Silver Beyond $40: How Much Further Could It Rise?

05:20 September 2, 2025 EDT

Key Points:

On September 1, the London spot silver price broke through and held above the $40/oz psychological level, reaching a high of $40.72/oz, marking a new peak since September 21, 2011.

The market widely anticipates that the September 17 meeting will kick off an interest rate cut cycle. This expectation directly weakens the U.S. dollar index, supporting precious metal prices, as lower interest rates reduce the opportunity cost of holding non-yielding assets like silver.

However, the rate-cut expectation is already largely priced in. If the actual rate cut falls short of expectations or the policy statement skews hawkish, a “buy the rumor, sell the fact” correction may occur.

On September 1, 2025, the international spot silver market witnessed a historic moment—London spot silver broke through and held above the $40/oz threshold, reaching a peak of $40.72/oz, the highest level since September 21, 2011. As of this report, London spot silver is quoted at $40.58/oz, up $0.86 from the previous trading day, representing a 2.15% gain.

Source: TradingView

This price breakthrough signifies the end of a 14-year consolidation period for silver. Historically, silver reached a peak of $49.82/oz on April 28, 2011, with an annual average price of $35.13/oz. By comparison, the 2024 annual average price had risen to approximately $28.28/oz, highlighting a long-term upward trend.

Monetary Policy Pivot Expectations Bolster Markets

The primary driver behind the recent silver price rally stems from clear market expectations of a shift in Federal Reserve monetary policy. Since late August, several Fed officials have repeatedly issued dovish signals, serving as a key catalyst for the rise in silver prices. Fed Governor Waller explicitly voiced support for a 25-basis-point rate cut in September and indicated that the easing cycle could continue over the next three to six months, reinforcing market confidence that a monetary easing phase is imminent.

Core officials, including New York Fed President Williams and San Francisco Fed President Mary Daly, also commented that “lowering rates at the appropriate time is warranted,” creating a collective dovish narrative.

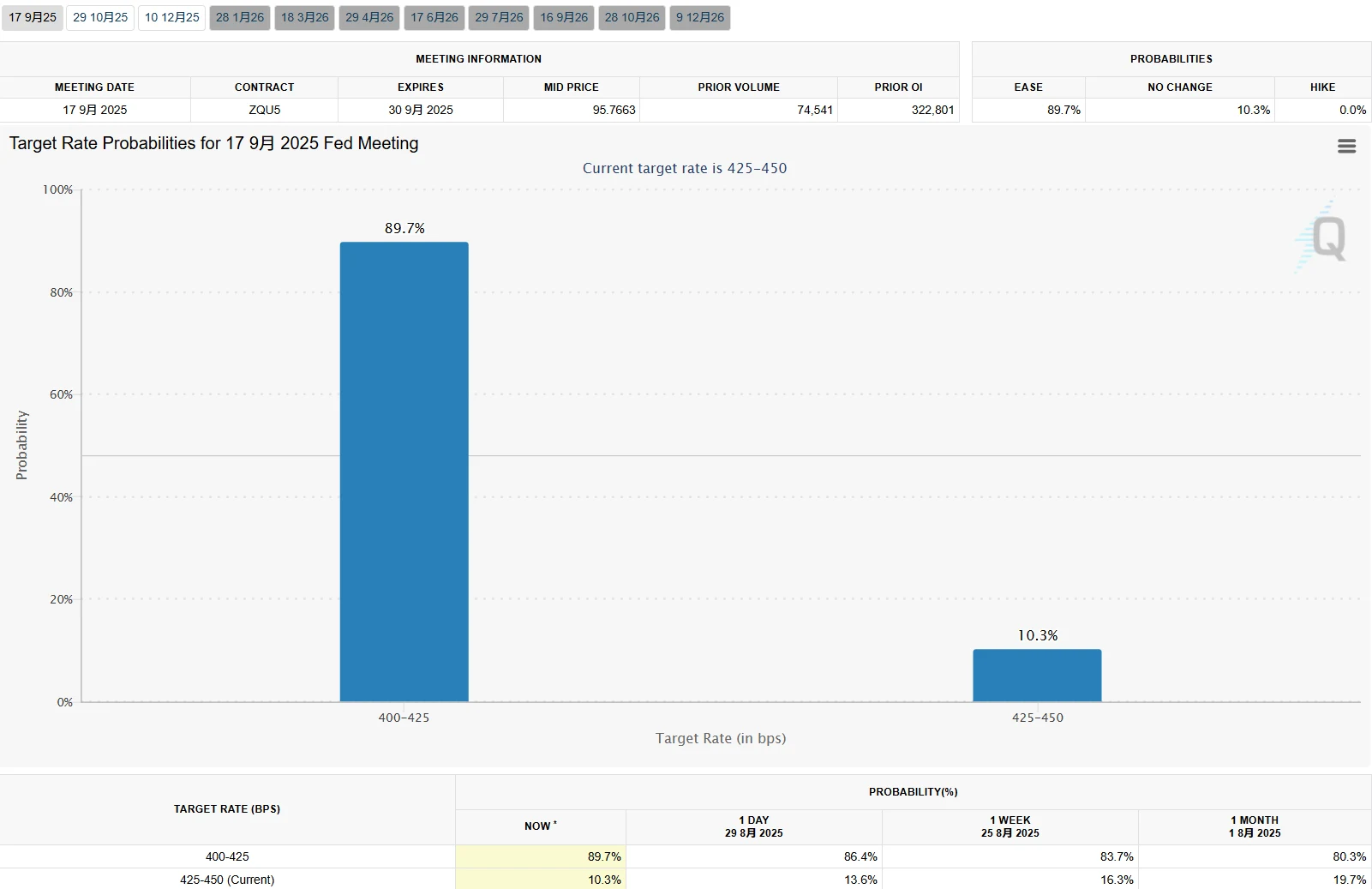

Expectations for rate cuts are already reflected in market pricing. According to FedWatch data, the market currently assigns nearly a 90% probability to a 25-basis-point cut at the September 17 meeting, up sharply from 37% a month ago, indicating that expectations for a policy shift have become broadly consensus-driven.

Source: CME

Historical data show that silver tends to perform strongly during Fed rate-cut cycles. During the 2019 easing cycle, silver rose cumulatively by 26%, while in the post-2008 financial crisis easing cycle, gains approached 150%. These historical patterns further reinforce current market bullish sentiment.

Source: TradingView

Fed Chair Powell’s remarks at the Jackson Hole symposium marked a key turning point in policy expectations. While acknowledging upside inflation risks, he highlighted rising downside risks to the labor market, signaling that monetary policy may need “adjustments to accommodate economic conditions.” His emphasis on employment risks provides a theoretical basis for easing. Analysts interpret Powell’s comments as indicating that, in the short term, downside risks to U.S. employment outweigh upside inflation risks, laying the groundwork for a September rate cut.

U.S. Dollar Credit Concerns

The Trump administration’s attempt to remove Fed Governor Cook continues to unfold, sparking broad market concerns over the Federal Reserve’s independence—another key factor suppressing the U.S. dollar index while supporting precious metals such as silver.

On August 25, Trump announced Cook’s dismissal, citing alleged mortgage fraud. Cook, the first Black woman to serve as a Fed governor, was originally appointed through 2038. She subsequently filed a lawsuit, describing the removal as “unprecedented and unlawful,” and emphasized that “an independent Federal Reserve is crucial for economic stability, as the president’s short-term political interests often conflict with sound monetary policy.”

On August 29, U.S. District Judge Jay Cobb heard a two-hour oral argument and required Cook’s legal team to submit a written brief by September 2, detailing why the dismissal was illegal. No ruling has yet been issued on the request for a temporary injunction. The uniqueness of this case lies in its direct challenge to the Fed’s role as an independent monetary policy institution—a cornerstone of the U.S. dollar’s credibility as the world’s primary reserve currency.

Analysts at Deutsche Bank note that a court ruling affirming the dismissal as unlawful and protecting Fed independence could temporarily boost confidence in the dollar. However, until such a ruling is delivered, market concerns over political interference in monetary policy are likely to continue weighing on the U.S. dollar index, providing safe-haven support for silver and other precious metals. Market reactions during the event show the U.S. dollar index falling from 98.5 to 97.2, a decline of 1.3%, contrasting with rising silver prices and validating this transmission mechanism.

Source: TradingView

Industry Logic

The recent rise in silver prices has been driven not only by the release of its financial attributes but also by strong support from fundamental supply-demand imbalances. Data from the World Silver Council show that silver has experienced a structural market deficit for five consecutive years, with total industrial demand reaching a record 680.5 million ounces in 2024. The mismatch between sluggish supply growth and rapidly expanding demand provides a solid foundation for long-term upward pressure on silver prices.

The surge in industrial demand has become the core driver of this supply-demand imbalance. In the global energy transition, the photovoltaic (PV) industry stands out as a major silver consumer. The International Energy Agency’s Global PV Market Overview 2025 reports that global PV installations exceeded 600 GW in 2024, significantly boosting silver demand.

The rapid growth of the electric vehicle (EV) sector further amplifies silver consumption. According to the World Silver Council, the silver content per hybrid and fully electric vehicle in 2024 increased by 21% and 71%, respectively, compared with conventional vehicles. With global EV penetration rising from 4.2% in 2020 to an expected 35% in 2025, silver demand in this segment is projected to maintain an 8%-15% annual growth rate, providing ongoing support for silver prices.

Investment demand has also contributed to market tightness. The world’s largest silver ETF, the iShares Silver Trust, recorded a net inflow of 20.378 million ounces in the first half of 2025, lifting total holdings to a temporary high of 482.852 million ounces, reflecting continued investor allocation to silver assets.

Source: TradingView

Compared with gold, silver offers a lower price threshold, higher volatility, and greater elasticity. As energy transition and green manufacturing accelerate, silver’s “industrial” and “safe-haven” attributes overlap, creating dual support for its price.

Gold-Silver Ratio Recovery Effect

From the perspective of precious metal ratios, the recent pullback in the gold-silver ratio has been another key factor supporting silver’s catch-up rally. In January of this year, the gold-silver ratio surged to a high of 104, well above the historical average of 58 since 1968, indicating that silver was significantly undervalued relative to gold. As market expectations for a Fed rate cut intensified, capital began flowing into the silver market for arbitrage, driving the gold-silver ratio down from its peak to around 86.

Source: GOLDPRICE

Historical patterns show that when the gold-silver ratio deviates too far from its mean, it often returns to a reasonable range through sharp market movements.

During silver’s price peak in 2011, the gold-silver ratio fell to around 30; during the 1979 silver bull market, it even dropped below 20. Citi research notes that if the Fed initiates rate cuts while the economy remains robust, the gold-silver ratio could decline further to 70, implying significant upside potential for silver. Ole Hansen, Head of Commodity Strategy at Saxo Bank, also expects the 2025 gold-silver ratio to fall from the current 88 to around 75, continuing to support silver price performance.

Wall Street Pricing

Overall, Wall Street analysts remain broadly bullish on silver’s medium- to long-term trajectory, though they differ in views on the pace of gains and near-term volatility, providing the market with a range of reference points.

Citi, in its latest research report, maintains a bullish outlook for silver, expecting prices to reach $43 per ounce over the next 6–12 months. Citi notes that silver’s inclusion on the U.S. critical minerals list could pave the way for the U.S. to initiate a Section 232 investigation and impose high import tariffs. Given that the U.S. relies on imports for 64% of its silver consumption, any such tariffs could create substantial arbitrage opportunities in COMEX silver futures. Citi analysts further project that once silver breaks through the key $40 per ounce resistance level, prices could climb to $46 per ounce by the end of Q3.

Nikki Shields, Head of Metals Strategy at MKSPAMP, expects silver to reach $42 per ounce in 2025. She highlights that industrial demand remains robust, the market has faced structural supply deficits for five consecutive years, and silver’s affordability relative to gold continues to enhance its investment appeal.

Nitesh Shah, Commodity Strategist at WisdomTree, notes that the current rally could push silver above the $40 mark in the near term, but with long positions elevated, a pullback to $35 would not be surprising. After a consolidation phase, Shah anticipates silver could move toward its historical high of $45 per ounce in 2026.

Underlying these forecasts is a shared view: silver is no longer purely driven by financial cycles but is entering a new valuation phase fueled by industrial demand.

Potential Outlook

Looking ahead, silver price movements will be highly sensitive to the outcomes of two key events: the Federal Reserve’s September monetary policy meeting and the judicial ruling in the Cook lawsuit.

If the Fed announces a 25-basis-point rate cut as expected at the September 17 meeting and maintains guidance for continued easing, the opportunity cost of holding silver would decline further, potentially pushing prices into the $42–$45 per ounce range. Historical data indicate that, in the month following an initial rate cut, silver has typically risen 5%–8% on average, outperforming gold. However, the market has already largely priced in the expected cut; if the rate reduction falls short of expectations or the policy statement leans hawkish, a “buy the rumor, sell the fact” pullback could occur.

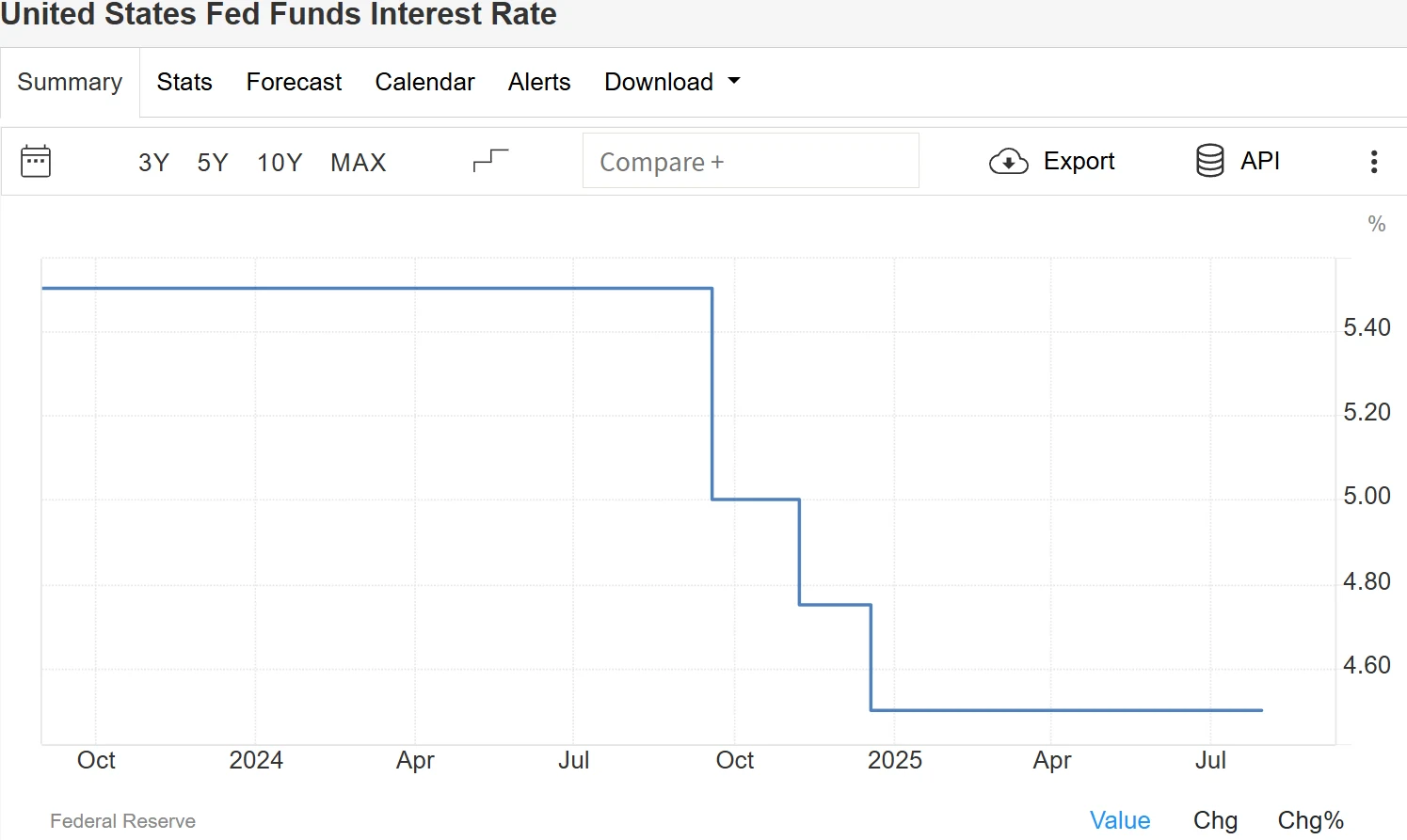

Source: Trading Economics

The Cook lawsuit ruling will indirectly affect silver through the U.S. dollar. If the court grants Cook’s request for a temporary injunction in early September, halting the dismissal, market concerns over Fed independence would ease, potentially providing a short-term boost to the dollar and exerting downward pressure on silver. Conversely, if the injunction request is denied, fears of political interference in the Fed would intensify, weakening dollar credibility and supporting silver as a safe-haven asset.

Deutsche Bank analysts note that, regardless of the ruling, the institutional risk highlighted by this case will have a long-term impact on dollar credibility, offering structural support to precious metals.

Ahead of these two events, U.S. economic data for August—particularly nonfarm payrolls and CPI—will serve as critical leading indicators. A stable unemployment rate of 4.2%–4.3% coupled with weak inflation rebound could reduce the urgency for a rate cut; conversely, signs of economic cooling would reinforce expectations for easing. These data releases are likely to directly influence market adjustments to Fed policy expectations and, in turn, cause short-term volatility in silver prices.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates