High-Yield Stocks Worthy of Investor Focus

05:26 September 3, 2025 EDT

As of the end of August 2025, equity indices continued to reach new highs, with the S&P 500 rising more than 9% year-to-date. In this environment, high-dividend-yield stocks are particularly attractive for providing stable cash flow returns.

Although high-dividend stocks underperformed the market average during the rate-hiking period from 2022 to 2025, historical data indicate that during periods of rising interest rates, high-yielding stocks delivered an average return of -5.2%, compared with 12.3% for non-dividend-paying stocks. With expectations for Federal Reserve rate cuts strengthening and the probability of a September cut approaching 90%, the relative value of this segment may improve.

In the current market environment, carefully selected high-yield dividend stocks can offer portfolios both steady cash flow and downside protection. While identifying high-quality high-yield dividend stocks has become increasingly challenging, it remains achievable.

Realty Income, Healthpeak Properties, and Pfizer not only offer dividend yields above 5% but also benefit from solid fundamentals and long-term growth potential. They represent companies within the REIT and pharmaceutical sectors that demonstrate robust cash flow generation capabilities.

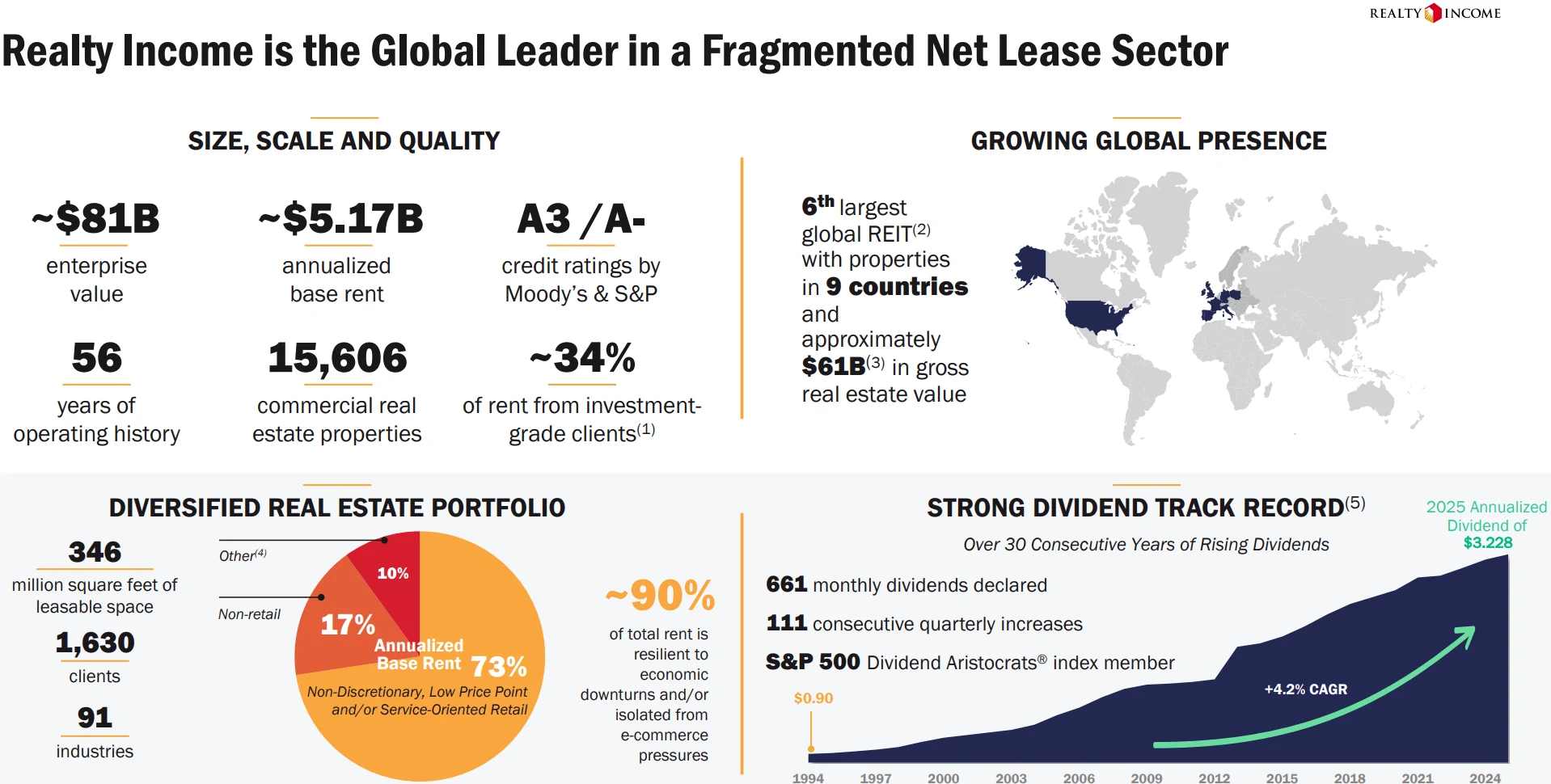

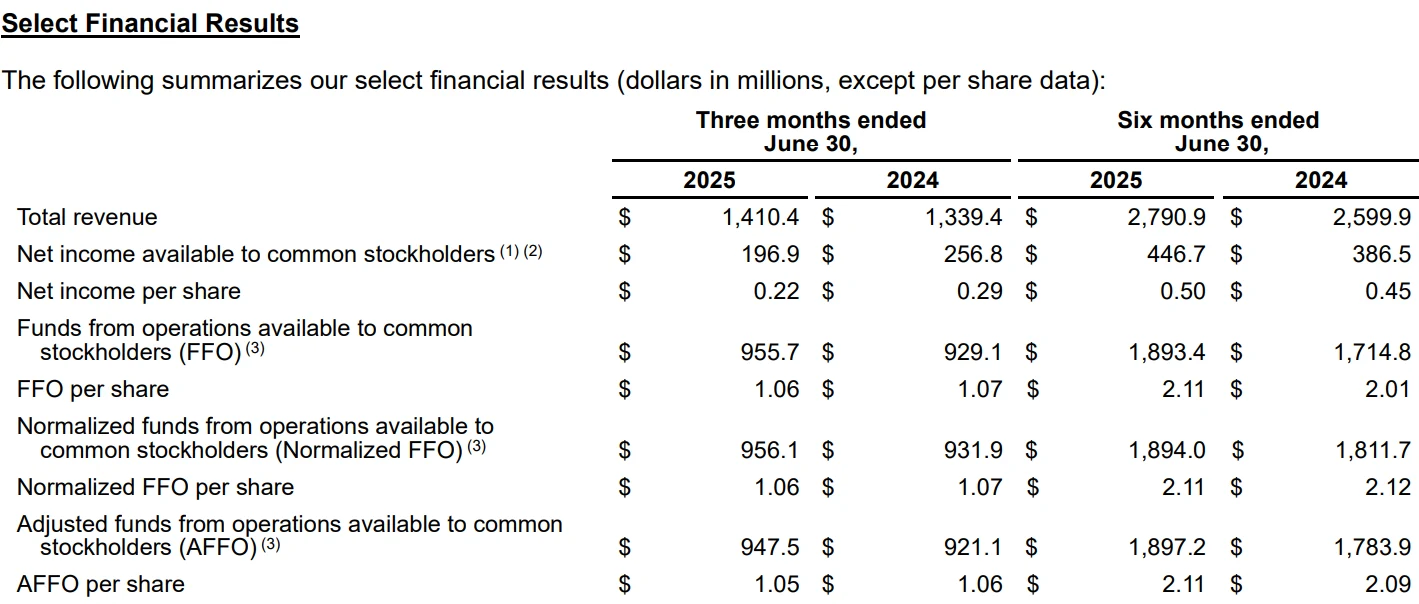

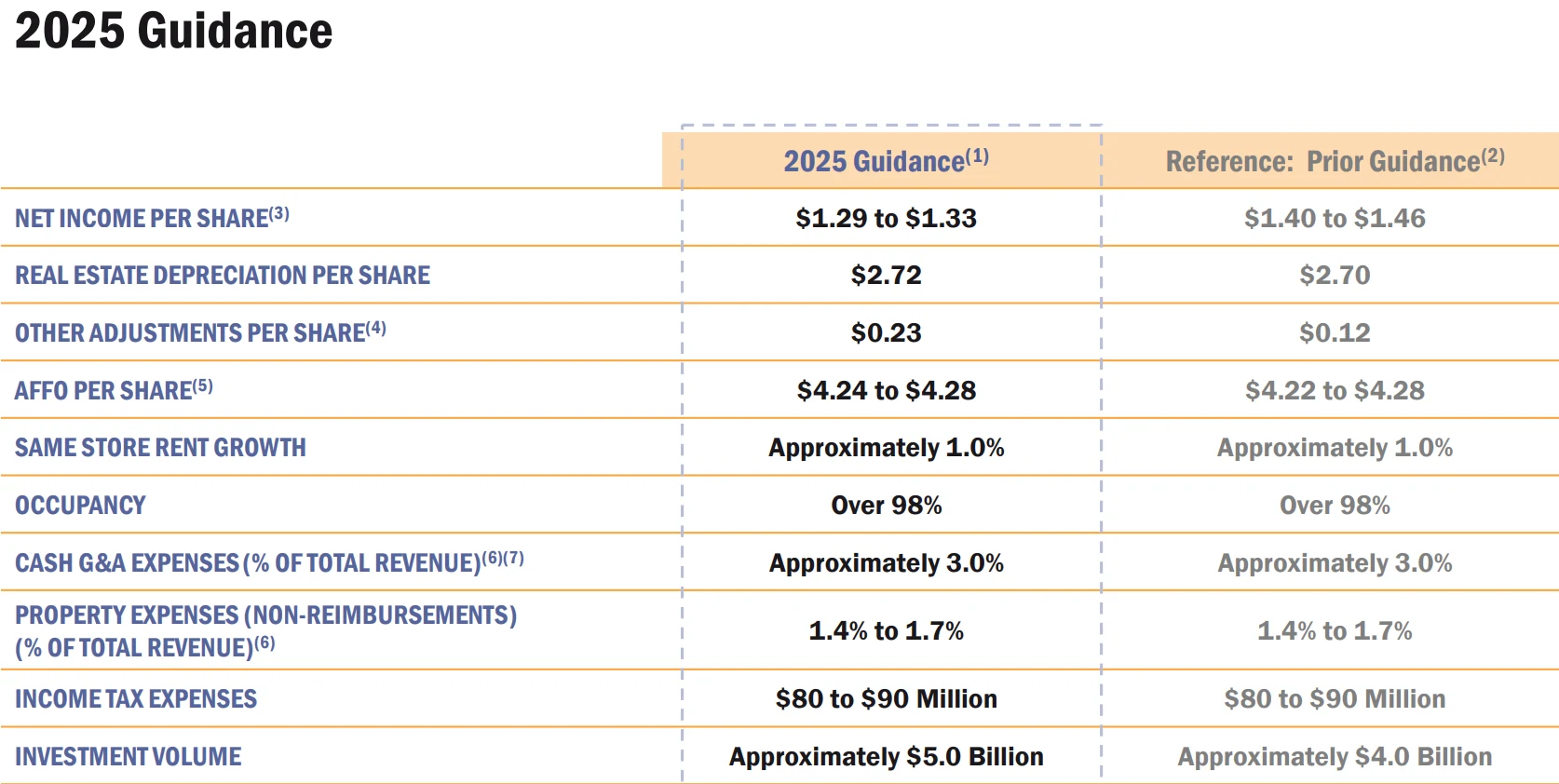

Realty Income

Realty Income is a net-lease real estate investment trust (REIT) focused on retail, industrial, and service properties. As of June 30, 2025, the company’s portfolio covered 15,450 properties across the United States and Europe, with total leasable space exceeding 150 million square feet, an occupancy rate of 98.6%, and an average lease term of 9.1 years, reflecting stable cash flow characteristics.

Source: Realty Income

From a shareholder return perspective, Realty Income has maintained long-term stable dividends. As of September 3, 2025, the stock price was $57.74, with an annualized dividend of $3.23, representing a yield of 5.59%. Dividends are paid monthly, with the most recent payment of $0.269 per share on July 15, 2025. Since its IPO in 1994, the company has paid 658 consecutive dividends and achieved dividend growth in all but one quarter in 2022. Over the past five years, the dividend has grown at a compound annual growth rate of 3.05%, indicating strong dividend sustainability.

Source: Realty Income

In terms of market positioning, net-lease REITs currently account for only 4% of the potential U.S. market, while penetration in Europe remains below 0.1%. Realty Income is accelerating its European expansion, acquiring $500 million worth of properties in 2025, which is expected to contribute approximately 3% to annual rental income, providing incremental growth for future earnings.

Wall Street analysts maintain a neutral stance on the stock, with a consensus rating of “Hold” and an average target price of $61.92, implying roughly 7.2% upside. In its August 2025 report, JPMorgan highlighted that the company’s tenant base is highly diversified, with the top five tenants accounting for less than 20%, which reduces concentration risk.

However, the company still faces uncertainty from interest rate volatility. If the 10-year U.S. Treasury yield rises above 4.5%, it could pressure overall REIT valuations. In addition, the company has $2 billion of debt maturing in 2025, with an average borrowing cost of 3.8%. Its debt-to-asset ratio stands at 45%, below the industry average of 50%, providing a buffer against interest rate fluctuations.

Overall, Realty Income’s stable operating cash flows, solid balance sheet, and proactive market expansion support steady growth on a high-dividend yield basis, although potential pressure from rising interest rates remains a key consideration.

Source: Realty Income

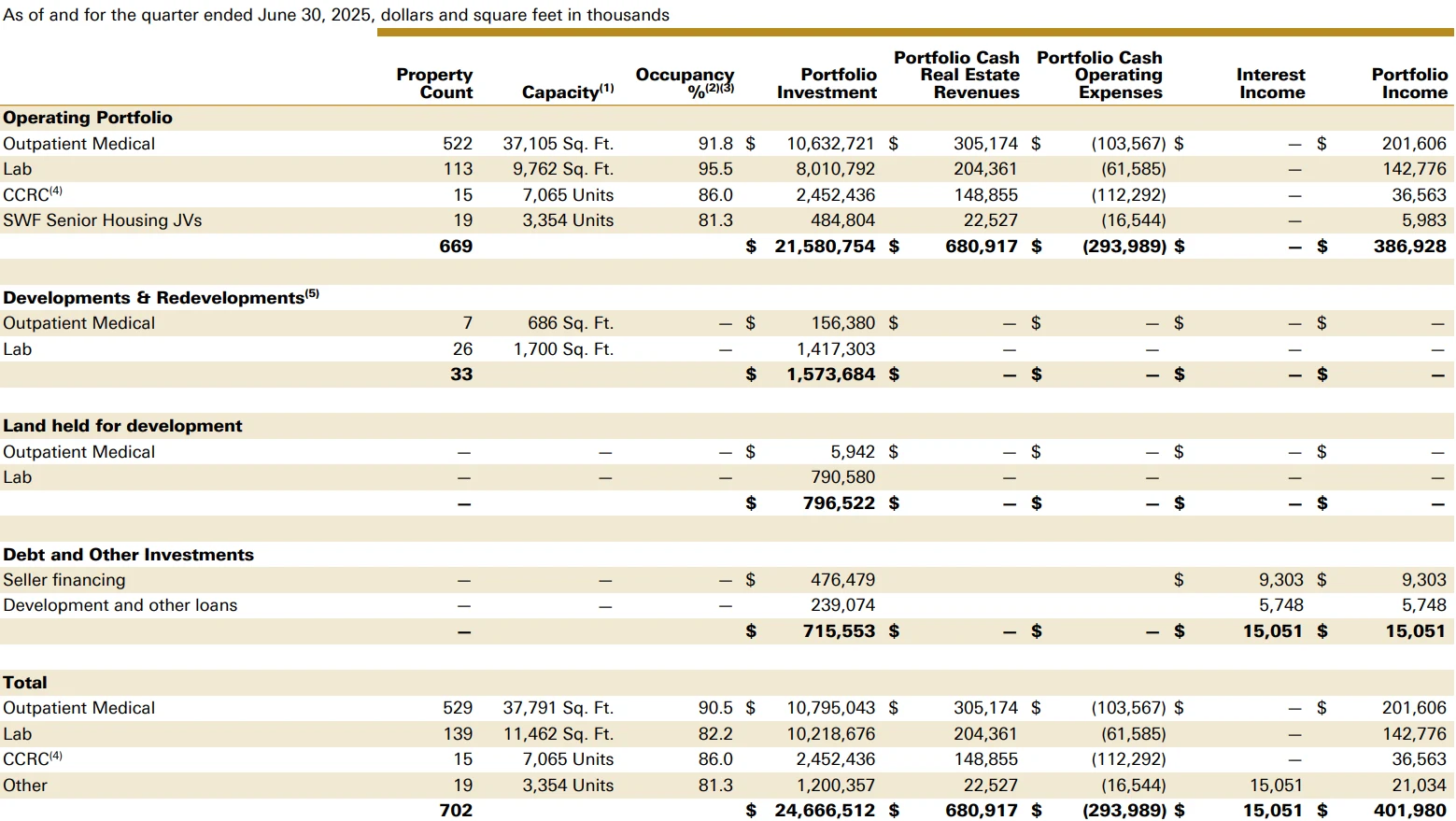

Healthpeak Properties

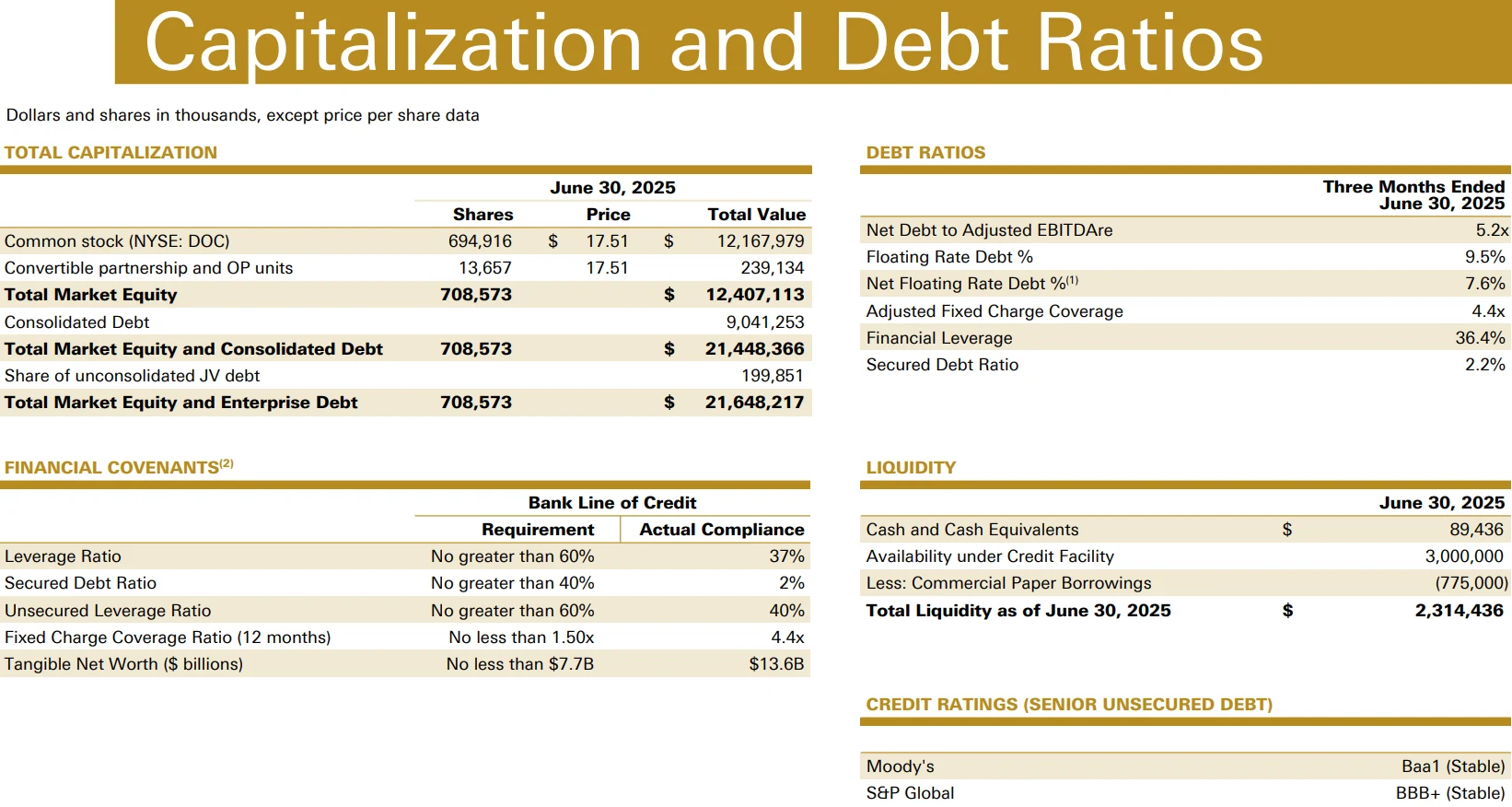

Healthpeak Properties is a real estate investment trust (REIT) focused on healthcare properties, primarily leasing laboratory space and medical office buildings to pharmaceutical and biotechnology companies. In March 2024, the company completed an all-stock merger with Physicians Realty Trust valued at approximately $21 billion. Following the merger, the company’s total property area reached approximately 52 million square feet, of which 40 million square feet are outpatient medical office assets.

Source: Healthpeak Properties

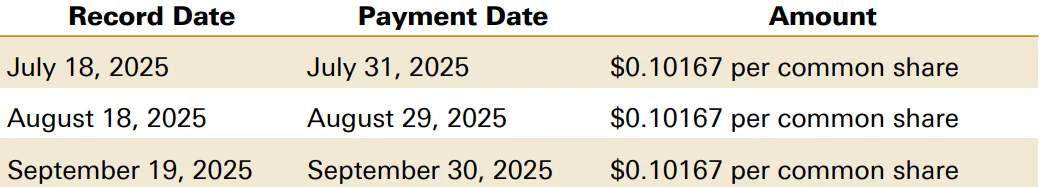

As of September 3, 2025, the stock price was $17.95, with an annualized dividend of $1.22, corresponding to a dividend yield of approximately 7.03%. Dividends are paid monthly, with the most recent payment of $0.1017 per share on June 27, 2025. Although the company adjusted its dividend policy after the merger, the average dividend growth rate over the past ten years remains 5.74%. In the second quarter of 2025, funds from operations (FFO) were $0.46 per share, with full-year guidance of $1.78 to $1.84, resulting in a dividend payout ratio of approximately 67%, indicating sustainable dividend capacity.

Source: Healthpeak Properties

Operationally, the company completed 797,000 square feet of new leases and renewals in the second quarter of 2025, with overall occupancy exceeding 90%. Laboratory space demand has slowed due to tighter biotech financing conditions, while medical office demand remains stable. Same-store cash net operating income (NOI) for outpatient medical operations increased 3.5% year-over-year.

Wall Street analysts generally maintain a positive outlook. The consensus rating is “Buy,” with an average target price of $21.07, implying approximately 17.38% upside. Goldman Sachs set the highest target at $29.00, citing the long-term growth potential in healthcare real estate demand. In its July 2025 report, UBS emphasized that merger-related synergies help enhance profitability and asset returns.

Potential risks primarily stem from volatility in the biotechnology sector. If startup financing tightens further, laboratory property vacancy rates could rise to 10%. On the financial side, the company issued $500 million of unsecured notes at 5.375% interest, with a net debt-to-EBITDA ratio of 5.2x at quarter-end and available liquidity of $2.8 billion.

Source: Healthpeak Properties

Overall, Healthpeak Properties, supported by stable medical office demand, cost synergies, and sufficient financial buffers, is positioned for steady medium- to long-term growth on a high-dividend-yield basis, although uncertainty remains from the potential slowdown in laboratory leasing demand.

Pfizer

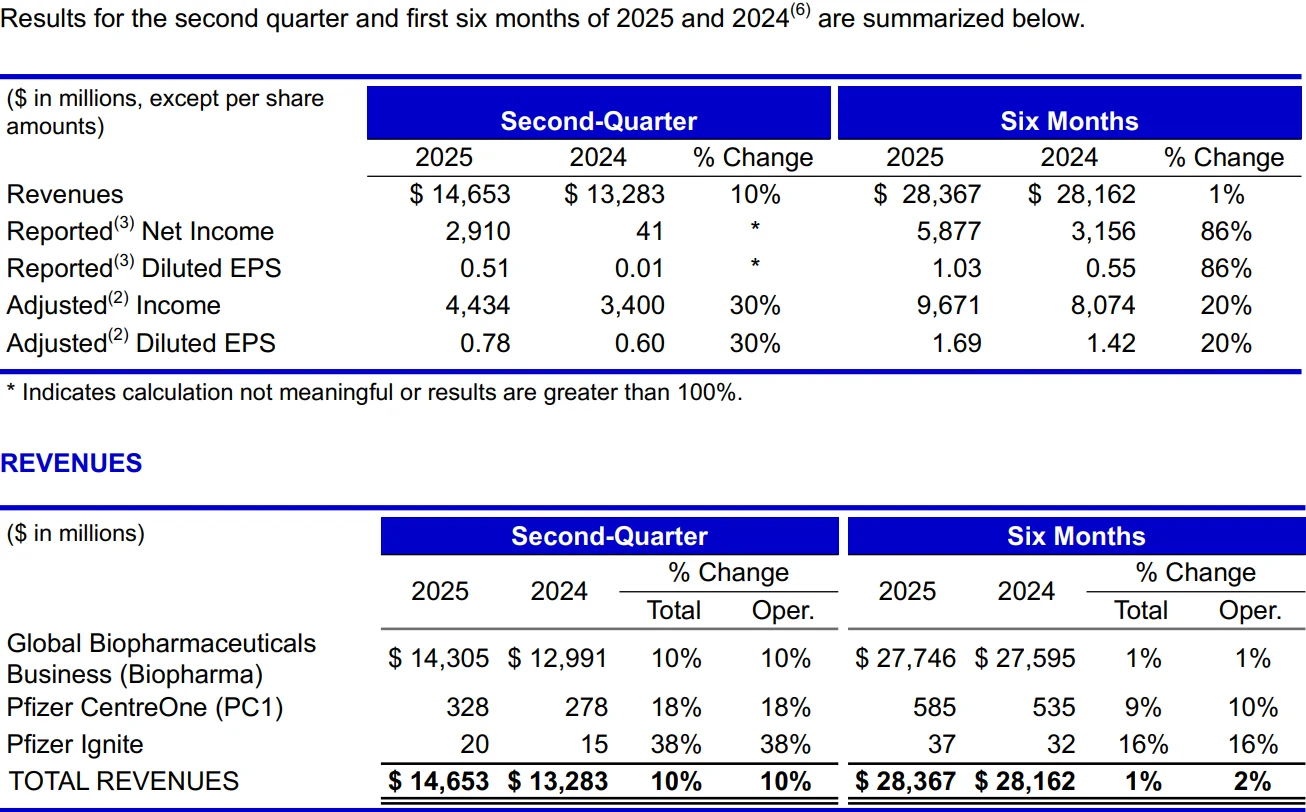

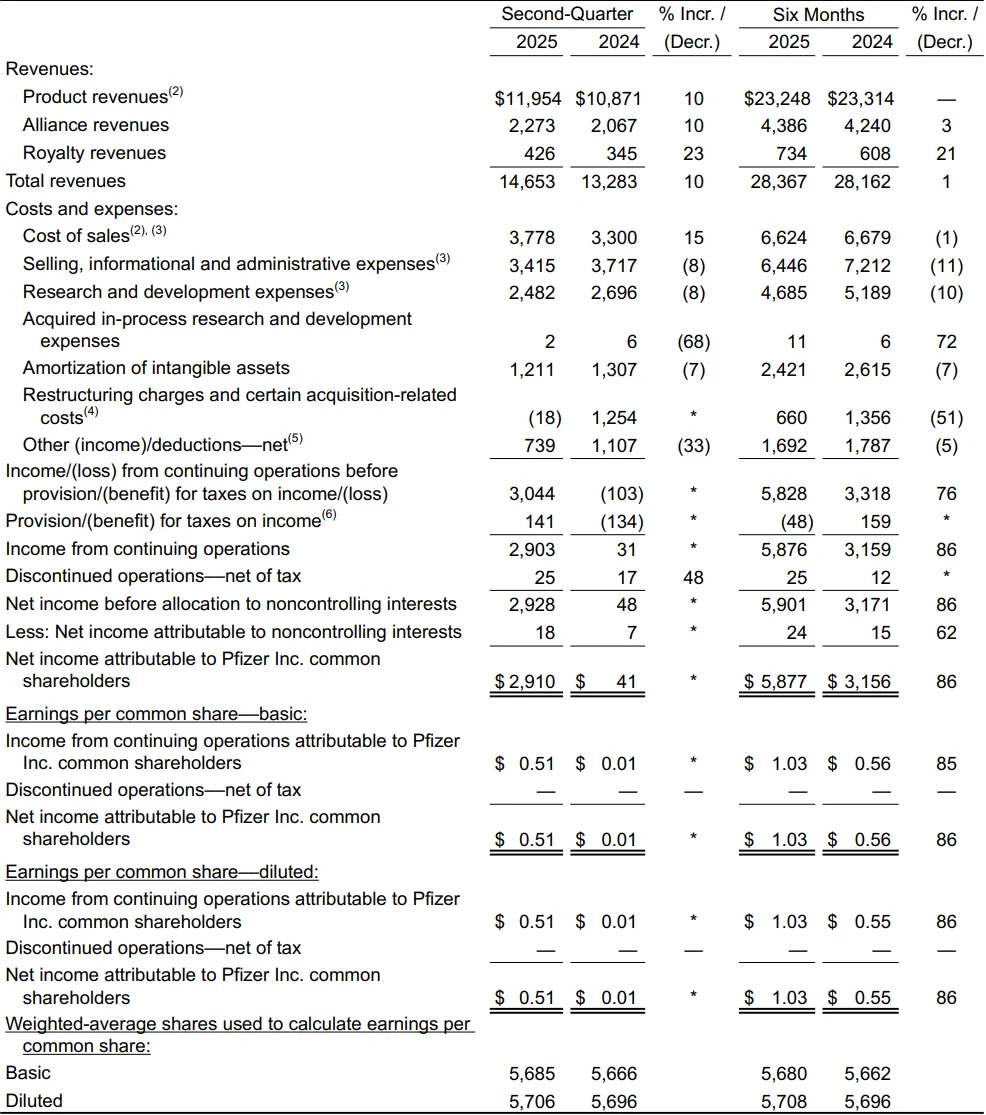

Pfizer is a global leading pharmaceutical company, with product lines covering vaccines, oncology, and cardiovascular drugs. In the first half of 2025, the company reported total revenue of $28.367 billion, with its core product lines showing continued recovery and growth momentum.

Source: Pfizer

As of September 3, 2025, the stock price was $24.98, with an annualized dividend of $1.72, corresponding to a dividend yield of 6.91%. Dividends are paid quarterly, with the most recent payment of $0.43 per share on June 13, 2025. The company has increased its dividend for 13 consecutive years, with a compound annual growth rate of 2.5% over the past five years. In the second quarter of 2025, earnings per share were $0.60, with a dividend payout ratio of approximately 50%, indicating a high level of dividend sustainability.

Source: Pfizer

The company’s main challenge is the patent cliff. Between 2026 and 2028, the expiration of key drug patents is expected to reduce annual sales by $17–18 billion, including Eliquis and Vyndaqel. To offset this impact, Pfizer has expanded its product pipeline through major acquisitions, including the $43 billion acquisition of Seagen in 2023 and the $5 billion acquisition of Global Blood Therapeutics in 2022. These transactions are expected to contribute approximately $20 billion in additional sales by 2030, with oncology products accounting for around $12 billion.

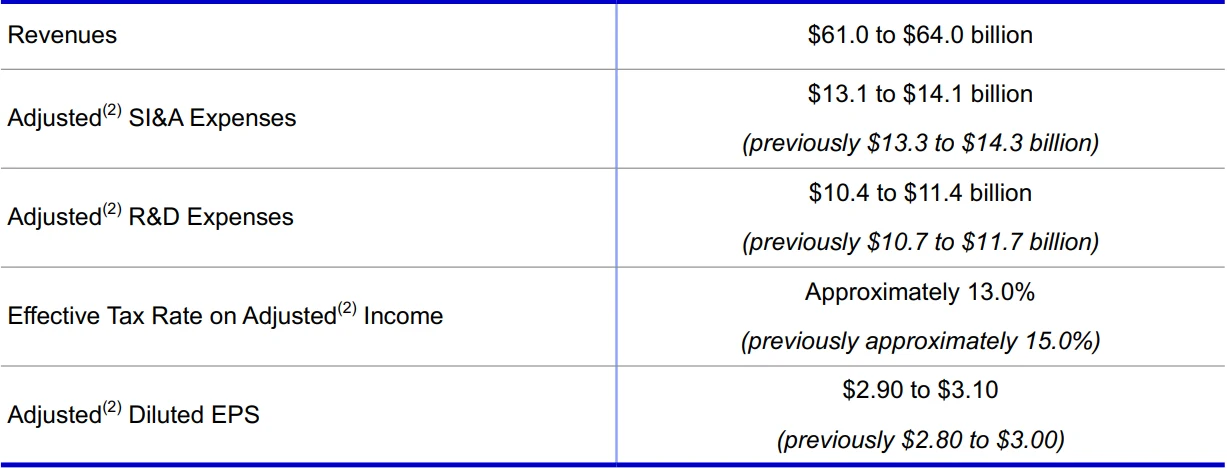

In 2025, the company expects full-year revenue of $61–64 billion, with adjusted earnings per share of $2.9–3.1. Research and development spending remains around 17.5%–18.3% of revenue, with two new drug approvals already obtained in the first half of the year.

Source: Pfizer

Wall Street analysts maintain a neutral stance on Pfizer, with a consensus rating of “Hold” and an average target price of $28.50, implying roughly 14.1% upside. In its August 2025 report, Morgan Stanley noted that the success rate of Pfizer’s R&D pipeline products is expected to be 60%, higher than the industry average of 50%, providing some support for future growth.

Risks include potential delays in regulatory approvals and intensified competition. If market share in the pan-oncology drug segment declines, the company’s revenue growth may face pressure. From a financial perspective, as of June 30, 2025, Pfizer’s total liabilities were $128.219 billion, with an interest coverage ratio of approximately 4.32x, reflecting a solid debt repayment capacity.

Overall, Pfizer is actively positioning for long-term growth through acquisitions and R&D investments in the face of patent expirations, though short-term attention is needed on the commercialization progress of its pipeline and industry competition dynamics.

In Summary

For income-focused investors, these three stocks all offer dividend yields significantly above the market average. However, each stock exhibits different risk-return characteristics:

Realty Income provides the most stable dividend growth history and an internationally diversified portfolio, making it suitable for investors seeking relative stability and monthly cash flow.

Healthpeak Properties offers the highest dividend yield, but its payout ratio is relatively high, posing potential dividend sustainability risks. It is therefore more appropriate for investors who can tolerate higher risk.

Pfizer, as a major pharmaceutical company, is supported by a strong R&D pipeline and cost-reduction initiatives, but it faces challenges from the patent cliff and debt obligations. It is better suited for long-term investors confident in the company’s ability to execute a successful transformation.

Investors should note that a high dividend yield can sometimes signal a value trap, reflecting market skepticism about a company’s future prospects. Before making investment decisions, further in-depth analysis of each company’s financial condition, industry position, and competitive advantages is recommended. Diversifying across these three stocks may provide sectoral diversification, balancing exposure between the real estate and pharmaceutical industries.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates