Galaxy Digital: Leveraging AI for Crypto Gaming

16:05 September 6, 2025 EDT

Key Points :

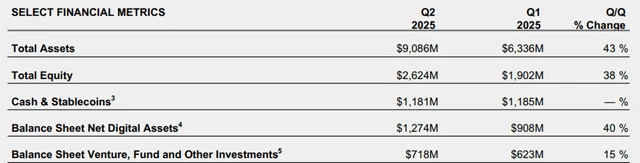

GLXY's core businesses encompass digital assets (investment banking, trading, asset management, and staking services), enterprise investments, and its ongoing AI data center transformation. Strong overall earnings performance in the second quarter was primarily driven by the appreciation of digital assets and the better-than-expected performance of its global markets business .

While the project's potential returns are attractive, the company faces significant risks, including high financing pressures, reliance on a single tenant, CoreWeave, and the company's lack of experience in data center construction .

Although GLXY's earnings are volatile and its balance sheet is heavily reliant on crypto assets, for investors willing to bear execution risk, the potential of AI data centers is sufficient to offset these uncertainties, making GLXY worth paying attention to.

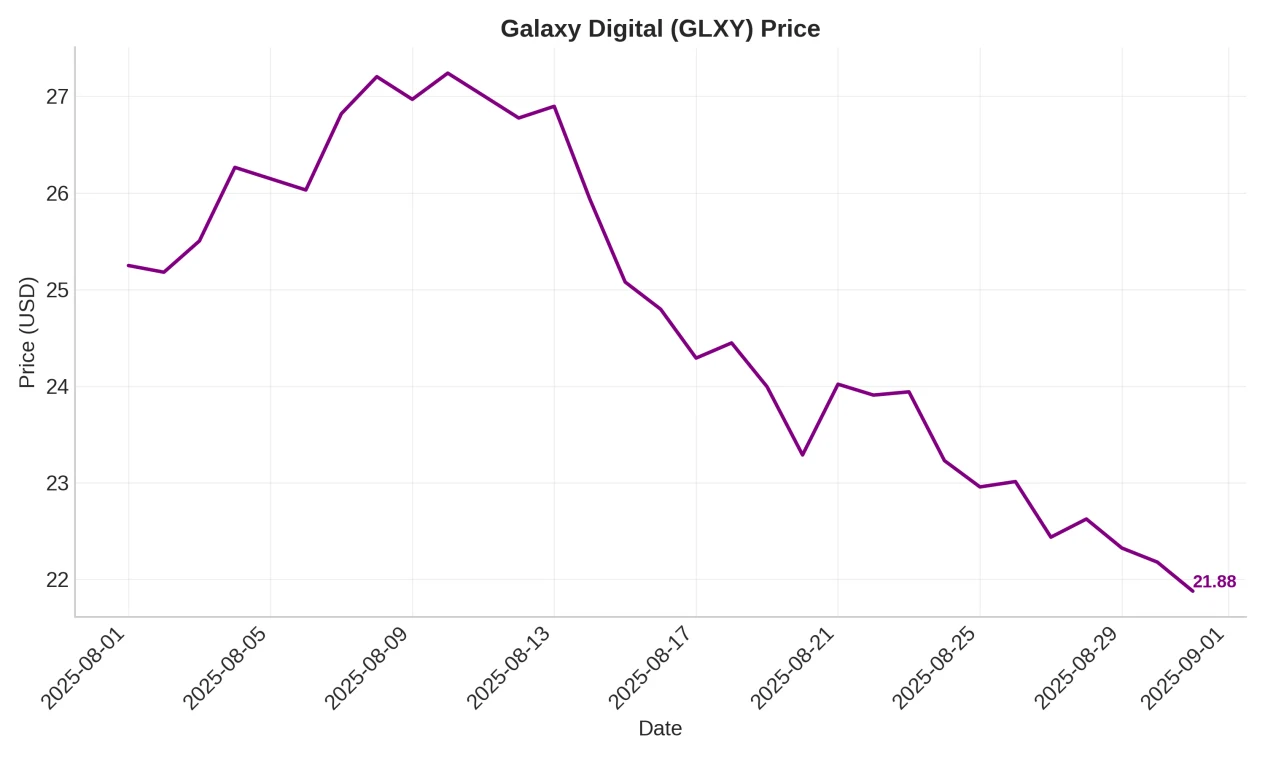

Galaxy Digital, one of the more diversified cryptocurrency groups, has consistently achieved milestones since its reverse takeover by founder and CEO Michael Novogratz in 2018. Recent developments include its Nasdaq listing earlier this year (GLXY is also available through over-the-counter trading and in Canada) and the establishment of a data center hub at the Helios facility in West Texas. These two factors have combined to support GLXY's strong triple-digit growth over the past year.

Currently, GLXY's core business segment is "Digital Assets," which encompasses Global Markets (investment banking, trading, and prime brokerage) and Asset Management & Infrastructure (exchange-traded funds, alternative investments, and collateral services). Additionally, GLXY's core business segment is "Finance & Corporate," which encompasses its on-balance sheet digital asset holdings and investments. Depending on the broader cryptocurrency cycle, Finance & Corporate can fluctuate between being primarily positive (upcycle) or negative (downcycle) profit and loss drivers.

Source: Galaxy Digital

Last but not least, data centers are where GLXY has placed its AI data center business (a repurposed Bitcoin mining operation). While this is a potential "crown jewel" asset, it isn't expected to generate revenue until the "first half of 2026." However, if GLXY can deliver on its data center promise, the stock is poised to benefit from two of today's hottest trends: digital assets and artificial intelligence. Despite a very solid second-quarter earnings report, GLXY's stock price has retreated from its July highs, making it worth keeping a close eye on.

Digital assets saw strong second quarter performance

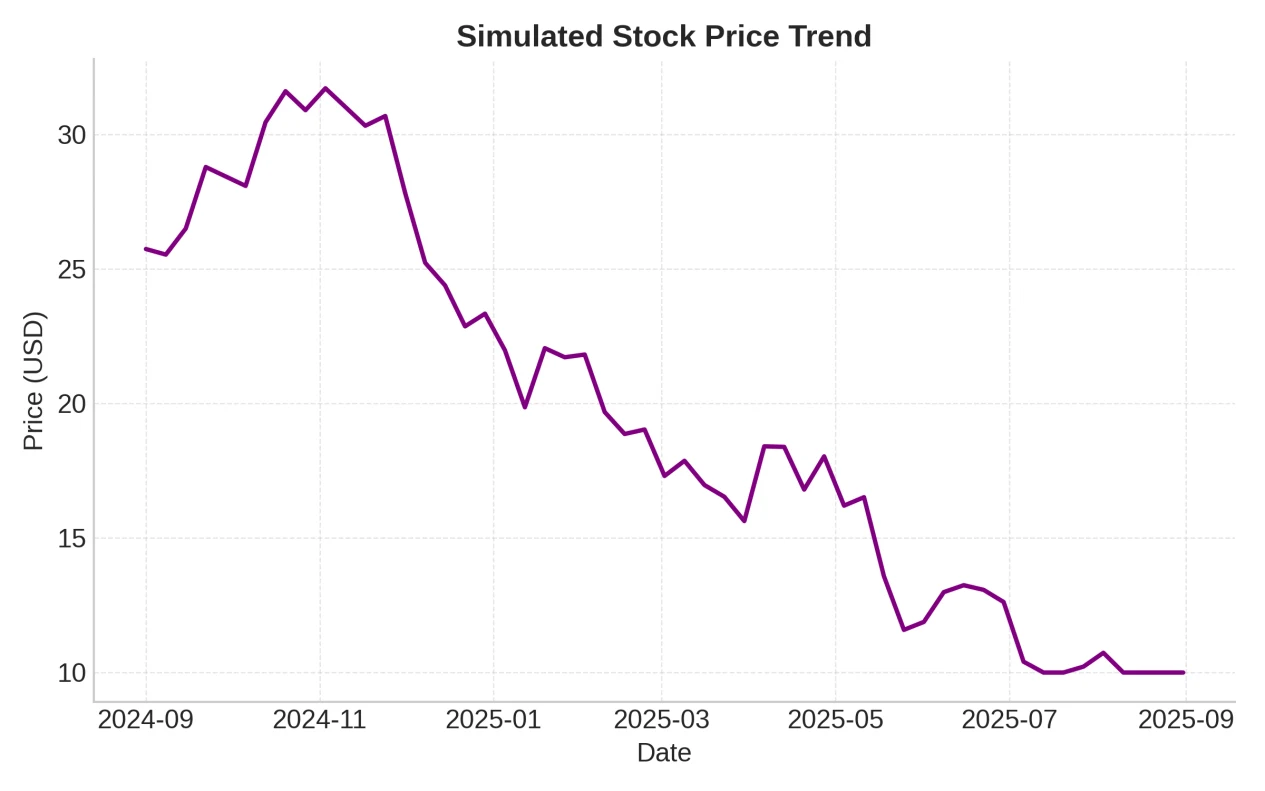

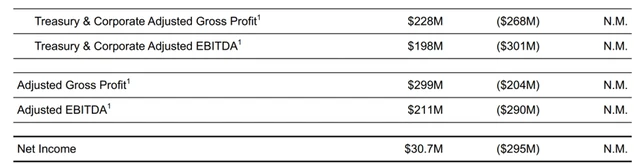

Overall, GLXY achieved a number of strong results in the second quarter. First, the company achieved profitability—from gross profit ($299 million) and adjusted EBITDA ($211 million) all the way to net profit ($30.7 million). However, this was almost entirely due to its digital asset holdings, which appreciated significantly during the quarter.

Source: Galaxy Digital

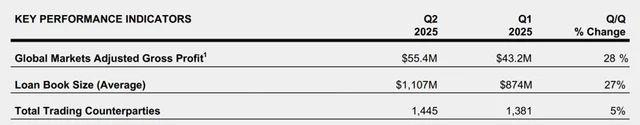

In terms of operational performance, Digital Assets, currently the only profitable division, also saw some positive developments. Global Markets led the way, with gross profit increasing 28% month-over-month, an impressive increase given the industry-wide decline in trading volumes. Other highlights included GLXY's loan book reaching a record high of approximately $1.1 billion, driven by "continued margin lending demand and a growing client base," as well as its role as an investment bank in the Bitstamp-Robinhood trade.

Source: Galaxy Digital

Within the digital asset space, the asset management and infrastructure solutions sector appeared less optimistic, with overall gross profit declining due to a "decline in on-chain activity across the industry." Digging deeper, it was discovered that Solana, for which GLXY is one of the largest staking infrastructure providers, was the biggest drag.

Source: Galaxy Digital

While this may appear to be negative data at first glance, the month-over-month growth is actually largely due to base effects ( “Trading volume on the Solana platform was quite active in the first half of the year and was limited to specific regions, such as the issuance of meme coins”). GLXY also made further progress in custody integration (for example, its partnership with Fireblocks in Q2) and benefited from a rapidly growing base of “platform assets,” so overall, it was a pretty good quarter.

The third quarter also showed a strong trend at the beginning

So far, the digital asset business is progressing very well—management stated, "July appears to be Galaxy's best month in every respect ." Global markets were a key factor in this performance, with the company completing one of the largest Bitcoin trades in history , a testament to GLXY's execution capabilities. Meanwhile, net inflows in the asset management division and organic growth in staked assets in the infrastructure solutions segment , coinciding with the significant rise in ETH, also bode well for the third quarter.

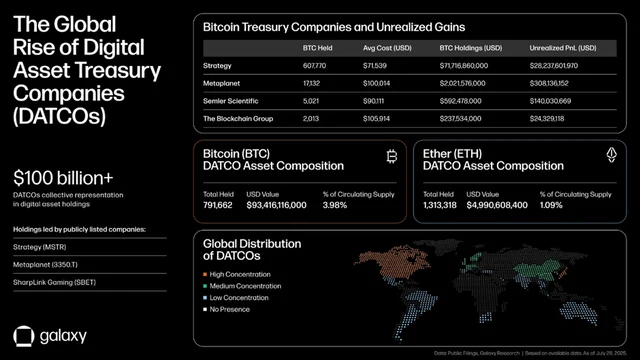

However, the huge opportunity lies in the "balance sheet company phenomenon" (similar to Strategy (MSTR)). There are not many cryptocurrency investment banks/asset management platforms in the market, so GLXY has a huge advantage in serving this growing ecosystem.

Momentum is accelerating—as of the second quarter, GLXY had partnered with “over 20 such firms,” with more expected to join as regulatory hurdles are removed. Notably, management hailed this as “one of the strongest institutional onboarding pipelines we’ve seen to date . ”

Source: Galaxy Digital

Thinking about the upside of the third phase of the data center plan

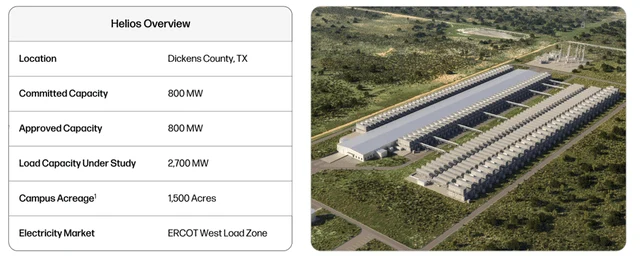

While non-revenue generating, the data center business is equally important. Its focus is entirely on the Helios facility in West Texas. GLXY previously acquired the facility for $65 million in 2022 for Bitcoin mining. Currently, GLXY is transforming it into a high-performance data center to meet the rapidly growing computing needs driven by artificial intelligence. GLXY has received approval from Texas power grid operator ERCOT for 800 megawatts of power, with a total of 2,700 megawatts under "various stages of study . "

Source: Galaxy Digital

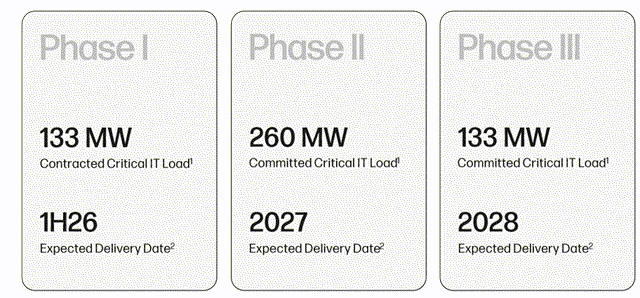

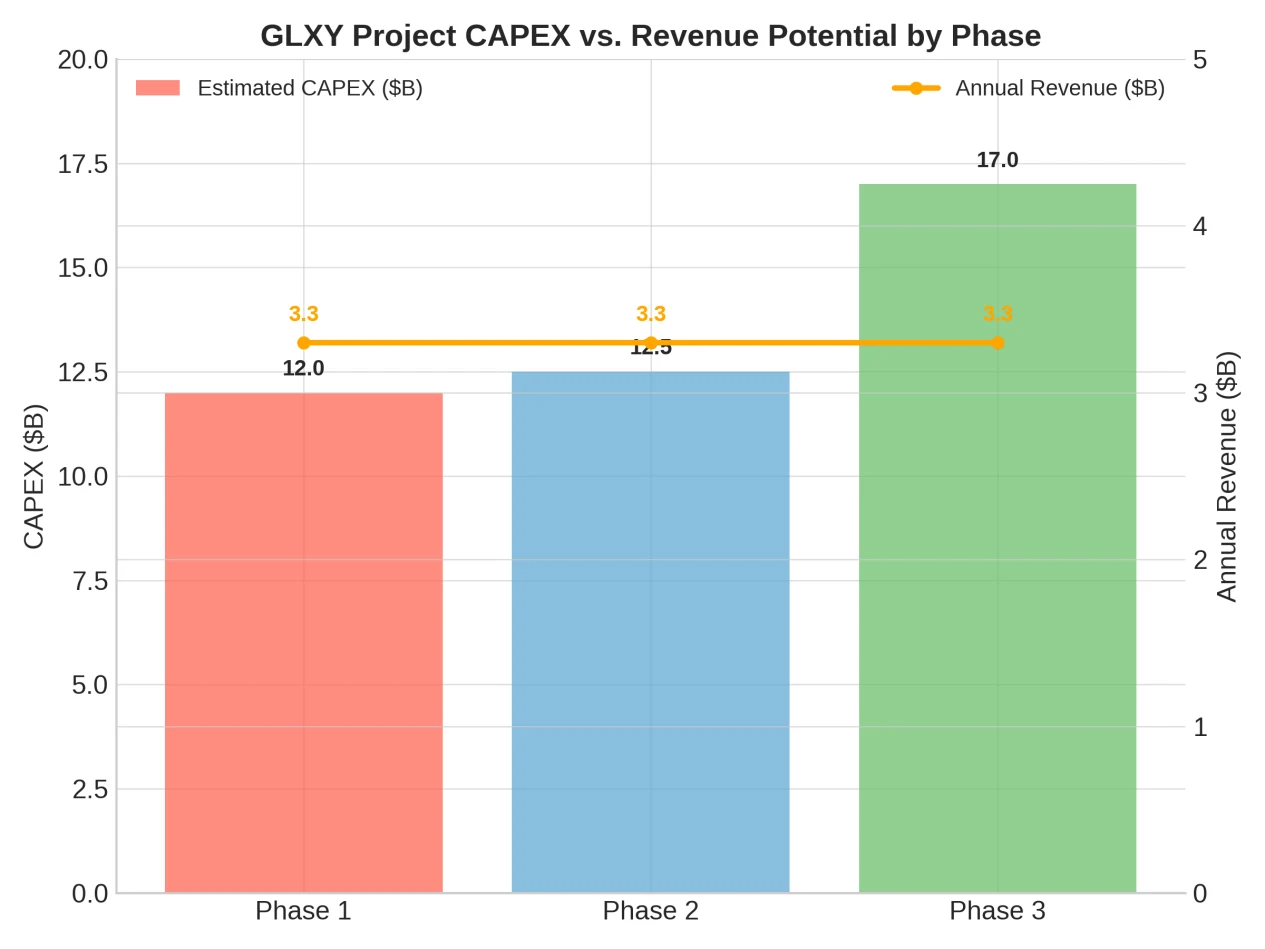

The project is divided into three phases: Phase 1 (133MW of critical IT capacity), Phase 2 (260MW of critical IT capacity) and Phase 3 (133MW of critical IT capacity). With anchor tenant CoreWeave deciding to exercise its Phase 3 option, all approved site capacity is now contracted.

On the other hand, delivery is still some way off. Phase 1, a former Bitcoin mining facility, is currently undergoing renovation and is scheduled to be operational in phases starting in the first half of 2026. Phase 2, a greenfield development, has not yet entered the construction phase but is scheduled to be operational in 2027. Phase 3 is still in its early stages, but management has confirmed delivery in 2028.

Source: Galaxy Digital

In theory, the data center's expanded capacity (up to 3,500 megawatts, or "one of the world's largest AI data center campuses" ) could represent enormous value creation potential. But financing all of this will be challenging. Granted, GLXY does have over $2.6 billion in equity, but it lacks a business that can consistently generate cash flow. Furthermore, many of its assets are tied to digital assets and investments. If we separate out immediately available funds (i.e., cash and stablecoins), the capacity approaches $1.2 billion. Also, note that this includes the approximately $480 million raised during GLXY's IPO in May.

Source: Galaxy Digital

Then there are the rather hefty capital expenditure requirements. Phase I costs $11 million to $13 million per megawatt, and Phase II "will cost slightly more per megawatt than Phase I." Combined, the GLXY project could cost well over $4 billion. Furthermore, Phase III, assuming similar economics to Phase I, could add another $1.7 billion in capital expenditures.

GLXY is now responsible for financing all capital expenditures, but it clearly cannot rely solely on cash and equivalents to cover all expenses. Therefore, the financing structure (whether through debt financing or project-level equity financing) will be key. Financing costs are also important; given CRWV's risk profile and the project's higher-risk construction, the interest rate on Phase II (greenfield) debt financing is expected to be significantly higher than previously.

Against all these costs and incremental risks, the profit potential is equally impressive. Under the terms of the 15-year lease agreement with CRWV, Phases 1, 2, and 3 (526 megawatts of critical IT load) will generate average annual revenue exceeding $1 billion (plus approximately 3% annual accruals). Meanwhile, EBITDA margins are projected to reach 90%—a very manageable outcome, given that operating expenses (excluding GLXY employees) will be borne by CRWV.

Therefore, the data center business has the potential to generate over $900 billion in EBITDA at peak. Using a conservative P/E ratio of approximately 20x, below the industry average, this implies an incremental enterprise value of over $18 billion. Even after deducting $5-6 billion in development expenses and assuming favorable financing terms for the second phase, GLXY should be able to achieve significant profitability if the project proceeds as planned.

Of course, this comes with risks. First, the economics of the data center depend on the assumption that AI demand will persist and that its sole tenant, CRWV, will be able to fulfill its lease obligations. Furthermore, from a valuation perspective, the business has a terminal value. Last but not least, GLXY, a company with no prior experience in data center construction, will be able to complete the construction without significant delays or cost overruns. However, given its enterprise valuation exceeding $7 billion, the market presents numerous hurdles for this type of business, so the risk/reward ratio still appears attractive.

Summarize

Given GLXY's volatile income statement and cryptocurrency-heavy balance sheet, underwriting is challenging. This situation isn't expected to change in the near term. However, for investors willing to bear execution risk and who haven't yet realized profitability, the strengths of its data center business more than offset these weaknesses. Overall, I believe GLXY is worth a look.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates