The market is entering its largest rotation cycle in decades

03:31 September 6, 2025 EDT

Key Points:

Current market sentiment is diverging from the real economy, with stubborn inflation and depressed market sentiment. The Fed's 2% growth target may no longer be realistic .

High inflation may become a long-term problem, and the Federal Reserve is gradually adjusting its targets. We can see a paradigm shift, where higher inflation and weak growth are forcing investors to rethink how to protect wealth and find value ;

While the economic landscape is challenging, the right strategy can turn challenges into opportunities. Value and energy stocks are currently performing well .

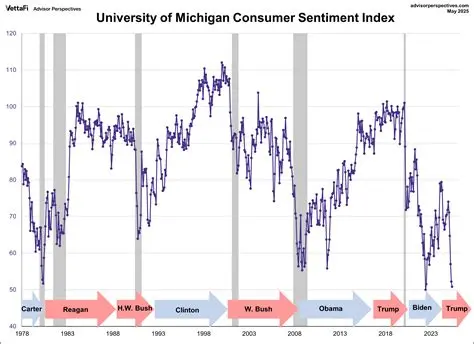

Tensions are high right now. Sentiments are generally strong regarding economic and political developments. New data from the University of Michigan confirms this: The negative impact of news headlines on business confidence has never been greater than it is now since the outbreak began.

This is intriguing. Since the 1960s, news-driven sentiment has fallen to similar lows only twice: during the pandemic, when the world was in lockdown and the extent of the epidemic was unknown; and during the financial crisis, when turmoil in the banking system hit nearly every industry.

But the situation today is different. There is no pandemic, no systemic bank failure, and no major natural disaster. Instead, the economic outlook remains solid, with optimistic GDP growth, with the Atlanta Fed projecting annualized growth close to 3.5%.

So, the question is: if the macro environment is not bad, why is market sentiment so depressed? In the following article, we will explain why and explore what this means. Because I believe we are on the eve of the largest market rotation in decades.

Inflation is becoming a problem

Overall, the current situation isn't as dire as some might think. The Atlanta Federal Reserve's GDP forecast remains optimistic, and the US economy hasn't suffered a pandemic-like shock, a systemic banking crisis, or a major natural disaster. The "misery index," which measures inflation and unemployment, is only 7.0%, far from peak.

So, what exactly is the problem?

The most prominent concern right now is inflation. Ever since the pandemic lockdowns were lifted, markets have consistently emphasized the potential for a prolonged period of high inflation and high interest rates. Unfortunately, this has become a reality. High inflation is not what investors desire. For example, a $100 bill from 2000 only has the purchasing power of approximately $52 today. Meanwhile, core housing rents have increased by 140% since the beginning of 2000. More and more people are unable to afford mortgages, and without asset protection, they are left directly bearing the brunt of rising living costs.

Recent data from the PCE (Personal Consumption Expenditures) price index further confirms these concerns. This index, similar to the CPI but with a broader coverage and a more comprehensive picture of household costs, shows that the annualized US inflation rate is 2.6%, 60 basis points above the Federal Reserve's target and trending higher. Of particular note, "super-core inflation," which excludes volatile items like food, energy, and housing, remains as high as 3.3%.

Source: apps.bea.gov

As Mohamed El-Erian has pointed out, the deflationary support from commodities since the pandemic is fading, which means core inflation is likely to remain above 3% for a prolonged period. I have emphasized a similar point in the past: even after a sharp drop in energy prices (oil and gas), inflation has already bottomed out.

Therefore, this actually marks a "regime change." Lawrence McDonald describes it as the arrival of an "era of long-term high interest rates." At the end of 2020, the super-core PCE began to deviate from its long-term downward trend, marking the beginning of a "long-term upward trend." However, the driving forces for higher inflation continue to accumulate: first, energy prices may have bottomed out, supported by fundamentals; second, the artificial intelligence revolution is driving electricity demand, and electricity prices in many regions have already seen double-digit increases, further driving housing-related inflation; and as for policy, government policies themselves may become the biggest driver of inflationary stickiness.

Fed's 2% target could be at risk

Since 2021, a frequent market discussion has been the Federal Reserve's de facto abandonment of its 2% inflation target. While the Fed has never publicly acknowledged this, growing evidence suggests a framework adjustment. For example, at the Jackson Hole conference, the Fed proposed a "2% average inflation rate," implying a willingness to tolerate periods of above-target inflation in exchange for employment and economic stability. This is consistent with the government's signals. The Trump administration has repeatedly called on the Fed to cut interest rates, and the president himself has even criticized Powell for "moving too slowly." Essentially, policymakers appear to be pursuing an "overheated economy," potentially even accepting inflation around 4% and nominal GDP growth in the high single digits. This implies a comprehensive shift: cyclical stocks, hard assets, and value stocks are likely to outperform growth stocks in the coming years. As Albert Marko has argued, investors need to reorient themselves to an environment shaped by high inflation and loose policy.

Source: tradingeconomics

However, the real economy isn't as robust as it appears. The bright spots in GDP growth primarily come from AI-related spending, while consumption's contribution to GDP has significantly weakened. In other words, growth lacks breadth, and the perceived prosperity is limited. High interest rates and high housing prices have compounded the real estate market, leading to a sharp decline in existing home sales and a crushing impact on the affordability of ordinary households. Manufacturing has continued to decline since 2021, and the job market has seen a decline in new jobs, with unemployment claims continuing to rise. Uncertainty about the impact of AI on future job demand has further undermined confidence. This explains why, despite the optimistic GDP figures, the American public remains pessimistic.

But this is not the end of the world.

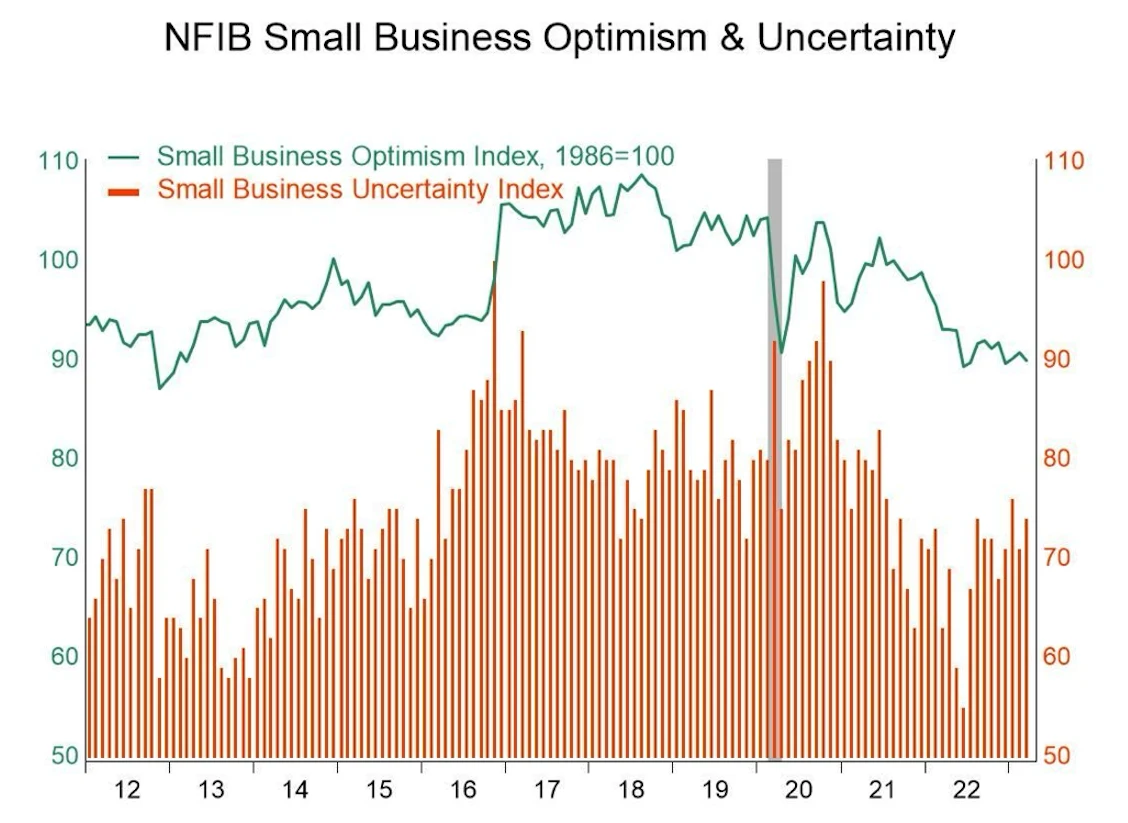

If the government can create an environment where high inflation is tolerated in exchange for growth, there is still hope for a recovery. The deregulation of the "Big Beautiful Act" has improved small business confidence. The US government is currently actively promoting the possibility of a central bank interest rate cut, as this could stimulate housing demand and real estate investment, pushing up housing prices and boosting employment.

Furthermore, uncertainty surrounding tariffs may actually stimulate some manufacturing and trade activity. Indeed, some signs of recovery are emerging: the small business optimism index has rebounded, and key indicators such as the New York Fed manufacturing index have improved after a long period of stagnation. This is a positive sign for cyclical value stocks.

So, what does the future hold?

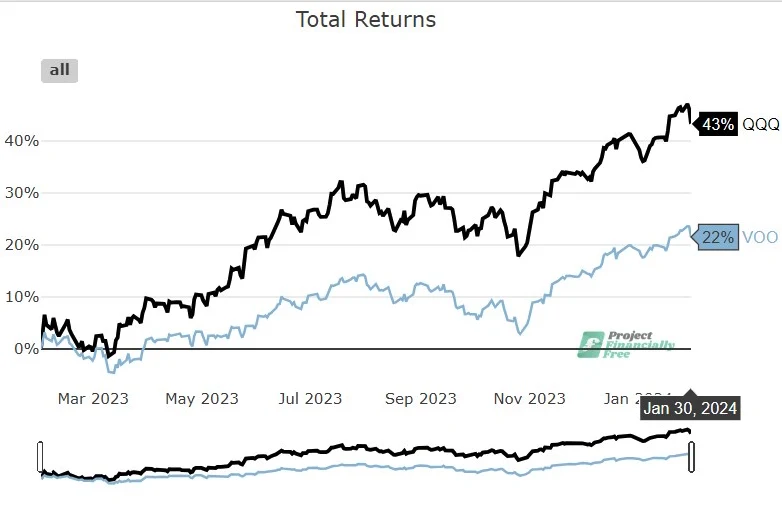

Investors can see that the energy and industrial sectors have remained relatively stable. While technology stocks have dominated over the past decade, industrial stocks have also outperformed over the long term. For example, the industrial sector, represented by the Industrial Select Sector ETF (XLI), has maintained a relatively stable ratio over the past five years relative to the tech-heavy QQQ. This suggests that industrial stocks have not been marginalized.

Source: NASDAQ

Industrial and infrastructure-related companies may be promising sectors with continued upward momentum. These sectors are directly or indirectly benefiting from the AI wave, including data center providers, power grid equipment manufacturers, integrated engineering firms, and railroads with pricing power and the potential for a cyclical demand recovery. For this reason, companies like Union Pacific (UNP) and Canadian Pacific-Kansas City Railway (CP) are currently undervalued. If the "cyclical value" logic holds true, we could witness a dramatic market rotation. AI will not only drive technology itself but also have a powerful trickle-down effect, benefiting industrials, materials, and even previously pressured small and mid-cap stocks.

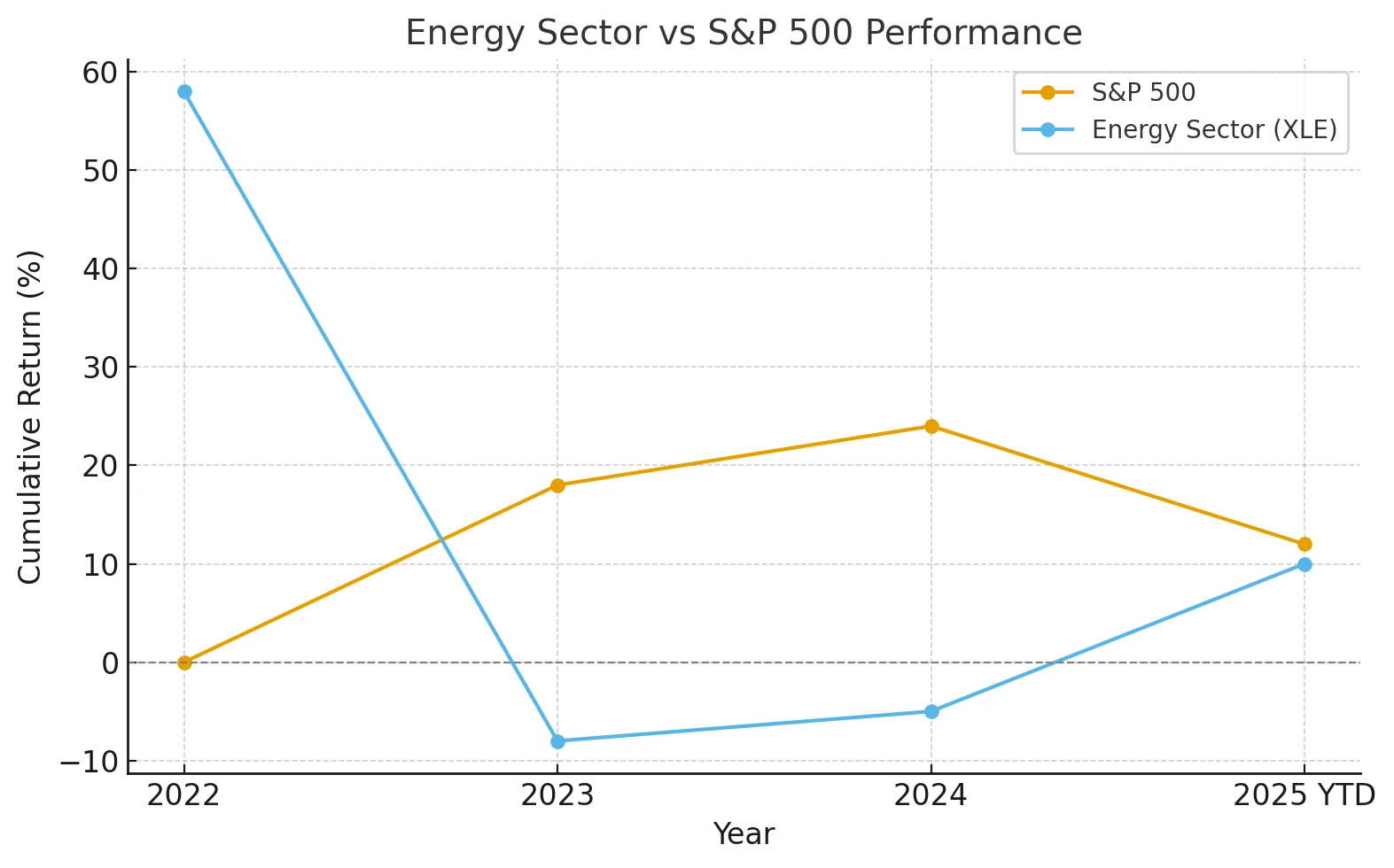

Energy stocks are also worth watching. The energy sector has underperformed relative to the S&P 500 since late 2022, but is now attempting to bottom out. I believe this phase is nearing its end, and therefore am actively allocating to inflation-protected energy assets. For example, Texas Pacific Land (TPL) and LandBridge (LB) offer scarcity value as highly profitable landowners, while Canadian Natural Resources (CNQ) can generate double-digit free cash flow with WTI crude oil above $80 and offers a dividend yield exceeding 5%. These are just a few examples; there are many more opportunities.

It should be emphasized that investors need to further understand the risks of chasing cyclical stocks. For now, it is a more advantageous investment option to focus on companies with wide moats, clear pricing power, and the ability to continuously create value for shareholders.

The current economic environment remains complex: while prices have slowed year-on-year, inflation has persisted since 2021; cyclical growth is weak, putting pressure on employment; and government debt and deficits remain stubbornly high, potentially even relying on inflation to absorb them. Policymakers are forced to make a difficult choice between protecting growth and curbing inflation.

Against this backdrop, holding the right assets is more important than ever. While index ETFs remain a solid long-term option, overweighting cyclical value stocks, which offer inflation protection and valuation advantages, is a more forward-looking strategy at this time. For long-term investors, this may be a key opportunity to generate excess returns.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates