Sell-off in US Treasuries Intensifies, 30-Year Yield Nears Key 5% Level

23:18 September 2, 2025 EDT

Key Points:

The global government bond market is experiencing a broad-based sell-off, with yields surging across the board. The 30-year U.S. Treasury yield is approaching the psychological threshold of 5%, while long-term bond yields in the U.K., Germany, France, and Japan have also reached multi-year highs.

Concerns over fiscal deficits in the bond market are likely to persist through the second half of 2025, and the upward trend in yields may be difficult to reverse unless governments implement effective deficit control measures. If elevated yield levels become entrenched, they could suppress economic growth and amplify global financial fragility.

Market focus is highly concentrated on the U.S. August employment report, set to be released this Friday. As the last key jobs data before the Federal Reserve's September policy meeting, it is expected to have a significant impact on the direction of the bond market.

Tuesday, September 2 — Global government bond markets came under heavy pressure as a wave of selling swept across both sides of the Atlantic. The 30-year U.S. Treasury yield briefly touched 4.997%, nearing the key psychological level of 5%. Meanwhile, bond yields in the U.K., France, and Germany also moved higher.

Source: TradingView

According to Federal Reserve System data, the 30-year yield stood at 4.88% in late August 2025 before climbing rapidly in early September, reflecting a shift in market sentiment in the short term. Historical data show that the 30-year yield had briefly fallen below 4.5% in the first half of 2025 but began steadily rising again starting in July.

The sharp adjustment in the global bond market is being driven by a clear set of factors: soaring fiscal deficits and rising public debt levels across major economies, persistently high inflation, eroding central bank credibility, and a shift in investor psychology marked by the return of the bond vigilantes.

Supply-Demand Imbalance

The immediate catalyst for the current bond market turmoil stems from a sharp shift in market supply and demand dynamics. September has traditionally been a peak season for corporate bond issuance, and this trend has been particularly pronounced in 2025.

Market projections indicate that U.S. investment-grade corporate bond issuance for the month could reach as high as $150 billion to $180 billion, potentially exceeding the $172.55 billion recorded in the same period of 2024 and marking a near-decade high. This week alone, approximately $60 billion in new corporate bond supply is expected to be absorbed by the market. This wave of supply is significantly diverting funds that might otherwise have flowed into the Treasury market.

Mike Cudzil, a portfolio manager at PIMCO, noted that part of the rise in yields is directly attributable to the substantial volume of issuance the market must digest. Mike Lorizio, head of rate strategy at Manulife Investment Management, described the current environment as an "endless primary market of different spread products," where investors are forced to adjust their portfolios to accommodate new issuance—a process that inevitably leads to selling of Treasuries to free up capacity.

In stark contrast to the surge in supply, demand for long-term bonds is weakening. For example, the Netherlands, with its nearly €2 trillion pension system, is undergoing significant reforms. The new system requires younger members to allocate more funds to risk assets such as equities, reducing the need for long-duration hedging tools. While older members tend to prefer safer assets like bonds, their hedging durations are also expected to shorten. According to European Central Bank data, Dutch pension funds hold nearly €300 billion in European bonds, accounting for more than half of the total pension savings in the EU. This shift in asset allocation is putting pressure on demand for long-term government bonds.

From a historical perspective, similar periods of high supply have often led to rising Treasury yields. For instance, in September 2023, when corporate bond issuance peaked, the 30-year Treasury yield briefly climbed above 4.8%. The situation in 2025 is more severe, as expectations of economic recovery are driving increased corporate financing demand, while the Federal Reserve's potential rate-cut path offers a low-cost window for corporate bond issuance. This factor directly contributes to weaker demand for Treasuries, pushing yields higher.

Source: TradingView

It is worth noting that September has historically been a challenging month for long-term bonds. Statistics show that over the past decade, global government bonds with maturities exceeding 10 years have experienced a median loss of 2% in September, making it the worst-performing month of the year. Mohit Kumar, chief European strategist at Jefferies International, attributes this seasonal pattern primarily to issuance patterns: "Supply is light in July and August, and again after mid-November," making the September supply pressure particularly pronounced.

Fiscal Sustainability Concerns

The underlying driver behind the global sell-off in government bonds is the market’s eroding confidence in the fiscal health of advanced economies. Massive fiscal spending in the wake of the pandemic has led to soaring government debt levels worldwide, forcing continued reliance on bond issuance for financing. This model of “deficit monetization” is now being repriced by the market.

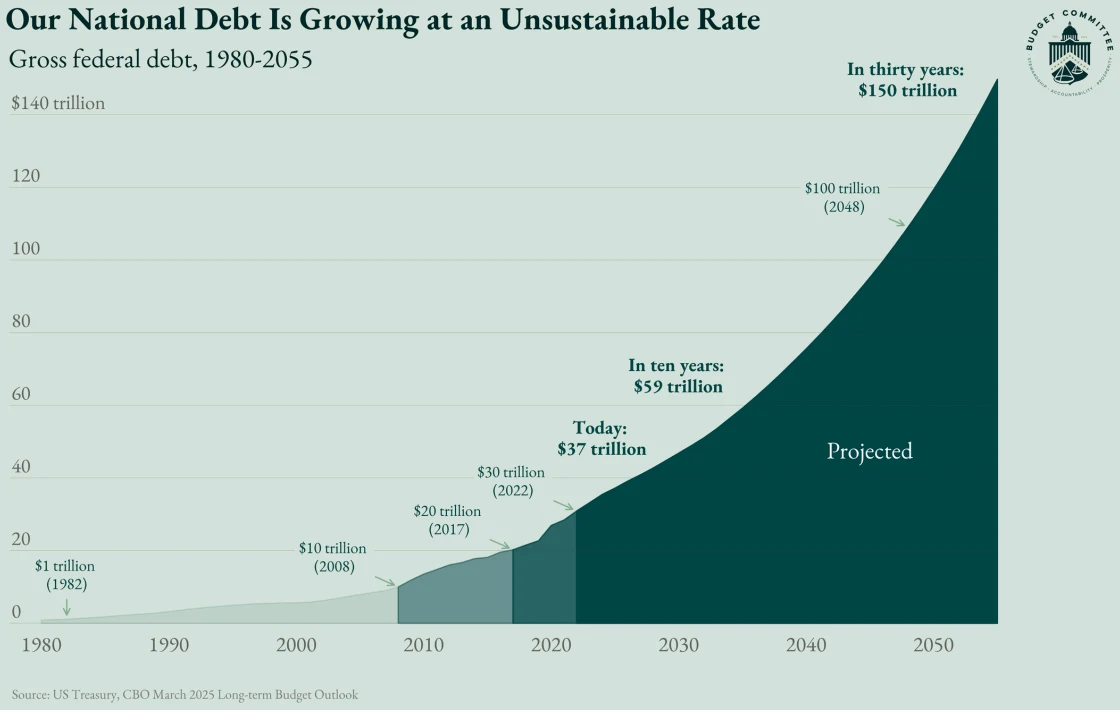

The situation is particularly severe for U.S. Treasuries. As of August 22, 2025, the total U.S. government debt reached $37.2 trillion, equivalent to 1.27 times the nominal GDP of 2024, with per capita debt standing at approximately $107,000. As the debt expands, the interest burden continues to grow. In fiscal year 2024, net interest payments surged to $881.1 billion, a year-on-year increase of 33.9%, accounting for over 13% of total government spending. This snowballing debt growth has sparked concerns over U.S. fiscal sustainability, directly reflected in the rising term premium.

Source: House Committee on the Budget

The term premium represents the additional compensation investors require for holding long-term bonds, serving as a hedge against risks such as interest rate fluctuations. The recent climb in U.S. Treasury yields has been largely driven by this rising term premium, stemming from policy uncertainty emanating from the White House and worsening supply-demand imbalances in the Treasury market. Kathy Jones, Chief Fixed Income Strategist at Charles Schwab, noted: “The bond market is telling you it’s worried about the path it’s on—not just here, but everywhere.”

Fiscal conditions in Europe are also concerning. French Prime Minister Bérou is facing a confidence vote on September 8 regarding the 2026 budget plan, which includes controversial measures such as cutting €43.8 billion in spending and eliminating two public holidays. Polls indicate that over 70% of French citizens do not want Bérou to win the confidence vote. This political uncertainty has triggered a sell-off in French government bonds, with spillover effects spreading to core European bond markets, including Germany and the Netherlands.

The U.K., meanwhile, is under pressure to address a fiscal shortfall ranging between £20 billion and £25 billion. Market attention is focused on how the Labour government’s upcoming autumn budget will balance fiscal priorities. Ironically, expectations of fiscal tightening have driven the yield on 30-year U.K. gilts to a record high. Danny Zaid, Portfolio Manager at Twenty Four Asset Management, observed: “The environment has changed. For many years, there was a ‘taken-for-granted’ structural demand for government bonds. But now, governments in developed markets need to prove themselves to investors to win back confidence.”

Risk-off sentiment builds

Technical liquidity factors and policy uncertainties have further amplified volatility in the bond market.

According to a research report from Barclays, due to the combined impact of the U.S. Treasury rebuilding its cash account (TGA), quarterly tax payments, and Treasury interest settlement, nearly $200 billion in reserves could be drained from the banking system on September 15. This “liquidity drain” effect is particularly potent amid historical seasonal patterns.

Although the Federal Reserve has deployed the Standing Repo Facility (SRF) as a liquidity “safety net,” market doubts about its effectiveness remain. Senior Fed official Lorie Logan previously indicated that the SRF was successfully utilized at the end of June and may again play a role in September. The facility allows financial institutions to quickly convert their holdings of U.S. Treasuries into cash. However, Barclays also noted that while the probability of avoiding a systemic funding crisis remains high, the liquidity tightening itself has already exerted substantial pressure on the market.

Multiple policy uncertainties have intensified risk-off sentiment among investors. Last Friday, a U.S. court ruled that most of former President Trump’s trade tariffs were illegal, casting doubt on hundreds of billions of dollars in revenue collected since their implementation in April. Trump promptly announced he would appeal to the Supreme Court, warning that a loss could cause “unprecedented shock.” The complexity of trade policy has directly pushed up market risk premiums.

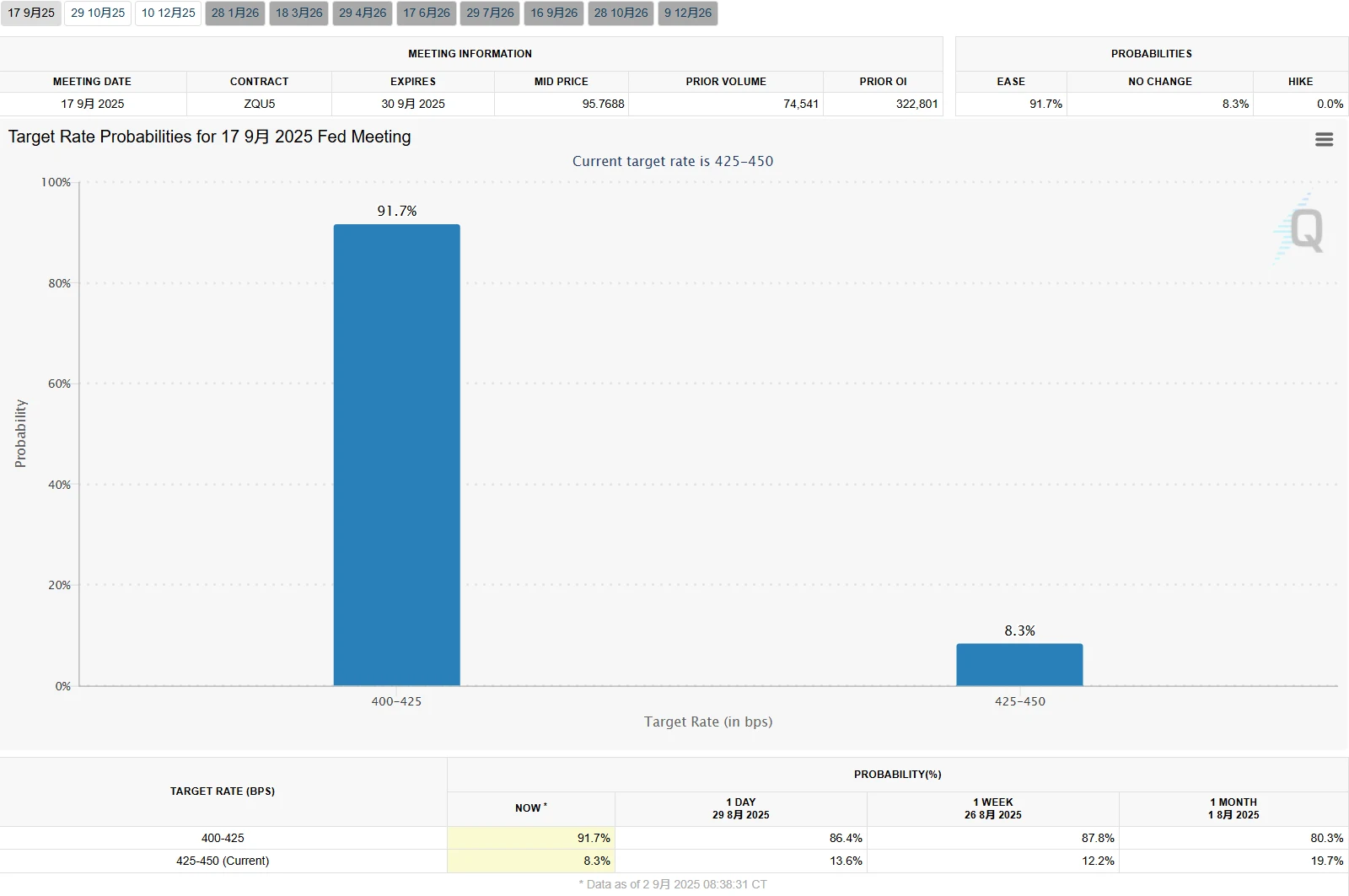

At the same time, the process of selecting the next Federal Reserve Chair has drawn market attention. On September 2, U.S. Treasury Secretary Besant began interviewing 11 candidates, including Fed Governors Christopher Waller and Michelle Bowman. This uncertainty has heightened concerns over the future direction of monetary policy. Traders currently assign a probability of over 90% to a 25-basis-point rate cut by the Fed in September, though this expectation remains highly dependent on the upcoming August employment report.

Source: CME

Rising policy uncertainty is reflected in asset prices. Spot gold broke through $3,500 per ounce, hitting a record high of $3,547, with year-to-date gains exceeding 33%. This underscores the strong correlation between market risk-off sentiment and policy developments.

Source: TradingView

Marija Veitmane, Head of Equity Research at State Street Global Markets, noted: “The risk-off mood we see today stems from broader unease in the bond market.” This sentiment has spread from bonds to equities, leading to a simultaneous decline in both stock and bond markets across Europe and the U.S.

Economic Data Signals

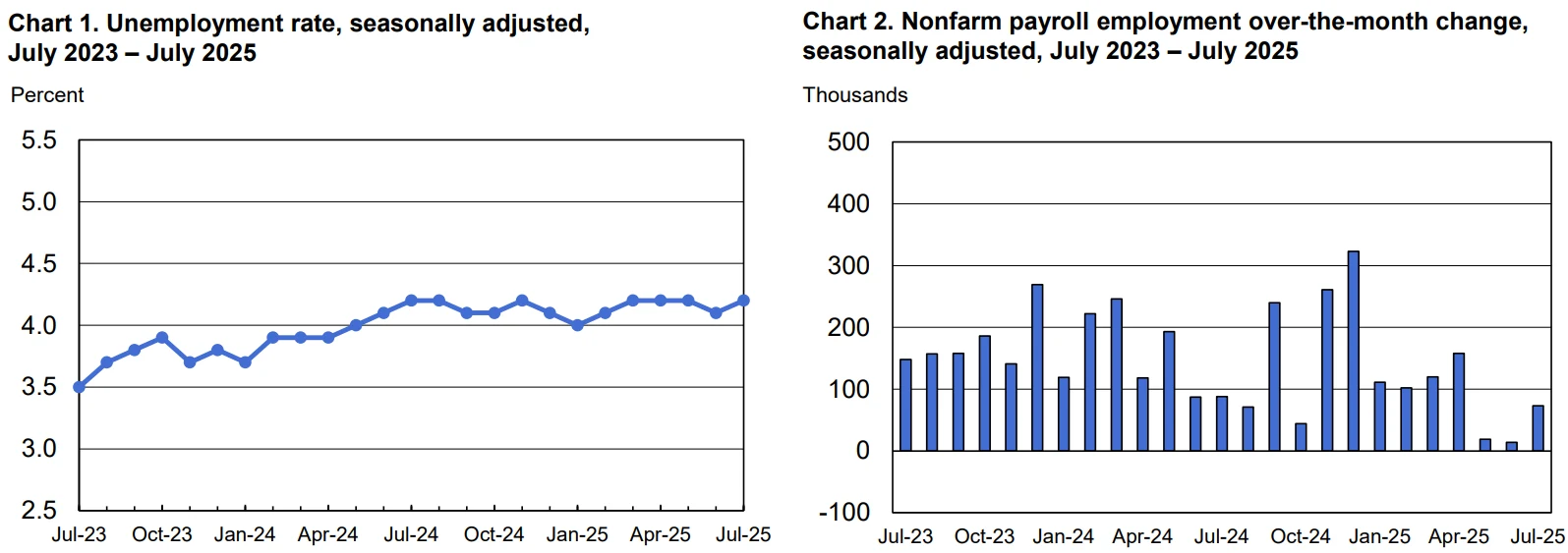

Market focus is intensely concentrated on the U.S. August employment report set for release this Friday. As the last key jobs data point before the Fed’s September policy meeting, it is expected to significantly influence the direction of the bond market. Federal Reserve Governor Christopher Waller expressed support last week for a 25-basis-point rate cut in September but added that his view could change if the employment report “points to a significant weakening of the economy.”

Source: U.S. Bureau of Labor Statistics

Historically, strong employment data tend to fuel concerns around “higher for longer” interest rates, potentially pushing Treasury yields further upward, while weak data could reinforce expectations for rate cuts, offering the bond market some relief. John Briggs, U.S. Rates Strategist at Natixis North America, suggested that if the report comes in soft again, “the market will start thinking about the possibility of a 50-basis-point cut.”

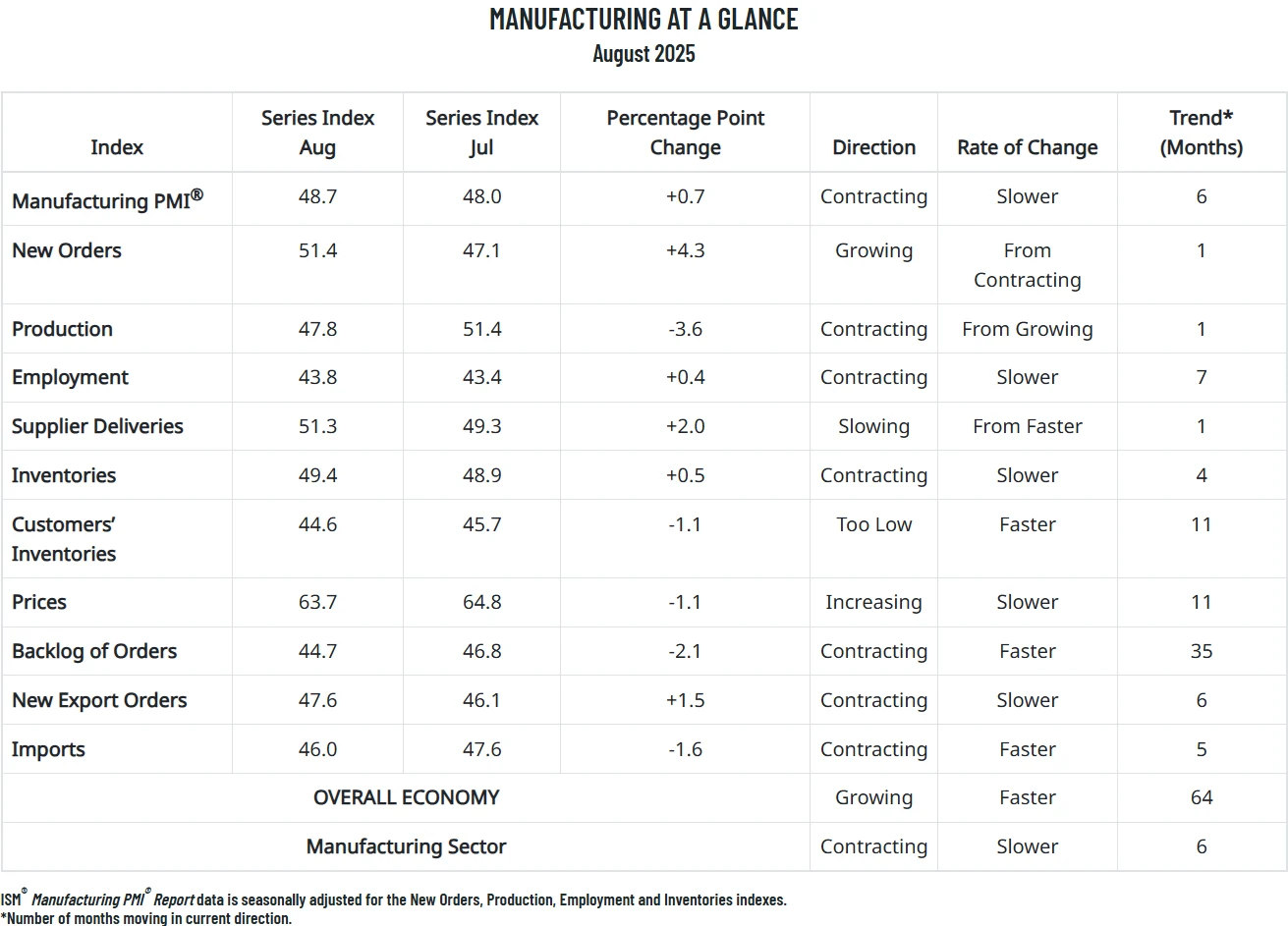

Other economic indicators present a mixed picture. The Institute for Supply Management’s August manufacturing index came in at 48.7, slightly above July’s 48 but still in contraction territory—marking the sixth consecutive month of decline. Within the index, the production component fell 3.6 points to 47.8, returning to contraction after nearly three months, while new orders jumped 4.3 points to 51.4, expanding for the first time since the beginning of the year and hinting at nascent recovery in manufacturing.

Source: ISM

Looking ahead, challenges in the global bond market are likely to persist. John Briggs, Head of North American Rates Strategy at Société Générale, noted: “The 30-year Treasury yield may only pause briefly around 5%. That level is by no means a magic number—I’ve had serious concerns about the global long-end bond market over the past week or two.” He particularly emphasized that cutting rates in a high-inflation environment would be “highly likely to lead to yield curve steepening,” implying that long-term bond yields could face further upward pressure.

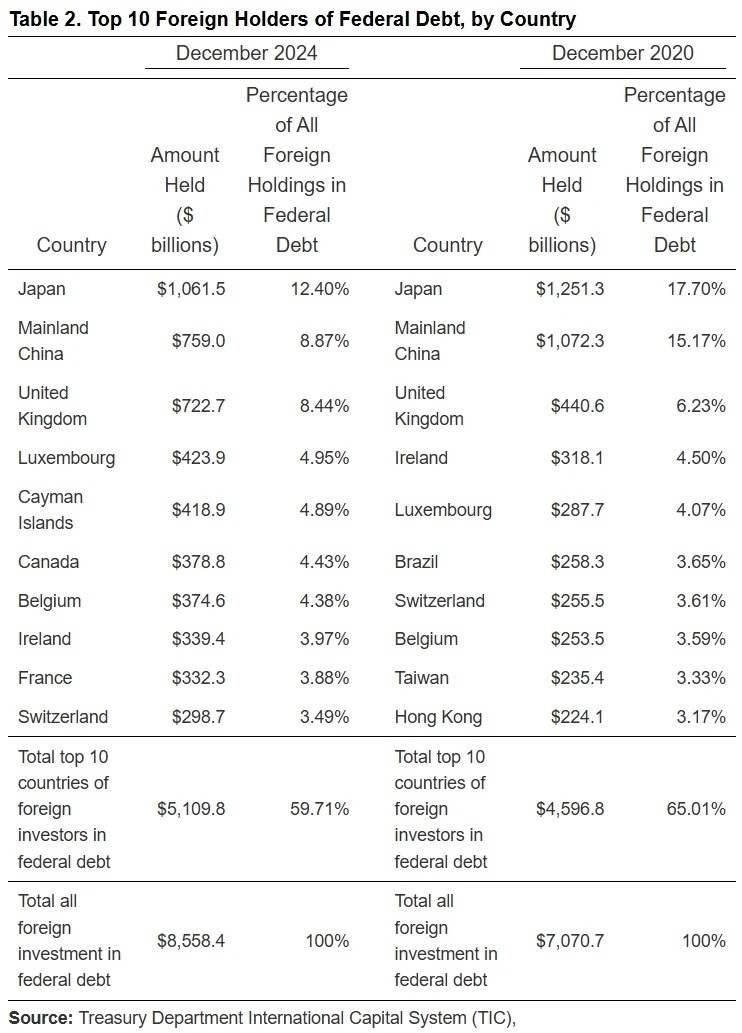

From a broader perspective, the current global bond sell-off reflects a market reassessment of the worldwide debt system. The share of U.S. Treasuries held by foreign owners has fallen from around 50% in 2015 to about 25% today, with recent reductions by countries such as China, Ireland, and Switzerland. The status of U.S. debt as the world’s core reserve asset is gradually eroding. Should this trend continue, it could lead to profound shifts in the global liquidity system.

Source: Library of Congress

Moreover, concerns over fiscal deficits in the bond market are likely to influence market dynamics through the second half of 2025. Unless governments implement effective deficit control measures, the upward trend in yields may be difficult to reverse. If elevated yield levels become entrenched, economic growth could be dampened, further amplifying financial fragility worldwide.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates