Collaboration, M&A, and Platformization: BioNTech's "De-Single Track"

16:32 September 6, 2025 EDT

Business Strategy and Outlook

Founded in 2008 and headquartered in Germany, BioNTech has become a key player in the development of personalized mRNA cancer therapies. The emerging biotech company's first commercial vaccine for COVID-19 was licensed in December 2020. Its early-stage pipeline and mRNA technology platform have attracted the attention of several major pharmaceutical companies, leading to collaborations. BioNTech has also used profits from its COVID-19 vaccine to acquire a more diversified pipeline of oncology biologic drug candidates, which could potentially be marketed starting in 2026.

BioNTech's internal discovery platform focuses on mRNA, including both off-the-shelf and personalized mRNA medicines, but opportunistic acquisitions have also yielded targeted antibodies and cell therapies. Consequently, BioNTech's pipeline is not overly reliant on any single key candidate or drug class, but rather aims to address cancer through a variety of different mechanisms. Its most significant pipeline asset is BNT327, a bispecific antibody targeting PD-L1 and VEGF, initially licensed from Biotheus in October 2023. In June 2025, Bristol-Myers Squibb agreed to pay BioNTech $2 billion in non-contingent payments and up to $7.6 billion in milestone payments for the 50/50 partnership. We believe BNT327 could significantly improve current treatments for certain tumor types. We also highlight BNT323, a HER2-targeting antibody-drug conjugate licensed from DualityBio, which could be submitted for approval in second-line endometrial cancer in late 2025 or early 2026.

BioNTech's flagship product is Comirnaty, the leading COVID-19 vaccine on the market and one of the first two approved mRNA vaccines. Developed in conjunction with Pfizer, Comirnaty is expected to generate approximately $5 billion in annual revenue in 2024 (BioNTech contributes half of Pfizer's gross profit, profit sharing from other smaller partners, and direct sales in Germany and Turkey). We assume that high-risk individuals will receive seasonal boosters annually, and BioNTech/Pfizer and Moderna will continue to dominate the market.

Financial strength

Like most of its emerging biotech peers, BioNTech has historically spent heavily to fund the research and development of its pipeline. The company carries minimal debt on its balance sheet as it funds its R&D efforts through equity issuance and collaboration payments from large pharmaceutical companies. BioNTech's financial health is further protected by the significant cash inflow from Comirnaty's gross profit in 2021-22. In addition to BioNTech's COVID-19 vaccine candidate, we believe BNT323 could be approved as early as 2026. Management has seized multiple opportunities to acquire early-stage assets and expand its geographic reach, establishing research centers in the United States at low cost. We expect the focus of capital allocation in the near term to remain on the R&D of vaccines and other therapeutics.

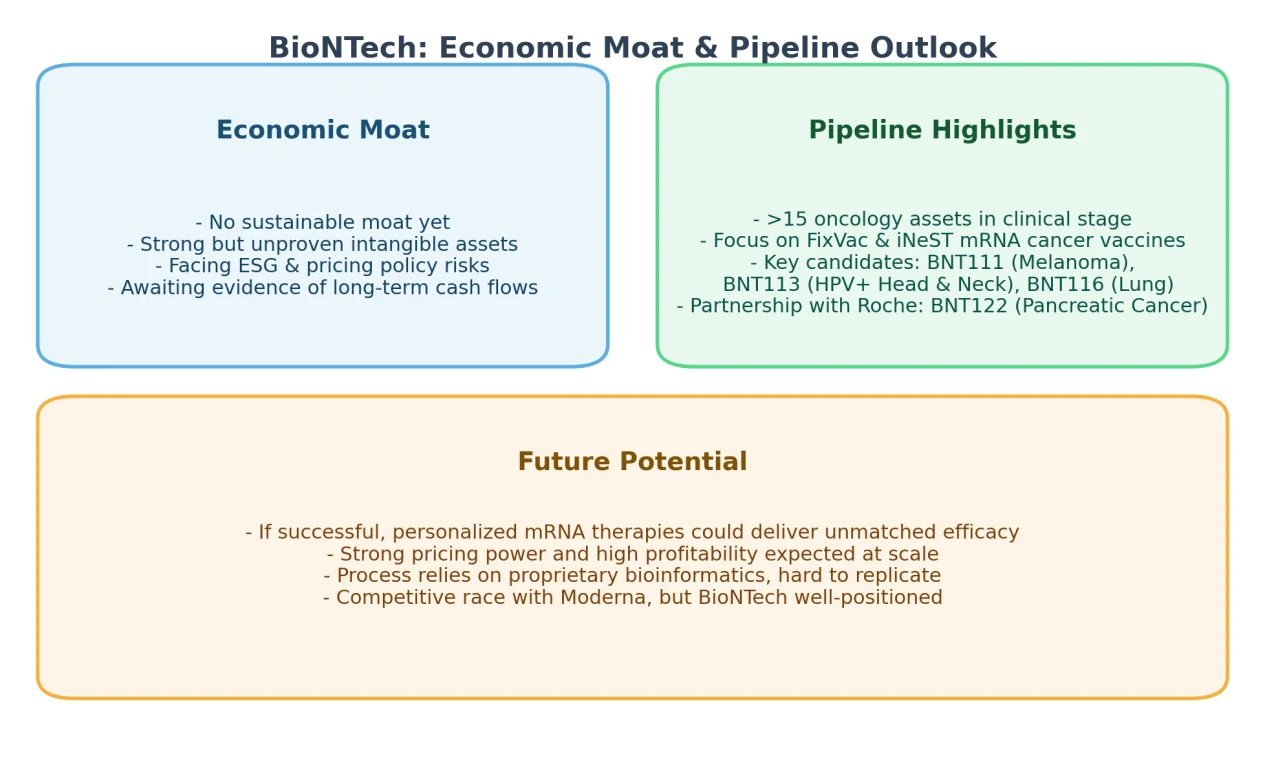

Economic moat

We believe that BioNTech, as an emerging biotech company, does not possess an economic moat. We believe the company has a strong but unproven portfolio of intangible assets and is in the mid-stage of development, resulting in significant uncertainty regarding approval. Both BioNTech and mRNA competitor Moderna spent approximately a decade honing their understanding of mRNA therapeutics, with their drug candidates only entering clinical trials in the past few years. We like BioNTech's focus on indications and drug categories worthy of an economic moat, and Comirnaty's regulatory approval is also a positive sign, but we are looking for evidence of long-term cash flow potential before assigning the company an economic moat. We believe the company does face environmental, social, and government risks, particularly related to potential US drug pricing policy reforms and ongoing product governance issues, including litigation. While we factor these threats into our analysis, we do not believe they are material to our valuation or economic moat rating.

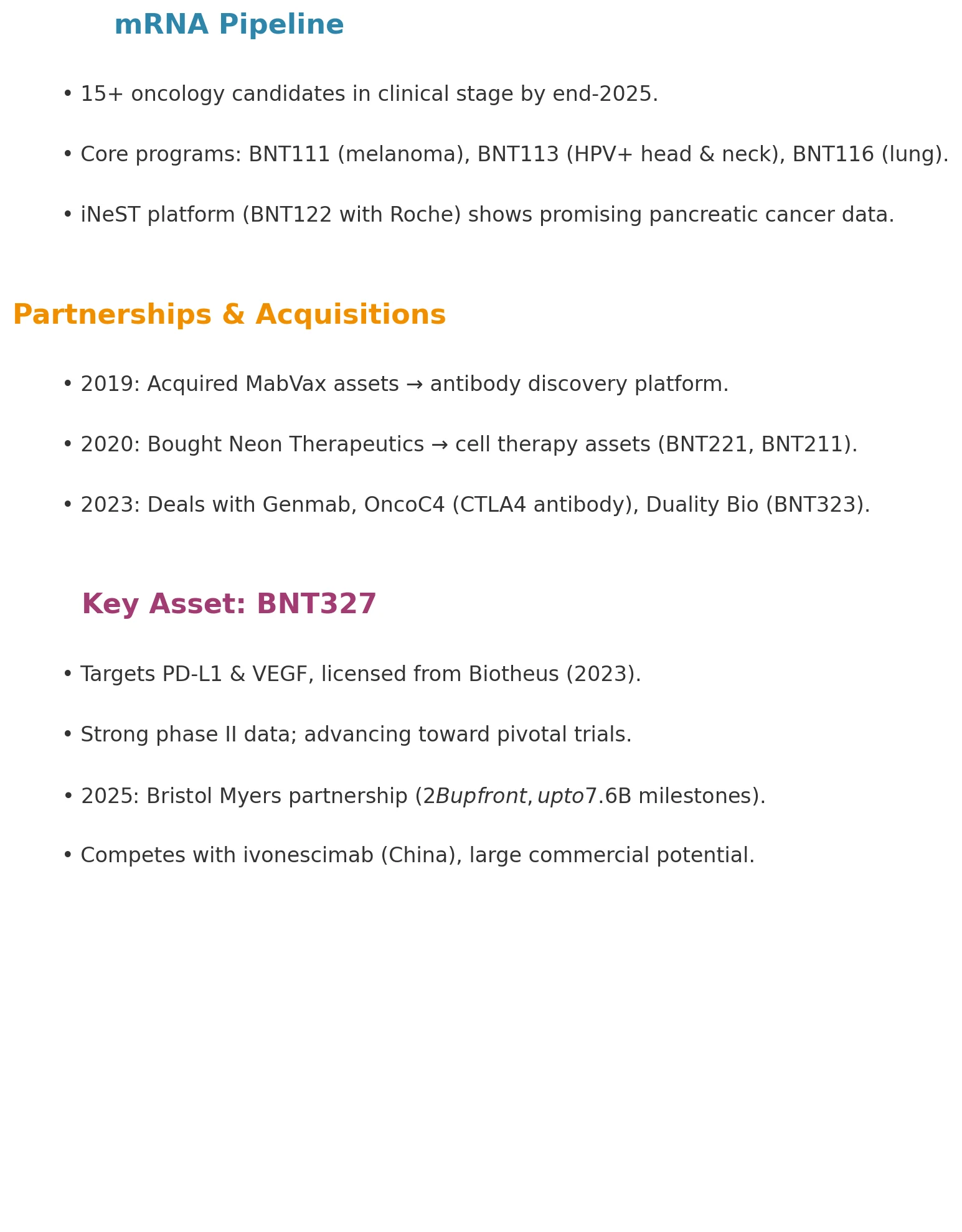

BioNTech has a very comprehensive, albeit early-stage, pipeline, with over 15 clinical-stage oncology drug candidates as of December 2025. Personalized and off-the-shelf cancer vaccines are the focus of BioNTech's internal R&D pipeline, but the pipeline also includes a growing portfolio of acquired therapies for mid- to late-stage cancers.

In addition to COVID-19, we see several oncology mRNA drug candidates forming the core of the company's product portfolio, including the off-the-shelf products BNT111 (advanced melanoma), BNT113 (HPV-positive head and neck cancer), and BNT116 (lung cancer). Of these, BNT111 and BNT113 are in the lead, as Phase II studies were initiated in mid-2021 after encouraging early results. These mRNA-based therapies are produced using BioNTech's FixVac technology, which produces off-the-shelf mRNA therapies based on shared antigens, and the iNeST platform, which produces personalized therapies based on a patient's individual neoantigens. The company's leading iNeST drug candidate is RO7198457 (or BNT122), which is in collaboration with Roche and in combination with Roche's Tecentriq for the treatment of pancreatic cancer, with encouraging preliminary data. BioNTech also uses its mRNA technology to encode cytokines (ribocytokine programs BNT 152/BNT 153 are in Phase 1 for solid tumors) and antibodies (BioNTech's RiboMAb BNT 142 is in Phase 1 for solid tumors).

Although the field is still in its infancy, we believe that if clinically successful, the development of personalized cancer immunotherapies represents a highly promising industry. The personalized nature of these drugs will result in unparalleled efficacy and significant pricing power in the market. Despite the high cost of producing personalized medicines, we expect personalized cancer vaccines to become high-margin products as the business scales up. Furthermore, we anticipate that competitors will find this business difficult to replicate. The process relies heavily on bioinformatics. Researchers use proprietary programs to analyze a patient's DNA, identify the patient's unique cancer-causing mutations, and determine which genetic instructions are capable of generating an immune response effective enough to attack cancer cells. Researchers can then design mRNA encoding these unique mutations, thereby producing a personalized cancer vaccine tailored to that patient. BioNTech's lead time from initiation to delivery is four to six weeks. Competitor Moderna is also developing personalized mRNA cancer vaccines and has set similar production targets.

While most of BioNTech's assets were developed internally, the company has also expanded its portfolio through several opportunistic acquisitions of struggling biotech companies and new collaborations. In May 2019, BioNTech acquired the assets and laboratories of MabVax, adding BNT321, a targeted antibody for pancreatic cancer currently in Phase I clinical trials. Pancreatic cancer is extremely aggressive and deadly, with a five-year survival rate of only 7%. In addition to establishing a US research center, the deal also provided an antibody discovery platform that complements the company's existing RNA platform. Subsequently, BioNTech acquired the troubled biotech company Neon Therapeutics for $67 million in early 2020, acquiring the cell therapy BNT 221, which complements BioNTech's internal CAR-T cell program BNT 211. A collaboration with Genmab also resulted in four bispecific antibody programs entering development. In 2023, BioNTech executed several transactions aimed at building a more advanced oncology pipeline beyond mRNA. The collaboration, through OncoC4's global license, includes rights to the CTLA4 antibody gotistobart, currently in Phase 3 development for the treatment of lung cancer. The two companies hope the drug will offer a better safety profile than Bristol's Yervoy, allowing for higher doses and longer dosing. BioNTech's collaboration with Duality Bio also advanced BNT 323 into pivotal trials in endometrial and breast cancer.

The most noteworthy immuno-oncology antibody under development is BNT327, a bispecific molecule targeting PD-L1 and VEGF. Licensed from BioNTech in October 2023, the drug has generated compelling Phase II clinical trial data and is currently approaching pivotal trials. In June 2025, Bristol-Myers Squibb agreed to pay BioNTech $2 billion in non-contingent payments and up to $7.6 billion in milestone payments as part of a 50/50 partnership. Currently, the most established bispecific antibody targeting the PD-(L)1 and VEGF pathways is ivonescimab, which inhibits both PD-1 and VEGF. Phase III clinical trial data from ivonescimab in China suggest that this novel bispecific strategy may outperform existing standard-of-care treatments in multiple indications, including non-small cell lung cancer. Although BNT327's development timeline lags behind ivonescimab, given the significant market potential of this bispecific strategy, we believe BNT327 will have competitive potential if both drugs are ultimately approved.

Expanding beyond mRNA into attractive drug classes: As BioNTech expands beyond its established areas of expertise, it is also acquiring talent in new areas and potentially enhancing its long-term growth potential. We are optimistic about the long-term potential of BioNTech's innovation and drug class portfolio, such as combining CAR-T cell therapy with its CAR-T cell expansion mRNA therapy (CARVac) for solid tumors and adding BNT211.

While oncology remains at the core of BioNTech's R&D pipeline, BioNTech's expertise in mRNA lends itself well to developing vaccines against viral infections, including COVID-19. The company's COVID-19 program builds on its existing partnership with Pfizer, which paid BioNTech $120 million upfront in 2018 to develop a flu vaccine (BNT161) that is more reliable and faster to produce than most current vaccines. Most current flu vaccines are produced in eggs or cell cultures, which takes about six months and requires the World Health Organization to select inactivated flu strains for the vaccine long before the flu season.

BioNTech's approach can be manufactured in approximately three months, which could improve the reliability of influenza strain selection and allow adjustments as the flu season progresses, while the mRNA-based process can limit mutations. While mRNA-based vaccine platforms hold great promise, we believe the current U.S. Food and Drug Administration (FDA) is taking a conservative approach to this approach and vaccines in general, a stance reflected in our forecasts.

Overall, we believe the company has several promising drug candidates that could bolster its moat in the future, but they are still in the early stages of development and insufficient to support its narrow moat. We currently estimate the probability of approval for the company's clinical drug candidates to be between 10% and 60%, with the majority of these therapies expected to be launched between 2026 and 2028.

Fair value and profit drivers

We lower our fair value estimate from $126/ADR to $100/ADR due to lower assumptions for Corminaty and flu vaccine revenues.

We estimate BioNTech's COVID-19 vaccine revenue to reach €1.6 billion in 2025, with sales remaining roughly flat thereafter as vulnerable populations (primarily the elderly, but also high-risk groups) continue to receive COVID-19 vaccines. Due to safety concerns surrounding combination vaccines, we no longer assume Pfizer/BioNTech will be able to launch a differentiated COVID-19/flu vaccine, which we previously believed could help boost COVID-19 vaccination rates.

The most important cancer antibody in development is BNT327 (a bispecific antibody to PD-L1 and VEGF), which will contribute approximately €1.8 billion in risk-adjusted revenue to our 2034 forecast. This pipeline asset has the potential to be broadly applicable across multiple cancer indications where PD-(L)1 blockade has been successful, with potential for expansion into additional indications.

We assume a probability-adjusted contribution of around €900 million by 2034 from its iNeST (personalized cancer vaccines) and FixVac (off-the-shelf cancer vaccines) programs.

We expect R&D costs to continue to rise as assets advance into late-stage trials, although these costs will be mitigated through cost-sharing partnerships. We also expect selling, general, and administrative costs to continue to rise as drug candidates approach commercialization.

We assume a cost of capital of 9%.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates