Market Update:August Jobs Report in Focus with Fed Speeches, Monday Market Holiday; Stocks Enter Traditionally Worst Month

22:31 August 31, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

U.S. August Nonfarm Payrolls Report Release

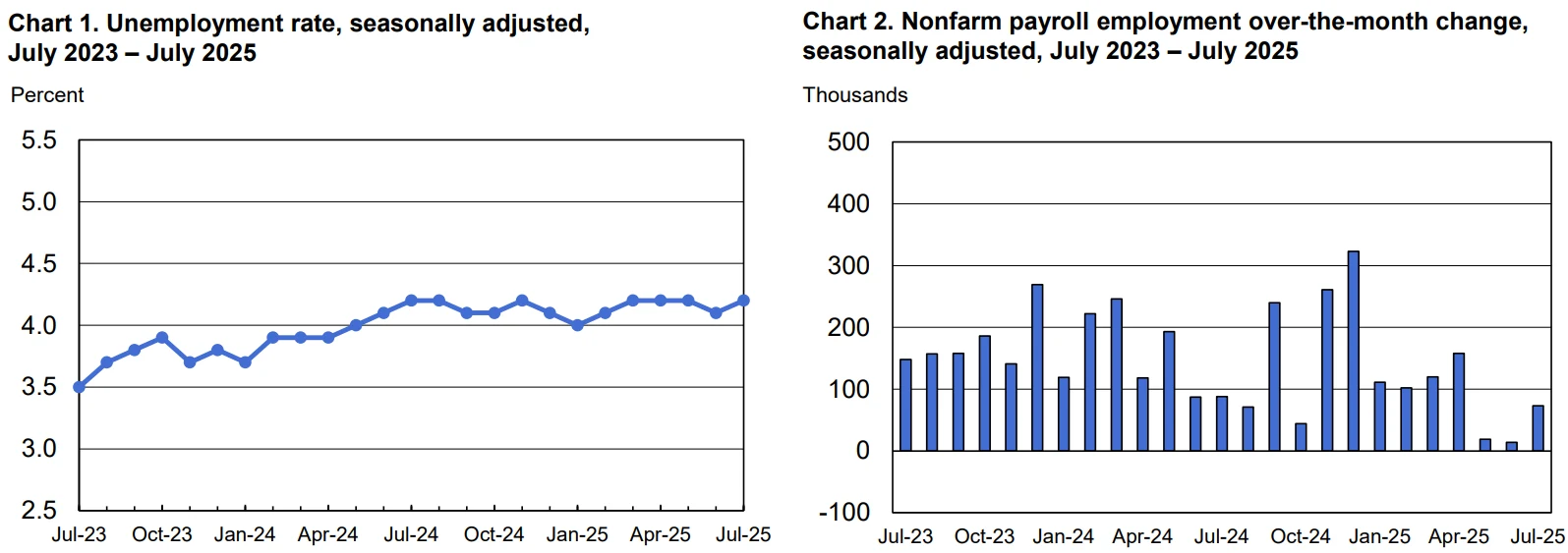

The U.S. Department of Labor will release the August Nonfarm Payrolls data on September 5. Market consensus expects job gains of approximately 120,000, with the unemployment rate holding steady at 4.2%. Notably, the prior reading (July: +73,000) fell well below expectations, and cumulative downward revisions of 258,000 for May–June indicate significant softening in the labor market. If the August data further weakens, it could heighten concerns about an economic downturn and prompt the Federal Reserve to accelerate rate cuts. Conversely, strong data could delay the easing cycle.

Source: U.S. Bureau of Labor Statistics

In his speech at the Jackson Hole Symposium, Fed Chair Jerome Powell emphasized that near-term inflation risks remain tilted to the upside, while employment risks are skewed to the downside. He noted that the labor market remains near maximum employment, and although inflation remains elevated, it has declined significantly from post-pandemic highs. The balance of risks appears to be shifting, with greater attention now paid to employment risks. However, he also pointed out that stringent immigration policies under the Trump administration have slowed labor supply, potentially dampening job gains.

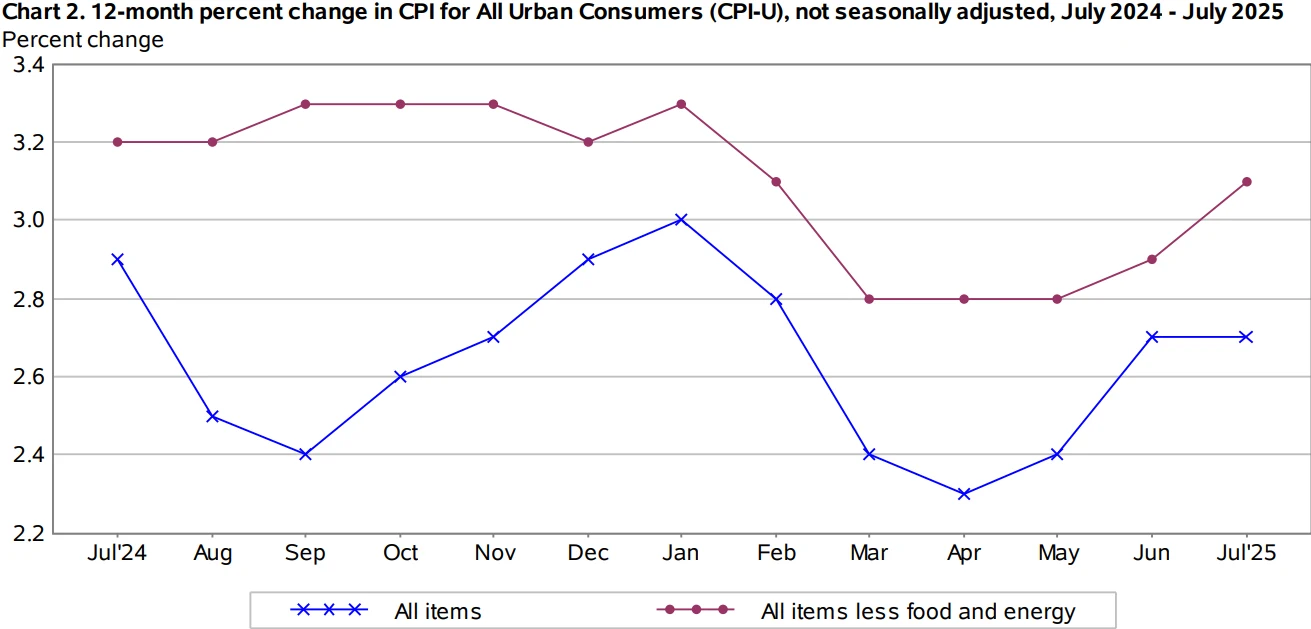

Meanwhile, the U.S. Bureau of Labor Statistics will release the August Consumer Price Index (CPI) and Producer Price Index (PPI) on September 1. These metrics are core indicators for the Fed to assess inflationary pressures. Market expectations suggest CPI may hold at 2.7% year-over-year, while core CPI (excluding food and energy) could edge up to 3.1%. PPI is anticipated to rise 2.8% year-over-year. Should the data exceed expectations, it could reinforce market expectations for a cautious Fed; weaker-than-expected data may solidify expectations for a 25-basis-point rate cut in September.

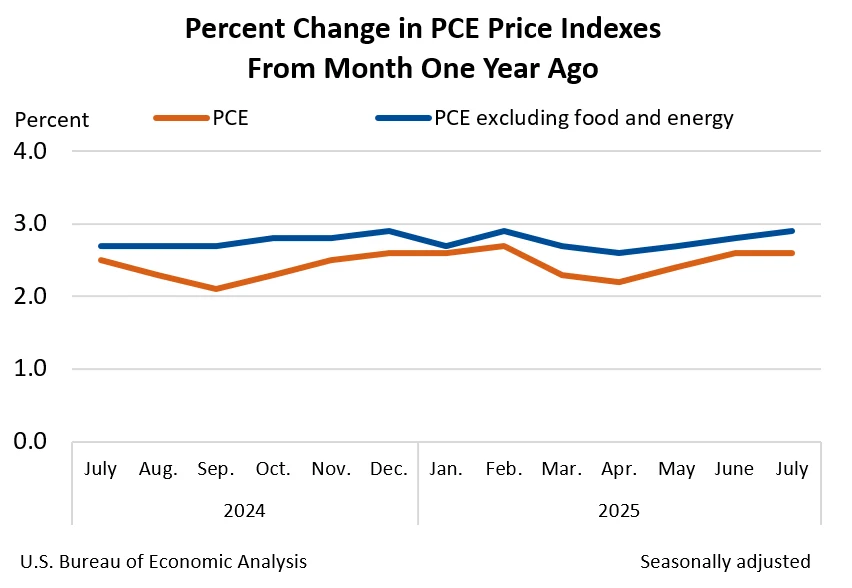

Source: BEA

Source: BEA

Ahead of Friday’s key data release, investors will also monitor a series of labor market indicators: July JOLTS job openings on Wednesday, and August ADP private employment and weekly initial jobless claims on Thursday.

Fed Officials Set to Speak

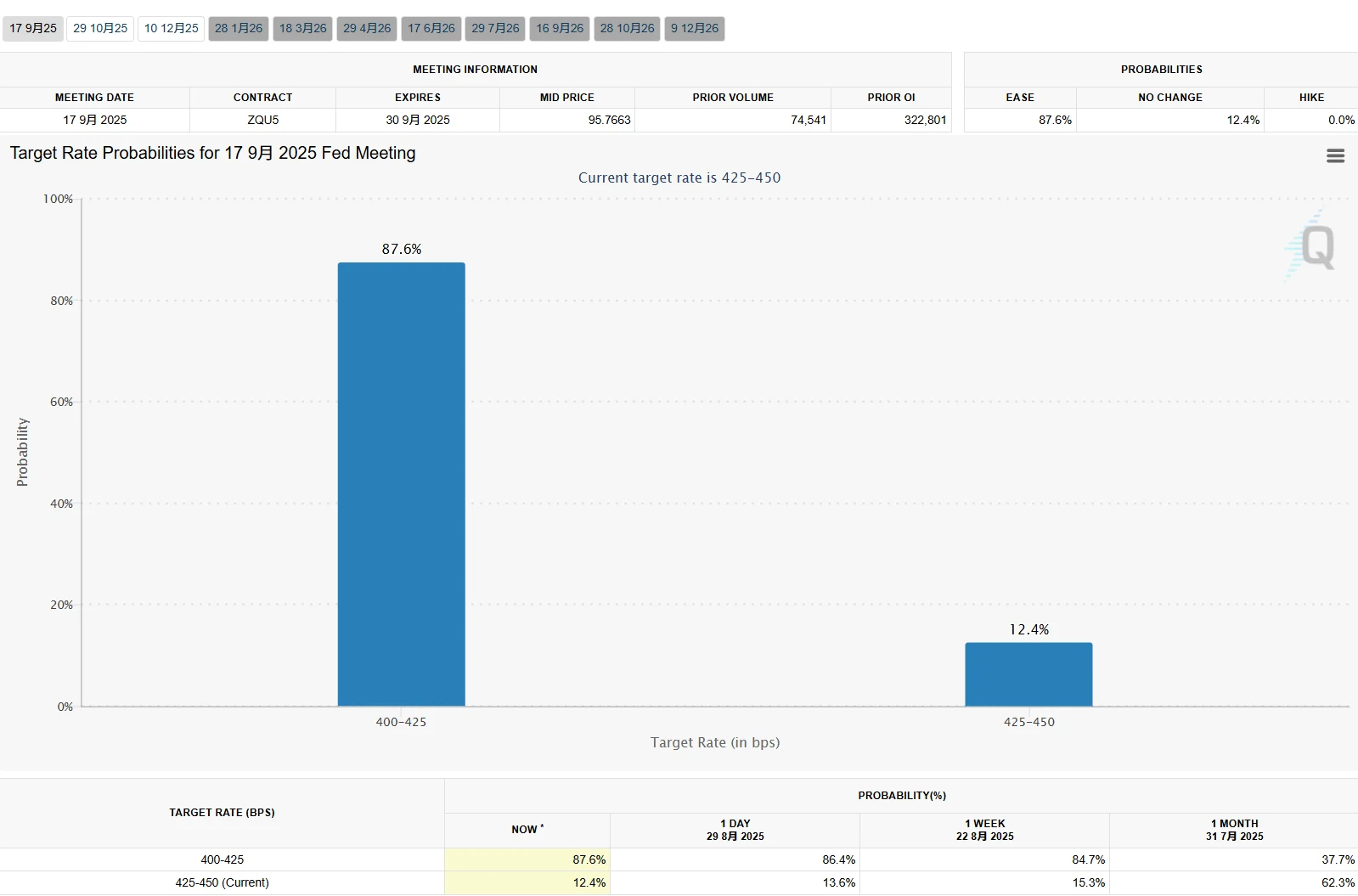

On August 29, Fed Governor Christopher Waller explicitly endorsed a 25-basis-point rate cut at the September 16–17 meeting and projected additional easing over the next 3–6 months. This aligns with the dovish signals from Chair Powell’s Jackson Hole address, with market-implied probability of a September rate cut rising to 87.6%.

Source: CME Group

Although the Fed entered its blackout period on September 1 (approximately one week ahead of the FOMC meeting), regional Fed presidents may still deliver remarks. For instance, St. Louis Fed President Musalem is scheduled to comment on monetary policy on September 3—market participants will closely monitor his views on inflation and employment.

The Fed currently faces a dilemma of "softening labor market + persistent inflationary pressures." Although core PCE remains above the 2% target, Powell’s emphasis on "prioritizing employment downside risks" suggests that rate cuts are geared more toward averting a recession than responding to short-term inflation fluctuations. Markets should remain vigilant—should CPI or payrolls data surprise to the upside, it could trigger a repricing of rate-cut expectations, leading to heightened volatility in the dollar and Treasury yields.

Notably, Fed personnel developments are also drawing market attention. On August 25, former President Donald Trump announced via his social media platform, Truth Social, the immediate dismissal of Fed Governor Lisa Cook. Cook has filed a lawsuit contesting the legality of her removal.

On August 28, Cook filed the suit in a Washington D.C. district court and sought a restraining order to block the dismissal. A hearing concluded on August 29 without an immediate ruling—Judge JaCob instructed Cook’s legal team to submit a brief by next Tuesday detailing why Trump’s move violated the law.

This unprecedented legal battle carries high uncertainty. A final ruling may take considerable time, and a Supreme Court decision could have profound implications for Fed independence.

Trump-Affiliated WLFI Token Begins Trading

The WLFI token, issued by DT Marks DEFILLC—an entity linked to the Trump family—will commence trading on major exchanges including Binance and Coinbase on September 1. Its fully diluted valuation exceeds $40 billion, with Trump’s personal holdings of 15.75 billion tokens valued at over $6 billion.

Source: WLFI

Key features of WLFI include:

Compliant stablecoin USD1: Custodied by BitGo, 100% backed by high-credit-quality real-world assets (RWA), mitigating algorithmic stablecoin risks.

Strategic market regulation: ALT5 Sigma committed to acquiring $750 million worth of WLFI tokens to provide liquidity during market volatility.

Regulatory premium: The project is viewed as a "model" for U.S. crypto compliance, though potential conflicts with the proposed GENIUS Act may attract regulatory scrutiny.

The token launch may trigger short-term volatility in crypto markets. Additionally, the SEC is expected to issue rulings on certain crypto exchanges or projects (e.g., Coinbase’s staking service) between September 1–5.

Broadcom Earnings Release

With Nvidia’s earnings release this week, the peak of Q2 earnings season has passed, but several notable reports remain. Broadcom is scheduled to report Q3 FY2025 results after the market close on Thursday, September 4. The earnings call webcast will begin at 2:00 PM PT.

Per Bloomberg consensus, Broadcom is expected to post revenue of $15.827 billion, up 21.07% year-over-year, and adjusted EPS of $1.66, up 34% year-over-year.

U.S. Markets Closed Monday

U.S. exchanges, including the NYSE and Nasdaq, will be closed on Monday, September 1, for Labor Day. Liquidity may thin in the pre-holiday (August 29) and post-holiday (September 2) sessions.

Despite a strong rally in August, investors are entering September—historically the worst month for equity performance. Since 1928, the S&P 500 has averaged a decline of 1.2% in September. According to Adam Turnquist, Chief Technical Strategist at LPL Financial, the S&P 500 has posted a positive return in September only 43% of the time since 1950, making it the weakest month for stocks.

Source: TradingView

Several factors may explain September’s weak historical performance:

Major market crashes occurred in September, including a 30% plunge in the S&P 500 in September 1931, a 12% drop in September 1974 amid the oil crisis-induced recession, an 11% decline in September 2002, and a >9% fall in September 2008 following Lehman Brothers’ collapse.

September marks the end of the U.S. fiscal year, requiring Congress to pass a budget for the new year. Delays often spur market anxiety.

Concentrated portfolio rebalancing as traders return from summer breaks may amplify volatility.

Market Recap

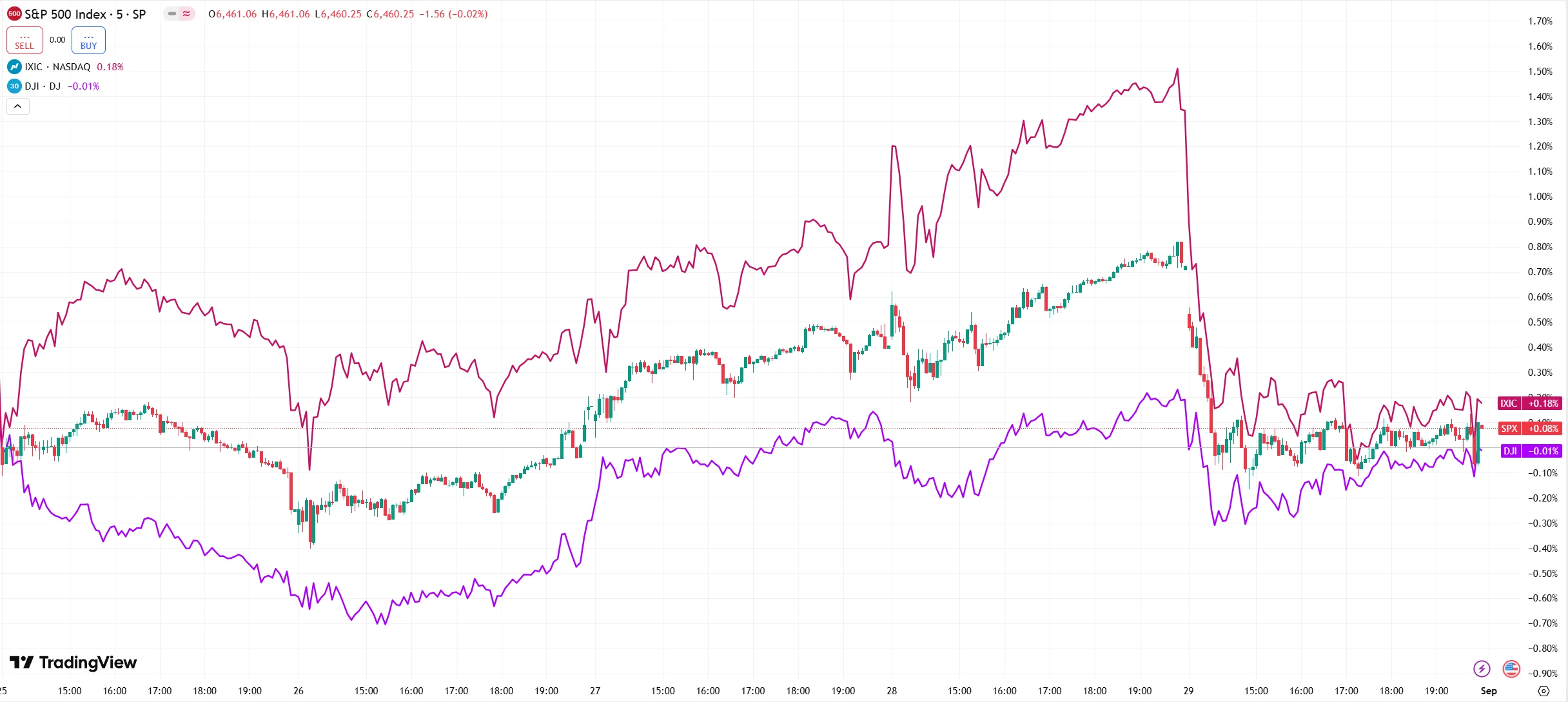

Over the past week, U.S. equities exhibited pronounced policy-sensitive movements. Although the S&P 500 briefly closed above 6500 for the first time, setting a fresh record, all three major indices ended the week in negative territory. The S&P 500 fell 0.1%, while the Dow and Nasdaq both declined 0.19%.

The market volatility was initially triggered by the U.S. announcement of a 50% tariff hike on Indian goods effective August 27, raising concerns over disruptions to global trade chains. From Tuesday to Thursday, markets oscillated amid trade policy uncertainty, with major indices showing minor fluctuations. However, on Friday, Fed Chair Jerome Powell signaled at the Jackson Hole Symposium that a September rate cut is "imminent," sparking a sharp shift in policy expectations and fueling a surge in market sentiment.

Source: TradingView

Powell explicitly shifted the monetary policy framework from “Flexible Average Inflation Targeting (FAIT)” to “Flexible Inflation Targeting (FIT),” marking the first official acknowledgment of underlying labor market risks and emphasizing the need for "preemptive rate cuts." Market-implied probability of a September cut rose from 60% prior to the meeting to 87%.

Notable Stock Moves:

NVIDIA’s Q2 revenue beat expectations, but growth in its data center segment slowed to 56% (below the expected 60%). Its shares fell 2.14% for the week, yet it remained the most traded stock. The results raised questions about the sustainability of AI hardware demand.

Source: TradingView

Affirm Holdings rose 10.59% on Thursday after reporting Q4 revenue of $876 million, up 33% YoY, with net income of $69.2 million (compared to a loss of $45.1 million a year earlier). Gross merchandise volume (GMV) increased 43% to $10.4 billion. The market is optimistic about the expansion potential of its consumer credit business in a declining rate environment.

Source: TradingView

Marvell Technology plummeted 18.6% on Friday, its largest one-day drop in three years. The company posted Q2 revenue of $780 million, down 12% YoY and below estimates of $820 million. Its weak guidance for AI chip demand led investors to doubt its competitiveness in the AI computing race.

Source: TradingView

Oracle fell 5.9% on Friday as its Q4 cloud revenue growth slowed to 18%, missing expectations of 22%. Combined with strong performance from competitor Microsoft Azure, this stoked concerns over market share erosion in cloud services.

Source: TradingView

Dell declined 8.88% on the same day. The company raised its full-year EPS guidance midpoint to $9.55 (an increase of only $0.10), well below market expectations of $9.80, reflecting dual pressures of weak PC demand and contraction in corporate IT spending.

Source: TradingView

This week, the market will focus on the August nonfarm payrolls data. If job gains fall below 100,000, expectations for a September rate cut could strengthen, potentially boosting small-cap and cyclical stocks. Conversely, strong data may lead to a reassessment of policy expectations, creating a potential rebound window for tech stocks.

Additionally, developments regarding the Trump administration’s negotiations on extending exemptions for China tariffs—set to expire on September 1—will be closely watched. Failure to reach an agreement could再度 disrupt supply chain-sensitive sectors.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates