Market Update: U.S. Nonfarm Payrolls Annual Report and CPI Data Release; Newly Adjusted Tariffs Take Effect; Apple Fall Event Set to Commence

23:16 September 7, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

U.S. Nonfarm Payrolls Benchmark Revision May Cut 804,000 Jobs

The U.S. Bureau of Labor Statistics (BLS) will release the annual benchmark revision for nonfarm payrolls on September 9, which will adjust the total nonfarm employment figures for the period from April 2024 to March 2025.

U.S. Treasury Secretary Besant, in an interview with NBC News, indicated that the upcoming benchmark revision could downwardly revise as many as 804,000 jobs. Additionally, Nomura Securities anticipates a significant downward adjustment in the range of 600,000 to 900,000 jobs, implying a reduction in monthly job growth by 50,000 to 75,000 positions.

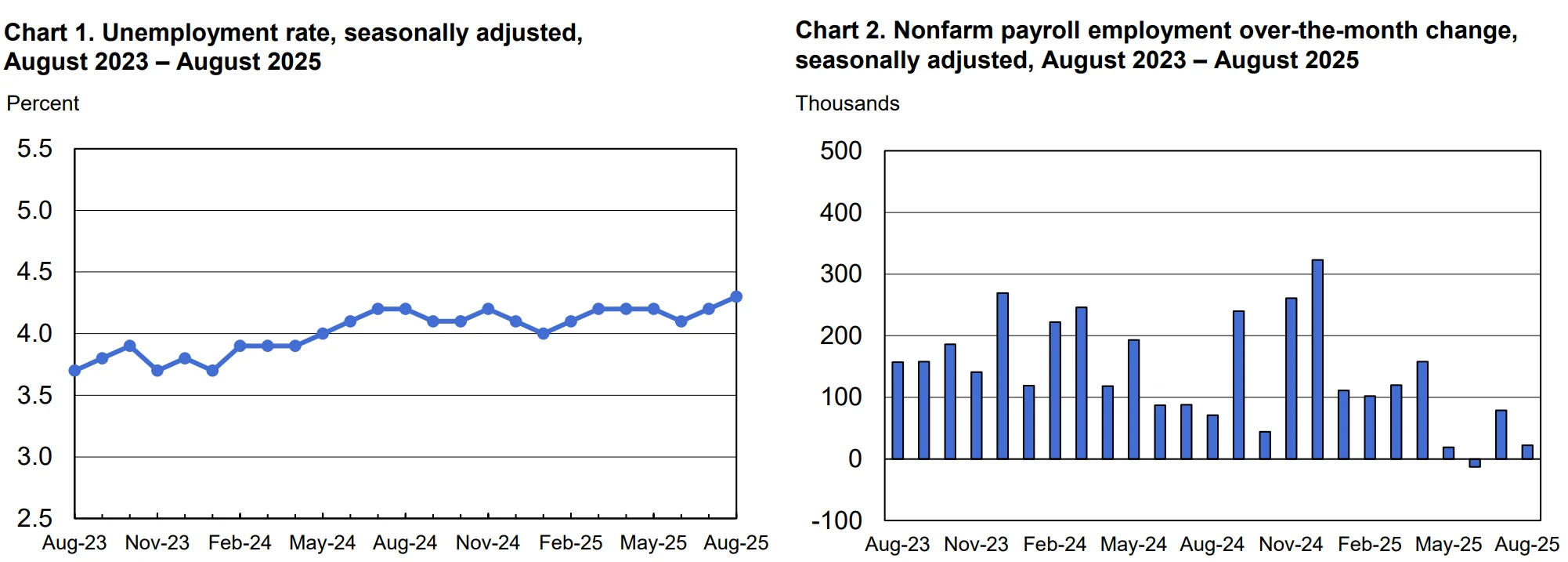

The August nonfarm payrolls report, released on September 5, showed an increase of only 22,000 jobs, marking one of the weakest monthly gains since late 2021. The unemployment rate rose to 4.3%, a nearly four-year high.

Source: U.S. Bureau of Labor Statistics

Key Inflation Data Ahead of Fed September Meeting

Before the Federal Reserve enters its blackout period for the September policy meeting, the August CPI and PPI reports will serve as critical inputs for determining its policy direction.

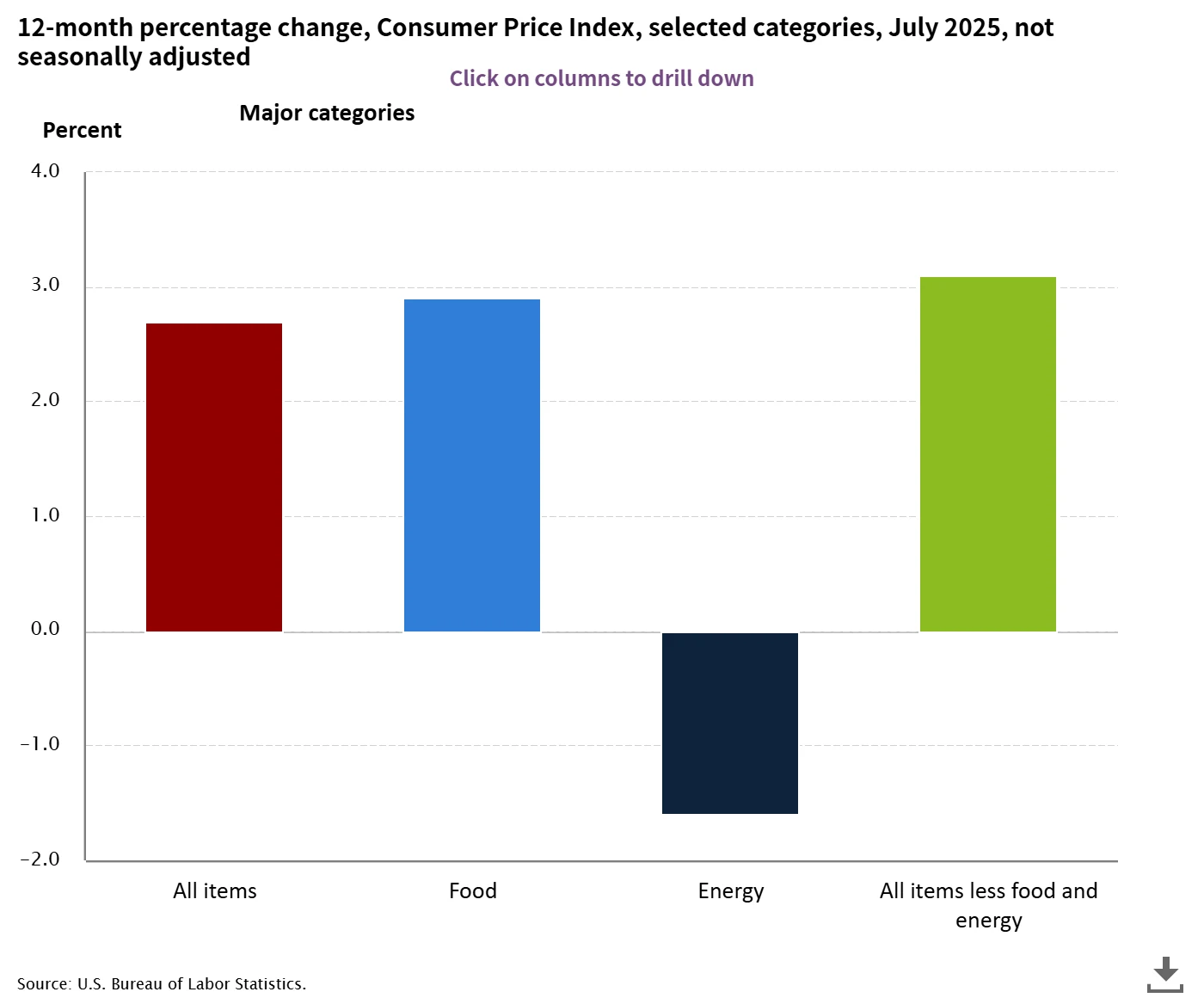

The August CPI report, scheduled for release on September 11, is widely expected to show headline CPI year-over-year growth accelerating to 2.9% from 2.7%, with monthly growth rising from 0.2% to 0.3%. Core CPI is projected to remain unchanged at 0.3% monthly and 3.1% annually.

Source: U.S. Bureau of Labor Statistics

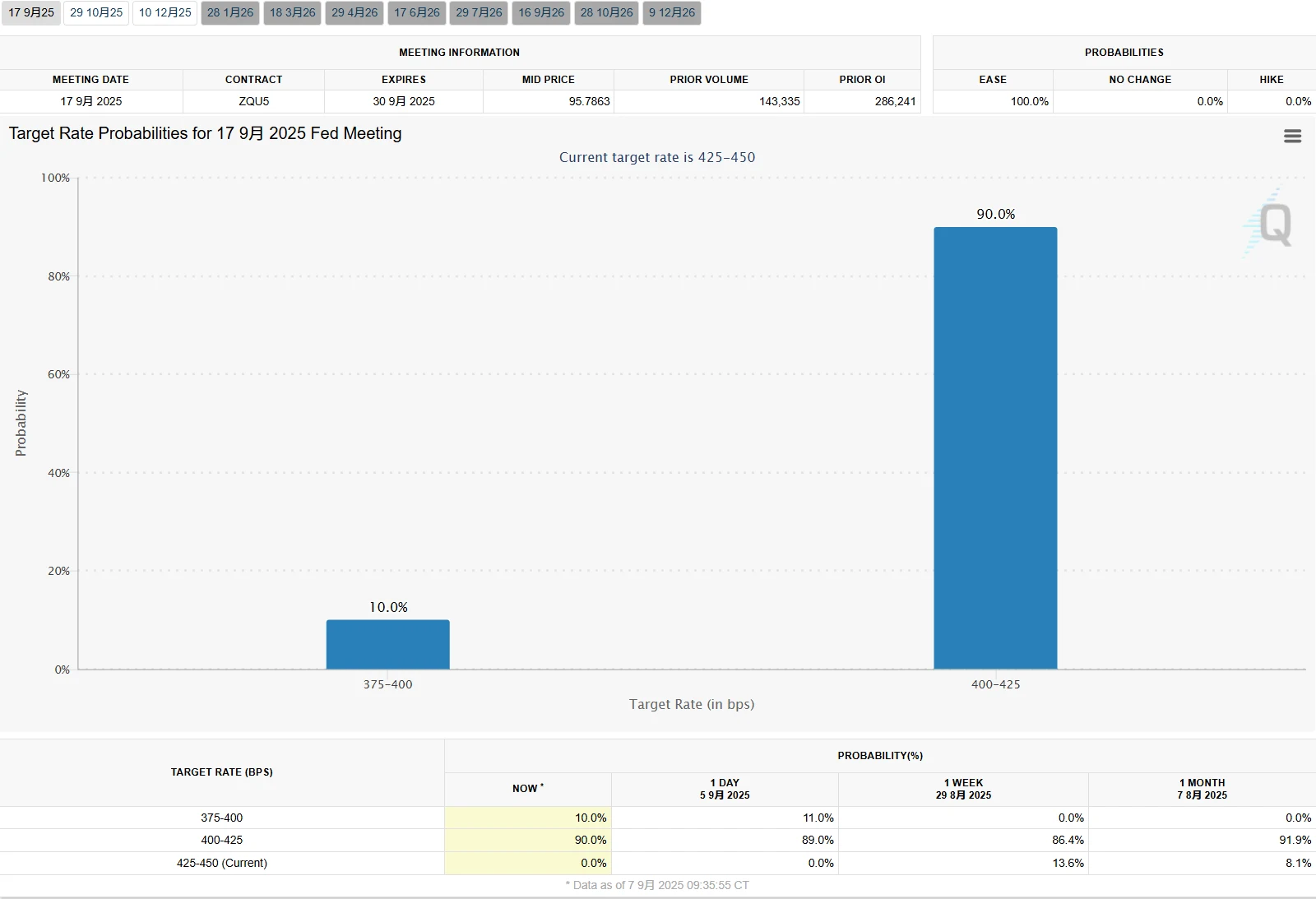

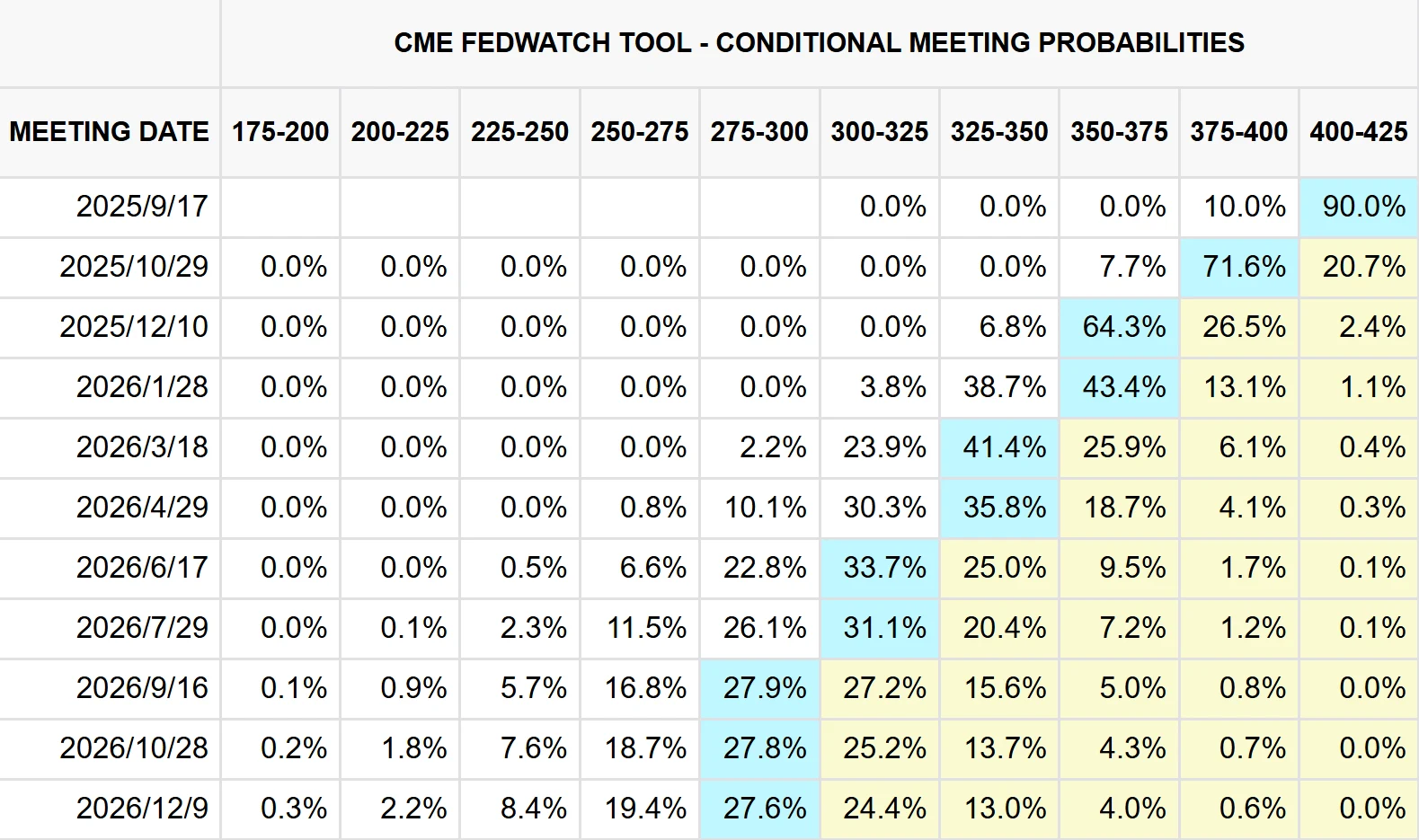

Markets are broadly pricing in a Fed rate cut in September. If the August CPI and PPI data show moderating price pressures, it could reinforce expectations for a series of subsequent cuts. Conversely, higher-than-expected inflation could lead markets to anticipate a more gradual easing cycle.

Source: CME Group

New U.S. Tariff Adjustments Take Effect Monday

On September 5, 2025, U.S. President Trump signed an executive order significantly adjusting import tariffs. The order exempts metal products such as graphite, tungsten, uranium, and gold bars from the global country-specific tariff system, while adding silicone products to the list and expanding tariffs on resins and aluminum hydroxide. These changes took effect on Monday.

Additionally, tariff reductions were granted for aircraft parts, generic drugs, and products not grown, mined, or naturally produced in the U.S., such as specialty spices and coffee. The White House stated that the move aims to address a previously declared "national emergency" and advance trade framework agreements with economies including the EU, Japan, and South Korea.

Japanese Prime Minister Shigeru Ishiba Resigns

On September 7, Japanese Prime Minister and ruling Liberal Democratic Party (LDP) leader Shigeru Ishiba announced his resignation at a press conference held at the Prime Minister’s Office.

Ishiba, elected LDP leader in September last year, was originally set to serve until September 2027. However, the ruling coalition of the LDP and Komeito lost its majority in the House of Representatives election in October last year and again failed to secure a majority in July’s House of Councillors election. This marks the first time since the LDP’s founding in 1955 that it has failed to hold a majority in both chambers of the Diet.

Ishiba stated at the press conference that he takes responsibility for the LDP’s defeat in the July election and that the response to U.S. tariff measures has been concluded. "I believe the timing is appropriate to hand over responsibility to a successor. Until a new leader is elected, I will steadfastly fulfill my duties to the nation." He also confirmed he would not run in the next LDP leadership election.

Several LDP figures are seen as potential candidates, including former Minister of Economic Security Sanae Takaichi, Agriculture Minister Shinjiro Koizumi, former Economic Security Minister Takayuki Kobayashi, and Chief Cabinet Secretary Yoshimasa Hayashi.

Concerns over political uncertainty have triggered selling in the yen and Japanese government bonds this week, with the 30-year bond yield hitting a record high on Wednesday.

Source: TradingView

OPEC+ Members Agree to Increase Oil Output by 137,000 b/d in October

On September 7, eight OPEC+ member countries held an online meeting and agreed to increase oil production by 137,000 barrels per day (b/d) starting in October.

OPEC+ stated in a release that, given stable global economic prospects and healthy market fundamentals reflected in low crude inventory levels, the eight countries decided to adjust production by 137,000 b/d from the additional voluntary cuts of 1.65 million b/d announced in April 2023. This increase signals the start of a gradual phase-out of the 1.66 million b/d cuts originally scheduled to remain in place until the end of 2026.

Saudi Arabia and Russia will account for the largest shares of the increase, each adding 42,000 b/d. This increment is significantly smaller than the monthly increases of approximately 555,000 b/d in September and August, and 411,000 b/d in July and June. OPEC+ also noted that the 1.65 million b/d cuts could be partially or fully reinstated depending on market conditions, with any adjustments implemented gradually. Member countries will continue to closely monitor and assess market developments.

The core objective of this production increase is to regain market share. Although most member countries are nearing full production capacity, and actual output increases may fall short of committed levels, the move sends a clear signal that OPEC+ prioritizes market share.

Apple Fall Event Held

Apple’s highly anticipated fall event, themed "Awe Dropping," is scheduled for September 9 at the Steve Jobs Theater in Apple Park, Cupertino.

Source: Apple

The event is expected to feature multiple new products, including smartphones, smartwatches, and earphones. The iPhone 17 series will be the center of attention, with four models: iPhone 17, iPhone 17 Air, iPhone 17 Pro, and iPhone 17 Pro Max. Additionally, the Apple Watch Series 11, Apple Watch Ultra 3, AirPods Pro 3, along with potential releases of AirTag 2 and a second-generation HomePod mini, are anticipated.

Wall Street firms highlight the event’s focus on product line adjustments and pricing strategies. JPMorgan predicts that starting prices for non-Pro models will remain unchanged. The iPhone 17 Pro is expected to eliminate the 128GB entry-level storage option, starting at 256GB with a price increase from $999 to $1,099, reflecting an "implicit" price hike strategy to boost average selling prices for premium models. The new iPhone 17 Air is projected to start at $899–$949. If priced near $800, making it eligible for subsidies in China, it could significantly boost sales in that market. Goldman Sachs also suggests Apple may adopt "implicit" price increases, with starting prices for the base iPhone 17 and Pro Max models expected to remain unchanged.

Goldman Sachs remains optimistic about the iPhone 17 series, expecting major updates and strategic pricing to stimulate upgrade demand, driving iPhone revenue growth to 5% year-over-year in FY2025 and accelerating to 7% in FY2026. However, BofA Securities analysts caution that Apple’s stock may face short-term pressure post-event, as historical trends show declines immediately after product launches, followed by a recovery within 30 to 60 days.

Market Recap

The U.S. stock market showed a volatile trend over the past week, with the three major indices posting mixed results. The Dow Jones Industrial Average fell 0.32% weekly, while the S&P 500 and Nasdaq Composite rose 0.33% and 1.14%, respectively.

Source: TradingView

The weaker-than-expected August Nonfarm Payrolls (NFP) report released last Friday heightened concerns about an economic slowdown. The report showed only 22,000 jobs added, significantly below the expected 75,000, while the unemployment rate climbed to 4.3%, the highest level since 2021. This led to lowered profit expectations for companies, prompting investors to sell equities and causing all three major indices to open higher but close lower.

However, the soft NFP data strengthened market expectations for Federal Reserve rate cuts. Traders are now pricing in a 10% probability of a 50-basis-point cut in September, with over a 60% chance of three rate cuts by year-end. These expectations triggered significant market volatility, shifting capital allocation toward risk assets and influencing broader market and individual stock movements.

Source: CME Group

Individual stocks showed divergent performances.

Tesla’s performance was volatile, falling 3.50% on September 1 but gaining 3.64% on September 5, with a trading volume of $37.903 billion. Additionally, on September 5, Tesla’s board proposed a new compensation plan for CEO Elon Musk, which could grant him up to $1 trillion over the next decade if he achieves a series of ambitious goals, including increasing Tesla’s market capitalization from its current $1 trillion to at least $8.5 trillion.

Source: TradingView

Notably, on September 7, Tesla launched an official Weibo account named "TeslaAI," verified as its official platform. The account’s bio states that it will focus on introducing Tesla’s AI products, including humanoid robots, assisted driving technology, Robotaxi autonomous ride-hailing services, and the Coetex computing cluster.

So far, the "TeslaAI" account has posted one update featuring the Optimus Gen 3 humanoid robot, captioned, "I’ve been working hard to improve my physique." The image shows a robot with a Tesla logo and a light gold/black color scheme. Later that evening, Tesla’s main Weibo account reposted the content with the caption, "Accelerating evolution."

Nvidia faced a downward trend throughout the week, declining 3.32% on September 1 and 2.70% on September 5. Goldman Sachs warned of potential risks in AI-related stocks, noting that an eventual slowdown in capital expenditure growth could pressure valuations.

Source: TradingView

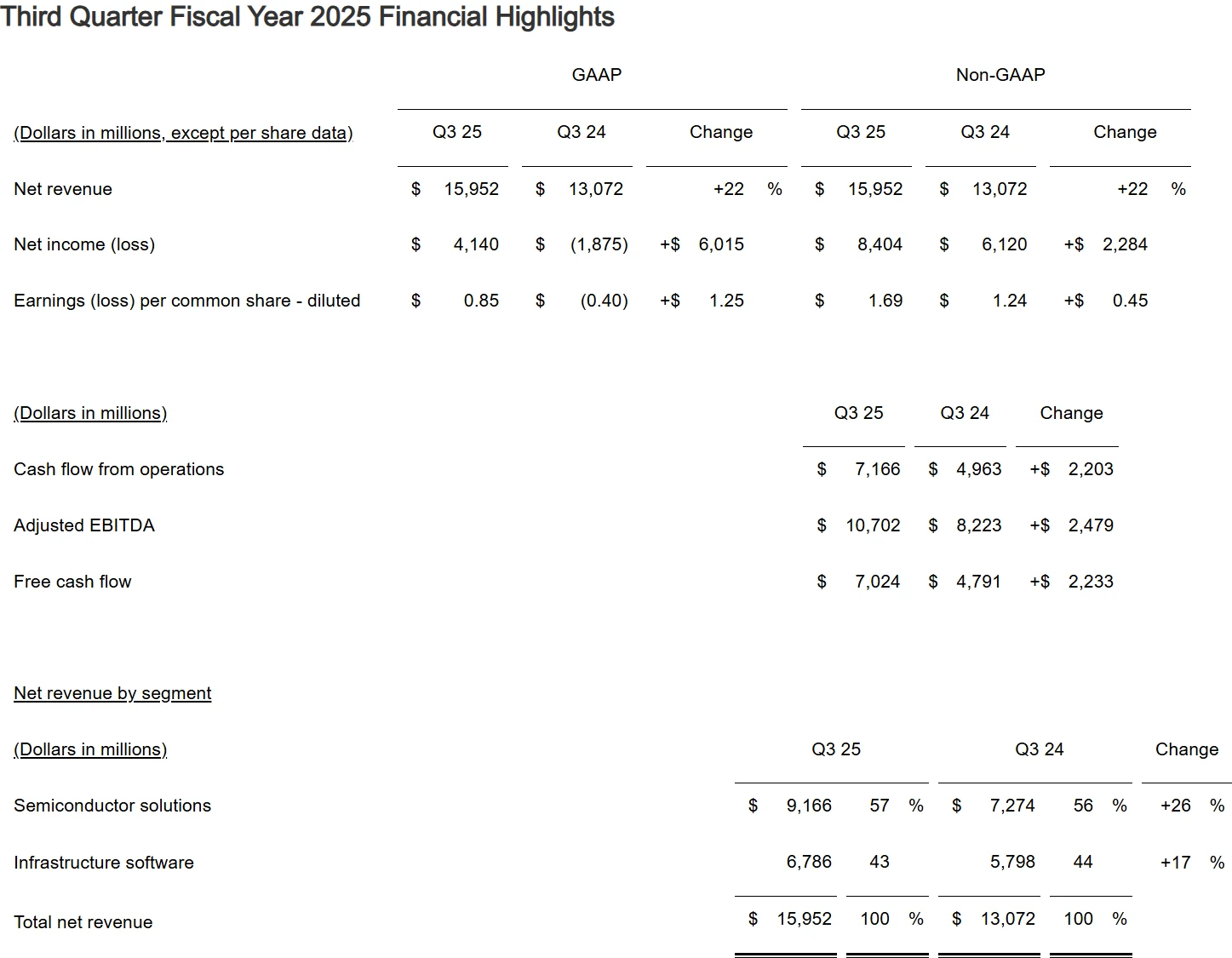

Broadcom saw a significant surge on September 5, jumping 9.41% with a trading volume of $26.52 billion, marking its largest gain since April.

Source: TradingView

The company reported better-than-expected earnings for fiscal Q3 2025 and secured large orders from new customers. Following the earnings release, several investment firms raised their price targets for Broadcom. Goldman Sachs maintained a "Buy" rating with a $340 target, Evercore ISI increased its target to $342, and Cantor Fitzgerald raised its target to $350.

Source: Broadcom

AMD declined for the fifth consecutive trading session, falling 6.58% on September 5 and hitting its lowest level since July 22. The slump was attributed to a downgraded stock rating, weak demand for AI accelerators, and export restrictions.

Source: TradingView

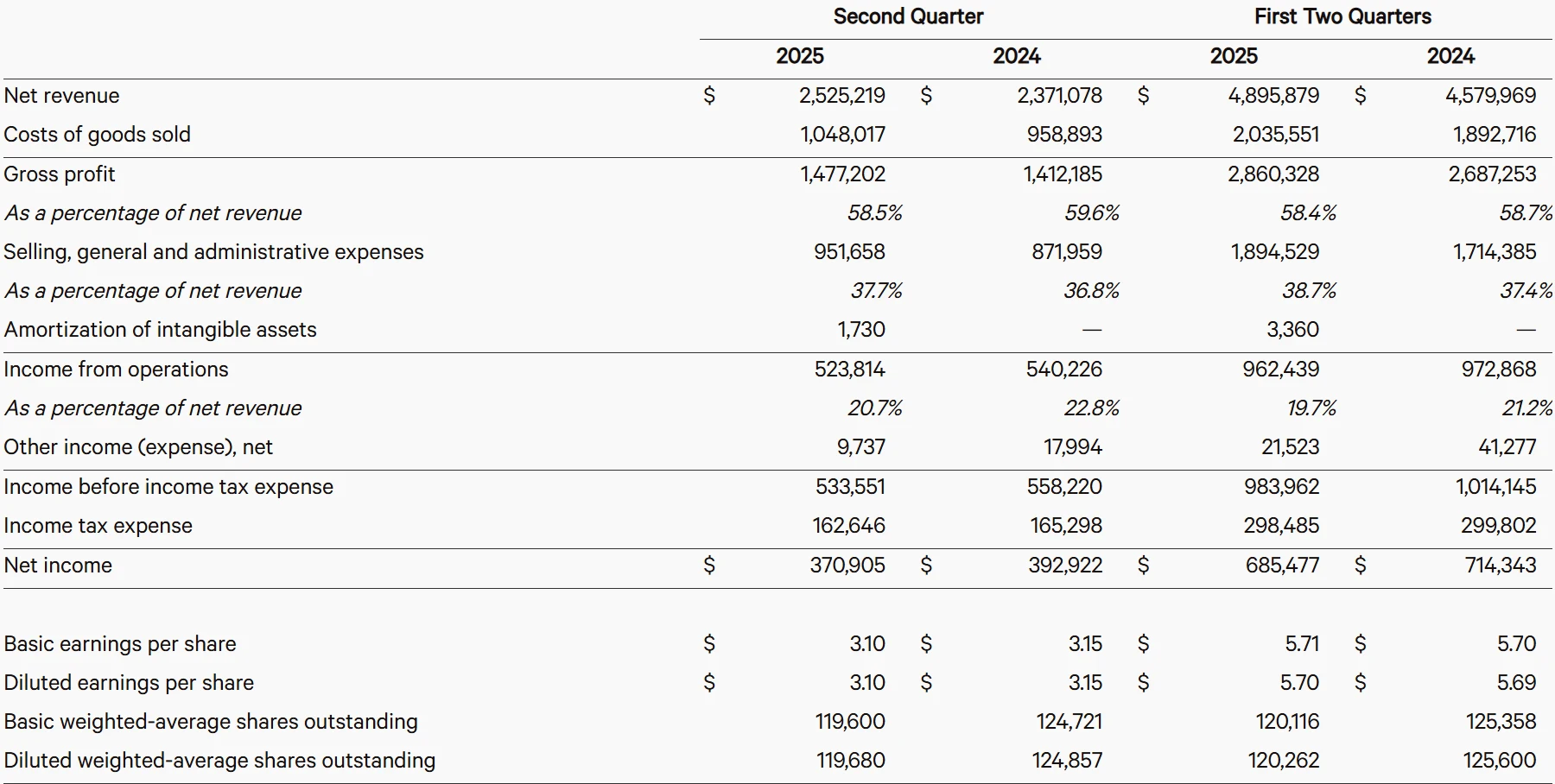

Lululemon plunged nearly 19% on Friday after reporting its Q2 earnings. Although the company’s profit significantly exceeded expectations, its revenue fell slightly short, and it lowered its full-year guidance for the second consecutive time.

Source: TradingView

According to FactSet data, Lululemon’s Q2 EPS was $3.10, well above analysts’ expectations of $2.86. Revenue increased 7% year-over-year to $2.53 billion but slightly missed the consensus estimate of $2.54 billion. Comparable store sales grew only 1%, significantly below the expected 3.7%.

Source: Lululemon

The company’s core North American business continued to face challenges, with Q2 comparable store sales in the Americas declining 4%. Management attributed the softness to overall slowing growth in the athleisure wear sector and increased competition eroding market share.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates