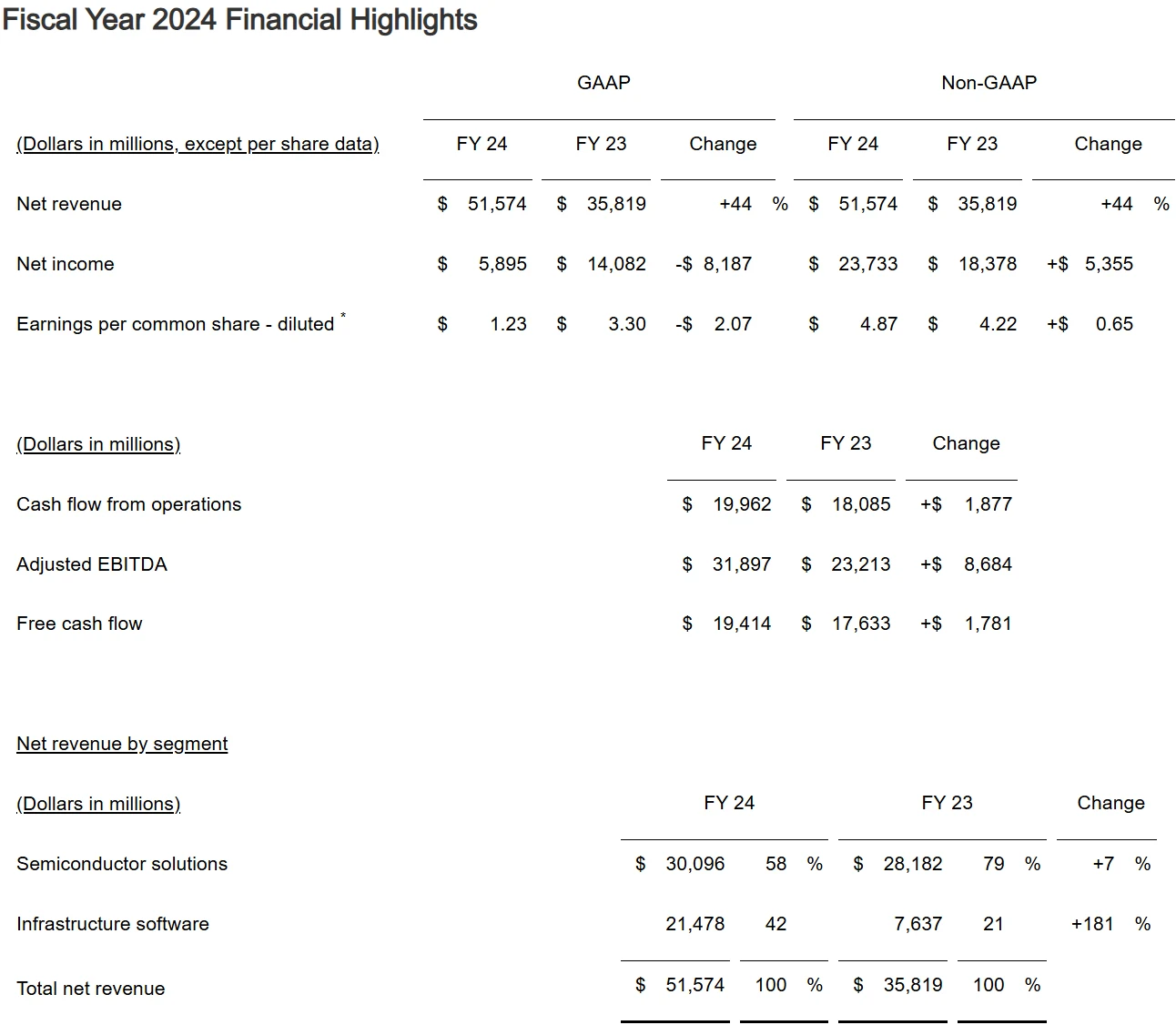

Source: Broadcom

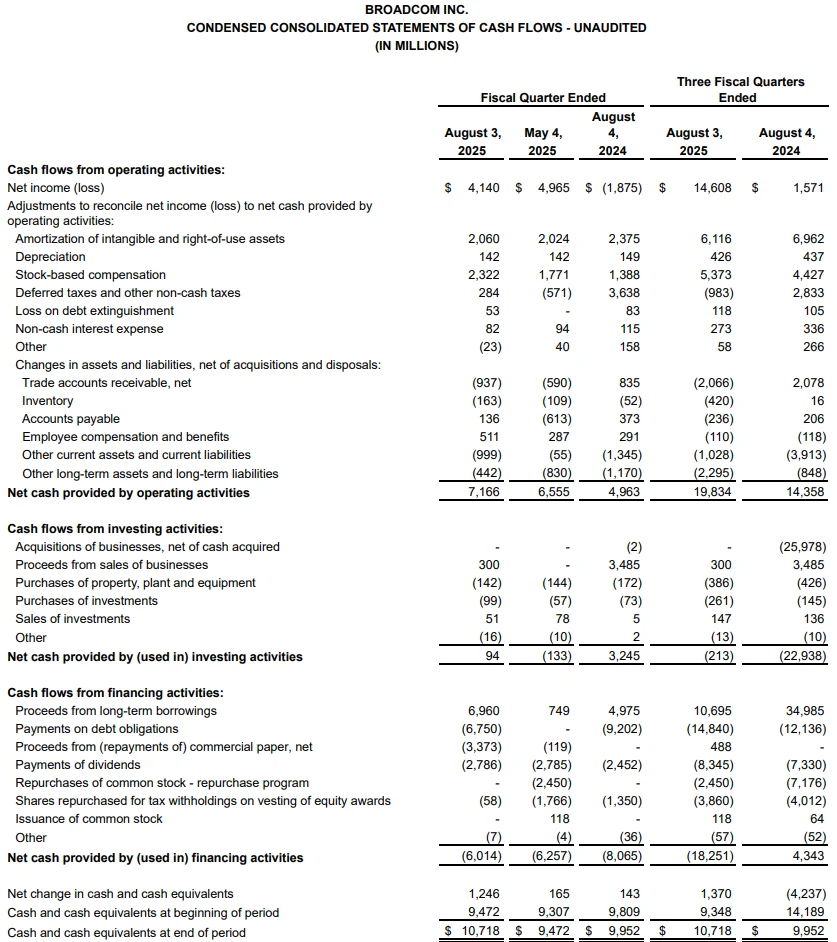

Non-GAAP net income came in at $8.404 billion, maintaining high profitability margins. Cash flow performance was particularly outstanding: operating cash flow generated $7.166 billion, while free cash flow reached $7.024 billion, equivalent to 44% of revenue, providing the company with substantial financial flexibility.

This record free cash flow level supported the company's capital return strategy, with $2.8 billion distributed to shareholders through dividends during the quarter. The cash and cash equivalents balance increased to $10.72 billion, growing by $1.25 billion from the end of the previous quarter.

Source: Broadcom

AI Business Sees Robust Growth

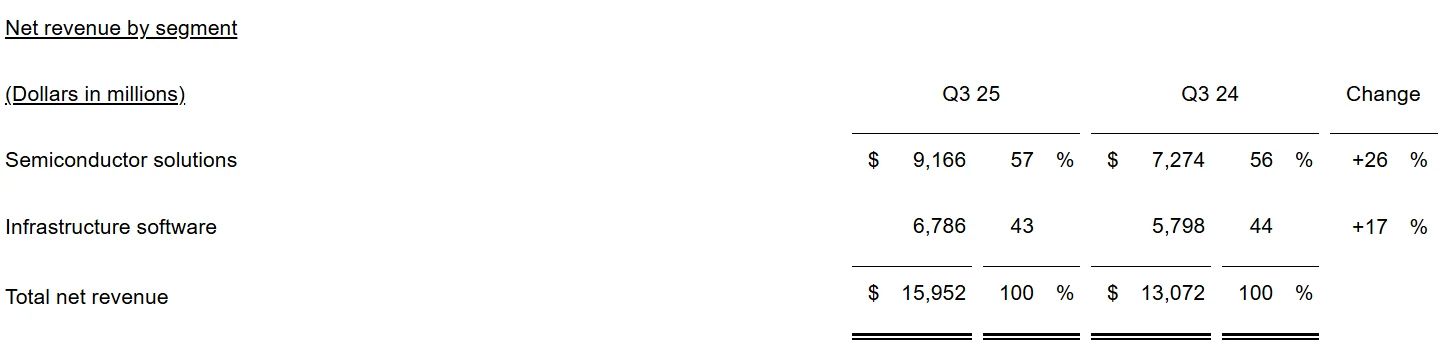

Broadcom's operations are divided into two main segments: Semiconductor Solutions and Infrastructure Software, both of which drove growth in the third quarter.

Source: Broadcom

The Semiconductor segment reported revenue of $9.17 billion, representing 57% year-over-year growth, with AI semiconductor revenue reaching $5.2 billion, exceeding the company's previous guidance of $5.1 billion. This performance was fueled by strong demand for custom AI accelerators (XPUs) and networking products. CEO Hock Tan highlighted that AI revenue has now grown for 11 consecutive quarters and is projected to increase to $6.2 billion in the fourth quarter. XPUs currently account for 65% of AI revenue, and the company has added a fourth customer with production orders exceeding $10 billion, expected to begin delivery in the second half of fiscal 2026. This order has led to an upward revision in the company's AI revenue forecast for 2026, with XPUs projected to represent an even larger share of AI revenue.

Reportedly, OpenAI plans to use these new chips exclusively for internal purposes rather than offering them to external customers, representing a key strategy to meet its substantial computational needs. Through its collaboration with Broadcom, OpenAI has secured advanced manufacturing capacity with TSMC, with production expected to commence in 2026.

This development reflects the intense competition for chip resources amid current computing capacity constraints. With Nvidia's GPUs holding approximately 80% market share, many Silicon Valley giants have been forced to engage in a bidding war for GPUs, driving up costs and prompting more companies to explore alternatives such as custom chips or external solutions.

The Infrastructure Software segment generated revenue of $6.79 billion, up 43% year-over-year, with organic growth of 17%. This performance was supported by the integration of VMware, acquired in 2023, with a focus on deploying VMware Cloud Foundation version 9.0. The company has sold licenses to the top 10,000 enterprise customers and expanded into security and disaster recovery services. The segment's operating margin improved from approximately 30% to 77%, with a customer conversion rate exceeding 90%, laying the foundation for future additional service sales. While non-AI semiconductor recovery follows a U-shaped trajectory, with meaningful improvement not expected until mid-to-late 2026, seasonal growth was observed in broadband, wireless, and server storage sub-segments. The company's order backlog reached a record $110 billion, providing strong visibility.

Networking solutions play a critical role in the expansion of AI data centers. Leveraging its expertise in Ethernet technologies, Broadcom has introduced products such as Tomahawk 6 and Jericho 4, designed to address network bottlenecks in AI clusters. Tomahawk 6 offers 102.4 Tb/s bandwidth, reducing network layers, while Jericho 4 supports cluster connections spanning approximately 100 kilometers. These innovations enable customers to scale to clusters exceeding 100,000 compute nodes, strengthening Broadcom's position in distributed AI infrastructure.

Intensifying Competition with Nvidia

Broadcom's strong emergence in the AI chip market is reshaping the competitive landscape with Nvidia. The two companies employ different technological approaches: Nvidia focuses on general-purpose GPU computing chips, while Broadcom's core strength lies in designing custom ASIC chips for cloud service providers.

These specialized chips are tailored for specific AI inference scenarios, offering unique advantages in energy efficiency and task-specific optimization. GPUs are better suited for large-scale, diverse AI training tasks, whereas ASICs provide greater cost efficiency for fixed-algorithm inference workloads.

Broadcom possesses extensive experience in custom chip design, exemplified by its collaboration with Google on the development of custom TPU AI chips. HSBC analysts project that by 2026, Broadcom's custom chip business growth rate will surpass that of Nvidia's GPU segment.

CEO Hock Tan noted that beyond adding a fourth XPU customer, Broadcom is gradually increasing its share among its existing three XPU clients. By 2026, XPUs are expected to represent a larger proportion of AI revenue, further consolidating the company's leadership in the custom chip market.

Market research indicates that Broadcom and Marvell collectively dominate over 60% of the ASIC market, with Broadcom holding approximately 55-60% and Marvell accounting for 13-15%. Despite Broadcom's strong position in ASICs, its full-year FY2024 AI-related revenue including ASICs reached $12.2 billion, still significantly trailing Nvidia's data center revenue.

Source: Broadcom

Long-term trends show diversification in the AI chip market. DIGITIMES analyst Chen Chenfei projects that between 2023-2028, high-end cloud AI accelerator shipments will demonstrate a compound annual growth rate of 50% for GPUs and 52% for AI ASICs. By 2028, AI ASIC shipments are expected to surpass GPUs, indicating greater growth potential in Broadcom's market segment.

In response to the rise of ASICs, Nvidia is adjusting its strategy. In May, the company launched NVIDIA NVLink Fusion, enabling cloud providers to integrate custom ASICs with NVIDIA's rack-scale systems and end-to-end networking platform to scale AI factories to millions of GPUs. Initial ecosystem partners include MediaTek and Marvell, demonstrating Nvidia's strategic intent to incorporate custom ASICs into its ecosystem.

Broadcom is countering competition through continuous innovation and customer expansion. The company is not only increasing its share among its three major XPU clients but also continuously attracting new customers. Additionally, Broadcom's strength in networking chips provides synergistic support for its AI chip business, with products like Tomahawk 6 addressing network bottlenecks in AI clusters and enhancing overall solution competitiveness.

Jim Awad of Clearstead Advisors noted that investors should prepare for increased competition for Nvidia in this sector, but due to the rapid expansion of the AI market itself, even with some market share loss, companies can maintain stable growth. This perspective reflects industry optimism about overall AI market growth and acceptance of evolving competitive dynamics.

Wall Street Bullish on Broadcom's Prospects

Following Broadcom's better-than-expected earnings report, multiple Wall Street institutions have raised their price targets for the stock. Over the past three months, the average 12-month price target among 26 Wall Street analysts covering Broadcom stands at $375.30, with the highest forecast reaching $400.

Bernstein upgraded Broadcom's price target from $295 to $400 while maintaining its "outperform" rating. The firm noted that despite sluggish recovery in non-AI semiconductor segments, AI semiconductor revenue demonstrated remarkable strength at $5.2 billion, representing 63% year-over-year growth that exceeded expectations.

Susquehanna analyst Christopher Rolland reaffirmed his "buy" rating on the stock with a $400 price target. He believes Broadcom's strategic positioning in AI, particularly after adding a significant new customer, will drive substantial revenue growth in the coming years.

As of Friday's (September 5) market close, Broadcom's stock jumped 9.41% to $334.89, after reaching an intraday peak of $356.24, setting new intraday and closing records. The company's market capitalization reached $1.58 trillion, surpassing energy giant Saudi Aramco.

Source: TradingView

Future Growth Prospects

Broadcom provided optimistic guidance for the fourth quarter of fiscal year 2025, projecting revenue of approximately $17.4 billion, representing 24% year-over-year growth and significantly exceeding market expectations of $17.0 billion. The company anticipates adjusted EBITDA to reach 67% of projected revenue for the quarter.

CEO Hock Tan forecasted that AI business would grow by an additional 60% in 2026, a projection that substantially exceeds the market's general expectation of a significant slowdown in global AI capital expenditure next year. Broadcom has surpassed AMD in AI chip market share, creating further potential for the custom ASIC market.

Source: Broadcom

The company also faces several challenges. Non-AI semiconductor demand recovery remains slow, following a U-shaped trajectory, with meaningful improvement not expected until mid-to-late 2026. The non-AI semiconductor business is projected to achieve low double-digit sequential growth in the fourth quarter, primarily driven by seasonal factors in wireless and server storage segments.

Geopolitical factors and export restrictions may also impact operations. The company needs to continue optimizing its supply chain to address potential policy risks. The integration with VMware will require additional time to realize full synergistic benefits.

Conclusion

Broadcom's stock price has surged more than 45% year-to-date and nearly doubled over the past 12 months, elevating the company's market capitalization to over $1.58 trillion and establishing it as the world's second-largest semiconductor company, trailing only Nvidia.

As AI applications extend from training to inference scenarios, the addressable market for ASIC chips—where Broadcom holds leadership—is expected to continue expanding. The landmark $10 billion order from OpenAI demonstrates that custom chips have become a critical strategic choice for AI giants seeking to reduce their reliance on Nvidia.

The AI chip market is likely evolving beyond Nvidia's dominant position toward a diversified landscape where GPUs and ASICs coexist long-term. Leveraging its strong technological capabilities, stable customer relationships, and unique business model, Broadcom is carving out a distinct successful path in the AI chip sector that differs from Nvidia's approach. For investors, Broadcom represents a compelling investment opportunity in AI infrastructure—benefiting from both the rapid growth of the AI industry and the company's solid financial foundation with clear growth trajectory.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates