Alibaba Shares Rally as Cloud Revenue Growth Hits 26%, a Three-Year High in Fiscal Q1 2026

04:10 September 1, 2025 EDT

Key Points:

Alibaba's Q1 FY2026 revenue increased 2% year-over-year (YoY) to RMB 247.65 billion, with cloud revenue growth of 26% and capital expenditure of RMB 38.6 billion both exceeding market expectations.

Following the earnings release, Alibaba’s U.S.-listed shares surged 12.9% in a single session, while its Hong Kong-listed stock rose over 18% intraday the next day, reaching its highest level since March of this year.

With continued progress in its dual strategic focus on AI and consumption, Alibaba is laying the groundwork for future growth.

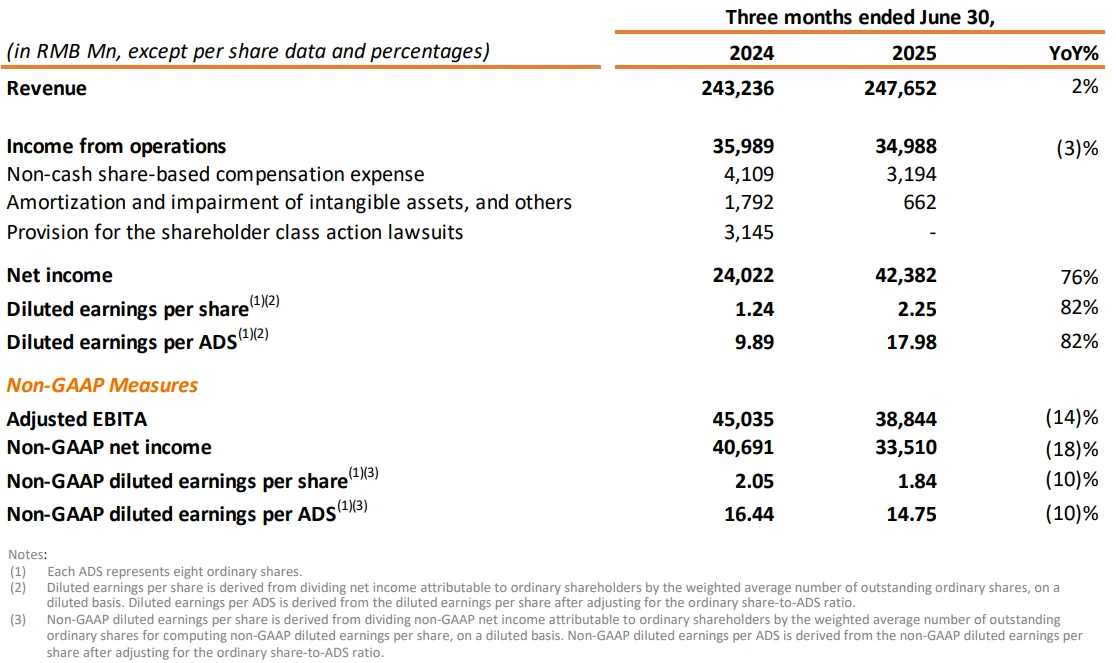

On August 29, Alibaba Group released its financial results for the first quarter of fiscal year 2026 (ended June 30, 2025). The report showed revenue reached RMB 247.65 billion, up 2% year-over-year. Excluding revenue from divested businesses such as Sun Art and Intime, like-for-like revenue growth was 10%. Net profit rose significantly by 76% YoY to RMB 42.38 billion, well ahead of market expectations.

After the earnings announcement, Alibaba’s U.S.-listed stock jumped 12.9% in one trading day, and its Hong Kong-listed shares gained more than 18% intraday the following session. The market’s response reflected strong approval of the better-than-anticipated results.

Source: TradingView

Revenue Growth Solid; Profit Beat Expectations

Alibaba’s quarterly earnings report exhibited characteristics of a strategic investment phase—revealing a divergence between revenue growth and profit performance, alongside a contrast between the financial contributions of core and non-core businesses. Group revenue increased 2% year-over-year to RMB 247.65 billion. While this growth rate appears modest, like-for-like revenue growth—excluding impacts from divested businesses such as Sun Art and Intime—reached 10%, indicating a recovery in the underlying momentum of core operations.

Source: Alibaba

In terms of profitability, net income attributable to ordinary shareholders was RMB 43.12 billion (USD 6.02 billion), up 76% year-over-year. However, non-GAAP net profit, which better reflects the earnings power of core operations, decreased 18% to RMB 33.51 billion. The company attributed this primarily to significant investments in Taobao Quick Pick, user acquisition, and technology R&D.

Adjusted EBITA declined 14% to RMB 38.84 billion, further underscoring near-term profit pressure. Still, double-digit revenue growth in China commerce and improved operational efficiencies across several businesses partially offset the impact of these investments.

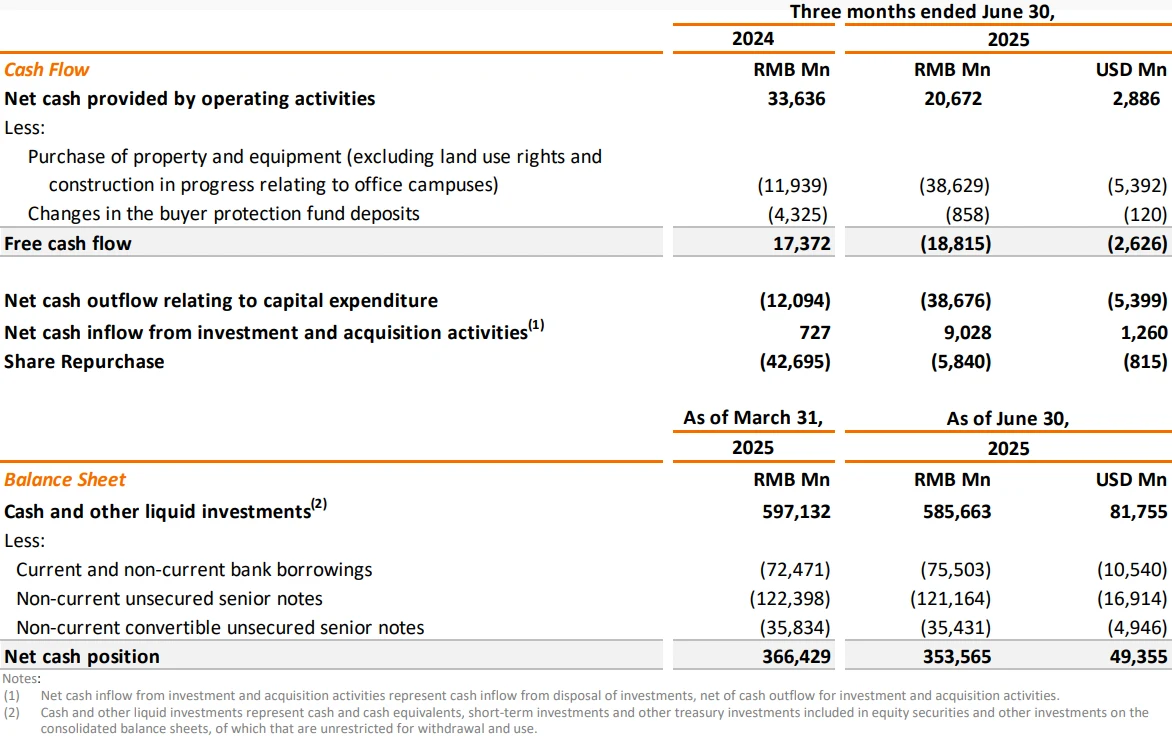

Cash flow dynamics shifted noticeably due to strategic spending. Net cash provided by operating activities decreased 39% year-over-year to RMB 20.67 billion, while free cash flow turned from an inflow of RMB 17.37 billion in the same period last year to an outflow of RMB 18.82 billion. This change was driven mainly by two factors: market subsidies and user acquisition costs for Taobao Quick Pick, and heavy capital expenditure on cloud infrastructure. This quarter, Alibaba’s capital expenditures for “AI + cloud” reached RMB 38.6 billion, surging 220% year-over-year to a record high. Cumulative investments over the past four quarters have now exceeded RMB 100 billion.

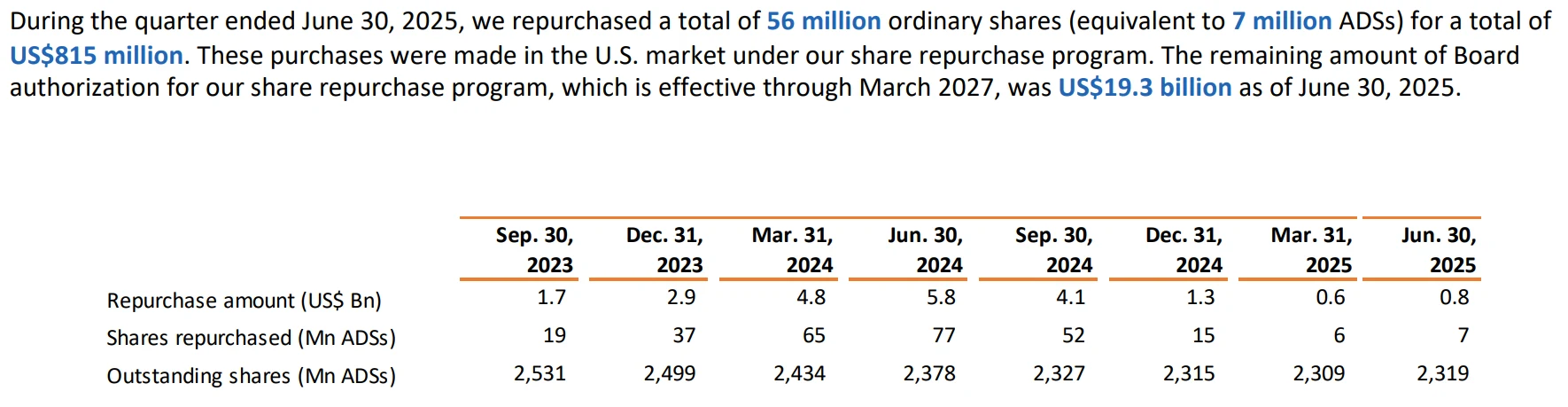

From a capital structure perspective, Alibaba maintains strong financial resilience. As of June 30, 2026, the company held cash and other liquid investments of RMB 585.66 billion (USD 81.76 billion), providing a solid foundation for continued strategic investment. During the quarter, the company repurchased 56 million ordinary shares for USD 815 million. As of the end of the quarter, USD 19.3 billion remained under the share repurchase quota, which is valid until March 2027. This ongoing repurchase program signals management’s confidence in the company’s value.

Source: Alibaba

AI and Cloud Business Emerges as Key Highlight

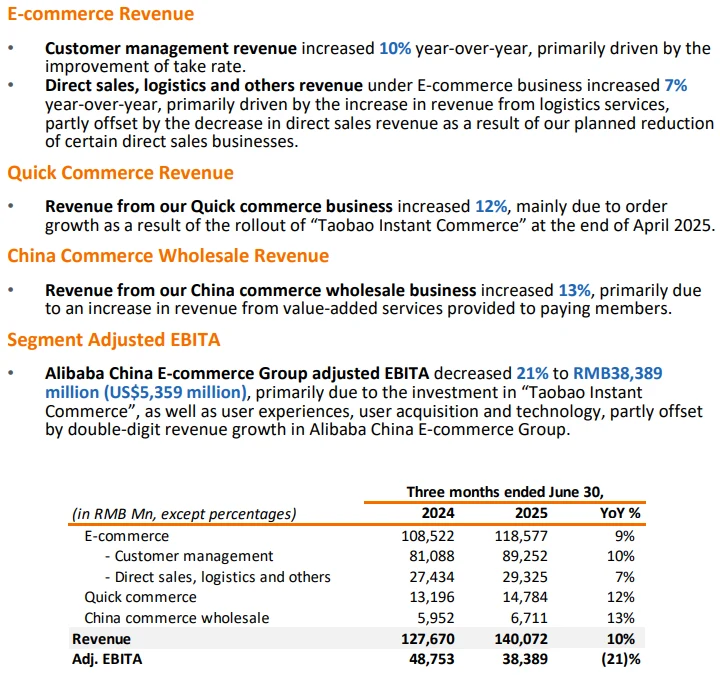

This quarter, Alibaba achieved solid progress in both its “core consumption” and “AI + cloud” strategic pillars. Business segments showed a clear “winner-takes-more” pattern as resources increasingly concentrated on core operations.

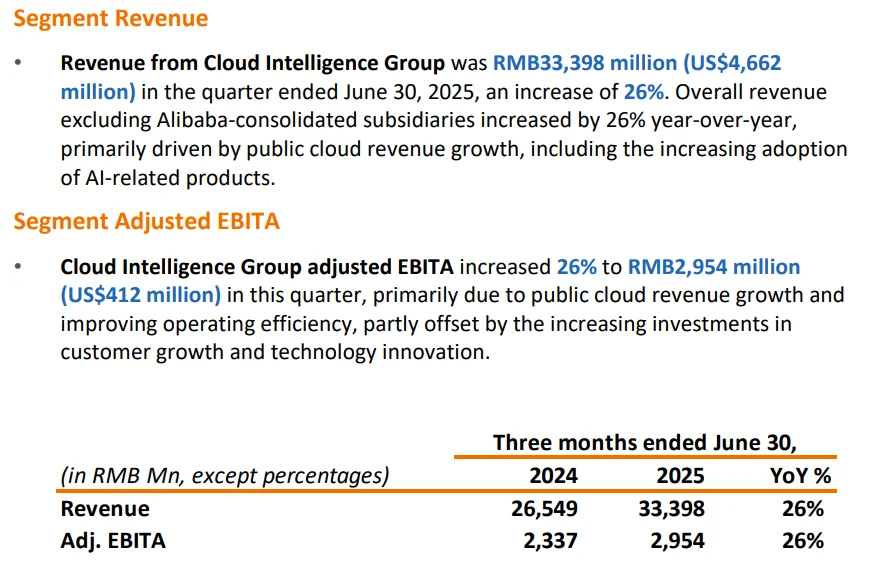

Alibaba Cloud Intelligence Group delivered the strongest performance of all segments, posting revenue of RMB 33.398 billion, up 26% year-on-year — the fastest growth rate in three years. Revenue from external customers also rose sharply, driven by accelerated AI adoption and stronger client demand.

Source: Alibaba

Notably, AI-related product revenue recorded triple-digit year-on-year growth for the eighth consecutive quarter, accounting for over 20% of external commercialization revenue. This shift not only optimized the revenue mix but also improved profitability — adjusted EBITA reached RMB 2.954 billion, up 26% year-on-year, with the EBITA margin rising to 8.8%, up 0.8 percentage points sequentially.

According to IDC’s latest report, Alibaba Cloud’s market share has expanded for three straight quarters. Globally, Forrester ranked its public cloud products and strategic capabilities second worldwide, awarding top scores in 17 of 30 evaluation criteria. Its strategy score climbed to second globally, underscoring its internationally recognized technical strength.

Beyond the rapid growth in cloud services, Alibaba’s breakthrough in on-demand retail also emerged as a core highlight this quarter. Revenue from this segment reached RMB 14.784 billion, up 12% year-on-year, largely fueled by surging order volumes from the Taobao Flash Sale service launched in late April.

Taobao Flash Sale delivered faster-than-expected results in just four months: daily peak orders reached 120 million in August, with weekly averages stabilizing at 80 million; monthly active buyers rose to 300 million, up 200% from April; and daily active delivery riders exceeded 2 million, tripling since April. This explosive growth significantly boosted engagement on the Taobao app — in the first three weeks of August, monthly active consumers on the platform rose 25% year-on-year, while the Flash Sale channel averaged 150 million daily active users, expanding overall user scale and stickiness.

Source: Alibaba

UBS reports that, measured by order volume, Alibaba’s share in the food delivery market jumped from 11% pre-launch to 28%, reshaping a space previously dominated by Meituan and Ele.me.

Although the ramp-up in on-demand retail raised near-term costs — selling and marketing expenses reached RMB 53.178 billion this quarter, accounting for 21.5% of revenue, up 8.1 percentage points year-on-year — the initiative has begun to create tangible value for Alibaba’s broader e-commerce ecosystem.

On the earnings call, Jiang Fan noted that traffic growth from Flash Sale is driving e-commerce advertising and CMR gains, enhancing user activity and helping reduce marketing costs. This positive feedback loop is expected to expand further in upcoming quarters. Membership growth remains robust — 88VIP subscribers increased at a double-digit pace year-on-year, exceeding 53 million. These high-value users are interacting actively with the Flash Sale platform, laying the groundwork for improved monetization efficiency.

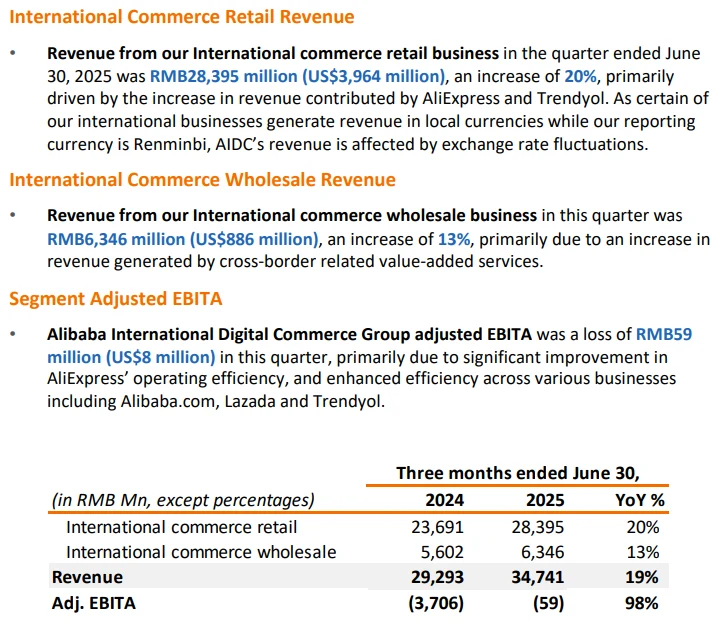

Alibaba International Digital Commerce Group (AIDC) also maintained strong momentum, with revenue up 19% year-on-year to RMB 34.741 billion, driven by robust cross-border business. More importantly, profitability improved substantially — adjusted EBITA loss narrowed to just RMB 59 million, compared with a loss of RMB 3.7 billion in the same period last year, representing a 98% reduction. This indicates that the international segment is moving steadily toward a sustainable growth trajectory while scaling operations.

Source: Alibaba

Despite global macroeconomic uncertainty and geopolitical risks, Alibaba’s international operations have become a key contributor to top-line growth and a potential driver of future profitability.

Broad Market Consensus

Alibaba’s latest earnings report triggered a strong market reaction and prompted institutional investors to reassess its valuation.

Following the release, Alibaba’s U.S.-listed shares surged sharply at the open on August 29, closing up 12.9% at $135, giving the company a market capitalization of $321.9 billion. The rally extended to the Hong Kong market on September 1, where the stock opened nearly 15% higher and rose as much as 18% intraday, reaching its highest level since March.

Source: TradingView

Equity analysts broadly expressed optimism about Alibaba’s outlook and raised their price targets. JPMorgan increased its price target from $140 to $170, highlighting the “synergistic growth potential between AI-driven consumer electronics and cloud services, with significant room for valuation recovery.” Morgan Stanley lifted its U.S. price target from $150 to $165, forecasting Alibaba Cloud’s quarterly growth to reach 30% with margins holding in the high single digits.

This optimism is underpinned by expectations of a valuation re-rating. Alibaba currently trades at a trailing P/E of about 16.08x and a P/B of 2.35x, with its price-to-book ratio near historical lows — levels that appear misaligned with its fundamentals and growth potential.

On a sum-of-the-parts basis, CICC applies a 13x P/E multiple for Alibaba’s e-commerce segment and a 3.5x P/S multiple for its cloud business. Considering Alibaba’s stakes in Ant Group, Cainiao, and Amap — collectively valued at roughly RMB 1.6 trillion — the company’s current market capitalization of HKD 2.61 trillion suggests its core e-commerce and cloud operations remain undervalued.

A more forward-looking valuation case comes from repricing Alibaba’s two strategic growth drivers. For cloud services, international peers suggest that revenue growth above 20% can persist for another 1–2 years, while the high-margin nature of AI-driven cloud services will gradually offset infrastructure-related depreciation costs, supporting sustainable margin expansion.

For the on-demand retail segment, although current investments are pressuring near-term profits, the business is expected to add RMB 1 trillion in incremental GMV over the long term. By strengthening user synergies and boosting overall platform monetization efficiency, this value creation has yet to be fully reflected in Alibaba’s current valuation.

Multiple catalysts are now driving this re-rating. Beyond strong earnings and operational progress, strategic partnerships with global players such as SAP not only contribute to tangible revenue growth but also reshape international perceptions of Alibaba Cloud’s global competitiveness. Additionally, GameStop CEO Ryan Cohen’s decision to increase his personal stake in Alibaba to $1 billion has served as a sentiment driver. Meanwhile, the company’s ongoing share repurchase program — with $19.3 billion still available — provides a valuation buffer against market volatility.

Source: Alibaba

As Alibaba continues to execute on its AI and consumption strategies, it is laying the groundwork for future growth. However, investors should also monitor profitability and free cash flow during this period of elevated capital investment.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates