Floor & Decor: Holding onto its moat during the real estate downturn and awaiting a long-term recovery

15:49 September 6, 2025 EDT

Key Points

Floor & Decor's large store footprint and focused product category create a clear competitive advantage. Its average store size of 78,000 square feet far exceeds that of Home Depot and Lowe's. Its diverse SKU offerings and low pricing, coupled with the support of design consultants and studios, give it an advantage in customer experience and conversion rates .

The company plans to open 500 stores in the United States. Although the current expansion pace has slowed due to the downturn in the real estate market, the management team and model have proven to have execution capabilities. Low debt and stable cash flow enable it to withstand cyclical fluctuations, and the long-term growth path is clear .

The current P/E ratio of over 40 appears high in the short term, and the continued downturn in the real estate market is putting pressure on sales. In the long term, as the market recovers, FND's market share expansion and commercial business growth are expected to drive valuation recovery or even higher.

Risks include competition, mismanagement, and macroeconomic headwinds, but I remain confident in FND's ability to achieve its long-term growth goals.

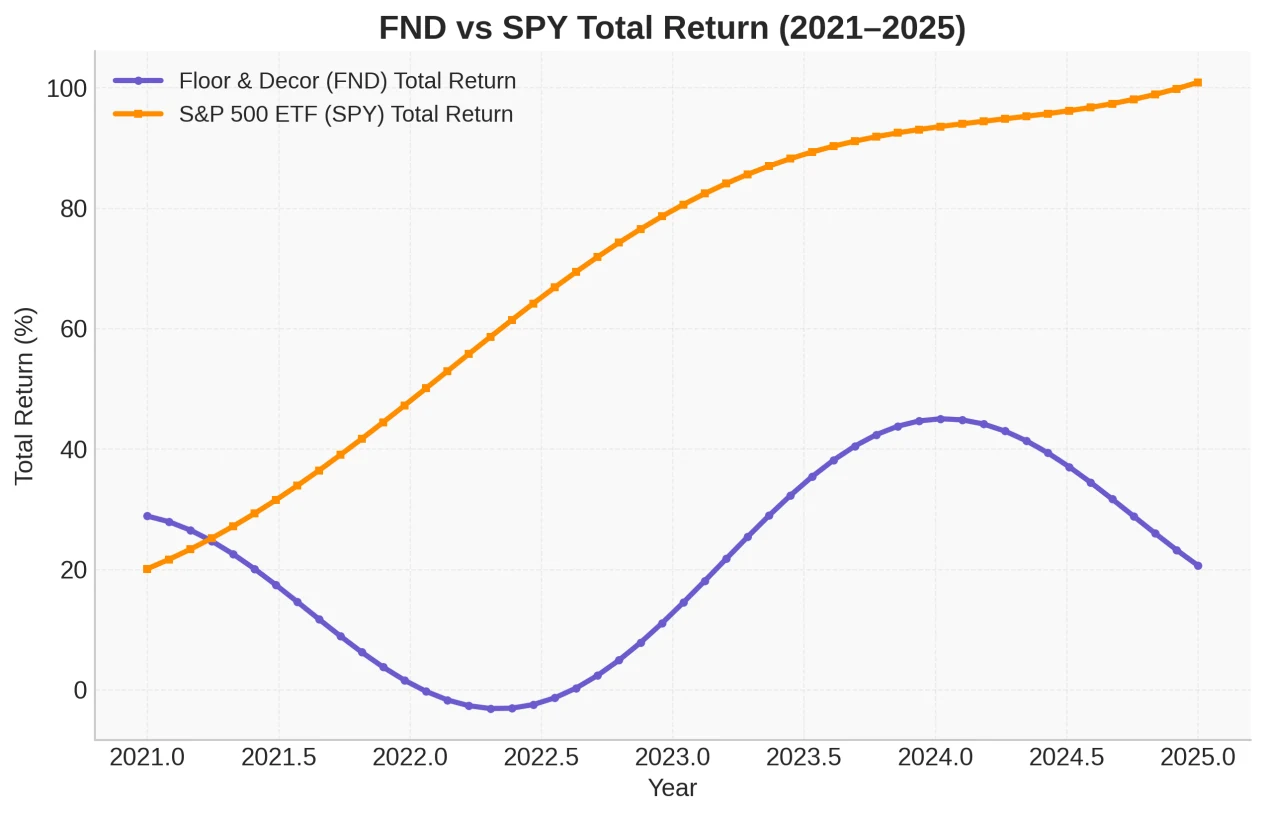

Ground & Decor has an excellent business model and long-term growth potential. Its stock price has been trading sideways for nearly five years due to a slowing real estate market and its initial valuation being too high. Despite this period of consolidation, I believe the company's stock price is slightly below its fair valuation and would prefer to enter the market during a market correction.

Business Model

Floor & Decor is the leading retailer in the hard flooring market. Its competitive advantage is clearly evident in the consumer experience. Compared to general retailers like Home Depot, Lowes, and even Wayfair, FND offers a more comprehensive selection of tile and flooring products, allowing consumers to meet most of their needs within a single store. Furthermore, while some product lines at large general retailers often require a combination of online and offline channels, FND's warehouse-style stores offer a differentiated advantage with a concentrated and comprehensive product portfolio.

FND serves professionals, DIY enthusiasts, and "do-it-yourself" customers who save money by purchasing their own materials. They're also a very focused company, selling only flooring, hard surface flooring (such as tile), and related installation materials. If you're a contractor or individual renovator with a Floor & Decor store, their convenient location, extensive product selection, and everyday low prices make them a great choice for flooring and tile. Besides Lowe's and Home Depot, their biggest competitors are stores like Tile Shop, which typically have a smaller selection and can't compete with the price advantage FND offers by working directly with manufacturers and shipping in large quantities. Their vast and expanding geographic presence is another advantage.

FND stores are roughly the same size as Lowe's or Home Depot, but offer a more focused offering. Each store carries an average of approximately 4,400 SKUs, encompassing tile, hard flooring, and related installation materials. Upon entering the store, customers are often provided with guidance on material selection by professional design consultants, which not only enhances the shopping experience but also drives higher conversion rates and average order value.

In recent years, FND has also launched smaller "design studios," also staffed by design consultants and offering access to the company's full product catalog. These studios boast higher customer conversion rates compared to warehouse-style stores, with average order amounts double those of non-design shoppers. For example, the Miami-based design studio boasts a 4.9-star rating on Google, with customers generally appreciating its pricing, product variety, and professional service provided by its design consultants.

Source: flooranddecor

Floor & Decor is also seeking new growth avenues in the commercial flooring sector. While the company typically targets DIY/BIY/Pro customers, it has recently expanded into commercial flooring markets such as hospitals, nursing homes, office buildings, and schools. This expansion into new markets began with the 2021 acquisition of Spartan Surfaces. FND values the commercial flooring market at $16 billion, and even after the acquisition of Spartan Surfaces, FND still holds only a small share, indicating significant white space for expansion. Commercial flooring sales are projected to grow 7% year-over-year by the first half of 2025.

Balance Sheet and Return on Capital

You might think a relatively small, fast-growing company would be burdened with a lot of debt, but that's not the case. As of the second quarter of 2025, Decor had only $194 million in long-term debt, in the form of a 6.33% floating-rate term loan. With $1.8 billion in tangible assets and $156 million in free cash flow expected in 2024, this debt is well covered. FND's low debt level stems from its decision to lease most of its stores and distribution centers. FND is better off leaving the capital-intensive/low-return real estate development work to others.

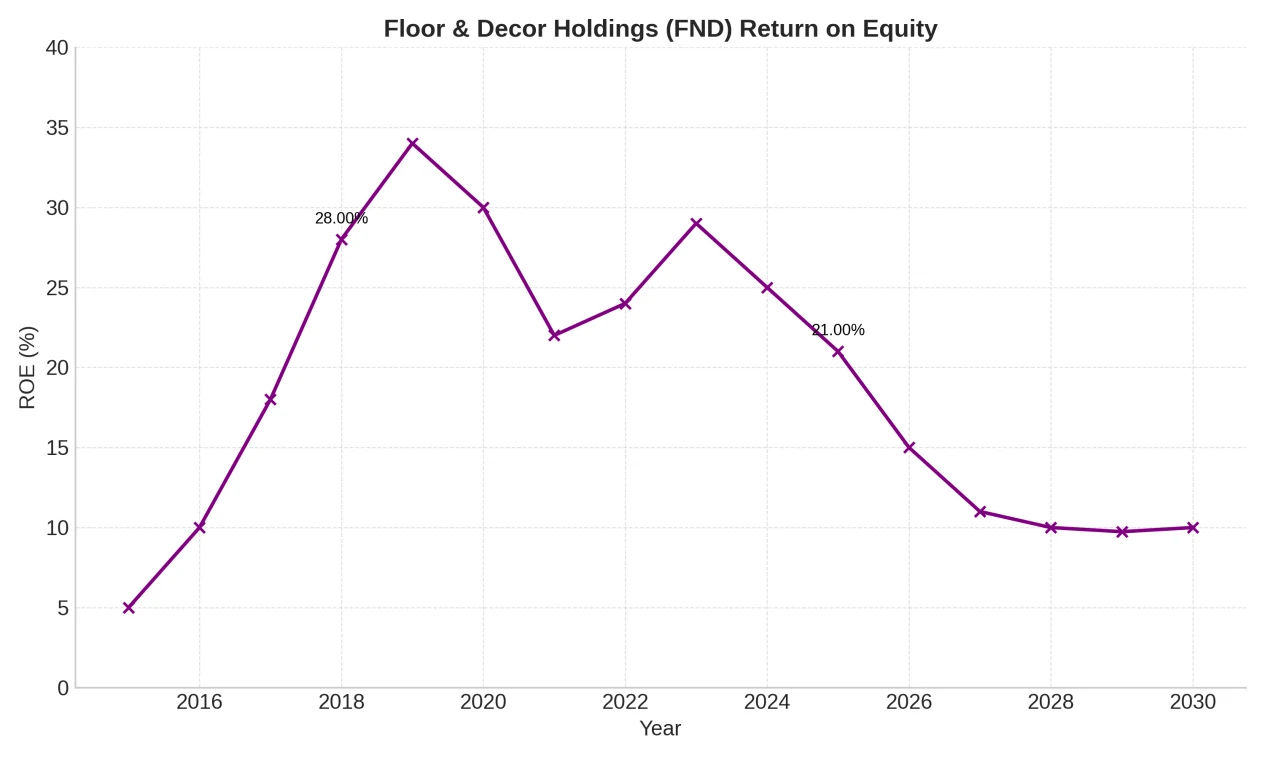

These types of decisions, combined with FND's excellent business model, resulted in strong returns on equity before the recent economic slowdown.

FND's business is heavily exposed to the real estate market, as people often renovate soon after purchasing a home. Due to historically low home sales, the company's same-store sales are expected to decline significantly, reaching a 7.1% year-over-year decline in both 2023 and 2024. Investors shouldn't be concerned about this downturn. Even strong companies face near-impossible challenges in overcoming the industry's economic challenges, and the current real estate market struggles to sustain strong sales growth. The situation will eventually improve, though it may take years. Given FND's low debt level and consistent profitability, long-term investors can be confident even during cyclical downturns.

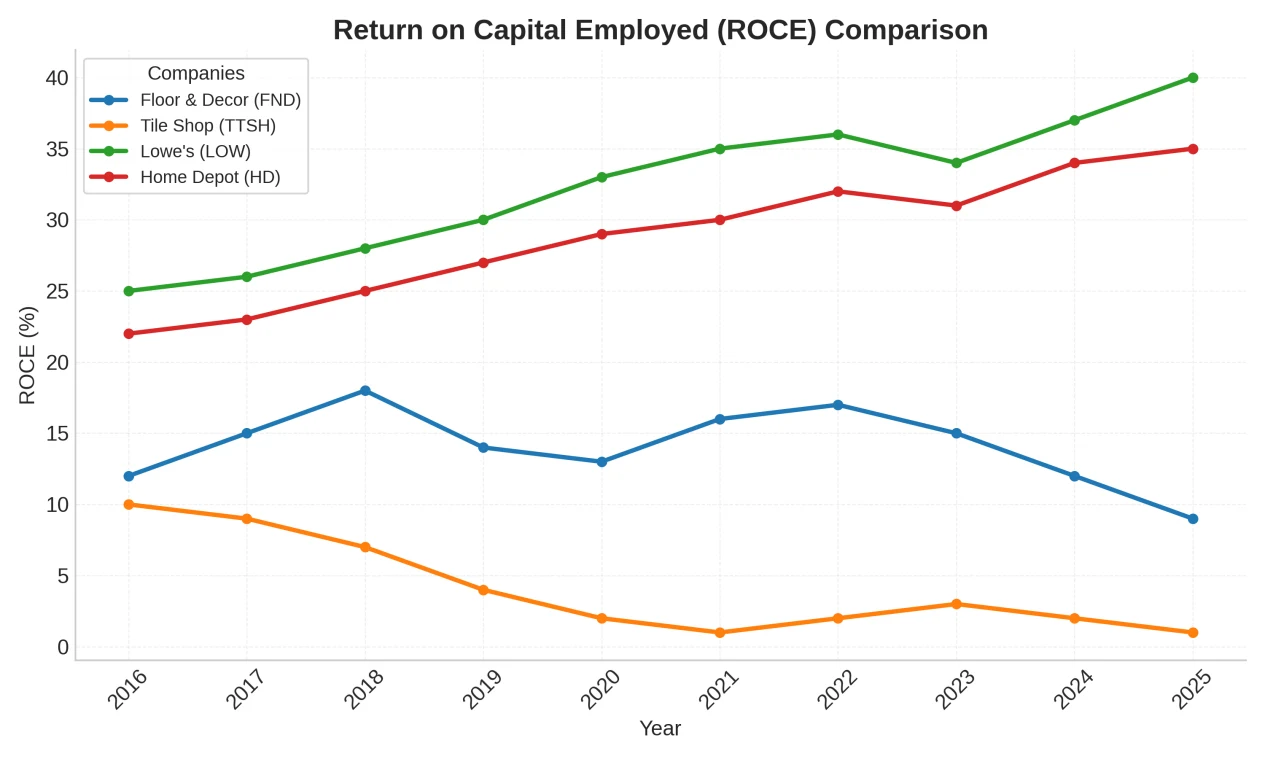

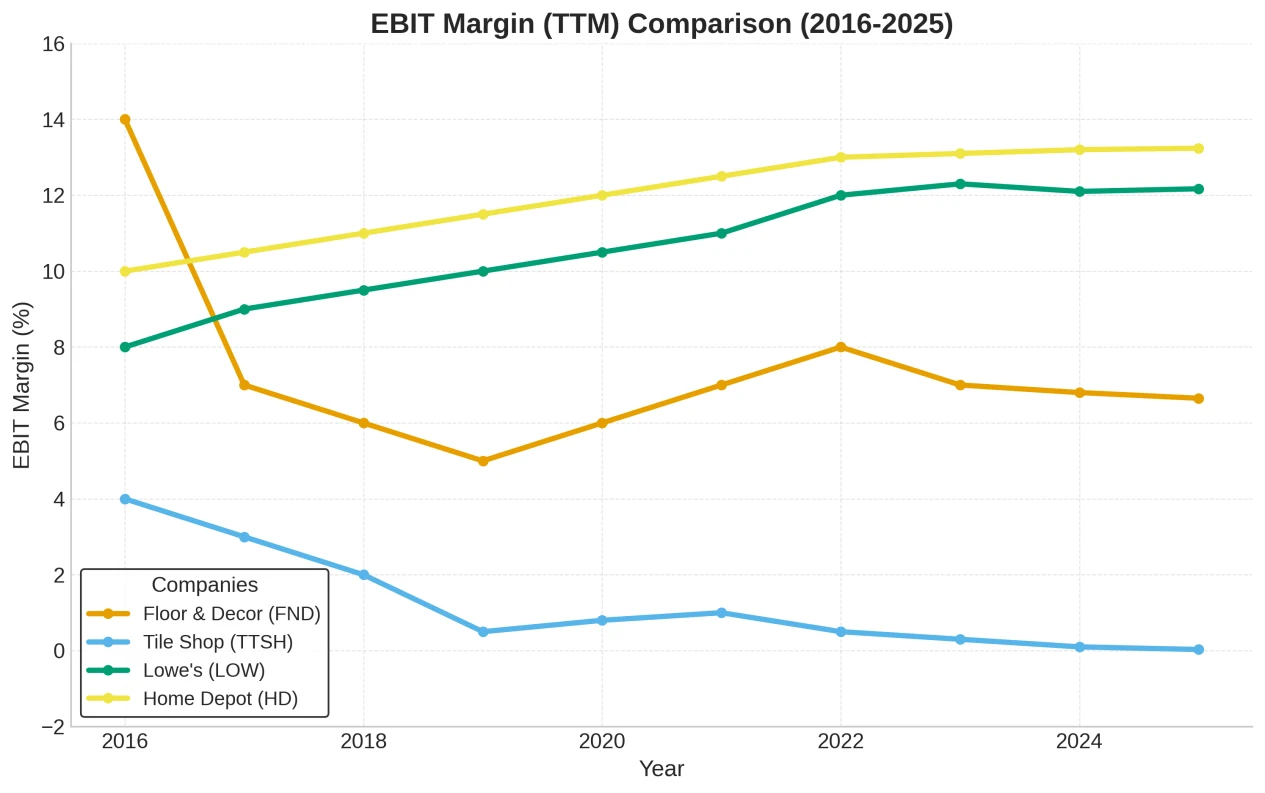

Profitability metrics based on GAAP earnings don't necessarily tell the full story for FND. The company hasn't reached the stage where it can reap the fruits of its labor, and therefore hasn't paid dividends or repurchased stock. That said, I've included a few charts below comparing various metrics to those of the company's main competitors, Home Depot, Lowe's, and Tile Shop Holdings, for comparison purposes and to provide an idea of the company's profitability as it matures. But it's important to remember that much of the money reinvested in FND's business flows to the finance department as expenses—they recorded $45 million in "pre-opening expenses" in 2024—which keeps potential operating returns low.

This reinvestment in growth is also reflected in the company's EBIT margin, which has been lower than that of its larger peers.

manage

Tom Taylor, CEO of Floor & Decor, started working at Home Depot at age 16 and became the company's youngest store manager at 22. He continued to rise through the ranks, eventually moving into a senior leadership position and joining a private equity firm. Since joining FND in 2012, Taylor has taken the company public and expanded its store count from approximately 30 when he joined to 251 by the end of 2024.

Taylor gained extensive experience learning operations and customer service at Home Depot, but he also proved himself to be an excellent capital allocator, as evidenced by the company's low debt and minimal equity issuance. He was committed to keeping FND focused on its areas of competitive advantage. FND had never made any acquisitions before acquiring Spartan Flooring, which made it a natural progression to expand into the commercial hard surface distribution market. Home Depot achieved great success by consolidating the previously fragmented market of small home improvement stores into the large warehouses we know today, using centralized purchasing. FND was founded on the same model, and in my opinion, the company selected an excellent manager to achieve this goal.

Growth prospects and valuations

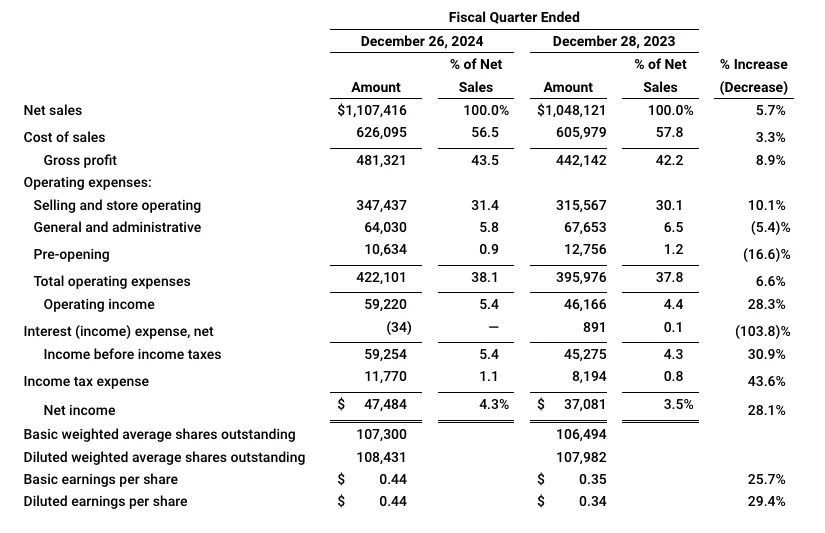

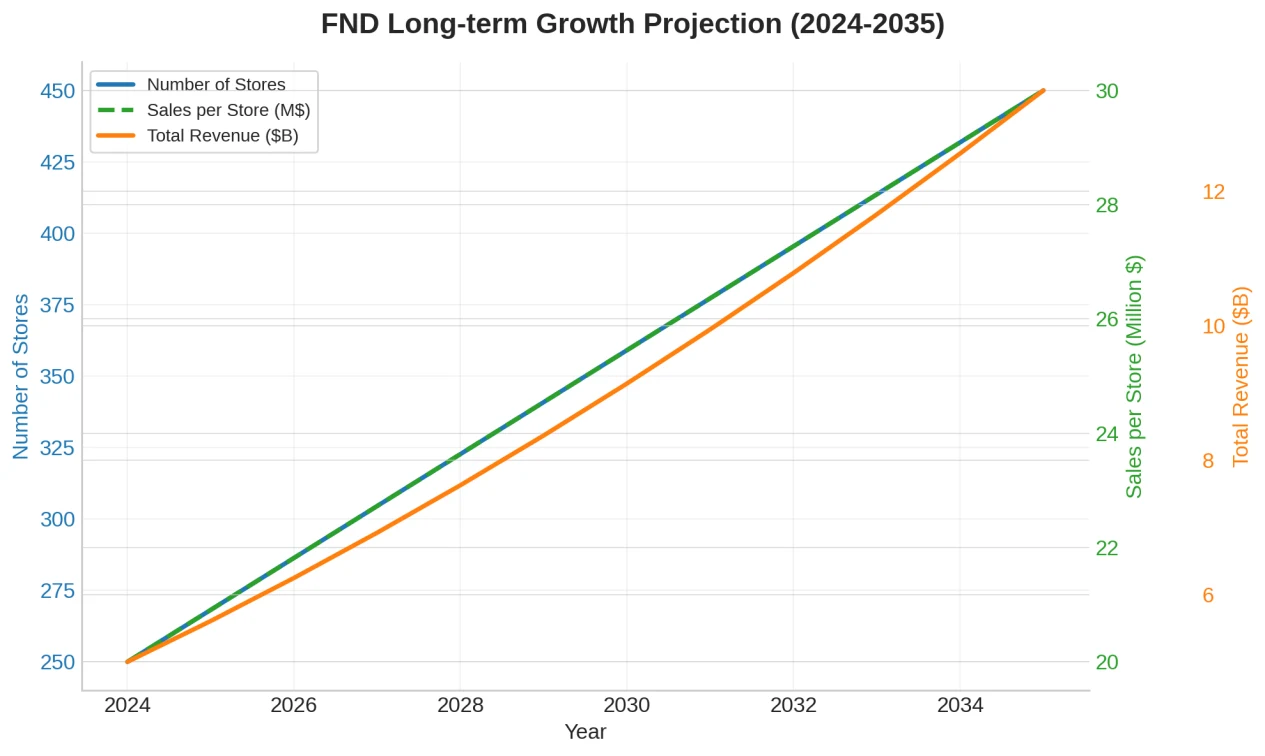

The recent decline in store turnover has had a significant impact on FND's financial performance, with sales growth slowing to 6.5% in the first half of 2025, and same-store sales actually declining year-over-year (albeit by less than 1%). After opening 30 new stores in 2024, FND is expected to open only 20 in 2025, down from the 25 estimated at the beginning of the year. While opening 20 new stores may seem acceptable for a relatively small company, this only represents an 8% growth rate, which is somewhat concerning when the stock trades above a forward price-to-earnings ratio of 40. Furthermore, achieving 20% growth rates in the future will become increasingly challenging as the company grows. FND must open 50 stores to achieve 20% growth in 2025, 60 in 2026, and so on. The company's long-term growth plan envisions eventually having 500 warehouse-style stores across the United States. They may be opening stores in the most advantageous locations first, which could result in later stores struggling to meet expectations.

Looking back at FND's 2022 investor presentation, after achieving impressive growth in 2021, it projected that its store footprint would reach 21.6 million square feet by 2024. However, the actual store footprint in 2024 was approximately 19.5 million square feet, approximately 11% below expectations. While it was difficult to predict the impending interest rate hike and subsequent real estate downturn in early 2022, this illustrates the risks of investing in high-growth companies. When these high-flying companies deliver on their plans, the returns are typically substantial. However, if the results fall short of the company's expectations, the returns can be minimal.

For long-term investors, FND's positioning in 2035 is more important than the short-term challenges it faces. The current estimation method used is to estimate the company's valuation ten years from now and then backtrack to the current valuation.

As mentioned above, Floor & Decor's management has set a goal of eventually opening 500 stores in the United States. Approximately half of these new stores will be open by the end of 2024, implying an average of 25 new stores per year for the next decade. The company has opened 30 or more stores in each of the past three years, so this goal seems feasible. Given the slowdown in demand, they expect to open only 20 stores in 2025. They will have to return to a pace of 30-plus stores at some point to make up the difference, but they have already demonstrated their ability to achieve this goal. Taylor confirmed this plan during the company's second-quarter 2025 earnings call.

Source: flooranddecor

CEO Tom Taylor stated: "Looking ahead to fiscal year 2026, the company currently expects to open at least 20 new warehouse-style stores. As previously stated, once the real estate market conditions improve, our company is well-positioned to support the opening of more than 20 new warehouse-style stores annually."

Excluding the renovation boom from 2020 to 2022, FND has generated approximately $20 million in annual sales per store since its IPO in 2017. I estimate this figure will grow as the company continues to increase brand awareness and market share. Somewhat offsetting store and market share gains is the concern that the next 250 stores will have below-average sales as the company expands into smaller or more saturated markets. This concern is warranted, as we can assume that continued market share gains driven by the superior economics of FND's business will offset sales declines in smaller markets. Market estimates of share expansion plus an optimistic 2% inflation rate will generate 4% nominal same-store sales growth. This implies $30 million in single-store sales in 2035, which, assuming FND operates 450 stores by then, would bring overall sales to approximately $13 billion—50 stores fewer than management's estimate. The company estimates its commercial sales will eventually reach $1.5 billion, but conservatively estimates its revenue by 2035 will be just $1 billion.

To estimate operating profits, we can look to more established mass-market distributors like Lowe's and Home Depot, which appear to have relatively stable operating margins between 12% and 15%. Adding in corresponding increases in debt and taxes, I arrive at a forecast of $10 per share in earnings over the next 10 years based on a little over $1 billion in funding. This translates to $10 per share after adjusting for a slight increase in share count. At a 20x P/E, multiple shares would be priced around $200, implying a return of about 10% relative to the current share price.

My goal is to achieve a 15% long-term annual return on any new investment. To achieve this—based on the estimates above—would require buying at the current price of around $50. But shares haven't been this low since the early days of the COVID-19 pandemic and are still trading above $80. However, for excellent companies with low debt, we can lower the floor slightly. As of June of this year, shares were still around $70, implying a 12% return on investment, a decent entry point. Given the conservative assumptions I outlined above, there's certainly more upside.

risk

The three major risks facing Floor & Decor are competition, mismanagement, and a slowing economy. First, from a competitive perspective, it's hard to see how other stores could effectively match FND's scale. With 78,000 square feet per store dedicated to hard surfaces (compared to just 3,000-5,000 square feet at home improvement stores), it's hard to see how this advantage can be overcome. Lowes and Home Depot are both well-run businesses and would undoubtedly be unhappy with FND's earnings. They could launch a competing specialty retail chain, much like Walmart launched Sam's Club to counter Costco. Both major retailers have relationships with manufacturers, which is crucial for executing such a strategy. However, these new specialty stores would undoubtedly cannibalize sales at their existing stores, making this an unattractive option.

FND's mismanagement risk stems from the pressure it faces to maintain high growth amid a sluggish real estate market. The company could stray from its focus on hard flooring, which forms the foundation of its competitive moat, and expand into areas where it lacks a competitive advantage. While FND's expansion into the commercial sector doesn't concern me, and we haven't seen any signs of expansion from management, investors should remain vigilant.

Finally, Flooring & Decor faces numerous economic challenges, including tariffs, a slowing housing market, and rising inflation. Regarding tariffs, the company's annual report indicates that 18% of its sales originate in China, which has little impact on cost of goods sold. However, surprisingly, as Taylor explained during the company's second-quarter 2025 earnings call, tariffs may actually help improve FND's competitive position.

As we noted on our first-quarter conference call, we've seen some independent retailers and distributors implement high-single-digit price increases or higher in response to tariffs. We believe tariffs will continue to put pressure on independent retailers as they've already been dealing with persistently weak industry fundamentals over the past three years... Customers are demanding American-made products, and we've taken steps to identify American-made products in our stores. The United States is now our largest manufacturing country, representing approximately 27% of our product sales in fiscal 2024, up from approximately 20% in fiscal 2018.

Home sales are a more pressing concern. Even if the Federal Reserve cuts interest rates before the end of the year, the 10-year interest rate, on which mortgages are based, will be largely unaffected. The company has low debt, positive free cash flow, and a strong market position, but sales could stagnate for several years before recovering. While investors can be confident in the company's ability to achieve its long-term financial goals, shareholders may have to wait a long time for the stock price to reflect the company's full potential.

Conclusion

Floor & Decor's valuation, at over 40 times its earnings, looks very high. To justify this valuation, the company will need to eventually return to the high growth rates seen before 2023. With market share gains, geographic expansion, and commercial sales growth, FND has ample market exposure when the real estate market recovers. At that point, I expect the company's strong business model and excellent management will put its growth back on track.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates