U.S. Soft Employment Data Halts Global Long-Term Bond Yield Rally

23:16 September 3, 2025 EDT

Key Points

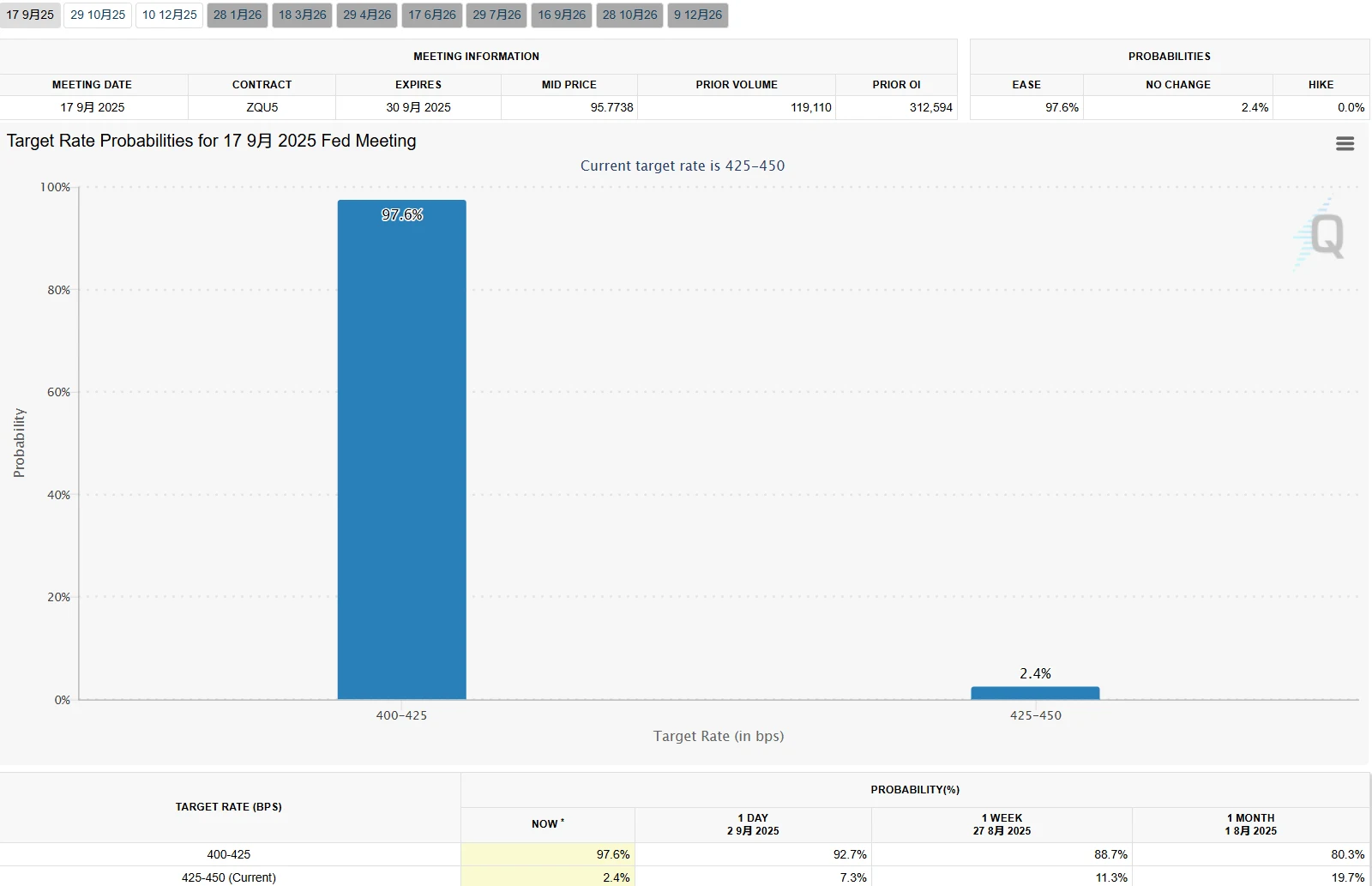

U.S. job openings fell to 7.181 million in July, the lowest level in ten months. The data marked a turning point for the bond market, temporarily halting the persistent rise in global long-dated yields.

The weak labor data quickly shifted market pricing. Traders now assign a 97.6% probability to a 25-basis-point Fed rate cut in September, up from 85% previously.

If Friday’s nonfarm payrolls report also comes in soft, the bond market may begin to price in the possibility of a 50-basis-point cut, providing additional support to global long-end bonds.

On September 3, the global long-end bond market staged a relief rally.

The U.S. 10-year Treasury yield fell 4.27 basis points to 4.217% on the day, while the 30-year yield retreated from the psychological 5% threshold to 4.897%. The yield curve flattened modestly. The 2s/10s spread narrowed to 59.5 basis points, compared with 62 basis points late Tuesday. Earlier Wednesday, the spread had touched 63.8 basis points, the widest since April.

Source: TradingView

This rebound also pulled down the U.K. 30-year gilt yield, which fell 7 basis points from its 1998 high of 5.75%. Eurozone yields moved lower as well, though France’s 30-year yield remains near its highest level since 2009, while Germany’s equivalent maturity is hovering near a 14-year peak.

The immediate catalyst for the move was the U.S. Labor Department’s JOLTS report. July job openings dropped to 7.181 million, the lowest since September 2024 and 200,000 below expectations, underscoring a faster-than-anticipated cooling in the labor market.

The data rapidly altered rate expectations. According to CME data, the probability of a 25-basis-point Fed cut in September surged from 85% to 97.6%. Chip Hughey, managing director of fixed income at Truist Advisory Services, noted that the JOLTS report weakened labor-market support for inflation and spurred tactical allocation into ultra-long Treasuries. Following the release, demand for the 30-year bond surged. Mischler Financial data showed the heaviest buying volume in nearly six months within the 4.95%-5% yield range.

Source: CME

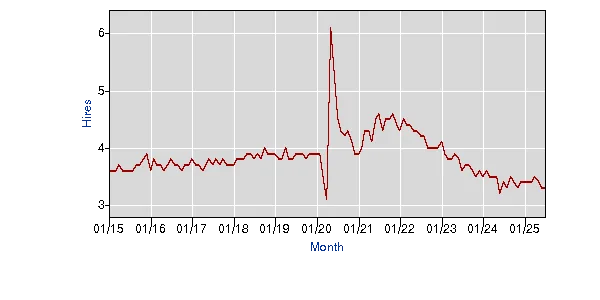

Labor Market Cooling

The U.S. Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) showed that job openings fell by 176,000 in July to 7.181 million—below market expectations and marking only the second time since the pandemic in 2020 that the figure has dropped under 7.2 million.

Source: U.S. Bureau of Labor Statistics

The hiring rate held steady at 3.3%, the lowest non-pandemic level since 2013. Layoffs rose by 12,000 to 1.808 million. In the private sector, the layoff rate climbed to 1.3% for the second straight month, up from a historic low of 1% a year ago.

Source: U.S. Bureau of Labor Statistics

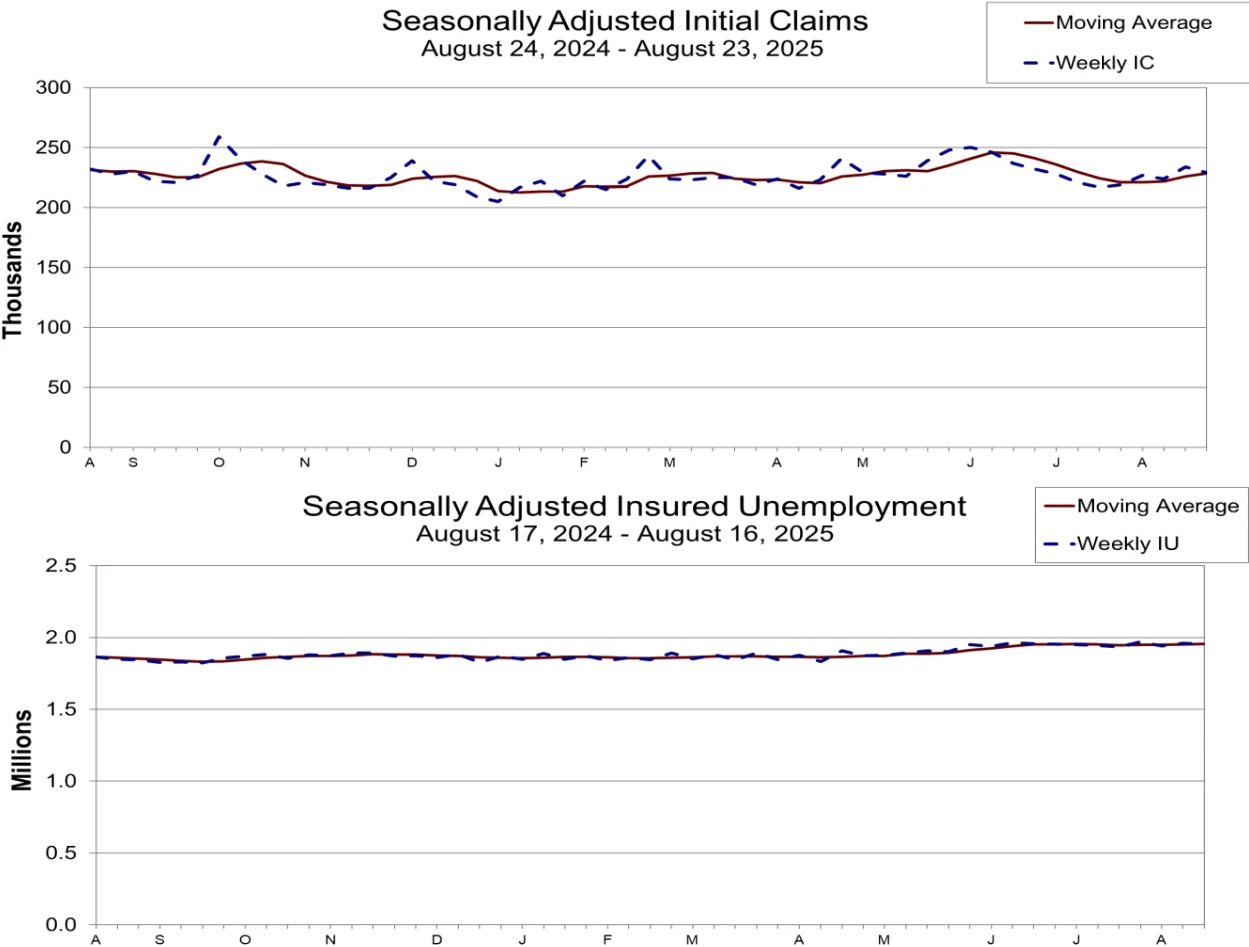

These figures align with recent trends in jobless claims. For the week ending August 23, initial unemployment claims rose to 229,000, while the four-week moving average climbed to 228,500, highlighting short-term instability in the labor market.

Continuing claims stood at 1.954 million for the week ending August 16. Although slightly down from the prior week, the level remains elevated, underscoring the slowing pace at which job seekers are finding work and pointing to a clear cooling in labor conditions.

Source: U.S. Bureau of Labor Statistics

Economists are focusing on the broader trend: job openings have stabilized between 7 million and 8 million over the past 12 months, down about 30% from their 2022 peak. This shift suggests the labor market has transitioned from “overheated” to a more “moderate and balanced” state. Such developments directly reduce the Federal Reserve’s need to maintain restrictive policy, with markets increasingly pricing in a near-certainty of a 25-basis-point rate cut in September.

Ratings and Bidding Support

Against the backdrop of shifting policy expectations driven by labor market data, S&P Global’s decision to maintain the U.S. sovereign credit rating has further eased concerns over Treasury credit risk.

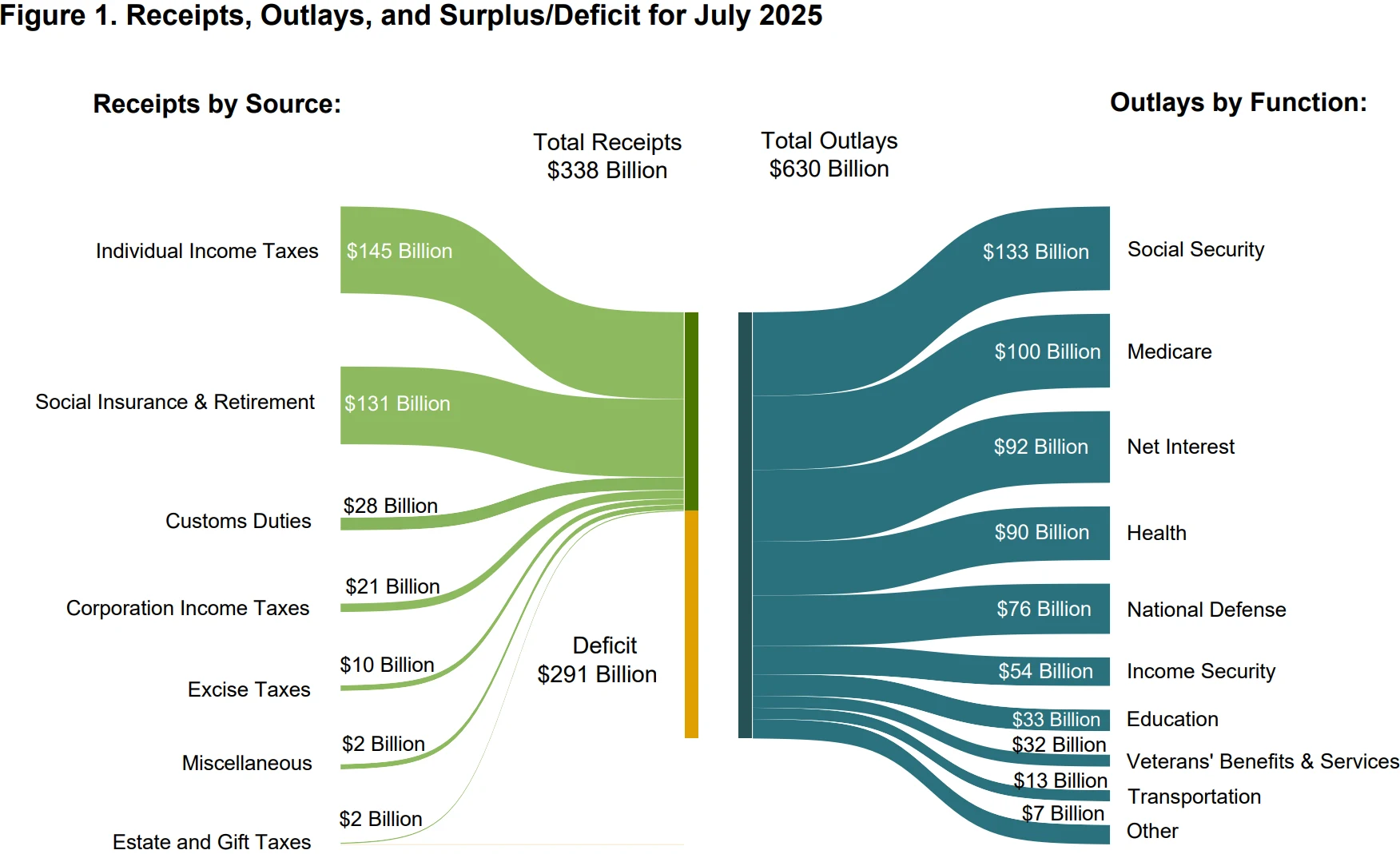

In August, S&P reaffirmed the U.S. long-term sovereign rating at AA+, highlighting the fiscal buffer provided by the Trump administration’s tariff policy. According to official data, U.S. tariff revenues reached $28 billion in July 2025, with full-year receipts projected to exceed 1% of GDP—partially offsetting the revenue loss from the “Big and Beautiful” tax cuts. While the national debt has climbed to $37.2 trillion, or 127% of GDP, S&P noted that tariff income could help keep the federal deficit ratio below 6% during 2025–2028, compared with 7.5% in 2024. The rating decision eased concerns over U.S. credit risk and pushed term premia lower in the near term.

Source: U.S. Department of the Treasury

Meanwhile, positioning and flows in the Treasury market are showing constructive signs. A JPMorgan client survey revealed that net short positions in 30-year Treasuries climbed to the highest level since February, leaving the market in a “crowded short” condition. As yields approached the key 5% psychological threshold, systematic trading models triggered stop-loss buying, unleashing roughly $12 billion of passive inflows into Treasury ETFs in a single day. This wave of short covering fueled a rapid retreat in long-end yields.

At the same time, flows from the corporate bond market are providing additional support. U.S. investment-grade issuance is expected to exceed $60 billion this week. Following the heavy supply, some allocation flows have rotated back into Treasuries, amplifying demand for the safety and liquidity of government bonds.

September Seasonal Pressure

While the latest data offer short-term support, seasonal headwinds in September could bring renewed pressure, as the month has historically been one of the toughest periods for long-duration bonds. Over the past decade, global government bonds with maturities beyond 10 years have posted a median loss of 2% in September—their weakest month of the year.

Mohit Kumar, chief European strategist at Jefferies International, attributes this seasonal pattern primarily to issuance dynamics: “September’s typical surge in long-dated issuance is the key driver of the seasonal decline. There isn’t much issuance in July or August, and very little after mid-November.”

This supply pressure is particularly pronounced at the end of summer, when liquidity tends to be thinner. Shimomura, senior portfolio manager at Tokyo-based Fivestar Asset Management, noted: “September is often when monetary policy pivots, and when investors reposition in anticipation of policy changes.”

In September 2025, global bond issuance is expected to exceed $500 billion, the highest for the month in nearly a decade. U.S. investment-grade corporate bond issuance alone could reach $150–180 billion, up 4.3% from the same period in 2024. This “supply flood” directly diverts demand away from Treasuries. Mike Cudzil, portfolio manager at PIMCO, pointed out that part of the recent rise in yields stems from the market’s need to absorb this heavy issuance. On the demand side, pressures are mounting—pension reforms in the Netherlands are projected to reduce European bond holdings by €30 billion, equal to 5% of total EU pension allocations.

Adding to the uncertainty, the Trump administration’s tariff policy faces a legitimacy challenge that could strip hundreds of millions of dollars in fiscal revenue annually. Meanwhile, uncertainty surrounding the Fed chair nomination process is amplifying volatility. Reflecting these risks, spot gold surged past $3,578 per ounce, setting a new all-time high, as investors increasingly price policy risk not as a “tail risk” but as a base-case scenario.

Source: TradingView

Crux Ahead

The U.S. nonfarm payrolls report for August, to be released on September 5, is set to be a pivotal data point. It will be the last major labor market update available to Federal Reserve officials before their policy meeting on September 16–17.

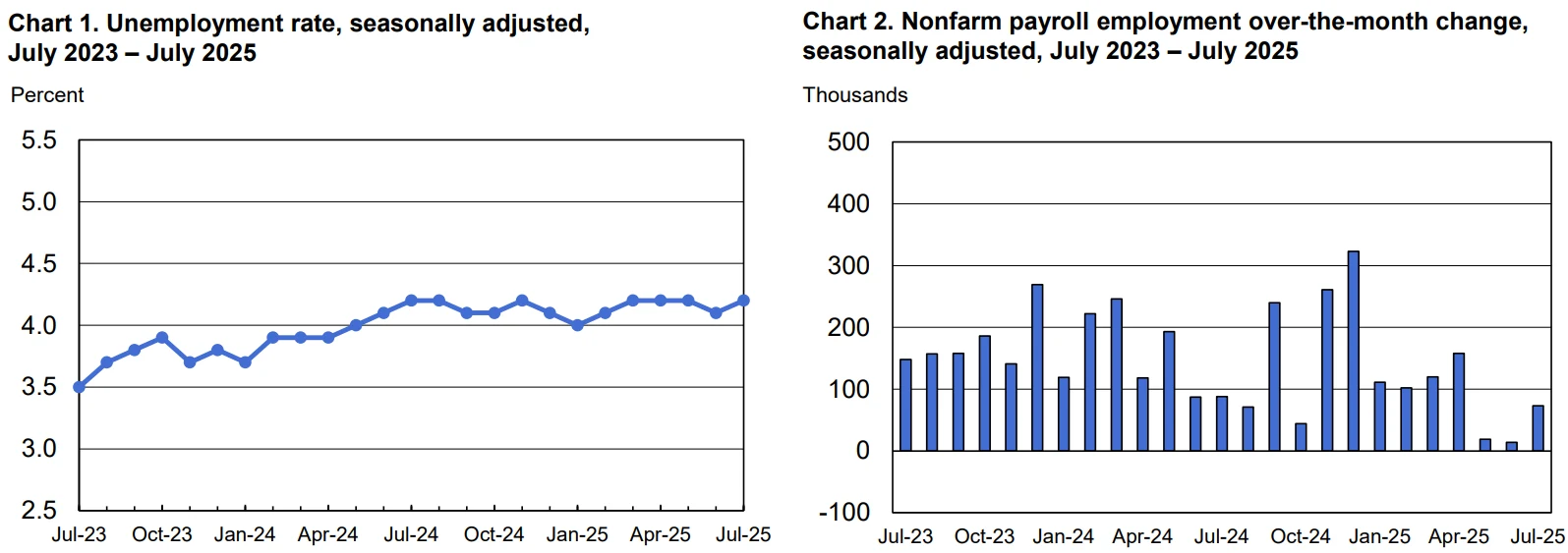

Markets expect nonfarm payrolls to rise by 75,000, with the unemployment rate ticking up by 0.1 percentage point to 4.3%. If realized, job growth would once again fall below the critical 100,000 threshold.

Source: U.S. Bureau of Labor Statistics

Fed Governor Christopher Waller said last week he supports a 25-basis-point rate cut at the September meeting but added that his outlook could shift if the jobs report “shows the economy weakening significantly while inflation remains well under control.”

Should Friday’s nonfarm payrolls report come in weak again, the bond market could start to price in the possibility of a 50-basis-point Fed cut, offering further support to global long-end bonds.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates