How Investors Can Position Themselves to Capitalize on the Ongoing Gold Rally

05:24 September 4, 2025 EDT

On September 3, 2025, London spot gold hit a record high of $3,578.50 per ounce during the session, while COMEX gold futures broke through the $3,600 level, reaching $3,617.50 per ounce, marking a new cyclical high in the global gold market’s ongoing bull run.

Source: TradingView

Year to date, gold has rallied 34%, outpacing the S&P 500 (9%) and Bitcoin (18%), establishing itself as one of the top-performing asset classes. Amid this sustained advance, the core questions for investors are likely:

Are the fundamental drivers behind gold’s strength sustainable?

Do positioning opportunities still exist at current elevated levels?

And how should strategic allocation to gold be calibrated within a portfolio to capture potential upside while managing risk?

The Fundamental Thesis Behind the Gold Bull Market

The current breakout in gold prices is not a short-term, speculation-driven spike, but rather the result of multiple driving factors working in concert. Each of these drivers exhibits considerable persistence, collectively forming a resilient "moat" supporting gold's ascent.

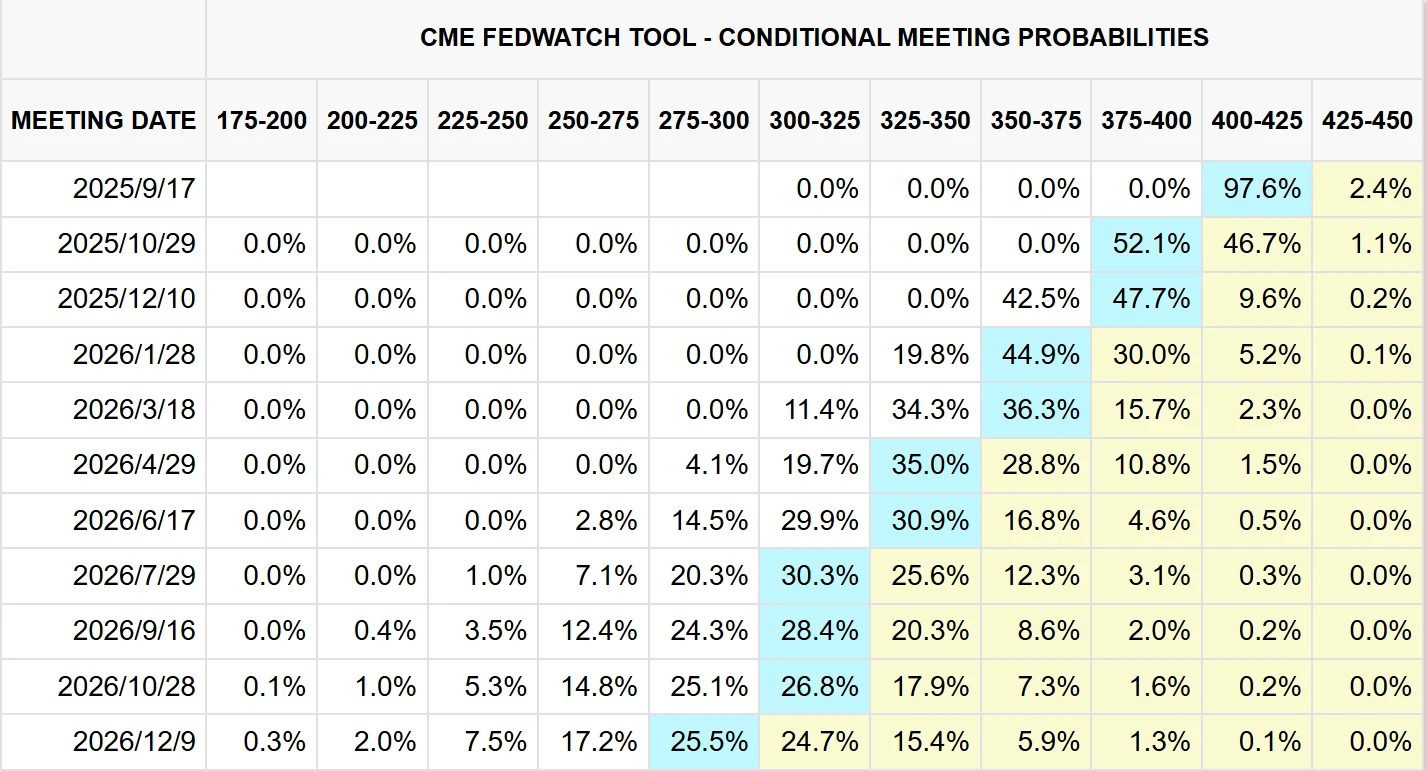

The core catalyst for this rally is the shift in the Federal Reserve's monetary policy. Since May 2025, market expectations for Fed rate cuts have steadily intensified. As of September, CME FedWatch Tool data indicates a 97% probability of a 25-basis-point cut at the September FOMC meeting.

Source: CME Group

This expectation has directly pressured real yields—the yield on the 10-year US Treasury Inflation-Protected Security (TIPS) has fallen 80 basis points to 1.2%, a low not seen since 2020. For a non-yielding asset like gold, lower real rates significantly reduce the opportunity cost of holding it. This effect has been amplified by a concurrently weakening US Dollar: the US Dollar Index (DXY) fell over 10% in the first half of 2025, its worst performance since 1973. As a dollar-denominated asset, gold has naturally become a core hedge against dollar depreciation.

Source: TradingView

Notably, ongoing uncertainty surrounding the Trump administration's trade policies continues to influence markets, making expectations of a weakened dollar credit difficult to reverse in the short term, thereby providing long-term support for gold.

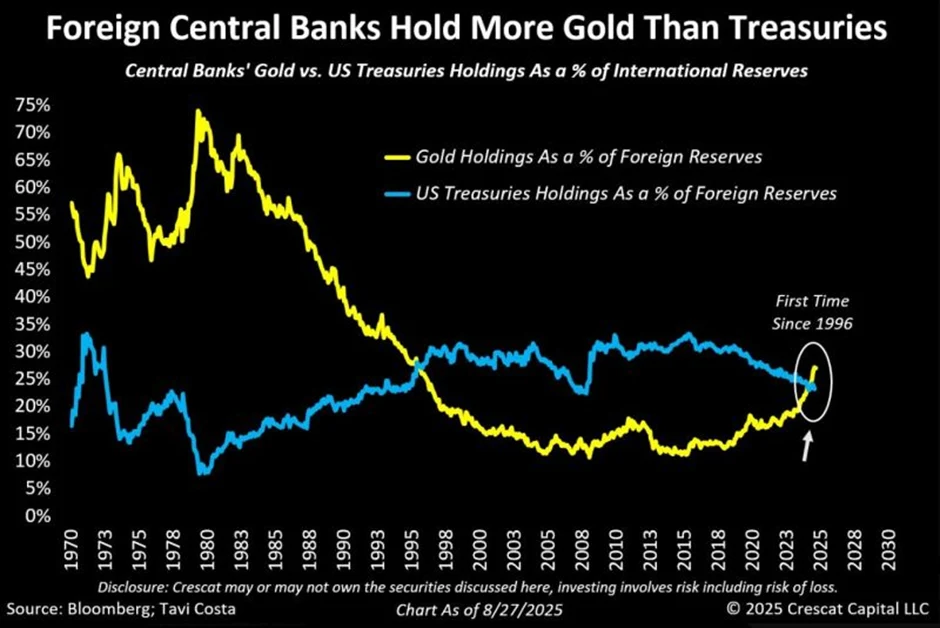

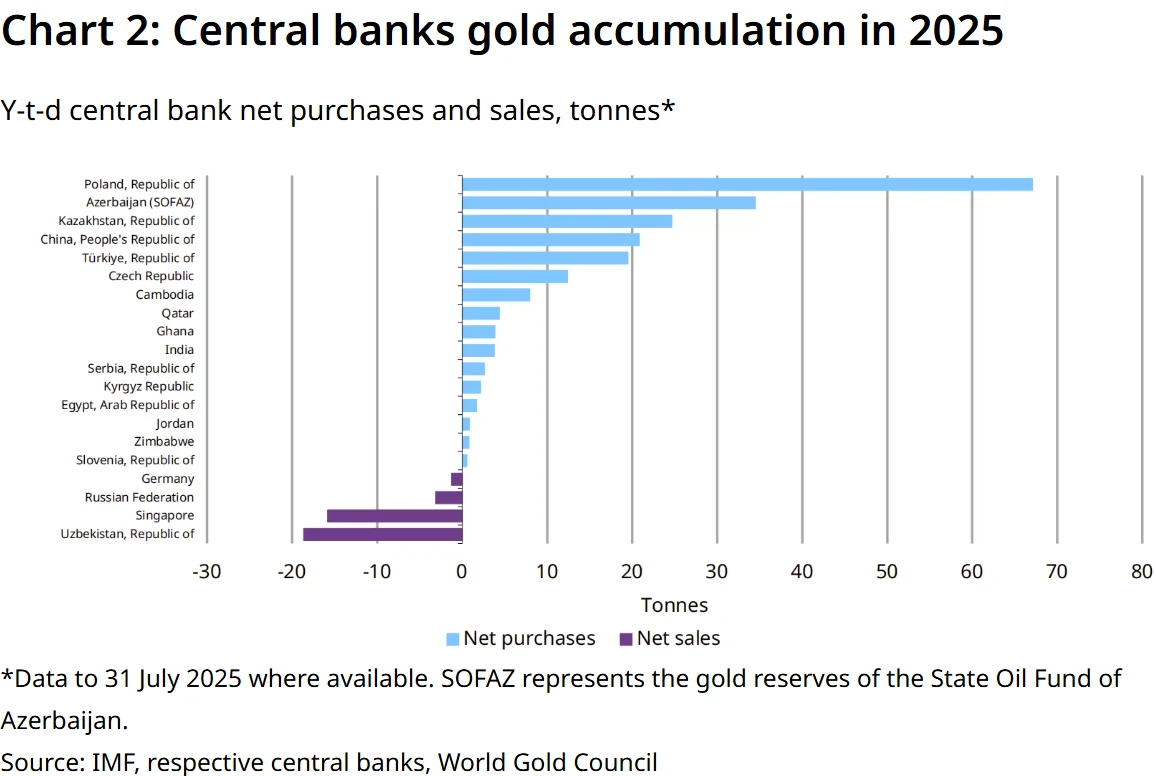

Beyond monetary policy, the deepening global "de-dollarization" trend is reshaping gold's strategic value. Data shows that global central bank gold reserves have reached 38,000 tonnes, accounting for 15.7% of foreign exchange reserves. In a historic shift, foreign central banks' net acquisitions of gold in the first half of 2025 surpassed their net purchases of US Treasuries for the first time since 1996.

Source: Crescat Capital

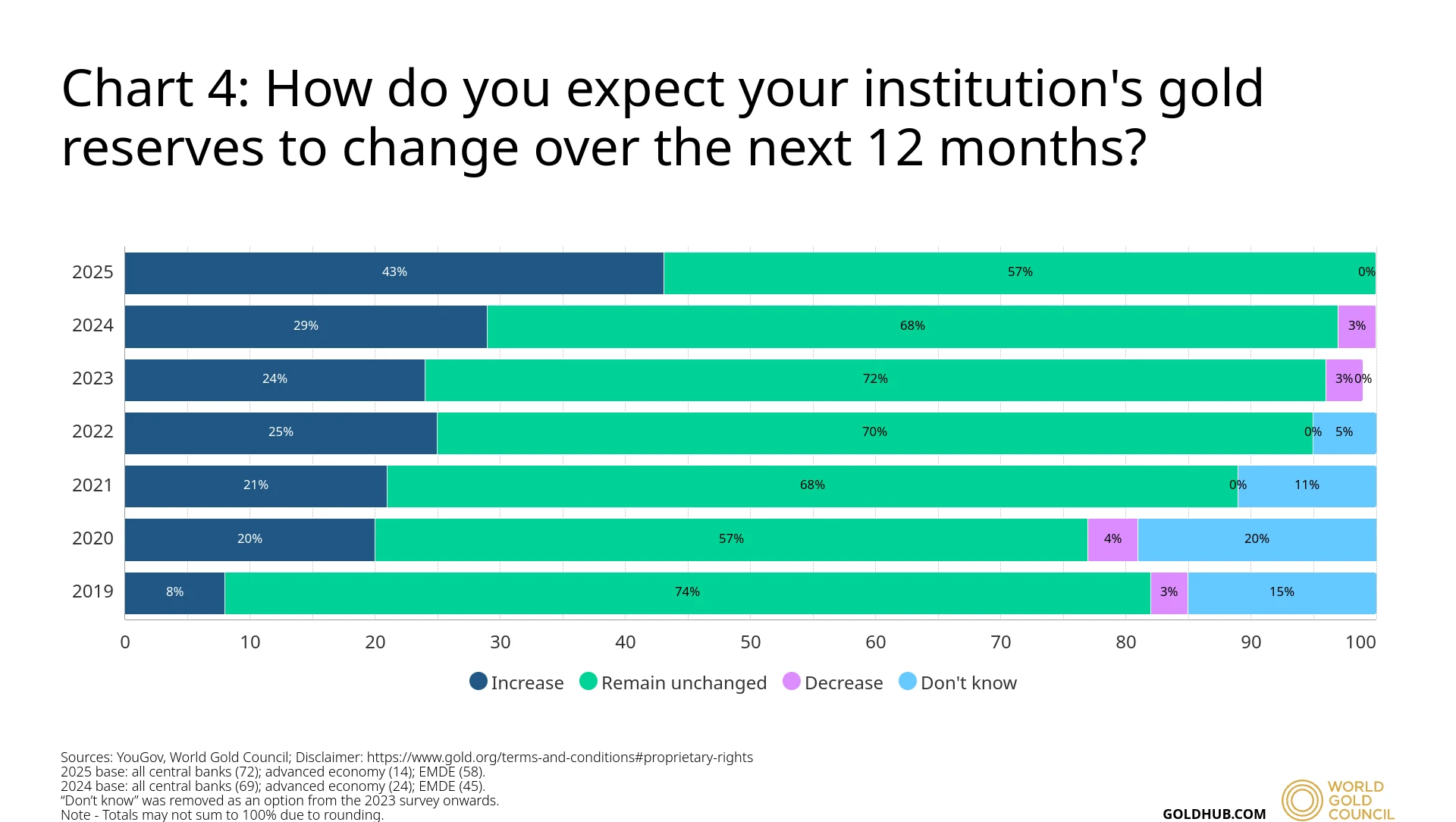

A World Gold Council survey reveals that nearly 43% of central banks plan to increase their gold holdings over the next 12 months, a significant rise from 29% in 2024 and a new record high.

Source: World Gold Council

The fundamental logic behind this trend is the escalating concern over the safety of the dollar-dominated reserve system, underscored by the US national debt surpassing $37.2 trillion—127% of GDP. In this context, gold, as the "ultimate means of payment," is being repriced for its irreplaceable safe-haven attributes.

Geopolitical risks and global debt pressures are further amplifying gold's allocation appeal. Since the start of 2025, escalating Middle East tensions and the ongoing Russia-Ukraine conflict have driven the Geopolitical Risk (GPR) index up nearly 40%, funneling short-term safe-haven flows into the gold market.

A more persistent pressure stems from the snowballing growth of global debt. The US net interest expense reached $882 billion in fiscal year 2024, accounting for 3.06% of GDP. This "debt-monetization" cycle continuously fuels skepticism about fiat currency credibility. As Professor Thorsten Polleit of the University of Bayreuth notes, central banks worldwide are trapped in a dilemma where "raising rates triggers a debt crisis, while low rates accelerate currency debasement." Gold, an asset not reliant on any counterparty credit, has become a prime choice for hedging this inherent contradiction.

From a market structure perspective, gold demand has shifted from being primarily driven by private investment to a dual engine of "official demand plus private investment." Holdings in the world's largest gold ETF, SPDR® Gold Shares, have surpassed 900 tonnes, a high not seen since 2020, with global gold ETFs seeing net inflows exceeding $20 billion year-to-date in 2025. Meanwhile, central bank purchasing creates a more stable long-term demand base—emerging market central banks directly accumulate physical gold to reduce dollar dependency, while investors in developed markets participate via financial instruments. This evolution in demand structure not only underpins prices but also extends the duration of the bull market.

Source: World Gold Council

Positioning at Current Elevated Levels

Facing historically high levels above $3,500 per ounce, investors’ core dilemma is whether to enter the market at this stage.

From a long-term perspective (1-3 years), the fundamental drivers behind gold’s strength show no signs of reversal, and the metal remains worthy of strategic allocation. First, if the Federal Reserve proceeds with an interest rate cut in September as expected, it will mark the beginning of a new easing cycle. Real yields are likely to remain low or decline further, sustaining the advantage of holding gold by minimizing its opportunity cost. Even if a short-term pullback occurs due to a “buy the rumor, sell the fact” reaction post-cut, the medium-to-long-term trend of monetary easing is unlikely to reverse abruptly.

Second, global de-dollarization is not a short-term policy fluctuation but a strategic shift rooted in concerns over dollar credit weakening. Central banks’ demand for gold is structural and will not diminish due to short-term price volatility, providing a solid floor for gold prices. Lastly, both equity and bond markets face elevated uncertainties—U.S. bond yields continue to climb, and stock valuations remain near historical highs. Gold’s low long-term correlation with stocks and bonds (historically below 0.2) makes it an effective tool for optimizing portfolio risk-adjusted returns, particularly for long-term capital seeking diversification.

That said, short-term risks should not be overlooked, with heightened volatility posing a challenge. Gold has rallied more than 34% year-to-date in 2025, and some short-term speculative positions have accumulated significant paper profits. Profit-taking may emerge in the $3,500–$3,600 range, creating intermittent downward pressure.

Furthermore, upcoming U.S. employment data and the September Fed meeting could spark expectation gaps—should job data surprise to the upside, it could dampen rate cut expectations; if the meeting delivers a “hawkish ease” (e.g., a 25-basis-point cut paired with a pause signal), it may also trigger a correction in gold.

Geopolitical risks, another key driver of gold’s gains over the past three years, remain susceptible to sudden alleviation. A ceasefire in the Russia-Ukraine conflict or de-escalation in the Middle East could substantially reduce this supportive factor. Historical patterns suggest that in such a scenario, gold could relinquish up to two-thirds of the gains accumulated since the Ukraine crisis.

Strategic Allocation to Gold Within an Investment Portfolio

As a non-producing store of value (NPSOV), gold does not generate cash flow. Its long-term value is primarily driven by factors such as global wealth growth, supply-demand dynamics, and its correlation with other assets. Within an investment portfolio, the core role of gold is not to enhance returns, but to reduce volatility and provide risk hedging.

A recent research report from the prominent hedge fund D.E. Shaw indicates that the optimal allocation to gold should range between 6.5% and 9%. When equities and bonds exhibit negative correlation, the marginal utility of gold in hedging against market crashes is relatively lower, warranting an allocation of around 6.5%. However, when the equity-bond correlation turns positive, gold’s role in mitigating systemic risk becomes more pronounced, justifying an allocation of up to 9%. Given that the current 12-month equity-bond correlation is near zero, the model suggests a neutral allocation of approximately 7.5%.

This conclusion aligns with data from the World Gold Council, which shows that gold typically constitutes between 1.8% and 7.3% of globally liquid wealth, further supporting the rationality of maintaining gold holdings within this range. D.E. Shaw’s model is based on historical averages: gold’s annual return exceeds the inflation-adjusted risk-free rate by about 0.5%, with volatility of 15%, consistent with long-term averages from 1971 to 2022, thus demonstrating strong statistical robustness.

It is worth noting that macroeconomic uncertainty stemming from 2025 tariff policies is driving increased equity-bond correlation. In this context, the utility of gold allocation becomes more significant. Estimates show that even a 5% allocation to gold can reduce overall portfolio volatility by approximately 10%, highlighting its value as a risk hedge in an environment of macroeconomic fluctuation.

The Bull Run Persists, Yet Prudence is Warranted

From the perspective of Wall Street institutions, Goldman Sachs maintains its forecast of $4,000 per ounce by mid-2026, UBS has raised its target price to $3,700, and Morgan Stanley has set a year-end target of $3,800. These projections underscore the market’s optimistic long-term outlook on gold.

However, investors must remain cognizant that in a high-price environment, prudence prevails over optimism. Current gold prices have already partially absorbed existing positive catalysts, and short-term volatility risks should not be overlooked. Chasing the rally or adopting a fully allocated position indiscriminately may prove unwise. Ultimately, the optimal allocation to gold should be determined by individual investment objectives, risk tolerance, and market perspective.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates