Is Kraft Heinz still a good stock to buy now?

15:36 September 6, 2025 EDT

Key Points:

Kraft Heinz announced plans to split into two independently listed companies, Global Taste Enhancement and North American Grocery, aiming to reduce corporate complexity and unlock shareholder value. However, its stock price fell by approximately 6.5% that day, reflecting market caution .

The two companies after the separation have different business structures: Global Taste Enhancement is larger and has outstanding growth potential, while North American Grocery is positioned as a "cash cow" with stable cash flow. Management expects to achieve approximately $300 million in synergies, but execution details and cost offset risks remain uncertain .

Overall, KHC's split plan makes strategic sense, but its execution and effectiveness are uncertain. While the stock remains attractive due to its low valuation, the split itself is not a near-term catalyst, suggesting a more cautious "moderate buy" approach.

On September 2nd, shareholders of food giant Kraft Heinz experienced a dramatic day. Following management's announcement of plans to split the company into two independently listed companies, the stock price plummeted approximately 6.5%. This move was not entirely without warning; earlier this year, management had mentioned considering potential strategic transactions to unlock shareholder value.

Logically, a spinoff does make sense, but the company hasn't disclosed sufficient future details, and the transaction itself has some significant flaws, so I'm cautious about the decision. At least currently, KHC's stock price is attractive, and the company has maintained positive overall performance in terms of both profit and cash flow this year. Therefore, I believe shareholders would be better off if management chooses not to proceed with the spinoff. However, considering its fundamentals, I still rate the stock a "Moderate Buy."

Shocking move

Before the market opened on September 2nd, Kraft Heinz announced it would split its business into two independent, publicly traded companies. Management stated the move was intended to reduce corporate complexity and allow for independent operations of business units with different growth paths, thereby better unlocking shareholder value. While the official names have yet to be determined, the two companies are tentatively designated as Global Taste Elevation Co. and North American Grocery Co.

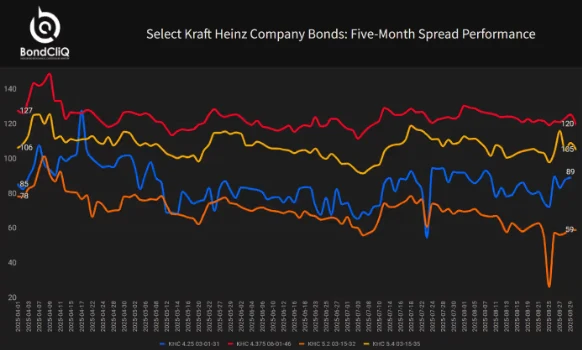

Source:BONDCLIQ

This logic is understandable: operating independently allows a company to focus on its core business, driving the expansion of high-growth businesses while improving the efficiency and profitability of mature operations. Similar cases have been seen in the separations of General Electric and AT&T. However, the market reacted coldly to the news, with the stock price falling approximately 6.5% that day. This is because, while the concept of the separation makes sense, the details remain uncertain.

According to management disclosures, the "Global Taste Enhancement Company" will be the larger entity, with revenue of $15.4 billion and EBITDA of $4 billion in 2024. It will include core brands such as Heinz, Philadelphia Cream Cheese, and Kraft Macaroni & Cheese. Over 75% of this business's revenue comes from market-leading brands, with strong growth in international markets, particularly emerging markets, with an average annual growth rate of 10% over the past five years. Furthermore, the expansion of the dining-out market provides continued growth potential.

In contrast, North American Grocery is smaller, with revenue of $10.4 billion in 2024 but a high EBITDA of $2.3 billion. Its brands (such as Oscar Mayer, Lunchables, Capri-Sun, and Maxwell House) reach over 90% of US households, making it a stable cash cow. Despite limited growth potential, its penetration rate in the food delivery channel (only 4%) remains below the industry average of 19%, suggesting potential for future growth.

Management expects the separation to generate approximately $300 million in synergies. However, as the two independent companies establish new management and accounting systems, some of the original cost savings will disappear, and it remains to be seen whether these potential efficiency losses can be fully offset.

Overall, Kraft Heinz's split plan makes sense strategically, but questions remain about the details of its implementation and its long-term effectiveness. The market's cautious reaction reflects investors' concerns about whether it can truly create shareholder value.

On the surface, the separation seems reasonable, but I remain skeptical of the deal. First, management anticipates synergies of up to $300 million. However, given that both companies will require independent management and financial systems going forward, some existing cost-saving measures will inevitably be ineffective. While management emphasizes that these impacts will be mitigated, the actual impact remains uncertain.

More importantly, I don't fully agree with the necessity of a split. Looking back at Kraft Heinz's financial performance over the past three years, and comparing the first half of 2025 with the same period last year, this year hasn't been particularly impressive. Declining sales and an unfavorable product mix are common problems across the food industry, primarily due to a weak economic environment. In its latest earnings report, the company even cited some impairment charges, attributing them to macroeconomic uncertainties.

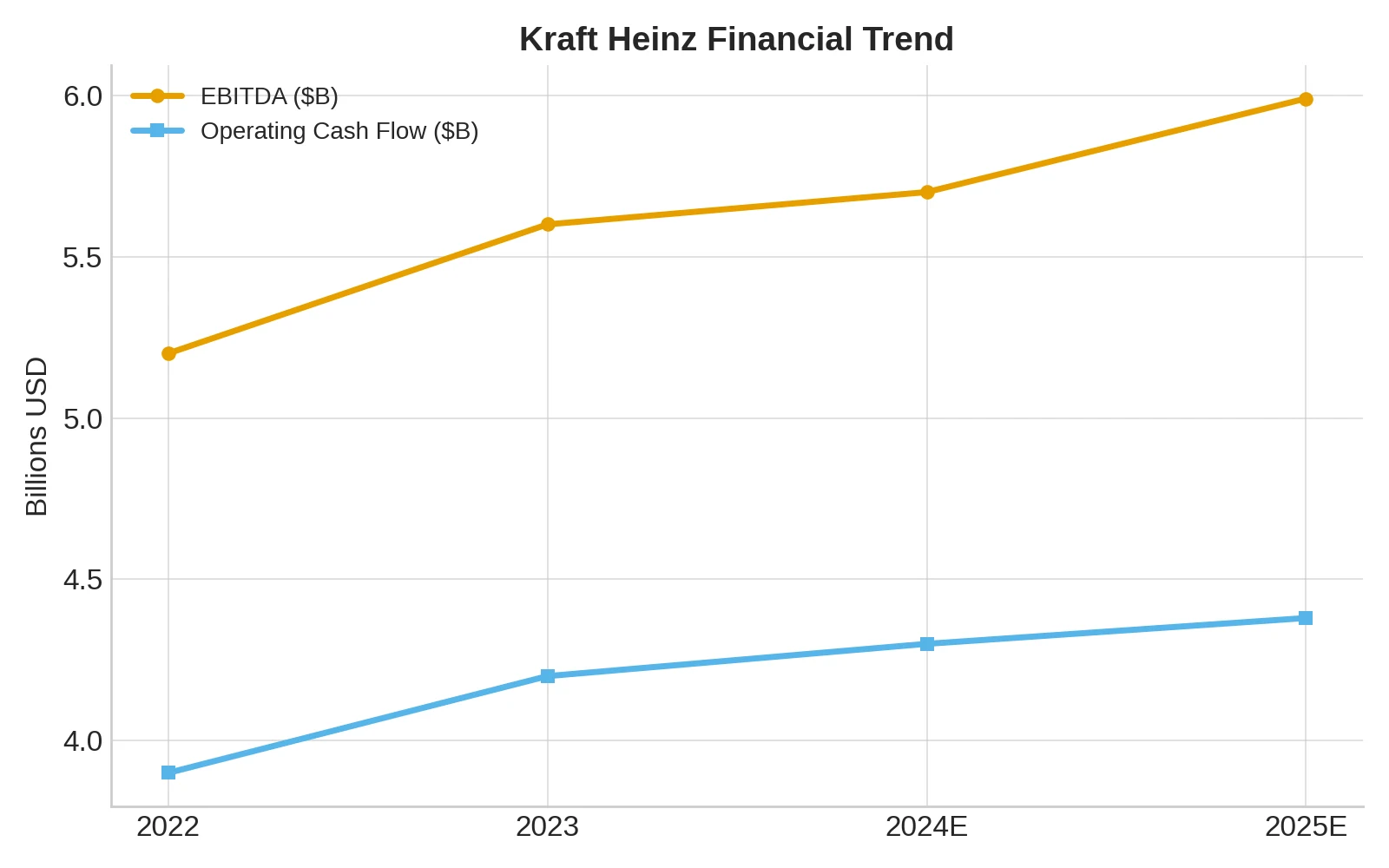

Despite this, the company's overall profit and cash flow trends remain positive. Management has demonstrated success in improving profitability in recent years, with margins continuing to improve. While organic revenue is expected to decline by 1.5% to 3.5% in fiscal 2024, with adjusted net income in the range of $3.07 billion, the trend projections suggest adjusted operating cash flow of approximately $4.38 billion and EBITDA of $5.99 billion in 2025.

The company also made progress on its balance sheet. From 2022 to 2024, net debt decreased by $495 million, reducing its net leverage ratio from 3.17 to 2.91. Even considering the full-year 2025 forecast, the net leverage ratio could rise to 3.12, still placing it in the middle of the pack compared to its peers.

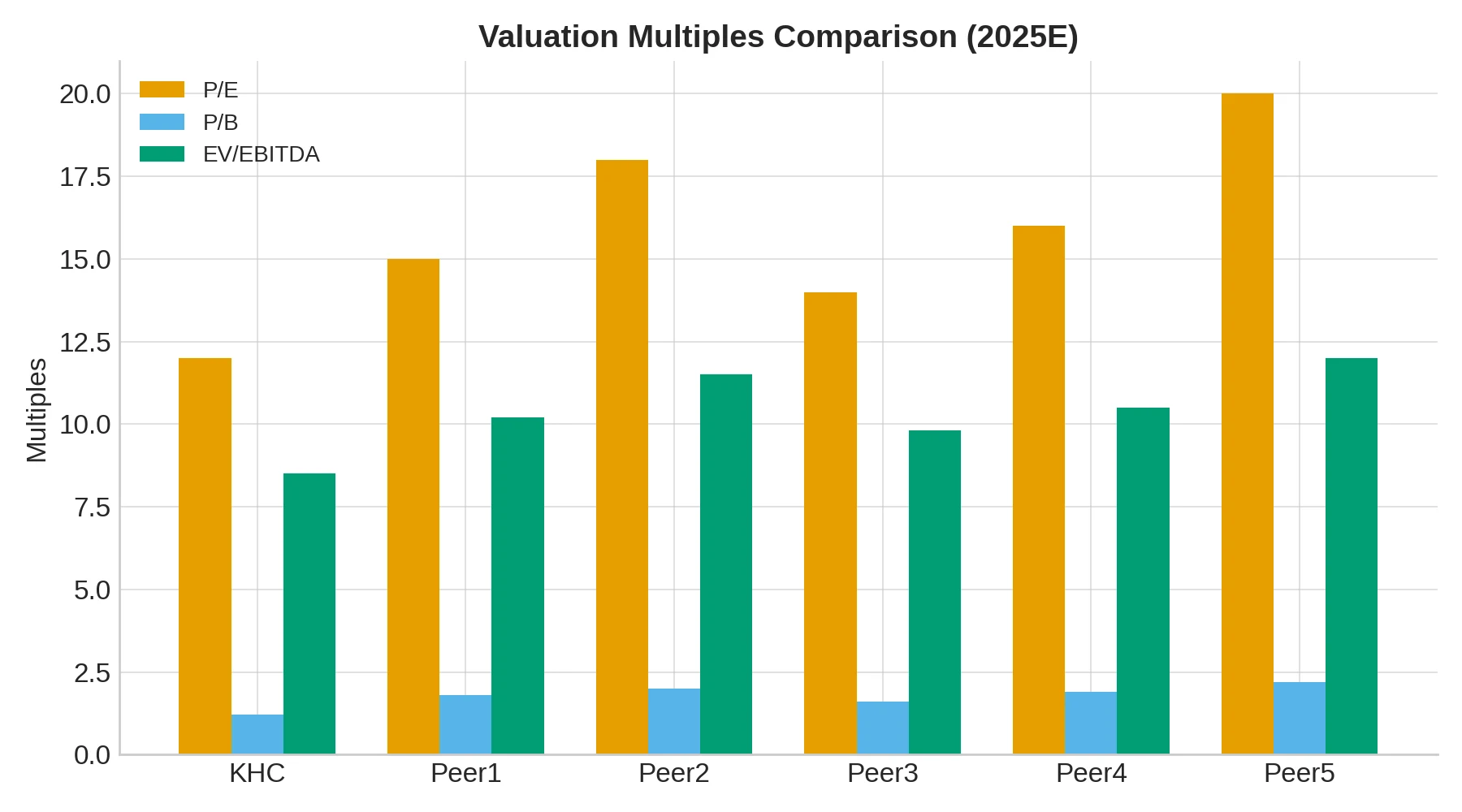

The company's valuation is also attractive. Based on 2024 results and 2025 forecasts, even without factoring in $300 million in synergies, Kraft Heinz's price-to-earnings and price-to-book ratios remain lower than those of most peers, and its enterprise value to EBITDA ratio is also relatively competitive. In other words, the current share price already reflects a significant margin of safety.

Notably, this split has not only puzzled ordinary investors but also disappointed major shareholder Berkshire Hathaway. Buffett himself admitted that the 2015 merger between Kraft and Heinz fell short of expectations and expressed his dissatisfaction with the split, believing it would not address the company's fundamental problems. Since the merger, the company's stock price has fallen by approximately two-thirds. Despite management's aggressive debt reduction and asset divestiture efforts, market returns remain poor. Whether Buffett will reduce his holdings in the future remains a key focus for investors. However, given the valuation, continued holding may still be justified.

takeout

Frankly, I understand the market's pessimism about this deal. It may ultimately create value for shareholders, but my biggest concern is that management hasn't provided a compelling enough rationale to justify this. They've certainly provided some rationale behind the separation and disclosed potential negative side effects, such as reduced synergies. But these explanations haven't been enough to convince investors that this move is superior to the company's consistent path of increasing profitability and cash flow in recent years.

Overall, Kraft Heinz's financials remain strong and its valuation appears cheap compared to its peers. Therefore, despite my reservations about the split itself, I still believe the current share price is attractive, making a Moderate Buy rating on the company more reasonable.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates