The Ongoing Rise in Gold

03:23 September 3, 2025 EDT

Key Points:

London spot gold touched a high of $3,547 per ounce, while New York gold futures surpassed the $3,600 mark, with gains exceeding 34% year-to-date in 2025, significantly outperforming other major asset classes.

Wall Street institutions exhibit a unanimously optimistic outlook toward gold. Goldman Sachs maintains its mid-2026 target of $4,000, citing gold ETF inflows and central bank purchasing as core drivers.

Gold market volatility is likely to intensify with the upcoming release of U.S. employment data on Friday and the approaching September Federal Reserve meeting.

The global gold market is experiencing an unprecedented bull run. On September 3, London spot gold reached $3,532.04 per ounce, briefly touching a record high of $3,547.06 during the session. Meanwhile, New York gold futures exceeded $3,600 per ounce, setting a new milestone.

Source: TradingView

Year-to-date in 2025, spot gold has gained more than 34%, sharply outperforming the S&P 500 (up 9%) and Bitcoin (up 19%), establishing itself as one of the top-performing major assets globally. Notably, bullish sentiment remains exceptionally firm—gold has advanced for eight consecutive months, marking its longest monthly winning streak since 1968.

Source: TradingView

Key Drivers of the Rally

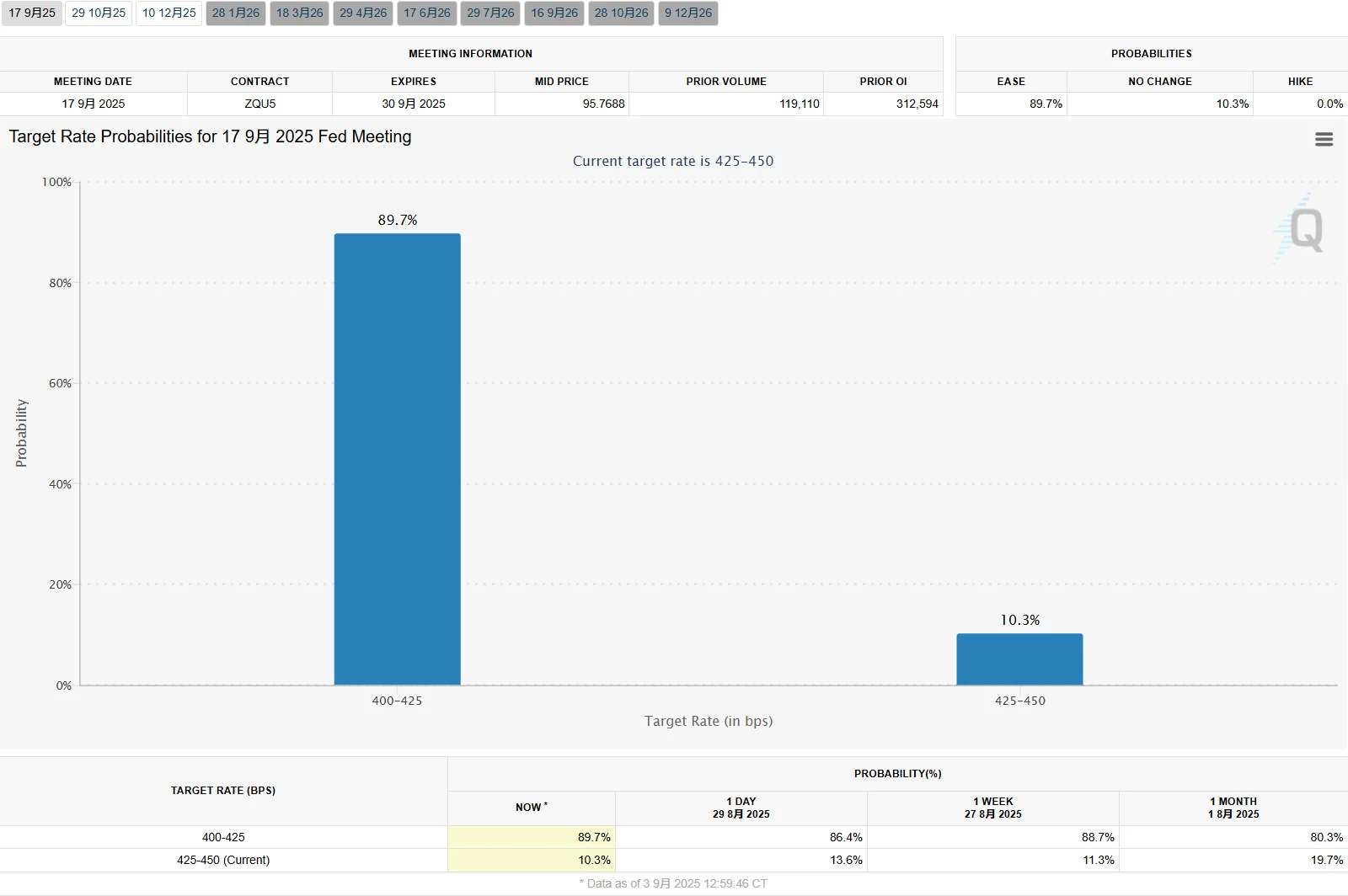

A Shift in Federal Reserve Monetary Policy Serves as the Core Driver Behind the Recent Gold Rally.Market expectations for a 25-basis-point rate cut at the September 16-17 policy meeting have reached nearly 90%. This strong anticipation of monetary easing has directly pushed down real interest rates—the yield on 10-year TIPS has declined by 80 basis points since May 2025 to 1.2%, a low not seen since 2020.

Source: CME

The decline in real rates has significantly reduced the opportunity cost of holding gold, while a weakening U.S. dollar has further amplified this effect. Data show that the U.S. dollar index fell more than 10% in the first half of 2025, marking its poorest performance since 1973. Its strong negative correlation with gold prices has been further reinforced amid rising trade policy uncertainty under the Trump administration.

Source: TradingView

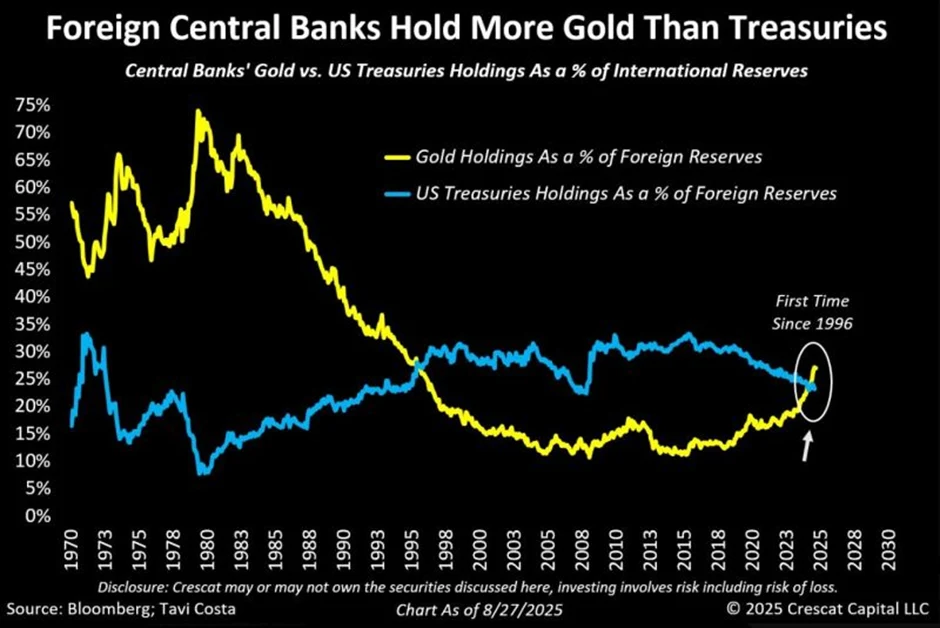

Global central banks’ asset allocation behaviors are reshaping gold’s strategic value. The People’s Bank of China has increased its gold reserves for nine consecutive months, bringing its total holdings to 2,300 tonnes as of August 2025. Gold now accounts for approximately 7.0% of China’s total foreign exchange reserves. This “de-dollarization” trend is widespread—according to Crescat Capital, foreign central banks’ gold holdings have surpassed their U.S. Treasury holdings for the first time since 1996. Global central bank gold reserves now total 38,000 tonnes, representing 15.7% of total foreign exchange reserves.

Source: Crescat Capital

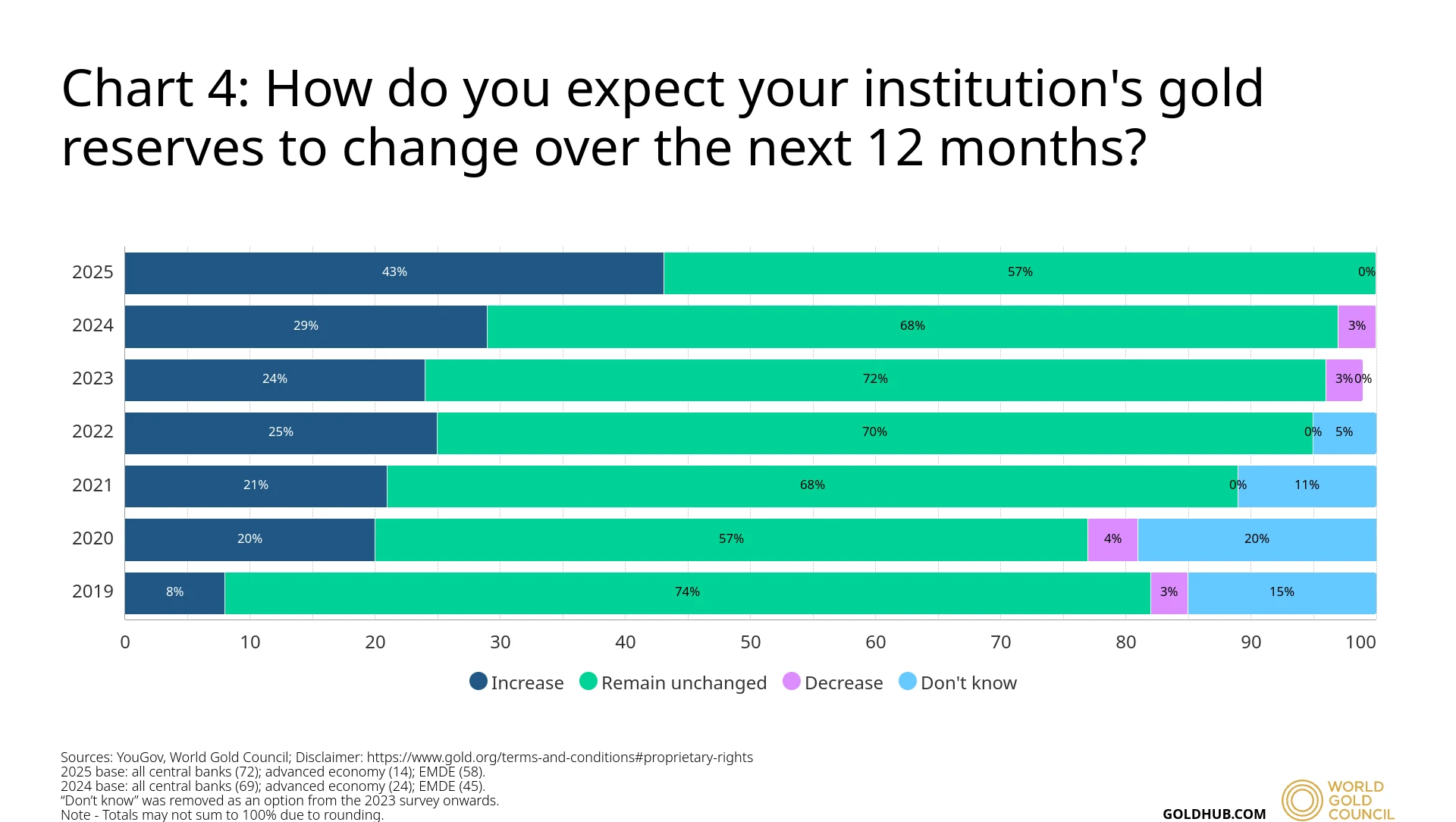

A World Gold Council survey indicates that nearly 43% of central banks plan to increase their gold reserves over the next 12 months, up from 29% in 2024 and a record high. This shift likely reflects a strategic adjustment away from the dollar-dominated reserve system, particularly as U.S. government debt has reached $37.2 trillion (127% of GDP). In this context, gold’s role as the “ultimate means of payment” has become increasingly prominent.

Source: World Gold Council

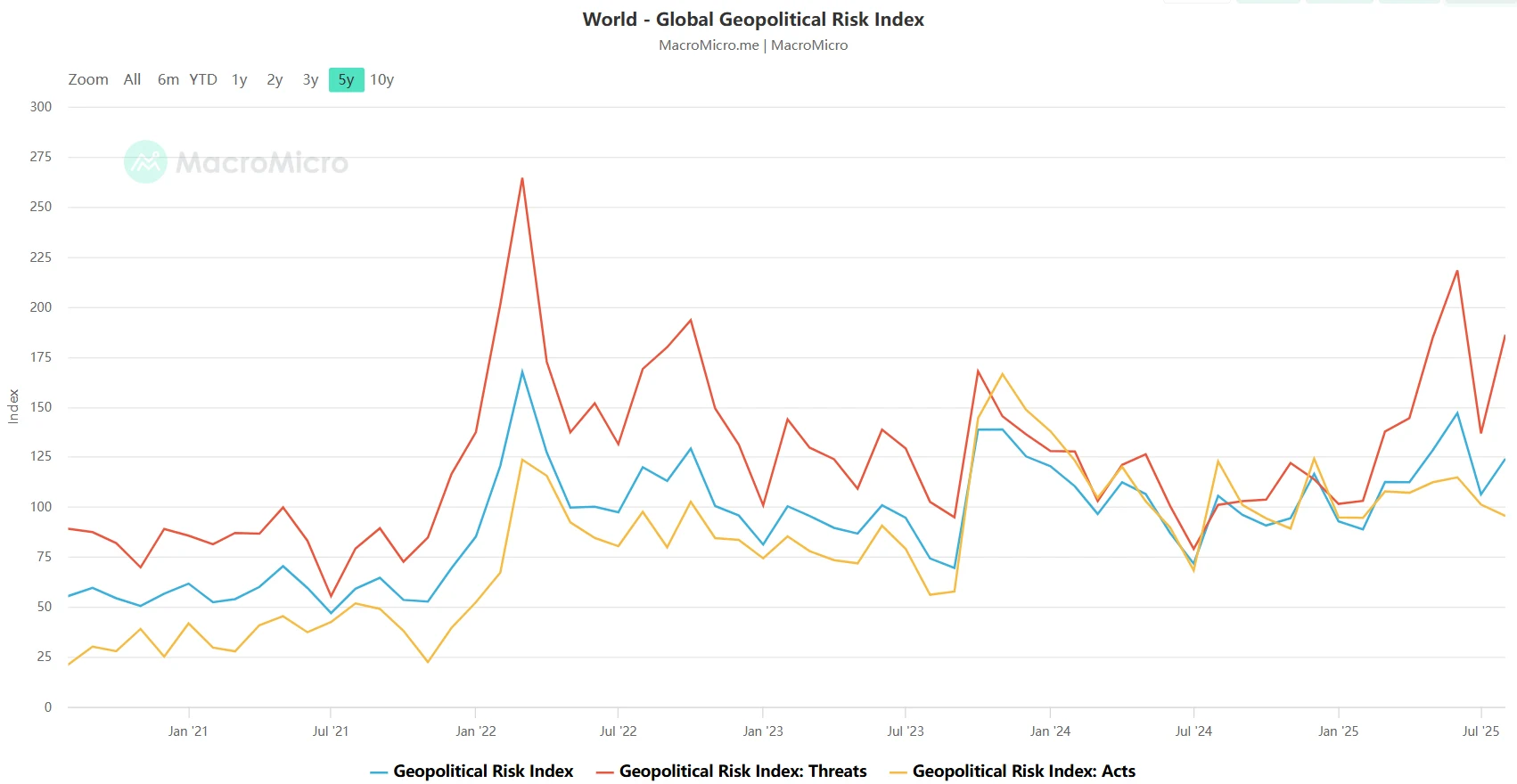

Geopolitical risks and debt monetization pressures have further amplified gold’s safe-haven properties. Escalating tensions in the Middle East and the ongoing Russia-Ukraine conflict have driven the Geopolitical Risk Index (GPR) up nearly 40% since the start of the year. Meanwhile, the snowballing growth of global government debt poses a more structural long-term challenge. In fiscal year 2024, U.S. net interest payments reached $882 billion, accounting for 3.06% of GDP. This cycle of “debt monetization” is forcing markets to reassess the credibility of fiat currencies.

As Thorsten Polleit, Professor of Economics at the University of Bayreuth, notes, central banks worldwide are caught in a “policy dilemma”—raising interest rates would trigger a debt crisis, while maintaining low rates accelerates currency devaluation. This contradiction has made gold one of the most effective hedging tools.

Source: MacroMicro

Market Composition

The investor structure of the gold market is undergoing a gradual shift. Traditionally dominated by private investment—through ETFs, bullion, and coins—the market is increasingly being led by official institutions, particularly central banks.

Data show that holdings in SPDR Gold Shares, the world’s largest gold ETF, have surpassed 900 metric tons, reaching their highest level since 2020. This indicates that private investment demand is also rising rapidly. However, central bank purchases have emerged as a more stable and consistent source of long-term demand.

Source: TradingView

From a regional perspective, emerging market central banks are the primary buyers of gold, while investors in developed economies tend to participate through ETFs and other financial instruments. This East-West divergence highlights differing views on the stability of the U.S. dollar–centric monetary system.

Flow data further show that since the beginning of 2025, global gold ETFs have recorded consecutive net inflows, with total assets increasing by more than $20 billion—marking the strongest annual performance since 2020.

Wall Street Consensus

Wall Street institutions are showing a rare consensus in their bullish outlook on gold.

UBS has raised its June 2026 price target to $3,700, warning that under a risk scenario prices could spike to $4,000. Morgan Stanley has set a year-end target of $3,800, highlighting the supportive impact of a weakening U.S. dollar. Goldman Sachs has maintained its mid-2026 forecast of $4,000, citing ETF inflows—up 210 metric tons this year—and central bank purchases as the primary drivers.

Notably, Citigroup, long regarded as a “gold bear,” shifted its stance in August 2025, raising its three-month price target from $3,300 to $3,500. The bank said that “the combination of rate-cut expectations and geopolitical risks is prompting a repricing of gold’s safe-haven value.”

Gold's Secular Bull Market

Historical data show that since entering a new upward channel in 2018, gold prices have been driven by multiple factors: the global liquidity surge during the 2020 pandemic, heightened safe-haven demand amid geopolitical tensions in 2022, the high-inflation and lower real-rate environment of 2023–2024, and, most recently, rising financial-system risks and sustained central bank gold purchases in 2025. These forces combined have propelled gold prices steadily higher.

Source: TradingView

The pace of this rally has been notably faster than in previous cycles. Measured by the time needed for each $500 increase, the past decade has shown a clear acceleration. Gold rose from $800 to $1,300 in about 27 months after 2008, from $1,300 to $1,800 in 37 months in 2019, and to $2,300 in 48 months by 2023. By contrast, in less than nine months of 2025, gold has surged nearly $900—from around $2,600 to $3,500—underscoring both rising macroeconomic uncertainty and strengthening investment demand.

Technical indicators confirm this trend. After breaking above the $3,000 psychological threshold in January 2025, gold prices consolidated quickly, then held above $3,200 in March, surpassed $3,400 in August, and moved beyond $3,500 in early September, forming an accelerated upward trajectory. On both weekly and monthly charts, major moving averages remain in bullish alignment, with prices consistently trading above long-term trend lines.

At the same time, Bollinger Bands on the weekly chart continue to widen, signaling higher volatility alongside strengthening bullish momentum, with no clear signs of a market top. Historically, this type of volume-price alignment suggests an ongoing uptrend rather than a short-lived, speculation-driven spike.

Source: TradingView

Importantly, gold’s accelerating price movement reflects not only safe-haven flows but also deeper concerns over the stability of the global monetary system. Viewed alongside central bank reserve diversification, persistently low U.S. real interest rates, and record-high global debt levels, the current gold bull market appears to be part of a broader, cross-cycle repricing of assets rather than a temporary rally triggered by any single event.

Conclusion

Despite the optimistic outlook for gold, potential risks remain. Analysts note that if geopolitical tensions ease—such as a cease-fire in Ukraine or de-escalation in the Middle East—the key driver behind gold’s rally over the past three years could dissipate. In that case, prices could retrace as much as two-thirds of the gains accumulated since the outbreak of the Ukraine crisis.

In addition, gold prices are already at elevated levels, and markets have largely priced in the impact of rate cuts. By the time the Federal Reserve actually delivers policy easing, the upward momentum for gold could weaken. While rising rate-cut expectations have supported prices, improving geopolitical conditions could exert downward pressure, leaving gold more prone to range-bound trading.

With U.S. employment data due Friday and the Fed’s September meeting approaching, volatility in the gold market is likely to increase. Traders are looking for fresh catalysts to determine whether gold can break above the $3,600 level or face a technical pullback.

Still, this gold bull market shows no signs of nearing its end.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates