Investors need to know this about Bloomin' Brands and be wary of market sentiment.

15:42 September 6, 2025 EDT

Key Points

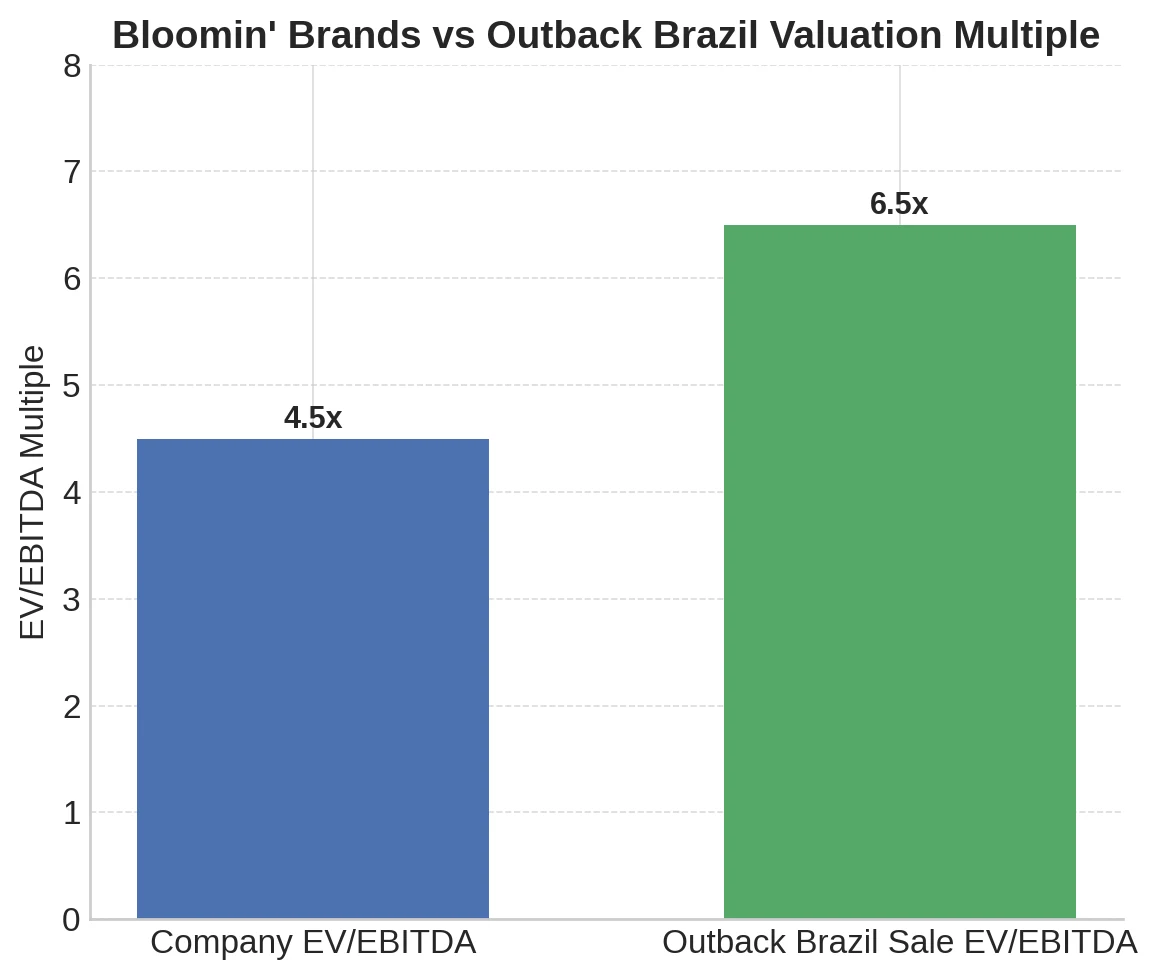

Even after selling its Brazilian operations at 6.5x EV/EBITDA, the company still trades at 4.5x EV/EBITDA ;

Thanks to the dividend cut and the sale of Brazilian assets, the company has repaid and refinanced some of its debt. Net profit and cash flow remain positive, net debt/EBITDA levels are manageable, and short-term financial risks are low .

Bloomin' Brands' fundamentals remain solid, and the sale of its Brazilian assets supports its valuation. The key focus is the recovery of Outback Steakhouse. If this turning point occurs, the stock price is expected to experience a valuation recovery, presenting a worthy buying opportunity.

Bloomin' Brands, once a shining behemoth, saw its stock price plummet again after releasing its second-quarter 2025 financial report, approaching its 2020 pandemic low. While it subsequently rebounded by approximately 20%, it remains far from fully recovered. Like other struggling companies, Bloomin' Brands has transitioned to a new leadership team, rolled out a new strategy, and is working to improve operational efficiency.

Source: bloominbrands

This article explores the company's latest restructuring efforts and highlights the sale of its Brazilian operations as a key indicator of its potential value. Meanwhile, comparable sales for both brands have returned to positive territory, and Outback Steakhouse's performance may be reaching a turning point. Combined with its solid financial profile, these factors lead us to believe that the company is poised to gradually reverse market sentiment, with its forward P/E ratio potentially recovering from 7x to at least 10x. Investors should therefore keep an eye on Bloomin' Brands, particularly Outback Steakhouse's recovery progress and shifts in US consumer confidence.

The value of the Brazilian business cannot exceed 50% of Bloomin' Brands

Bloomin' Brands began exploring strategic alternatives for its Brazilian assets before 2019, but the transaction wasn't finalized until late 2024. According to its 8-K filing (page 3), the company signed an agreement with Vinci Partners on November 6, 2024, to sell a 67% stake in Outback Brazil for BRL 1.4 billion (approximately US$243 million), representing an enterprise value of BRL 2.06 billion and a valuation of approximately 6.5 times its trailing 12-month EBITDA (net of royalties). The payment was to be made in two installments: 52% on the closing date and the remaining 48% one year after closing, with an option to sell the remaining stake in 2028.

It's worth noting that at the time, Bloomin' Brands' market capitalization was just over $1 billion, and the Brazilian assets sold were valued at 37% of the parent company's overall market capitalization. Today, with the company's market capitalization down to $625 million, the Brazilian business is valued at over half of the parent company's market capitalization, despite contributing only 12% of revenue in 2023. More importantly, according to the 10-K (page 62), the business is projected to incur cumulative net losses of approximately $18 million between 2022 and 2024.

But the value of the transaction is not limited to the asset sale. Outback Brazil will continue to pay a 5% to 6% royalty to the parent company as a franchisee (the specific percentage is undisclosed). Based on 2023 revenue of 3 billion Brazilian reais, the parent company expects to receive approximately $30 million in franchise revenue, an amount even higher than the revenue contributed by the business before the sale. In the future, if Vinci Partners expands its store count from 200 to 300+, the royalties are expected to approach $50 million. Based on the current market capitalization of $625 million, the valuation corresponding to the royalties alone is less than 13 times the PE, which means that the market has barely priced in the value of the company's other businesses.

Even more interesting is that experienced investors such as Vinci Partners, Advent, and Mubadala Capital are bullish on this asset and are willing to pay 6.5 times EV/EBITDA, while the parent company's overall EV/EBITDA is only 4.5 times. This suggests that this is not a fire sale, but rather a strategically significant transaction: it locks in a one-time profit, preserves long-term profit distribution rights, and opens up the possibility of a future IPO.

Waiting for Outback Steakhouse's revival

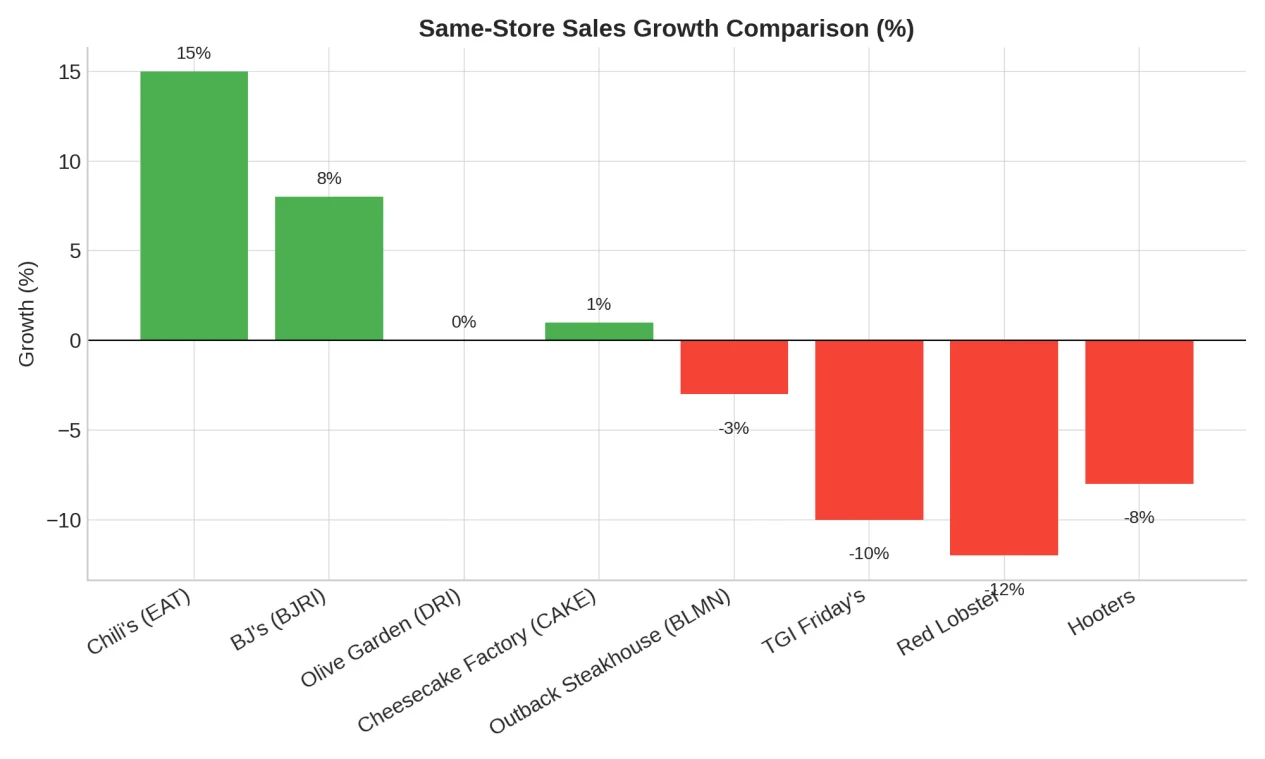

If the US business is valued so cheaply, the problem must lie at the operational level. Numerous studies have shown that consumer confidence significantly impacts restaurant sales. From fast food to casual dining, Red Lobster's bankruptcy and Chili's (EAT) resurgence are prime examples. Bloomin' Brands' performance is no exception. From the first quarter of 2023 to the second quarter of 2025, with the exception of the first quarter of 2023, the company's overall comparable sales have been mostly flat or negative, making the past two and a half years a difficult time.

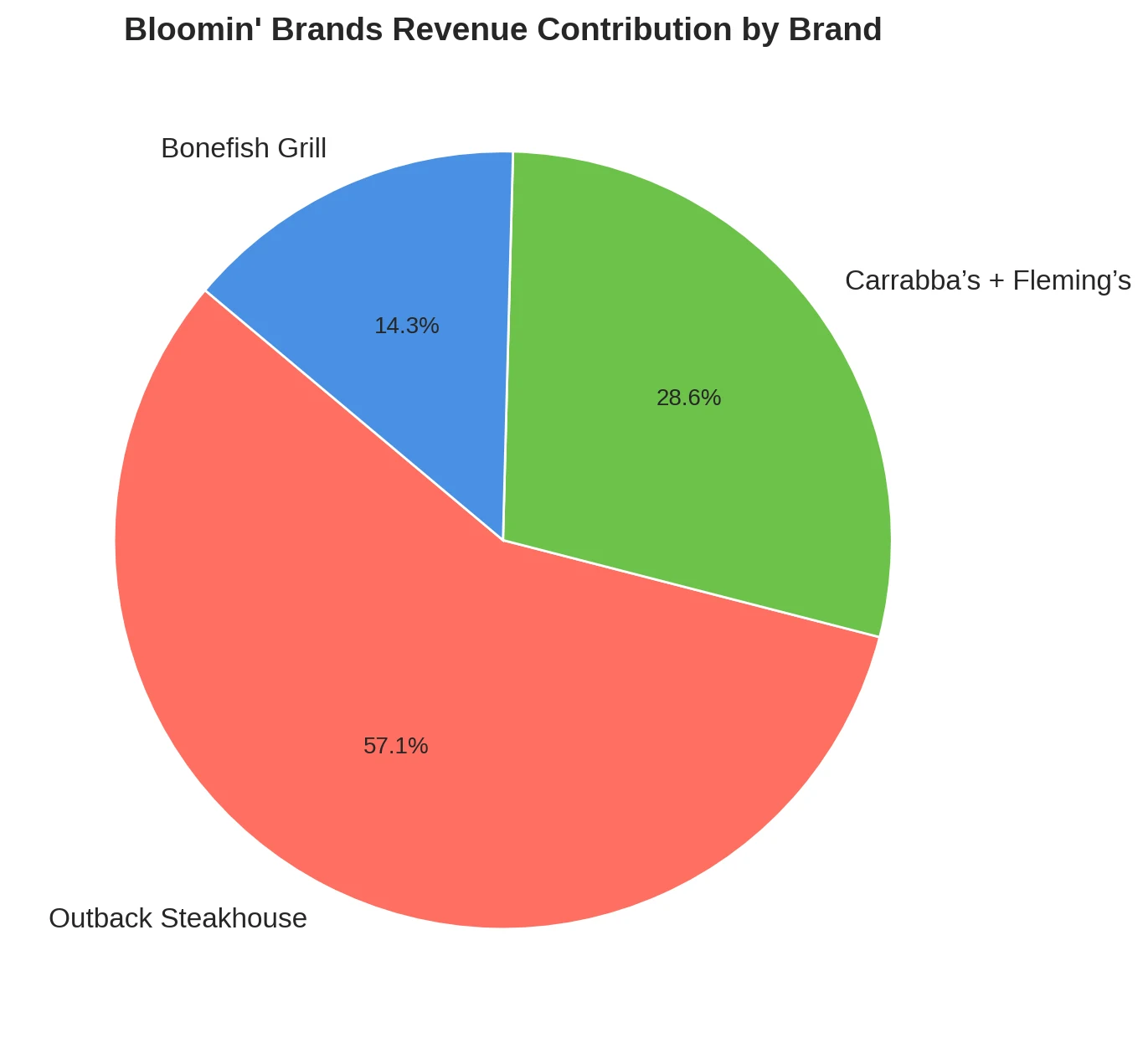

However, not all brands are declining. Carrabba's Italian Grill and Fleming's Prime Steakhouse have returned to positive growth since bottoming out in 2024, but their scale is limited, accounting for less than 30% of the company's stores and revenue. By comparison, Bonefish Grill accounts for approximately 15%, while Outback Steakhouse accounts for nearly 60%, making them the key to the revitalization.

Outback Steakhouse has prioritized a turnaround. In the second half of the year, the company plans to reduce new store expansion and instead accelerate renovations of existing locations. The company is also implementing several initiatives: decentralizing some brand decision-making; streamlining the menu by 15% to 20%; reducing short-term promotions in favor of more stable discounts; and introducing Ziosk tablets at tables to improve operational efficiency. If these adjustments can help Outback achieve positive comparable sales, market sentiment is expected to improve significantly.

This logic has been borne out repeatedly. Performance across chains has varied significantly: Chili's and BJ's (BJRI) have seen steady comparable sales growth, Olive Garden (DRI) and The Cheesecake Factory (CAKE) have remained roughly flat, while TGI Friday's, Red Lobster, and Hooters have experienced sharp declines. This demonstrates that even in a consumer-situated environment, brands with strong execution can still excel. For Outback Steakhouse, the outlook is more likely to be similar to Chili's.

Financially, Bloomin' Brands maintains a relatively strong liquidity position. Despite recent bankruptcies in the industry, the company is far from distressed. Thanks to a dividend cut and proceeds from the sale of Brazilian assets, the company has repaid a portion of its revolving credit line and completed a refinancing, leaving it with minimal short-term debt risk.

From a cash flow perspective, net profit and operating cash flow (CFO) remain positive, demonstrating stable cash flow generation. Assuming CFO in the second half of 2025 is comparable to the first half, with slight improvements in fiscal years 2026 and 2027, while maintaining current capital expenditures, the company's cash reserves are expected to grow gradually. This opens up three options for the future: increasing renovation investment, prepaying debt, or gradually resuming dividends.

While the company typically uses "lease-adjusted leverage" to measure financial health, net debt/EBITDA is more intuitive given the difficulty of forecasting. Currently, this metric suggests the company is not facing significant short-term risks.

Valuation based on market sentiment recovery and peer comparison

It's precisely this shift in market sentiment that lends this valuation logic some legitimacy. Bloomin' Brands' current low valuation essentially reflects investors' pessimism about its prospects. This is reflected in the market's generally accepted valuation: the company scores highly on valuation metrics, but underperforms on growth (pending a turnaround at Outback Steakhouse), profitability (impacted by the sale of Brazilian assets and debt repayment), and momentum (long-term negative comparable sales growth). However, it's worth noting that the ratings have seen marginal improvement: the quantitative analysis has been upgraded from "Strong Sell" to "Sell," the growth rating has been upgraded from "F" to "D," and the momentum rating has also rebounded from "F" to "D-."

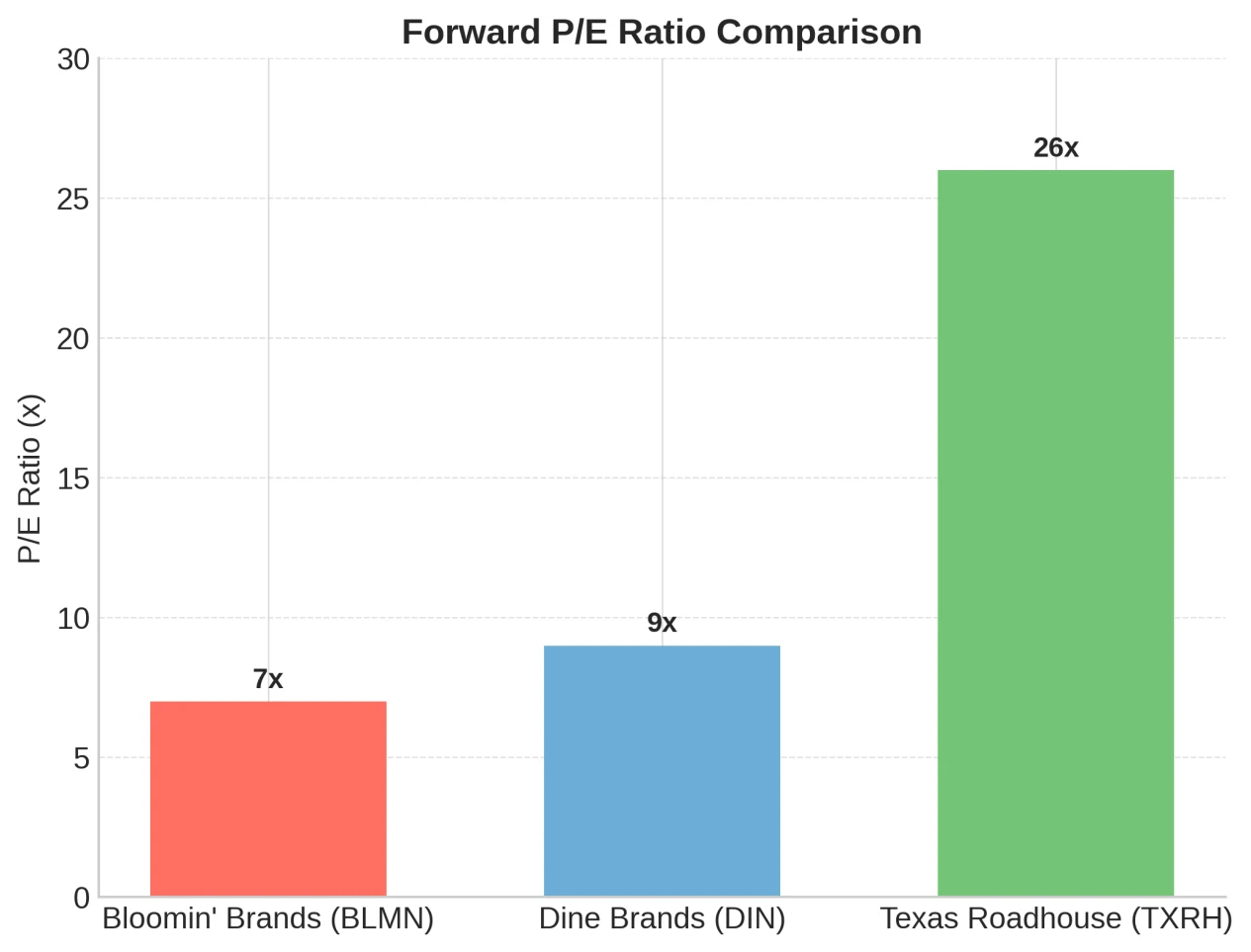

Compared to its peers, Bloomin' Brands' forward P/E ratio is only higher than Dine Brands Global (DIN) and significantly lower than Texas Roadhouse (TXRH), which trades at 26x. While we disagree with TXRH's current valuation, Bloomin' Brands' P/E ratio of just 7x is clearly too low. Even if market sentiment improves and the valuation rises to 10x, the stock still has nearly 50% upside potential.

Therefore, my views can be summarized as follows: First, the company has stable profits and free cash flow to support business transformation, store renovations, debt repayment and dividend adjustments; second, comparable sales of its two major brands have returned to growth, and Outback Steakhouse's turnaround signs are particularly critical; the sale of Brazilian assets releases value and provides new management with room and motivation to improve the core business; finally, once Outback Steakhouse reverses its decline, the market may re-price its P/E ratio to at least 10 times, or even higher.

In my buying logic, there are also three major risk factors, ranked in order of importance as follows:

First, the recovery of Outback Steakhouse is crucial. This brand contributes approximately 60% of the group's restaurant count and revenue. Without sustained positive comparable sales growth in the coming quarters, all of my previous earnings and cash flow forecasts will be invalidated. This factor is central to my entire investment thesis.

Second, there's rising pressure from beef prices. Declining US inventories, coupled with the 50% tariff on Brazil (which accounts for approximately 15% of US beef imports), could drive up costs and directly erode profit margins. This squeeze in gross profit margins could also offset the company's other margin-improving measures.

第三,Macroeconomic and consumer sentiment risks. If tariff increases drive inflation, or if an economic slowdown leads to higher unemployment, consumer spending could weaken. However, I'm less concerned about this than the previous two points. This is because restaurant spending has become a daily expense for American families. The real challenge lies in which brand offers the best value and captures market share, as Chili's recently demonstrated.

Is Bloomin' Brands worth buying?

As I emphasized in the valuation section, Bloomin' Brands remains a profitable company with solid cash flow and is currently focused on revitalizing its core franchise business. If this transformation is successful, a market reassessment will be imminent. In particular, if Outback Steakhouse can achieve sustained positive comparable sales growth in the coming quarters, its forward P/E ratio could be repriced to 10x or above. Therefore, investors should closely monitor this key metric while maintaining a keen eye on changes in consumer confidence.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates