Trump Administration Appeals to Supreme Court: Dispute Over Tariff Legality and Its Implications

03:17 September 4, 2025 EDT

On September 3, 2025, the Trump administration formally petitioned the U.S. Supreme Court to overturn a July 29 ruling by the U.S. Court of Appeals for the Federal Circuit, which decided 7-4 that the administration’s imposition of tariffs on multiple countries under the International Emergency Economic Powers Act (IEEPA) exceeded presidential authority. The appellate court upheld the ruling of the U.S. Court of International Trade, stating that IEEPA does not authorize broad, open-ended tariffs on nearly all imported goods and that tariff authority constitutionally resides with Congress. This appeal seeks to restore the executive branch’s capacity to leverage IEEPA for tariff implementation to address trade imbalances and national security concerns.

According to The Wall Street Journal, the Supreme Court is unlikely to decide whether to take up the case until December 2025 or January 2026. If certiorari is granted, oral arguments could be scheduled for late winter or early spring of 2026, with a final decision expected by summer 2026.

Pending the Supreme Court’s final ruling, and under an order issued by the Federal Circuit, the currently challenged tariffs may remain in effect until October 14, 2025, providing the Trump administration a transitional window to pursue its appeal.

The White House has expressed confidence in a favorable Supreme Court review. Senior officials, including Treasury Secretary Besant, indicated they expect the Court to uphold the use of IEEPA to justify tariffs. Concurrently, the administration is preparing contingency measures. Secretary Besant disclosed that one alternative under consideration is invoking Section 338 of the largely dormant Smoot-Hawley Tariff Act of 1930, which authorizes the President to impose tariffs of up to 50% on imports from countries found to be discriminating against U.S. commerce.

Legal Proceedings and Points of Contention

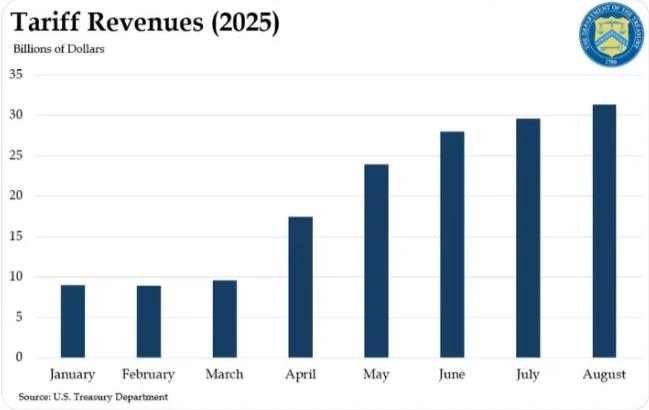

The controversy over the U.S. government’s tariff policies stems from its broad-based “universal tariffs” imposed in 2025 under the International Emergency Economic Powers Act (IEEPA), including “reciprocal tariffs” targeting multiple countries and fentanyl-related import duties. According to U.S. Customs and Border Protection data, as of August 25, 2025, the Trump administration had collected a total of $65.8 billion in tariffs authorized under IEEPA.

On August 29, 2025, the U.S. Court of Appeals for the Federal Circuit ruled 7–4 that the White House’s invocation of IEEPA to implement these tariffs exceeded presidential authority. The majority opinion emphasized that “these tariffs apply to nearly all goods imported into the United States, are imposed at high and fluctuating rates that exceed those set forth in the U.S. tariff schedule, and are open-ended in duration,” underscoring that “tariff authority lies at the core of Congress’s constitutional powers, not the President’s.” The ruling affirmed an earlier decision by the U.S. Court of International Trade, marking the Trump administration’s second legal defeat in lower courts.

Facing this adverse ruling, the Trump administration formally appealed to the Supreme Court on September 3. Former President Trump asserted that overturning IEEPA-based tariffs would be “catastrophic” and emphasized that tariffs are “essential to America’s success.” Treasury Secretary Scott Besant also stated that the appellate court’s decision, “though judicially stayed, creates legal uncertainty regarding the tariffs and severely impairs the President’s ability to conduct real-world diplomacy and protect U.S. national security and economic interests.”

At the heart of the legal dispute is the scope of authority under IEEPA. Enacted in 1977, the law grants the President certain economic powers to address “unusual and extraordinary threats” in emergencies. However, the appeals court concluded that the statute does not explicitly confer broad tariff-imposing powers on the President.

Professor Mark Graber of the University of Maryland School of Law noted that the Supreme Court is likely to scrutinize the legal basis of Trump’s tariff stance closely, as there is no indication IEEPA was intended to permit the continuous imposition and adjustment of tariffs for enduring issues such as drug trafficking and trade deficits. He also observed that legal precedents supporting unilateral executive tariff actions are exceedingly rare, with President Nixon being the last president who attempted to reshape global trade through tariff measures.

Ryan Majerus, a former senior Commerce Department official and current partner at King & Spalding, suggested that given the strongly worded majority and dissenting opinions in the Federal Circuit’s ruling, the Supreme Court is likely to resolve the central question of whether IEEPA permits the executive branch to levy tariffs. This decision, he added, will significantly influence the trajectory of U.S. trade policy.

Notably, the Supreme Court currently holds a 6–3 majority of justices appointed by Republican presidents. Legal and trade experts generally believe this could marginally improve the Trump administration’s chances of preserving the tariffs. However, historical precedents indicate that the Court does not always rule along partisan lines in fundamental separation-of-powers cases. For instance, in *Clinton v. City of New York*, the Court struck down the presidential line-item veto as unconstitutional under the Presentment Clause of the Constitution, despite President Clinton being a Democrat and several Republican-appointed justices serving on the bench at the time.

Potential Ramifications

The final ruling in this case is poised to have profound implications for the U.S. political system, particularly regarding the balance of power between the executive and legislative branches. If the Supreme Court upholds the lower court’s decision, it would reinforce constraints on executive overreach, affirm Congress’s constitutional authority over fiscal matters, and further clarify the separation of powers as defined by the Constitution. Conversely, if the Court overturns the ruling, it would signify an unprecedented expansion of presidential authority, potentially leading to a structural shift in the long-standing framework of U.S. governance.

The case has already exacerbated partisan divisions. Congressional Democrats have largely endorsed the appellate court’s decision, characterizing it as a necessary check on executive power. In contrast, the Trump camp has denounced the ruling as “deeply partisan.” As the case advances to the Supreme Court, these divisions are likely to intensify, further polarizing the U.S. political landscape.

From a governance perspective, the outcome will directly impact the credibility of the Trump administration’s policies. Should the tariff measures be invalidated, it could undermine the government’s public credibility and expose weaknesses in the legal foundations of its policy agenda. Moreover, the stability of U.S. domestic policy would be called into question, raising concerns among both citizens and the international community regarding the predictability of American policymaking.

Economically, tariffs have become a notable source of federal revenue. In August 2025, U.S. tariff receipts reached $31.37 billion, a record monthly high, bringing the fiscal year-to-date total to $183.56 billion. A significant portion of these collections derives from tariffs authorized under IEEPA. If these tariffs are ruled illegal, the U.S. government would not only lose this revenue stream but could also face pressure to refund the $65.8 billion already collected.

The Trump administration has repeatedly advocated replacing corporate and individual income taxes with high tariffs, claiming that tariff revenue could “very likely” supplant income tax. Former President Trump even asserted that the government could collect “$2–3 billion per day” in tariffs. However, data from U.S. Customs and the Treasury Department indicate that daily tariff collections averaged approximately $200–300 million even after the partial implementation of “reciprocal tariffs” on April 5, 2025.

Economists widely regard the proposal to replace income taxes with tariffs as mathematically unfeasible. Erica York, Chief Economist at the Tax Foundation, noted that to offset the approximately $2 trillion in annual income tax revenue—using 2023 as a benchmark—tariff rates would need to reach 69.9%, assuming no decline in import volumes, a scenario that is practically implausible.

Torsten Slok, Chief Economist at Apollo Global Management, emphasized that the federal government collects roughly $3 trillion annually from income taxes, while U.S. imports total about $3 trillion per year. This implies that tariff rates would need to reach at least 100% to replace income tax revenue, far exceeding the current effective tariff rate of 22.8%.

Meanwhile, the legal uncertainty surrounding the tariff policy has strained U.S. relations with trade partners. Many governments are now compelled to factor in the volatility of U.S. tariff policy when negotiating trade agreements, potentially delaying or even obstructing the finalization and implementation of such deals.

Notably, the U.S. has recently been accused of leveraging tariff threats to dissuade countries from supporting a United Nations agreement aimed at reducing shipping fuel emissions. The Netherlands and other nations have received verbal warnings from U.S. representatives that adopting the so-called “net-zero framework” could trigger retaliatory measures, including tariffs, visa restrictions, and port fees.

Retaliatory actions from trade partners remain a significant risk. Historical precedent suggests that unilateral tariff measures often provoke chain reactions, leading to heightened global trade barriers. Previous U.S. tariffs targeting China and the European Union, for example, prompted countermeasures from affected countries. Moon Seung-hok, First Vice Minister of South Korea’s Ministry of Trade, Industry and Energy, cautioned that export conditions are likely to deteriorate, citing “tariff shocks, the spread of protectionism, and global supply glut as potential headwinds for Korean exports.”

Historical Precedents

Historical U.S. tariff policies provide critical context for understanding current developments.

The Smoot-Hawley Tariff Act of 1930 remains one of the most consequential case studies in American tariff history. Signed into law by President Hoover, the legislation imposed steep tariffs on over 20,000 imported goods, triggering widespread retaliatory measures from trading partners. Within years, U.S.-Europe trade volumes plummeted by two-thirds, global commerce contracted significantly, and the U.S. economy faced additional headwinds during the Great Depression. This episode demonstrates how specific tariff policies can materially impact global trade and domestic economic conditions.

The "Nixon Shock" of the 1970s offers another historical reference for analyzing tariff and trade policy implications. In August 1971, President Nixon announced the suspension of dollar-gold convertibility alongside a 10% surcharge on all imports to address economic challenges. These measures strained relations with key trading partners, accelerated the collapse of the Bretton Woods system, triggered substantial dollar volatility, and disrupted international financial markets. This historical sequence illustrates how presidential tariff and trade policy adjustments can significantly reshape international financial architecture and trade patterns.

In the 21st century, the Bush administration's imposition of tariffs up to 30% on ten categories of steel imports in 2002 yielded mixed results. While the measures created several thousand new jobs in the steel sector, they also increased steel prices—raising production costs for downstream industries such as automotive and appliance manufacturing. According to estimates, approximately 200,000 U.S. jobs were lost in 2002 due to industry adjustments related to the steel tariffs, exceeding total employment in the steel industry itself. The World Trade Organization ultimately ruled the tariffs inconsistent with U.S. obligations, prompting the Bush administration to terminate the measures prematurely in December 2003.

This case illustrates how targeted tariff policies may produce differential effects across sectors: while providing support to specific industries, they can simultaneously impose cost pressures on interconnected segments of the economy.

Conclusion

The Trump administration’s appeal to the Supreme Court over the legality of IEEPA-based tariffs centers on a pivotal constitutional dispute regarding the boundaries of presidential trade authority. The Court’s ruling will delineate the scope of executive power in trade policy, with major implications for future fiscal revenue, economic stability, and international relations. Historical precedents demonstrate that expansive tariff measures can provoke substantial economic disruption and global repercussions.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates